Economy

Related: About this forumWeekend Economists Kickoff the Season, September 6-8, 2013

It is the start of football season, the start of school, and the start of Autumn following shortly thereafter.

It is the start of Budget Mania in Washington, with a Debt Ceiling kicker.

If we are very unfortunate, it is the start of the punishment of random innocent Syrians for the actions of the bastard who used chemical weapons on random innocent Syrians, and which will probably ignite World War 3.

In other words, the Silly Season in DC goes into full swing. And of course, there are local elections coming up.

The football cognoscenti among us are going to talk football. I'll throw in the stuff I can find.

I do know that Saturday night U of Michigan hosts its second ever night game, against Notre Dame, after which Notre Dame will pack up and never darken our stadium's doors again. Until the scheduled season changes. C'est la Vie!

Demeter

(85,373 posts)but check this space for updates!

Demeter

(85,373 posts)In a few days, we’ll reach the fifth anniversary of the fall of Lehman Brothers — the moment when a recession, which was bad enough, turned into something much scarier. Suddenly, we were looking at the real possibility of economic catastrophe.

And the catastrophe came.

Wait, you say, what catastrophe? Weren’t people warning about a second Great Depression? And that didn’t happen, did it? Yes, they were, and no, it didn’t — although the Greeks, the Spaniards, and others might not agree about that second point. The important thing, however, is to realize that there are degrees of disaster, that you can have an immense failure of economic policy that falls short of producing total collapse. And the failure of policy these past five years has, in fact, been immense. (THERE'S STILL TIME FOR THE 1% TO FINISH THE JOB--DEMETER) Some of that immensity can be measured in dollars and cents. Reasonable measures of the “output gap” over the past five years — the difference between the value of goods and services America could and should have produced and what it actually produced — run well over $2 trillion. That’s trillions of dollars of pure waste, which we will never get back. Behind that financial waste lies an even more tragic waste of human potential. Before the financial crisis, 63 percent of adult Americans were employed; that number quickly plunged to less than 59 percent, and there it remains. How did that happen? It wasn’t a mass outbreak of laziness, and right-wing claims that jobless Americans aren’t trying hard enough to find work because they’re living high on food stamps and unemployment benefits should be treated with the contempt they deserve. A bit of the decline in employment can be attributed to an aging population, but the rest reflects, as I said, an immense failure of economic policy.

Set aside the politics for a moment, and ask what the past five years would have looked like if the U.S. government had actually been able and willing to do what textbook macroeconomics says it should have done — namely, make a big enough push for job creation to offset the effects of the financial crunch and the housing bust, postponing fiscal austerity and tax increases until the private sector was ready to take up the slack. I’ve done a back-of-the-envelope calculation of what such a program would have entailed: It would have been about three times as big as the stimulus we actually got, and would have been much more focused on spending rather than tax cuts. Would such a policy have worked? All the evidence of the past five years says yes. The Obama stimulus, inadequate as it was, stopped the economy’s plunge in 2009. Europe’s experiment in anti-stimulus — the harsh spending cuts imposed on debtor nations — didn’t produce the promised surge in private-sector confidence. Instead, it produced severe economic contraction, just as textbook economics predicted. Government spending on job creation would, indeed, have created jobs.

But wouldn’t the kind of spending program I’m suggesting have meant more debt? Yes — according to my rough calculation, at this point federal debt held by the public would have been about $1 trillion more than it actually is. But alarmist warnings about the dangers of modestly higher debt have proved false. Meanwhile, the economy would also have been stronger, so that the ratio of debt to G.D.P. — the usual measure of a country’s fiscal position — would have been only a few points higher. Does anyone seriously think that this difference would have provoked a fiscal crisis? And, on the other side of the ledger, we would be a richer nation, with a brighter future — not a nation where millions of discouraged Americans have probably dropped permanently out of the labor force, where millions of young Americans have probably seen their lifetime career prospects permanently damaged, where cuts in public investment have inflicted long-term damage on our infrastructure and our educational system.

Look, I know that as a political matter an adequate job-creation program was never a real possibility. And it’s not just the politicians who fell short: Many economists, instead of pointing the way toward a solution of the jobs crisis, became part of the problem, fueling exaggerated fears of inflation and debt. Still, I think it’s important to realize how badly policy failed and continues to fail. Right now, Washington seems divided between Republicans who denounce any kind of government action — who insist that all the policies and programs that mitigated the crisis actually made it worse — and Obama loyalists who insist that they did a great job because the world didn’t totally melt down.( BUT THEY ARE BOTH WRONG, STILL--DEMETER) Obviously, the Obama people are less wrong than the Republicans. But, by any objective standard, U.S. economic policy since Lehman has been an astonishing, horrifying failure.

Demeter

(85,373 posts)American football and its rules evolved from other codes of football, rugby and association (soccer). The first game was played on November 6, 1869. A set of rule changes drawn up from 1880 onward by Walter Camp established the snap, eleven-player teams and downs. Later rule changes legalized the forward pass, created the neutral zone and specified the width of the football. It is one of the two main forms of gridiron football, the other being Canadian football.

American football is the most popular sport in the United States and the National Football League's championship game, the Super Bowl, is among the most-watched sporting events in the world.

My father played football in high school, and after a car crash injured his spine, gave it up for engineering. He did not spend a significant amount of time following the sport, or any team.

In high school, I played trombone in the band, and got my total exposure through that. nothing like today's stuff, though.

More like this:

and of course, now I'm learning this one:

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)and

Demeter

(85,373 posts)American football evolved from the sport of rugby football. The first football game was played on November 6, 1869 between Rutgers and Princeton. The game was played between two teams of 25 players each, used a round ball, and resembled a combination of rugby and soccer in its rules. The ball could not be picked up or carried, but it could be kicked or batted with the feet, hands, head or sides.

Collegiate play continued for several years in which matches were played using the rules of the host school. Representatives of Yale, Columbia, Princeton and Rutgers met on October 19, 1873 to create a standard set of rules. Teams were set at 20 players each, and fields of 400 by 250 feet were specified. Harvard abstained from the conference, as they favored a rugby-style game that allowed running with the ball.

An 1875 Harvard-Yale game played under rugby-style rules was observed by two impressed Princeton athletes. These players introduced the sport to Princeton, a feat the Professional Football Researchers Association compared to "selling refrigerators to Eskimos." Princeton, Harvard, Yale and Columbia then agreed to intercollegiate play using a form of rugby union rules with a modified scoring system. These schools formed the Intercollegiate Football Association, although Yale did not join until 1879. Yale player Walter Camp, now regarded as the "Father of American Football," passed rule changes in 1880 that reduced the team size from 15 to 11 players and instituted the snap to replace the chaotic and inconsistent scrum.

Evolution of the game

The introduction of the snap resulted in unexpected strategy changes. Previously, the strategy had been to punt if a scrum resulted in bad field position. A group of Princeton players realized that, as the snap was uncontested, they now could hold the ball indefinitely to prevent their opponent from scoring. In 1881, both contestants in a Yale-Princeton game used this strategy to maintain their undefeated records. Each team held the ball, gaining no yardage, for an entire half. This "block game" proved extremely unpopular with spectators and fans.

A rule change was necessary to prevent this, and a reversion to the scrum was considered until Camp passed a rule in 1882 that stated that a team would have three downs, or tackles, to advance the ball five yards. Failure to do so would forfeit control of the ball to the other team. This change made American football a separate sport from rugby, and the resulting five-yard lines added to the field made it resemble a gridiron in appearance. Other major rules changes included a reduction of the field size, to 110 yards long by 53.3 yards wide, and the adoption of a scoring system that awarded four points for a touchdown, two for a safety and a goal following a touchdown, and five for a goal from field. The last major remnant of rugby was removed in 1888, when tackling below the waist was legalized.

Football remained a violent sport despite these innovations. Dangerous mass-formations like the flying wedge resulted in serious injuries and even death. A 1905 peak of 19 fatalities nationwide resulted in President Theodore Roosevelt's threat to abolish the game unless major changes were made. Sixty-two schools met in New York City to discuss rule changes on December 28, 1905. These proceedings resulted in the formation of the Intercollegiate Athletic Association of the United States, later named the National Collegiate Athletic Association (NCAA).

The legal forward pass was introduced in 1906 after its suggestion by John Heisman, although its impact was limited due to the restrictions placed on its use. Further 1906 rules changes included the reduction of the time of play from 70 to 60 minutes and the increase of the distance requirement for a first down to 10 yards over three downs. Additionally, the neutral zone was created along the width of the football. Field goals were lowered to three points in 1909 and touchdowns raised to six points in 1912. The field was also reduced to 100 yards long, but two 10-yard-long end zones were created, and teams were given four downs instead of three to advance the ball 10 yards. The roughing-the-passer penalty was implemented in 1914, and eligible players were first allowed to catch the ball anywhere on the field in 1918.

The professional era

The first instance of professional play in football was on November 12, 1892, when William "Pudge" Heffelfinger was paid $500 to play a game for the Allegheny Athletic Association in a match against the Pittsburgh Athletic Club. This is the first recorded instance of a player being paid to participate in a game of American football, although many athletic clubs in the 1880s offered to help players attain employment, gave out trophies or watches that players would pawn for money, or paid double in expense money. Football at the time had a strict sense of amateurism, and direct payment to players was frowned upon, if not outright illegal.

Professional play became common, and with it came rising salaries, unpredictable player movement, and the illegal use of amateur collegiate players in professional games. The National Football League, a group of professional teams that was originally established in 1920 as the American Professional Football Association, aimed to solve these problems. This new league's stated goals included an end to bidding wars over players, prevention of the use of college players, and abolition of the practice of paying players to leave another team. The NFL by 1922 had established itself as the premier professional football league.

The dominant form of football at the time was played at the collegiate level, but the upstart NFL received a boost to its legitimacy in 1925 when an NFL team, the Pottsville Maroons, defeated a team of Notre Dame all-stars in an exhibition game. A greater emphasis on the passing game helped professional football to further distinguish itself from the college game during the late 1930s. Football in general became increasingly popular following the 1958 NFL Championship game, a match between the Baltimore Colts and the New York Giants that is still referred to as the "Greatest Game Ever Played". The game, a 23–17 overtime victory by the Colts, was seen by millions of television viewers and had a major impact on the popularity of the sport. This helped football to become the most popular sport in the United States by the mid-1960s.

A rival, the American Football League (AFL), arose in 1960 and challenged the NFL's dominance. The AFL began in relative obscurity but survived for several years due to a television contract with the ABC network. Competition for players heated up in 1965, when the AFL New York Jets signed rookie Joe Namath to a then-record US $437,000 contract. A five-year, $40 million NBC television contract followed, which helped to sustain the young league. The bidding war for players ended in 1966, when the two leagues agreed on a merger that would take full effect in 1970. This agreement provided for a common draft that would take place each year, and it instituted an annual championship game to be played between the champions of each league. That game began play in 1966 and came to be known as the Super Bowl.

College football maintained a tradition of postseason bowl games. Each bowl game would be associated with a particular conference, and earning a spot in a bowl game was the reward for winning a conference. This arrangement was profitable, but it tended to prevent the two top-ranked teams from meeting in a true national championship game, as they would normally be committed to the bowl games of their respective conferences. Several systems have been used since 1992 to determine a national champion of college football. The first was the Bowl Coalition, in place from 1992 to 1994. This was replaced in 1995 by the Bowl Alliance, which gave way in 1997 to the Bowl Championship Series (BCS). The BCS arrangement has been controversial, and will be replaced in 2014 by a four-team playoff system.

American football is today the most popular sport in the United States. In a 2013 poll conducted by Harris Interactive, professional and college football were the first and third most popular sports, respectively, and 45% of participants ranked some form of the game as their favorite sport. The Super Bowl is the most popular single-day sporting event in the United States and is among the biggest club sporting events in the world.

Demeter

(85,373 posts)He’s there in every corner of Congress where a microphone fronts a politician, there in Russia and the British Parliament and the Vatican. You may think George W. Bush is at home in his bathtub, painting pictures of his toenails, but in fact he’s the biggest presence in the debate over what to do in Syria. His legacy is paralysis, hypocrisy and uncertainty practiced in varying degrees by those who want to learn from history and those who deny it. Let’s grant some validity to the waffling, though none of it is coming from the architects of the worst global fiasco in a generation...Time should not soften what President George W. Bush, and his apologists, did in an eight-year war costing the United States more than a trillion dollars, 4,400 American soldiers dead and the displacement of two million Iraqis. The years should not gauze over how the world was conned into an awful conflict. History should hold him accountable for the current muddy debate over what to do in the face of a state-sanctioned mass killer. Blame Bush? Of course, President Obama has to lead; it’s his superpower now, his armies to move, his stage. But the prior president gave every world leader, every member of Congress a reason to keep the dogs of war on a leash. The isolationists in the Republican Party are a direct result of the Bush foreign policy. A war-weary public that can turn an eye from children being gassed — or express doubt that it happened — is another poisoned fruit of the Bush years. And for the nearly 200 members of both houses of Congress who voted on the Iraq war in 2002 and are still in office and facing a vote this month, Bush shadows them like Scrooge’s ghost.

In reading “Lawrence in Arabia,” Scott Anderson’s terrific new biography of one outsider who truly understood the tribal and religious conflicts of a region that continues to rile the world, you’re struck by how a big blunder can have a titanic domino effect. The consequences of World War I, which started 100 years ago next year, are with us still — particularly the spectacularly bad decisions made by European powers in drawing artificial boundaries in the Mideast. Syria and Iraq are prime examples. Until the Syrian crises came to a head, we had yet to see just how much the Bush fiasco in Iraq would sway world opinion. We know now that his war will haunt the globe for decades to come. Future presidents who were in diapers when the United States said with doubtless authority that Saddam Hussein had weapons of mass destruction will face critics quoting Bush, Donald Rumsfeld and Dick Cheney with never-again scorn. The parallels are imprecise and many degrees apart: Iraq was a full-scale invasion, Syria is a punishment. But there it is — the Bush hangover, felt by all.

At the least, when the main cheerleaders for the last war talk about what to do now, they should be relegated to a rubber room reserved for Bernie Madoff discussing financial ethics or Alex Rodriguez on cheating in baseball...Rumsfeld has been all over the airwaves with fussy distinctions about this war and his, faulting Obama for going to Congress for approval to strike. Like the man he served in office, he shows not a hint of regret or evidence that he’s learned a thing. “You either ought to change the regime or you ought to do nothing,” he said this week, as if he were giving fantasy football advice. Calling Obama a weak leader, he said: “Did he need to go to Congress? No. Presidents as commanders in chief have authority, but they have to behave like a commander in chief.” In other words, more swagger, bluster and blind certainty...Liz Cheney, in a feckless run in Wyoming for the Senate highlighted by a sellout of her own lesbian sister’s right to marry, says she would vote against the resolution to use force in Syria. She’s made a career, such as it is, backing her father’s legacy of waterboarding, nation invading and pillorying supporters of diplomacy before war....And Senator Marco Rubio, robust defender of the Iraq war, has just cast a no vote on taking action against Syrian President Bashar al-Assad. He did this for one reason: to fend off the Bush-spawned neo-isolationists who will play a big role in the 2016 presidential nomination.

There are people on the public stage who have genuinely agonized over lessons of the Bush disaster. They say, with some conviction, that they will never be fooled again. But for all of these neocons stuck on the wrong side of history — Dick Cheney, Donald Rumsfeld, John Bolton, say the names loud and clear — it’s not a change in conscience at work; it’s a change in presidents. Later this month, dozens of Republicans in Congress will make the same decision, simply because they hate Obama, and would oppose him if he declared Grandmother Appreciation Day. The voice that stands out most by his silence, the one that grates with its public coyness, is Bush himself. He has refused to take a side in the Syrian conflict. The president, he said, “has a tough choice to make.” Beyond that, “I refuse to be roped in.” This is cowardice on a grand scale. Having set in motion a doctrine that touches all corners of the earth and influences every leader with a say in how to approach tyrants who slaughter innocents, Bush retreats to his bathtub to paint.

COWARDICE? W DOESN'T KNOW THE MEANING OF FEAR....EXCEPT WHEN THE TOWERS CAME DOWN. THEN HE DIDN'T HAVE A SECURE LOCK ON EVENTS. BUT THAT'S ALL OVER NOW. HE'S INVINCIBLE. HE DOESN'T HAVE TO DO ANYTHING MORE. AND SO, HE DOESN'T. WE ARE ALL GRATEFUL FOR HIS IDLENESS IN RETIREMENT....AND HOPE HE GETS HIS JUST REWARD SOONER RATHER THAN LATER.

Demeter

(85,373 posts)...Stockton is the second-most dangerous city in California, to FBI statistics....

"There are still an unacceptable number of hours in a day when police will only respond to crimes in progress," says Bob Deis, the city manager. But problems with crime and city finances aren't as bad as they were. Stockton intends to present a federal judge with its plan to get out of bankruptcy as early as this month. There's no guarantee the city will meet with success. It continues to face legal challenges and one incredibly steep political hurdle: Convincing residents who have not been getting much by way of government services that they should start paying higher taxes. In November, Stockton voters will have to decide whether to raise the sales tax by three-quarters of a penny, from 8.25 to 9 percent, which would raise roughly $30 million a year.

"If we can get the tax measure passed — and that's a big if — Stockton will be well on its way to recovery," says Katherine Miller, a member of the city council. "We won't be rolling in dough or anything, but we'll be through the crisis."

Most of the money would be devoted to hiring cops, but a portion would be used to pay down debt...A nearby industrial park has emptied out, the jobs gone elsewhere. In the park itself, the water in the swimming pool has turned a sludgy shade of pine green. "It's never been changed for, like, three years," Beltran says. There's no question services have suffered as a result of budget cuts. Due to furloughs, city offices are closed every other Friday. Library hours are shorter and recreation programs for kids and seniors alike have been slashed. But if the tax measure fails, Miller warns, cuts will grow more drastic. Parks and libraries would be shut altogether. The fire department budget, already reduced 37 percent, would be cut an additional 14 percent. "In our case, you can't cut any more and be a viable city," says Deis, the city manager....City officials recognize they have a long way to go to win back the trust of the public. Prior generations of leaders banked on growth that never happened, spending big dollars on waterfront and downtown developments and offering unaffordably generous compensation packages to city workers.

"Two years ago, three years ago, the city was not deserving of additional resources," says Deis, the city manager. "Unfortunately, we had to fix 15 to 20 years of mismanagement in a year or two."

Stockton's leaders will have to convince taxpayers that they're now doing the right thing. What's more, they also have to convince a judge that their plan moving forward is the right one. It could be a tough sell. The city has eliminated retirement health benefits for its workers, saving about $1 billion over the next 30 years. But the city still faces pension debt of up to $332 million. It's been years since city workers have seen a raise and their retirement packages have already been cut at least 30 percent with the loss of health benefits, Deis says. Stockton can't attract or retain workers if pensions go, too. (Since 2009, the city has reduced its workforce, outside the public safety functions, by 42 percent.) But asking bondholders and other creditors to take big losses while refusing to trim pensions won't fly, predicts Michael Sweet, a municipal finance lawyer in San Francisco.

"The city has indicated they will not impair the pensions, although the judge has told them he might not be able to approve a plan that doesn't do that," Sweet says. "He said the day of reckoning will come on these issues."

Rising From The Bottom

Despite all this — despite the legal wrangling in bankruptcy court and the fight over taxes and the political food-fighting at City Hall — Stockton is actually doing better than it was not so long ago. Parts of the city have always remained pleasant and prosperous. But even in the troubled parts of town, things aren't slipping out of control, the way they seemed to be doing leading up to the bankruptcy. With California's housing market heating up, the foreclosure rate — a major factor in Stockton's fall — is now the national average. There's more of a visible law enforcement presence, thanks to other governments, if not any more police. A dozen city parks have been adopted by their neighborhoods or nonprofit groups and are getting some much-needed maintenance.

"The city seems to be flourishing, more than before they declared bankruptcy," says Gwen Davis, a Stockton resident looking for work in medical billing. "As a matter of fact, it seems like there's more police."

How To Avoid Landmines

If Stockton can get its plan approved, it will have emerged out of bankruptcy in well under two years — a much faster turnaround than happened in nearby Vallejo, which faced a much smaller set of financial problems when it went bust in 2008. Miller, the city councilwoman, says that people in Detroit and other cities in crisis will be pointing to Stockton and saying, "That's how you do it." She may be right. Stockton's choices were all terrible, but city officials owned up to the mistakes of the past and made the difficult choices needed to chart a sustainable course. They may not get there. The fiscal plan will have to be torn up if voters aren't convinced the city deserves more of their money. But regardless of how the tax measure plays out, the type of waste that long typified Stockton's spending habits appears to be a thing of the past.

"Believe it or not, this is now one of the more fiscally savvy cities in the state," says Michael Fitzgerald, a columnist with the Stockton Record. "We've all read the big boring book of bonds to avoid stepping on any more landmines."

Demeter

(85,373 posts)When Devon Walker returned to the Tulane University campus last week, he was greeted with kisses in the hallways. Students and faculty applauded him. One year ago this weekend, in the second game of the football season, Walker, a team captain for Tulane, went in for a tackle and broke his neck. He was paralyzed from the shoulders down. For months, he recovered far from home in two different hospitals. But now he's back in Louisiana and re-enrolling at Tulane, in New Orleans. When asked how he's doing, Walker keeps it simple. "I'm fine, I'm fine," he says. He usually doesn't go into the details: the challenge of using a ventilator to talk. How he can't sleep at night because he just can't get comfortable. Or about the searing nerve pain he suffers all too often, his whole body burning like it's on fire.

There was no need to rush back to school. But Walker did.

"I guess I'm pretty stubborn when it comes to a lot of things. You can ask a lot of my friends and stuff; they can attest to that," Walker says. "When I get something on my mind, I just do it. And if it doesn't happen when I think it's gonna happen, I'm going to keep fighting to make it happen sooner or later."

...A year later, the football team still prays for Walker's recovery while Walker himself is working for it. He's bound to a wheelchair. Just leaving the house in the morning takes 90 minutes and the help of a nurse. Still, three days a week, he's at a rehabilitation center at Touro Infirmary in New Orleans, pushing his therapists to push him.

"I'll put it this way: Sometimes I need a break before Devon needs a break," says Holly Pellerito, Walker's occupational therapist. She worries that Walker might be trying to do too much, too soon.

But this young man has goals. He wants to graduate, with a degree in cell and molecular biology, in the spring. And physically, there's at least some reason for hope. In Walker's arm muscles, Pellerito says, there's twitching.

"So there's something there. There's some connection being made," she says. "So we're not gonna stop until we can try to make something functional."

MORE PATHOS AT LINK

Demeter

(85,373 posts)U.S. employers hired fewer workers than expected in August and the jobless rate hit a 4-1/2-year low as Americans gave up the search for work, complicating the Federal Reserve's decision on whether to scale back its massive monetary stimulus this month. Nonfarm payrolls increased by 169,000 jobs last month, the Labor Department said on Friday, falling short of the 180,000 Wall Street had expected and adding to signs that economic growth may have slowed a bit in the third quarter. While economists believe the Fed could still announce a tapering of its monthly bond purchases at its September 17-18 policy meeting, they said the weak data increased chances of a delay.

"A compromise between hawks and doves might be that the tapering will be announced in September but that the purchase amount will be reduced by an even smaller amount than we currently anticipate," said Harm Bandholz, chief U.S. economist at Unicredit Research in New York.

The U.S. central bank has been buying $85 billion in bonds per month to hold interest rates down. A Reuters poll of big bond dealers conducted after the jobs data was released found that 13 of the 18 institutions expect the Fed to dial back its purchases this month. Of those 13, the median forecast was for a cut of $15 billion. The dollar fell from a seven-week high against the euro and slumped against the yen after the jobs report. The data also fueled a rally in U.S. government bonds, with the yield on the benchmark 10-year note falling back below 3 percent. U.S. stocks ended little changed as investors remained jittery over a potential military strike against Syria.

Not only did hiring miss expectations last month, but the job count for June and July was revised to show 74,000 fewer positions added than previously reported. While the unemployment rate fell a tenth of a percentage point to 7.3 percent, its lowest level since December 2008, the decline reflected a drop in the share of working-age Americans who either have a job or are looking for one. That participation measure reached its lowest point since August 1978, a further sign of underlying economic weakness. The rate for men touched a record low.

"Declining participation is bad for financing entitlements long-term and the potential economic growth trend," said John Silvia, chief economist at Wells Fargo in Charlotte, North Carolina.

MUCH HAND-WAVING AND CONFIDENCE FAIRY-TALES AT LINK

Demeter

(85,373 posts)...On September 17-18 the Federal Reserve Open Market Committee will meet to decide if they should begin the “taper” — the slow withdrawal of monetary stimulus begun with the first rate cut on September 2007. Much depends on their decision. The Fed’s announcement that the taper is coming has doubled the ten year treasury rate — now slightly below the 3% level at which severe disruptions are likely. This interest rate rise is affecting US industries, seen in trend in housing starts and purchase mortgage applications — and disrupted money flows which have destabilized many emerging nations. That’s just from announcement of the taper. The actual event will produce even larger waves. Especially with the state of the economy so uncertain.

How’s the economy doing?

Although most economists expect a continuation of the acceleration of growth from the near-standstill of Q4 2012 — which warrants the withdrawal of the monetary and fiscal stimulus programs — the economic data does not show it. So far there are few signs of the sustainable acceleration of growth that so many have seen soon ahead for so long. Fed tapering could turn ugly with energy prices high, the sequester’s effects still being felt, and rates rising fast. Who can say for certain? Most surveys of people show growing confidence: surveys of builders, of consumers (Conference Board, Michigan Survey), and especially of purchasing managers. But the actual economic data is less exciting. Almost all show either continued slow growth or slowing growth. For results from a wide range of indicators see Status report on the US economy. Here are a few of special interest. Start with the Big Four, looking anemic in July and August:

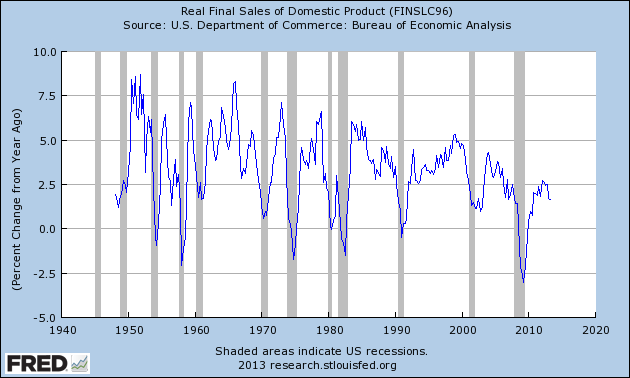

Another important indicator: YoY percent change in real final sales of domestic product. At +1.6% in Q2, this was at a level only associated with recessions excerpt for one occasion: an oddball print of +1.3% in Q3 of 1956.

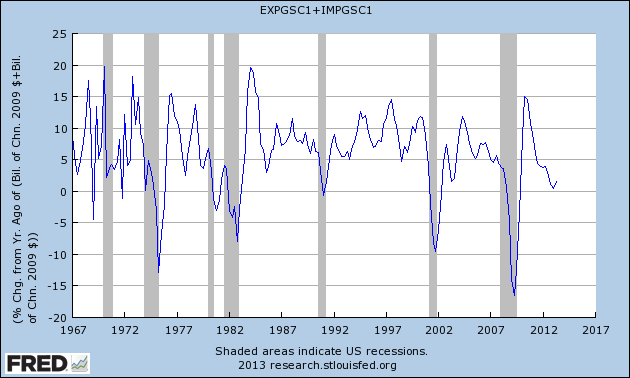

Another dark picture: YoY percent change in real trade of goods and services (imports plus exports). Also at a level seen only before or in recessions, except for Q4 of 1972.

SUPPORTING LINKS AND COMMENTARY FOLLOWS

Demeter

(85,373 posts)Bank of America Corp agreed to pay $39 million to settle a gender bias lawsuit by female brokers who claimed they were paid less than men and deprived of handling their fair share of lucrative accounts, court papers made public on Friday show. The settlement was disclosed less than two weeks after news that the bank reached a $160 million settlement with hundreds of black Merrill Lynch & Co brokers who alleged racial bias in pay, promotions and how big accounts were allocated. About 4,800 current and former female financial advisers and trainees at Bank of America and Merrill, which the bank bought in January 2009, are eligible for the latest settlement.

The lawsuit filed on their behalf accused Bank of America and Merrill of intentionally discriminating by favoring male brokers when awarding pay, allocating client accounts and referrals, and providing professional and marketing support. According to court papers, such practices created a "cumulative advantage" effect that perpetuated and widened earnings disparities by gender. Bank of America was also accused of retaliating against female brokers who complained of bias. The three-year settlement agreement requires Bank of America to retain an independent monitor to oversee improvements to its practices, and hire a consultant to study how it "teams" brokers and how its teaming practices affect the allocation of accounts.

Bank of America did not admit wrongdoing in agreeing to the settlement, which requires approval by U.S. District Judge Pamela Chen in Brooklyn, New York.

"The world of financial advisers remains a very male environment in this company and this industry," said Rachel Geman, a partner at Lieff Cabraser Heimann & Bernstein representing the plaintiffs, in an interview.

She said the settlement provides "significant monetary relief, as well as programmatic relief to help insure that women are on a fair playing field."

Bill Halldin, a Bank of America spokesman, said the bank is pleased to settle, and that the accord "will enrich our existing diversity, inclusion and development programs, providing even more opportunities for women to succeed as financial advisers."

DETAILS AT LINK

Demeter

(85,373 posts)mjayrosenberg.com/2013/09/06/its-a-cold-world-why-we-shouldnt-bomb-syria-by-jeremy-gruenbaum/

There should be a punishment for anyone who uses chemical weapons to kill people. It seems to me that in a perfect world, the only acceptable punishment would be to remove Assad from power and either kill him or charge him in the ICC. The problem is, you can’t just remove a dictator and expect everything to work out. Iraq taught us that. It’s a lesson we can’t afford to forget.

The only way I’d support removing Assad by force would be if the entire UN Security Council agreed AND all the countries contributing to the military effort guaranteed that they’d provide adequate troops to secure Syria after Assad is gone. That means something like maybe 300,000-500,000 troops (including troops from China and Russia) for up to a decade. In other words, a huge commitment no country should have to make.

Of course, no one is talking about a decade-long, international occupation of Syria. They’re talking about unilateral “limited airstrikes” that won’t remove Assad from power. What is their purpose? They’re just empty gestures to make us feel better about ourselves. There’s a good chance Assad, backed into a corner, would lash out at Syrians again, or perhaps at US interests in the region. Certainly we should expect that Al Qaeda and other anti-US terror groups in the region would try to attack US/Israeli interests across the Middle East.

And what if Assad continues massacring his people after we attack? The world will expect us to do something. Either we do these “limited airstrikes” indefinitely, or we have to up the ante and invade...

MORE SWEET RHYME AND PURE REASON AT LINK

Demeter

(85,373 posts)Hopes for a positive G20 summit crumbled today as President Obama blurted to Russia’s Vladimir Putin at a joint press appearance, “Everyone here thinks you’re a jackass.” The press corps appeared stunned by the uncharacteristic outburst from Mr. Obama, who then unleashed a ten-minute tirade at the stone-faced Russian President.

“Look, I’m not just talking about Snowden and Syria,” Mr. Obama said. “What about Pussy Riot? What about your anti-gay laws? Total jackass moves, my friend.”

As Mr. Putin narrowed his eyes in frosty silence, Mr. Obama seemed to warm to his topic.

“If you think I’m the only one who feels this way, you’re kidding yourself,” Mr. Obama said, jabbing his finger in the direction of the Russian President’s face. “Ask Angela Merkel. Ask David Cameron. Ask the Turkish guy. Every last one of them thinks you’re a dick.”

Shortly after Mr. Obama’s volcanic performance, Mr. Putin released a terse official statement, reading, “I should be afraid of this skinny man? I wrestle bears.”

After one day of meetings, the G20 nations voted unanimously on a resolution that said maybe everyone should just go home.

HEAR, HEAR!

Demeter

(85,373 posts)I'll try for better in the morning. Sweet dreams!

hamerfan

(1,404 posts)A Dying Cubs Fan's Last Request by Steve Goodman:

Oops, wrong sport. Still a cool song by a great songwriter.

RIP, Steve.

hamerfan

(1,404 posts)Still nothing about football, but this song does mention Michigan.

The Wreck Of The Edmund Fitzgerald by Gordon Lightfoot:

Fuddnik

(8,846 posts)It used to bring ore to our docks. We hauled out the carloads of ore that was offloaded to our docks.

There was another one named the "Paul Thayer" who was a Chairman of LTV. He later became Reagans Undersecretary of Defense, and was convicted of bribery and insider trading (when here was such a thing). They slapped a coat of paint on it with a new name.

xchrom

(108,903 posts)Greek Prime Minister Antonis Samaras says the country's six years of recession will end next year.

He said that Greece was now an "island of stability" in an ever less stable region.

Mr Samaras was speaking at the Thessaloniki trade fair, which has been the scene of protests about the country's tough austerity measures.

More protests are expected on Saturday, this time in support of civil servants who face losing their jobs.

Demeter

(85,373 posts)xchrom

(108,903 posts)G20 members say they expect to begin automatically sharing tax information by the end of 2015.

The system of information sharing forms part of plans to tackle global tax evasion.

In a communique published on Friday, G20 leaders said they would take steps to close loopholes that allow legal tax avoidance by big businesses.

They also pledged to help developing nations tackle tax evasion by helping them track funds in tax havens.

xchrom

(108,903 posts)In the end, even a meeting between Barack Obama and Vladimir Putin failed to deliver results. Participants at the G-20 summit in St. Petersburg couldn't manage to find a common position on Syria. The American president demanded that punitive action be taken against Syria, but his Russian counterpart stood between Obama and his allies. Now any decision on a possible military strike against Damascus will be up to the US Congress.

Washington has left no doubt that, from this point on, it will prepare an intervention without a United Nations mandate. Samantha Power, the US ambassador to the UN, said negotiations in the Security Council had failed because of opposition from Moscow. And it is also unclear whether Washington will still wait for a report on the use of poison gas in Syria before taking action. It could still take a few more weeks before that report is delivered.

No Common Position

The failure at the G-20 summit to reach an agreement that would have enabled a Security Council deal was expected. The meeting of the world's 20 most important industrialized and emerging nations was originally conceived as an economic forum. Its limits are quickly reached when it is used to discuss issues of foreign policy. Only a few years ago, fans of the G-20 dreamed the constellation could be developed into a substitute for the large and often unruly UN, but few speak in such broad strokes today.

Skeptics of the G-20, like German Chancellor Angela Merkel, noted before the expansion of the G-8 to including 20 members in 2008 that making the group bigger would not necessarily make it any easier to solve problems. From the looks of things now, such concerns were prescient. Yet another summit, this time in St. Petersburg, demonstrated that the differences in interests and political views between the member states are simply too great.

xchrom

(108,903 posts)In a bustling area of Nyarugusu, in the heart of Tanzania's gold lands, a stocky man is fanning a dustbin lid of smouldering charcoal, gold ore and mercury on the pavement. Each waft sends a cloud of toxic vapour into the faces of children and adults as they gather to watch.

The burning of mercury is a common sight in the streets, homes and cottage-industry mines throughout east Africa. The liquid metal is used to extract the gold and then vaporised to leave behind flakes of the precious metal.

But in this dangerous industry, seeds of a gold revolution are being sown: Fairtrade International announced this week that up to 12 mines in Tanzania, Uganda and Kenya are on course to sell Africa's first ethical gold within a year.

There are no official figures for how many Tanzanians are poisoned by mercury fumes, but accounts of memory problems, sickness and impaired vision are common in the small mines that litter the countryside. The sight of open mercury poisoning may seem shocking, but it is just one of a host of appalling working conditions that blights the production of gold throughout east Africa.

Demeter

(85,373 posts)Thanks for the posts, X. I was working really hard this morning....got something done, at least.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

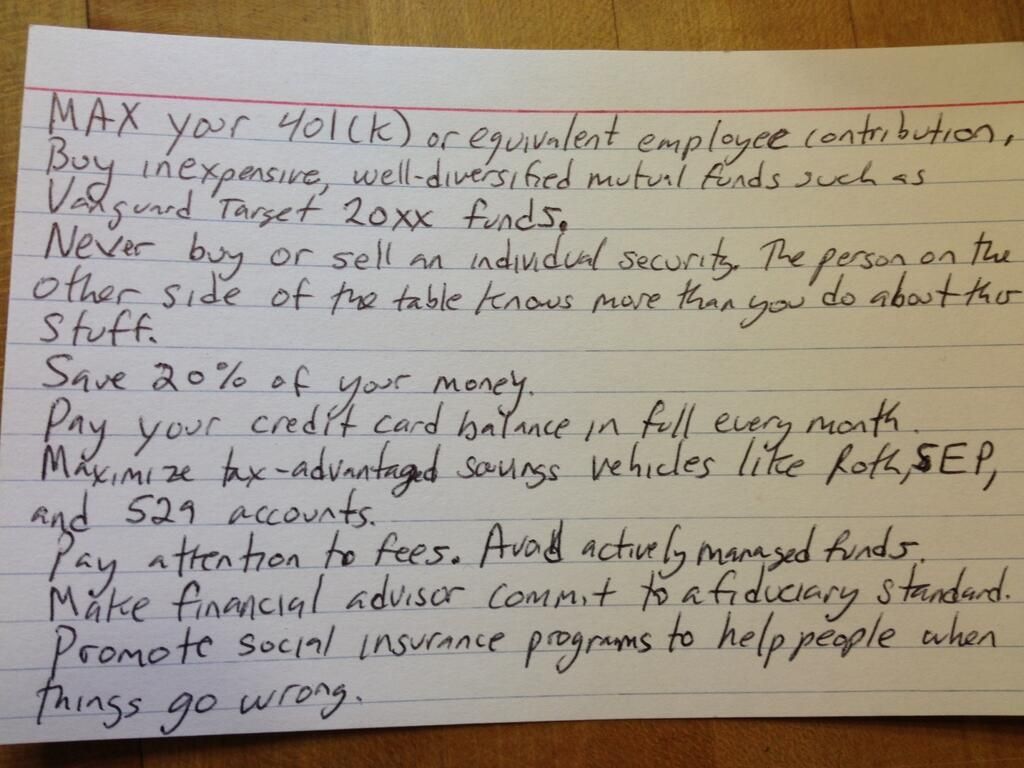

(85,373 posts)NICE SUMMARY FOR ARGUMENTS

http://opinionator.blogs.nytimes.com/2013/09/06/why-janet-yellen-not-larry-summers-should-lead-the-fed/?hp&_r=0

The controversy over the choice of the next head of the Federal Reserve has become unusually heated. The country is fortunate to have an enormously qualified candidate: the Fed’s current vice chairwoman, Janet L. Yellen. There is concern that the president might turn to another candidate, Lawrence H. Summers. Since I have worked closely with both of these individuals for more than three decades, both inside and outside of government, I have perhaps a distinct perspective. But why, one might ask, is this a matter for a column usually devoted to understanding the growing divide between rich and poor in the United States and around the world? The reason is simple: What the Fed does has as much to do with the growth of inequality as virtually anything else. The good news is that both of the leading candidates talk as if they care about inequality. The bad news is that the policies that have been pushed by one of the candidates, Mr. Summers, have much to do with the woes faced by the middle and the bottom.

The Fed has responsibilities both in regulation and macroeconomic management. Regulatory failures were at the core of America’s crisis. As a Treasury Department official during the Clinton administration, Mr. Summers supported banking deregulation, including the repeal of the Glass-Steagall Act, which was pivotal in America’s financial crisis. His great “achievement” as secretary of the Treasury, from 1999 to 2001, was passage of the law that ensured that derivatives would not be regulated — a decision that helped blow up the financial markets. (Warren E. Buffett was right to call these derivatives “financial weapons of mass financial destruction.” Some of those who were responsible for these key policy mistakes have admitted the fundamental “flaws” in their analyses. Mr. Summers, to my knowledge, has not.)

Regulatory failures have been at the center of previous crises as well. At Treasury in the 1990s, Mr. Summers encouraged countries to quickly liberalize their capital markets, to allow capital to flow in and out without restrictions — indeed insisted that they do so — against the advice of the White House Council of Economic Advisers (which I led from 1995 to 1997), and this more than anything else led to the Asian financial crisis. Few policies or actions have greater culpability for that Asian crisis and the global financial crisis of 2008 than the deregulatory policies that Mr. Summers advocated.

Supporters of Mr. Summers argue that he is exceptionally qualified to manage crises — and that, while we hope that there won’t be a crisis in the next four years, prudence requires someone who excels at those critical moments. To be fair, Mr. Summers has been involved in several crises. What matters, however, is not just “being there” during a crisis, but showing good judgment in its management. Even more important is a commitment to taking actions to make another crisis less likely — in sharp contrast to measures that almost ensure the inevitability of another one. Mr. Summers’s conduct and judgment in the crises was as flawed as his lack of commitment in that regard. In both Asia and the United States, he seemed to me to underestimate the severity of the downturns, and with forecasts that were so off, it was not a surprise that the policies were inappropriate. The performance of those in the Treasury who were responsible for managing the Asian crisis was, to say the least, disappointing — converting downturns into recessions and recessions into depressions. So, too, while the banking system was saved, and the United States avoided another depression, those responsible for managing the 2008 crisis cannot be credited with creating a robust, inclusive recovery. Botched efforts at mortgage restructuring, a failure to restore the flow of credit to small and medium-size enterprises, and the mishandling of the bailouts have all been well documented — as were the failure to foresee the severity of the economic collapse.

MUCH MORE AT LINK

Demeter

(85,373 posts)When the members of the Harvard Business School class of 2013 gathered in May to celebrate the end of their studies, there was little visible evidence of the experiment they had undergone for the last two years. As they stood amid the brick buildings named after businessmen from Morgan to Bloomberg, black-and-crimson caps and gowns united the 905 graduates into one genderless mass.

But during that week’s festivities, the Class Day speaker, a standout female student, alluded to “the frustrations of a group of people who feel ignored.” Others grumbled that another speechmaker, a former chief executive of a company in steep decline, was invited only because she was a woman. At a reception, a male student in tennis whites blurted out, as his friends laughed, that much of what had occurred at the school had “been a painful experience.”

He and his classmates had been unwitting guinea pigs in what would have once sounded like a far-fetched feminist fantasy: What if Harvard Business School gave itself a gender makeover, changing its curriculum, rules and social rituals to foster female success?

The country’s premier business training ground was trying to solve a seemingly intractable problem. Year after year, women who had arrived with the same test scores and grades as men fell behind. Attracting and retaining female professors was a losing battle; from 2006 to 2007, a third of the female junior faculty left...

NO WONDER THEY DUMPED LARRY SUMMERS, THEY HAD TO.

DemReadingDU

(16,000 posts)9/6/13 Smithfield Receives U.S. Approval for Biggest Chinese Takeover

Smithfield Foods Inc. (SFD), the world’s largest hog and pork producer, said U.S. regulators will allow the company to be bought by China’s Shuanghui International Holdings Ltd. in what would be the biggest Chinese purchase of a U.S. firm. “This transaction will create a leading global animal protein enterprise,” Zhijun Yang, Chief Executive Officer of Shuanghui International, said in a joint statement from both companies released yesterday.

The Committee on Foreign Investment in the U.S., or CFIUS, approved the transaction and it will be voted on by Smithfield shareholders at the company’s annual meeting Sept. 24. The government of Ukraine also approved the deal, according to the statement.

Shuanghui, based in Hong Kong, said May 29 it would buy Smithfield for $4.72 billion in a deal that has drawn scrutiny from senior members of Congress in both U.S. political parties, including Senate Finance Committee Chairman Max Baucus, a Democrat from Montana, and Orrin Hatch, a Republican from Utah, who had asked for a “thorough review” of the plan.

CFIUS blocked at least three transactions in the past four years that would have resulted in Chinese companies gaining control of assets near military facilities. Huawei Technologies Co. and Bain Capital Partners LLC also dropped a bid to buy computer equipment maker 3Com Corp. in 2008 in the face of opposition from CFIUS.

The committee, led by the Treasury Department, is made up of representatives from the Justice, Homeland Security and Defense departments and five other agencies, any of which might have particular concerns about a takeover by a given foreign buyer. Elizabeth Bourassa, a spokeswoman for the Treasury Department, declined to comment.

more...

http://www.bloomberg.com/news/2013-09-06/smithfield-receives-u-s-regulator-approval-for-shuanghui-deal.html

Demeter

(85,373 posts)Last edited Sat Sep 7, 2013, 10:01 PM - Edit history (1)

http://www.nytimes.com/2013/09/08/sunday-review/the-hands-tied-presidency.html?pagewanted=printAS the debate on the Syria intervention began in Congress last week, some wondered why President Obama, who has been frustrated repeatedly by Republican legislators, would risk being thwarted yet again and possibly jeopardize the ability of future presidents to pursue ambitious foreign policy objectives. In explaining his decision, Mr. Obama stressed constitutional imperatives. “I’m the president of the world’s oldest constitutional democracy,” he said, adding that he must respect “members of Congress who want their voices to be heard.”

But Mr. Obama might also have been acknowledging something else: that he holds office at a time when the presidency itself has ceded much of its power and authority to Congress. His predecessors found this, too. Bill Clinton discovered it after the 1994 election, when Newt Gingrich, the architect of the Republican victory in the House, briefly seemed the most powerful politician in the land. George W. Bush discovered it 10 years later when he claimed a mandate after his re-election, only to see two of his prized programs — privatizing Social Security and immigration reform — wither amid resistance in Congress. This is the history Mr. Obama has inherited. The major accomplishment of his first term, his health care reform bill, owed less to his leadership, perhaps, than to that of Nancy Pelosi, the House speaker in 2009-10. In his second term Mr. Obama effectively rallied public support for gun-law reform, and yet the bill was defeated in the Senate.

The perception that this is a time of diminishing presidential power has even made its way into popular culture. A decade ago, television’s top political drama was “The West Wing,” with its idealistic president and his smart and hyper-energetic staff who charged through the hallways and camped in their offices at night. Contrast this with the signature political fictions of the current moment. In the HBO comedy “Veep,” the humor flows from the mordant premise that the neurotic, bumbling vice president, played by Julia Louis-Dreyfus, is “a heartbeat away” from the White House (whose occupant is all but invisible). In the Netflix melodrama “House of Cards,” the president is a bystander of his own administration. It’s run instead by the conniving House majority whip, played by Kevin Spacey, who in one story line exerts his power in a marathon “mark up” session in which House members insert pet provisions in a bill.

Divided government has been a staple of American politics for many years, and Mr. Obama, a former professor of constitutional law, needs no education in the system of checks and balances. But analysts usually emphasize other factors. In ideological terms there is a Tea Party-caffeinated insurgency within the House Republican caucus. In personal terms, there is Mr. Obama’s inability to charm adversaries as Ronald Reagan did. And while the executive branch’s role in national security has grown mightily in recent decades, Mr. Obama’s decision to go to Congress arguably shows a greater deference on war and peace than any president since Franklin D. Roosevelt. BUT what if the problem isn’t a matter of ideology or personality? What if it is structural and institutional? This is the case some political theorists have been making for many years. “The actual form of our present government is simply a scheme of congressional supremacy,” one close student of politics, Woodrow Wilson, wrote in his book “Congressional Government,” published in 1885, when Wilson was not yet 30, and when a succession of weak presidents — Ulysses S. Grant, Rutherford B. Hayes, Chester A. Arthur — seemed unable to master the uses of power. Wilson did not fault individual presidents. Instead he pointed to the weakened condition of the presidency itself. “Its power has waned,” Wilson wrote. “And its power has waned because the power of Congress has become predominant.” As the nation got bigger, so did the House of Representatives. But it also became more atomized. Its “doings seem helter-skelter, and without comprehensible rule,” Wilson wrote. The “almost numberless bills that come pouring in” were parceled among 47 “standing committees,” with the lines of jurisdiction hopelessly tangled. No one could shape a coherent vision of it — except, possibly, the president. He alone was elected by and accountable to the whole of the country, Wilson argued, and so was rightfully the “unifying force in our complex system, the leader of both party and nation.” Thus the idea of the presidential “mandate,” a principle that “cannot be found in the Framers’ conception of the Constitution,” as the political scientist Robert Dahl noted in 1990. Wilson’s own presidency, as the historian Jill Lepore pointed out last week in The New Yorker, can be interpreted as an attempt to put his theory into practice, and he too was unable to realize much of what he envisioned, though his two terms represent the fist modern instance of the “imperial presidency.”

MORE

PERSONALLY, I'M JUST FINE WITH A HANDS-TIED PRESIDENT. WISH THEY INCLUDED A GAG, SOMETIMES, TOO. IMPERIAL FOPS ARE NOT AMERICAN.

DemReadingDU

(16,000 posts)9/4/13 Store's entire staff up and quits, leaves amazing note for boss

How to make a point to your jerk boss: You can quit, sure. Or you can convince the entire staff to quit with you, lock up the shop midday during the height of back to school shopping and leave a note accented with pink marker explaining your motives for everybody in the mall (and on the Internet) to see. Ding ding ding! Well done, Niki, Jess and TJ. This mighty resignation letter was spotted outside the Journeys footwear and apparel store at the Marketplace Mall in Rochester, N.Y., Gawker reports, and it's safe to say that Jamie got the point. If not, surely the $500 fine most malls charge their stores for not opening on time will do the trick.

click link to see the note to the boss

http://now.msn.com/mall-staff-quits-leaves-boss-epic-note-at-journeys-store?ocid=vt_fbmsnnow

Demeter

(85,373 posts)The monthly employment report provides the opportunity to look at the New America being built on the ruins of the own. While seldom remarked, it clearly appears in the data....

Better days are here, for some of us.

“Big industry constantly requires a reserve army of unemployed workers for times of overproduction. The main purpose of the bourgeois in relation to the worker is, of course, to have the commodity labour as cheaply as possible, which is only possible when the supply of this commodity is as large as possible in relation to the demand for it …”

— Marx (1847, unpublished work)

“Taking them as a whole, the general movements of wages are exclusively regulated by the expansion and contraction of the industrial reserve army …”

— Marx, Das Kapital (1867)

One of the goals of the FM website is too provide its readers with a different perspective on events. We do this by presenting information, reporting expert analysis, and the occasional prediction. Hopefully this helps you see our complex and changing world more clearly than relying solely on mainstream sources.

Looking at the economy shows how this works. For the past 3 years I have shown that the widespread claims that the recession had not ended were false. I predicted that forecasts of an imminent return to post-WW2 average growth were likewise false.

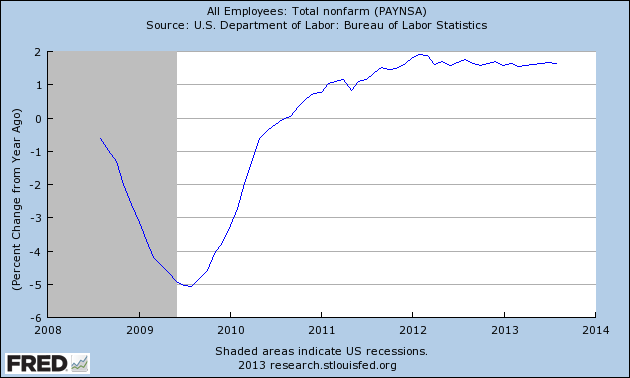

The monthly employment reports show this alternative perspective at work in another way. Each month brings a tide of forecasts. Boom! Bust! And analysis of the report is similarly dramatic. That’s how newspapers are sold and website traffic grows. It is, however, quite fallacious. Each month we duly and dully report that nothing has changed. Just more slow growth. As seen in this graph of monthly percent changes in the number of jobs (YoY, NSA). Steady, slow:

?w=900&h=540

?w=900&h=540

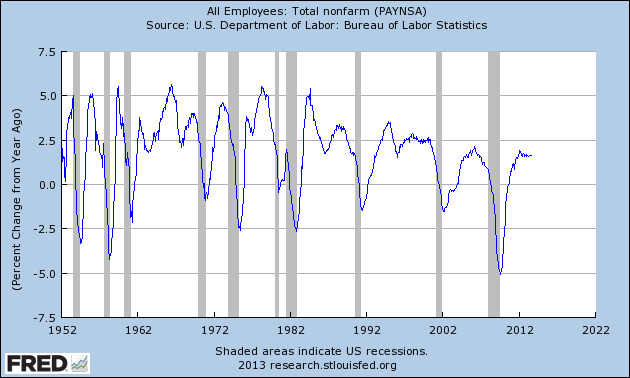

As usual, let’s put this in a longer-term context. Job growth has stabilized at an unusually low level. Also note how the business cycle was tamed after 1982. The magic ingredient: rapid debt growth. Being used today, but most aggressively by the Federal government. Without this fiscal stimulus we probably would look like Europe, and there would be fewer stories about America Ascendent.

?w=900&h=540

?w=900&h=540

This is the big story. The breathless analysis monthly commentary in the media mostly discusses noise, which masks the important conclusion: at this rate the US will return to full employment in 4 or 5 years. Unfortunately the normal business cycle will likely give us another recession by then (we’re now in the 5th year of the expansion). But is this slow job growth a bug or a feature?

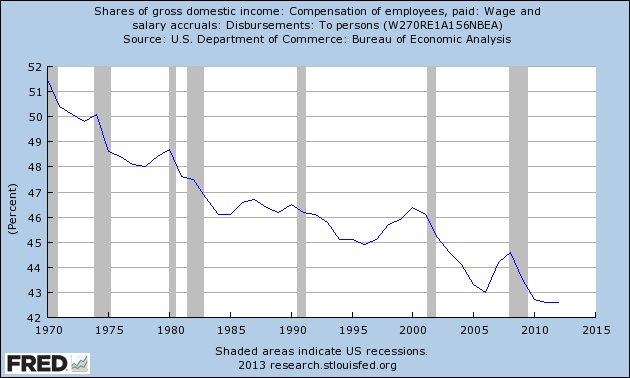

Marx was clearly wrong about the first wave of the industrial revolution. He might have the last laugh, however. Look at the trend in wages as a share of total domestic income (NSA).

?w=900&h=540

?w=900&h=540

Crush unions, cuts taxes on business, fragment work into jobs that require minimal skills, fragment jobs into a largely part-time contingent workforce, expand training so that there is a surplus to demand, increase immigration, outsource work to other nations to create internal competition — and the profits will flow. This is the New America being built by large corporations from McDonald’s to Amazon.

Training too many skilled people is an important part of the game. Tight controls on the supply of doctors shows the effect of too-small supply. The relatively low wages of engineers and scientists shows how corporations run the supply-demand equation for their benefit: “The STEM Crisis Is a Myth“, Robert N. Charette, IEEE Spectrum, 30 August 2013 — “Forget the dire predictions of a looming shortfall of scientists, technologists, engineers, and mathematician.” A reliable formula for higher profits: training more than there are jobs AND import more workers from other nations.

Demeter

(85,373 posts)In the post-New Deal America of the 1950s and '60s, the idea of the United States becoming a banana republic would have seemed absurd to most Americans. Problems and all, the U.S. had a lot going for it: a robust middle-class, an abundance of jobs that paid a living wage, a strong manufacturing base, a heavily unionized work force, and upward mobility for both white-collar workers with college degrees and blue-collar workers who attended trade school. To a large degree, the nation worked well for cardiologists, accountants, attorneys and computer programmers as well as electricians, machinists, plumbers and construction workers. In contrast, developing countries that were considered banana republics—the Dominican Republic under the brutal Rafael Trujillo regime, Nicaragua under the Somoza dynasty—lacked upward mobility for most of the population and were plagued by blatant income equality, a corrupt alliance of government and corporate interests, rampant human rights abuses, police corruption and extensive use of torture on political dissidents.

Saying that the U.S. had a robust middle-class in the 1950s and '60s is not to say it was devoid of poverty, which was one of the things Dr. Martin Luther King, Jr. was vehemently outspoken about. King realized that the economic gains of the post-World War II era need to be expanded to those who were still on the outside of the American Dream looking in. But 50 years after King’s "I Have a Dream" speech of 1963, poverty has become much more widespread in the U.S.—and the country has seriously declined not only economically, but also in terms of civil liberties and constitutional rights. Here are 10 ways in which the United States has gone from bad to worse, and is looking more and more like a banana republic in 2013.

1. Rising Income Inequality and Shrinking Middle Class

In a stereotypical banana republic, income inequality is dramatic: one finds an ultra-rich minority, a poor majority, a small or nonexistent middle class, and a lack of upward mobility for most of the population. And according to a recent study on income inequality conducted by four researchers (Emmanuel Saez, Facundo Alvaredo, Thomas Piketty and Anthony B. Atkinson), the U.S. is clearly moving in that direction in 2013. Their report asserted that the U.S. now has the highest income inequality and lowest upward mobility of any country in the developed world. They found that while the picture grows increasingly bleak for American’s embattled middle-class, “the share of total annual income received by the top 1% has more than doubled from 9% in 1976 to 20% in 2011.” And earlier this year, a report by the Organization for Economic Co-operation and Development OECD also found that the U.S. now leads the developed industrialized world in income inequality.

2. Unchecked Police Corruption and an Ever-Expanding Police State

Journalist Chris Hedges made an excellent point when he said that brutality committed on the outer reaches of empire eventually migrates back to the heart of empire. Hedges asserted that with the increased militarization of American police, drug raids in the U.S. are now looking like military actions taken by American soldiers in Fallujah, Iraq. And, to be sure, there have been numerous examples of militarized narcotics officers killing innocent people in botched drug raids or sting operations gone wrong. To make matters worse, narcotics officers who kill innocent people rarely face either civil or criminal prosecution; they essentially operate with impunity. And in addition to the abuses of the war on drugs, the U.S. government has far-reaching powers it did not have prior to 9/11. Between the drug war, the Patriot Act, the National Defense Authorization Act, and warrantless wiretapping, the United States is employing the sorts of tactics that are common in dictatorships.

3. Torture

During the Cold War, the U.S. supported many fascist regimes and banana republics that engaged in torture. But it didn’t openly flaunt such tactics itself. That changed after 9/11. Post-9/11, the U.S. crossed a dangerous line when the CIA used waterboarding on political detainees with the blessing of the George W. Bush administration. Waterboarding and other forms of torture are not only bad interrogation methods that do nothing to decrease or prevent terrorism, they are a blatant violation of the rules of the Geneva Convention. As Amnesty International observed, “In the years since 9/11, the U.S. government has repeatedly violated both international and domestic prohibitions on torture and other cruel, inhuman or degrading treatment in the name of fighting terrorism.”

4. Highest Incarceration Rate in the World

According to the London-based International Center for Prison Studies, the U.S. has 716 prisoners per 100,000 residents compared to 114 per 100,000 in Canada, 79 per 100,000 in Germany, 106 per 100,000 in Italy, 82 per 100,000 in the Netherlands or 67 per 100,000 in Sweden. Even Saudi Arabia, which has an incarceration rate of 162 per 100,000, doesn’t imprison nearly as many of its residents as the United States. One of the main reasons the U.S. has such a high incarceration rate is its failed war on drugs, which has emphasized draconian sentences for nonviolent offenses. The prison industrial complex has become quite a racket. From prison labor to construction companies to companies specializing in surveillance technology, imprisoning people is big business in the United States—and the sizable prison lobby has a major stake in keeping draconian drug laws on the books. Further, the drug war has included harsh asset forfeiture laws that, in essence, place the burden of proof not on the courts, but on people whose assets have been seized.

5. Corrupt Alliance of Big Business and Big Government

Trends forecaster Gerald Celente has asserted that the U.S. has become a “fascist banana republic” and now lives up to Italian dictator Benito Mussolini’s definition of fascism: the merger of state and corporate power. Celente, a frequent guest on the cable news network RT, has repeatedly said that systemic corruption in the banking sector has not decreased since the financial crash of September 2008 and the bailouts that came after it, it has gotten worse, and too-big-to-fail banks now operate with impunity. That union of corporate and state power fits Mussolini’s definition of fascism, which was followed by a long list of dictators in banana republics. In a democratic republic, banks and corporations are not above the law; in a banana republic, they are—and with the legislation and reforms of Roosevelt’s New Deal (which did a lot to prevent banks and corporations from enjoying unchecked power) having been undermined considerably (most notably, by the 1999 repeal of the Glass-Steagall Act of 1933), the U.S. is looking more and more like a banana republic.

6. High Unemployment

According to the Bureau of Labor Statistics, the unemployment rate in the U.S. decreased to 7.4% in July 2013. But that figure is misleading because it fails to take into account the millions of Americans who have given up looking for work (that is, they have been unemployed for so long the BLS no longer counts them as part of the work force) or workers who have only been able to find temp work. And according to economist/researcher John Williams, the unemployment crisis in the U.S. is much more dire than the BLS’ 7.4% figure. Williams’ research counts the millions of Americans the BLS excludes, and his newsletter, Shadow Statistics, reported that in June 2013, the U.S.’ actual unemployment rate was a disturbing 23.3% (which is only slightly less than the unemployment rate in 1932). Also, BLS figures don’t take into the account the fact that most of the new jobs created in 2013 have been low-paying service jobs. Clearly, much of the American population is growing poorer while the 1% are doing better than ever.

7. Inadequate Access to Healthcare

The United States continues to be the only developed country that lacks universal healthcare. And since the economic meltdown of September 2008, the number of Americans who lack health insurance has increased. According to a study the Commonwealth Fund conducted in 2012, 55 million Americans lacked health insurance at some point last year—and that 55 million doesn’t even count all of the Americans who are underinsured, meaning that they have gaps in their coverage that could easily result in bankruptcy in the event of a major illness. Americans have some of the highest healthcare expenses in the world but are plagued with much worse outcomes than residents of Canada, Australia, New Zealand or any country in Western Europe. From medical bankruptcies and sky-high premiums to a lack of preventative care, the American healthcare system is a disaster on many levels. The U.S. took a small step in the direction of universal healthcare with the passage of the Affordable Care Act of 2010, but many proponents of health insurance reform have been quick to point out that it doesn’t go far enough. According to Robert Reich, “Obamacare is an important step, but it still leaves 20 million Americans without coverage.”

8. Dramatic Gaps in Life Expectancy

In many banana republics, it is common knowledge that the poor die much younger than the wealthy minority. The disparity in life expectancy rates dramatically illustrates the severity of the growing rich/poor divide in the United States. Life expectancy for males is 63.9 years in McDowell County, West Virginia compared to 81.6 years in affluent Fairfax County, Virginia or 81.4 in upscale Marin County, Calif. That is especially alarming when one considers that life expectancy for males was 68.2 in Bangladesh in 2012 and 64.3 for males in Bolivia, one of the poorest countries in Latin America, in 2011. The news for many American women isn’t very good either. According to the United Nations, American women on the whole fell from #14 worldwide in life expectancy in 1985 to #41 in 2010. And in September 2012, the New York Times reported that nationally, life expectancy was down to 67.5 years for the least educated white males compared to 80.4 for more educated white males. The Times also reported that life expectancy was 73.5 years for less educated white females compared to 83.9 for more educated white females.

9. Hunger and Malnutrition

In the 1950s and '60s, hunger was a word one associated with developing countries rather than the United States. But with millions of Americans having slipped into poverty during the current economic downturn, the number of people who are now poor enough to qualify for food stamps has increased from 17 million in 2000 to 47 million in 2013. Only one in 50 Americans received food stamps in the 1970s; now, the number is one in seven. According to Share Our Strength, 48.8 million Americans now suffer from food insecurity. In 2010, Ariana Huffington came out with a book titled Third World America: How Our Politicians Are Abandoning the Middle Class and Betraying the American Dream. That title was no exaggeration; the U.S. is, as Huffington said, “on a trajectory to become a Third World country,” and the fact that food stamp use has more than doubled since 2000 bears that out.

10. High Infant Mortality

Earlier this year, the organization Save the Children released the results of its 14th annual State of the World’s Mothers Report. The report found that “the United States has the highest first-day death rate in the industrialized world” (babies dying the day they are born) and that the European Union has “only about half as many first-day deaths as the United States: 11,300 in the U.S. vs. 5,800 in EU member countries.” “Poverty, racism and stress are likely to be important contributing factors to first-day deaths in the United States,” said the report. Save the Children also reported that the U.S. had a rate of three first-day deaths per 1,000 births, the same rate the organization reported for developing countries like Egypt, Tunisia, Sri Lanka, Peru and Libya. Meanwhile, Mexico, Argentina, Chile, El Salvador and Costa Rica were among the Latin American countries that had only two first-day deaths per 1,000 births. So, a baby born in El Salvador or Mexico has a better chance of living to its second day than a baby born in the United States.

***

What will it take for the United States to reverse its dramatic decline? Robert Reich, in a video released on Labor Day 2013, called for six things: 1) a living wage for more American workers; 2) an earned income tax credit; 3) better childcare for working parents; 4) easier access to good schools and a quality education; 5) universal health insurance; and 6) union rights. Those are all excellent ideas. The U.S. also should replace the war on drugs with a sane drug policy (something Attorney General Eric Holder recently addressed), abolish the prison industrial complex, rebuild the U.S.’ decaying infrastructure, abolish the Patriot Act and the NDAA, restore the Glass-Steagall Act and break up too-big-to-fail banks. Obviously, accomplishing even a third of these would be an uphill climb. But unless most or all of those steps are taken, the U.S. can look forward to a grim future as a banana republic.

Alex Henderson's work has appeared in the L.A. Weekly, Billboard, Spin, Creem, the Pasadena Weekly and many other publications.

Demeter

(85,373 posts)I'll be back after the Sunday papers are distributed. May your sweetest dreams be a shadow of your waking joy.

xchrom

(108,903 posts)On the edge of deep green mountain forests in the centre of Germany – where east once met west – lies Germany's "toy town". As in every corner of Germany right now, smiling election candidates beam out from posters tied to lampposts in Sonneberg with snappy slogans promising "safe jobs" and to "keep Germany strong".

There is little mention of looming problems that many experts predict will send Germany tumbling down the economic league tables over coming years. Instead, they are playing on the strengths of Sonneberg's mix of small and family-owned companies – the kind that dominate the buoyant German business landscape. Toy town is, for now, enjoying the latest of many resurgences through the centuries.

"Sonneberg and the area around it has one of the highest employment levels in Germany," says Christian Dressel, who runs the local job centre. "Businesses have set up here … we have car industry companies, electronics firms making vacuum cleaners and TVs, toymakers and a training school for toymakers."

In its heyday at the turn of the 20th century, Sonneberg was the world's leading toy producer. Mothers and fathers, son and daughters, crammed into home workshops and, with their neighbours, made up production lines that churned out every fifth toy in the world. One house would make dolls' wigs, the next along stuffed the bodies and another would craft their faces.

xchrom

(108,903 posts)In a world increasingly polarised by wealth, the efforts to find a metaphor that unifies rich and poor, a shared humanity, if you like, has become both a lucrative and a slightly desperate publishing enterprise. Most of the academic traffic is concentrated at the busy crossroads between economics and psychology, where a nudge is as good as a blink. The idea that we are defined by and subject to market forces is taken as a given in this work; the interest lies in the gap between the economist's faith in rational decision-making and the psychologist's stacked-up evidence of our less than rational behaviours: in the exposure of our almost comical inability to understand risk and reward and to do what is best for us.

This gap was first comprehensively explored in the pioneering work of Daniel Kahneman and the late Amos Tversky, through their Nobel-prize winning analysis of how man (and woman, but mainly man) is anything but a creature of logic in market places of all kinds. Kahneman's recent bestselling precis of his life's work, Thinking, Fast and Slow, was a catalogue of examples of people using the wrong kind of analysis when confronting pivotal problems: relying on instinct when precise weighing of probabilities would be crucial, and vice versa. The seductive tone of Kahneman's writing comes in part from his understanding that no one is exempt from these failings. When I interviewed him about his ideas, he observed that the most useful subject for his study of internal biases and wonky reasoning had always been himself. Though he spent a lifetime proving the fundamental weakness of human beings in predicting the outcomes of any relatively complex choice, it happily didn't stop him making all sorts of errors of judgment in his own life.