Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 13 June 2014

[font size=3]STOCK MARKET WATCH, Friday, 13 June 2014[font color=black][/font]

SMW for 12 June 2014

AT THE CLOSING BELL ON 12 June 2014

[center][font color=red]

Dow Jones 16,734.19 -109.69 (-0.65%)

S&P 500 1,930.11 -13.78 (-0.71%)

Nasdaq 4,297.63 -34.30 (-0.79%)

[font color=green]10 Year 2.60% -0.02 (-0.76%)

30 Year 3.41% -0.04 (-1.16%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I don't give a FF.

Happy Friday the 13th, all! I've got a theme for this special weekend. It's unusual. Some might even call it daft, but that's where the spirit moved me.

The kitty has forgiven me. She must be feeling 100% already. She was severely annoyed with me when I didn't immediately let her out of the carrier. She rocked it, trying to escape, tipped it off the couch to land upside down on the carpet.

It was an interesting day, to be sure.

Demeter

(85,373 posts)http://orwell.ru/library/books/htm_file/latu

Socialism is usually defined as ‘common ownership of the means of production’. Crudely: the State, representing the whole nation, owns everything, and everyone is a State employee. This does not mean that people are stripped of private possessions such as clothes and furniture, but it does mean that all productive goods, such as land, mines, ships and machinery, are the property of the State. The State is the sole large-scale producer. It is not certain that Socialism is in all ways superior to capitalism, but it is certain that, unlike capitalism, it can solve the problems of production and consumption. At normal times a capitalist economy can never consume all that it produces, so that there is always a wasted surplus (wheat burned in furnaces, herrings dumped back into the sea etc. etc.) and always unemployment. In time of war, on the other hand, it has difficulty in producing all that it needs, because nothing is produced unless someone sees his way to making a profit out of it.

In a Socialist economy these problems do not exist. The State simply calculates what goods will be needed and does its best to produce them. Production is only limited by the amount of labour and raw materials. Money, for internal purposes, ceases to be a mysterious all-powerful thing and becomes a sort of coupon or ration-ticket, issued in sufficient quantities to buy up such consumption goods as may be available at the moment.

However, it has become clear in the last few years that ‘common ownership of the means of production’ is not in itself a sufficient definition of Socialism. One must also add the following: approximate equality of incomes (it need be no more than approximate), political democracy, and abolition of all hereditary privilege, especially in education. These are simply the necessary safeguards against the reappearance of a class-system. Centralized ownership has very little meaning unless the mass of the people are living roughly upon an equal level, and have some kind of control over the government. ‘The State’ may come to mean no more than a self-elected political party, and oligarchy and privilege can return, based on power rather than on money.

But what then is Fascism?

Fascism, at any rate the German version, is a form of capitalism that borrows from Socialism just such features as will make it efficient for war purposes. Internally, Germany has a good deal in common with a Socialist state. Ownership has never been abolished, there are still capitalists and workers, and – this is the important point, and the real reason why rich men all over the world tend to sympathize with Fascism – generally speaking the same people are capitalists and the same people workers as before the Nazi revolution. But at the same time the State, which is simply the Nazi Party, is in control of everything. It controls investment, raw materials, rates of interest, working hours, wages. The factory owner still owns his factory, but he is for practical purposes reduced to the status of a manager. Everyone is in effect a State employee, though the salaries vary very greatly. The mere efficiency of such a system, the elimination of waste and obstruction, is obvious. In seven years it has built up the most powerful war machine the world has ever seen.

But the idea underlying Fascism is irreconcilably different from that which underlies Socialism. Socialism aims, ultimately, at a world-state of free and equal human beings. It takes the equality of human rights for granted. Nazism assumes just the opposite. The driving force behind the Nazi movement is the belief in human inequality, the superiority of Germans to all other races, the right of Germany to rule the world. Outside the German Reich it does not recognize any obligations. Eminent Nazi professors have ‘proved’ over and over again that only nordic man is fully human, have even mooted the idea that non-nordic peoples (such as ourselves) can interbreed with gorillas! Therefore, while a species of war-Socialism exists within the German state, its attitude towards conquered nations is frankly that of an exploiter. The function of the Czechs, Poles, French, etc. is simply to produce such goods as Germany may need, and get in return just as little as will keep them from open rebellion. If we are conquered, our job will probably be to manufacture weapons for Hitler's forthcoming wars with Russia and America. The Nazis aim, in effect, at setting up a kind of caste system, with four main castes corresponding rather closely to those of the Hindu religion. At the top comes the Nazi party, second come the mass of the German people, third come the conquered European populations. Fourth and last are to come the coloured peoples, the ‘semi-apes’ as Hitler calls them, who are to be reduced quite openly to slavery...

Demeter

(85,373 posts)http://www.truth-out.org/news/item/24234-does-snowden-know-why-the-nsa-doesnt-need-warrants-he-might

...The email the NSA disclosed showed Snowden asked a fairly simple legal question arising from an NSA training session that outlined various legal authorities, from the US Constitution on down.

"Hello Ed," came the reply from an NSA lawyer. "Executive orders . . . have the 'force and effect of law.' That said, you are correct that E.O.s cannot override a statute."

What the Email Means

Based on the NSA training he was given, Snowden was questioning which carries more weight within the NSA - an actual law passed by Congress, or an order from the president (an E.O., or executive order). The answer was a bit curvy, saying that absent a specific law to the contrary, an order from the president has the force of a law.

By way of a trite illustration, if Congress passed a law requiring Snowden to eat tuna every day for lunch in the NSA canteen, he'd have to do that, even if the president ordered him to have the tomato soup instead. However, absent a law specifically telling him what to eat, the president's order meant he would have to eat soup. Of course, if Congress did not even know of the president's order, it could not pass a law countering it...

A NICE BIT OF LEGAL SOPHISTRY FROM OUR REAL ENEMIES...

Demeter

(85,373 posts)One of the instant storylines dangled by Prof. David Brat’s surprise primary drubbing of Rep. Eric Cantor in Virginia Tuesday is that it’s a defeat for big U.S. banks, which were staunch backers of the majority leader (and vice versa). Yet one large banking institution, based next door in North Carolina, was firmly opposed, in name and spirit, to Cantor’s incumbency.

Brat is a professor of economics and business in the BB&T Moral Foundations of Capitalism Program at Randolph-Macon College in Ashland, Va., established by a foundation arm of BB&T Corp. (BBT), the tenth-largest bank-holding company in the country. The program is rooted in the libertarian “pure capitalist” teachings of writer-philosopher Ayn Rand and was created by BB&T‘s former longtime chief executive and current Cato Institute president John A. Allison, a key patron of the Ayn Rand Institute. Brat co-authored the paper “An Analysis of the Moral Foundations in Ayn Rand," and told the National Review several months ago that, while he doesn't consider himself a Randian, he appreciates the writer's free-market philosophy.

The BB&T philosophy

Allison not only espouses the Randian vision of minimal state involvement and absolute individualism, but he rooted BB&T’s corporate culture in this philosophy as well. The bank — which has $185 billion in assets, a $28 billion stock-market value and a leading position in retail and business banking in the Southeast — requires employees to adopt a “BB&T Philosophy” described in a 20-page guide available on its Website. It begins by stating that:

While not a controversial position in business-school lecture halls or hedge-fund conference rooms, such a declaration is in vivid contrast to many banks’ fuzzy message lines about fostering community prosperity and serving all their constituencies at once. BB&T certainly emphasizes delivering good client service, and consistently scores well in industry customer-relations rankings. Yet it is more explicit about the fact that this is a means to the end of delivering shareholder returns, and is blunt about creating an individual-first, sink-or-swim organization. The manual goes on:

Also:

Allison started his banking career at BB&T (formerly Branch Banking and Trust Co.) in 1971, and became CEO in 1989, honing his worldview informed by Rand’s novel “Atlas Shrugged” and imbuing his bank’s culture with it during the 1990s...

MORE

Demeter

(85,373 posts)The U.S. Justice Department is spending some of the $13 billion JPMorgan Chase & Co agreed to pay to settle claims stemming from mortgage misdeeds to speed up similar punishments against other lenders, possibly including Bank of America Corp and Citigroup, according to people familiar with the matter.

U.S. Attorney's offices that have been among the most active in probing banks over the toxic loans they bundled into mortgage securities and sold to investors have received funds to hire new civil prosecutors, the people said.

U.S. Attorneys in New Jersey, Colorado and the Eastern District of California, based in Sacramento, are among those most experienced in pursuing the probes, the people said.

The increased activity is a sign that President Barack Obama is trying to follow through on his 2012 pledge to hold more banks accountable for their role in the housing crisis, after prosecutors faced criticism for little high-profile action. Attorney General Eric Holder has also expressed a desire to wrap up more of mortgage securities-related cases this year.

"There is a widespread recognition that the banks have not yet been held fully accountable for their origination practices and the harm that did to borrowers, investors and the American economy in general," said Don Hawthorne, a partner with Axinn, Veltrop & Harkrider in New York who has represented clients in mortgage-backed securities litigation.

MORE

Demeter

(85,373 posts)Goldman Sachs Group Inc will pay $67 million and Bain Capital Partners LLC will pay $54 million to settle their portions of a lawsuit accusing several big private equity firms of conspiring not to outbid each other in takeovers.

The preliminary settlement with former shareholders of companies acquired in leveraged buyouts from 2003 to 2007 was disclosed in papers filed on Wednesday in Boston federal court, and requires approval by U.S. District Judge William Young.

Goldman and Bain did not admit wrongdoing in agreeing to settle. Five defendants remain: Blackstone Group , Carlyle Group , KKR & Co , Silver Lake Partners and TPG Capital Management. A trial is set for Nov. 3.

The December 2007 lawsuit, which has shined a light on how Wall Street operates behind the scenes, accused private equity firms of running an "overarching" conspiracy not to outbid, or "jump," each other after transactions were announced...

MORE

THERE'S ALWAYS MORE... WHITE COLLAR CRIME IS INFINITE, SINCE NOBODY EXCEPT MADOFF EVER GETS PUNISHED WITH PRISON AND ASSET SEIZURE

Demeter

(85,373 posts)HASN'T BOA BEEN PUNISHED ENOUGH? OH, THE HUMANITY!

https://news.yahoo.com/judge-considers-dismissing-u-fraud-case-against-bank-205611346--sector.html

A federal judge on Wednesday said he would consider dismissing a U.S. Department of Justice lawsuit accusing Bank of America Corp of civil fraud in the sale of mortgage securities that soured during the global financial crisis.

While not issuing a formal ruling, U.S. District Judge Max Cogburn said he had concerns and indicated at a hearing in Asheville, North Carolina that he might adopt the recommendation of a federal magistrate judge for a dismissal of the fraud claims tied to the $850 million (506.29 million pounds)sale of securities.

"DOJ may not have the evidence to try this as a fraud case," Cogburn said.

Cogburn's skepticism comes at a crucial time, as the second-largest U.S. bank negotiates with the Justice Department and other federal and state authorities to potentially pay more than $12 billion to resolve a range of probes into its sale of mortgage securities that quickly imploded.

Cogburn also told assistant U.S. Attorney Daniel Ryan that the government needed to provide more substantial information to support its case....

MAYBE THEY COULD ASK THE NSA FOR ASSISTANCE...

Demeter

(85,373 posts)Former Goldman Sachs Group Inc director Rajat Gupta has failed to persuade the U.S. Supreme Court to delay the June 17 start of his two-year prison term while he pursues an appeal of his insider trading conviction.

Gupta, also a former global managing director of the consulting firm McKinsey & Co, had asked the country's highest court for permission to stay free during his appeal, after the 2nd U.S. Circuit Court of Appeals in Manhattan on May 30 denied him the same request.

Justice Ruth Bader Ginsburg, who handles emergency applications from the 2nd Circuit, on Wednesday denied Gupta's request to stay out of prison.

The full 2nd Circuit has yet to decide whether to rehear Gupta's appeal of his conviction, which a three-judge panel of that court upheld on March 25.

MORE

Demeter

(85,373 posts)U.S. Marshals are preparing to auction nearly 30,000 bitcoins that were seized from Ross Ulbricht, the man charged for creating an anonymous drug sales site, Silk Road.

Ulbricht was charged with drug trafficking, computer hacking and money laundering for his connection to Silk Road, a hidden Web site that was designed to enable its users to buy and sell illegal drugs over the Internet anonymously, the U.S. Marshals said.

The auction is set for June 27. Potential bidders must register and make a refundable deposit of $200,000.

Demeter

(85,373 posts)The Supreme Court on Thursday ruled unanimously that inherited Individual Retirement Accounts are not afforded the same protection from creditors in bankruptcy proceedings as retirement assets held by the original owner, the Associated Press reports.

The case centered on a Wisconsin couple who argued that a $300,000 IRA the wife inherited from her mother should be shielded from creditors when the couple filed bankruptcy. Writing for the court, Justice Sonia Sotomayor said the change in ownership status of the account makes it less like retirement savings and more like a pot of money available to pay off creditors, the AP reports. Without the ruling, she wrote, nothing would prevent the couple from using their balance “on a vacation home or a sports car immediately after her bankruptcy proceedings are complete,” according to the AP.

The ruling will likely affect some families’ estate planning decisions, Encore reported last fall. Attorneys said at the time that if the Supreme Court rules the way it did, some families will decide to bequeath their IRA assets through trusts, which could shield them from bankruptcy settlements but would also involve more paperwork, costs and complexity. It’s not easy to incorporate an IRA into a trust, said Jeffrey Levine, IRA technical consultant with Ed Slott and Company, in Rockville Centre, New York, and parents will need to weigh their children’s savviness with money, among other factors, when making that decision.

Demeter

(85,373 posts)In his new book The Bigs, Wall Street veteran and CRT Capital Group vice chair Ben Carpenter tells job seekers and young professionals how to choose a career, be a leader, manage their money and more. Carpenter's advice includes a counterpoint to the conventional wisdom to "follow your passion," as embodied by the 2011 best-seller: Do What You Love and the Money Will Follow. Instead, Carpenter advises young professional to think about what they have to offer potential employers: “Instead of asking yourself what you love to do, ask yourself what someone will be willing to hire you to do,” he writes.

Carpenter recommends younger workers should "focus on what they can do well versus what they want to do. You need to be focused in on how you can help a company succeed. That's why they're going to want to hire you; that's why they're going to want to promote you."

Carpenter also pushes back against the growing movement in corporate America to encourage workers to "disconnect" from the office. Even on Wall Street, Goldman Sachs is telling junior bankers to take Saturdays off and restricting analysts from going to the office or logging in to company systems from 9 p.m. Fridays to 9 a.m. Sunday. Separately, J.P. Morgan (JPM) and Bank of America (BAC) are respectively giving junior bankers one "protected weekend" a month and telling junior employees to take off four weekend days per month. A growing body of academic work says disconnecting can help reduce burnout and lead to a more-productive workforce. But Carpenter's advice seems to run counter to those trends and includes the following:

Be available at all hours: always respond to emails and phone calls as soon as you can, whether late at night, early in the morning, on vacation, weekends.

Don't take any days off from work for the first 6 months in a new job.

Schedule all personal appointments after business hours -- if your doctor doesn't offer late hours, get a new doctor.

"To me, the way particularly young people but really everybody should be approaching their job is to think like an entrepreneur," he says. "If you had a company and you were the sole employee, you'd get up everyday and go to to work. When you were at work you'd be thinking about 'what is it I need to do to make this company successful?' You wouldn't be thinking about 'how can I protect my time off?'"

As far as working on Wall Street, Carpenter admits it's not likely to be as glamorous or lucrative for new hires as it was in the prior generation. Still, he would absolutely advise young people drawn to the industry to pursue careers there, noting it's still likely to be more interesting and lucrative than most other industries.

THANK YOU, EBENEEZER SCROOGE

Demeter

(85,373 posts)HAHAHA, SAYS OBAMA....I'D LIKE TO SEE PUTIN STOP ME ON THIS ONE!

SO WOULD THE 99% OF AMERICA...

http://hosted.ap.org/dynamic/stories/U/US_UNITED_STATES_IRAQ?SITE=AP&SECTION=HOME&TEMPLATE=DEFAULT

Less than three years after pulling American forces out of Iraq, President Barack Obama is weighing a range of short-term military options, including airstrikes, to quell an al-Qaida inspired insurgency that has captured two Iraqi cities and threatened to press toward Baghdad.

"We do have a stake in making sure that these jihadists are not getting a permanent foothold," Obama said Thursday in the Oval Office.

However, officials firmly ruled out putting American troops back on the ground in Iraq, which has faced resurgent violence since the U.S. military withdrew in late 2011. A sharp burst of violence this week led to the evacuation Thursday of Americans from a major air base in northern Iraq where the U.S. had been training security forces.

Obama, in his first comments on the deteriorating situation, said it was clear Iraq needed additional assistance from the U.S. and international community given the lightning gains by the militant group Islamic State of Iraq and Levant. Republican lawmakers pinned some of the blame for the escalating violence on Obama's reluctance to re-engage in a conflict he long opposed...

MUCH MORE HELP FROM US, AND THE IRAQI NATION AND ITS PEOPLE WILL CEASE TO EXIST...

Demeter

(85,373 posts)THAT LEVITATION IN CRUDE PRICES IS THANKS TO YOU-KNOW-WHO...

http://www.cnbc.com/id/101751907

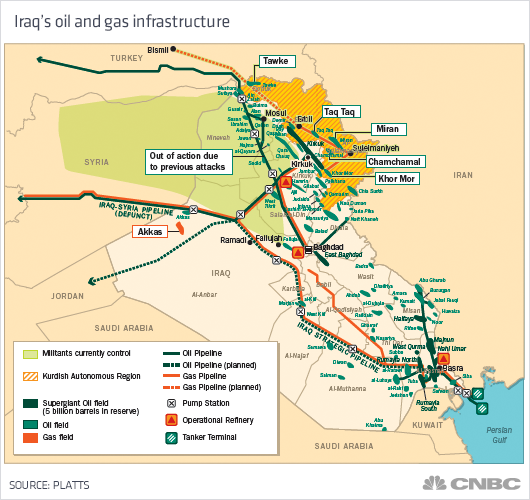

Iraq has become an important swing player with big promise in the global energy market, and the widening conflict has experts worried any supply disruptions could lead to a sharp oil price spike.

That worry and concern about a wider sectarian conflict drove oil prices higher Thursday, weighed on stocks and sent buyers into bonds.

Brent futures rallied more than 3 percent, to $113.02 a barrel, the highest price since Sept. 9. WTI rose $2.13, to $106.53 per barrel. Gasoline futures jumped $0.8, to $3.08 per gallon.

Demeter

(85,373 posts)It’s looking like the Federal Reserve may be taking its all-you-can-eat option off the menu.

The presidents of the New York and Boston Fed banks have made the case in recent weeks that financial stability concerns could lead to changes in the way a program to control short-term interest rates is finally implemented.

The officials were discussing the future of the Fed’s overnight reverse repurchase agreement program. These so-called reverse repos have been in testing since last September and will be through this year. The reverse repos take in cash from eligible banks in exchange for overnight loans of Treasury securities owned by the Fed. The central bank has never done something like this on a large scale, hence the testing.

If adopted, the reverse repos are poised to become a significant part of the Fed’s tool kit once it decides to start increasing interest rates from near zero, because officials believe the facility will set a floor for short-term borrowing costs. A number of Fed officials have expressed satisfaction with how the testing has gone...

http://blogs.wsj.com/economics/2014/06/11/two-fed-officials-suggest-reverse-repos-may-need-borrowing-limits-after-all/

Demeter

(85,373 posts)Spain's banks are creating a form of "bad bank" to pool their stakes in struggling companies, bankers and financial advisers said, in a scheme aimed at reviving firms hit by the country's deep recession.

The new plan - which could be backed by private equity investors and echoes one being developed by Italy's Intesa Sanpaolo and UniCredit with U.S. investor KKR to pool some problematic loans - could get off the ground by this summer with a handful of small companies.

"There are different formulas being studied, like in Italy," said Fernando de la Mora, managing director at financial advisory firm Alvarez & Marsal, which is working on the Intesa and UniCredit deal.

"There are investment firms thinking of putting money in, to finance (companies') working capital needs," de la Mora told Reuters, in reference to the Spanish plan.

Spain's lenders, which are recovering from a property market slump that pushed some into state bail-outs, are still trying to find ways to cope with poor investments. Some have already transferred soured real estate assets to another government-backed "bad bank", known as Sareb.

The country left recession in the second half of 2013 and banks' bad loans as a percentage of total credit, at 13.4 percent in March, is starting to come off an all-time high reached at the start of this year...MORE

Demeter

(85,373 posts)Southern states are mad as hell and aren’t going to take it any more. After more than five years of watching their cities and towns suffer foreclosure and mortgage abuse from the biggest firms on Wall Street, rigged Libor swaps impoverishing local governments, and massive stock losses to municipal workers’ pensions, the South is rising up and suing Wall Street over its latest fleecing scheme – high frequency trading.

And before anyone starts to chuckle about the chances of Southern lawyers outfoxing the mega Wall Street law firms in their own stomping ground in the U.S. District Court for the Southern District of New York, you should know this one salient detail: one of the key Southern lawyers involved is Michael Lewis. That’s not bestselling author Michael Lewis; that’s Big Tobacco Cartel suing and winning lawyer Michael Lewis who mightily assisted in bringing the tobacco cartel out of the shadows and changed the health of a Nation forever.

Even more problematic for Wall Street and its hideously shrewd lawyers is that one of the smartest programming brains in U.S. markets, Eric Hunsader, is cooperating with the Southern lawyers...Why is Hunsader who runs a successful data business involving himself in what is likely to be the biggest legal free-for-all of the century? Andrew Smith of the Guardian shares this with us:

“When Hunsader’s finance friends pointed out that nobody was driving busloads of children over cliffs, he would grab their wallet and remove a $20 bill, then hand the wallet back. ‘Does anyone in the world really care what just happened there?’ he would ask. ‘It makes no difference to anyone but you, and even then not much. It’s just that in a civilised society, we don’t tolerate that. Civilisation breaks down when people don’t follow the rules, because nobody can trust anybody else.’ ”

xchrom

(108,903 posts)BEIJING (AP) -- Six months ago, China's housing market was so red-hot that Feng Xiaowei, a sales manager at a real estate agency in the eastern city of Hangzhou, rarely took a day off.

Then lending and sales curbs imposed by the government to cool soaring housing costs started to bite and business evaporated. Now Feng and the seven salespeople he supervises spend the day playing cards.

"There are no buyers," said Feng, 24. "We take three days off a week. We go out for barbecue and play poker."

China's house prices have marched higher for 15 years, helping to drive an economic boom but making home ownership unaffordable for many families. Now a slump is dragging down economic growth that already was slowing. Some analysts worry banks might be shaken if developers default on loans.

xchrom

(108,903 posts)VALENCIA, Spain (AP) -- At the height of Spain's crushing economic crisis, the Villareal soccer club sported an eye-catching logo across its jerseys: Aeroport Castello. The local government paid the club 20 million euros ($27 million) to promote what was to become Spain's most notorious "ghost airport" - one that hasn't seen a single flight since it opened in 2011.

The deal illustrates one of the peculiarities of Spain's meltdown: As austerity measures sap the life from health, education and welfare programs, Spain's soccer teams have been receiving hundreds of millions of dollars in government aid. The government says soccer subsidies are simply part of a policy of supporting sports around the country.

An Associated Press review of official documents shows that Spain's highly autonomous regions are helping to keep some soccer teams alive through massive direct cash injections. The financing has some politicians and ordinary Spaniards questioning the support.

The 20 clubs in Spain's top soccer league received at least 332 million euros in direct public aid between 2008 - the beginning of Spain's financial meltdown - and 2012, according to the AP review. The funds were allocated through public agencies and companies run by the country's 17 regional governments. In the same time period, the clubs have also benefited from an additional 476 million euros in indirect aid, such as allowing clubs to run up tax and social security debts.

xchrom

(108,903 posts)NEW YORK (AP) -- If you hope to get a raise that finally feels like one, it helps to work in the right industry.

Historically, at this stage in the economy's recovery, pay would be rising in most sectors. But five years after the Great Recession officially ended, raises remain sharply uneven across industries and, as a whole, have barely kept up with prices. Overall pay has been rising about 2 percent a year, roughly equal to inflation.

The best raises have gone to workers with specialized skills in a few booming industries - energy, transportation, health care, technology. Those in retail or government have been less fortunate.

"If you're in an in-demand field, with the right skill set, the chance of getting a raise is much higher," says Katie Bardaro, an economist at PayScale, a pay-tracking firm.

xchrom

(108,903 posts)NEW YORK (AP) -- The upheaval in Iraq could throw the world's remarkably stable oil market out of balance, threatening a delicate equilibrium that has kept prices steady for much of the last four years.

Iraqi oil production is at risk because of the outbreak of violence involving militant groups who seized two cities this week and have pledged to march on Baghdad.

For now, the fighting is mostly in Iraq's north, away from important oil-producing regions in the south. But the turmoil sent the price of Brent crude, the key international benchmark, up 2.8 percent Thursday to $113.02, its biggest gain since August.

More important, it raised questions about Iraq's ability to continue to rebuild its oil infrastructure and increase production to meet rising global demand.

xchrom

(108,903 posts)The European Union has served notice that senior bondholders will be in the firing line for losses when banks go bust, yet the law’s fine print leaves room for confusion.

Policy makers from Michel Barnier to Jeroen Dijsselbloem have heralded legislation published yesterday as an iron-clad system for shifting the burden of bank failures from taxpayers to investors. In time of crisis, the directive’s exemptions and caveats will give regulators plenty of wiggle room.

“The text itself is full of loopholes,” said Nicolas Veron, a fellow at the Bruegel research group in Brussels. “Even if it wasn’t, it would still take time for the practical application of the law to bed down. Each of these two levels is sufficient to raise doubts about how the framework will really play out. As a famous general said, no plan survives first contact with the enemy.”

Under the new rules set out in the Bank Recovery and Resolution Directive or BRRD, starting in 2016 authorities will, as a general rule, require 8 percent of a struggling bank’s liabilities to be wiped out before recourse can be made to industry funds or taxpayer support.

xchrom

(108,903 posts)The rise of off-exchange trading in the U.S. stock market continues unabated even as regulators question the wisdom of allowing the shift to continue.

Shares changing hands in private venues such as dark pools accounted for 40.4 percent of total share volume on June 10, according to data compiled by Bloomberg. That’s the most since 41.7 percent took place off-exchange on June 22, 2012. The three biggest exchange companies each matched about 20 percent of trading on June 10.

The high came after Securities and Exchange Chair Mary Jo White last week voiced concerns about the level of trading taking place on venues where bids and offers are kept private, masking the true depth of demand for shares. The rise in off-exchange trading came as calmness pervaded markets, with the Chicago Board Options Exchange Volatility Index, also known as the VIX, sliding to a seven-year low last week.

“Its been clearly demonstrated that the less volatile markets are, the more people trade away from exchanges,” Justin Schack, partner and managing director for market structure analysis at Rosenblatt Securities Inc., said in a phone interview. “Brokers also have an incentive to avoid exchanges and their fees, and with overall volumes low, the pressure to avoid costs is quite high.”

xchrom

(108,903 posts)China’s home buyers are being offered no-money-down purchases in an echo of the subprime lending that triggered a U.S. economic meltdown and the global financial crisis.

Deals skirting government requirements for minimum 30 percent down payments have emerged this year from Guangzhou and Shenzhen in the south to Beijing in the north as real-estate sales slump, according to state media and statements by government agencies and developers.

Loosening down-payment requirements could erode China’s financial stability by adding to risks for property companies, lenders and an economy already heading for the weakest growth in 24 years. Government warnings to consumers indicate that officials will strive to limit such arrangements, a sign of stress in a property market with a glut of homes.

“The risk is severe for developers and third parties because there is no commitment from home buyers,” said Ding Shuang, senior China economist at Citigroup Inc in Hong Kong. “Zero down payment has appeared in the U.S. before. It basically enabled unqualified people to buy houses,” said Ding, who used to work for the International Monetary Fund.

xchrom

(108,903 posts)The leaders of Romania and Slovakia, two former communist NATO members that border Ukraine, called for the European Union to unite in the face of resurgent Russian expansionism.

The 28-member bloc must come together to send Russia a clear message after the annexation of Crimea from Ukraine, Romanian Prime Minister Victor Ponta said in an interview yesterday. Slovak President-elect Andrej Kiska in a separate interview said the EU’s ability to confront Russia with a united stance is being undermined by a narrow-minded pursuit of business interests by some member states.

The unrest in Ukraine is sending shockwaves across eastern Europe, a region that broke free of Soviet influence 25 years ago. For Romania, the events in Crimea across the Black Sea make the crisis “more intense” than for countries in other parts of the continent, Ponta said.

“Russia has been for centuries -- in different names, Russia, Soviet Union, it doesn’t matter -- but it has been a great power and a great power must have a clear answer from Europe that this is the red line,” Ponta said in Bucharest yesterday. “Nobody wants confrontation, but there must be a red line which can’t be crossed.”

xchrom

(108,903 posts)Intel Corp. (INTC) Chief Executive Officer Brian Krzanich is getting help from other corporations as they upgrade their office machinery.

The world’s largest semiconductor maker yesterday raised its second-quarter revenue forecast and said annual sales will increase for the first time since 2011, buoyed by improving business demand for personal computers. The company’s shares rose as much as 6.6 percent in extended trading.

The higher forecast provides another hint of optimism in the PC industry, where Intel gets most of its revenue, after two straight years of declining global shipments. Even as consumers shun PCs in favor of mobile devices, demand for Intel’s microprocessors is getting a lift as companies replace aging computer systems, said Ian Ing, an analyst at MKM Partners.

“In the short to medium term, it looks like the market has stabilized, and business and corporate PCs are driving a lot of strength,” said Ing, who has the equivalent of a hold rating on Intel stock. “It’s really a nice positive for them, even without needing the consumer to come back yet.”

xchrom

(108,903 posts)The Nordic nations, home to some of the world’s most egalitarian societies, should be concerned about growing rates of income inequality, according to Thomas Piketty.

“We don’t need to wait for the rise in inequality to be as large as in the U.S. to start worrying about it,” Piketty, author of the best-selling book ‘Capital in the Twenty-First Century’ and a professor at the Paris School of Economics, told reporters in Helsinki yesterday.

Sweden, Norway, Denmark and Finland have since World War II used income transfers to build welfare states intended to bridge the gap between rich and poor and increase social cohesion by providing free public services such as health care and education.

For the first time ever, the wealth gap grew more in the Nordic region and Germany than anywhere else in the “traditionally low-inequality countries” during first decade of the 21st century, the Organization for Economic Cooperation and Development said in a report in 2011. One reason is that the wages of the top 10 percent have been rising faster than pay for the middle class, according to the report.

xchrom

(108,903 posts)China’s industrial output and retail sales increased at a faster pace in May, adding to evidence that Premier Li Keqiang’s support measures are stabilizing the world’s second-biggest economy.

Factory production rose 8.8 percent in May from a year earlier, the National Bureau of Statistics said in Beijing today, up from 8.7 percent in April. Retail sales increased 12.5 percent and January-May fixed-asset investment growth was little changed at 17.2 percent.

Today’s reports may bolster Chinese leaders’ confidence that so-called mini-stimulus measures will prevent a deeper economic slowdown. Even so, policy makers are contending with a property market slump, along with risks from shadow banking and rising bad loans that threaten to limit the scale of a recovery.

“The data confirms stabilization of economic activity and even a modest improvement on the manufacturing side,” said Dariusz Kowalczyk, senior economist at Credit Agricole SA in Hong Kong. “Unfortunately, home sales by area contracted sharply, highlighting continued weakness of the real-estate sector and the risks it poses to overall growth.”

Demeter

(85,373 posts)

So what if it's only 6 AM?

Fuddnik

(8,846 posts)It won't improve my thinking, but I'll feel better.

My DirecTV is down with technical difficulties. Thunderstorms all around and a thunderphobic dog under my feet. McLame wants to re-invade the Mideast.

xchrom

(108,903 posts)Credit ratings agency Fitch has warned South Africa that its credit rating may be lowered following a five-month platinum strike in the country.

Fitch changed the country's outlook from stable to negative, citing poor economic prospects and rising public debt.

Its economy contracted by 0.6% in the first quarter, in part because of a fall in platinum production.

However, unions said a platinum miners' wage deal was on the horizon.

xchrom

(108,903 posts)How Increasing Ideological Uniformity and Partisan Antipathy Affect Politics, Compromise and Everyday Life

Republicans and Democrats are more divided along ideological lines – and partisan antipathy is deeper and more extensive – than at any point in the last two decades. These trends manifest themselves in myriad ways, both in politics and in everyday life. And a new survey of 10,000 adults nationwide finds that these divisions are greatest among those who are the most engaged and active in the political process.

The overall share of Americans who express consistently conservative or consistently liberal opinions has doubled over the past two decades from 10% to 21%. And ideological thinking is now much more closely aligned with partisanship than in the past. As a result, ideological overlap between the two parties has diminished: Today, 92% of Republicans are to the right of the median Democrat, and 94% of Democrats are to the left of the median Republican.

Partisan animosity has increased substantially over the same period. In each party, the share with a highly negative view of the opposing party has more than doubled since 1994. Most of these intense partisans believe the opposing party’s policies “are so misguided that they threaten the nation’s well-being.”

Demeter

(85,373 posts)Well, that's unfortunately true for BOTH parties' policies, regarding economics, SPYINIG ON Americans, BLOWING UP Americans WITH DRONES, and foreign affairs.

So I guess we have something in common to build on.

Demeter

(85,373 posts)Cash deposited overnight with the European Central Bank plunged to the lowest level since 2011 as a negative interest rate took effect. Euro-area banks parked 13.6 billion euros ($18.4 billion) in the deposit facility yesterday, down 25 billion euros from the previous day. The ECB has started charging 0.1 percent for holding cash in excess of minimum reserves, making it the first major central bank to do so.

ECB President Mario Draghi is fighting a prolonged period of low inflation that threatens to derail the 18-nation currency bloc’s fragile economic recovery. His package of measures announced last week also included cutting all key rates to record lows and offering long-term loans to banks conditional on them lending the money to companies and households.

Commerzbank AG, Germany’s second-biggest bank, will no longer deposit surplus cash at the ECB, Chief Executive Officer Martin Blessing said on June 10.

The ECB’s measures have helped push down money-market rates. The cost of overnight unsecured interbank lending, or Eonia, fell to 0.06 percent yesterday, compared with an average of 0.248 percent last month. The yield on the German two-year bond dropped to 0.03 percent today, the lowest level in more than a year.

Demeter

(85,373 posts)1. We saw an example of the court orders that authorize the NSA to collect virtually every phone call record in the United States—that’s who you call, who calls you, when, for how long, and sometimes where.

2. We saw NSA Powerpoint slides documenting how the NSA conducts “upstream” collection, gathering intelligence information directly from the infrastructure of telecommunications providers.Prsim/Upstream slide

3. The NSA has created a “content dragnet” by asserting that it can intercept not only communications where a target is a party to a communication but also communications “about a target, even if the target isn’t a party to the communication.”

4. The NSA has confirmed that it is searching data collected under Section 702 of the FISA Amendments Act to access American’s communications without a warrant, in what Senator Ron Wyden called the "back door search loophole."

5. Although the NSA has repeatedly stated it does not target Americans, its own documents show that searches of data collected under Section 702 are designed simply to determine with 51 percent confidence a target’s “foreignness.’”

6. If the NSA does not determine a target’s foreignness, it will not stop spying on that target. Instead the NSA will presume that target to be foreign unless they “can be positively identified as a United States person.”

7. A leaked internal NSA audit detailed 2,776 violations of rules or court orders in just a one-year period.

8. Hackers at the NSA target sysadmins, regardless of the fact that these sysadmins themselves may be completely innocent of any wrongdoing...

MUCH, MUCH MORE