Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 14 December 2012

[font size=3]STOCK MARKET WATCH, Friday, 14 December 2012[font color=black][/font]

SMW for 13 December 2012

AT THE CLOSING BELL ON 13 December 2012

[center][font color=red]

Dow Jones 13,170.72 -74.73 (-0.56%)

S&P 500 1,419.45 -9.03 (-0.63%)

Nasdaq 2,992.16 -21.65 (-0.72%)

[font color=red]10 Year 1.73% +0.02 (1.17%)

[font color=green]30 Year 2.90% -0.01 (-0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Fuddnik

(8,846 posts)At least we're lucky he's a Democratic skunk. Non-union? Right to work?

Monday Dec 10, 2012 5:11 pm

Rahm Emanuel Evades Questions Over Mob Ties in Non-Union Deal

By Anthony Mangini

NBC Chicago reports that Mayor Rahm Emanuel evaded questions over alleged mob ties in a $99 million custodial contract awarded for O'Hare International Airport. The contract went to the non-union employer United Maintenance, a subsidiary of United Services Co., which has connections to several prominent Chicago mob families.

United Services' executive vice president, Paul Fosco, was convicted and imprisoned in 1987 for a "racketeering...scheme to swindle the Laborers Union through manipulations of lucrative benefit plans," the Chicago Tribune reports. Fosco's father, Angelo Fosco, and the infamous Anthony "Big Tuna" Accardo were also tried for their involvement, although both were ultimately acquitted. United Services' owner, Richard Simon, previously ran National Maintenance Facilities with partner William Daddano, Jr., whose father was a notorious enforcer and loan shark for the Chicago mob.

In a press conference last Tuesday, Emanuel insisted that the contract was awarded via a "competitive process," but skirted the issue of mob connections.

Unions were already outraged over the deal; the new contractor, United Maintenance will replace the unionized employees of its predecessor, Scrub, Inc., with low-wage employees. "This is about the mayor taking care of his millionaire friends," SEIU Local 1 secretary-treasurer Laura Rueda told NBC Chicago, "and this is about the mayor taking away middle-class jobs."

On November 29, the mayor's birthday, dozens of angry janitorial employees gathered outside his house in protest, lighting candles and singing Happy Birthday in English, Spanish and Polish. SEIU Local 1, which has spearheaded a campaign on behalf of O’Hare's custodial workers, will be sponsoring a City Hall demonstration at 3:30 pm on December 11 to protest "Rahm Emanuel’s War on Wages."

http://www.inthesetimes.com/ittlist/entry/14277/rahm_emanuel_is_silent_on_the_syndicate_at_ohare/

Demeter

(85,373 posts)

I'm going to replenish body and soul, and see you all in the morning....it was nice to have a day off.

xchrom

(108,903 posts)

Saturday is the Messiah singalong! It isn't Christmas until the Hallelujah Chorus says so.

And Sunday is the community concert: Poulenc's Gloria, Jesu, Joy of Man's Desiring, and traditional carols (you should see my friend from China struggle with the 12 Days of Christmas at full speed!)

And of course, the Sunday edition of the "Shopper's Gazette", which will be twice as big (and heavy) as usual...

xchrom

(108,903 posts)i hope there is some Wassail to go along with...

Demeter

(85,373 posts)Whet your appetite; wet your whistle

"Whet your appetite"

This phrase is often confused with 'wet your whistle'. Uncertainty about the spelling of the first word, either as whet or wet, leads to both phrases being wrongly spelled too. In fact there's no connection between the two terms, which are properly spelled as 'whet your appetite' and 'wet your whistle'. The allusion in the former is to the sharpening of tools on a whetstone (grindstone) and to whet means just to sharpen. So, 'whetting our appetite' is 'sharpening our appetite'.

'Wet your whistle' predates 'whet your appetite' by some centuries, and was first recorded in the 1386 Towneley Mysteries:

"Had She oones Wett Hyr Whystyll She couth Syng full clere Hyr pater noster."

Whistle here means throat or voice and the phrase just means 'take a drink'.

You may see it put about that 'wet your whistle' derives from the practice of using a whistle in the taverns of Olde Englande to summon the landlord with more drinks. This is complete tosh. The Internet makes it easy to circulate information; unfortunately it isn't discriminating and stories like that tend to gain a foothold quite quickly. That form of digitally enhanced folk etymology is called netymology. As French wine growers used to say when complaining of inferior wines that were labelled as the prestigious Appelation Controllé - "the paper never refuses the ink". If you would like to dispel some popular fallacies you could try life in the 1500s or the Nonsense Nine.

Back to whet/wet your appetite/whistle. The spelling as 'wet your appetite' is quite understandable. Whet is no longer a common word, whereas its homonym 'wet' obviously is. Also, when tools are ground on whetstones they need to be lubricated with water or oil to prevent overheating. Whetstones were normally constructed with a water bath or some form of drip on to the stone. The assumption that 'whet' and 'wet' are the same word is thus encouraged. Added to that is the 18th century habit of serving liqueurs as hors d'oeuvre - in that case literally wetting the appetite (they also served turnips as appetizers - thankfully we have moved on).

Although not as old as 'wet your whistle', 'whet your appetite' has been in the language for some time. It is first alluded to in Thomas Shadwell's The Squire of Alsatia, 1688:

"Let's whett; bring some Wine. Come on; I love a Whett."

A more explicit use is in Thomas Dekker's If it be not good, the diuel is in it, 1612:

"[He] seekes new wayes to whet dull appetite."

By the early 19th century the phrase had begun to be used figuratively to refer to sharpening the appetite for things other than food, as here in a report from The Times, May 1801:

"It [defending Portugal] would only whet the appetite of Bonaparte and increafe ftill more the dangers of invafion."

http://www.phrases.org.uk/meanings/whet%20your%20appetite.html

xchrom

(108,903 posts)whet is also what you do to a knife.

kickysnana

(3,908 posts)Fuddnik

(8,846 posts)We have tickets for the 3:00pm show, and will have a good dinner after.

DemReadingDU

(16,000 posts)and dinner!

Fuddnik

(8,846 posts)xchrom

(108,903 posts)Earlier this week I calculated what initial jobless claims were likely to have been ex-Sandy. I can now calculate that number for the week ending December 1.

NY and NJ together were 60,888 of a total of 500,931, or 12.6% of the total of non-seasonally adjusted claims, which after seasonal adjustment were revised to 372,000. A year ago NY and NJ constituted 91.2% of all claims in the same week. Backing them out and calculating the total jobless claims number had the remaining 48 states constituted 90.7% (compared with October of this year) or 91.2% (compared with a year ago) of total claims gives us estimates of 360,000 and 358,000 respectively.

That makes the best estimate for what initial jobless claims would have been one week ago had Sandy not occurred, 359,000. The 4 week average would have been 372,000.

While I can't calculate this week's number, assuming the effects of Sandy have dissipated, yesterday's report of 343,000 would lower the 4 week moving average to 362,000, a new post-recession low.

Read more: http://bonddad.blogspot.com/2012/12/initial-claims-blow-away-sandy-maybe.html#ixzz2F1lYcUpE

Demeter

(85,373 posts)A little Christmas bubble isn't going to paper over the Eurocrisis, the China collapse, and the Hollowing out of the US economy...

Demeter

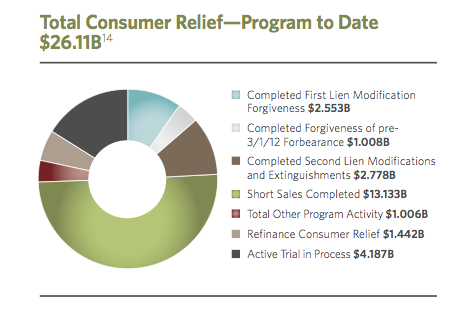

(85,373 posts)... the mortgage settlement was a big exercise in optics. The $26.1 billion number sounds impressive until you compare it to the size of the housing market and the damage done to homeowners. 40% of the value of the settlement can come from junk credits, things the banks would have done anyhow or should be doing in the normal course of business, like razing vacant homes, short sales, and giving homes to charities. And of the remaining part, which was a relatively small amount of actual cash payment ($5.8 billion, but that included over a billion of fines federal regulators rolled into that total), the rest is supposed to be reduction of mortgage principal. Oh, but wait, they can take credit for modifying OTHER PEOPLE’S MORTGAGES, meaning those owned by investors. And they’ve been doing that in more than half the cases. As the Financial Times reported NOVEMBER:

The banks – JPMorgan Chase, Bank of America, Wells Fargo, Citigroup and Ally Financial – agreed to forgive billions of dollars worth of distressed borrowers’ mortgage principal in exchange for waivers from potential liability.

On Wednesday, BofA said that 60 per cent of the $4.75bn in first-lien mortgage principal it has thus far agreed to forgive would come from non-government guaranteed loans that were packaged into bonds and sold to investors.

Of JPMorgan’s $3bn in forgiven mortgage debt, slightly less than half has come from investors’ holdings, a person familiar with the matter said. The other three banks either declined to provide numbers or did not respond to requests for comment.

The Charlotte Bank has far and away the biggest settlement obligation, $8.5 billion versus $4.3 billion for Wells and $4.2 billion for Chase, the next two in size rank. Remember also that banks were offering principal mods on loans in their portfolio before the settlement; it’s a no-brainer that most if not all of the mods on bank owned loans were ones they would have done anyhow.

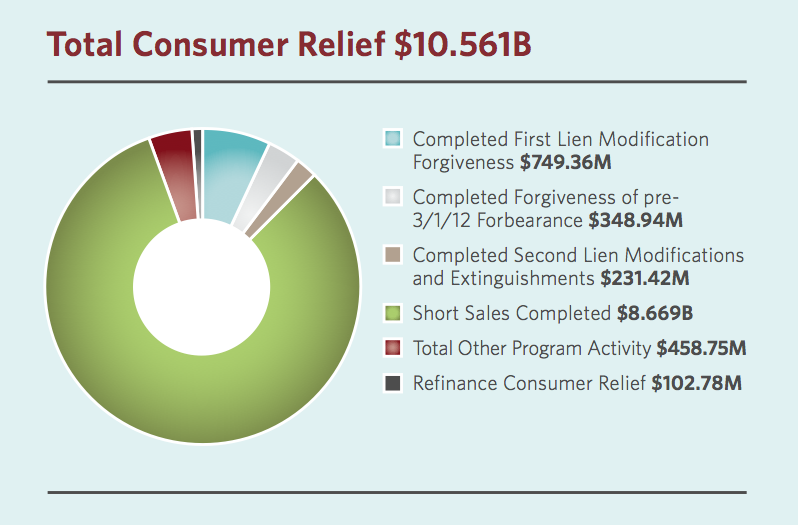

Today, the settlement monitor Joseph Smith released another PR piece, um, progress report. These reports are already sus since the monitor isn’t require to say anything about his work until first quarter 2013. So this looks like an exercise in messaging over moving the ball forward (reports like this take a lot of work and divert resources from oversight). We can see with this report that more effort has gone into creative accounting to make the results look better than they really are. Smith’s first progress report gave prominent play to this chart, which was troubling. Despite the claim, taken up by the media, that borrowers got “relief”, what it showed instead is that they got overwhelmingly was short sales...We weren’t alone in criticizing the prevalence of short sales, which results in borrowers losing their homes, over various forms of relief, most important, deep principal mods, which keep them in place. Even with the housing market bounce, losses on foreclosures are so high (70%+ of mortgage value) that a deep mod (30% to 50%) is a win-win if the borrower has an adequate level of income:

Dave Dayen hits this issue hard:

Short sales should be reserved for homeowners who couldn’t afford to live in a home even with a lower principal or for people who need to move, said UC Irvine law professor Katherine Porter, who was appointed by the state attorney general’s office to monitor the deal.

“I am pushing hard to make sure that … short sales are being used for families for whom other options are really not available,” Porter said.

It’s difficult to see whether that’s the case.

Yves again. So if you look at the updated version of the chart, things look much better, right? I mean, that big green area which is short sales, is still more than half, but at least it’s a much smaller percentage of the total pie than it was the last time. So the servicers are moving in the proper direction, right?

Um, not to the degree you’d think. Notice the dark grey area, the “Active Trial in Progress”? They were not included in the chart in the first report. And there’s no reason they should be. Those are trial modifications. And there is no assurance these will lead to permanent mods; banks have been known to call payment catch up plans, in which borrowers try to make up for missed payments or clear out late and related junk fees, as “trial mods” even though they result in higher, not lower, monthly payments. Back that out and you have short sales at 59% of the total of the latest version of the pie chart. Yes, that is still a meaningful improvement compared to the 82% it was last time. But this little trick shows how the monitor’s priority is be making the program look successful, as opposed to getting tough with the servicers (which might mean calling them out on lack of progress, what a thought!). Oh, and even better: the amount of relief from these “maybe they’ll get done, maybe they won’t” mods is $4.118 billion, versus actual completed principal mods of only $2.53 billion.

And get a load of this doozy, from Smith’s cover letter (emphasis mine):

MORE

So this sorry settlement is playing out as predicted: relief for only a small number of borrowers, and then mainly better off ones, with the banks getting a huge “get out of liability” card on the cheap. And to add insult to injury, we have to read colored pie charts doctored to make a bad story look a smidge less awful.

xchrom

(108,903 posts)

Juniper berries give gin its signature flavor. The national drink of England actually has its roots in the Netherlands, coming very much into fashion when Dutch prince William III of Orange ascended to the English throne in 1689. Thanks to a succession of deregulations to distillation laws, by 1736, gin production exceeded beer production by a factor of six.

Gin is now making a comeback in Germany. Trendy bars are stocking many more types of gin, and bargoers are drinking more gin-based drinks. "Vodka is for people who are drinking for the effect it brings. Gin is for people who are drinking for the fine experience of it," says Jörg Meyer, a star bartender in Hamburg. Here, substances used to make gin at the Preussische Spirituosen Manufaktur (Prussian Spirits Manufactory), a small-scale producer in Berlin.

A man walks into a bar and orders a Gin and Tonic. In the past, that might have been the opening line of a joke. But, today, it could just as easily mark the start of an evening in which, if he isn't careful, the man might end up making a fool of himself.

"Which gin?" any discerning bartender will ask him. "With which tonic?"

And, of course, the bartender could also simply reveal the customer's lack of savvy in a subtler way. Ordering the drink in the way it's traditionally been done in Germany -- by calling it a "gin tonic" -- betrays the drinker's lack of refinement, and the subtly superior bartender may respond by emphasizing the drink's name in the original English: "And how would you like your Gin AND Tonic?"

"Just ordering a normal Gin and Tonic is hardly even an option anymore," says Uwe Voigt, owner and founder of Germany's oldest bartending school, in the northwestern German port city of Rostock.

Hotler

(11,428 posts)mmmmmmmmm! tasty. Leopold Bros. Gin distilled here in Colorado.

http://www.leopoldbros.com/New_site/Leopold_Bros.html

Their whiskies are good also. I'm more of a Tequila guy, but their whiskey is tasty over ice.

Hotler

(11,428 posts)to serve with a gin mojito???

Thank you.

xchrom

(108,903 posts)i like the idea of something pork -- the gin mojito would and the slight sweetness of the pork would be good.

maybe lamb kefta -- ground lamb, seasoned and grilled on a skewer.

xchrom

(108,903 posts)Five hundred officials with the German Federal Criminal Office (BKA), the federal police and tax investigators searched Deutsche Bank's headquarters on Wednesday morning. A short while later, the finance giant declared that its CEO Jürgen Fitschen had become the subject of an investigation. Officials are looking into possible value-added tax evasion by Fitschen and the company's chief financial officer Stefan Krause.

Specifically, investigators areexamining whether the company conducted illegal trade in carbon emissions certificates. The Frankfurt public prosecutor's office has accused 25 of the bank's employees of serious tax evasion, money laundering and obstruction of justice. On Wednesday, they ordered the arrest of five suspects.

Now Fitschen is also the subject of investigation. Is there a chance of him losing his job, though? Probably not.

What may seem like automatic grounds for stepping down in the world of politics is handled a bit differently in business. In contrast to political leaders, executives are capable of withstanding quite a bit more. Indeed, quarterly reports can be far more dangerous for most executives than a team of prosecutors. That makes it unlikely that Fitschen or Krause would immediately step down.

Demeter

(85,373 posts)Demeter

(85,373 posts)Obamacare extends health insurance to tens of millions of Americans, assists the nation’s most vulnerable by outlawing the worst excesses of the private insurance industry, and keeps Medicare solvent for American seniors. And the Wall Street Journal observes that the landmark health law will prove a crucial asset to yet another segment of the American population: those who are are trapped in their current jobs out of fear for losing access to health insurance.

This phenomenon — known in the industry as “job lock” — is an unintended consequence of America’s primarily employer-sponsored health insurance system. Studies have shown that workers who don’t receive insurance through their employers are one and half times more likely to switch jobs than the workers who have employer-sponsored plans. Since insurance coverage can’t be shifted between jobs, some Americans remain in their current positions longer than they would have otherwise because of their fear of losing health coverage, since private insurance might prove unaffordable for them.

This problem is particularly prevalent among older employees in their 50s and 60s, some of whom remain in their jobs simply because they are waiting to qualify for Medicare coverage. Even aside from the fact that this dynamic forces some people to work longer than they might want to, it also creates an inefficient labor market, since workers might not switch over to higher-utility job in order to maintain continuous benefits.

Luckily, Obamacare’s insurance exchanges will allow individuals to purchase coverage on a statewide market, and the law gives consumers tax subsidies with which they can purchase care. Furthermore, small employers might be less likely to forgo hiring due to coverage costs, sinceObamacare actually reduces smaller firms’ health care spending.

But proposals to raise the Medicare eligibility age from 65 to 67 would undo some of the progress made by Obamacare in this regard, forcing elderly Americans to work for even longer and exacerbating the “job lock” phenomenon — all while reducing health care spending marginally and shifting costs onto states, employers, and Americans’ health insurance premiums.

IN OTHER WORDS, WHETHER YOU GO OR YOU STAY, YOU GET THE SAME CRAPPY, EXPENSIVE HIGH COPAY AND DEDUCTIBLE SCREW OVER.....

TALK ABOUT TRY TO TURN A SOW'S EAR INTO A SILK PURSE.

Demeter

(85,373 posts)The Republicans are demanding $600 billion in Medicare cuts over the next 10 years. Their only concrete proposal is to deny Medicare coverage to Americans during what is now their first two years of eligibility at ages 65 and 66. But their official offer isn’t even that specific. It just throws out that figure: $600 billion. But you can’t get there from here. At least you can’t do it their way—not without causing enormous hardship and not without costing the public twice as much from other sources as would be saved in government spending. In fact, there are only two paths to $600 billion in savings. One’s macabre and morbid, and is offered here only to make as a Swiftian “modest proposal.” The other would take a chunk out of corporate profits.

Which path do you think the GOP would prefer?

This entire Medicare debate’s being held under false pretenses. Here are four multibillion-dollar Medicare secrets they don’t want you to know—along with that funereal “modest proposal:”

1. Runaway corporate profits are squeezing medicare.

Republican Sen. Bob Corker echoed the party line today when he said that cutting “entitlements” was needed in order to “save the nation.” But benefit cuts aren’t where the money is: profits are. We did some rough calculations to show you just how much profit’s involved: Roughly $200 billion in Medicare spending will go to drug company profits in the next 10 years. (We got that figure by averaging the profit margins for large pharmaceutical corporations by projected Medicare drug expenditures.) And yet the Republicans have blocked legislation that would allow the government to use its purchasing power to negotiate for a better deal. So the drug companies can charge us whatever they want—and we pay it. Medicare has reportedly underpaid for hospital services at times. But for-profit hospitals have an average profit margin of 5.5 percent. What they’re not receiving from Medicare is ‘cost-shifting’ to private health insurance. We pay for that, too – in insurance premiums and tax concessions for employer-sponsored coverage. With, Medicare hospital expenditures likely to approach $2.5 trillion in the next 10 years, that’s costing society a fortune. And that doesn’t include high margins in the non-profit hospital field, where CEOs frequently earn more than a million dollars as a reward for maximizing revenue. Nor does these figures include the profits received by a whole range of other for-profit health providers ranging from diagnostic centers to ambulatory surgery clinics.

2. We receive far too much unnecessary care, and are often fraudulently billed for the care that is given... A series of exposés (some of which we discussed in “Sick Money,” a review of Bain Capital’s health investments) have revealed gross patterns of fraudulent Medicare overcharging. Even worse tis the overtreatment that’s done to boost profits. Unnecessary procedures are difficult and uncomfortable at best, and at worst they can lead to pain, disability, even death. This overtreatment’s been documented in both academic studies (John Wennberg’s Dartmouth Atlas is a great resource) and some excellent journalism. And it’s getting worse. Now hospitals are buying physician practices and exerting financial pressure on doctors to perform more surgeries. But the truth is that doctors have always been under financial pressure to overtreat. They graduate from medical school with tons of debt and must then maintain a profitable practice, including everything from equipment to office staff. And yet Republicans have beaten back attempts to control this overtreatment with their “death panel” hoax. That myth is only slightly less believable than “black helicopters.” There are death panels – but they’re manned by insurance executives, not bureaucrats. Republicans have fought Medicare by telling us that doctors shouldn’t be “employees” of the government. Now they’re employed by MBAs who want a fat bonus....

3. Seniors are already being hit hard by medical costs.

People who aren’t covered by Medicare and don’t know much about it often assume it covers all, or most, medical expenses. But the average person on Medicare pays roughly $4,600 per year in out-of-pocket medical costs, and that figure can be much higher for those who are severely or chronically ill or who have suffered a serious injury. Boehner’s figure of $600 billion over 10 years is a reduction of approximately 7.8 percent from current projections. But Medicare enrollment will increase from 49 million people to 85 million over the same period. Assuming that these Republican cuts are made permanent, that means that Medicare’s per-person budget will have been cut by more than 15 percent by the year 2022.

4. Chronic conditions and end of life illnesses are extraordinarily expensive.

They’re not proposing to do anything about Medicare’s biggest cost problem: the care that’s provided to the severely ill, especially in the final year of life. As the Dartmouth Atlas reports, “Patients with chronic illness in their last two years of life account for about 32 percent of total Medicare spending.” That comes to nearly $2.5 trillion over the next 10 years, based on current projects. And yet the GOP is proposing to slash, not increase, funding for research that might help us provide end-of-life care more effectively and humanely. The elderly are particularly prone to other costly chronic conditions like cancer and diabetes, which can be treated much more effectively – and much less expensively—if they are caught early. Instead, their plan to deny Medicare for 65 and 66 year olds will lead to less early diagnosis and intervention, making us sicker and driving up Medicare’s costs.

It’s Your Funeral

That leads us to our “modest proposal.” Any way you look at it, we’re going to be seeing an increase in the number of funerals if Medicare benefits are cut. Research has shown that the survival for seniors in this country increased by 13 percent when Medicare was introduced in the 1960s. It’s reasonable to assume that those survival rates will begin to fall again—and death rates will rise—if we impose mindless benefit cuts, instead of taking an intelligent cost management approach that focuses on expense drivers such as overtreatment, overbilling, and excessive profiteering. The Republicans want drastic cost reductions without disturbing corporate profits. Using their logic, they shouldn’t take away our first two years of Medicare coverage. They should take away the last two years. That would cut Medicare expenditures by more than a third.

And what do they care about one more funeral here or there – as long as it’s not theirs?

Demeter

(85,373 posts)When it comes to reducing Medicare spending, asking wealthier seniors to pay more is one of the few areas where Democrats have shown a willingness to even consider the subject...Besides, making the rich pay more would hardly be breaking new ground. Medicare already charges wealthy people more and poor people less.

"We already don't have a common standard social insurance system where everybody gets the same benefits," Moffit says. "We already have means testing."

Indeed, as part of a 2003 Medicare law, Congress imposed higher outpatient premiums for the program's optional Part B on wealthier beneficiaries. And then in 2010, as part of the Affordable Care Act, Congress asked wealthier beneficiaries to pay more for their prescription drug coverage, too. Meanwhile, at the other end of the income scale, says Moffit, low-income Medicare beneficiaries get special breaks. The very poorest get coverage through Medicaid. And even those with moderate incomes are spared having to pay increases in their outpatient premiums in years when there's no or only a small increase in Social Security.

"When premiums go up, if premium increases exceed their cost-of-living adjustment for Social Security they're held harmless," he said. "They don't pay the higher premiums."

So Moffit thinks there's plenty of precedent, and plenty of room, to increase the amount, or lower the income threshold for better-off beneficiaries.

"Given the size of the debt, it's probably a good idea for Congress to simply say to the rest of taxpayers, 'Look, we're not going to require you to continue to subsidize the wealthiest retirees. That's probably not the best policy,' " he said. "Those people who can afford to pay more for their health care should do it."

But that sentiment is far from universal. For one thing, wealthy means something far different when it comes to Medicare than it does when it comes to income taxes. "Higher income is defined as people with incomes of $85,000 or more, and obviously in the tax world we're talking about people with $250,000 in income or higher," said Patricia Neuman of the nonpartisan Kaiser Family Foundation.

Then there's the idea that Medicare premiums are the only thing most seniors pay when it comes to health care. Rep. Allyson Schwartz, D-Pa., who has worked on Medicare issues, says that's hardly the case.

"They get Medigap; they get supplemental insurance. There are copays," she said, referring to the idea that seniors tend to have both lower incomes, and higher health care costs, than most other Americans.

She added: "We want to make sure that we don't do anything that reverses that universality or the benefits and hurt beneficiaries."

There's still one more complication: The Affordable Care Act imposed one other new Medicare tax on the wealthy that's just about to take effect. Starting in January, people with incomes over $200,000 will have to pay the Medicare payroll tax on income from interest, dividends and other nonwage activities. That's one more place budget negotiators won't be able to go to mine more money from Medicare.

SO EVEN MEDICARE IS AN UNDEMOCRATIC, EXCEPTION-RIDDEN EXCUSE OF A HEALTHCARE SOLUTION...

WE SHOULD JUST GIVE IT ALL UP FOR UNIVERSAL SINGLE PAYER, AND BE DONE WITH IT...INSTEAD OF "MEANS TESTING" WE SHOULD HAVE PROGRESSIVE TAXATION...PAY FOR WHAT YOU GET, NOT FIDDLING WITH ALLOWANCES.

MAKES ME WONDER IF I REALLY WANT TO LIVE INTO MEDICARE AGE...I CAN'T HANDLE THE PAPERWORK IN MY LIFE ALREADY!

Roland99

(53,342 posts)DOW +0.3%

NASDAQ +0.4%

http://www.marketwatch.com/story/stock-futures-up-ahead-of-cpi-china-data-inspires-2012-12-14?dist=beforebell

Demeter

(85,373 posts)I ALWAYS THOUGHT THE REAL REASON THEY WENT AFTER HBSC WAS THE IRAN TRADING...

http://www.rollingstone.com/politics/blogs/taibblog/outrageous-hsbc-settlement-proves-the-drug-war-is-a-joke-20121213

...Breuer this week signed off on a settlement deal with the British banking giant HSBC that is the ultimate insult to every ordinary person who's ever had his life altered by a narcotics charge. Despite the fact that HSBC admitted to laundering billions of dollars for Colombian and Mexican drug cartels (among others) and violating a host of important banking laws (from the Bank Secrecy Act to the Trading With the Enemy Act), Breuer and his Justice Department elected not to pursue criminal prosecutions of the bank, opting instead for a "record" financial settlement of $1.9 billion, which as one analyst noted is about five weeks of income for the bank.

The banks' laundering transactions were so brazen that the NSA probably could have spotted them from space. Breuer admitted that drug dealers would sometimes come to HSBC's Mexican branches and "deposit hundreds of thousands of dollars in cash, in a single day, into a single account, using boxes designed to fit the precise dimensions of the teller windows."...Though this was not stated explicitly, the government's rationale in not pursuing criminal prosecutions against the bank was apparently rooted in concerns that putting executives from a "systemically important institution" in jail for drug laundering would threaten the stability of the financial system. The New York Times put it this way:

It doesn't take a genius to see that the reasoning here is beyond flawed. When you decide not to prosecute bankers for billion-dollar crimes connected to drug-dealing and terrorism (some of HSBC's Saudi and Bangladeshi clients had terrorist ties, according to a Senate investigation), it doesn't protect the banking system, it does exactly the opposite. It terrifies investors and depositors everywhere, leaving them with the clear impression that even the most "reputable" banks may in fact be captured institutions whose senior executives are in the employ of (this can't be repeated often enough) murderers and terrorists. Even more shocking, the Justice Department's response to learning about all of this was to do exactly the same thing that the HSBC executives did in the first place to get themselves in trouble – they took money to look the other way.

And not only did they sell out to drug dealers, they sold out cheap. You'll hear bragging this week by the Obama administration that they wrested a record penalty from HSBC, but it's a joke. Some of the penalties involved will literally make you laugh out loud. This is from Breuer's announcement:

Wow. So the executives who spent a decade laundering billions of dollars will have to partially defer their bonuses during the five-year deferred prosecution agreement? Are you fucking kidding me? That's the punishment? The government's negotiators couldn't hold firm on forcing HSBC officials to completely wait to receive their ill-gotten bonuses? They had to settle on making them "partially" wait? Every honest prosecutor in America has to be puking his guts out at such bargaining tactics. What was the Justice Department's opening offer – asking executives to restrict their Caribbean vacation time to nine weeks a year?...there is absolutely no reason they couldn't all face criminal penalties. That they are not being prosecuted is cowardice and pure corruption, nothing else. And by approving this settlement, Breuer removed the government's moral authority to prosecute anyone for any other drug offense. Not that most people didn't already know that the drug war is a joke, but this makes it official.

Demeter

(85,373 posts)AS IF WE NEEDED FURTHER PROOF OF IT

http://www.guardian.co.uk/commentisfree/2012/dec/12/hsbc-prosecution-fine-money-laundering

The US is the world's largest prison state, imprisoning more of its citizens than any nation on earth, both in absolute numbers and proportionally. It imprisons people for longer periods of time, more mercilessly, and for more trivial transgressions than any nation in the west. This sprawling penal state has been constructed over decades, by both political parties, and it punishes the poor and racial minorities at overwhelmingly disproportionate rates.

But not everyone is subjected to that system of penal harshness. It all changes radically when the nation's most powerful actors are caught breaking the law. With few exceptions, they are gifted not merely with leniency, but full-scale immunity from criminal punishment. Thus have the most egregious crimes of the last decade been fully shielded from prosecution when committed by those with the greatest political and economic power: the construction of a worldwide torture regime, spying on Americans' communications without the warrants required by criminal law by government agencies and the telecom industry, an aggressive war launched on false pretenses, and massive, systemic financial fraud in the banking and credit industry that triggered the 2008 financial crisis.

This two-tiered justice system was the subject of my last book, "With Liberty and Justice for Some", and what was most striking to me as I traced the recent history of this phenomenon is how explicit it has become. Obviously, those with money and power always enjoyed substantial advantages in the US justice system, but lip service was at least always paid to the core precept of the rule of law: that - regardless of power, position and prestige - all stand equal before the blindness of Lady Justice.

It really is the case that this principle is now not only routinely violated, as was always true, but explicitly repudiated, right out in the open. It is commonplace to hear US elites unblinkingly insisting that those who become sufficiently important and influential are - and should be - immunized from the system of criminal punishment to which everyone else is subjected....

MORE

RIGHTEOUS RANT! GREENWALD POINTS OUT THAT THIS STARTED WITH NIXON'S PARDON...AND I THINK HE'S RIGHT.

DemReadingDU

(16,000 posts)all the banksters should be indicted and sent to jail

Demeter

(85,373 posts)As BuzzFlash noted in its commentary yesterday:

HSBC didn't just launder countless dollars and pesos for profit by accident. According, to the Department of Justice report, it played an active and knowing role in facilitating the money laundering, which allows the narcos to safely bank – and move around -- their billions of dollars in sales. According to the Justice Department's findings – and a Senate investigation earlier this year – HSBC became the "preferred money launderer" for Mexican cartels because the bank adopted policies that were narco-friendly. As described in an article in MarketWatch:

Specifically, the government says HSBC failed to monitor over $670 billion in wire transfers from HSBC’s Mexico division between 2006 and 2009 and failed to monitor over $9.4 billion in purchases of U.S. dollars from HSBC’s Mexico unit over the same period. (The Justice Department’s said HSBC’s Mexico division became the “preferred financial institution for drug cartels and money-launderers.”)

The Washington Post cited Assistant Attorney General Lanny A. Breuer:

The illicit money was submerged in the billions of dollars of transfers that flowed between HSBC’s Mexican and American affiliates. In many cases, the illicit cash was generated by drug sales in American cities, smuggled to Mexico and deposited at HSBC there. Then it was wired back to an account at HSBC in the United States as clean money. In other cases, bulk cash was deposited and converted into local currency, a process called the Black Market Peso Exchange by investigators.

The Department of Justice has fined banks involved with money laundering token amounts (although they appear large, they are a small percentage of a bank's profits and the loss is covered by shareholders, not the executives responsible for the money laundering). The violations have ranged from accepting narco money knowingly to taking funds from banks and nations with ties to terrorists to doing banking with countries that the US has sanctions against.

The Post reminds readers:

For big banks and Wall Street financial firms, there are a different set of rules; there are basically few violations of banking laws -- very few -- that will lead to criminal prosecution. Yes, an individual bank executive might be indicted for embezzling from a bank, but bank executives won't be prosecuted for facilitating the fortunes made by drug traffickers or financially working with banks and nations that, according to the US government, seek to attack or undermine the interests of America.

Given the death toll in Mexico, Central America, Colombia and elsewhere due to the show-war on drugs, banks like HSBC (and the other banks that have and likely continue to engage in illicit drug money laundering in Mexico and South America) aren't just violating laws when they willingly accept the deposits of narco; they are acting as accessories to murder....As long as the US government continues to value "too big to fail" money machines over the value of lives, HSBC and other untouchable financial institutions and corporations will continue to have a license to be an accessory to murder. This isn't just a perverse injustice: it's a deadly one...The United States Department of Justice and the Obama administration have betrayed these victims and their families by letting bankers who are, in essence, "silent" financial partners with the narcos go free.

Demeter

(85,373 posts)

BRITAIN’S biggest bank, HSBC, has settled a money-laundering probe by American authorities for $1.9 billion. The bank admitted that its money-laundering controls and compliance with sanction laws had been inadequate. The allegations had included links to drug cartels and terrorist financing. This record settlement with American authorities comes after another British bank, Standard Chartered, agreed to $327m in fines for violating money-laundering rules, on top of an earlier fine of $340m levied in August. Both banks have deferred prosecution agreements; these defer prosecution as long as stringent conditions are met. For HSBC these conditions include increasing spending on anti-money-laundering and setting up a new financial-crime compliance unit. The cases are part of a wider money-laundering crackdown by American authorities, which have imposed over $4 billion in fines in the past three years.

jtuck004

(15,882 posts)SS, Medicare, or Medicaid cut for what is a temporary spike in the older population.

My planning is the early stages, but I am thinking the docks along the West Coast, from Washington to California.

I mean, if you are gonna die without medical care, you might as well do it on tv. And if we get on the Ed show maybe Dr's will come out with those little tents like they did for Katrina? We could start the party in California while the weather is cool up North, and slowly expand through Washington. I have to get some ice...

Now, I can think of at least one problem with this. Does anyone need anything from China before I send out the invites? Hey, I just thought - maybe we could open up one of those old factories and make it here, pay someone a decent wage to do it. There are 24 million said they want a job on that last report.

Oh, and that coal China was gonna get from those 60 additional trains they want to drive across town every day soon? Well, they may not need it. Well, I hope not.

And that inflation thing I am sure will take a bounce someday, but with crap for demand and 50,000 people being yanked out of their homes every month, I am guessing it will be awhile. And maybe by that time folks will find out that those who are already suffering deprivation may weather it better than the wealthy we are supporting today.

Anybody got any folding chairs we can use?

Tansy_Gold

(17,864 posts)about a dozen of those plastic stackable chairs, a couple small folding tables, and some camping gear.

Oh, I forgot -- I also have one of those white canopy things for craft shows and five big folding tables, plus an enclosed utility trailer to haul everything in.

xchrom

(108,903 posts)Divorced and unemployed, Fran Lopez is back at home with his parents again.

Five years ago, he was living in Madrid’s wealthiest suburb with his wife and new-born daughter and earning as much as 4,000 euros ($5,175) a month upgrading electricity substations for Iberdrola SA (IBE), Spain’s largest utility. Now Lopez, 26, is studying for his high-school diploma.

“I’m starting from zero,” Lopez said. “They want a load of qualifications. So I’m studying. My aim is to work, and if there’s no work, I’ll keep studying.”

With Europe’s debt crisis entering its fourth year, Lopez’s life-lived-backwards is an example of how the fortunes of many of the continent’s 500 million citizens have been upended. Rich and poor, north and south, the upheaval is the face of a new economic reality as taxes increase while people get less from the governments and the bond markets they used to rely on.

Demeter

(85,373 posts)We are not having a debt crisis.

It’s important to make this point, because I keep seeing articles about the “fiscal cliff” that do, in fact, describe it — often in the headline — as a debt crisis. But it isn’t. The U.S. government is having no trouble borrowing to cover its deficit. In fact, its borrowing costs are near historic lows. And even the confrontation over the debt ceiling that looms a few months from now if we do somehow manage to avoid going over the fiscal cliff isn’t really about debt....No, what we’re having is a political crisis, born of the fact that one of our two great political parties has reached the end of a 30-year road. The modern Republican Party’s grand, radical agenda lies in ruins — but the party doesn’t know how to deal with that failure, and it retains enough power to do immense damage as it strikes out in frustration.

...these aren’t normal negotiations in which each side presents specific proposals, and horse-trading proceeds until the two sides converge. By all accounts, Republicans have, so far, offered almost no specifics. They claim that they’re willing to raise $800 billion in revenue by closing loopholes, but they refuse to specify which loopholes they would close; they are demanding large cuts in spending, but the specific cuts they have been willing to lay out wouldn’t come close to delivering the savings they demand. It’s a very peculiar situation. In effect, Republicans are saying to President Obama, “Come up with something that will make us happy.” He is, understandably, not willing to play that game. And so the talks are stuck. Why won’t the Republicans get specific? Because they don’t know how. The truth is that, when it comes to spending, they’ve been faking it all along — not just in this election, but for decades.

Which brings me to the nature of the current G.O.P. crisis. Since the 1970s, the Republican Party has fallen increasingly under the influence of radical ideologues, whose goal is nothing less than the elimination of the welfare state — that is, the whole legacy of the New Deal and the Great Society. From the beginning, however, these ideologues have had a big problem: The programs they want to kill are very popular. Americans may nod their heads when you attack big government in the abstract, but they strongly support Social Security, Medicare, and even Medicaid. So what’s a radical to do? The answer, for a long time, has involved two strategies. One is “starve the beast,” the idea of using tax cuts to reduce government revenue, then using the resulting lack of funds to force cuts in popular social programs. Whenever you see some Republican politician piously denouncing federal red ink, always remember that, for decades, the G.O.P. has seen budget deficits as a feature, not a bug. Arguably more important in conservative thinking, however, was the notion that the G.O.P. could exploit other sources of strength — white resentment, working-class dislike of social change, tough talk on national security — to build overwhelming political dominance, at which point the dismantling of the welfare state could proceed freely. Just eight years ago, Grover Norquist, the antitax activist, looked forward cheerfully to the days when Democrats would be politically neutered: “Any farmer will tell you that certain animals run around and are unpleasant, but when they’ve been fixed, then they are happy and sedate.”

O.K., you see the problem: Democrats didn’t go along with the program, and refused to give up. Worse, from the Republican point of view, all of their party’s sources of strength have turned into weaknesses. Democratic dominance among Hispanics has overshadowed Republican dominance among southern whites; women’s rights have trumped the politics of abortion and antigay sentiment; and guess who finally did get Osama bin Laden. And look at where we are now in terms of the welfare state: far from killing it, Republicans now have to watch as Mr. Obama implements the biggest expansion of social insurance since the creation of Medicare. So Republicans have suffered more than an election defeat, they’ve seen the collapse of a decades-long project. And with their grandiose goals now out of reach, they literally have no idea what they want — hence their inability to make specific demandsIt’s a dangerous situation. The G.O.P. is lost and rudderless, bitter and angry, but it still controls the House and, therefore, retains the ability to do a lot of harm, as it lashes out in the death throes of the conservative dream.

Our best hope is that business interests will use their influence to limit the damage. But the odds are that the next few years will be very, very ugly.

YEAH, LIKE THAT WILL HAPPEN...THE BUSINESS GUYS JERK AROUND THE GOP, AND THAT WHOLE RELATIONSHIP GOES OUT THE WINDOW, TOO.

THE GOP IS A BUNCH OF SCARED AND ANGRY WHITE GUYS (SAWG). THEIR EGOS ARE ON THE LINE.

THEY DON'T KNOW HOW TO DEAL WITH DEFEAT, AND "COMPROMISE = DEFEAT", IN SAWG LANGUAGE. "KNUCKLING UNDER = DEFEAT".

IN FACT, ANYTHING THAT ISN'T "GRIND THEIR FACES INTO THE GROUND" EQUALS DEFEAT.

SO THERE'S NO EXIT FOR THE GOP. THEY HAVE TO BE THROWN OUT, ONE BY ONE.

Demeter

(85,373 posts)You might never spot an air marshal on your flight, but it’s reassuring to know one might be there. In a few weeks, though, many of them are likely to get pink slips — along with food safety inspectors, border patrol agents and countless other government employees who play a crucial if hidden role in everyone’s lives. These and many other cuts to important programs like child nutrition and low-income housing are part of a giant buzz saw known as the sequester, which will indiscriminately slash $100 billion in discretionary spending beginning in January and will continue for nine years. The cuts, mandated by the 2011 budget agreement, would not affect entitlement programs like Social Security, and have not received the same attention as the tax increases that are also scheduled to take effect in January. They are the rarely discussed part of the so-called fiscal cliff, and negotiators have little time left to prevent their impact. But all signs suggest that Republicans remain unrelenting in their insistence on preserving the full amount of the cuts, and adding many billions more.

The slogan that Republicans have relentlessly repeated on every talk show, and that Speaker John Boehner invoked Thursday — Washington has a spending problem, not a revenue problem — may sound superficially appealing to weary taxpayers, but those who mouth it never bother to give details on what their budget-cutting demands really mean. It is not an abstraction, like their vague calls for “entitlement cuts.” None of these brave budget-cutters want to go on television and say, cut the F.B.I. Or cut the Border Patrol. Or cut the Centers for Disease Control and Prevention. But that’s exactly what they’re doing by insisting on slashing discretionary spending. Republicans are so afraid of this reality that they won’t even detail their demands for cuts to the White House in the fiscal-cliff talks, instead waiting for President Obama to go first so they won’t be stuck with the blame.

The sequester cuts were balanced between domestic and military programs, to spread the pain evenly. The Republicans have sought to move all the cuts to the domestic side and make the president do the dirty work of choosing which popular programs go on the block.

“Where are the president’s spending cuts?” Mr. Boehner asks, without mentioning any of his own. But Mr. Obama already agreed to more than $1.5 trillion in cuts last year that will extend for a decade. In exchange, Republicans agreed to exactly nothing, except not to default on the nation’s credit last year, a threat they are preparing again for 2013. White House officials are hoping that if a deal is reached combining higher tax revenues with some of the spending cuts the president has already proposed, Republicans will agree to postpone or vastly reduce the unpopular sequester. If they do not, and the country finds itself without vital services, the public will know exactly whom to hold responsible.

Demeter

(85,373 posts)To get to "yes" on a "fiscal cliff" accord, Congress and the White House first might have to get to "no." That is, an impasse that sends them over the cliff by missing their Dec. 31 deadline to pass a major deficit-reduction plan. Such a breach would immediately change the political dynamics, making it easier for many lawmakers — especially Republicans — to agree to a second-chance compromise in the new year.

NOT BLOODY LIKELY..SEE MY SAWG POST

This scenario strikes a good number of Washington insiders as irresponsible and improbable — who knows how the markets will react? But others argue it will be easier to round up the congressional votes needed for a big compromise if the deadline passes and lawmakers rush back to Washington next month under a starkly new political reality.

The new landscape would allow President Barack Obama to face his liberal base —NOT IF HE KNOWS WHAT'S GOOD FOR HIM AND HIS "LEGACY"!-- and, more importantly, let House Republicans face their conservative constituents — and say in essence: "See, I did the best I possibly could, and it didn't work. The other side didn't blink. Now everyone's taxes have gone up, and it's time for compromise." So long as there is even a day left to negotiate, some hard-liners in both parties will demand that their leaders hold fast. Having the Dec. 31 deadline expire would finally show there's no more time to negotiate. A number of lawmakers in both parties say the fiscal cliff could actually become a gentle slope, with the economic impact quickly mitigated under circumstances easier for Republicans to swallow.

"We can do something on the third of January which isn't unreasonable," said Rep. Jack Kingston, R-Ga., a 20-year House veteran. "And I think it'll pass the Senate real quickly."

IS THERE A PSYCHOLOGIST IN THE HOUSE? OR SENATE?

Demeter

(85,373 posts)Hopes dimming for a wide-ranging bargain, the White House and many congressional Republicans are setting their sights on a more modest deal that would extend current tax rates for most Americans, raise rates for top earners and leave other, vexing issues for the new year. President Barack Obama and House Speaker John Boehner met late Thursday for less than an hour at the White House, but there were few signs of progress. Both sides agreed to describe the talks as "frank," a less than optimistic assessment that suggested the president and the speaker stuck to their opposing positions. Boehner was sticking with his plans to leave for his home state of Ohio on Friday, limiting opportunities for further in-person talks in the coming days.

While Boehner took the lead in negotiations, a growing number of Senate Republicans were calling on their House colleagues to yield on their opposition to letting top tax rates increase on income over $250,000 for couples, while extending Bush-era tax cuts for everyone else. Such a step would require capitulating to Obama's demands, but it would leave other fiscal issues unsolved until 2013, including an increase in the nation's borrowing limit. Republicans have insisted that the debt cap is a key piece of leverage to extract spending cuts from the Obama administration.

"I think it's time to end the debate on rates," Sen. Richard Burr, R-N.C., said. "It's exactly what both parties are for. We're for extending the middle-class rates. We can debate the upper-end rates and what they are when we get into tax reform."

"He's got a full house and we're trying to draw an inside straight," Sen. Johnny Isakson, R-Ga., said. When it was observed that making a straight would still be a losing hand, Isakson said: "Yeah, I know."

White House spokesman Jay Carney conceded that "one aspect of a way to deal with this at the very least would be to pass the tax cuts for 98 percent of the American people. That would deal with a chunk of the so-called fiscal cliff."

But he said Obama remained committed to a broad deal that combined existing spending cuts and reduced the deficit significantly. "He doesn't want to pass up that opportunity," Carney said.

A narrow deal, involving only an increase in top marginal rates for top income earners would guarantee a second round of negotiations and brinkmanship over the debt ceiling. Carney took a hard line on using the debt ceiling as leverage.

"We cannot play this game, because while it might be satisfying to those with highly partisan and ideological agendas, it's not satisfying to the American people and is punishing to the American economy," he said. "We cannot do it."

Thursday evening's meeting came shortly after Obama suggested that the sluggish pace of deficit-cutting talks between the administration and congressional Republicans was a result of a "contentious caucus" of GOP lawmakers who were making it difficult for Boehner to negotiate.

Boehner saw it differently. "Unfortunately, the White House is so unserious about cutting spending that it appears willing to slow-walk any agreement and walk our economy right up to the fiscal cliff," he said earlier in the day.

Thursday night's meeting was the two men's second face-to-face encounter in five days as they seek to find an agreement that avoids major tax increases and across-the-board spending cuts scheduled to kick in in January.

Boehner remains caught between a tea party faction and more pragmatic Republicans advising a tactical retreat....

IT'S LIKE READING TEA LEAVES--OR THE ENTRAILS OF SACRIFICED ANIMALS

xchrom

(108,903 posts)Wal-Mart Stores Inc. (WMT) and Kroger Co. (KR) are among the bidders for assets being sold by Hostess Brands Inc., the bankrupt maker of Wonder bread and Twinkies, said a person familiar with the matter.

There are about two dozen bidders, said the person, who asked not to be named because the process is confidential. Last month, financial adviser Joshua Scherer of Perella Weinberg Partners LP said the liquidation sale may generate about $1 billion.

A few of the bids are for all the assets, some are for just the cakes or breads businesses, and others are interested in individual Hostess plants or products, according to the person. Other first-round bidders include Grupo Bimbo SAB and Alpha Baking Co., the person said.

The 82-year-old maker of Hostess CupCakes, Ding Dongs and Ho Hos said last month that it would liquidate and fire more than 18,000 workers after failing to reach agreement with its striking bakers’ union on concessions to help it emerge from its second bankruptcy. Changes in American diets led to years of declining sales at Hostess, while ingredient costs and labor expenses climbed.

xchrom

(108,903 posts)Euro-area services and manufacturing output contracted at a slower pace than economists forecast in December as European leaders declared progress on the latest plan to combat the debt crisis, now entering its fourth year.

A composite index based on a survey of purchasing managers in both industries rose to 47.3 from 46.5 in November, London- based Markit Economics said today. Economists had forecast a November reading of 46.9, according to the median of 16 estimates a Bloomberg News survey. A reading below 50 indicates contraction. A separate report showed European car sales fell 10 percent in November, bringing registrations so far this year to a 19-year low.

European finance ministers yesterday declared a two-front victory over the fiscal turmoil, assuring a lifeline to Greece and laying the groundwork for a single bank supervisor. Government leaders early this morning pledged to seek a joint strategy for handling failing lenders as the next step toward banking union. The European Central Bank last week left its benchmark rate unchanged as risks to the economy led policy makers to debate a reduction.

“The rate of contraction in output at the euro-zone level is diminishing,” said Ken Wattret, chief euro region economist at BNP Paribas SA in London. “The marked improvement in financial-market conditions and now some improvement in economic conditions mean the likelihood of the European Central Bank cutting rates again have diminished.”

Demeter

(85,373 posts)IT'S AN INTERESTING TRIP TO LOOKING-GLASS WORLD...

Demeter

(85,373 posts)

xchrom

(108,903 posts)A new report from Citizens for Tax Justice explains that among the Fortune 500 corporations, 290 have revealed that they, collectively, held nearly $1.6 trillion in profits outside the United States at the end of 2011. This is one indication of how much they might benefit from a so-called “territorial” tax system, which would permanently exempt these offshore profits from U.S. taxes.

Just 20 of the corporations — including household names like GE, Microsoft, Apple, IBM, Coca-Cola and Goldman Sachs — held $794 billion offshore, half of the total. The data are compiled from figures buried deep in the footnotes of the “10-K” financial reports filed by the companies annually with the Securities and Exchange Commission.

The appendix of the report includes the full list of 290 corporations and the size of their offshore profits in each of the last three years, as well as the state in which their headquarters is located.

Corporate lobbyists and their allies in Congress are pushing for two changes that would benefit their investors but leave America worse off. Neither one of these should be included in any deal coming out of the so-called “fiscal cliff” negotiations.

Demeter

(85,373 posts)Michigan has just passed a corporate servitude law. It is designed to take away many of the worker rights that unions have conferred throughout their history: The right to a living wage. The right to equal pay for women. The right to deferred payments in the form of pensions. The right to negotiate workplace standards and working conditions. The right to overtime pay.

The law is intended to destroy unions, or at least make then ineffective. It says simply that workers do not have to pay union dues to take a job—even if they get benefits previously negotiated by a union. Most workers who don't have to pay dues won't pay, and that will defund the unions, killing them and taking away rights unions have fought hard for over generations. Without workers negotiating as a unified group, corporations will not have to grant those union-created rights. Corporations will have take-it-or-leave-it power over individual workers. In short, this is corporate servitude: you do what you are told and take what you are offered.

The deeper truth about unions is that they don't just create and maintain rights for workers; they work for and create crucial rights in society as a whole. Unions created weekends, the eight-hour workday, and health benefits. And through their politics, they have been at the center of support for civil rights and other social justice issues. In short, unions don't just work for their members. They work for all of us. Including businesses: workers are profit creators.

Since Democratic candidates tend to support the same progressive views, defunding unions would take away their power to campaign for Democratic candidates. The new Michigan law is thus also a partisan law supporting the Republican party...MORE

PERHAPS THE UGLIEST FEATURE OF THIS COUP--IT WASN'T DONE AT THE BEHEST OF THE PEOPLE OF MICHIGAN.

IT WAS DONE AT THE BEHEST OF A SMALL GROUP OF FASCISTS, WITH OUTSIDE SUPPORT AND FUNDING.

AnneD

(15,774 posts)I am a steward for union member Nurses. I say members because I can't tell you how many times I have had a call/complaint from a Nurse. When I ask them if they are a member, I usually get a "No". That is when I say I wish I could help them but I can only deal with member issues. Once the problem occurs, it is pre existing an the union can't do much, but I strongly urge them to become members before the little problems become major ground for termination.

I paid union dues for years and never had a problem. But when I was unfairly terminated 2 years ago, it was the union that talked me through the process of filing a grievance and had an attorney lined up for me. It saved my job and my reputation. I would never even think of working in a non-union shop and I sure as heck would sign up to pay union dues. In fact I an a regular contributor to their political arm and personally donate to our endorsed candidates, in addition to phone banking etc.. In the mass layoff 2 years ago, close to 80% of those union members terminated had a successful resolution of their case; either they were rehired, their contract was bought out or their record was unblemished and they got work in other districts.

It is a set back for sure but we have to organize better and provide members real value for service. I love my union!!!!!!!!!!!

xchrom

(108,903 posts)EU leaders have agreed on a roadmap for eurozone integration beyond the deal on centralised banking supervision, German Chancellor Angela Merkel said.

Specific dates have not yet been agreed for the phases of integration.

But the EU summit chairman, Herman Van Rompuy, said a deal should be reached next year on a joint resolution scheme for winding up failed banks.

Mr Van Rompuy's far-reaching roadmap was the main topic of the two-day Brussels summit.

xchrom

(108,903 posts)Sentiment among Japanese businesses worsened in the three months to December, the Bank of Japan's Tankan survey has indicated, underlining the weakness in the country's economy.

The survey's large manufacturers' index deteriorated to minus 12, from minus three in the previous quarter.

Japanese manufacturers have been hurt by slowing export demand, a strong yen and subdued domestic consumption.

The index plays a role in driving the central bank's monetary policy.

xchrom

(108,903 posts)Fitch has maintained the French government's top credit rating - the only major ratings agency left to say the country deserves to be AAA.

Rival agency Moody's downgraded France in November and while Standard & Poor's cut its rating in January.

However, Fitch has kept its negative outlook, suggesting France could be downgraded soon.

In the eurozone, only Germany has a AAA rating from all three agencies. The UK also has the top credit rating.

xchrom

(108,903 posts)Standard & Poor's (S&P) has become the last of the three main rating agencies to put the UK's top AAA rating on "negative outlook".

S&P said it could lower the UK's rating "if fiscal performance weakens beyond our current expectations".

Fellow agencies Moody's and Fitch both revised the UK to negative outlook in the first half of this year.

The Treasury pointed out that S&P endorsed the government's "strong commitment" to reducing the deficit.

xchrom

(108,903 posts)

Bacon: more people are making a meal of it due to the rising cost of more expensive meats, according to the latest data on the UK's shopping habits. Photograph: Frank Baron for the Guardian

The UK's poorest households are being disproportionately hit by the impact of soaring food prices, according to new government figures that also show the consumption of every major nutrient has fallen in the last four years.

In order to cut costs since 2007, UK households have bought less bread, lamb, beef, fish, fruit, vegetables, potatoes and alcoholic drinks – but more bacon.

The government's annual Family Food survey, which provides the most detailed annual snapshot of food and drink spending and consumption, found that weekly spending per person on all household food in 2011 was £27.99, an increase of 1.5% on the previous year. But because of price rises, that bought less food - 4.2% less in 2011 than in 2007.

The survey also showed how households saved 6.8% by "trading down" to cheaper – and in many cases, less healthy – products, hitting consumption of fresh fruit and vegetables.

kickysnana

(3,908 posts)When I asked what it was she told me "carrots". This I had to see. But she was right but she had also just heated up some precooked bacon.

I guess she didn't want take the chance I might want some. ![]()

AnneD

(15,774 posts)but English 'bacon' is a different leaner cut that American style 'bacon'. Just as what we call Canadian bacon is different from American style. In fact what I got when asking for an American breakfast was something akin to Canadian bacon and very tasty. I had the beans and toast, bangers, mash, fish and chips and of course...spotted dick. Kidney pie left much to be desired. It seemed that English food was cooked to a uniform grey color. The bright spot....some of the best Indian food on the planet, even better than in India.

xchrom

(108,903 posts)i also make sure i have bangers and mash when i'm there -- somehow it's always better there.

xchrom

(108,903 posts)When the words “jobs” and “Europe” are in the same sentence these days, it’s usually not good news. Unemployment in the euro zone hit a record high last month, with 11.4 percent, or 18.2 million people, out of work. More than half of younger workers in Spain and Greece are unemployed. Frustrations over the state of the economy have given rise to violent far-right groups in Greece and protests over job cuts in Spain, including a recent strike by employees at the luxury Parador hotels, which are set in historic castles and palaces.

But for some European nations, the jobs picture is actually a little rosy.

A new report from the European Foundation for the Improvement of Living and Working Conditions shows that employment in Europe’s tiniest member states — Malta and Luxembourg — actually grew dramatically throughout the recession, and that Germany, Poland and Austria are also showing gains. (The blue lines are for 2010-2012, the green ones for 2008-2010:

Demeter

(85,373 posts)THIS IS WHERE OBAMA CAN PROVE HIS METTLE.

http://www.newyorker.com/online/blogs/johncassidy/2012/12/why-is-big-business-supporting-obama.html

I can’t help it. When I see Fortune 500 titans like Rex Tillerson, the chief executive of ExxonMobil, calling for higher taxes on the rich, I suspect there’s something fishy happening. Tillerson, a conservative Texan who earned about thirty-five million dollars last year and is a longtime skeptic of global warming, is one of the dozens of prominent businessmen who have signed an open letter calling on “Congress to agree on more revenue—whether by increasing rates, eliminating deductions, or some combination thereof.” The call to soak the rich—for that was what it amounted to—was released under the auspices of the Business Roundtable, a lobbying group for America’s biggest corporations. If Tillerson’s name was perhaps the most surprising C.E.O. signatory, there were plenty of others that bear scrutiny, such as Doug Oberhelman, of Caterpillar; Riley Bechtel, of Bechtel; Michael Dell, of Dell Computer; and Michael Duke, of Walmart. Oberhelman endorsed Mitt Romney; Bechtel served on an advisory board in the Bush Administration; Dell and Duke have each contributed to numerous G.O.P. candidates. Why would such men do a big favor to the White House, which is seeking business support to put pressure on the Republicans and to knock down charges it is leading the country in the direction of high-tax Europe? According to the C.E.O.s’ letter, it is all about avoiding the dire consequence for the economy if no deal is done before January 1st on taxes and spending:

Who said that America’s overpaid C.E.O.s are only in it for themselves? In order to head off the possibility of another economic downturn, they are willing to bear a tax increase. And all they are demanding in return is that some less fortunate folks who don’t have retirement packages that extend into eight figures take a hit to their Social Security and Medicare benefits:

After reading this clarion call, I was feeling so uplifted that I went for a mid-morning cup of tea. When I got back to my desk, I happened across another headline about the fiscal cliff, this one in the Wall Street Journal: “Corporate Taxes on Table in Cliff Talks.” The story began:

That’s a bit strange, I thought. The C.E.O.s didn’t mention anything about corporate taxes in their letter, although it’s no secret that they have long been pushing for a break. Under the current system, companies like Boeing and General Motors pay to the federal government thirty-five per cent of their taxable U.S. profits, which is higher than the rate assessed in some countries, such as Germany (fifteen per cent), Japan (25.5 per cent) and the United Kingdom (twenty-six per cent). Because of an array of loopholes and deductions, the actual rate that corporations pay is much lower than thirty-five per cent, but that hasn’t prevented business groups like the Business Roundtable and the Chamber of Commerce, and their Republican allies, from insisting that the rate differential makes American firms uncompetitive. During the Presidential campaign, Mitt Romney said he would cut the rate to twenty-five per cent. Other G.O.P. candidates said they would go even further. Herman Cain famously called for a nine-per-cent rate. Now, according to the Journal, which is usually reliable on these things, the White House is quietly saying it will go at least some way in the direction that corporate America wants to go. Its “corporate-tax suggestion wasn’t specific other than committing to overhaul the corporate tax code in 2013,” the report said. “White House officials, in making the suggestion, cited a corporate-tax plan the administration unveiled in February but said they weren’t wedded to any specifics.” Note the phrase “weren’t wedded to any specifics.” Back in February, President Obama, in an effort to compete with the Republicans, proposed cutting the corporate-tax rate from thirty-five per cent to twenty-eight per cent. But this proposal was much less of a giveaway than it appeared. The Administration also called for the elimination of loopholes—for example, it suggested that that U.S. multinationals should pay a minimum amount of tax on their overseas earnings, which are often kept abroad to avoid any U.S. taxes. Google, for example, ended up paying a tax rate of more than fourteen per cent on its U.S earnings and 3.2 per cent (that’s no typo) on its overseas earnings. In the face of opposition from the business community and Republicans in Congress, the President’s proposal went nowhere.