Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 4 February 2014

[font size=3]STOCK MARKET WATCH, Tuesday, 4 February 2014[font color=black][/font]

SMW for 3 February 2014

AT THE CLOSING BELL ON 3 February 2014

[center][font color=red]

Dow Jones 15,372.80 -326.05 (-2.08%)

S&P 500 1,741.89 -40.70 (-2.28%)

Nasdaq 3,996.96 -106.92 (-2.61%)

[font color=green]10 Year 2.58% -0.09 (-3.37%)

30 Year 3.53% -0.09 (-2.49%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Halfway to a 10% "correction", or just starting a real serious Depression?

Demeter

(85,373 posts)Argentina's president, Cristina Fernández de Kirchner, and her ministers blame foreign 'vultures' for an economic meltdown as power cuts hit Buenos Aires and goods vanish from supermarket shelves...Even in normal years, the summer heat in Buenos Aires is overwhelming. Among a population of nearly 13 million packed into the long shore of the wide River Plate, the phrase most often heard from the lips of porteños is: "It's the humidity that kills you."

For those who can't afford to escape to the exclusive summer resort of Punta del Este, across the river in Uruguay, or make the longer trip to the golden beaches of Brazil, there is only one solution: air conditioning. But a combination of global warming and an abrupt economic collapse scuppered even that consolation for shopper Graciela Fernández last week. When the temperature insisted on staying at around 40C and humidity levels rose to a drenching 90%, Fernández rushed to buy an air-conditioning unit she had seen on sale a week before.

"When I went to buy it, the price had gone up 25% since when I checked prices last week," she complained outside the Alto Palermo shopping mall. "The same thing just happened to me at the pharmacy where I went to buy the medicine my husband takes: the price was up 20%."

The economic panic leading to price mark-ups of this kind began in mid-January, when Argentina's central bank reserves dipped below $30bn, forcing the government of President Cristina Fernández de Kirchner to drop its policy of injecting large quantities of dollars into the exchange market to shore up the overvalued peso....

ARGENTINA HAS NEVER BEEN A STABLE PLACE, HAS IT?

Demeter

(85,373 posts)Since yesterday's futures didn't survive the open, I don't expect this one will, either.

What does it take to convince all the predicters to update?

Demeter

(85,373 posts)Should be interesting.

Demeter

(85,373 posts)

Demeter

(85,373 posts)THE ACTUAL TITLE IS:

Bailout Architect Runs For California Governor; World Laughs By Matt Taibbi

AND IT'S ENTERTAINING IN A SHALLOW CALIFORNIA WAY....

Demeter

(85,373 posts)IT'S CALLED "CITIZEN SEARCH AND SEIZURE" AND IT'S ONE OF THE MORE BIZARRE NOTIONS I'VE EVER READ....

http://wagingnonviolence.org/feature/fbi-files-free-trade-negotiating-texts-liberate-secret-documents/

Demeter

(85,373 posts)HOW LONG CAN THIS GO ON?

http://www.theguardian.com/world/2014/feb/02/germany-preparing-third-financial-rescue-greece?CMP=ema_565

New loan, outlined in a German finance ministry position paper, would be worth €10bn-€20bn, says Der Spiegel magazine...Germany has signalled it is preparing a third rescue package for Greece – provided the debt-stricken country implements "rigorous"austerity measures blamed for record levels of unemployment and a dramatic drop in GDP.

The new loan, outlined in a five-page position paper by Berlin's finance ministry, would be worth between €10bn to €20bn (£8bn-16bn), according to the German weekly Der Spiegel, which was leaked the document.

Such an amount would chime with comments made by the German finance minister, Wolfgang Schäuble, who, in a separate interview due to be published on Monday insisted that any additional aid required by Athens would be "far smaller" than the €240bn it had received so far.

"What is sure is that any further aid would be much less expansive than whatever help [has been given] so far," he is quoted as telling the German finance magazine Wirtschaftswoche in what appears to be a calibrated move aimed at preparing public opinion....

A COUNTRY COULD DIE FROM SUCH HELP...MAYBE THAT'S THE PLAN?

Demeter

(85,373 posts)Companies from banks and technology firms to energy suppliers are set to face European Union swaps rules, amid warnings from some businesses that they may not have all the systems in place to meet this month’s deadline.

Starting Feb. 12, firms in the EU must begin systematic reporting of their derivatives transactions to data banks known as trade repositories. The measure marks the EU’s implementation of a global agreement targeted at preventing any repeat of the financial crisis that followed the collapse of Lehman Brothers Holdings Inc.

The rules are “a huge administrative requirement” for non-financial companies, Richard Raeburn, chairman of the European Association of Corporate Treasurers, said in a telephone interview. “It is a big issue.”

The reporting requirements stem from an accord among the Group of 20 Nations aimed at bolstering the resilience of the $693 trillion market for over-the-counter derivatives -- a term used to describe swaps traded away from exchanges. Regulators say the step will enhance their ability to monitor risk taking, curb market abuse, and make it easier to understand who owns what when a financial institution fails. (Lehman’s collapse in 2008 sparked a wave of litigation and lengthy bankruptcy proceedings, as authorities sought to untangle its various activities and establish ownership of different assets -- a process that continues to this day. )

MORE

Demeter

(85,373 posts)Britain's financial watchdog has issued its first warning notices of proposed action against two bankers for their part in alleged manipulation of benchmark interest rates.

The Financial Conduct Authority (FCA) did not name the people, stating only that it gave a warning notice to a submitter of benchmark interest rates for failings over a period of more than two years, and another warning to a manager at a bank for failings over more than three years.

The warnings, issued in November but only published on Monday, relate to the London Interbank Offered Rate or Libor and its continental European counterpart Euribor.

A number of banks have been fined $6 billion (3.6 billion pounds) by European, British and U.S. regulators for manipulating Libor and Euribor, which are used to price around $400 trillion worth of products worldwide, from derivatives to home loans....

MORE: http://uk.reuters.com/article/2014/02/03/uk-britain-warnings-libor-idUKBREA120GM20140203

Demeter

(85,373 posts)Save

German Chancellor Angela Merkel’s coalition is ready to accept a levy on stock trades as part of a first step toward a European tax on all financial transactions amid resistance to a broader application.

The retreat, signaled by lawmakers from the two governing parties, may advance Germany’s goal of teaming up with France to enlist Italy and Spain to enact the tax in the four biggest euro-area economies. French Finance Minister Pierre Moscovici, whose country started taxing share transactions last year, said on Jan. 27 that broader fees risk driving investors away.

“We will continue to work for the broadest possible scope, as agreed in the coalition accord, but we’re also aware of the unanimity principle” in the European Union, Antje Tillmann, finance policy spokeswoman for Merkel’s Christian Democrat bloc in parliament, said in a written reply to questions. “If we can’t convince our European partners, we of course wouldn’t close our minds to a discussion of a gradual introduction.”

EU finance ministers allowed member countries a year ago to move forward on a financial-transaction tax they expected to reap as much as 34 billion euros ($46 billion) a year, including 11.8 billion euros in Germany. France, Germany and nine other EU countries signed up for the plan, which includes taxing trades of stocks, bonds and derivatives...

Germany’s Social Democratic Party, Merkel’s third-term coalition partner since December, would accept a phased-in financial transaction tax if there’s a commitment at the start to the timing of all later stages, said Carsten Sieling, a Social Democrat on Germany’s lower-house Finance Committee.

MORE

xchrom

(108,903 posts)For the past few years the world has been in thrall to all things Nordic (for which purpose we must of course add Iceland and Finland to the Viking nations of Denmark, Norway and Sweden). "The Sweet Danish Life: Copenhagen: Cool, Creative, Carefree," simpered National Geographic; "The Nordic Countries: The Next Supermodel", boomed the Economist; "Copenhagen really is wonderful for so many reasons,"gushed the Guardian.

Whether it is Denmark's happiness, its restaurants, or TV dramas; Sweden's gender equality, crime novels and retail giants; Finland's schools; Norway's oil wealth and weird songs about foxes; or Iceland's bounce-back from the financial abyss, we have an insatiable appetite for positive Nordic news stories. After decades dreaming of life among olive trees and vineyards, these days for some reason, we Brits are now projecting our need for the existence of an earthly paradise northwards.

I have contributed to the relentless Tetris shower of print columns on the wonders of Scandinavia myself over the years but now I say: enough!Nu er det nok! Enough with foraging for dinner. Enough with the impractical minimalist interiors. Enough with the envious reports on the abolition of gender-specific pronouns. Enough of the unblinking idolatry of all things knitted, bearded, rye bread-based and licorice-laced. It is time to redress the imbalance, shed a little light Beyond the Wall.

Take the Danes, for instance. True, they claim to be the happiest people in the world, but why no mention of the fact they are second only to Iceland when it comes to consuming anti- depressants? And Sweden? If, as a headline in this paper once claimed, it is "the most successful society the world has ever seen", why aren't more of you dreaming of "a little place" in Umeå?

Demeter

(85,373 posts)I would take it with more than a grain of salt, or not at all, actually.

xchrom

(108,903 posts)Demeter

(85,373 posts)Treasury Secretary Jack Lew urged Congress on Monday to act quickly to raise the federal debt limit, saying he will run short of cash to pay the nation’s bills by the end of the month without additional borrowing authority.

Enforcement of the debt limit is suspended, but it will come back into force Friday under the terms of a deal lawmakers struck in the fall. That leaves Lew bumping up against the limit in tax-filing season, he said Monday, when he will have far less flexibility to juggle the books and ward off disaster.

MORE

Demeter

(85,373 posts)Mathew Martoma sought out a "canary in the coal mine" to give him inside information on drug companies, a federal prosecutor said on Monday, urging jurors to convict the former SAC Capital Advisors portfolio manager of insider trading.

Martoma, 39, built up contacts with doctors involved in a clinical trial of an Alzheimer's drug, which paid off in a "dramatic way" when one of them told him the final results, Assistant U.S. Attorney Eugene Ingoglia said.

But Martoma's defense lawyer, Richard Strassberg, told jurors the entire case came down to the unreliable testimony of a single doctor who cooperated with the government in the hopes of avoiding prison.

Martoma, Strassberg added, was the victim of a "rush to judgment" by investigators whose true target was Steven A. Cohen, the founder of SAC Capital, who has not been criminally charged...

Demeter

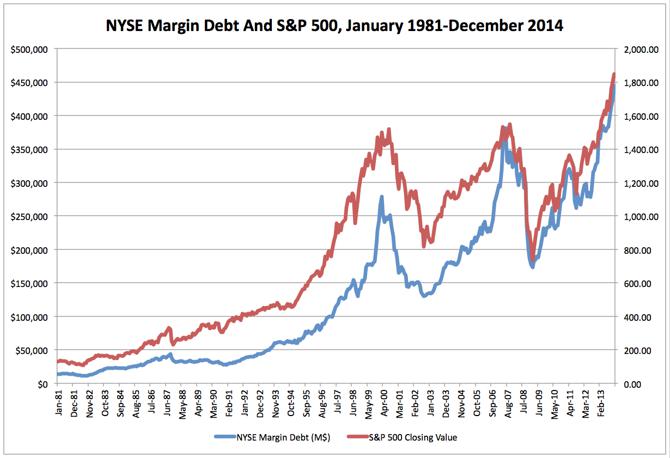

(85,373 posts)The Fed’s easy money policies have pushed margin debt on the New York Stock Exchange (NYSE) to record levels laying the groundwork for a severe correction or another violent market crash. In December, margin debt rose by $21 billion to an all-time high of $445 billion. Buying equities on margin, that is, with loads of borrowed cash, is a sign of excessive risk taking the likes of which invariably takes place whenever the Central Bank creates subsidies for speculation by keeping interest rates pegged below the rate of inflation or by pumping trillions of dollars into the bloated financial system through misguided liquidity programs like QE. Investors have shrugged off dismal earnings reports, abnormally-high unemployment, flagging demand, droopy incomes, stagnant wages and swollen P/E ratios and loaded up on stocks confident that the Fed’s infusions of liquidity will keep prices going higher. It’s only a matter of time before they see the mistake they’ve made.

The chart below illustrates how zero rates and QE lead to excessive risk taking. The correlation between the stratospheric rise of margin debt and the Fed’s destabilizing monetary policy is hard to avoid. This is what bubblemaking looks like in real time.

https://ci4.googleusercontent.com/proxy/B696ywPg4CVg4E55mXpNqgmzuNpXt4CoHVx8eqz0RPTnfzPbo_bpvHDICylMwuOdIPGw7MQNBZeDERW72fzptoNgKddEfKdcOGQWJRRuzi9y8NlLrdiirw6hyz5q893pEucoFa6V-UFKRPJ5qw=s0-d-e1-ft#

In the minutes of the FOMC’s December meeting, FOMC officials acknowledge the froth they’ve created in financial assets which is why they’ve begun to scale back their asset purchases. The Fed hopes that by gradually winding down QE they’ll be able to stage a soft landing rather than a full-blown crash. Here’s an excerpt from the FOMC’s minutes:

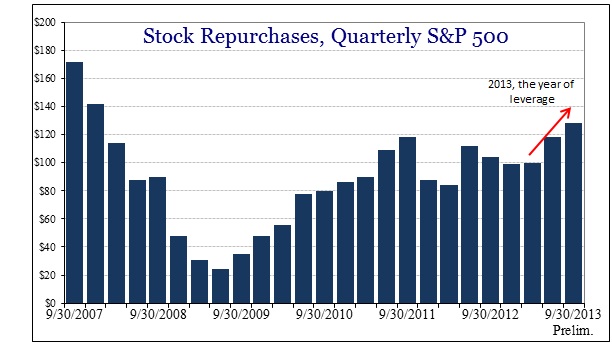

“In their discussion of potential risks, several participants commented on the rise in forward price-to-earnings ratios for some smallcap stocks, the increased level of equity repurchases, or the rise in margin credit. One pointed to the increase in issuance of leveraged loans this year and the apparent decline in the average quality of such loans.”

There you have it, the Fed sees the results of its work; the distortions in P/E ratios, the exuberant stock buybacks (“equity repurchases”), the deterioration in the quality of leveraged loans, and the steady rise in margin debt. They see it all, all the bubbles they’ve created with their gargantuan $3 trillion surge of liquidity. Now they have started to reverse the policy by reducing their asset purchase from $85 bil to $65 bil per month, the effects of which can already be seen in the Emerging Markets. The bubble in Emerging Markets has burst sending foreign currencies plunging and triggering a sharp reversal in capital flows. The hot money that flooded the EMs,–(which lowered the cost of borrowing for businesses and consumers)–is entirely attributable to the Fed’s policy. QE pushes down long-term interest rates forcing investors to search for higher yield in other markets. Thus, the cost of money drops in EMs creating a boom that abruptly ends when the policy changes (as it has). Capital is fleeing EMs at an unprecedented pace precipitating a dramatic slowdown in economic activity, higher consumer prices and widespread public distress. The Fed is 100% responsible for the turmoil in emerging markets, a fact which even mainstream news outlets blandly admit. Here’s an excerpt from an article in Bloomberg just this week:

Emerging economies have benefited from cheap money as three rounds of Fed bond buying pushed capital into their borders in search of higher returns…

The Fed’s asset purchases had helped fuel a credit boom in developing nations from Turkey to Brazil. Accumulated capital inflows to developing-country’s debt markets since 2008 reached $1.1 trillion, or $470 billion more than their long-term trend, according to a study by the International Monetary Fund in October.” (“Record Cash Leaves Emerging Market ETFs on Lira Drop“, Bloomberg)

The Fed doesn’t care if other countries are hurt by its policies. What the Fed worries about is how the taper is going to effect Wall Street. If the slightest reduction in asset purchases causes this much turbulence abroad, then what’s it going to do to US stock and bond markets? The answer, of course, is that stocks are going to fall…hard. It can’t be avoided. And while the amount of margin debt is not a reliable tool for calling a top; it’s safe to say that the recent spike in investor leverage has moved the arrow well into the red zone. Investors are going to cash out long before the Fed ends QE altogether, which means the selloff could persist for some time to come much like after the dot.com bubble popped and stocks drifted lower for a full year. Now check out this clip from Alhambra Investment Partners newsletter titled “The Year of Leverage”:

Repeat: “The $142 billion leveraged bet on stocks far surpasses any twelve month period in history.”

Investors are “all-in” because they think that the Fed has their back. They think that Bernanke (or Yellen) will not allow stocks to fall too far without intervening. (This is called the “Bernanke Put”) So far, that’s been a winning strategy, but that might be changing. The Fed’s determination to taper suggests that it wants to withdraw its stimulus to avoid being blamed for the bursting bubble. (“Plausible deniability”?) That’s what’s driving the current policy. Here’s more on margin debt from Wolf Richter at Testosterone Pit:

Stock market crashes are always connected to massive leverage, loosey-goosey monetary policy and irrational exuberance (“excessive risk taking”), the toxic combo that presently rules the markets. The Federal Reserve is invariably the source of all bubblemaking and financial instability. As we noted earlier, equity repurchases or stock buybacks are another sign of froth. Here’s an excellent summary on the topic by Alhambra Investment Partners:

The common argument advanced in favor of such share repurchases is that companies are using cash to recognize undervalued stocks, but that is total hogwash…

…corporate managers are no different than the reviled stereotypical retail investor. Both leverage themselves further and further as the market goes higher, not in recognizing undervalued stocks or companies but in full froth of chasing obscene values via rationalizations.” ( Alhambra Investment Partners newsletter titled “The Year of Leverage”)

https://ci4.googleusercontent.com/proxy/U7jkvKnnM2IuYn7vzhRZICG8dKftVKrEJ4Z_nBKUEoOfZStZr9ejfcRXp7II3vz-M8v4zkpjs69tv3VMmr3wU78qKZ_KPVyo3J7ralL6C2awyHeO-bfl33ugMmNyr1qcDdnwHiMDk30zoFt3kp7ypXVsCKhoPMxFZ74lM2AHtvrk=s0-d-e1-ft#

ABOOK Jan 2014 Margin Debt Stock Repurchases

In other words, corporate managers are doing the same thing as your average margin investor. They are loading up on financial assets–not because they think they are a good value or because they expect higher earnings –but because Fed policy supports artificially-high prices. That’s what’s driving the bull market, the Fed’s thumb on the scale. Remove the thumb, and you have a whole new ballgame (as we see in the EMs). There’s also a bubble in high yield “junk” bonds which just had their second biggest year on record (Total issuance $324 billion) Investors are only too happy to dump their money into high-risk debt believing that companies never default or that the Fed will save the day again credit tightens and the dominoes start tumbling through the debt markets. According to Testosterone Pit:

“The cost of a high-yield bond on an absolute coupon basis is as low as it’s ever been,” explained Baratta, king of Blackstone’s $53 billion in private equity assets. Even the riskiest companies are selling the riskiest bonds at low yields… Why would anyone buy this crap?” (“Bubble Trouble: Record Junk Bond Issuance, A Barrage Of IPOs, “Out Of Whack” Valuations, And Grim Earnings Growth”, Testosterone Pit)

Why, indeed? Of course, the author is just being rhetorical, after all, he knows why people are piling into junk. It’s because the Fed has kept a gun to their heads for 5 years, forcing them to grab higher yield wherever they can find it. That’s how Bernanke’s dogwhistle monetary policy works. By slashing rates to zero, the Fed coerces investors to speculate on any type of garbage that’s available. That why junk “just had its second biggest year on record.” You can thank Bernanke. Housing is also in a bubble due to the Fed’s zero rates, withheld inventory, government modification programs, and an unprecedented uptick in all-cash investors. Clearly, there’s never been a market more manipulated than housing. It’s a joke. The surge of Wall Street liquidity has spilled over into housing distorting prices and reducing the number of first time homebuyers to an all-time low. The homeownership rate is actually falling even while prices climb higher, which is just one of many anomalies created by the Fed’s policy. (Who’s ever heard of a housing boom, where the number of firsttime homebuyers is dropping?) Also, the Central Bank has purchased more than $1 trillion in mortgage-backed securities (MBS) via QE, which begs the question: How can housing prices NOT be in a bubble?

As we noted earlier, the Fed understands the impact its policies have had. They know the markets are overheated and they’re determined to do something about it. A recent article in Bloomberg explains the Fed’s plan for winding down QE “without doing damage to the economy”. Here’s a short excerpt from the piece:

Yellen is ‘going to be trying to do something that no one has ever done,’ said Stephen Cecchetti, former economic adviser for the Bank for International Settlements, the Basel, Switzerland-based central bank for monetary authorities. She needs ‘to ensure that accommodative monetary policy doesn’t create significant financial stability risks,’ he said in an interview…

The Fed’s ‘first, second and third lines of defense” for dealing with such imbalances is to rely on supervision, regulation and so-called macro-prudential policies, such as mortgage loan-to-value restrictions, Bernanke told the Brookings Institution in Washington on Jan. 16. ….Only as a last resort would it consider raising interest rates.’ (“Yellen Faces Test Bernanke Failed: Ease Bubbles“, Bloomberg)

You got that?

So the Fed is going into the “bubble-deflating” biz.

Check.

And uber-dove Yellen is going to put things right. She’s going to eliminate the price distortions and gradually return the markets to normalcy.

Right, again.

She’s going to wind down QE and start to reduce the Fed’s $4 trillion balance sheet.

Oakie dokie.

And she’s going to do all of this without raising interest rates or sending stocks into freefall?

Right. It’s a pipedream. The first sign of trouble and old Yellen will be scuttling across the floor of the New York Stock Exchange with a punch bowl the size of Yankee Stadium.

You can bet on it.

Hotler

(11,428 posts)the guillotine now be called Occupy's Razor

Tansy_Gold

(17,864 posts)I love good puns. I really do.

![]()

westerebus

(2,976 posts)Tansy_Gold

(17,864 posts)and as much as I abhor violence and try to avoid thoughts of bloodshed. . . . .

![]()

westerebus

(2,976 posts)Demeter

(85,373 posts)And when shall we give the 1% a really close shave?

xchrom

(108,903 posts)And we're back!

Good morning folks, and welcome to what's already another very interesting day in world markets.

Japan got creamed again yesterday, with the Nikkei falling over 4%. Year to date, the formerly red-hot index is off 14%! Hong Kong fell nearly 3%, and now it has officially entered "correction" territory.

European markets are down across the board.

These moves follow an ugly day in the US yesterday, which saw the Dow tumble over 300 months, as the index hit a 3-month low.

Suddenly a world that seemed quite calm economically is having issues pop up all over the place. China is slowing. The US data has been so-so. There's pressure on the Bank of England to tighten. Emerging markets are getting clobbered. People are losing confidence in Abenomics.

Read more: http://www.businessinsider.com/morning-markets-february-4-2014-2#ixzz2sMFcHSxb

xchrom

(108,903 posts)BI contributor Randy Olson passed along this map, created by reddit user Phaenthi, that presents U.S. states and corresponding countries with similar GDP.

Olson, who moderates the subreddit DataisBeautiful, noted that the map is not adjusted for population size "e.g., Minnesota has a population of ~5.5 million and Nigeria has a population of ~175 million."

California is the obvious powerhouse, with a GDP of about $2 trillion in in 2012 compared to Canada's 2012 total of about $1.82 trillion.

And the 2012 GDP of Texas was about $1.4 trillion, making it considerably bigger than Mexico $1.18 trillion. New York saw a 2012 GDP of about $1.2 trillion compared to South Korea's $1.12 trillion.

Read more: http://www.businessinsider.com/map-of-of-us-states-gdp-and-other-countries-2014-2#ixzz2sMGVHOPv

xchrom

(108,903 posts)HONG KONG — It’s a favorite pastime: Americans worried about their country’s direction love threatening to move abroad. “That’s it, I’m going to Canada!” they say.

Of course, they almost never do.

In China, however, that’s now no idle threat, especially for the rich.

Amid a widening crackdown on corruption, China’s wealthiest citizens are increasingly seeking a better life abroad.

The United States is their favored destination.

Read more: http://www.globalpost.com/dispatch/news/regions/asia-pacific/china/140131/war-corruption-ramps-china-s-wealthy-flock-america#ixzz2sMHIYpoR

Tansy_Gold

(17,864 posts)many of whom no doubt made their money enslaving the poor to make cheap plastic crap to foist on consumers, are the new poor, tired, huddled masses yearning to breathe free?

Emma must be rolling in her grave.

xchrom

(108,903 posts)Feb 4 (Reuters) - The U.S. government has authorized limited crude oil exports to Europe, for the first time in years, raising new questions about how companies are testing the limits of a controversial, decades-old exports ban.

The Department of Commerce has granted two licenses to export U.S. crude to the UK since last year and another two to Italy, according to data Reuters obtained through a Freedom of Information Act request.

One application for German exports was filed in January and is awaiting a decision by the Bureau of Industry and Security (BIS), which is responsible for reviewing requests to export crude under a 1975 law that bans most shipments with a few exceptions, including sales to Canada and re-export of foreign oil.

These are the first permits for shipments to the UK since at least 2000 and the first to any European country since 2008, according to data from the BIS. The bureau has approved 120 licenses since January 2013, nearly 90 percent of which were for sales to Canada, the data show.

xchrom

(108,903 posts)LONDON (Reuters) - European banks have loaned in excess of $3 trillion to emerging markets, more than four times U.S. lenders and putting them at greater risk if financial market turmoil in countries such as Turkey, Brazil, India and South Africa intensifies.

The risk is most acute for six European banks - BBVA, Erste Bank, HSBC, Santander, Standard Chartered, and UniCredit - according to analysts.

But the exposure could be a headache for the industry as a whole, just as it faces a rigorous health-check by the European Central Bank, aiming to expose weak points and restore investor confidence in the wake of the 2008 financial crisis.

"We think EM (emerging markets) shocks are a real concern for 2014," said Matt Spick, analyst at Deutsche Bank. "When currency (volatility) combines with revenue slowdowns and rising bad debts, we see compounding threats to the exposed banks."

Read more: http://www.businessinsider.com/euro-banks-exposure-to-emerging-markets-2014-2#ixzz2sMJNee50

xchrom

(108,903 posts)WASHINGTON (AP) — Banks and big retailers are locked in a debate over the breach of consumer data that gripped Target Corp. during the holiday season. At issue: Which industry bears more responsibility for protecting consumers' personal information?

The retailers' argument: Banks must upgrade the security technology for the credit and debit cards they issue.

The banks' counterargument: Newer electronic-chip technology wouldn't have prevented the Target breach. And retailers must tighten their own security systems for processing card payments.

The finger-pointing is coming from two industries with considerable lobbying might. Their trade groups have been bombarding lawmakers with letters arguing why the other industry must do more — and spend more — to protect consumers.

Read more: http://www.businessinsider.com/target-data-breach-pits-banks-against-retailers-2014-2#ixzz2sMJzbL3L

xchrom

(108,903 posts)Massachusetts Senator Elizabeth Warren wants to solve two American problems with one solution — turn the country's increasingly empty post offices into simple retail banks for low-income citizens without bank accounts.

In an op-ed in the Huffington Post, Warren writes that "about 68 million Americans — more than a quarter of all households — are underserved by the banking system. Collectively, these households spent about $89 billion in 2012 on interest and fees for non-bank financial services like payday loans and check cashing, which works out to an average of $2,412 per household."

That means poor Americans spend roughly 10% of their income on basic banking services, according to a recent report from the Office of the Inspector General.

Meanwhile, we've got an entire infrastructure of post offices and postal employees who are seeing the number of letters and packages they deliver dwindle more and more by the day.

Read more: http://www.businessinsider.com/warren-wants-to-turn-post-offices-into-banks-2014-2#ixzz2sMKhJC00

xchrom

(108,903 posts)Stock markets across Europe have fallen, following steep declines in Asia and the US.

The UK's FTSE 100 index was down 0.3%, Germany's Dax index dropped 1% and France's Cac 40 was trading 0.2% lower in lunchtime trade.

Investors have been rattled by weak factory data from both the US and China - the world's two biggest economies.

On Monday, the main US stock indexes fell by more than 2%, and Japan's Nikkei dived 4.2% on Tuesday.

xchrom

(108,903 posts)US Treasury Secretary Jack Lew has warned the US may default on its debt by the end of the month if Congress does not raise its borrowing limit.

Mr Lew said he could rely on emergency measures to pay US debts after the limit is reinstated on 7 February.

But he anticipated the treasury's reserves would quickly be exhausted as it issues annual income tax refunds.

Congress suspended the debt limit in October as part of a deal to reopen the federal government after a shutdown.

xchrom

(108,903 posts)Emerging-market stocks fell to a five-month low as weaker-than-expected manufacturing data from China to the U.S. spurred concern global growth will falter. The ruble strengthened as Russia scrapped a bond auction.

Lenovo Group Ltd. sank 16 percent after at least five brokerages cut their ratings on the world’s largest maker of personal computers. The Hang Seng China Enterprises Index tumbled 3.1 percent in the first trading day since data showed an official gauge of factory output fell to a six-month low. South African stocks slid for an eighth day, while the rand strengthened 1.2 percent versus the dollar. The ruble climbed 0.4 percent against the dollar after Russia canceled a debt sale for the second consecutive week.

The MSCI Emerging Markets Index declined 1.1 percent to 916.44, the lowest level since Aug. 29, at 12:15 p.m. in London. The gauge is off to the worst start of a year on record amid an equities rout that’s erased about $2.9 trillion from global stocks in 2014 due to concerns Chinese growth is slowing, and as the Federal Reserve trimmed monetary stimulus.

Data showing U.S. factories expanded at the slowest pace in eight months in January were “disappointing,” Martial Godet, the head of emerging-market equity and derivatives strategy at BNP Paribas SA in Paris, said by e-mail. “Markets now price a somewhat weaker level of growth in the U.S. and EM.”

xchrom

(108,903 posts)The World Bank, best known for helping developing nations from Kenya to Pakistan combat chronic poverty, is advising euro-area members Greece and Cyprus on how to strengthen their economies in the wake of debt crises.

About 55 World Bank staff have spent some time in the Mediterranean nations to advise them on competitiveness, welfare policies or public administration, according to Dirk Reinermann, who manages the programs. Based on the collaboration, Greece this month plans to announce a new system to simplify the process of setting up a business, Development Minister Kostis Hatzidakis said in an e-mail.

World Bank President Jim Yong Kim is taking on little-publicized consulting work from developed nations to find a new outlet for the bank’s expertise in a test of the demand for services that would otherwise be provided by private companies. Officials in Greece and Cyprus, initially reluctant to work with a poverty-reduction agency, are indicating the partnerships are starting to show results.

“In some parts of the world, some parts of Europe, we have a bit of a perception of being the bank of poor countries only,” Reinermann said in an interview last month in Washington. “As we work in more countries, this perception will fade over time.”

xchrom

(108,903 posts)What a difference a year makes.

At the end of January 2013, Japanese stocks trailed only Portugal for the biggest rally among developed markets. Now the Nikkei 225 Stock Average is leading declines, slumping 8.5 percent last month and today capping a 14 percent drop from its Dec. 30 peak.

Losses snowballed in Tokyo during a global retreat that has erased $2.9 trillion from equity values worldwide this year amid signs of slower growth in China and stimulus cuts by the U.S. Federal Reserve. The yen, down 18 percent in 2013, halted its slide and started to strengthen, potentially curbing company profits, says Coutts & Co. A sales tax increase for April will damp consumer spending, according to Sumitomo Mitsui Asset Management Co.

“Japan’s market finally came to its senses,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co, which oversees about 79 billion yen ($778 million). “Investors ignored risk too much toward the end of last year and the market was out of balance.”

antigop

(12,778 posts)International Business Machines Corp. (IBM) has reduced its tax rate to a two-decade low with help from a tax strategy that sends profits through a Dutch subsidiary.

The approach, which involves routing almost all sales in Europe, the Middle East, Africa, Asia and some of the Americas through the Netherlands unit, helped IBM as it gradually reduced its tax rate over 20 years at the same time pretax income quadrupled. Then last year, the rate slid to the lowest level since at least 1994, lifting earnings above analysts’ estimates.

IBM is aiming for $20 a share in adjusted earnings by 2015, up from $11.67 in 2010 -- a goal made more difficult as the company posted seven straight quarters of declining revenue. To stay on target, IBM has bought back shares, sold assets, and fired and furloughed workers. A less prominent though vital role is played by its subsidiary in the Netherlands, one of the most important havens for multinational companies looking for ways to legally reduce their tax rates.

.......

Attracted by the Netherlands’ policies and extensive network of tax treaties, IBM joins companies such as Yahoo! Inc., Google Inc. and Cisco Systems Inc. that have used Dutch subsidiaries to cut taxes.

Offshore tax strategies like the one used by IBM are coming under increased scrutiny. In the past year, the tax-avoidance techniques of companies including Apple Inc., Google and Amazon.com Inc. have been the subject of U.S. Senate and U.K. Parliament hearings. Meanwhile, the Organization for Economic Cooperation and Development, a government-funded think tank, is developing a plan to fight so-called profit-shifting at the direction of the Group of 20 nations.