Economy

Related: About this forumSimple "Weekend Economists" October 18-20, 2013

'Tis the gift to come down where we ought to be,

And when we find ourselves in the place just right,

'Twill be in the valley of love and delight.

When true simplicity is gain'd,

To bow and to bend we shan't be asham'd,

To turn, turn will be our delight,

Till by turning, turning we come 'round right.

Portrait of Elder Joseph Brackett Jr,

1797-1882

Source:

The Aletheia:Spirit of Truth

by Aurelia G. Mace.

Farmington, Maine:

Press of the Knowlton & McLeary Co., 1907

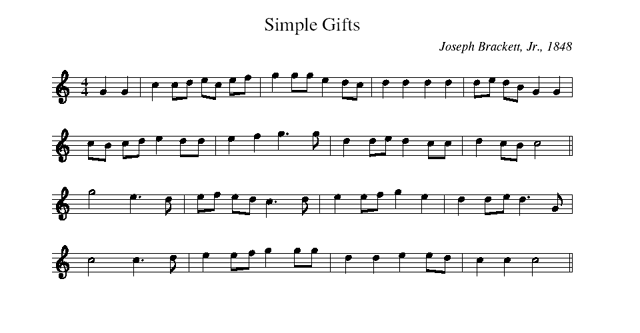

"Simple Gifts" was written by Elder Joseph Brackett while he was at the Shaker community in Alfred, Maine. These are the lyrics to his one-verse song. Several Shaker manuscripts indicate that this is a "Dancing Song" or a "Quick Dance." "Turning" is a common theme in Christian theology, but the references to "turning" in the last two lines have also been identified as dance instructions. A manuscript of Mary Hazzard of the New Lebanon, New York, Shaker community records this original version of the melody:

Among other uses and adaptations, the Shaker's "Simple Gifts" melody shows up as a part of Aaron Copland's Appalachian Spring Suite, choreographed by Martha Graham 1944. (I don't think Martha had a clue about the Shakers...especially their tendency to eschew marriage and reproduction, hence the title "Appalachian Spring"

This is the movement based on the Shaker tune

Two additional, later non-Shaker verses exist for the song, as follows:

'Tis the gift to be loved and that love to return,

'Tis the gift to be taught and a richer gift to learn,

And when we expect of others what we try to live each day,

Then we'll all live together and we'll all learn to say,

(refrain)

'Tis the gift to have friends and a true friend to be,

'Tis the gift to think of others not to only think of "me",

And when we hear what others really think and really feel,

Then we'll all live together with a love that is real.[9]

(refrain)

Tis the gift to be loving, tis the best gift of all

Like a quiet rain it blesses where it falls

And with it we will truly believe

Tis better to give than it is to receive

And an additional alternative:

The Earth is our mother and the fullness thereof,

Her streets, her slums, as well as stars above.

Salvation is here where we laugh, where we cry,

Where we seek and love, where we live and die.

When true liberty is found,

By fear and by hate we will no more be bound.

In love and in light we will find our new birth

And in peace and freedom, redeem the Earth.[10]

Another alternate verse:

'tis a gift to be simple, 'tis a gift to be fair

'tis a gift to wake and breathe the morning air

and each day we walk on the path that we choose

'tis a gift we pray we never shall lose

"Lord Of The Dance" is another hymn, with words written by English songwriter Sydney Carter in 1963, that uses the melody of the "Simple Gifts" hymn..

I danced in the Moon & the Stars & the Sun

I came down from Heaven & I danced on Earth

At Bethlehem I had my birth:

Dance then, wherever you may be

I am the Lord of the Dance, said He!

And I'll lead you all, wherever you may be

And I'll lead you all in the Dance, said He!

(...lead you all in the Dance, said He!)

I danced for the scribe & the pharisee

But they would not dance & they wouldn't follow me

I danced for fishermen, for James & John

They came with me & the Dance went on:

Dance then, wherever you may be

I am the Lord of the Dance, said He!

And I'll lead you all, wherever you may be

And I'll lead you all in the Dance, said He!

(...lead you all in the Dance, said He!)

I danced on the Sabbath & I cured the lame

The holy people said it was a shame!

They whipped & they stripped & they hung me high

And they left me there on a cross to die!

Dance then, wherever you may be

I am the Lord of the Dance, said He!

And I'll lead you all, wherever you may be

And I'll lead you all in the Dance, said He!

(...lead you all in the Dance, said He!)

I danced on a Friday when the sky turned black

It's hard to dance with the devil on your back

They buried my body & they thought I'd gone

But I am the Dance & I still go on!

Dance then, wherever you may be

I am the Lord of the Dance, said He!

And I'll lead you all, wherever you may be

And I'll lead you all in the Dance, said He!

(...lead you all in the Dance, said He!)

They cut me down and I leapt up high

I am the Life that'll never, never die!

I'll live in you if you'll live in Me -

I am the Lord of the Dance, said He!

Dance then, wherever you may be

I am the Lord of the Dance, said He!

And I'll lead you all, wherever you may be

And I'll lead you all in the Dance, said He!

And of course, Michael Flatley took it from there:

Human beings don't do simple very well....certainly not this one! Nor the Congresscritters, as evidenced by their antics this month and last...

Warpy

(111,277 posts)

Bonus points to anyone who can name that blog without looking it up.

Demeter

(85,373 posts)Demeter

(85,373 posts)I refer to the Tea Party, of course, has been resolved ...

The Congress has 88 days, and counting, to get a real budget, good through October 1, 2014 on the President's desk.

Obama Wins: POTUS Signs Budget Deal, Furloughed Workers To Return To Work

http://newsone.com/2741634/house-passes-bill-shutdown-over/

President Barack Obama signed a last-minute bi-partisan deal early Thursday morning to avert a debt default and to reopen the government after the 16-day GOP shutdown.

From the White House:

H.R. 2775, the “Continuing Appropriations Act, 2014,” which provides fiscal year 2014 appropriations for projects and activities of the Federal Government through Wednesday, January 15, 2014. The effective time for the continuing resolution begins on October 1, 2013. H.R. 2775 also extends the Nation’s debt limit through February 7, 2014.

"Tonight the Republicans and Democrats in Congress have come together around an agreement that will reopen our government." —President Obama

— Barack Obama (@BarackObama) October 17, 2013

Thanks to the millions of Americans who made their voices heard and helped bring the shutdown to an end. Now let's get back to work.

— Barack Obama (@BarackObama) October 17, 2013

—————————————————————————————————————

UPDATE: 11:07 PM EST, 10/16/2013:

————————————————————————————————————–

UPDATE: 10:28 PM EST, 10/16/2013:

A bill to end the GOP government shutdown passed the House of Representatives with a 285-144 vote. All 198 Democrats present voted yes. All 144 no votes came from Republicans.

The bill has been sent to President Obama for his signature.

————————————————————————————————————-

A weary President Barack Obama held a solemn but victorious press conference after the Senate voted 81-18 to pass a bi-partisan deal that would end the GOP government shutdown and halt the country from careening into default.

“There’s a lot of work ahead of us, including the need to earn back the trust of the American people,” President Obama said at the White House.

DON'T EVEN BOTHER, MR. PRESIDENT. YOU PUT THE CHAINED CPI AND VOUCHERS FOR MEDICARE ON THE TABLE, AND YOUR EFFORTS WILL BE SQUANDERED.

Demeter

(85,373 posts)It happens every time: Republicans and Democrats get into a standoff over the federal budget, and their best plan for wriggling out of it is to nickel-and-dime people on Social Security and Medicare. The worst zombie in this package, a terrible idea that simply won't die, is the "chained CPI." This is a version of the consumer price index that purportedly yields a more "accurate" reading of inflation, which is supposed to be virtuous because Social Security recipients get a cost-of-living increase every year based on inflation. The chained CPI has risen to walk among us again in the muttering and jawboning around the government shutdown/debt limit standoff and the search for an exit. We're hearing again about a "grand bargain" on the government deficit -- never mind that the deficit is falling, not rising -- that would trade, say, cuts in Social Security and Medicare and some kind of tax reform for an end to the government shutdown and an increase in the debt limit. In other words, the average person gets a kick in the slats, and the politicians in Washington get to deliver it. That's some bargain. A few things to remember about the chained CPI, which I've written about here, here, and here. LINKS AT OP (If you're going to kill a zombie, you have to keep coming at it.)

First, its vaunted accuracy is a myth. An index like the CPI can't be judged more or less accurate, because it measures only what it's defined to measure. Does the market basket measured by the CPI accurately define what people spend money on? Yes, if they spend money on what's in the basket. And we know that retirees don't spend money the same way as young or middle-aged families; they spend disproportionately more on healthcare and housing. The agency that produces the inflation index recognized that elderly consumers are a special case by developing an experimental index, known as the CPI-E, for those 62 and older. What really makes the chained CPI attractive to budget cutters is that it consistently comes in lower than the traditional CPI. For retirees, the gap builds over time; after 30 years, benefits would be 10% lower than under the traditional CPI. The CPI-E, however, rises slightly faster than the traditional index. That's why you never hear pundits praising it for its "accuracy." The chained CPI also involves another nasty shock for average Americans. For the sake of fairness, using it as the Social Security cost of living measure would mean using it for other government calculations indexed to inflation, such as income tax brackets.

What would that mean? Well, according to the Tax Policy Center, it would hit low-income taxpayers especially hard. Someone earning $30,000 to $40,000 would get whacked three times as hard, measured by the tax increase as a share of total income, as someone earning more than $1 million...Social Security advocates have always considered President Obama to be a little squishy when it comes to resisting Republican efforts to cut Social Security and Medicare and hit the middle class with higher taxes. Thus far, Democrats in Congress have held the line. But every crisis brings yet another effort to preserve the prerogatives of the wealthy and take the cost out of middle- and working-class hides. On this occasion, when the costs of the shutdown have fallen on Head Start children, medical patients and middle-class workers, to slice away another portion of their safety net would be a truly unspeakable act.

Demeter

(85,373 posts)have the FDIC been recalled? Check back later.

Demeter

(85,373 posts)http://www.marketwatch.com/story/obamacare-boomers-are-health-firms-new-challenge-2013-10-15?siteid=YAHOOB

Providers face a ‘reimbursement cliff’ no one is talking about

In these early days of state- and federally run health insurance exchanges, the health care industry — from insurers to health providers — faces uncertainty about the best path to long-term financial survival. The most basic threat is clear: Reimbursement per unit, or what is paid for each patient visit, is going to decline. This “reimbursement cliff” will only be exacerbated by the collision of two mega-events: rates being set low on the new insurance exchanges and the baby-boomer migration to Medicare. Taken together, providers are looking at a future where they will make less per patient than ever before. That is the reality both in the fee-for-service market we largely operate in today, and in the outcomes-based model the industry will migrate to over the next decade. The rates of reimbursement set by the insurance exchanges are low. Insurers committed to the exchange marketplaces before reimbursement rates had been negotiated with providers to treat the roughly 25 million anticipated newly insured (7 million expected to join the exchanges this year alone). Reimbursement rates have fallen somewhere between commercial insurance rates and the average Medicare and Medicaid reimbursement of 85% and 60%,respectively, of the cost of care delivery — rates that in recent years have driven physician groups across the country to stop seeing Medicare patients or taking in new ones. These low rates also have led insurers to create narrow networks, which are designed to limit patient choices and access in order to reduce costs. Plus, the 2% reduction in Medicare reimbursements due to Sequestration will further lower reimbursement per unit. At the same time, commercial insurers and health systems are losing their best customers — baby boomers — to Medicare. At their apex, the boomers were a significant contributor to fiscally better times for health providers. Today, boomers are transitioning from the more lucrative commercial plans (lucrative to insurers and health-care providers) to Medicare at a rate of 5,000 to 10,000 per day; the lack of ability to cost-shift to the baby boomers is a major drain on health providers.

Watch what businesses do with the option of continuing to fund employee health care or pushing employees into the individual choice of the exchanges. A sluggish economy will be a key driver of how businesses will respond to this newly available management choice. At the same time, watch for how many young, healthy people sign up for exchange insurance — the critical success factor of funding Obamacare. A consumer market will eventually develop for health care, but currently the industry has far fewer levers to combat the trend of declining reimbursement than companies that serve consumers in just about any other industry. The risks of rapid and significant declines in provider reimbursement are clear and arguably highly problematic. Over the past decade, health care has become a tough business. By some estimates, one-third of health systems are currently unprofitable. The more efficient hospitals typically realize 4%-5% margins and have to manage significant fixed costs that allow for less-than- optimal wiggle room. Sliding reimbursement rates that started pre-insurance exchanges will be exacerbated by the exchanges and pushed to the brink by the baby boomer transition — potentially turning modest margins meaningfully negative for many not-for-profit hospitals.

Bridging the divide

So how can providers manage this shift towards lower payments? Industry consolidation is a popular option. Health systems are buying each other or physician groups, and insurers and health systems are coming together and vertically integrating. On its own, however, these strategies will not outrun declining reimbursement-per-unit rates. In other cases, health systems are experimenting with business models that push care delivery outside of the hospital.

For all of the pain and flaws in the health-care reform regulations, there is a clear pathway to success. It is within health-care organizations’ control, but is hardly simple. Running more efficient operations is key to managing the realities of the market. Industry reforms will force health-care providers to eliminate hundreds of billions of dollars in waste and inefficiency found in the current system, while promoting coordinated care and community wellness initiatives. The good news: Health-care organizations recognize that the industry’s underlying cost structure is unsustainable and uncompromising. The industry must manage with greater precision and care. Providers must implement coordinated, sustainable improvement across all business and clinical areas. This will help the industry survive and ultimately thrive.

The collision of the insurance exchanges and baby-boomer insurance migration — the formation of the reimbursement cliff — is a seminal moment. This is the period when health care has met the reality of big business, and has the chance to become more businesslike about delivering affordable, high-quality care without breaking the system.

John Bardis is chairman, CEO and president of MedAssets Inc. MDAS +0.39% , a health-care performance improvement company.

Tansy_Gold

(17,862 posts)Demeter

(85,373 posts)Not bad for white men, either! I was reminded of Moon Walking...

Tansy_Gold

(17,862 posts)I stumbled on a PBS airing of Riverdance years ago and loved it, but that was when it was relatively simple and true to its origins. I felt that Flatley, while talented, corrupted the art form. Just personal opinion.

But that was because I'd grown up watching the film classics with other Irishmen, particularly Cagney and Gene Kelly. Throw in Hope, Astaire, Crosby, O'Connor, Van Johnson, Russ Tamblyn -- It's the dance that's the thing. Sometimes the music, but forget the lights, the flash. Just dance the damn dance.

AnneD

(15,774 posts)Hope got his start on the Vaudeville circuit in London.

DemReadingDU

(16,000 posts)They sure don't make those movies anymore.

Ghost Dog

(16,881 posts)(The song/dance is so very English/Irish/American...).

Demeter

(85,373 posts)As it dragged on in recent weeks, the debate about the budget, the debt ceiling and Obamacare felt like an epic battle. But now that it's over, there's reason to think it was actually only another skirmish during the long period of partisan warfare Americans have become accustomed to. The polls, the pundits and certainly Democrats all suggest that the GOP's Tea Party wing got its clock cleaned. After shutting down parts of the government for more than two weeks, Congress on Wednesday approved a spending bill that included essentially nothing from the Tea Party's wish list. But conservatives sounded anything but resigned in defeat..."While the political debate has ended for the moment, like any prizefight there are many rounds," Republican Rep. John Fleming of Louisiana in USA Today. "We must continue to fight on."

Congress has set itself new deadlines for dealing with both the budget and the debt ceiling early in the coming year. And the new law calls for high-level budget negotiations to take place between the House and Senate in the coming weeks. But no one seems terribly optimistic that they'll come up with a package that will please all sides...."I view this as another skirmish, and there will probably continue to be more," says Craig Robinson, editor of The Iowa Republican, a news and opinion site. "What it shows, especially [at the moment], is there's a wide split among the Republican Party."

A Fractured Party

One reason to think there willl be more rancor ahead: festering Republican divisions. Conservatives who wanted more out of the budget deal did nothing to conceal their unhappiness. A clear majority of the House GOP conference — 144, to be exact — voted Wednesday night against legislation that reopened the government and averted a debt default. Many continued to sound warnings about the dangers of a national debt that will soon exceed $17 trillion, while putting the blame on President Obama for being intransigent..."With this ... deal, Washington Establishment wins, rest of America loses," GOP Rep. Tim Huelskamp of Kansas. Republicans have also turned their fire on one another, using terms such as "lunacy" and "no intelligence" in describing their colleagues...Those were comments from California Rep. Devin Nunes of California and Sen. John McCain of Arizona, respectively, who were critical of their own party's confrontational strategy. Republicans who favored taking a harder line have loudly complained that they were undermined by such commentary coming from their own ranks.

"It'd be a good idea if they stopped referring to other Republicans as Hitler appeasers because they opposed the strategy they put forward, which failed," Grover Norquist, the president of Americans for Tax Reform and a longtime GOP activist, National Review.

"They can read the [national] polls, sure, but those are not their people," Andrew Rudalevige, a government professor at Bowdoin College in Maine, says, referring to their generally conservative districts. "I don't think there's any reason to think the Tea Party folks are ever going to change."

............................

Democrats will be further emboldened by the fact that they were ultimately able to block the GOP, says Lewis Gould, author of Grand Old Party: A History of the Republicans. The Tea Party Republicans may have an even greater desire to come away with something to show from the next confrontation, he says, but they've already overplayed their hand.

"They've sort of had their bluffs called," he says. "The next time would have to be, 'We are going over the edge no matter what — no business community and nothing else is going to stop us from going over.' "

GOD PROTECT US FROM SIMPLE PEOPLE.

Demeter

(85,373 posts)Most Americans found little to cheer in the congressional deal to reopen the government and avoid a national default, and Republicans suffered the biggest political damage in the crisis, according to a Reuters/Ipsos poll released on Friday. Nearly one-third of Americans - 32 percent - were dissatisfied with the agreement to end the fiscal impasse and 40 percent were neither satisfied nor dissatisfied. Only 28 percent were satisfied with the outcome. Among those who were not satisfied or were neutral, 45 percent said it was because the deal failed to resolve the budget battles at the heart of the stalemate and only extended government funding and borrowing authority into early next year. A further 23 percent expressed general frustration with the whole process, which closed the federal government for 16 days and pushed the country to the edge of default, rattling financial markets and threatening economic chaos.

The poll, conducted on Thursday and Friday after Congress approved the deal and it was signed by President Barack Obama, found congressional Republicans suffered the most for stoking the crisis by demanding changes to Obama's healthcare law before they would support government funding. The biggest political losers were Republicans in the House of Representatives and Senate, House Speaker John Boehner and conservative Tea Party Republicans. House Republicans were viewed less favorably by 47 percent, Republican senators and Boehner by 45 percent and Tea Party Republicans by 44 percent. Obama was viewed less favorably by 41 percent, but also scored best among those viewed more favorably, with 17 percent taking a more positive view of the president. House Democrats were viewed more favorably by 13 percent and Senate Democrats by 10 percent, and less favorably by 33 percent and 36 percent, respectively.

Republican Senator Ted Cruz of Texas, the Tea Party firebrand who led the charge to delay or defund the healthcare law, was viewed more favorably by 10 percent, and less favorably by 38 percent.

Asked who came out the winner, 17 percent said Democrats and 4 percent said Republicans. The vast majority, 70 percent, said neither side won.

"People were extremely upset with the process and very unamused, but this has absolutely been more damaging for Republicans," Ipsos pollster Julia Clark said. "There doesn't seem to be a real winner."

.................................................................

The online poll of 516 Americans had a credibility interval, which is similar to a margin of error, of plus or minus 4.9 percentage points.

Demeter

(85,373 posts)REMEMBER--"SIMPLE" IS A EUPHEMISM FOR FOOLISH

http://www.salon.com/2013/10/16/theyre_fools_and_work_for_fools_alan_grayson_unloads_on_gop_staffers_and_much_more/singleton/

On the first day of the government shutdown, firebrand Democratic Congressman Alan Grayson told Salon that Republicans’ on-the-job drinking was partially to blame. Now he says the current showdown will end the party – for good.

In an interview late Tuesday afternoon, Grayson accused Republicans of pushing “health suppression” and measures “torturing” congressional staffers, and repeatedly “dragging America into heavy traffic.” The Florida Democrat also defended the effectiveness of the Congressional Progressive Caucus, predicted the demise of any “Great Betrayal” targeting Social Security or Medicare, and said voters will soon send the Republican Party “to the ash heap of history.” A condensed version of our conversation follows:

What’s your sense of what’s going on in the House right now?

Pathetic flailing around to little or no purpose.

What do you think John Boehner is trying to accomplish?

John Boehner is trying to maintain his position as President Obama’s golf partner.

Do you think the intention is to pass something that will become law?

No. I think that has never been the Tea Party’s intention. The Tea Party’s intention is destruction.

Do you expect that Boehner’s proposal will pass the House?

I’d have to see it first… You may recall that when they took over the House, they promised we’d have 72 hours to deal with anything before we voted on it. And now we’re not even getting 72 minutes.

What do you make of this Vitter Amendment?

I think that only those Republicans who were determined to shut down the government should have their healthcare benefits cut. Not the rest of us.

And the drive to take benefits away from congressional staffers?

We have always had staffers get the same benefits as other federal employees. They are federal employees. I’ve never understood the logic of abandoning that principle.

What would you say to the Republican staffers who could be affected by this?

That they’re fools and they work for fools.

AND GRAYSON GOES ON....

Demeter

(85,373 posts)Demeter

(85,373 posts)http://www.alternet.org/economy/simple-reform-could-save-america-wall-street-and-boost-economy-whats-washington-waiting?akid=11049.227380.mEtjdQ&rd=1&src=newsletter911096&t=4

Financiers have been getting a free ride for too long. Let's make them pay their share instead of robbing seniors... It’s a simple tweak that would rein in an out-of-control financial sector, stimulate jobs, generate billions of revenue, and possibly prevent another heart-wrenching crisis. Nobel Prize-winning economists like Joseph Stiglitz and Paul Krugman want it. Billionaires like Warren Buffett and Bill Gates want it. Polls show the majority of Americans want it. Even the Pope wants it. We’re talking about a financial transaction tax (FTT) — a tiny tax of, say, less than half a percent: maybe 3 cents per $100 — on Wall Street trading. It’s simple, more than fair, widely supported by the public, and long overdue.

Over the last weeks, Americans have been kept from going to work and the fragile economy has been strained as members of Congress wrangled over another phony budget crisis, even as the deficit is shrinking. Meanwhile, Wall Street has been raking in billions of dollars in profits from financial transactions. And they pay not a penny in taxes on most of them. Instead of talking about nickel-and-diming seniors by cutting their Social Security and Medicare, letting our infrastructure crumble, and forcing our children to go without proper education or medicine, we could be returning sanity and balance to our financial system. The FTT would put the breaks on the sort of reckless, breakneck-speed computer gambling that helped tank the American economy five years ago. It could raise hundreds of billions annually. Did you hear that, deficit hawks? We’d have enough to close the funding gaps in states that had their budgets destroyed by Wall Street’s risky behavior and predation. We’d even have enough to invest in new jobs.

As Jeremy Scott of Forbes put it: “What is important is that the financial sector, which bears a disproportionate share of the blame for the deep recession that is still affecting employment and growth, share in the costs of insuring against future bailouts and be forced to restructure itself to better insulate the rest of the economy from excessive risk.”

Once upon a time, we had a financial transaction tax in America, and it served us well from 1914 to 1966. Wall Street leaders at the time complained bitterly that the tax would be ruinous, but if you stop and think about those years, you notice that the American economy was actually much healthier than it is today. Income inequality was much lower, and jobs were more secure. After the Wall Street crash of 1987, major politicians, including Senate Majority leader Bob Dole and President H.W. Bush, called for a return of the FTT. Since the Wall Street-driven crash of 2008, renewed support for the tax has surged from every direction — except, of course, from Wall Street and the politicians who rely on their donations. Because of their outlandish size and undue influence, financial firms have wriggled out of just about every attempt to introduce sane rules of the road since 2008, and they’re more dangerous and concentrated today than they before the crisis. Bankers and financiers left millions of Americans to suffer, and if something is not done soon, they will almost certainly do it again. It’s merely a question of when.

One of the biggest arguments against the FTT is that it will somehow hurt the economy by discouraging Wall Street activity. Of course, what it would actually do is protect Wall Street from itself by reducing the wild volatility of the market and the speculation fever which have prompted ordinary investors to run scared and caused jitters in the overall economy. Over the last decade, speculative activity has skyrocketed 400 percent — and only a miniscule fraction of that actually does anything to build the real economy in goods and services. The vast majority of it is just arbitrage, high-speed trading, casino gambling, and siphoning more money from ordinary people to the super-rich. Another argument you hear is that regular folks would be hurt when they do things like make transactions on their 401(k)s or use a debit card. But this is nonsense. The tax would not apply to normal consumer activities, and traders could also be legally blocked from dumping costs onto consumers. The FTT is about giant banks and investment firms — behemoth companies like Bank of America, Citigroup, JPMorgan, and Goldman Sachs. Not you and me. Some huff that high-frequency traders will simply leave the country if we slow them down. Here’s an idea: can we help you pack? Seriously, don’t let the door hit you on the way out. Many industrial nations already have some form of FTT, including Hong Kong and Singapore. Some members of the European Union have tried to push ahead with an FTT, but it has gotten caught in the complicated web of the European legal framework. Naturally, the big financial firms have lobbied relentlessly to block it and convince the media (much of which relies on advertising dollars from Big Finance) that it’s a bad idea. They’ve succeeded in getting the tax’s effective date pushed into the middle of 2014.

Over on this side of the Atlantic, you may have heard that bank CEOs having been meeting with the president during the shutdown. It’s not hard to imagine what they had to say: Just carve another pound of flesh from the American populace in the form of cuts to Medicare and Social Security, and leave us to make our billions at their expense. Protect Big Finance at any cost. So far, Obama has done pretty much just that. He has surrounded himself with economic advisors, like Timothy Geithner and Larry Summers who have played Santa Claus to bankers and oppose the FTT. Current Treasury Secretary Jacob Lew is against the tax and gives us the official White House position: "The administration has consistently opposed a financial transaction tax on the grounds that it would be vulnerable to evasion, create incentives for financial re-engineering and burden retail investors.” Which is all a big pile of baloney.

So is there any hope? Much of Congress, attentive only to the drumbeat from Wall Street, has turned a deaf ear to the idea, despite a recent proposal from Sen. Tom Harkin and Rep. Peter DeFazio. The bottom line is that we need people in Washington willing to challenge banks. You could take Elizabeth Warren’s election to the Senate as a sign that we might finally be getting somewhere. She is a very popular politician, and if she were to get behind the FTT, there could actually be a chance of getting it passed. In the meantime, we really need to mob our representatives with messages of support for the FTT. Flood them with letters, emails, and phone calls. Make noise. Tell them that if they are not willing to champion the public good, they will not get your vote. And if the President dares to move forward with cuts to social programs, public services, Medicare, and Social Security while such a strong, sane idea as the FTT is supported by the population, well, maybe it’s time to take to the streets.

Lynn Parramore is an AlterNet senior editor. She is cofounder of Recessionwire, founding editor of New Deal 2.0, and author of 'Reading the Sphinx: Ancient Egypt in Nineteenth-Century Literary Culture.' She received her Ph.d in English and Cultural Theory from NYU, where she has taught essay writing and semiotics. She is the Director of AlterNet's New Economic Dialogue Project. Follow her on Twitter @LynnParramore.

Demeter

(85,373 posts)assuming I survive the morning paper drive and the afternoon football game/rain showers...

hamerfan

(1,404 posts)Simple Man by Lynyrd Skynyrd:

xchrom

(108,903 posts)On the global financial stage, China is playing chess while the U.S. is playing checkers, and the Chinese are now accelerating their long-term plan to dethrone the U.S. dollar. You see, the truth is that China does not plan to allow the U.S. financial system to dominate the world indefinitely. Right now, China is the number one exporter on the globe and China will have the largest economy on the planet at some point in the coming years.

The Chinese would like to see global currency usage reflect this shift in global economic power. At the moment, most global trade is conducted in U.S. dollars andmore than 60 percent of all global foreign exchange reserves are held in U.S. dollars. This gives the United States an enormous built-in advantage, but thanks to decades of incredibly bad decisions this advantage is starting to erode. And due to the recent political instability in Washington D.C., the Chinese sense vulnerability. China has begun to publicly mock the level of U.S. debt, Chinese officials have publicly threatened to stop buying any more U.S. debt, the Chinese have started to aggressively make currency swap agreements with other major global powers, and China has been accumulating unprecedented amounts of gold. All of these moves are setting up the moment in the future when China will completely pull the rug out from under the U.S. dollar.

Today, the U.S. financial system is the core of the global financial system. Because nearly everybody uses the U.S. dollar to buy oil and to trade with one another, this creates a tremendous demand for U.S. dollars around the planet. So other nations are generally very happy to take our dollars in exchange for oil, cheap plastic gadgets and other things that U.S. consumers "need".

Read more: http://www.zerohedge.com/news/2013-10-18/9-signs-china-making-move-against-us-dollar#ixzz2iAh1HcFd

Read more: http://www.zerohedge.com/news/2013-10-18/9-signs-china-making-move-against-us-dollar#ixzz2iAguNR5O

xchrom

(108,903 posts)thank you!

DemReadingDU

(16,000 posts)10 minutes of rain

8 hours of "Rain Sounds" "Sleep Sounds"

xchrom

(108,903 posts)So I got curious, where are the 144 from and who elected them to office. Here are the facts:

It is not news that an overwhelming number of the naysayers are from the South. The Daily Kos published a piece on Friday, showing that over 56% of them are from the southern states, with the Midwest accounting for over 24%. Only 28 of the no votes came from the West and Northeast.

West: 20

Midwest: 35

Northeast: 8

South: 81

The 144 no-voting congressmen were elected (in 2012) by just under 25.5 million U.S. voters.

Those who elected this the 144 naysayers equal approximately 11.1% of all eligible voters in the U.S. and about 18.5% of all those who actually voted in the last congressional election.

The 144 represent lopsided districts (heavily Republican) and were elected by an average of 63.4% of those voting in their constituencies. A handful of them ran unopposed in their last election, or nearly so.

Read more: http://www.businessinsider.com/tryranny-of-the-minority-2013-10#ixzz2iAxuQIGZ

xchrom

(108,903 posts)JPMorgan Chase will pay $4 billion to settle allegations that it sold billions of dollars worth of bottom-quality mortgages to state housing finance companies, the Wall Street Journal said Friday.

The Journal said JPMorgan had reached a deal to settle the charges that it overstated the quality of the mortgages it sold on to Fannie Mae and Freddie Mac, resulting in significant losses for the two companies that required government bailouts.

The deal would be less than the $6 billion originally sought by the Federal Housing Finance Agency, which oversees Fannie and Freddie, the Journal said.

It said the bank hoped to wrap that settlement into a larger deal, possibly $11 billion, to get past a range of charges of misbehavior dating to the financial crisis that involve the Justice Department and other agencies.

Read more: http://www.businessinsider.com/us-to-fine-jpmorgan-4-billion-for-selling-junk-mortgages-2013-10#ixzz2iAybA0gJ

xchrom

(108,903 posts)NEW YORK (AP) -- Will Washington be the Grinch who stole Christmas?

After weeks of bickering between Congress and the White House, President Barack Obama on Wednesday signed into law a plan that ended a partial 16-day government shutdown and suspended the nation's debt limit until early next year.

But the measure, which comes just weeks ahead of the holiday shopping season, only temporarily averts a potential default on U.S. debt that could send the nation into a recession.

Retailers hope that short-term uncertainty won't stop Americans from spending during the busiest shopping period of the year, but they're fearful that it will.

xchrom

(108,903 posts)NEW YORK (AP) -- Investment bank Morgan Stanley's third-quarter earnings almost doubled as the firm's stock sales and trading revenue rose.

THE RESULTS: The bank earned $1.01 billion from July to September after stripping out an accounting charge. That compares with earnings of $560 million a year earlier. That profit works out to 50 cents per share before the charge, compared with 28 cents per share in the same period a year earlier. Financial analysts polled by FactSet expected earnings of 40 cents. Analysts generally strip out one-time items.

Total revenue amounted to $8.1 billion, up 6.5 percent from $7.6 billion a year earlier.

HOW IT HAPPENED: Stock sales and trading were bright spots for the bank and revenue in that part of its business increased to $1.7 billion from $1.3 billion. Investment revenue also rose after the bank sold an investment in an insurance broker. Profit at the bank's wealth management unit also rose.

xchrom

(108,903 posts)Spain’s economy is starting to see results after the government slashed deficits and overhauled labor laws, said Angel Gurria, the head of the Organization for Economic Cooperation and Development.

The country’s 26 percent unemployment rate has “stopped growing” as labor costs converge with productivity similar to Germany, Gurria said. He complimented Spain’s coalition government for passing reforms while facing pressure from protests.

“Spain is on the right track,” Gurria, Secretary General of the Paris-based OECD, said in an interview on the sidelines of the Ibero-American summit in Panama. “It’s been tough, but it’s a time of reckoning.”

Prime Minister Mariano Rajoy said in a Sept. 26 interview that the Spanish economy is emerging from its two-year recession and the government doesn’t plan additional austerity measures as it’s confident it can meet this year’s deficit goal of 6.5 percent of gross domestic product.

***

Demeter

(85,373 posts)Demeter

(85,373 posts)

Demeter

(85,373 posts)or maybe it was sleet...in any event, we had everything except snow and a twister at the game today.

Also some heart-stopping plays from Indiana and Michigan, until the home team prevailed.

We tried very hard not to freeze to death, and mostly succeeded. My new winter coat and stadium mittens worked perfectly...it was the legs that were a bit cold and damp. The wind, the clouds, the rain (and hail) made for challenging watching, but we stayed to the last scary minute.

The skies cleared in time for the sun to set, and we missed the lunar eclipse due to the height of the the skyboxes blocking it...

xchrom

(108,903 posts)Acting Bank of Israel Governor Karnit Flug, passed over twice for the central bank’s top job, was nominated for the post today in an effort to wrap up a bungled selection process that’s left the institution without a permanent chief since June.

Prime Minister Benjamin Netanyahu named Flug three months after two other nominees withdrew during the vetting process, and nine months after former Governor Stanley Fischer, who deemed her a worthy successor and handpicked her as his deputy, announced he would leave June 30.

“We were impressed with Dr. Flug’s performance as head of the Bank of Israel in the past few months, and we are sure she will continue to help us lead the Israeli economy to new achievements amid the global economic turmoil,” Netanyahu and Lapid said in a joint e-mailed statement.

The yield on the 4.25 percent benchmark bond fell 3 basis points to 3.62 percent, the lowest on a closing basis since May 28, at 1:37 p.m. in Tel Aviv after the announcement. Israel’s benchmark TA-25 (TA-25) stock index was up 0.4 percent to 1,302.28 at 1:30 p.m. in Tel Aviv.

xchrom

(108,903 posts)

The pitch was enticing. At a time when the Standard & Poor’s 500 Index had suffered a decline of 41 percent in the previous three years, Morgan Stanley (MS) was offering its clients the possibility of some relief.

In a prospectus, the New York securities firm invited its customers to put their money into a little-known area of alternative investing called managed futures.

“If you’ve never diversified your portfolio beyond stocks and bonds, you should know about the powerful argument for managed futures,” the bank wrote. “Managed futures may potentially profit at times when traditional markets are experiencing losses.”

Morgan Stanley presented a chart telling investors that over 23 years, people who put 10 percent of their assets in managed futures outperformed those whose investments were limited to a combination of stocks and bonds, Bloomberg Markets magazine will report in its November issue.

xchrom

(108,903 posts)

PARIS (Reuters) - A newspaper open on the bar of this Paris cafe tells of a row over France's Sunday trading rules. But the bar owner, Zhang Chang, says he has little time to follow such debates. He's too busy working.

While French workers worry the country's long economic downturn could mean the end of laws banning Sunday trading and enforcing a 35-hour week, Zhang and Chinese immigrants like him are quietly getting ahead the old-fashioned way - 11 hours a day, six days a week.

"As I see it, when you work, you're paid. So why stop at 35 hours?" he asks, perplexed by France's landmark law which shaved four hours off the statutory working week in the late 1990s.

Zhang owns the Cafe Le Marais in central Paris and is part of a wave of entrepreneurial migrants from China's coastal Wenzhou region who are taking over France's "bar tabac" business. They are doing it by sweat and sacrifice - and by navigating restrictive labor rules, focusing on the bar and restaurant sector that is exempt from the 35-hour rule and the Sunday trading ban, unlike many other industries.

Read more: http://www.businessinsider.com/chinese-cant-understand-why-the-french-work-so-little-2013-10#ixzz2iGQW9yav

xchrom

(108,903 posts)

(Reuters) - KIEV - In 1993, the late Harvard political scientist Samuel Huntington proposed that "the principal conflicts of global politics will occur between nations and groups of different civilizations." His theory that the world was divided into potentially warring civilizations - and later, his book on the topic - have been denounced by legions of critics, mainly on the liberal side. But it had and has retained one group of unlikely fans: Russian nationalists.

They saw in his definition of "Slavic-Orthodox culture" (including much of the former Soviet Union and reaching deep into East-Central Europe) a confirmation, albeit from a surprising quarter, of their own view of the world. That is, that Russia is and must remain the central and organizing power of a collection of states that history, religion and culture had predisposed to unity, and to a distinctly separate identity from a West that would devour them behind a front of "spreading democracy."

President Vladimir Putin of Russia is an ardent Huntington-ite. His much quoted view that the collapse of the Soviet Union was the greatest geopolitical tragedy of the 20th century signaled a deeply felt loss of a world in which Russia ruled not so much by force but by cultural and political leadership. In such a view, the nations that comprise that civilization are less important than the civilization itself. For a Slavic-Orthodox state to shift to the West would not be a choice, but a betrayal of the bloc's essence.

In a few weeks, the state that lives on the fault line between Huntington's Western and Slavic civilizations will have to make what James Sherr, one of its foremost Western observers, calls "a civilizational choice." Sherr writes that the European Union is about to offer Ukraine an Association Agreement and trade pact that will "provide tangible mechanisms of integration with the EU" - an open invitation to shift the core of Ukraine's statehood to the West.

Read more: http://www.businessinsider.com/ukraine-must-make-a-civilization-defining-choice-between-russia-and-the-west-2013-10#ixzz2iGRFmiM1

bread_and_roses

(6,335 posts)I started to read the article I am about to post yesterday AM ... just got back to it now. Life interrupted.

xchrom

(108,903 posts)WASHINGTON (Reuters) - Despite his win last week in a debt ceiling standoff with Republicans, President Barack Obama has limited ability to achieve his policy goals through legislation, which could result in increased use of executive powers, administration officials and Democratic strategists said.

The 16-day partial government shutdown highlighted Obama's challenges in basic governing. Although he refused to concede to Republicans in exchange for reopening the government and raising the U.S. borrowing limit, he could not block the emergence of what he called a "manufactured" crisis.

The president would now like to seize momentum to push forward three legislative priorities: the farm bill, immigration reform and a more lasting budget deal.

But his chances of progress on those issues, particularly immigration reform, depend on convincing embittered Republicans to work with a White House many of them detest. That leaves Obama more or less at the same strategic juncture he encountered before the shutdown began.

Read more: http://www.businessinsider.com/obama-will-have-to-rely-more-and-more-on-executive-orders-2013-10#ixzz2iGSYICfP

xchrom

(108,903 posts)With the US fiscal crisis resolved, at least for the moment, the European stock markets on Friday took advantage of some good figures out of China, whose economy grew 7.8 percent in the third quarter, to continue their recent rally.

In the case of the Spanish bourse, the blue-chip Ibex 35 index improved on its closing high for the year so far for the eighth session in a row ending at above 10,000 points for the first time since July 2011. The benchmark index added 0.85 percent to close at 10,001.80 points.

In the rest of Europe, the DAX in Frankfurt put on 0.43 percent, the CAC 40 in Paris was 0.90 percent to the good, while the FTSE 100 in London was up 0.71 percent.

“The big pick-up in the Ibex 35 is due basically to improved macroeconomic prospects, and a perception of lower risk on the part of investors – above all foreigners – of Spanish assets,” said Diego Jiménez-Albarracín, who heads Deutsche Bank España’s equity operations. “While things remain the same, there are no important resistance levels ahead until we get to 10,400 points, meaning that the rally could continue,” he said.

xchrom

(108,903 posts)The European Anti-Fraud Office (OLAF) has reportedly ignored repeated tip-offs about squandered European Union funds in Greece, according to an article in the Friday edition of the Süddeutsche Zeitung.

The German daily reports that a Greek civil servant uncovered multiple cases of nepotism and vastly inflated salaries while inspecting the finances of a vocational training institute. Officials in Brussels have apparently not acted on any of the whistleblower's suspicions, which he communicated in several letters, the paper added.

According to the newspaper report, Giorgos Boutos, a government finance official in Athens, began auditing the books of the Organization for Vocation Education and Training (OEEK) in 2006. The institute receives and distributes EU funds earmarked for vocational training in Greece. Boutros repeatedly stumbled upon irregularities and documented the cases in numerous letters to OLAF.

The suspected squandering of public funds is a particularly touchy issue, as it was considered a contributing factor in Greece's ongoing debt crisis.

The case involves at least €6 million ($8.2 million). It's not an excessive sum of money, but it is well documented. Boutos was able to substantiate the irregularities in his letters to the EU with contracts, hotel bills and bank statements. He reportedly found that 75 percent of the misappropriated money had come from the EU.

bread_and_roses

(6,335 posts)Nobel Prize? Meet the Economic Movement That Really Deserves Praise

This week, the Nobel Prize for economics may have gone to three academics, but the real work of fixing our local economies was happening on the ground—as part of New Economy Week.

by Laura Flanders

The winners of the so-called Nobel Prize for economics were announced this week, and what a peculiar pick: The three who will share the award this year sit on two diametrically opposed sides of their field’s most critical debate.

Are markets magic, efficient, rational, and in need of no regulation? Or are they irrational, hysterical, and error-prone, like the humans who bet on them? That’s the debate.

Splitting the prize between Eugene Fama and Lars Peter Hansen (two "magical markets" guys) and Robert Shiller (whose 1992 book, Market Volatility, was all about exactly that) is kind of like splitting the biology prize between Charles Darwin and the Tea Party Creationist Caucus. It makes no sense.

... “New Economy groups are emerging all around the country in response to local conditions: transition towns, sustainable business networks, the cooperative movement, local first,” added Mike Sandmel, New Economy Week coordinator.

http://neweconomy.net/about_us

... Our plan begins with the recognition that a tremendous number of people around the country understand that the system is broken, and that we must work to replace it with something different, something new.

I don't think there is anything here we have not talked about before, to one degree or another, but I do like the frank acknowledgment that the system we have is broken.

Demeter

(85,373 posts)I was in pain delivering the papers (as well as chilly weather) and went right back to bed. I thought fun wasn't supposed to be harmful to one's health?

I think we will have to keep this theme going next week. So that some of the substance of simplicity can be addressed.

Until then, Keep it Simple, Keep it Real, and don't let the bastards grind you down!