Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 16 January 2014

[font size=3]STOCK MARKET WATCH, Thursday, 16 January 2014[font color=black][/font]

SMW for 15 January 2014

AT THE CLOSING BELL ON 15 January 2014

[center][font color=green]

Dow Jones 16,481.94 +108.08 (0.66%)

S&P 500 1,848.38 +9.50 (0.52%)

Nasdaq 4,214.88 +31.87 (0.76%)

[font color=green]10 Year 2.89% -0.01 (-0.34%)

[font color=black]30 Year 3.82% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)(Editor’s Note: When MIT Sloan School of Management Professor Zeynep Ton faces her students, she tells the future executives that they don’t have to treat employees and customers poorly to make money—especially in service jobs.

Ton knows they have heard all the stereotypes; that cutting costs is the key to profits. But she has found that’s not true, especially in the service sector. Better treatment of workers translates into more sales. Higher pay means less turnover. Better service creates loyalty among consumers. Ton profiles a handful of good and bad employers in a new book, The Good Jobs Strategy: How The Smartest Companies Invest In Employees to Lower Costs and Improve Profits.

In this excerpt, we see contrasting profiles where management has chosen bad and good job strategies. Ton’s insights underscore that America’s business owners do not have to pay workers poorly, treat them and consumers with contempt, to make money. It is a powerful analysis that, if heeded, could transform the workplace.)

Excerpted from The Good Jobs Strategyby Zeynep Ton,with permission from Amazon Publishing/New Harvest:

CONTINUES AT LINK

Demeter

(85,373 posts)It has taken an amazingly long time, but inequality is finally surfacing as a significant unifying issue for progressives in the United States - including the president. And there is also, inevitably, a backlash, or actually a couple of backlashes.

One comes from groups like the organization Third Way. Josh Marshall, the editor of Talking Points Memo, characterized that position best in a recent article: "That captures a lot of what the 'Third Way' is about: a sort of fossilized throwback to a period in the late 20th century when there was a market for groups trying to pull the Democrats 'back to the center and away from the ideological extreme' in an era when Democrats are the fairly non-ideological party and have a pretty decent record of winning elections in which most people vote."

There's also an intellectual backlash, with people like the Washington Post columnist Ezra Klein arguing that inequality, while an issue, doesn't rate being described as "the defining challenge of our time." This in turn infuriates other commentators.

Well, I'm not infuriated, but I would argue that Mr. Klein has gotten this one wrong. The case that inequality is a major, indeed defining challenge - and is something that should be at the center of progressive concerns - rests on multiple pillars. Taken together, the reasons to focus on inequality are overwhelmingly convincing, even if you are skeptical about particular arguments...

http://truth-out.org/opinion/item/21082-inequality-remains-a-critical-issue-in-the-us

Demeter

(85,373 posts)In spring 2003, Peter Janes decided to do something most people only dream of — that is, if they think about it at all. He left behind an academic education and the urban life that went with it to move to a small island off British Columbia's coast. Appalled at what he saw as industrial humankind's destruction of the natural world, Janes figured the most honest response was to build an alternative system: by producing his own food, building his own house and generating his own power.

"I wanted to physically make the world a better place," Janes said. With his family's help, he bought 40 acres of forested land on Denman Island. It came with two trailers. Janes and a girlfriend he's no longer with moved into one, and promptly sold the other — "a big, ugly, white vinyl doublewide," he said. They planted a vegetable garden and got some chickens. Self-sufficiency "was definitely an ideal," Janes explained, "but we were doing everything we could" to achieve it.

That ideal has since become an influential driver of North American culture. It's in " The 100-Mile Diet." The rise of agritourism. The urban gardens of Vancouver, Detroit, Brooklyn and Mexico City. Bill McKibben bestsellers like "Deep Economy" and "Eaarth." The Global Village Construction Set. Modern Farmer magazine. Resurging farmers' markets. The Degrowth movement — a "shift away from our current industrial society," as adherents put it — across North America and Europe.

For Janes, it now presents a philosophical dilemma. After 10 years striving to build a self-sustaining farm on Denman Island, he's struggling with questions that probe his life's meaning. Assuming he could cut all ties to the industrial system — and that's "a very tall order," he realizes — would it be worth the immense time and energy he must continue expending for the next five, 10, 50 years? Can the actions of a few people in the woods, he wonders, truly make the world a better place? MORE

Demeter

(85,373 posts)With every multimillion dollar acquisition deal, the technology startups space must seem more enticing to those stuck in unfulfilling jobs. As interest in the sector grows, there's an increasingly competitive market for retraining courses that offer the chance of fulfilment, excitement – and a slice of the pie.

Initiatives from the government, industry and the charitable sector all exist to help potential entrepreneurs gain the skills and confidence they will need to launch their own business. Many still fail, but not through lack of aid.

The same is less true of those who come after. Joining a start-up, whether as employee two or two hundred, frequently takes almost as much courage and talent as setting out alone. Organisations such as Steer and General Assembly offer the opportunity to learn portable skills like coding or marketing, but without the specific focus on small companies.

Startup Institute started in Boston as an attempt to correct that imbalance, and launches in the UK and Berlin on Tuesday...

Demeter

(85,373 posts)TOO BAD THEY AREN'T MANDATED TO PAY OFF THE CREDITORS WHO SUFFERED IN THEIR BANKRUPTCY...

http://www.reuters.com/article/2014/01/15/us-autoshow-gm-dividend-idUSBREA0D1JH20140115

General Motors Co (GM.N) will pay the first quarterly dividend on its common stock in almost six years, marking another step in the U.S. automaker's recovery from its bankruptcy in 2009 and sending shares up 3.2 percent in after-hours trading. The No. 1 U.S. automaker, which last paid a dividend in June 2008 before it moved to save money during the U.S. recession, said it will pay shareholders a quarterly dividend of 30 cents a share, payable on March 28 to shareholders of record on March 18. In 2008, its quarterly dividend was 25 cents a share.

"This return to shareholders is consistent with our capital priorities and is an important signal of confidence in our plans for a continuing profitable future," Chief Financial Officer Dan Ammann said in a statement.

Ammann, who said on Sunday that GM was closer than ever to paying a dividend, will become GM's president on Wednesday. GM also named Chuck Stevens as the company's new CFO, effective on Wednesday. He had been CFO of GM North America.

Investors have been pushing GM to return cash to them in the form of a dividend or a stock buyback, especially since the U.S. Treasury sold the last of its stake in the company last month. The dividend reintroduction by GM, which is showing new cars and trucks this week at the Detroit auto show, is likely to attract investors who buy stocks that generate income...MORE

Demeter

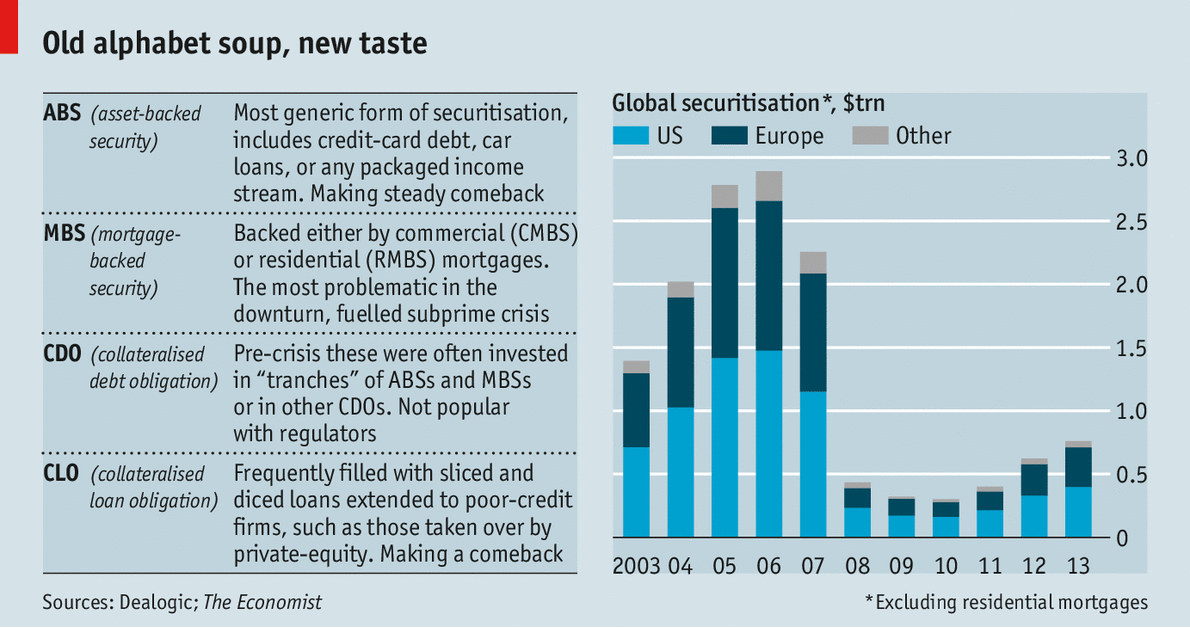

(85,373 posts)IF YOU asked regulators in 2008 which financial instrument they most wished had never been invented, odds were that they angrily splurted a three-letter acronym linked to securitisation. The practice of bundling up income streams such as credit-card and car-loan repayments, repackaging them as securities and selling them on in “tranches” with varying levels of risk once seemed like enlightened financial management. Not so after many a CDO, CLO, ABS, MBS and others (see table) turned out to be infested with worthless American subprime mortgages.

Find the same regulator today and he is probably devising a ploy to resuscitate the very financial vehicle he was bemoaning five years ago. Enthusiasm for the once-reviled practice of transforming a future income stream into a lump sum today—the essence of securitisation—is palpable. In Britain Andy Haldane, a cerebral official at the Bank of England, recently described it as “a financing vehicle for all seasons” that should no longer be thought of as a “bogeyman”. The European Central Bank (ECB) is a fan, as are global banking regulators who last month watered down rules that threatened to stifle securitisation.

Watchdogs will be pleased that, after once looking as if it was heading for extinction, securitisation is making a recovery. Issuance of ABSs (securities underpinned by car-loan receivables, credit-card debt and the like) are at double their 2010 nadir. Issuance of paper backed by non-residential mortgages is up from just $4 billion in 2009 to more than $100 billion last year. There have even been offerings of securities underpinned by more esoteric sources, such as cashflows from solar panels or home-rental income—the sort of gimmick once derided as a boomtime phenomenon. Excluding residential mortgages, where the American market is skewed by the participation of federal agencies, the amount of bundled-up securities globally is showing a steady rise (see chart).

The comeback of securitisation is related to the growth in economic activity: in order for car loans to be securitised, say, consumers have to be buying cars. Investors desperate for yield are also stimulating supply: securitised paper can offer decent returns, particularly at the riskier end of the spectrum. More important, though, is the regulators’ enthusiasm....

Why are regulators so keen on the very product that nearly blew up the global economy just five years ago? In a nutshell, policymakers want to get more credit flowing to the economy, and are happy to rehabilitate once-suspect financial practices to get there. Some plausibly argue it was the stuff that was put into the vehicles (ie, dodgy mortgages) that was toxic, not securitisation itself. This revisionist strand of financial history emphasises that packaged bundles of debt which steered clear of American housing performed well, particularly in Europe.

THEY ARE GOING TO BE EXTRA CAREFUL, THIS TIME...DEFINITION OF INSANITY APPLIES HERE.

Demeter

(85,373 posts)Demeter

(85,373 posts)One of Nasdaq OMX Group Inc. (NDAQ)’s U.S. options markets experienced a technical malfunction that prompted it to briefly stop trading some contracts. Options with symbols beginning with A through M were halted on the Nasdaq Options Market as of 11:42 a.m. New York time today. Transactions resumed at about noon, according to a statement from the exchange operator.

The outage was caused by Nasdaq’s computers being temporarily unable to process data from the industry’s main pricing feed, known as OPRA, according to a person with direct knowledge of the matter, who asked to not be identified because the details are private.

Representatives from other U.S. options exchanges -- including CBOE Holdings Inc. (CBOE), IntercontinentalExchange Group Inc., International Securities Exchange LLC, and Bats Global Markets Inc. -- said they didn’t experience any issues.

“Nasdaq went down but the other exchanges were there to take orders, so the consequences are limited,” said James Ramelli, an options strategist for Keeneonthemarket.com. “One instance is not a problem, but the fact that glitches continue to happen is making these situations a big deal. It’s a problem for market confidence.”

Demeter

(85,373 posts)http://truth-out.org/news/item/21191-you-cant-opt-out-10-nsa-myths-debunked

The debate Edward Snowden envisioned when he revealed the extent of National Security Agency (NSA) spying on Americans has taken a bad turn. Instead of a careful examination of what the NSA does, the legality of its actions, what risks it takes for what gains, and how effective the agency has been in its stated mission of protecting Americans, we increasingly have government officials or retired versions of the same demanding -- quite literally -- Snowden’s head and engaging in the usual fear-mongering over 9/11. They have been aided by a chorus of pundits, columnists, and present as well as former officials offering bumper-sticker slogans like "If you have nothing to hide, you have nothing to fear," all the while claiming our freedom is in direct conflict with our security.

It’s time to face these arguments directly. So here are ten myths about NSA surveillance that need debunking.Let's sort them out.

1) NSA surveillance is legal.

True, if perhaps you put “legal” in quotes. After all, so was slavery once upon a time in the U.S. and apartheid in South Africa. Laws represent what a government and sometimes perhaps even a majority of the people want at a given point in time. They change and are changeable; what once was a potential felony in Colorado is now a tourist draw.

Laws, manipulated for terrible ends, must be challenged when they come into conflict with the fundamental principles and morals of a free society. Laws created Nelson Mandela, the terrorist (whom the U.S. kept on its terror watch list until 2008), and laws created Nelson Mandela, the president.

There’s a catch in the issue of legality and the NSA. Few of us can know just what the law is. What happens to you if you shoplift from a store or murder someone in a bar fight? The consequences of such actions are clearly codified and you can look them up. Is it legal to park over there? The rules are on a sign posted right where you'd like to pull in. If a cop tickets you wrongly, you can go to court and use that sign to defend yourself. Yet almost all of the applicable “law,” when it comes to the National Security Agency and its surveillance practices, was secret until Edward Snowden began releasing his documents. Secret interpretations of the shady Patriot Act made in a secret court applied. The fact that an unknown number of legal memos and interpretations of that secret law (themselves still classified) are operative means that we really don’t know what is legal anymore...

MUST READ AND BOOKMARK FOR YOUR FASCIST FRIENDS...

Demeter

(85,373 posts)President Obama should ensure that U.S. surveillance, both inside and outside U.S. territory, complies with the right to privacy as enshrined in international human rights law, Amnesty International said in an open letter today.

Amnesty International is deeply concerned that President Obama's anticipated reforms, reportedly to be announced before the State of the Union address, will fall short.

"President Obama correctly recognized that U.S. surveillance is out of control, but to ensure real reform he must put human rights at the center of U.S. policy. This includes acknowledging the importance of whistleblowers such as Edward Snowden and respecting their rights - not persecuting them," said Steven W. Hawkins, Executive Director of Amnesty International USA. "Snowden should not be prosecuted for revelations about human rights violations by the U.S. government."

In the open letter, Amnesty International calls on President Obama to take a number of steps to end unlawful mass surveillance:

Disclose the scope of U.S. surveillance to ensure comprehensive reform;

Respect the rights of all people, not only U.S. citizens;

Recognize the application of international human rights standards to U.S. practice;

Take into account the International Principles on the Application of Human Rights to Communications Surveillance, which provide guidance in implementing these international standards;

Establish an independent privacy rights champion before the FISA Court;

Support encryption standards to increase security and trust;

Respect the rights of whistleblowers such as Edward Snowden.

"We urge Obama to appoint a public interest advocate - a position he has embraced - to ensure that human rights are protected and considered in the balance," Hawkins said.

Read Amnesty's letter to President Obama here:

http://www.amnestyusa.org/pdfs/AIUSA_LetterToObamaSurveillanceJan2014.pdf

Demeter

(85,373 posts)Christine Lagarde, who heads the International Monetary Fund, offered some positive comments about Congress on Wednesday. Her assessment was a shade better than "faint praise," but something less than "Attaboy!" Speaking at the National Press Club, Lagarde said she was pleased to see U.S. lawmakers have been moving forward "in a more orderly fashion" as they work on spending legislation.

Back in October — during the peak of the federal government shutdown — the IMF was holding its annual meeting in Washington, D.C. The world's top central bankers, finance ministers and economists were all there to witness congressional gridlock first-hand. Lagarde was sharply critical at the time, warning that if Congress did not pass a budget, "it will have financial consequences that will apply not just to this country but across the globe."

Now with lawmakers pushing for final passage of a $1.1 trillion spending package, it appears the United States finally will have fiscal stability, at least for a while. "We are all very pleased to see an orderly budget process is back," Lagarde said. "Any deal is better than no deal."

But she noted that congressional negotiators failed to include funding to help support the IMF....

SURPRISE, CHRISTINE!

xchrom

(108,903 posts)BARCELONA, Spain (AP) -- A European season of separatist fervor kicked off Thursday with Catalan lawmakers voting on whether to seek the right to hold a referendum on independence from Spain. The EU will be watching closely as Belgium's Dutch speakers gear up to push for greater autonomy in May elections, and Scotland prepares to hold its own referendum on breaking away from Britain in the fall.

The vote is a milestone in years of mass protests by Catalans, who are fiercely proud of their distinct culture and language, demanding the right to decide whether they want to secede. As lawmakers entered the Catalan parliament in Barcelona on Thursday morning to debate ahead of the vote, dozens of Catalans waved independence flags and a smaller group unfurled Spanish flags, yelling "Catalonia is Spain!"

But the vote is also largely a symbolic one.

Catalonia can ask Spain for permission to hold an independence vote all it wants; Madrid still has the power to say "no" - and it almost certainly will.

xchrom

(108,903 posts)LOS ANGELES (AP) -- The number of U.S. homes that got started on the path to foreclosure fell last year to a low not seen since before the high-flying days of the housing boom, the latest evidence that the threat of foreclosures continues to diminish.

Lenders also took back the fewest number of homes last year since 2007, at the dawn of the foreclosure crisis, foreclosure listing firm RealtyTrac Inc. said Thursday.

While foreclosures remain elevated in many populous states, such as Florida, New York and California, they have been steadily declining since the U.S. housing market and economy began to rebound after years of decline.

The U.S. housing market has emerged from a deep slump, aided by rising home prices, steady job growth and fewer troubled loans dating back to the housing-bubble days. Meanwhile, more homeowners are keeping up with their mortgage payments.

Tansy_Gold

(17,874 posts). . . prices got so low the banks couldn't make money any more. What's left are the "performing" loans, after the investors have gobbled up and are now renting out the rest.

Demeter

(85,373 posts)and all that's left are "ordinary" unlucky slobs with divorce, medical or other issues putting their homes in jeopardy.

SNAFU...whoopee.

xchrom

(108,903 posts)HONG KONG (AP) -- World stock markets struggled on Thursday as they fought to scrape out more gains a day after a key U.S. benchmark climbed to a new high on strong earnings and economic data.

Asian investors were initially reassured after the S&P 500 closed at its highest level yet, squeaking past its previous record set less than a month ago. The rally was helped along by Bank of America, the country's No. 2 bank, reporting that quarterly profits quadrupled.

A Federal Reserve survey that showed economic growth remained healthy also bolstered sentiment, as did optimistic comments about the state of the global economy by the World Bank and the head of the International Monetary Fund.

In early European trading, France's CAC 40 dipped 0.2 percent to 4,322.80, while Germany's DAX lost 0.1 percent to 9.724.61. The FTSE 100 index of leading British companies was nearly unchanged at 6,820.09.

xchrom

(108,903 posts)Bank of England officials discussed trading practices around key foreign-exchange benchmarks with senior currency dealers 18 months before regulators opened formal investigations into alleged rate-rigging.

Records of a meeting in April 2012 released yesterday by the central bank show dealers discussed the rules they were subject to when trading close to the times when key market benchmarks, such as the WM/Reuters rates, are set.

The traders, concerned by regulators’ scrutiny of instant messages in the London interbank offered rate probe, talked about how they shared information about orders to reduce the risk of losses in the minutes before benchmarks are calculated, said two people with knowledge of the meeting who asked not to be identified because the meeting was private. Investigators are deciding whether those communications amount to collusion.

The discussion raises the question of how much Bank of England officials, already criticized by lawmakers for failing to heed warnings Libor was vulnerable to abuse, knew about the potential for manipulation of the $5.3 trillion-a-day currency market before regulators opened their formal probes. Three members of the panel, two of whom were at the meeting at BNP Paribas SA’s London office, have since been fired, suspended or put on leave by their firms.

xchrom

(108,903 posts)

Fresh snow covers the brim of a woman's hat as she walks past the Kongress Zentrum,

Davos, the spiritual home of globalization, is having to defend its vision.

As the Swiss ski resort prepares to host its next who’s who of decision-makers on Jan. 22-25, the World Economic Forum’s abiding belief that “improving the state of the world” is compatible with closer integration has taken a beating.

The financial crisis that struck in 2008 raised questions about whether globalization was more of a threat than a boon, Bloomberg Businessweek reports in its Jan. 20 issue. Even as recession recedes, its ravages are visible and countries are more inclined to protect trade and their financial markets than become vulnerable again. Charles Collyns, who was assistant U.S. Treasury secretary for international finance, puts it bluntly, saying “globalization has stalled.”

“What we’re moving toward is a system which on paper is open, but beneath the surface is increasingly distorted by all kinds of subsidies and buy-local provisions,” said Simon Evenett, professor of international trade at the University of St. Gallen in Switzerland.

Demeter

(85,373 posts)It's like farming with clones...one little mass extinction, and you are screwed.

We need diversity in the species and in the political and economic schemes we devise.

ONE SIZE DOES NOT FIT ALL.

xchrom

(108,903 posts)Bailed-out euro-area countries are facing “painful” challenges with worse-than-anticipated consequences of economic adjustment, including high unemployment and slow growth, central banks and finance ministries said.

Officials and ministers from Greece, Ireland, Portugal and Cyprus, in responses to European Union lawmaker questions published yesterday, described how their countries’ emergency aid had been followed by social hardship and continuing economic difficulties.

The bailout program had a “worse-than-expected impact on both output and employment,” Portugal’s finance ministry said. The program in Cyprus was “rigorous and painful,” according to the island’s central bank. Adjustment in Greece, after four years of cuts and efforts to make the economy more competitive, has come at “an extremely high socioeconomic cost,” Greek Finance Minister Yannis Stournaras said.

The testimonies come three-and-a-half years after Greece became the first euro-area country to be bailed out, using EU and International Monetary Fund loans. Since then the German-led path of aid in return for reforms and debt cuts has seen 396 billion euros ($538 billion) committed to the region’s four most fragile economies, with an additional 100 billion euros pledged for Spain’s banking sector. The bloc has endured the longest recession in its history and unemployment has reached record levels.

Demeter

(85,373 posts)xchrom

(108,903 posts)The European Central Bank favors requiring banks to show their capital won’t fall below 6 percent of their assets when it puts them through a simulated recession later this year, said two euro-area officials with knowledge of the matter.

A majority of policy makers and technical officials have reached consensus on the benchmark for the ECB’s stress test, the people said, asking not to be identified as the deliberations aren’t public. The threshold must still be agreed on with the European Banking Authority that coordinates the exams, and a small number of countries wanting an easier benchmark may press for a compromise lower than 6 percent, one of the people said.

A benchmark of 6 percent would be tougher than the 5 percent set by the London-based EBA in 2011, when models of an economic “adverse scenario” failed to reveal shortcomings at banks that later collapsed. ECB President Mario Draghi has said he’s determined to convince investors that the health check of institutions is thorough and credible as the central bank prepares to take over supervision of about 130 euro-area lenders from France’s BNP Paribas SA (BNP) to Bank of Valetta Plc in Malta.

Not Final

“At first sight the 6 percent target looks manageable and less ambitious than what people might have expected,” said Antonio Guglielmi, head of equity analysts at Mediobanca SpA (MB) in London. “However, given Draghi has been very explicit in willing to carry a tough and credible stress test, this might also imply that the macro adverse scenario the ECB will apply will be much more severe than what the EBA did last time.''

xchrom

(108,903 posts)Spain auctioned three-year notes at the lowest yield on record as bonds from Europe’s most-indebted nations rallied and the government upgraded its assessment of the Iberian country’s economy.

The Treasury sold notes maturing in April 2017 at an average yield of 1.595 percent, the lowest at a three-year auction since Bloomberg started compiling the data in 2004. The sale, which also included debt due in 2026 and 2028, raised 5.91 billion euros ($8 billion), the largest amount for an auction of bonds in a single day since January 2012.

Securities from the euro region’s periphery are surging as their economies recover from the debt crisis that sparked a recession and pushed borrowing costs to euro-era records. Spain’s expansion probably accelerated in the fourth quarter of last year, Prime Minister Mariano Rajoy said this week.

“Getting cheaper funding is important in making debt sustainable,” said Ciaran O’Hagan, head of European rates strategy at Societe Generale SA in Paris. “If interest rates fall Spain gets cheaper and cheaper levels at each auction and that does help to restore confidence in the longer-term outlook,” he said.

xchrom

(108,903 posts)Mario Draghi’s strengthened pledge to keep interest rates low has improved the impact of the European Central Bank’s forward guidance, economists said.

The Frankfurt-based central bank’s vow on borrowing costs has been effective, according to 77 percent of respondents in the Bloomberg monthly survey of economists. That’s up from 68 percent last month and 48 percent when they were first asked in September. The ECB President unveiled the policy in July and said last week that officials chose “firmer words” to emphasize decisiveness and keep a lid on market interest rates.

By refusing to say the fight against Europe’s debt crisis is won, Draghi highlighted the diverging outlooks for the region and the U.S., where the Federal Reserve is tapering monetary stimulus as the recovery strengthens. It’s too soon to say that the region is out of danger, Draghi told reporters on Jan. 9, after ECB officials kept interest rates at a record-low 0.25 percent and didn’t rule out future reductions.

“The repeating and the strengthening of the message had a positive impact in terms of keeping interest rate expectations low,” said Azad Zangana, a London-based economist at Schroder Investment Management, which manages $416 billion in assets. “It’s also supported market expectations that another form of policy action might follow.”

xchrom

(108,903 posts)The rupiah will go from worst to first among Asian currencies this year as Indonesia’s resilient economy and a shrinking current-account deficit draw funds to the nation’s assets, the most accurate forecaster says.

The currency will rally 6.8 percent in 2014 to 11,400 per dollar, recouping a third of last year’s 21 percent plunge, according to Lloyds Banking Group Plc, which had the closest estimates in the last four quarters as measured by Bloomberg Rankings. Societe Generale SA, the fifth-best, sees the rupiah at 10,250 by year-end, compared with the 12,200 median estimate of 23 analysts surveyed by Bloomberg. Among Asia’s 10 biggest economies, only China is expanding faster than Indonesia.

The Southeast Asian nation’s current-account deficit swelled to a record in the second quarter of 2013, denting investor confidence just as the Federal Reserve signaled plans to curb stimulus that fueled demand for emerging-market assets. Last year’s slide in the rupiah battered imports, driving the trade surplus to a 20-month high in November and paving the way for a rebound in the currency.

“We think the rupiah is undervalued at this level given its growth dynamics,” Jeavon Lolay, director of global research at Lloyds, said in a telephone interview from London yesterday. “The recent trade numbers have been positive. We have a more positive outlook on global growth as well, which should help the export recovery in the second half.”

xchrom

(108,903 posts)The head of the International Monetary Fund has warned about the risks to global economic recovery of deflation.

Christine Lagarde said that "optimism is in the air" about growth, but the recovery is still "fragile".

"If inflation is the genie, then deflation is the ogre that must be fought decisively," she said in a speech in Washington.

Earlier, the World Bank said that the global economy was at a "turning point" but "remained vulnerable".

xchrom

(108,903 posts)Income inequality is making us sick.

Well, it's not making all of us sick. Only the poorest of us. That's what a new paper in Health Affairs by Hilary Seligman, Ann Bolger, David Guzman, Andrea López, and Kirsten Bibbins-Domingo found they looked at when people go to the hospital for hypoglycemia (low blood sugar).

The basic idea is that people struggling to make it paycheck-to-paycheck (or benefits-to-benefits) might run out of money at the end of the month—and have to cut back on food. If they have diabetes, this hunger could turn into an even more severe health problem: low blood sugar. So we should expect a surge of hypoglycemia cases at the end of each month for low-income people, but not for anybody else.

That's what researchers found when they looked at the numbers for California between 2000 and 2008. As you can see in their chart below, low-income people (red line) were <27 percent more likely to be hospitalized for hypoglycemia in the last week of the month than in the first. There was no week-to-week difference for high-income people (orange line).

xchrom

(108,903 posts)(Reuters) - Sales at European retailers Carrefour (CARR.PA), Metro (MEOG.DE) and Dixons Retail (DXNS.L) have returned to growth in southern Europe as consumers start spending again after years of economic turmoil, austerity and job losses.

Europe's biggest retailer Carrefour said its sales in Spain grew in the fourth quarter for the first time since 2008, while French hypermarkets improved further, though at a slower pace than in the previous quarter.

Dixons, the continent's No. 2 electricals retailer, saw sales at its Greek business, Kotsovolos, rise 3 percent in the November 1-January 4 period, driven by its wholesale business. However, sales at retail stores that have been open for more than a year fell 8 percent.

"It's still quite tough in Greece and the market is still under pressure. We are beginning to see some evidence that it is flattening out," Chief Executive Sebastian James told reporters. "That business is going to come right."

xchrom

(108,903 posts)(Reuters) - The "bogeymen" of derivatives and securitised debt, blamed for deepening the financial crisis, may escape a new euro zone transactions tax as policymakers fear harming funding for companies and the economy, a document seen by Reuters showed.

The 11 euro zone countries currently discussing the tax, which include France and Germany but not Britain, are meeting on Thursday to hammer out a revised proposal for the tax, which will make banks repay some of the public money that kept them going during the 2007-09 financial crisis.

Legal doubts over the original proposal has forced a rethink amid concerns that funding could be hit.

The document prepared for the two-day meeting shows the scale of exemptions on the table as countries are increasingly anxious not to crimp funding to companies or fuel concerns over government bonds just as the euro zone appears to be turning the corner after a lengthy debt crisis.

mahatmakanejeeves

(57,659 posts)Source: Department of Labor, Employment and Training Administration

Read More: http://www.dol.gov/opa/media/press/eta/ui/eta20140040.htm

UNEMPLOYMENT INSURANCE WEEKLY CLAIMS REPORT

SEASONALLY ADJUSTED DATA

In the week ending January 11, the advance figure for seasonally adjusted initial claims was 326,000, a decrease of 2,000 from the previous week's revised figure of 328,000. The 4-week moving average was 335,000, a decrease of 13,500 from the previous week's revised average of 348,500.

The advance seasonally adjusted insured unemployment rate was 2.3 percent for the week ending January 4, an increase of 0.1 percentage point from the prior week's unrevised rate. The advance number for seasonally adjusted insured unemployment during the week ending January 4 was 3,030,000, an increase of 174,000 from the preceding week's revised level of 2,856,000. The 4-week moving average was 2,908,750, an increase of 38,250 from the preceding week's revised average of 2,870,500.

UNADJUSTED DATA

The advance number of actual initial claims under state programs, unadjusted, totaled 534,431 in the week ending January 11, an increase of 51,190 from the previous week. There were 556,621 initial claims in the comparable week in 2013.

....

The total number of people claiming benefits in all programs for the week ending December 28 was 4,703,499, an increase of 508,309 from the previous week. There were 5,873,824 persons claiming benefits in all programs in the comparable week in 2012.

== == == ==

Good morning, Freepers and DUers alike. I ask you to put aside your differences long enough to read this post. Following that, you can engage in your usual donnybrook.

The word "initial" is important. The report does not count all claims, just the new ones filed this week.

Note: The seasonal adjustment factors used for the UI Weekly Claims data from 2007 forward, along with the resulting seasonally adjusted values for initial claims and continuing claims, have been revised. These revised historical values, as well as the seasonal adjustment factors that will be used through calendar year 2012, can be accessed at the bottom of the following link: http://www.oui.doleta.gov/press/2012/032912.asp

xchrom

(108,903 posts)That seemed like the possible beginning of a shifting story. So I looked into racial and ethnic demographic numbers for Detroit's usual-suspect peer cities: Buffalo, Cleveland, Milwaukee and Pittsburgh. I also threw Chicago in since it's the undisputed capital of the region.

Here's what I found:

Change in Population, 2010-12

White Black Hispanic Other

Buffalo -0.1% -4.8% -1.3% 20.0%

Chicago 1.1% -2.0% 1.2% 8.9%

Cleveland -4.8% -0.8% 5.3% 0.6%

Detroit 3.0% -2.7% 7.7% -8.2%

Milwaukee -3.1% 1.1% 5.6% 7.1%

Pittsburgh 0.6% -5.3% 20.3% 9.9%

That is indeed the beginning of a shifting story. If this is accurate (and caveats do apply; ACS data has been wildly variable from year to year), Detroit's white population is growing faster than that of its close peer cities. This is a remarkable feat, considering that Detroit's white population decreased in every Census from 1950 to 2010, declining from 1.6 million in 1950 to just 55,000 in 2010.

Read more: http://www.businessinsider.com/detroit-is-getting-whiter-2014-1#ixzz2qZS1ughq

xchrom

(108,903 posts)December consumer prices data are out.

The consumer price index rose 0.3% in December from a month earlier, right in line with expectations. The December gains brought the headline year-over-year inflation rate to 1.5% from November's 1.2% level, right in line with expectations.

Core consumer prices — a measure that strips out food and energy — rose 0.1% from the previous month, as expected, marking a slowdown from November's 0.2% rate of growth but leaving the year-over-year rate of core price inflation unchanged at 1.7%.

The inflation rate is under close scrutiny by market participants as it takes on increased importance in the Federal Reserve's forward guidance on the likely future path of short-term interest rates. Most project tame inflation in 2014, which will offer continued justification for extraordinary monetary stimulus from the Fed.

Read more: http://www.businessinsider.com/consumer-price-index-december-2014-1#ixzz2qZSYupkh

DemReadingDU

(16,000 posts)1/16/14 Best Buy holiday same-store sales fall

NEW YORK, Jan 16 (Reuters) - Best Buy Co Inc said on Thursday that total revenue and sales at its established U.S stores fell in the all-important holiday season due to intense discounting by rivals, supply constraints for key products and weak traffic in December.

Sales at its stores open at least 14 months were down 0.9 percent in the United States and up 0.1 percent internationally in the nine weeks ended Jan. 4.

Total revenue fell about 2.6 percent to $11.45 billion in the nine-week period.

The world's largest consumer electronics chain cut prices aggressively to thwart fierce competition from Wal-Mart Stores Inc and other rivals in what turned to be one of the most promotional seasons since the recession.

http://finance.yahoo.com/news/best-buy-holiday-same-store-121751611.html

xchrom

(108,903 posts)

The Jantar Mantar observatory complex in Delhi. (Flickr/Tony Young)

Jantar Mantar Road, a short passageway through the administrative center of New Delhi, takes its name from a complex of gigantic red astronomical instruments at its north terminus, built by Maharaja Jai Singh II in 1724. The Jantar Mantar consists of a series of geometric jungle gyms that surround the all-important shadow of the Supreme Instrument, a four-story, right-triangular sundial surrounded by semi-circular wings. The complex reflects the style of politics practiced by its autocratic creator — one based on charting the positions of the sun and planets across the zodiac with maximum pomp and precision.

The road named after the Jantar Mantar, however, better reflects the aspirations of India’s past few decades as the world’s most populous democracy. In the space of several hundred yards between two sets of hand-painted red-and-yellow police barricades, an assortment of political and religious outfits have set up tents, encampments and shrines each dedicated to some particular cause — for the prosecution of a high-placed rapist, for the rights of migrant workers, for various flavors of spiritual-social awakening. Several tents contain men on hunger strikes, each reclining on a couch and nursed by supporters, on behalf of a petition like airline employee pensions or voting rights for Indians living abroad. Despite the amplified speeches and droning chants, Jantar Mantar Road is a respite from Delhi’s non-stop hustle; people slowly mill through to listen, strike up conversations and eat deep-fried snacks.

This style of politics received lavish validation in the latter months of 2013. After existing for only a little more than a year, the Aam Aadmi Party — aam aadmi means “common man” in Hindi — seized the New Delhi city government in an electoral coup in December. The party owes its quick ascent in large part to Anna Hazare, a stubborn septuagenarian who mounted a much-publicized series of hunger strikes at Jantar Mantar in 2011 to demand the passage of his proposal for combating corruption. (Both houses of the national parliament passed a version of it in December.) Hazare has remained aloof from the new party that arose from his movement, but just before New Year’s fellow hunger striker Arvind Kejriwal, a tax official turned activist in his mid-40s, became chief minister of India’s capital on the Aam Aadmi ticket.