Economy

Related: About this forumWeekend Economists in the Children's Hour: Hallowe'en to El Dia de Los Muertos, 2014

Autumn is the perfect time for nostalgia! Try to think back to your childhood's innocent (or not) time (some of you never left, some barely made it out, some can't remember):

Burning leaves in the streets, dial telephones, ice cream trucks with popsicles for a nickel

NASA and New Math

Color television replacing black and white

Big sedans and station wagons giving way to all kinds of strange vehicles

and kids cartoons morphing into Sesame Street.

How on earth did we get to today?

Demeter

(85,373 posts)DJIA goosed 195 points, 50 of those in the last 45 minutes of trading...it's madness, madness, I say!

Demeter

(85,373 posts)Last edited Fri Oct 31, 2014, 06:19 PM - Edit history (1)

The Archdruid Report... the political struggles that pit the elites of a failing civilization against the proto-warlords of the nascent dark age reflect deeper shifts in the economic sphere—the economics of decline and fall need to be understood in order to make sense of the trajectory ahead of us. One of the more useful ways of understanding that trajectory was traced out some years ago by Joseph Tainter in his book The Collapse of Complex Societies...Tainter begins with the law of diminishing returns: the rule, applicable to an astonishingly broad range of human affairs, that the more you invest—in any sense—in any one project, the smaller the additional return is on each unit of additional investment. The point at which this starts to take effect is called the point of diminishing returns. Off past that point is a far more threatening landmark, the point of zero marginal return: the point, that is, when additional investment costs as much as the benefit it yields. Beyond that lies the territory of negative returns, where further investment yields less than it costs, and the gap grows wider with each additional increment. The attempt to achieve infinite economic growth on a finite planet makes a fine example of the law of diminishing returns in action. Given the necessary preconditions—a point we’ll discuss in more detail a bit later in this post—economic growth in its early stages produces benefits well in excess of its costs. Once the point of diminishing returns is past, though, further growth brings less and less benefit in any but a purely abstract, financial sense; broader measures of well-being fail to keep up with the expansion of the economy, and eventually the point of zero marginal return arrives and further rounds of growth actively make things worse.

Mainstream economists these days shove these increments of what John Ruskin used to call “illth”—yes, that’s the opposite of wealth—into the category of “externalities,” where they are generally ignored by everyone who doesn’t have to deal with them in person. If growth continues far enough, though, the production of illth overwhelms the production of wealth, and we end up more or less where we are today, where the benefits from continued growth are outweighed by the increasingly ghastly impact of the social, economic, and environmental “externalities” driven by growth itself. As The Limits to Growth pointed out all those years ago, that’s the nature of our predicament: the costs of growth rise faster than the benefits and eventually force the industrial economy to its knees. Tainter’s insight was that the same rules can be applied to social complexity. When a society begins to add layers of social complexity—for example, expanding the reach of the division of labor, setting up hierarchies to centralize decision-making, and so on—the initial rounds pay off substantially in terms of additional wealth and the capacity to deal with challenges from other societies and the natural world. Here again, though, there’s a point of diminishing returns, after which additional investments in social complexity yield less and less in the way of benefits, and there’s a point of zero marginal return, after which each additional increment of complexity subtracts from the wealth and resilience of the society.

There’s a mordant irony to what happens next. Societies in crisis reliably respond by doing what they know how to do. In the case of complex societies, what they know how to amounts to adding on new layers of complexity—after all, that’s what’s worked in the past... If too much complexity is at the root of the problems besetting a society, though, what happens when its leaders keep adding even more complexity to solve those problems?...Here in America, certainly, we’ve long since passed the point at which additional investments in complexity yield any benefit at all, but the manufacture of further complexity goes on apace, unhindered by the mere fact that it’s making a galaxy of bad problems worse. Do I need to cite the US health care system, which is currently collapsing under the sheer weight of the baroque superstructure of corporate and government bureaucracies heaped on top of what was once the simple process of paying a visit to the doctor? We can describe this process as intermediation—the insertion of a variety of intermediate persons, professions, and institutions between the producer and the consumer of any given good or service. It’s a standard feature of social complexity, and tends to blossom in the latter years of every civilization, as part of the piling up of complexity on complexity that Tainter discussed. There’s an interesting parallel between the process of intermediation and the process of ecological succession. Just as an ecosystem, as it moves from one sere (successional stage) to the next, tends to produce ever more elaborate food webs linking the plants whose photosynthesis starts the process with the consumers of detritus at its end, the rise of social complexity in a civilization tends to produce ever more elaborate patterns of intermediation between producers and consumers. Contemporary industrial civilization has taken intermediation to an extreme not reached by any previous civilization, and there’s a reason for that. White’s Law, one of the fundamental rules of human ecology, states that economic development is a function of energy per capita. The jackpot of cheap concentrated energy that industrial civilization obtained from fossil fuels threw that equation into overdrive, and economic development is simply another name for complexity. The US health care system, again, is one example out of many; as the American economy expanded metastatically over the course of the 20th century, an immense army of medical administrators, laboratory staff, specialists, insurance agents, government officials, and other functionaries inserted themselves into the notional space between physician and patient, turning what was once an ordinary face to face business transaction into a bureaucratic nightmare reminiscent of Franz Kafka’s The Castle.

In one way or another, that’s been the fate of every kind of economic activity in modern industrial society. Pick an economic sector, any economic sector, and the producers and consumers of the goods and services involved in any given transaction are hugely outnumbered by the people who earn a living from that transaction in some other way—by administering, financing, scheduling, regulating, taxing, approving, overseeing, facilitating, supplying, or in some other manner getting in there and grabbing a piece of the action. Take the natural tendency for social complexity to increase over time, and put it to work in a society that’s surfing a gargantuan tsunami of cheap energy, in which most work is done by machines powered by fossil fuels and not by human hands and minds, and that’s pretty much what you can expect to get...

Demeter

(85,373 posts)...I show an example of this having already happened in the U.S. to my classes when I demonstrate the shortcomings of Gross Domestic Product (GDP) as a measure of economic health. One of my slides places a bar graph of U.S. GDP next to a bar representing the total of all the negative externalities as calculated by the people who put together the Genuine Progress Indicator (GPI). The externalities are much taller, so the result is negative. People are actually worse off. Only the positive externalities (all of the free services done by friends and family, for example) that also contribute to the GPI allow the economy to be positive at all.

Also, while the GDP per capita has gone up and up since World War II, the GPI per capita has been stagnant since the mid 1970s. It seems that we hit the point of diminishing returns 40 years ago....

WELL, SOMETHING HAPPENED IN THE MID 1970'S....I'D CALL IT 1% ELITIST THEFT CRANKED INTO HIGH GEAR. THAT WAS THE POINT AT WHICH THINGS STARTED TO GET COMPLEX FOR NO GOOD REASON...EXCEPT TO RUN A CON GAME.

antigop

(12,778 posts)Demeter

(85,373 posts)When Peggy Young became pregnant in 2006, she had every intention of continuing to work delivering packages for UPS in Maryland. At the urging of the company's occupational health manager, Young visited her doctor to obtain a note detailing any work restrictions she might need. Her doctor recommended that she not lift more than 20 pounds for the first 20 weeks of her pregnancy.

Based on the doctor's note, UPS placed Young on unpaid leave, an all too common experience for women nationwide. Although UPS often put workers with other conditions on light duty, it told Young that such accommodations wouldn't apply to an "off-the-job" condition such as her pregnancy. Not only would she lose her income, she would have to suddenly switch to her husband's health insurance plan, changing the hospitals at which she could potentially give birth.

"I wanted to work," Young told The Huffington Post. "I all but begged for them to let me work."

The unborn child Young was carrying in 2006 is now a 7-year-old girl named Trinity. Young no longer works for UPS, but she's still fighting the shipping giant for denying her accommodations while she was pregnant. Young sued UPS alleging discrimination, and her case, Young v. UPS, is now before the Supreme Court, with oral arguments expected in December.

If the policy enforced on Young in 2006 doesn't seem particularly enlightened, UPS itself would seem to agree. In a memo sent to employees this week, the company announced that it will begin offering light duty to pregnant workers on Jan. 1, the Washington Post reported Wednesday. The turnaround puts UPS in the peculiar position of defending before the Supreme Court a policy that it is already walking away from...

Demeter

(85,373 posts)

Vampire Squid

In the low-oxygen environment 300 to 3,000 meters below the sea’s surface lurks Vampyroteuthis infernalis, or “the vampire squid from hell”. Despite its fearsome name, it’s neither a vampire nor a squid. In 2012, researchers at the Monterey Bay Aquarium Research Institute discovered that the small cephalopod lives off marine snow, or particles of detritus (dead bodies, poop and snot) that float to the bottom of the ocean. The name comes from its dark red body and glowing eye spots, which give it a fearsome appearance. The animal is also well adapted for life in the shadows. In addition to its eight webbed arms, two long filaments extend out behind it sensing and capturing food. The filaments may also serve to detect larger predators, but since there’s not a lot to eat down there, the vampire squid is mostly free to mosey along as it pleases.

http://www.smithsonianmag.com/science-nature/seven-vampires-arent-bats-bela-lugosi-180953188/?utm_source=feedburner&no-ist

SHOWING THAT VAMPIRE SQUID IS NOT AN ACCURATE NAME FOR GOLDMAN SACHS...A MUCH BETTER EXAMPLE WOULD BE THE LAMPREY EEL, FAMED FOR DESTROYING THE GREAT LAKES FISH POPULATIONS....SEE LINK FOR DETAILS.

Fuddnik

(8,846 posts)Demeter

(85,373 posts)The Koch bros. are somewhere looking for rum.

and the Dimon's in the rough.

Trick or treat!

In spite of ghastly conditions: wind, rain verging on snow, and the dark, we had trick-or-treaters tonight. I never did carve the pumpkin, but managed dinner.

Demeter

(85,373 posts)For almost two decades, Japan has been held up as a cautionary tale, an object lesson on how not to run an advanced economy. After all, the island nation is the rising superpower that stumbled. One day, it seemed, it was on the road to high-tech domination of the world economy; the next it was suffering from seemingly endless stagnation and deflation. And Western economists were scathing in their criticisms of Japanese policy.

I was one of those critics; Ben Bernanke, who went on to become chairman of the Federal Reserve, was another. And these days, I often find myself thinking that we ought to apologize.

Now, I’m not saying that our economic analysis was wrong. The paper I published in 1998 about Japan’s “liquidity trap,” or the paper Mr. Bernanke published in 2000 urging Japanese policy makers to show “Rooseveltian resolve” in confronting their problems, have aged fairly well. In fact, in some ways they look more relevant than ever now that much of the West has fallen into a prolonged slump very similar to Japan’s experience.

The point, however, is that the West has, in fact, fallen into a slump similar to Japan’s — but worse. And that wasn’t supposed to happen. In the 1990s, we assumed that if the United States or Western Europe found themselves facing anything like Japan’s problems, we would respond much more effectively than the Japanese had. But we didn’t, even though we had Japan’s experience to guide us. On the contrary, Western policies since 2008 have been so inadequate if not actively counterproductive that Japan’s failings seem minor in comparison. And Western workers have experienced a level of suffering that Japan has managed to avoid...

ACTUALLY, THE JAPANESE WORKERS ARE JUST AS BAD OFF AS WE ARE, IF NOT WORSE. THEY JUST DON'T GET AS MUCH PRESS, NOR COMPLAIN AS PUBLICLY.

YOU SEE IT IN THE SUICIDE RATES:

JAPAN: 21.3 SUICIDES PER 100,000

USA: 12 SUICIDES PER 100,000

OF COURSE, THESE ARE "OFFICIAL" NUMBERS...SO WHO KNOWS WHAT THEY REALLY ARE..

Demeter

(85,373 posts)The number of Japanese who committed suicide declined last year, but remained above 30,000 for the 13th straight year with a sharp jump in deaths by those citing grim job prospects, a government report said Thursday.

Japan has for years had one of the world's highest suicide rates.

In all, 31,690 people killed themselves last year, a 3.5 percent decrease from the year before. Many cited depression, economic hardships and job-related concerns, according to the annual report by the National Police Agency.

The number of people who committed suicide indicating "failure to get jobs" rose to 424, up 20 percent from the year before and more than doubling from 180 in 2007, the report said. About one-third were in their 20s, including new graduates seeking jobs.

The results underscore the tough reality for student job seekers as companies cut back on hiring amid a lengthy economic slump.

A record one-third of university students graduating this month have not found jobs, a separate government survey said in January....

Demeter

(85,373 posts)

In neighborhoods across Detroit, the intense orange glow of burning houses pierced the black sky Thursday night and Friday morning. A blaze at 3140 E. Kirby erupted just before 11:30 p.m. engulfing three homes and sending huge plumes of gray and black smoke twisting into the night. Ash and embers fell from above. Minutes later, less than five blocks away, another large fire enveloped two apparently vacant houses at Mount Elliot and East Warren.

Over 3,000 people were still logged into the Detroit Fire Department online dispatch feed at 2 a.m. Friday listening to fire activity across the city. Dispatch and firefighters receiving the runs remained busy well into the morning.

"McDougall and East Ferry, request for box alarm," the dispatcher said as a new fire erupted at 2:36 a.m.

Photographers from well beyond Detroit descend on the city each Oct. 30 hoping to capture dramatic fire images on what is known as Devils' Night -- Angels' Night to those trying to change its malicious reputation. Although there hasn't been an official count, Motor City Muckraker, a Detroit news website operated by reporter Steve Neavling, recorded at least 36 fires between midnight Wednesday and Friday morning, fewer than in previous years, according to Neavling. Motor City Muckraker is mapping all fires and offering live updates.

Mayor Mike Duggan's office said there were 28 fires, seven suspicious, Wednesday.

Twenty-six is the average number of fires per night in the city Fire Commissioner Edsel Jenkins estimated when speaking to MLive Detroit last week. At the peak of Devils' Night activity in the 1980s, the number of reported arson fires were in the hundreds through the three-day period, from Oct. 29 through the morning of Nov. 1. City officials reported 95 fires at the end of the three-day period in 2013, compared to 93 in 2012 and 94 in 2011. There were 169 in 2010 and 119 in 2009.

GIVEN THE PLANS TO STEAL THE HOUSING OUT FROM UNDER THE PEOPLE....WELL, IT'S ONE WAY TO DEPRIVE THE PROFITEERS...

Demeter

(85,373 posts)Banca Monte dei Paschi di Siena (BMPS.MI) and Carige CRCI.MI will make up the capital shortfalls revealed in the ECB stress tests through private sector financing, Italian Economy Minister Pier Carlo Padoan said on Friday.

"The remaining capital needs of our banking system will be filled through the mobilization of private resources," Padoan said in a speech at a conference in Rome.

He made no comment on the status of repayments of existing state aid offered to Monte dei Paschi in a previous bailout. But the comments dampen prospects of outright new state aid being offered to the two banks, which were among the biggest losers in the European Central Bank's health check of the sector.

Monte dei Paschi was left with a shortfall of 2.1 billion euros, while Carige had a gap of 814 million euros...

Demeter

(85,373 posts)Many authorities have said it: banks do not lend their deposits. They create the money they lend on their books.

When a bank makes a loan, it simply adds to the borrower’s deposit account in the bank by the amount of the loan. The money is not taken from anyone else’s deposits; it was not previously paid in to the bank by anyone. It’s new money, created by the bank for the use of the borrower.

The Bank of England said it in the spring of 2014, writing in its quarterly bulletin:

The reality of how money is created today differs from the description found in some economics textbooks: Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits.

. . . Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.

All of which leaves us to wonder: If banks do not lend their depositors’ money, why are they always scrambling to get it? Banks advertise to attract depositors, and they pay interest on the funds. What good are our deposits to the bank? The answer is that while banks do not need the deposits to create loans, they do need to balance their books; and attracting customer deposits is usually the cheapest way to do it.

Reckoning with the Fed

Ever since the Federal Reserve Act was passed in 1913, banks have been required to clear their outgoing checks through the Fed or another clearinghouse. Banks keep reserves in reserve accounts at the Fed for this purpose, and they usually hold the minimum required reserve. When the loan of Bank A becomes a check that goes into Bank B, the Federal Reserve debits Bank A’s reserve account and credits Bank B’s. If Bank A’s account goes in the red at the end of the day, the Fed automatically treats this as an overdraft and lends the bank the money. Bank A then must clear the overdraft.

Attracting customer deposits, called “retail deposits,” is a cheap way to do it. But if the bank lacks retail deposits, it can borrow in the money markets, typically the Fed funds market where banks sell their “excess reserves” to other banks. These purchased deposits are called “wholesale deposits.”

Note that excess reserves will always be available somewhere, since the reserves that just left Bank A will have gone into some other bank. The exception is when customers withdraw cash, but that happens only rarely as compared to all the electronic money flying back and forth every day in the banking system.

Borrowing from the Fed funds market is pretty inexpensive – a mere 0.25% interest yearly for overnight loans. But it’s still more expensive than borrowing from the bank’s own depositors.

MORE BANKING ARCANA AT LINK

Warpy

(111,367 posts)and those were dial phones and mechanical typewriters. I've gotten blistered fingers from having to make a ton of calls and I could never manage the typewriters and flunked typing, nobody knew a 14 year old kid could and did have arthritis.

I miss the smell of burning leaves but the smell of roasting green chile around here makes up for it, even if it does make me hungry at the same time.

Dia de los Muertos is a big deal here and out on the Pueblo reservations. I've been invited out to the reservations and have always regretted not being able to go due to work. Sugar skulls are sold in the markets in the heavily Mexican immigrant areas of town, meaning about a five minute drive from me. It's really a nice holiday, sort of like a yearly Irish wake with drinking and remembrance and music along with the sugar skulls and masses of marigolds.

One hopes the custom will survive television and increasing poverty in a country that does not care about its people.

DemReadingDU

(16,000 posts)10/31/14 Japan: QE As Morphine For A Terminal Patient

by Ilargi at The Automatic Earth

You can jot down Halloween 2014 in your calendar, and it’s unfortunately too tragic to make proper use of the irony involved, as the day Japan committed suicide. The sun is no longer rising. Not that the vital signs weren’t bad before, indeed it might not have survived regardless, but this lethal blow announced today is still quite the statement.

That financial markets interpret it as a reason to cheer and party and make lots of dough is yet one more proof of how shallow and single-minded the people operating in these markets are, lacking all insight in historical context, longer term consequences, wars and politics, and the human mind.

Because the ‘QE as morphine’ concept introduced today by the megalomaniac Shinzo Abe and his central bank raving mad puppets will change the world in ways that make financial gain less than even an afterthought, except perhaps for those of us who cannot see beyond today, or beyond the one single lonely dimension money is of any use in.

If and when a country resorts to having it central bank buy up – the equivalent of – all sovereign bonds it issues, the snake truly eats its tail, and not in a metaphorical sense. Japan eats it children, most of them as yet unborn, to keep its rapidly ageing population contented and in relative wealth, because the alternative would cost Tokyo’s financial-political power cabal their jobs and heads.

Japan’s problem is, and has been for many years, twofold: first, the Japanese people lost the spending power to keep the domestic real economy growing some 20 years ago and never got it back, and second, a whole slew of successive governments refused to restructure the debts in the financial sector, and instead put those debts on the public tally.

The negative growth announced today in US consumer spending should be a warning sign, as should similar numbers that have come from across Europe for a while now, a sign that we need to think about how to run our societies and economies without everlasting growth, and without the ever more failing and ever more costly policies aimed at constructing and maintaining that growth.

However, the worse the policies are for the real economy and the people who depend on it for survival, the more money the financial markets, and the banks, make. It truly is QE as morphine, and Japan has shown us today that morphine can alleviate pain, but it is also in the end the ultimate killer.

It may already be too late, but we can still make the effort to not fall into the same trap Japan has fallen in. Which in essence is simply trying to recreate a past world that is long gone, by applying measures that ‘wise men’ say are sure to bring back the past, and then more.

We must look at ourselves and wonder why we want more. And realize that if we don’t take that look, and we continue on our present path, we will all end up like Japan, guaranteeing that our quest for more will leave us with less, much less. We cannot build our world with credit, we need to work in order to build it. And we cannot borrow our way into growth, nor do we need to grow.

Halloween 2014. A day we could have learned something.

http://www.theautomaticearth.com/japan-qe-as-morphine-for-a-terminal-patient/

Demeter

(85,373 posts)DemReadingDU

(16,000 posts)#t=8

antigop

(12,778 posts)Demeter

(85,373 posts)Now that I have a portion of my mind back, my memory should improve, if there's anything worth remembering that happens henceforth.

It's amazing what a refusal to destroy oneself does for a body. I don't miss my crazy clients or the paper route, and I don't have to eat as much, since I'm not compensating for so many things being so stressful...

antigop

(12,778 posts)Demeter

(85,373 posts)antigop

(12,778 posts)Demeter

(85,373 posts)With the Dow hitting new highs, I don't suppose any would....

Demeter

(85,373 posts)Demeter

(85,373 posts)Demeter

(85,373 posts)The U.S. Federal Reserve awarded $186.28 billion in fixed-rate reverse repurchase agreements on Friday, the highest amount in more than four weeks, due to strong investor demand for ultra short-dated, risk-free assets at month-end. The central bank has been testing them as a tool to drain cash from the financial system to achieve their interest rate target when it decides to tighten monetary policy.

At Friday's operation, the Fed paid 72 bidders including Wall Street firms, money market funds and mortgage finance agencies an interest rate of 0.05 percent for them to borrow its Treasuries holdings until Monday.

This was the highest amount of fixed-rate reverse repos, commonly referred as RRPs, the Fed awarded since the $212.48 billion to 53 bidders on Oct. 1.

On Thursday, the Fed awarded $142.24 billion RRPs to 47 bidders at an interest rate of 0.05 percent.

Demeter

(85,373 posts)And you wouldn't even have to learn a new language!...Students just have to be willing to leave the country:

1. Brazil: Brazil's universities charge registration fees, Noack notes, but they do not require regular tuition. Many of them also offer courses in English.

2. Germany: Germany has 900 programs in English, and is eager to attract foreign students to tuition-free universities due to the country's shortage of skilled workers.

3. Finland: Finland doesn't have tuition fees but the government does warn foreigners that they have to cover living expenses. Imagine going to college and only worrying about room and board.

4. France: France does charge tuition – but normally around 200 dollars at public universities. A far cry from what you'd pay in the United States, even in a state school.

5. Norway: Norwegian students, including foreigners studying in the country, do not have to pay any college tuition. Be forewarned, however, of the harsh winters and high cost of living.

6. Slovenia: If Eastern Europe is more your thing, Noack notes that Slovenia has 150 English-language programs, and only charges a registration fee – no tuition.

7. Sweden: Sweden, a country which has so successfully solved so many of its social problems that there are now U.S. Sitcoms about the glories of moving there, has over 300 English-language programs. Although college there is free, cost of living may be pricey for foreigners.

MattSh

(3,714 posts)By Thomas C. Frohlich | 24/7 Wall St. – Fri, 12 Sep, 2014 1:52 AM EDT

According to data recently released by the Organization for Co-operation and Development (OECD), more than half of Russian adults held tertiary degrees in 2012 -- the equivalent of college degree in the United States -- more than in any other country reviewed. Meanwhile, less than 4% of Chinese adults had tertiary qualifications in 2012, less than in any other country. 24/7 Wall St. reviewed the 10 countries with the highest proportion of adults holding a college degree.

The most educated populations tend to be in countries where tertiary education spending is among the highest. Tertiary education spending in six of the most educated countries was higher than the OECD average of $13,957. Spending on tertiary education in the U.S., for example, was $26,021 per student, by far the most in the world.

Despite the value of investing in education, there are exceptions. Korea and the Russian Federation both spent less than $10,000 on tertiary education per student in 2011, considerably lower than the OECD average. Yet, they still have among the most educated populations.

Qualifications do not always translate into stronger skills. While only 1 in 4 of U.S. college graduates reach the top-end of literacy skill, more than 35% reach that level in Finland, Japan, and the Netherlands. As Schleicher explained, “We typically describe people by their formal qualifications, but this data suggests that the skill value of formal qualifications vary considerably across countries.”

Complete story at - https://ca.finance.yahoo.com/news/most-educated-countries-world-135700294.html

They certainly picked some strange photos to illustrate this story...

10) Ireland

9) New Zealand

8) UK

7) Australia

6) Korea (South, of course)

5) USA

4) Israel

3) Japan

2) Canada

1) Russia

Crewleader

(17,005 posts)

MattSh

(3,714 posts)Kool-Aid. Every hear of drinking the Kool-Aid?

![]()

Demeter

(85,373 posts)Good morning, Matt. It's a cold one, out there. Won't be long before we are blanketed in snow at this rate...a little early, but not unprecedented.

MattSh

(3,714 posts)Anti-Russian sanctions have backfired on the Old World’s tourist industry.

Far fewer Russians go to Europe on holiday these days. On some destinations, tourist flow has slumped between 20% and 50% against 2013. Experts see two reasons for this: reluctance to put up with outbreaks of Russophobic sentiment and the ruble’s slump against the euro.

Europeans are ringing the alarm. Dwindling tourist flows from Russia is a heavy blow to Western economies because Russians have firmly held the leading place in the EU’s tourist industry for the past few years.

In 2014, anti-Russian sanctions by the EU prompted Russian holiday-makers to set their eyes on Turkey and Egypt while Europe suffered a “catastrophic setback,” says spokeswoman for the Russian Tourist Industry Union Irina Tyurina. In a bid to lure back Russian vacationers, European tour operators have had to resort to unprecedented dumping offers.

According to the European Tour Operators Association (ETOA), Britain’s tour industry will lose about £50 million (about $50 million) in 2014. Finland, which last year was in the top 10 countries most popular with Russian tourists, this year has slumped to the 13th place.

Complete story at - http://russia-insider.com/en/politics_business_society/2014/10/24/04-54-07pm/more_sanctions_backfire_european_tourism_bruised

MattSh

(3,714 posts)September and October are favored months for major market collapses, but the markets pulled through (though it did get a bit scary at times). But hey, there's always room for new traditions to be created. Maybe November will be the new October?

![]()

Demeter

(85,373 posts)they don't want the herd to stampede. but seriously, what is the point of it all? Keeping paper assets from realizing their true worth?

I have no idea when it will all collapse...but I'm sure the Saudi oil play ticked off a lot of people.

According to one opinion I've read, it was the Saudis cheapening oil that collapsed the USSR, when the bills couldn't be paid any more. And this is their second attempt at it.

I think, however, that it won't work this time. Two reasons:

1. Russians can and do learn from experience, unlike the US government, which is unteachable. The US government always learns the wrong way to do something, and sticks to it like revealed dogma...

2. So Russia went and found new customers: China, India, and the like, who might even pay in gold, and so avoid (and sink) the petro-dollar trap, but certainly the yuan can become the new reserve currency.

At this point, anything that destroys and removes the 1% Idiocracy is fine with me. It no longer matters if we are reduced to peasants by our government, or by outside forces. What matters is revolution.

DemReadingDU

(16,000 posts)I think the 1% were warned by Greenspan on Wednesday that the bubble is getting ready to burst, in effect, to cash out of the markets. If the wealthy have all the money, what do they care if we peasants suffer. Well, not until the peasants revolt, but that likely won't happen for a long time.

"Asked whether he regrets not doing more with Fed policy to stop the financial-market bubbles that preceded the crisis, Mr. Greenspan said “no.” He observed that history shows central banks can only prick bubbles at great economic cost. “It’s only by bringing the economy down can you burst the bubble,” and that was a step he wasn’t willing to take while helming the Fed … "

http://www.democraticunderground.com/?com=view_post&forum=1116&pid=60186

MattSh

(3,714 posts)The Saudi oil war against Russia, Iran and the US — Pepe Escobar

Saudi Arabia has unleashed an economic war against selected oil producers. The strategy masks the House of Saud’s real agenda. But will it work?

Rosneft Vice President Mikhail Leontyev; “Prices can be manipulative…Saudi Arabia has begun making big discounts on oil. This is political manipulation, and Saudi Arabia is being manipulated, which could end badly.”

A correction is in order; the Saudis are not being manipulated. What the House of Saud is launching is “Tomahawks of spin,” insisting they’re OK with oil at $90 a barrel; also at $80 for the next two years; and even at $50 to $60 for Asian and North American clients.

The fact is Brent crude had already fallen to below $90 a barrel because China – and Asia as a whole – was already slowing down economically, although to a lesser degree compared to the West. Production, though, remained high – especially by Saudi Arabia and Kuwait - even with very little Libyan and Syrian oil on the market and with Iran forced to cut exports by a million barrels a day because of the US economic war, a.k.a. sanctions.

The House of Saud is applying a highly predatory pricing strategy, which boils down to reducing market share of its competitors, in the middle- to long-term. At least in theory, this could make life miserable for a lot of players – from the US (energy development, fracking and deepwater drilling become unprofitable) to producers of heavy, sour crude such as Iran and Venezuela. Yet the key target, make no mistake, is Russia.

A strategy that simultaneously hurts Iran, Iraq, Venezuela, Ecuador and Russia cannot escape the temptation of being regarded as an “Empire of Chaos” power play, as in Washington cutting a deal with Riyadh. A deal would imply bombing ISIS/ISIL/Daesh leader Caliph Ibrahim is just a prelude to bombing Bashar al-Assad’s forces; in exchange, the Saudis squeeze oil prices to hurt the enemies of the “Empire of Chaos.”

Yet it’s way more complicated than that.

Complete story at - http://rt.com/op-edge/196148-saudiarabia-oil-russia-economic-confrontation/

Demeter

(85,373 posts)German Chancellor Angela Merkel told Russian President Vladimir Putin on the phone that Sunday's planned elections in eastern Ukraine were illegitimate and would not be recognized by European leaders, a Berlin government spokesman said on Friday. Merkel and Putin held a joint telephone conversation with French President Francois Hollande and Ukrainian President Petro Poroshenko, Merkel's spokesman Georg Streiter said at a government news conference. He said in the call there were diverging opinions on Sunday's "so-called elections" in the self-proclaimed people's republics of Donetsk and Luhansk.

"Merkel and Hollande underlined that there can only be a ballot in line with Ukrainian law," he said, adding that the vote would violate an agreement endorsed by Russia and further complicate efforts to end the crisis in eastern Ukraine.

"The German government will not recognize these illegitimate elections," Merkel's spokesman said. European leaders were united on this issue and had agreed on this at a summit last week in Brussels.

...A 12-point protocol, issued after talks in early September in the Belarussian capital of Minsk involving Russia, Ukraine, the Organisation for Security and Cooperation in Europe and separatist leaders, foresees the holding of "early local elections" in the east in accordance with Ukrainian legislation. The Ukrainian leadership sees this as part of efforts to de-centralize power in the east to give people there greater say in running their own affairs - a strategy aimed at blunting calls for autonomy. It wants to hold these elections in December.

U.S. CAUTIONS RUSSIA OVER TROOPS

In Washington, a spokeswoman for the White House National Security Council said the United States would not recognize any results from the vote.

"We also caution Russia against using any such illegitimate vote as a pretext to insert additional troops and military equipment into Ukraine, particularly in light of recent indications that the Russian military is moving forces back to the border along separatist-controlled areas of eastern Ukraine," spokeswoman Bernadette Meehan added in a statement.

Sunday's separatist poll is aimed at electing leaders and a parliament in a self-proclaimed autonomous republic. Though Russian Foreign Minister Sergei Lavrov said last Tuesday that Moscow would recognize the results of the rebel vote, the Kremlin made no mention of the ballot in its account of the four-way phone-in on Friday.

"The Russian side speaks out in favor of establishing a sustainable dialogue between the central Ukrainian authorities and the representatives of the Donetsk and Luhansk regions which, beyond any doubt, would contribute to an overall stabilization of the situation," it said in a statement.

Poroshenko on his website said that he, Merkel and Hollande had expressed a "clear, general position" not to recognize Sunday's election and had "called on Russia also not to recognize these elections".

Speaking to a group of Western journalists on Friday, Ukrainian Foreign Minister Pavlo Klimkin denounced "totally fake, unlawful elections with people trying to elect so-called presidents of Donetsk and Luhansk and a so-called parliament."

"Russia must discourage the terrorists from carrying out these elections … it will be yet another step towards a ‘frozen conflict’ which is what we have to prevent there," he said.

He said Kiev was committed to elections of local officials in the east with which a plan for de-centralization could be worked out. "But they should be clear local elections according to Ukrainian legislation," Klimkin said.

Demeter

(85,373 posts)Natural gas exploration company Marion Energy Inc., based in McKinney, Texas, sought bankruptcy protection to prevent the appointment of a receiver and a forced liquidation. The company blamed its financial woes on heavy snowfall and severe winter cold, as well as equipment problems and unexpected delays. It listed assets and debt of more than $100 million each in Chapter 11 documents filed today in U.S. Bankruptcy Court in Salt Lake City.

Marion began negotiating a forbearance agreement with creditor Castlelake LP to gain time to obtain new financing. The forbearance period agreed to by the investment fund runs through today, according to court papers. Castlelake has refused to grant further forbearance, according to court papers.

“Marion filed this Chapter 11 case to prevent Castlelake from appointing a receiver and forcing an uneconomic liquidation of Marion’s assets using a 60-day sale process,” Jeffrey Clarke, a director, said in court papers.

The company needs time to complete a refinancing with a new lender to “preserve its going-concern value,” Clarke said. Marion owes $34.4 million under the credit agreement with Castlelake. Additionally, the lender alleges that it is owed about $17.6 million as a “make-whole” premium in the event the loan is paid early, Clarke said.

Marion’s primary assets are Clear Creek Field, a producing gas field located in Utah’s Uinta Basin, and Helper Field, a currently unproductive field located near Helper, Utah.

WELL, PRICES ARE DEPRESSED, BUT WINTER HAS BEGUN FOR SURE....CAN THEY MAKE IT UP ON VOLUME?

Demeter

(85,373 posts)If your Internet service goes down and you call a technician, can you be certain that the person who arrives at your door is actually there to restore service? What if he is a law enforcement agent in disguise who has disabled the service so he can enter your home to look around for evidence of a crime? Americans should not have to worry about scenarios like this, but F.B.I. agents used this ruse during a gambling investigation in Las Vegas in July. Most disturbing of all, the Justice Department is now defending the agents’ actions in court.

During the 2014 World Cup, the agents suspected that an illegal gambling ring was operating out of several hotel rooms at Caesar’s Palace in Las Vegas, but they apparently did not have enough evidence to get a court-issued warrant. So they enlisted the hotel’s assistance in shutting off the Internet to those rooms, prompting the rooms’ occupants to call for help. Undercover agents disguised as repairmen appeared at the door, and the occupants let them in. While pretending to fix the service, the agents saw men watching soccer matches and looking at betting odds on their computers.

There is nothing illegal about visiting sports-betting websites, but the agents relied primarily on that evidence to get their search warrant. What they failed to tell the judge was that they had turned off the Internet service themselves. Of course, law enforcement authorities regularly rely on sting operations and other deceptive tactics, and courts usually allow them if the authorities reasonably believe they will find evidence of a crime. Without that suspicion, the Constitution prohibits warrantless searches of peoples’ residences, including hotel rooms. The authorities can jump that hurdle if a home’s occupant consents to let them enter, as when an undercover officer is invited into a home to buy drugs.

The Las Vegas case fails on both counts, according to a lawyer for the defendants. Although one of the defendants in the case, Wei Seng Phua, a Malaysian citizen, had been arrested in Macau earlier this year for running an illegal sports-gambling business, the agents did not have probable cause to believe anything illegal was happening in two of the rooms they searched. And a federal prosecutor had initially warned the agents not to use trickery because of the “consent issue.” In fact, a previous ruse by the agents had failed when a person in one of the rooms refused to let them in.

............................................................................

In a separate case out of Seattle, F.B.I. agents pretended to be journalists in a 2007 investigation of high school bomb threats, according to documents recently uncovered by the Electronic Frontier Foundation. Agents there concocted a fake online news article by The Associated Press about the threats. They sent a link to the Myspace page of a student they suspected of making the threats, and when he opened the link, it downloaded malware that enabled the agents to track him down and arrest him. The A.P. is rightly outraged and has protested the F.B.I.’s misappropriation of its name as undermining “the most fundamental component of a free press — its independence.”

The F.B.I. has a history of pushing the limits that protect Americans’ civil liberties. And it has continued to broaden agents’ investigative powers in troubling ways. The deceptive tactics used in Las Vegas and Seattle, if not prohibited by the agency or blocked by courts, risk opening the door to constitutional abuses on a much wider scale.

Demeter

(85,373 posts)Dow weekly gain best in nearly two years

https://secure.marketwatch.com/story/us-stocks-futures-point-to-wall-street-rally-after-boj-surprise-2014-10-31

The U.S. stock market rallied on Friday, sending the S&P 500 and Dow Jones Industrial Average into record territory, after a surprise stimulus plan from the Bank of Japan was announced.

Some analysts noted that the recovery from the recent pullback, which sent the S&P 500 down nearly 8% early this month, was the second fastest recovery since 2010. The main benchmarks finished the week and the month higher.

The measures announced by Japan appeared to encourage investors, who have been looking for regions like Europe and Asia to take further steps toward boosting flagging growth, as the Federal Reserve wraps its own stimulus program...

Demeter

(85,373 posts)LET'S SEE: FEAR, GREED, AND FUNNY MONEY FROM QE4EVER....

https://secure.marketwatch.com/story/the-3-things-that-make-the-stock-market-tick-2014-10-31

What is the secret of the stock market? How come it goes up and up and up — and then, sometimes, goes down and down and down? It’s a simple question, but one — as a result — that gets asked so rarely. And it gets asked very rarely indeed at times when the stock market is booming and no one wants to ask any awkward questions at all... like now....Some people, who subscribe to a cult known as Modern Portfolio Theory, think it’s magic. The market goes up “10% a year on average,” or “6% a year above inflation,” they say. No reason. It just does. These folks view the stock market with a charming, naive, unquestioning awe. Others point to the role of dividends. Others seem to think it’s a symbol of national pride, like the U.S. Olympics squad. Still others mutter darkly about conspiracies, the Federal Reserve, and “the Goldman Sachs.” Maybe they all have a point. But economics professors Daniel Greenwald and Sydney Ludvigson from New York University, and Martin Lattau from U.C. Berkeley, offer a different perspective.

After studying the movements of the stock market going back to 1952 they found that nearly all of it can be explained empirically — in other words, by observation, not merely by theory — by three uncorrelated factors....And together they explain the great mysteries and secrets of the stock market:

That’s it. Changes in these three factors explain 85% of the stock market’s movements over the past 70 or so years — the modern era. That’s quite something. But where this really gets interesting is where they look at the past 35 years. In the early 1980s Wall Street began a boom which, arguably, hasn’t ended yet. Many investors have come to believe that this is the normal order of things and that it will continue indefinitely. The standard rationale on Wall Street is that this has been caused by rising productivity...Not so, respond the professors. The trend in productivity has actually been going backwards. And indeed this is one of the disturbing, under-reported facts about the U.S. economy. Government data show that “real,” inflation-adjusted gross domestic product has been growing more slowly than we usually admit. In the 2000s it rose by 1.6% a year — half the rate of the 1950s, ‘70s or ‘80s, and more like one-third the rate of the 1940s and 1960s.

The real driver of the stock market boom? Lost ground by workers. The share of the economy going into the pockets of workers has been declining for decades, and especially since the early 1980s. Profits as a share of GDP are now near record levels. Great for investors, of course. Companies pay out dividends, buy back stock, or spend the money taking over disruptive startups in Silicon Valley. The professors argue that this one factor accounts for most of the stock market’s real gains for the past 35 years. For investors this offers a double-edged sword. On the one hand, maybe it means we should all buy more stocks, even at today’s elevated levels, because the stock market basically hedges against declining wages. On the other hand, it suggests that the stock market boom, which has taken the Dow Jones above 17,000 and the S&P 500 above 2,000, may be built upon sand. If labor can lose ground, it can, presumably, claim it back in due course.

The professors calculate that simple fear or risk aversion accounts for 75% of the short-term variations of the stock market. That’s it. In other words, in the short term it’s all about emotion. (Warren Buffett likes to say much the same thing, and he has the billions to suggest he knows what he’s talking about.) To put the idea another way: Buy when people are fearful, and sell when people are cheerful. Maybe it isn’t magic after all.

Demeter

(85,373 posts)Yves here. There’s one thing to add to Richter’s useful recap of what the supposedly sparkling 3Q GDP results mean for those of us who live in the real economy. The GDP deflator fell from 2.1% in the second quarter to 1.3% this quarter, so some of the rosiness of the results was due to the swing in the deflator.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

For individual Americans, economic “growth” means the opposite.

That the economy grew at a “faster than expected” annual rate of 3.5% in the third quarter has been touted as a sign that now – finally, after years of false promises – it is reaching that ever elusive “escape velocity.” But instantly, people with keen eyes began to quibble with it.

One big factor was military spending, which spiked 16%, the fasted since Q2 2009. This rate is based on the increase from the second quarter that is then annualized, assuming that spending wound continue at this rate for a year. This type of quarter-to-quarter annualized rate is volatile. For example, it plunged 20% in Q4 2012, jumped 17% in Q2 2009, and 18% in Q3 2008. Spikes and plunges often run in sequence (chart).

In reality…. According to data from the US Treasury, the Department of Defense spent $149 billion in Q3, which was actually down a smidgen from the $150 billion it spent in Q3 2013. This lets out a lot of hot air. That spike was likely a fluke, much like other spikes and plunges before it, and much of it may well be undone in Q4.

The other two big factors in that “faster than expected” growth of GDP were inventories, which ballooned and will eventually have to be whittled back down, and exports.

The surges in these three categories caused JPMorgan to cut its Q4 GDP growth forecast to 2.5% from 3.0%. “All three of these categories tend to be associated with payback the following quarter,” explained chief US economist Michael Feroli. And the crux of the economy, the consumer? “Still plodding along in a steady, but unspectacular, manner….”

Whether or not that annualized quarterly rate of 3.5% was a mirage – year over year, the economy grew by just 2.3%.

A growth rate barely above 2% is exactly where the US economy has been for the last five years! Nothing has changed. For a recovery by US standards, it’s a very crummy growth rate, and far from the escape velocity that Wall Street hype artists have predicted for years in their justification for the ceaselessly skyrocketing stock market.

But it gets worse. The population in the US has been growing too. And the economic pie has to be divvied up among more people. So the pie has to grow faster than the population or else, on an individual basis, that growing overall economy, gets cut into smaller slices of the pie.

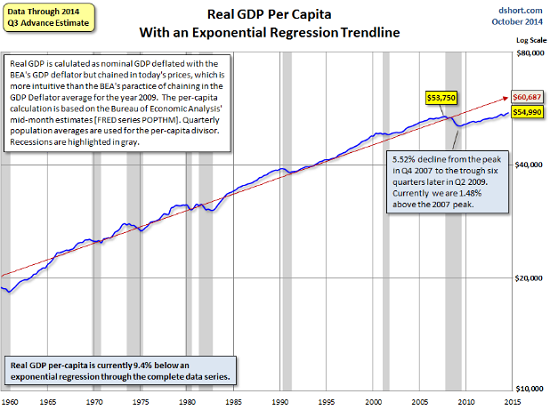

GDP adjusted for inflation as well as population growth produces real per-capita GDP. It is the sort of economic growth that people actually experience. Doug Short at Advisor Perspectives has been tracking this measure for years (here is his update and methodology). And it paints a gloomier picture.

Before the financial crisis, real per-capita GDP peaked in Q4 2007. Then it fell 5.5% to bottom out in Q2 2009. Since then, it has been working its way back up. In 2013, it surpassed its pre-crisis peak. Now, it is up a measly 2.3% from where it was nearly seven years ago! And it remains far below the long-term trend (red line):

On this per-capita basis, the economy grew only 1.7% from Q3 last year. That’s less than half the annualized quarterly rate that has been bandied about all day.

It doesn’t even include the fact that the fruits of this economy have been very unequally distributed over those seven years, with the gains concentrated at the very tippy-top of the heap of humanity that makes up America. For the rest, this economy has been a tough slog.

And then, of course, it gets even worse.

The deflator used in the GDP calculations to come up with an inflation-adjusted growth rate is the Personal Consumption Expenditure (PCE) index. But the PCE index is usually lower than the already dubious CPI. The only time since the financial crisis when PCE was higher than CPI was in 2010. In the latest reading, core PCE (without food and energy) was 1.47%, while core CPI came in at 1.73%. Same inflation, different numbers.

The difference each month may not be huge, but it’s cumulative, and over the years, it adds up. This chart by Doug Short (here is his latest update) shows the diverging paths of PCE (blue line) and CPI (red line) – and the game that those who’re using PCE are playing with us:

Since PCE is used to adjust GDP for inflation, “real” economic growth has been systematically overstated by understating inflation. If GDP had been deflated over the years with CPI, instead of PCE, that measly 2.3% growth of per-capita GDP since 2007, as crummy as it may appear, would likely be negative. And that explains why so many people – struggling with soaring rents, medical expenses, college costs, etc. – find that their slice of the economic pie has been shrinking since the financial crisis.

And this is the economy that has been stimulated since 2008 by the Fed’s relentless zero-interest-rate policy and $3.5 trillion in QE, on top of an additional $8.8 trillion in federal government debt. More “stimulus” can hardly be imagined. It makes otherwise sane people walk off in an uncertain direction, muttering to themselves and shaking their heads uncontrollably.

So, right in line, the essential ingredient in a thriving housing market is skidding inexorably in America. Read… The American Dream Going Bust – in One Chart

Demeter

(85,373 posts)- A handful of toss-up U.S. Senate races next week could hold the key to whether the stock market glides through the year-end in a typical post-midterm election rally or gets hit with a fresh bout of volatility. U.S. investors appear less concerned with whether Republicans take control of the Senate, as expected, or Democrats hang on to their majority by a slim margin. They just want to know - come Wednesday morning - the actual outcome.

"If we have a really uncertain situation, where the Senate is divided and candidates are threatening recounts, that's really not good," said Robbert van Batenburg, director of market strategy at Newedge USA LLC in New York.

In two southern matchups - Louisiana and Georgia - polls show the races are too tight to call, raising the potential for run-off elections that could delay for weeks knowing who will control Congress' upper chamber. Louisiana's run-off election is scheduled for Dec. 6. In the market's worst-case scenario, the majority party may not be known until after Jan. 6, when Georgia will hold its run-off election if no Senate candidate wins at least 50 percent of the vote on Nov. 4.

Such an outcome, while considered unlikely, nevertheless rekindles uncomfortable memories for some of the 2000 presidential election, when George W. Bush's victory over Al Gore was not confirmed for more than a month after Election Day. That uncertainty contributed to a spike of almost 11.2 percent in the CBOE Volatility index (.VIX) and a 7.6 percent drop in the S&P 500 (.SPX) from Election Day through the Electoral College vote in late December that certified the outcome...

AH, YES, THERE'S ALWAYS THE FLORIDA PLAN FOR BACK-UP...STEAL IT IN THE COUNTING.

Demeter

(85,373 posts)

Wasn't there a diatribe about "Amusing Ourselves to Death"?

Amusing Ourselves to Death: Public Discourse in the Age of Show Business (1985) is a book by educator Neil Postman. The book's origins lay in a talk Postman gave to the Frankfurt Book Fair in 1984. He was participating in a panel on George Orwell's Nineteen Eighty-Four and the contemporary world. In the introduction to his book, Postman said that the contemporary world was better reflected by Aldous Huxley's Brave New World, whose public was oppressed by their addiction to amusement, than by Orwell's work, where they were oppressed by state control.

It has been translated into eight languages and sold some 200,000 copies worldwide. In 2005, Postman's son Andrew reissued the book in a 20th anniversary edition. It is regarded as one of the most important texts of media ecology.

Postman distinguishes the Orwellian vision of the future, in which totalitarian governments seize individual rights, from that offered by Aldous Huxley in Brave New World, where people medicate themselves into bliss, thereby voluntarily sacrificing their rights. Drawing an analogy with the latter scenario, Postman sees television's entertainment value as a present-day "soma", by means of which the citizens' rights are exchanged for consumers' entertainment.

The essential premise of the book, which Postman extends to the rest of his argument(s), is that "form excludes the content," that is, a particular medium can only sustain a particular level of ideas. Thus Rational argument, integral to print typography, is militated against by the medium of television for the aforesaid reason. Owing to this shortcoming, politics and religion are diluted, and "news of the day" becomes a packaged commodity. Television de-emphasises the quality of information in favour of satisfying the far-reaching needs of entertainment, by which information is encumbered and to which it is subordinate.

Postman asserts the presentation of television news is a form of entertainment programming; arguing inclusion of theme music, the interruption of commercials, and "talking hairdos" bear witness that televised news cannot readily be taken seriously. Postman further examines the differences between written speech, which he argues reached its prime in the early to mid-nineteenth century, and the forms of televisual communication, which rely mostly on visual images to "sell" lifestyles. He argues that, owing to this change in public discourse, politics has ceased to be about a candidate's ideas and solutions, but whether he comes across favorably on television. Television, he notes, has introduced the phrase "now this", which implies a complete absence of connection between the separate topics the phrase ostensibly connects. Larry Gonick used this phrase to conclude his Cartoon Guide to (Non)Communication, instead of the traditional "the end".

Postman refers to the inability to act upon much of the so-called information from televised sources as the Information-action ratio.

Drawing on the ideas of media scholar Marshall McLuhan — altering McLuhan's aphorism "the medium is the message", to "the medium is the metaphor" — he describes how oral, literate, and televisual cultures radically differ in the processing and prioritization of information; he argues that each medium is appropriate for a different kind of knowledge. The faculties requisite for rational inquiry are simply weakened by televised viewing. Accordingly, reading, a prime example cited by Postman, exacts intense intellectual involvement, at once interactive and dialectical; whereas television only requires passive involvement. Moreover, as television is programmed according to ratings, its content is determined by commercial feasibility, not critical acumen. Television in its present state, he says, does not satisfy the conditions for honest intellectual involvement and rational argument.

He also repeatedly states that the eighteenth century, being the Age of Reason, was the pinnacle for rational argument. Only in the printed word, he states, could complicated truths be rationally conveyed. Postman gives a striking example: The first fifteen U.S. presidents could probably have walked down the street without being recognized by the average citizen, yet all these men would have been quickly known by their written words. However, the reverse is true today. The names of presidents or even famous preachers, lawyers, and scientists call up visual images, typically television images, but few, if any, of their words come to mind. The few that do almost exclusively consist of carefully chosen soundbites....

https://en.wikipedia.org/wiki/Amusing_Ourselves_to_Death

READ IT HERE: PDF FILE (THERE ARE SEVERAL ON THE INTERNET)

https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=2&cad=rja&uact=8&ved=0CCYQFjAB&url=https%3A%2F%2Flibcom.org%2Ffiles%2FNeil%2520Postman%2520-%2520Amusing%2520Ourselves%2520to%2520Death.pdf&ei=odFUVPDqIJKtyATil4KQCQ&usg=AFQjCNFtmncWmSLVBWbjmrhMHw3bs0JwoQ&bvm=bv.78677474,d.aWw

Demeter

(85,373 posts)" Aldous Huxley's Brave New World, whose public was oppressed by their addiction to amusement, than by Orwell's work, where they were oppressed by state control. "

CENTURIONS AND CIRCUSES! JUST NO BREAD....WHICH MAY BE THE ONLY THING THAT ENDS THIS TRAP...

xchrom

(108,903 posts)China's manufacturing PMI missed expectations, coming in at 50.8 rather than 51.1.

This is also down from September's read of 51.2.

Remember that any number lower than 50 in this metric suggests a contracting economy.

So this is bad.

What people watching the China slow down have been hoping for is some consistancy here.

In August PMI got walloped along with a whole host of other economic indicators. That was a warning to the government that China's economic landing was getting rough, and so they responded with some capital injections — nothing major — to keep cash moving through the economy as demand slowed.

In September, numbers came in a little rosier. There was a bit of a sigh of relief.

Read more: http://www.businessinsider.com/china-misses-october-pmi-2014-10#ixzz3HosP2TDs

Demeter

(85,373 posts)This is no way to Enlightenment. Any official number should be wholly disregarded, especially when it paints an unbelievably rosy picture that doesn't match the reality.

Demeter

(85,373 posts)WHAT REALLY HAPPENED TO MATT TAIBBI WHEN HE JOINED THE BRAVE NEW WORLD?

YVES DISHES THE DIRT! AND IT IS DIRTY DIRT...CUBIC YARDS OF DIRT

http://www.nakedcapitalism.com/2014/10/slugfest-taibbi-exodus-first-look-fails-address-editorial-meddling-doubts.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

GO READ FOR AN INSIDE LOOK ON THE FACE OF INTERNET JOURNALISM AND OLD-FASHIONED MEGALOMANIA

MattSh

(3,714 posts)And it seems he's still up to something here...

Omidyar-funded candidate takes seat in new Ukraine parliament | PandoDaily

Ukraine just held its first post-revolution parliamentary elections, and amid all of the oligarchs, EU enthusiasts, neo-Nazis, nepotism babies, and death squad commanders, there is one newly-elected parliamentarian’s name that stands out for her connection to Silicon Valley: Svitlana Zalishchuk, from the billionaire president’s Poroshenko Bloc party.

Zalishchuk was given a choice spot on the president’s party list, at number 18, ensuring her a seat in the new Rada. And she owes her rise to power to another oligarch besides Ukraine’s president — Pierre Omidyar, whose funding with USAID helped topple the previous government. Zalishchuk’s pro-Maidan revolution outfits were directly funded by Omidyar.

Earlier this year, Pando exposed how eBay billionaire and Intercept publisher Pierre Omidyar co-funded with USAID Zalishchuk’s web of nongovernmental organizations — New Citizen, Chesno, Center UA. According to the Financial Times, New Citizen, which received hundreds of thousands of dollars from Omidyar, “played a big role in getting the [Maidan] protest up and running” in November 2013. Omidyar Network’s website features Zalishchuk’s photograph on its page describing its investment in New Citizen. Zalishchuk was brought into the NGOs by her longtime mentor, Oleh Rybachuk, a former deputy prime minster who led the last failed effort to integrate Ukraine into the EU and NATO.

Zalishchuk’s photos also grace the Poroshenko Bloc’s website and twitter feed, as she emerged as one of the presidential party’s leading spokespersons. The Poroshenko Bloc is named after Ukraine’s pro-Western president, Petro Poroshenko, a billionaire with a lock on Ukraine’s confectionary industry, as well as owning a national TV station and other prized assets. He came to power this year thanks to the revolution originally organized by Zalishchuk’s Omidyar-funded NGOs, and has rewarded her with a seat in the Rada.

The president’s party tasked Zalushchik with publicly selling the highly controversial new “lustration law” — essentially a legalized witch-hunt law first proposed by the neo-fascist Svoboda Party earlier this year, and subsequently denounced by Ukraine’s prosecutor general and by Human Rights Watch, which described a draft of the law as “arbitrary and overly broad and fail(s) to respect human rights principles,” warning it “may set the stage for unlawful mass arbitrary political exclusion.”

Complete story at - http://pando.com/2014/10/30/omidyar-funded-candidate-takes-seat-in-new-ukraine-parliament/

Demeter

(85,373 posts)Such behavior went out with William Randolph Hearst.

Now THERE'S a topic for the future!!

xchrom

(108,903 posts)After a whipsaw summer that included the close of a decade-long lawsuit, a technical default, the most dramatic of political theatrics, and a contempt ruling from a US court — things have been relatively silent out of Argentina.

But some rumblings out of Wall Street indicate that there could be a change afoot. One word — "acceleration" — threatens to force an end to the stalemate between Buenos Aires and its creditors that has been in place since the country went into default this summer.

Acceleration is the nuclear option. It is the ultimate expression of the collective belief that Argentina will not pay bondholders. With acceleration, all bondholders call in their entire debt immediately. In its fullest expression, that amount in the tens of billions of dollars — far greater than what Argentina, with only $28 billion in its central bank reserves, can pay.

The country went into default this summer for refusing to pay a group of holdout bondholders led by Paul Singer of Elliott Management. For years the holdouts insisted on being paid 100 cents on the dollar for Argentine bonds dating back to the country's 2001 default. They argued that all bondholders, regardless of whether they had accepted a haircut on their debt, should be paid equally. That argument won, but Argentina did not care.

Read more: http://www.businessinsider.com/new-threat-to-argentina-is-acceleration-2014-10#ixzz3HoxrtZDR

MattSh

(3,714 posts)So I'm wondering if this 'acceleration' process might put Argentina on a fast track to BRICS membership, or at least as an associate member.

Not necessarily because they're up there with the big 5 yet, but because they're either up and coming, BRICS wants more allies, or just to spite Uncle Sam.

Indonesia and Turkey have been mentioned as candidates for full membership of the BRICS, while Egypt, Argentina, Iran, Nigeria, Syria and most recently Bangladesh have expressed interest in joining BRICS.

Demeter

(85,373 posts)I have tried, in my capacity as liaison for the social committee, to set up various social events in the condo community: a candidate meet-and-greet, a "social" community-generated newsletter where people can put their birthday greetings, classified ads, poetry, etc., and the Board (which is ONLY in charge of the community's finances and legal issues) has shot those both down.

I intend to ask the fascists if they would like to take over the social committee, rename it "The Anti-Social Committee" and never meet, since the answer is always NO.

IMO, the BRICS as the anti-West, anti-US/UK, is just what the social forces for good needed. Argentina could do a lot worse. The parasitism of the USA 1% Elite must stop.

Demeter

(85,373 posts)Yves here. This discussion with Michael Hudson on RT focuses on the real meaning of the Ukraine-Russia gas deal. One point that Hudson makes that readers might doubt is that Russia loves the US sanctions. I’m not sure “love” is the right word, but there is reason to think they aren’t working out as the US had hoped. First, they’ve greatly increased Putin’s popularity. Even the intelligentsia in Moscow, who were hostile to him, have largely rallied to his side in the face of foreign bullying. Second, the Western press may be overstating the amount of damage done to the economy by the sanctions. Arguably the biggest negative is the fall in the price of oil, which came about growth in Europe and China slowing, and the Saudis announcing that they’d allow the price to reset at a much lower level than most analysts anticipated. But the ruble has been falling, which blunts that effect, but increases the drain on FX reserves as Russia tries to keep it falling too far and will increase inflation. Third, the sanctions have allowed Russia to engage in protection of domestic industries as a retaliatory measure, for instance, blocking many food imports from Europe.

Now all good well-indoctrinated neoliberals will say, “Trade protectionism merely allows domestic producers to become inefficient and uncompetitive.” It’s not so simple. Development economists are increasingly of the view that trade restrictions can help smaller economies develop domestic businesses to the point where they can compete in international markets, while if they foreign firms in, they’ll find it nearly impossible to build any local champions.

A colleague who does business in Russia but has no deep loyalties there, says he sees no signs of negative impact of the sanctions in Moscow (he describes it as now looking like any post World War II European capital). This is confirmed by recent surveys in Russia, so the lack of meaningful impact on Russian citizens isn’t an artifact of his seeing only the better parts of Moscow. Note that the latest EU forecasts anticipate very weak growth this year and next, as opposed to outright recession.

This visitor describes how the sanctions are helping Russian businesses. One of his friends has the Papa Johns franchise. They used to get their cheese from the Netherlands, but those supplies were cut off by the Russian sanctions against Europe. So they had to buy cheese domestically. It was cheaper but not as good. So he is working with the local farmers and cheese-makers to bring the cheese up to the standard of the cheese he used to import. So he expects to eventually have cheese that is lower cost than what he brought in and of comparable quality. And if he succeeded, the cheesemakers will be more competitive in Europe when the sanctions are relaxed.

The shorter version of this story is that Russia has a large enough domestic market and enough resources that unlike Iran, it may be closer to being able to function as an autarky when its imports and exports are restricted. The open question is whether it can go through the pain of a reset, with some serious and painful short-term dislocations, and escape the slow strangulation that the US claims it has imposed.

Now to the RT interview, with the transcript below.

RT: How important is this gas deal for Ukraine and for Europe?

Michael Hudson: It’s apparently most important for Europe because it was Europe that gave in on the deal. The problem was never about the price of the Russian gas. The problem was whether Ukraine was doing to keep up trying just to run up a larger and larger gas bill every month and every year and finally default. In the US Treasury, strategists have already discussed in public how Ukraine can simply avoid paying Russia the money that it owed by going to court and stalling it. So Russia understandably said, “We need credit in advance.” Mr. Oettinger of the European Commission said “Wait a minute, Russia, why don’t you just lend them the money. They will repay you.” And Mr. Putin at the Valdai Club speech in Sochi last week made it very clear. Look, [Russia] has already lent them 11 billion dollars, much more than anyone else has lent to Ukraine. Ukraine is bankrupt, it’s torn itself apart. Why didn’t perhaps a European Bank underwrite the loan? Finally, Mr. Oettinger gave in. Europe said “OK, the IMF is going to lend Ukraine the money to pay Russia for the gas for the balance of the year.” So that Ukraine would end up owing the IMF money and the European Commission money, not Russia. So Russia will not be exposed to having to lend any more money to a dead-beat economy.

RT: You think that it was the EU who gave in on that deal and not Ukraine or Russia. Why?

MH: Ukraine has passed. Ukraine said “We are broken, we don’t have any money, we have spent all our money on war. Our export industry is collapsing. If we need gas, we’ll simply steal the gas that Russia is sending to Europe. We are not going to starve – we’ll just take your gas.” And Putin said, “Well, if they try to steal gas like they did a few years ago, we’ll just turn off the gas and Europe won’t get gas”. So Europe realized that it wouldn’t get the gas if it didn’t step behind Ukraine and all of a sudden Europe is having to pay for Ukraine’s war against Russia. Europe is having to pay for the whole mess in Ukraine so that it can get gas, and this is not how they expected it to turn out.

RT: Do you think this deal will improve relations between Europe and Russia?

MH: Europe is very uncomfortable with being pressured by the US that essentially said “Let’s you and Russia fight.” Europe is already suffering. Germany has always been turning towards Russia, all the way. 50 years ago, I remember Konrad Adenauer in Germany always spoke very pro-Western and pro-American, but always turned economically towards Russia. So of course Europe, and Germany especially, has wanted to maintain its ties with Russia. The problem is the US [wants] to start a new Cold War. It created a lot of resentment in Europe, and Europe is finally capitulating. This means that the US pressure to set Europe against Russia has failed.

RT: Could we expect now easing of sanctions on Russia?

MH: No, Europe is still being pressured, the sanctions are pressured by NATO, and NATO is pressing for a military confrontation with Russia. The sanctions are going to continue unless Russia gives back Crimea, which of course it won’t. The sanctions are hurting Europe, they are turning out to be a great benefit for Russia because finally Russia is realizing: “We can’t depend on other countries to supply our basic imports, we have to rebuild our industry.” And the sanctions are enabling Russia to give subsidies to its industry and agriculture that it couldn’t otherwise do. So Russia loves the sanctions, Europe is suffering and the Americans are finding that the Europeans are suddenly more angry at it than they are at Russia.

xchrom

(108,903 posts)STAMFORD, Conn. (AP) -- Gov. Dannel P. Malloy says financial services giant UBS has committed to remaining in Connecticut through 2021.

The Democrat announced Friday that UBS and the state have amended their partnership agreement. It provided UBS with a $20 million loan that was fully forgivable if the company maintained 2,000 jobs for five years. Under the amended arrangement, the same $20 million loan will be forgiven, but the percentage of forgiveness will be based on the number of jobs retained annually, through 2021.

Economic Development Commissioner Catherine Smith said if the number of jobs declines, a portion of the loan must be repaid. She called the new formula "a win-win proposition."

Malloy recently cast doubt that UBS, with offices in Stamford, would keep the 2,000 jobs through the end of 2016.

Demeter

(85,373 posts)nope....it was a Democrat--Malloy was his name...doubling down on a bad bet, governor?

xchrom

(108,903 posts)NEW YORK (AP) -- The sight is so surprising that Americans are sharing photos of it, along with all those cute Halloween costumes, sweeping vistas and special meals: The gas station sign, with a price of $2-something a gallon.

"It's stunning what's happening here," says Tom Kloza, chief oil analyst at the Oil Price Information Service. "I'm a little bit shocked."

The national average price of gasoline has fallen 33 cents in October, landing Friday at $3.00, according to AAA. Kloza said the average will fall under $3 by early Saturday morning for the first time in four years.

When the national average crossed above $3 a gallon in December of 2010, drivers weren't sure they'd ever see $2.99 again. Global demand for oil and gasoline was rising as people in developing countries bought cars by the tens of millions and turmoil was brewing in the oil-rich Middle East.

Now demand isn't rising as fast as expected, drillers have learned to tap vast new sources of oil, particularly in the U.S., and crude continues to flow out of the Middle East.

xchrom