Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 16 January 2015

[font size=3]STOCK MARKET WATCH, Friday, 16 January 2015[font color=black][/font]

SMW for 15 January 2015

AT THE CLOSING BELL ON 15 January 2015

[center][font color=red]

Dow Jones 17,320.71 -106.38 (-0.61%)

S&P 500 1,992.67 -18.60 (-0.92%)

Nasdaq 4,570.82 -68.50 (-1.48%)

[font color=green]10 Year 1.73% -0.11 (-5.98%)

30 Year 2.37% -0.10 (-4.05%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

http://tools.investing.com/market_quotes.php?

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I'll believe it when I see it.

They will do what Michigan GOP did, raise the tax, and spend it on anything but roads.

Demeter

(85,373 posts)Bruce Krasting: I wrote about the Swiss National Bank being forced to abandon its currency peg to the Euro on 12/3/14, 12/8/14 and 1/11/15. That said, I'm blown away that this has happened today...Thomas Jordan, the head of the SNB has repeatedly said that the Franc peg would last forever, and that he would be willing to intervene in "Unlimited Amounts" in support of the peg. Jordan has folded on his promise like a cheap suit in the rain. When push came to shove, Jordan failed to deliver. The Swiss economy will rapidly fall into recession as a result of the SNB move. The Swiss stock market has been blasted, the currency is now nearly 20% higher than it was a day before. Someone will have to fall on the sword, the arrows are pointing at Jordan.

The dust has not settled on this development as of this morning. I will stick my neck out and say that the failure to hold the minimum rate will result in a one time loss for the SNB of close to $100B. That's a huge amount of money. It comes to 20% of the Swiss GDP! If this type of loss were incurred by the US Fed it would result in a loss in excess of $2 Trillion! In the coming days and weeks there will be more fallout from the SNB disaster. There will be reports of big losses and gains from today's events. But that is a side show to the real story. We have just witnesses the collapse of a promise by a major central bank. The Fed, Bank of Japan, ECB, SNB and other Central Banks have repeatedly made the same promises over the past half decade:

I never believed in these promises, but the vast majority of those who are active in financial markets did. The entire world has signed onto the notion that Central Banks are all powerful. We now have evidence that they are not. Anyone who continues to believes in the All Powerful CB after today is a fool. Those who believed in Jordan's promises now have red ink on their hands - lots of it!

The next central bank that will come into the market's cross hairs is the ECB. Mario Draghi has made promises that he would "Do anything - in any amount". Like I said, you would be a fool to continue to believe in that promise as of this morning. We've just taken a huge leap into chaos. The linchpin of the capital markets has been the trust in the CBs. The market's anchors have now been tossed overboard.

COMMENTS ARE ALSO ILLUMINATING AND THOUGHT-PROVOKING:

A massive vote of no confidence for the Euro from the Swiss. They wouldn't do this unless they were worried that the Euro might have a lot further to fall.

so japan has effectively jumped ship with their jellowback yen and now the swiss divorcing the euro. who is next?

Not sure how this is a bad plan. Why hitch your wagon to a team of horses determined to run off of a cliff? If the Euro goes to zero which in my opinion it will sooner or later then how is in your interest to be pegged at 1.2 x zero?

Sure right now they are going to lose business because everyone within a few minutes of a border will drive across the line to buy their groceries and gas but in the future they will still drive over the border to buy stuff but they will be buying land and property for nothing.

The SNB did this because they have inside information.

The EU and/or euro will blow up soon.

Soon SNB will be called heroes.

Good thing they didn't go for that old-fashioned gold standard idea.

I have been stating that the CB has been defunct since March 10th, 2008 Bear Stearns New York time. I fully support Krasting's assertion wholeheartedly and without equivocation, Z/H. What I don't understand is why it took him so long given that we have all just witnessed 28 successive business quarters of contractions with no prospect of any change in the trend.

Well, while we crow about the SNB's losses and enjoy a little smack of reality for their stupid ventures in the race to the bottom, I remember something else that Bruce wrote about a few years ago: Swiss exports and employment at the expense of the youth employment throughout the EU.

It doesn't translate that youth employment throughout the EU will get a boost, but the other side of the argument - Swiss export industries - are surely going down the sewer and along with them their much touted employment stats. It's analogous to the curse of natural resources: Having them does not necessarily make your nation rich in a world controlled by fiat. A strong currency may be great for imports and savers but not so much for their exports and employment. They should just stick to what they do best: Keep other people's money safe. Although with this faux-pas, who will still want to go to them for advice?

Who else is going to dump the anchor and de-peg from the Euro and even the USD? I'm trembling with excitement.

The criminality of central banks is the cornerstone of One World Governance or the NWO. Nations need to restore their sovereignty by issuing their own currencies with no interest from their Treasury and through a National State bank. One world governance is a disaster for all humanity and the planet.

anyone who thinks the ECB is going to fold up is making the wrong bet. but don't confuse what you want to happen with what is really happening. its been a rocky start for the EURO but nothing to suggest anyone is going back to the old sovereign nation system of currency. remember the EURO had the benefit of providing uniform pricing among the trading partners, and any dissolution will probably be inflationary. the USCB has already included EU banks in its QE, the real issue is competing currencies, will RussiaChina form a joint currency. now i think i understand why the AMERO never got traction, it would be competing currency as well, and create conflicting tensions between EU and NA business partners.

The take away message for all of us is this: central banks will never reveal their plans in advance, the surprise will always be to the benefit of the government. I'm thinking when the dollar gets its big surprise it will happen like this too. The change will be instantaneous. One moment one world, the next moment a different set of conditions.

One moment, the ATMs work, the next, they do not.

Only the (shadow) Fed knows....

You are right that the Central Banks are falling like dominoes. Should we care? We are replacing their worn out paper currencies with aurum http://www.peakprosperity.com/podcast/84359/new-way-hold-gold from the Global Debt Facility.

bruce , you are a fool. the swiss bank coordinates every action behind the scenes with the ecb, the bis, the fed, the boe, and the most powerful banking families of the western empires. this was a calculated inside job BY the central banks to screw someone---you just don't want to accept the world and world financial history is a game of inside dealings by the bankers against the exporters/industrialists/politicians/media etc....., and in your ignorance, you seek to push a a narrative the denies basic reality. the bankers are in charge. the snb move demonstrates their power, not their weakness. they just surprised you and many other people, and you consider this "weakness"?

I don't think Bruce is a fool, but you are exactly right. This was planned and coordinated by all CBs. I suspect it is easier to confiscate wealth by "surprise" moves like this and NIRP, than through direct taxation.

Yes, it's their "crack suicide squad" in action. Reminds me of Blazing Saddles - "Stand back or the nigga gets it". Still amazed at how well it actually works.

I don't think Bruce is a fool, but I do agree that it is highly unlikely that this decision was made without all the other CBs input and approval.

"BY the central banks to screw someone"

Demeter

(85,373 posts)The entire rally in stocks post-2009 has been due to Central Bank intervention of one kind or another. Whether it be by cutting interest rates, printing money, buying bonds, or promising to do more/ verbal intervention, the Fed and others have done everything they can to push stocks higher. As a result, today, more than 90% of market price action is based on investors’ perceptions of what the Central Banks will do… NOT fundamentals. For instance, if bad economic data hits the tape, the market tends to rally because investors believe this will result in the Fed having to print more money.

Again, the primary driver of stocks is no longer fundamentals, but Central Bank intervention.

As a direct result of this, the final and ultimate round of the Crisis that begin in 2008 will occur when faith is lost in the Central Banks. That round is now beginning, with the Swiss National Bank breaking its promise to maintain the 1.2 Franc/Euro peg. This is the proverbial emperor has no clothes moment: the time in which the investing public realizes that Central banks are not omnipotent. There have been hints of this for years now.

Firstly there was the ongoing “is it legal or is it not legal?” arguments for the ECB’s OMT program. Mario Draghi “saved” the financial system and the EU in 2012 by promising to do “whatever it takes.” Two years later, it’s still not even clear that he could do “what it takes” from a legal standpoint. Then came Bank of Japan Governor Haruhiko Kuroda’s decision to increase the Bank of Japan’s QE program, not because it would benefit Japan’s economy, but because doing so would make his colleagues’ forecasts better match his own. All of the above indicated that Central Bankers were just making it all up on the fly… but it wasn’t until the Swiss National Bank broke an outright promise, broke a set currency peg, AND lost between $60-$100 billion in a single day, that things really got ugly.

At this point, the writing is on the wall: nothing can be taken for granted. No assurances or promises or proclamations will hold.

The next time stuff hits the fan, will the world be as trusting in Central Banker proclamations? Will we continue to believe these folks are omnipotent? Or will their phony promises accomplish nothing?

We’ll find out.

dixiegrrrrl

(60,010 posts)to the effect that oil is being priced to reality, showing how price discovery is supposed to work.

gonna be an interesting week.

Demeter

(85,373 posts)For what appears to be the first time on record, Powerball Lottery Sales declined year-over-year. As the following slides show, lottery sales declined 19% in FY14 vs FY13 and even more stunningly reflective of a nation whose disposable income (and hope) is in such short supply, sales in the first half of FY15 are down 40% from the first of FY14. As LaFleurs concludes, this will make it very challenging for most Lotteries to manage their budgets...Lottery Sales are plunging...

and the first half of 2015 looks even worse...

And it's widespread...

And FY15 looks like a disaster...

But apart from that... The US economy is recovering!!! It's not just the US...

Revenue from the various Lottery games slumped to almost £2.3 billion in the period to September 28, down 5.2% on the same time last year.

DemReadingDU

(16,000 posts)Buy 1 $2 ticket, get 1 free! Wheeee!

It has been done the past few years, one time I won $2 so I bought another ticket, lol!

tclambert

(11,087 posts)Well, maybe not "all." Just the ones they could make a profit on. Long highways through rural areas? Probably no one will bid for those. And, of course, it has to be understood that the private road companies get to raise tolls whenever they feel like it, get a complete waiver of liability for any damage to vehicles from poorly maintained roads, and get non-compete agreements that guarantee all the opportunity for abusing customers that monopolists love. You know, it would cut into profits if they had to pay any damages. And it would cut into profits if they had to maintain quality road surfaces. (Just ignore the so-called conflict of interest that every road company would own repair shops along their roads.) And it would cut into profits if the governments could build alternative routes to relieve congestion or serve the needs of the community.

I'm afraid that, like many privatization plans worshippers of the "free market" promote, they will continue to aggressively sell the imaginary advantages of their theoretical models until weary politicians say, "What the hell, let's try it," and then years later when all the criticisms prove right, we've got a real mess to fix. The people who originally sold the plan will have made their money and moved on, though, so their real model for making a fortune off the deal will have worked.

dixiegrrrrl

(60,010 posts)The deal was made to let a private company add tolls to a road going to Orange Beach, just before the 2008 bust.

So that helped add to the failure.

Demeter

(85,373 posts)Syriza may not be as radical as we want, but its message is simple: there is an alternative...National elections in Greece are to be held on January 25. Conditions in the country are still awful, with unemployment rates hovering around 25 percent and wages down 30 percent since austerity measures were introduced in 2010. There’s even talk of another three billion dollar cut to pensions. It’s no wonder that the Coalition of the Radical Left (Syriza) looks destined to emerge from the contest as the top party.

As the elections draw nearer, the agents of austerity have warned Greek voters of the horrible consequences of a Syriza victory. Greek Prime Minister Antonis Samaras pleaded that if his party (New Democracy) is defeated, there would be a “relapse into the deepest and most dramatic crisis.” German Finance Minister Wolfgang Schaeuble cautioned that there was “no alternative” to austerity policies and that he would not renegotiate existing measures and agreements. An Angela Merkel confidant and member of the German parliament, Michael Fuchs, even went as far as to claim that Greece was now expendable and could be easily kicked out of the eurozone should Syriza take power: “The times where we had to rescue Greece are over. There is no potential for political blackmail anymore. Greece is no longer of systemic importance for the euro.”

In addition to the chorus of threats from technocrats within Greece, Germany, Wall Street, and beyond, there is also an ensemble of voices on the Left that equate a Syriza victory with catastrophe. Rather than brace for the wrath of financial markets these groups on the Left predict that Syriza will fail to overthrow capitalism in Greece. Their claim is that Syriza aspires to be the social-democratic caretaker of the system rather than its gravedigger and that a victory for the party would deepen the capitalist path in Greece rather than derail it. The Greek Communist Party (KKE) has steadfastly refused any collaboration with Syriza, and its members even refuse to march with other groups during demonstrations and strikes, choosing alternative times and routes so as not to be contaminated by different opinions...Unsurprisingly, electoral support has dropped for KKE from 9.5 percent in 2004 to 6.1 percent in 2014. It is at 5 percent today. It takes real talent for a left party to continually lose support as wages plummet and unemployment and discontent soars. The Front of the Greek Anticapitalist Left (Antarsya), currently polling around 1 percent (far less than the 3 percent minimum needed to gain parliamentary representation), is much closer to Syriza than to KKE but they also steadfastly refuse to join forces since, among other differences, Syriza’s platform does not advocate leaving the European Union and the euro. This style of sectarian politics in Greece is certainly not exclusive to it, and many left factions of various stripes throughout Europe and beyond proclaim their opposition to Syriza for similar reasons.

Unfortunately, the political conditions today are far more bleak than when Eduard Bernstein and Rosa Luxemburg were debating reform and revolution more than a century ago. Yet very often, the historical failure of social democracy to achieve socialism is provided as evidence of Syriza’s intrinsic opportunism and inevitable inadequacy. Regrettably, the political conjuncture in Greece and beyond does not present us with an urgent task of deciding which path to socialism is the best. All political parties (Syriza, KKE, Antarsya, included) are, quite the opposite, largely debating which path is best for restoring jobs, wages, health care, education, and the like. No one is advocating a radical break with the past and the creation of a new society. The desire on the streets, in the meeting halls, and in the voting booths is not the desire for the new and more excellent, it is a desire for security, predictability, and jobs.

MORE

Demeter

(85,373 posts)Saxo Bank CIO and chief economist Steen Jakobsen warns the US is not Europe, the Euro is not a good idea, and the ECB is About to Make Biggest Mistake in History.

Via Mish-modified translation from El Economista.

In his view, the ECB wants to get funding rates low for listed and public companies. However, big companies have taken much of the credit, while SMEs (small and medium size enterprises) remain unfunded. Funding goes to the 20% of companies that "never again will create jobs." Interest rates declining few tenths more will not improve the economy.

Europe is not USA

Jakobsen says success stories like the three QE Federal Reserve (Fed) cannot be extrapolated to the Eurozone. His reason? The US is a net debtor and falling interest rates affects international creditors and rising national income. In Europe the opposite is true. Citizens of the euro countries are net savers, which means that falling interest rates deteriorates their income and does nothing to activate the economy.

In addition, Jakobsen believes that monetary stimulus suffers from a glitch: "The negative deposit facility and buying sovereign bonds are counter each other." This means that banks will not be willing to get rid of their bond portfolio to deposit excess liquidity at the ECB when interbank rates are negative.

In the case of monetary policy in the US, Jakobsen believes the Fed will have a very difficult raising interest rates in 2015. In his view, unless wages start to increase steadily, neither the Fed nor other major central bank may tighten monetary policy.

Consequences of Poor Construction of the Euro

To Jakobsen, many of the current problems stem from poor construction of the euro. "I do not think that the euro is a good idea. It's poorly built, without a fiscal union, and without consolidation of common funding streams for all member states. As designed, the euro does not have sufficient foundation to support the Eurozone.

ECB Has Done Nearly Everything Wrong

So the ECB has done it all wrong? No ... but almost.

The great mistake of the European entity was to (not) allow the economic cycle of the economy take its course. "They have not allowed the market to purge mistakes and now the situation is worse."

Had the business cycle been left alone, many broken banks would have been acquired by larger ones, reducing debt and generating a prone position to lay the foundations for recovery indicates. Instead, entities transferred bad debts from one place to another, from financial institutions to "bad banks", not solving anything in the process.

"Full-Board Bingo"

That's a "full-board" European bingo, with every square covered. The euro cannot and will not work because it's fatally flawed as I have noted for years. Fatal flaws include no fiscal union, wildly differing social agendas of member states, wide variances in productivity, wage discrepancies, and retirement benefit discrepancies. Those problems make it impossible to conduct monetary policy. The "Target2" system of payments is icing on the fatally flawed cake.

Finally, I maintain QE did not work in the US either, unless "work" means creating one of the biggest equity bubbles in history coupled with the absolute biggest junk bond bubble in history.

Nothing Fixed Anywhere

It's not just Europe. Nothing has been fixed anywhere. Bernanke says letting Lehman fail was his biggest mistake. What a bunch of nonsense. Lehman failed in every sense of the word. In effect, Bernanke wanted to bail out a failed institution at taxpayer risk and expense. The markets need to purge excesses. Instead, central banks refuse to allow just that, blowing bubbles of increasing amplitude over time in the wake.

Mike "Mish" Shedlock

Demeter

(85,373 posts)Alexis Tsipras, head of the Greek radical-left party Syriza, currently in the lead in national elections, wants a new bailout deal for Greece, including huge debt writeoffs. Socialist policies aside, on that score Tsipras is correct. Greece cannot possibly pay back the €245 billion it owes creditors.

Contagion Catch 22

Germany fears contagion in the form of demands by other countries that will also want bailout deals or rule changes if Greece gets one. Yet, yet a much more destructive contagion via a cascade of defaults is all but assured if Greece is forced into default.

New Hurdle in Finland

Making matters worse, Finland has joined the no bailout parade. Even if Germany was willing to offer Greece some concessions, Finland does not want to go along. This poses an additional problem, for the eurozone block that must agree unanimously to all such deals. With that backdrop, please consider:

Finland has emerged as the biggest stumbling block to negotiating a new bailout deal with an incoming Greek government, telling its eurozone partners that it will not support debt forgiveness and is reluctant to back another extension of the €172bn rescue.

In an interview, Finland’s prime minister Alex Stubb said he would give a “resounding no” to any move to forgive Greece’s debts and warned that a new government in Athens would have to stick to the terms of the existing bailout.

“We will remain tough. It is clear that we would say a resounding no to forgiving the loans,” Mr Stubb said.

“We naturally do not want to influence the Greek elections,” Mr Stubb added. “But I think it’s fair to Greeks and Finns to say out loud that some of the statements by Greek parties, and their presentations and ideas about the current programmes are simply unacceptable for Finland.”

The bailout of Greece has been a lightning rod for anti-euro sentiment in Finland. It was arguably the most enthusiastic cheerleader for austerity during the euro crisis. In an unusually tough stance that angered other European countries, it insisted in 2011 on receiving collateral from Athens before giving its backing to one of the Greek bailouts.

“We believe there is no going back on the loans or any of the other programmes. We should keep crystal clear in mind that the loans have already been eased many different times.”

Limited Scope for Solutions

Even if Finland was agreeable to bailout changes, the:

Eurozone finance ministers agreed in November 2012 to consider further debt relief for Greece once it reached a budget surplus before interest payments, which it did for the last two years, and as long as it stuck to its promises of austerity and reform.

But how much scope is there to reduce Greece’s debt burden?

Around three-quarters of Greek public debt — or around €270bn out of a total of €317bn — is held by the official sector — the EFSF eurozone rescue fund, the European Central Bank as well as the IMF, according to IMF figures.

Of the €270bn, defaulting on the €24bn owed to the IMF is considered the ultimate taboo, even by Syriza.

The ECB and national central banks are owed €54bn. The ECB is unable to offer any relief, since it could constitute illegal monetary financing of national governments.

According to an analysis of options by the Bruegel think-tank, reducing interest rates on the €53bn in bilateral loans to the three-month borrowing costs of each eurozone governments would reduce Greece’s debt mountain by 3.4 per cent of GDP by 2050 (in net present value terms). A further 10-year maturity extension would shave off another 4.5 per cent of GDP.

On its €142bn in EFSF loans, Greece only pays 1 basis point over the rescue fund’s borrowing costs, so there is little room for cutting the interest rate. But a 10-year maturity extension would cut the debt pile by a further 8.1 per cent of GDP.

Together, these concessions would reduce Greece’s debt burden to only around 160 per cent of GDP, a long way from Syriza’s objective. But EU officials argue that the overall total matters less if annual payments are low and spread out over several decades.

Other options, such as cheap fixed rate loans, or a much more radical debt forgiveness scheme along the lines of the Paris club, would impose direct losses on lenders and could be impossible for Greece’s eurozone partners to swallow.

High-Growth Impossibility

The burden of debt in and of itself rules out the "high-growth" scenario. Yet all other options leave Greece with debt-to-GDP near 150% for as far as the eye can see. Recall that the Troika once said that debt over 120% of GDP was untenable. Now officials conveniently argue "the overall total matters less if annual payments are low and spread out over several decades". The longer this stretches out, the longer Greece will remain a mess.

Now vs. Then

Recall that the Troika forced €245 billion of bailout debt on Greece just to prevent default on €40 to €50 billion or so in obligations. Bailouts never made any sense. However, what makes the most sense now, is to recognize what cannot be paid back, won't. Given that Germany and now Finland don't want to make that kind of ruling, outright default and a eurozone exit looks increasingly likely. Should that happen, the creditor countries will all be worse off than if they did grant a change in terms.

Financial Chicken

What's going on is an amazing game of financial chicken, arguably coupled with financial ignorance. Let's take a look at Finland and Germany's Responsibility should Greece default. Here is some charts and commentary from Bluff of the Day: Germany Warns "Greece is No Longer of Systemic Importance For the Euro".

Eurozone Financial Stability Contribution Weights

Country Guarantee Commitments (EUR) Millions Percentage

Austria € 21,639.19 2.78%

Belgium € 27,031.99 3.47%

Cyprus € 1,525.68 0.20%

Estonia € 1,994.86 0.26%

Finland € 13,974.03 1.79%

France € 158,487.53 20.32%

Germany € 211,045.90 27.06%

Greece € 21,897.74 2.81%

Ireland € 12,378.15 1.59%

Italy € 139,267.81 17.86%

Luxembourg € 1,946.94 0.25%

Malta € 704.33 0.09%

Netherlands € 44,446.32 5.70%

Portugal € 19,507.26 2.50%

Slovakia € 7,727.57 0.99%

Slovenia € 3,664.30 0.47%

Spain € 92,543.56 11.87%

Eurozone 17 € 779,783.14 100%

The above table from European Financial Stability Facility

Here's a second table that will put a potential €245 billion default into proper perspective based on percentage liabilities.

Responsibility in Euros

Country Percentage Greek Debt Responsibility

Austria 2.78% 6.79875

Belgium 3.47% 8.49317

Cyprus 0.20% 0.479465

Estonia 0.26% 0.62671

Finland 1.79% 4.3904

France 20.32% 49.79527

Germany 27.06% 66.308515

Greece 2.81% 6.88009

Ireland 1.59% 3.88913

Italy 17.86% 43.75651

Luxembourg 0.25% 0.611765

Malta 0.09% 0.221235

Netherlands 5.70% 13.96451

Portugal 2.50% 6.12892

Slovakia 0.99% 2.42795

Slovenia 0.47% 1.151255

Spain 11.87% 29.076355

Eurozone 17 100% 245

The idea that Greece is responsible to cover its own default is of course ridiculous, so mentally spread Greece's €6.88 billion liability to the other countries. Where is Spain going to come up with €30 billion? Italy €45 billion? France €51 billion? A quick check shows that Finland would need to come up with €4.3 billion? To Finland, that's a huge pile of money. Where will any of these countries come up with their share? The simple answer is they aren't. So, does the ECB print the money in violation of rules and pass it out? If not, who's bluffing whom regarding "systemic importance" of Greece?

Extreme Irony

Greece was no systemic threat to the eurozone until the Troika foolishly threw €245 billion at Greece hoping to prevent a default. Curiously, the Troika made Greece a systemic threat by pretending it was, when it really wasn't. And now that it is, they pretend that it isn't.

Mike "Mish" Shedlock

Demeter

(85,373 posts)Instead of too much inflation, as so many hand-wringers were worrying about a few years ago, we now find ourselves with too little. Maybe it’s about time the Federal Reserve did something about it...Just how little anyone expects prices to rise can be seen in inflation expectations, which have fallen off a cliff. Here is a graph of anticipated inflation, as measured by the 5-year Treasury inflation protected securities breakevens:

This is the financial market’s prediction for inflation rates during the next five years. The first thing to note is that expected inflation is now down below the level of late 2010, when the Fed announced its second round of bond-buying known as quantitative easing. The second thing to note is that expected inflation, at about 1.2 percent, is well below the Fed’s target of 2 percent. As for the economy, unemployment is down but wage growth is slow, and a drop in the stock market since the start of the new year may signal a weak patch ahead, as oil price declines clobber the once-booming shale industry. Thus, it seems reasonable to expect that the Fed will do some kind of easing soon -- a delay in planned rate increases, or even another shot of QE. These tools might be sufficient. But there might be better ways to generate more inflation.

The first would be for the Fed to stop paying interest on reserves. As things stand, when banks hold reserve accounts at the Fed -- which we normally call “cash” -- they get paid 0.25 percent annual interest. As insignificant as it might seem, that provides an incentive for banks to hold excess reserves rather than lend out their cash. Some economists, such as Harvard's Martin Feldstein, have argued that this incentive, although it looks small, is actually so big that it is holding down inflation...In a recent paper, the University of Chicago’s John Cochrane put forth an even more intriguing hypothesis. When bank balance sheets are large, he argues, paying interest on reserves turns standard monetary policy on its head. No longer do lower interest rates cause higher inflation -- instead, Cochrane says, we enter a Neo-Fisherian world where promising to keep rates lower for longer actually reduces inflation. So if Cochrane is right, the policy of paying interest on reserves is interfering with forward guidance. So eliminating interest on reserves is one thing the Fed might do in order to raise the inflation rate. Another idea is for the Fed to stop seeming so scared of moderate inflation.

The Fed’s official inflation target is 2 percent. That means that on average, inflation should be 2 percent -- sometimes lower, sometimes higher. But in recent years, it has started to look like that 2 percent is a ceiling. In other words, people may have started to believe that the Fed is fine with 1.2 percent inflation, but would view 2.2 percent inflation as dangerous. The Fed’s motivation to err on the downside of its stated target is natural, since the Fed tends to take the blame for high inflation, while low inflation or deflation is usually blamed on the economy instead. In monetary policy, expectations matter a lot. No one knows the central bank’s true preferences and goals, so if the Fed allows the world to believe that 2 percent is the highest it will allow inflation to go, that could become a self-fulfilling prophecy. Even worse, as departing Federal Reserve Bank of Minnesota President Narayana Kocherlakota recently warned, allowing inflation to undershoot its target for an extended period of time might risk damaging the credibility of the Fed itself, which could hurt future monetary-policy efforts.

An obvious solution, therefore, would be to have Fed officials, including Chair Janet Yellen, make remarks explicitly stating that 3 percent inflation -- or even 4 percent -- wouldn't be the end of the world. This would fight against the “anchoring” of inflation expectations below 2 percent.

AS IF THAT WOULD HAPPEN! MORE AT LINK

Demeter

(85,373 posts)The arc of the political universe is long, but it bends towards monetary policy.

That's the boring truth that nobody wants to hear. Forget about the gaffes, the horserace, and even the personalities. Elections are about the economy, stupid, and the economy is mostly controlled by monetary policy. That's why every big ideological turning point—1896, 1920, 1932, 1980, and maybe 2008—has come after a big monetary shock. Think about it this way: Bad monetary policy means a bad economy, which gives power back to the party that didn't have it before. And so long as the monetary problem gets fixed, the economy will too, and the new government's policies will, whatever their merits, get the credit. That's how ideology changes.

In 1896, for example, Republicans completed their transformation from being the anti-slavery party to the anti-inflation one. Back then, the U.S. was on the gold standard, but there wasn't enough gold. Miners had found so little of it that overall prices were falling, which was particularly bad news for anyone who'd borrowed money. That's because wages fall if prices do, so debts that don't become harder to pay back. The result was two decades of slower-than-it-should-have-been growth where the economy was in recession more often than not. Democrats, for their part, finally came up with a solution: stop crucifying mankind on a cross of gold, and use silver as money, too. They were four years too late, though. Gold discoveries in South Africa in 1896 and the Yukon in 1898 made the gold standard sustainable just in time for the Republicans, who had become the party of the financial elite that stood to lose a lot of money from inflation, to rally to its defense. Wall Street threw more money, as a percent of gross domestic product, into defeating the pro-silver Democrats than has been spent in any presidential election before or since. And it worked. Republicans won, the gold standard survived, and a new old era of conservative politics, of balanced budgets and low inflation, was ushered in.

Well, at least until World War I. That's because Republicans agreed on fiscal and financial policy, but not on regulation. That split let Woodrow Wilson win a three-way race in 1912, and, despite getting reelected on the slogan that "he kept us out of war," he didn't in 1917. Now, gold had already been pouring into the U.S., fueling inflation, as people moved it out of Europe, but once we joined the Allies, we also partially suspended the gold standard by banning gold exports. That left us with higher prices and a big pile of shiny rocks after the war ended. So, in 1920, the Fed raised rates so much that prices not only stopped rising, but actually started falling. A deep recession followed, right before the presidential election. That, together with general war weariness, was enough for an extreme mediocrity like Warren G. Harding to win the biggest popular vote victory, by percentage points, on record just on the strength of three word: return to normalcy. A year later, the Fed lowered rates, the Roaring Twenties were born, and the conservative orthodoxy of low taxes and low spending once again seemed to be vindicated. It wouldn't for long. Households, you see, went on a borrowing binge in the 1920s. They borrowed money to buy cars. They borrowed money to buy homes. And, yes, they borrowed money to buy stocks. So once the market crashed, this pyramid of debt did too. Even zero interest rates weren't enough to stop the economy's free fall. This only got worse when people panicked, sometimes justifiably so, that all these bad debts would make their banks go bust. That became a self-fulfilling prophecy as people rushed to pull their money out before everyone else, and the Fed, which was more concerned about propping up the gold standard than propping up the financial system, let everything collapse.

The craziest part was that the U.S., along with France, had so much gold that they could have created inflation and still stayed on the gold standard if they wanted to. But they didn't. They were so pathologically afraid of anything even resembling inflation that they chose depressions that forced them off gold instead. Hoover tried to run balanced budgets in the face of 25 percent unemployment, and the Fed raised rates in the face of bank runs, all to try to maintain the gold standard that, to them, was synonymous with civilization. This wasn't exactly popular. FDR came in and immediately did everything Hoover hadn't been willing to: going off gold, stress testing the banks, and spending money even if it meant running deficits. Recovery followed, and, in the process, discredited laissez-faire government for more than a generation.

By the 1970s, though, the Fed had made the opposite mistake of the one it made in the 1930s. This time, instead of saying there was nothing it could do about falling prices, it said there was nothing it could do about rising prices. Part of it was because Richard Nixon pressured it not to raise rates before his reelection. Another part was that the oil shocks pulled it in opposite directions—higher oil prices hurt the economy, but also increased inflation—and it didn't know what to do. And the final part was that widespread cost-of-living-adjustment contracts turned price shocks into wage shocks that then made the price shocks even worse. Now, even though this didn't have anything to do with actual Keynesianism, which, remember, is when the government runs deficits to fight recessions, "Keynesianism" became the bête noire of stagflation.

It was more than enough to undo Jimmy Carter, who had the misfortune of appointing the right Fed Chair at the wrong time, at least for him. Paul Volcker, you see, tried raising rates in 1980, just enough to create a small recession, before really raising them in 1981 and whipping inflation for good at the cost of a much deeper recession. This was perfectly timed, though, for Ronald Reagan, who got to run against Carter during a slump, and then watch Volcker engineer an inflation-killing slump that ended just in time for his own reelection. You know the rest of the story: it looked like government really was the problem, not the solution, and now it was Morning in America, etc., etc...Now, it's worth pointing out that politics can change without ideology also changing. Richard Nixon's Southern strategy, for example, created a new conservative coalition, but it didn't create new conservative policies. Instead, Nixon tried to co-opt Democrats by using price controls to fight inflation, setting up the Environmental Protection Agency to fight pollution, and offering a healthcare reform bill to bring down the uninsured rate. Bill Clinton similarly showed Democrats how to win in the post-Reagan world, peeling off professionals and soccer moms, without really challenging the prevailing "era of big government is over," deregulating ethos.

So will 2008 be an ideological inflection point? Well, like the French Revolution, it's too early to say. Turning points come when the old policies aren't working, and the old policies don't work when there's a big monetary shock. That doesn't mean everything else is irrelevant—some policies are good ideas and others aren't—but rather that politics is a status quo business, and as long as the Fed is keeping the economy growing, people tend to be reasonably happy with what they have. But there's something a little false about any "turning point." It's something we half-invent in retrospect. FDR's New Deal took Hoover's half-measures and made them full-measures. Reagan deregulated business like Carter had already started to. And Obama, well, he used the same healthcare plan as Mitt Romney. But if politics is the art of the possible, then these stories we tell matter because they change what we think is possible.

And that only changes when the Fed thinks something isn't.

Demeter

(85,373 posts)Jobs are coming back, but pay isn’t. The median wage is still below where it was before the Great Recession. Last month, average pay actually fell. What’s going on? It used to be that as unemployment dropped, employers had to pay more to attract or keep the workers they needed. That’s what happened when I was labor secretary in the late 1990s. It still could happen – but the unemployment rate would have to sink far lower than it is today, probably below 4 percent.

Yet there’s reason to believe the link between falling unemployment and rising wages has been severed. For one thing, it’s easier than ever for American employers to get the workers they need at low cost by outsourcing jobs abroad rather than hiking wages at home. Outsourcing can now be done at the click of a computer keyboard. Besides, many workers in developing nations now have access to both the education and the advanced technologies to be as productive as American workers. So CEOs ask, why pay more?

Meanwhile here at home, a whole new generation of smart technologies is taking over jobs that used to be done only by people. Rather than pay higher wages, it’s cheaper for employers to install more robots. Not even professional work is safe. The combination of advanced sensors, voice recognition, artificial intelligence, big data, text-mining, and pattern-recognition algorithms is even generating smart robots capable of quickly learning human actions.

In addition, millions of Americans who dropped out of the labor market in the Great Recession are still jobless. They’re not even counted as unemployment because they’ve stopped looking for work. But they haven’t disappeared entirely. Employers know they can fill whatever job openings emerge with this “reserve army” of the hidden unemployed – again, without raising wages.

Add to this that today’s workers are less economically secure than workers have been since World War II. Nearly one out of every five is in a part-time job. Insecure workers don’t demand higher wages when unemployment drops. They’re grateful simply to have a job. To make things worse, a majority of Americans have no savings to draw upon if they lose their job. Two-thirds of all workers are living paycheck to paycheck. They won’t risk losing a job by asking for higher pay. Insecurity is now baked into every aspect of the employment relationship. Workers can be fired for any reason, or no reason. And benefits are disappearing. The portion of workers with any pension connected to their job has fallen from over half in 1979 to under 35 percent in today. Workers used to be represented by trade unions that utilized tight labor markets to bargain for higher pay. In the 1950s, more than a third of all private-sector workers belonged to a union. Today, though, fewer than 7 percent of private-sector workers are unionized.

None of these changes has been accidental. The growing use of outsourcing abroad and of labor-replacing technologies, the large reserve of hidden unemployed, the mounting economic insecurities, and the demise of labor unions have been actively pursued by corporations and encouraged by Wall Street. Payrolls are the single biggest cost of business. Lower payrolls mean higher profits. The results have been touted as “efficient” because, at least in theory, they’ve allowed workers to be shifted to “higher and better uses.” But most haven’t been shifted. Instead, they’ve been shafted. The human costs of this “efficiency” have been substantial. Ordinary workers have lost jobs and wages, and many communities have been abandoned. Nor have the efficiency benefits been widely shared. As corporations have steadily weakened their workers’ bargaining power, the link between productivity and workers’ income has been severed. Since 1979, the nation’s productivity has risen 65 percent, but workers’ median compensation has increased by just 8 percent. Almost all the gains from growth have gone to the top.

This is not a winning corporate strategy over the long term because higher returns ultimately depend on more sales, which requires a large and growing middle class with enough purchasing power to buy what can be produced. But from the limited viewpoint of the CEO of a single large firm, or of an investment banker or fund manager on Wall Street, it’s worked out just fine – so far...

I THINK PITCHFORKS AND TORCHES WILL BE THE NEXT BIG COTTAGE INDUSTRY

Warpy

(111,270 posts)A living wage for a day's work is simple social justice and corporations can't be counted upon to do anything but try to drive wages down below subsistence, their profits depend upon cheating labor.

Forcing adequate pay comes under the heading of "promoting the general welfare." A country full of people who are not able to feed their kids the kind of foods that prevent mental deterioration is not going to be a strong one and that's about where the corporations have us now.

If the Democrats want to be anything but a despised party that doesn't stand for anything but Wall Street, it's going to have to put up or shut up in the next election: either campaign on an adequate minimum wage or don't bother running, at all.

xchrom

(108,903 posts)Casualties from Thursday's astonishing boom in the value of the Swiss Franc are rolling in this morning.

FX brokers that had relied on the stability of the Swiss Franc, which until Wednesday was pegged to the euro were taken by surprise when the Swiss National Bank abolished its controls, and millions of dollars were lost at a host of firms around the world.

UK-based FX broker Alpari just announced that is has entered insolvency. Here's what they said:

The recent move on the Swiss franc caused by the Swiss National Bank’s unexpected policy reversal of capping the Swiss franc against the euro has resulted in exceptional volatility and extreme lack of liquidity. This has resulted in the majority of clients sustaining losses which has exceeded their account equity. Where a client cannot cover this loss, it is passed on to us. This has forced Alpari (UK) Limited to confirm today, 16/01/15, that it has entered into insolvency.

That follows New Zealand's Excel Markets, which made the same statement earlier, according to the Financial Times.

Read more: http://www.businessinsider.com/foreign-exchange-brokers-are-getting-wiped-out-by-the-swiss-francs-surge-2015-1#ixzz3OzFd8exm

DemReadingDU

(16,000 posts)1/15/15 Numerous FX Brokers Shutter After Suffering "Significant Losses" Following SNB Stunner

.

.

In a re-run of the catastrophic trading losses that occurred around the Russian Ruble collapse last month (as we described here and here in great detail), two FX brokers (US-based FXCM and New Zealand-based Excel Markets) announced tonight that they “can no longer meet regulatory minimum capitalization requirements," due to "significant losses" suffered by clients. For FXCM these losses mean a $225 million negative equity balance and they are actively discussing alternatives with regulators. For Excel Markets, it is over... "we will not be able to resume business...Client positions will be closed within the next hour."

.

.

more...

http://www.zerohedge.com/news/2015-01-15/2-fx-brokers-suffer-significant-losses-after-snb-surprise-breach-regulatory-capital-

1/16/15 Swiss-Franc Move Crushes Currency Brokers

FXCM Suffers ‘Significant’ Losses; Alpari Enters Insolvency; New Zealand Currency-Trading House to Close

.

.

The trading losses occurred within minutes of the Swiss central bank’s announcement. Because major currencies rarely move more than 1% or 2% in a short period, investors are able to borrow large sums to juice their bets. Traders can put down $50,000—or even less—and make a bet worth $1 million or more. Excel Markets, which is connected to New Zealand’s Global brokers NZ, advertises 400 times leverage. The downside: a small adverse move can lead to a wipeout.

.

.

more...

http://www.wsj.com/articles/swiss-franc-move-cripples-currency-brokers-1421371654

xchrom

(108,903 posts)NEW YORK/SAN FRANCISCO (Reuters) - Tumbling oil prices have strengthened rather than weakened the Federal Reserve's resolve to start raising interest rates around midyear even as volatile markets and a softening U.S. inflation outlook made investors push back the timing of the "liftoff."

Interviews with senior Fed officials and advisors suggest they remain confident the U.S. economy will be ready for a modest policy tightening in the June-September period, while any subsequent rate hikes will probably be slow and depend on how markets will behave.

While they are hard-pressed to explain why bond yields have fallen so low, their confidence in the recovery stems in part from in-house analysis that shows falling oil prices are clearly positive for the U.S. economy.

Internal models also suggest that a decline in longer-term inflation expectations probably does not signal a loss of faith in the Fed's 2-percent inflation goal.

Read more: http://www.businessinsider.com/r-unfazed-by-market-swings-fed-sticks-to-mid-2015-hike-scenario-2015-1#ixzz3OzJZqIAW

xchrom

(108,903 posts)The UK and US are about to launch cyber attacks on each other. But don't worry: there'll actually be staged exercises to test out defences against hackers as online global threats rise, the BBC says. The move has been hailed an "unprecedented" arrangement between the allies.

Cyber attacks will be carried out by the countries' intelligence services, the MI5 and the FBI.

First up is the financial sector: The Bank of England and commercial banks in the City and Wall Street are going to be targeted to see how well businesses can cope with hacking dangers. Transport services will also be hit in the digital battles.

The move, announced today, will "test critical national infrastructure" and is in direct response to recent attacks on Sony Pictures and the US military's Central Command Twitter feed, the BBC explains.

Read more: http://www.businessinsider.com/uk-and-us-cyber-war-game-2015-1#ixzz3OzKU0a1A

xchrom

(108,903 posts)Benoit Coeure, who sits on the six-member executive board of the European Central Bank, just stoked expectations for the eurozone's likely looming quantitative easing (QE) programme even higher.

When asked about what a QE programme might look like in an interview for the Irish Times, Coeure said: "The only thing I can say is that for it to be efficient it would have to be big."

Coeure went on:

So we have to make the case in a convincing way that we have the resolve and the instrument to move the European economy out of the low growth, low inflation situation before it becomes a trap... And then all institutions have to contribute according to their mandate. The ECB has a mandate which has to do with inflation. We certainly have to act and show in a convincing way that we have instruments to act to deliver on our mandate.

One of the things investors and analysts have stressed in recent weeks is that there's a risk that even if the ECB does agree to QE, a hashed-together compromise will make it too small and ineffective.

Read more: http://www.businessinsider.com/ecb-benoit-coeure-qe-has-to-be-big-2015-1#ixzz3OzLGEDwq

Demeter

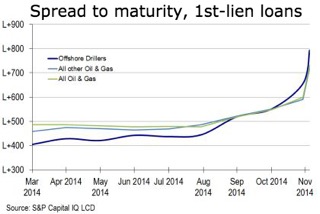

(85,373 posts)A big puzzle, as oil prices have plunged and look unlikely to return to their former levels, is who is holding energy-related debt, particularly give the high level of issuance in 2014. Yet it is troublingly difficult to get hard information, a situation troublingly similar to the mortgage backed securities and CDO markets in 2008...

One issue under discussion is the energy debt concentration in CLOs. That has come into focus due to the amounts on bank balance sheets (numerous reports on Twitter indicate that the market froze last July) and that one of the provisions of Dodd-Frank-gutting HR 37 that is now moving through Congress is to delay for two years a stipulation that would (force?) banks to sell most collateralized loan obligations held on their balance sheets. The reason for wanting CLOs out of banks is that they are actively traded vehicles, effectively mini hedge funds. The reason for concern is the recent plunge in energy-related debt prices and their questionable prospects, and where that debt is sitting.

oil gas -borrowing costs

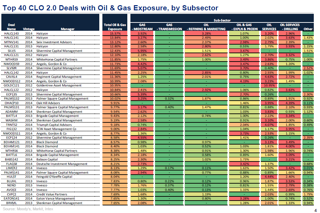

When the subprime mortgage market shut down, banks wound up eating a lot of their cooking. If that has happened again, it could show up not only in CLOs but in other assets and exposures. And if not the banks, then who were the bagholders? This chart shows energy debt concentrations in top 40 CLOs. The maximum concentration is 15%, presumably set by section concentration limits.

CLO concentration limits energy debt

Unfortunately, it doesn’t provide the dollar amount of those deals so we can’t determine what the dollar amount of that energy related exposure is...And this is from a discussion of a recent JP Morgan investor call:

JP Morgan’s projected default rates for US high yield energy: at $65 oil, 3.9% in 2015 and 20.5% in 2016. At $75 oil, 3.9% and 4.8%.

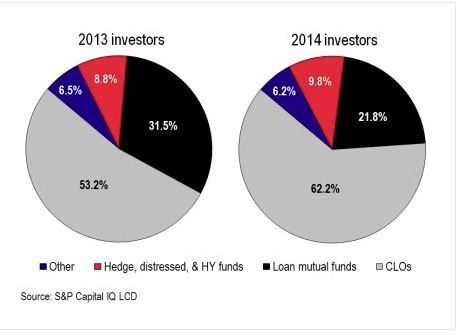

Those forecasts look to be in need of updating to show what would happen if oil prices remain at their current $50 (and below) level...Total leveraged loan issuance was $530 billion in 2014 and $606 billion in 2013 (two year total $1.136 billion). If energy made of 16-20% of 2013/2014 issuance, via above info, that would be roughly $182 to $227 billion (16-20% of $1.,136 billion)...Total US CLO issuance in 2014 was about $120 billion (the most ever) and about $85 billion in 2013. If energy debt didn’t exceed 15% of the CLOs issued in those years, that means CLOs bought less than $31 billion of energy debt, vs. around $200 billion of total energy debt issued. Mutual funds had been big buyers of leveraged loans, but were net sellers by the second half of 2014. So who was buying all of those energy related leveraged loans – about $170 billion worth?

According to LeveragedLoan.com, other than CLOs and loan mutual funds, the buyers of leveraged loans were hedge funds, representing 9% of the total 2013-14 loan issuance (about $105 billion) and “other” representing about 6.4% of total 2013/14 loan issuance (about $72 billion). So, if hedge funds and “other” only bought energy loans, that might account for all of the energy debt left looking for a home after CLOs and mutual funds. That seems unlikely.

energy debt CLO buyers

There may be a definitional issue. Maybe what CLOs call “energy related loans” are not what we, or leveragedloan.com or the bank analysts would call “energy related”? Remember, there was a lot time spent during the crisis trying to define what was subprime vs. Alt A vs. prime? Then during financial crisis litigation, the various bank defendants just redefined all of those terms again, to deny responsibility.

Another possibility is that a lot of the loans never actually got sold to investors – and ended up staying on bank balance sheets.

Investors are asking a lot of questions and are worried. That’s why the banks are parceling out pieces of information. It’s troubling that this sort of thing can’t be answered easily. It’s troubling that this sort of thing can’t be answered easily.

xchrom

(108,903 posts)SAN FRANCISCO / WASHINGTON (Reuters) - U.S. healthcare executives say Obamacare is likely here to stay, despite repeated calls from Republican lawmakers for repeal of the 2010 law aimed at providing health coverage for millions of uninsured Americans.

Top executives who gathered in San Francisco this week for the annual J.P. Morgan Healthcare conference, say that while President Obama's signature domestic policy achievement may well be tweaked, it is too entrenched to be removed.

The Obama administration said in November that it aims to have over 9 million people enrolled in government-backed federal and state health insurance marketplaces in 2015, their second year of operation. Another 10 million have enrolled for coverage under an expansion of the Medicaid program for the poor.

Opponents of the law in the newly-elected Congress, now dominated by Republicans, seek to replace Obama’s Affordable Care Act with their own healthcare reforms. Some are betting that the U.S. Supreme Court strikes down the federal tax subsidies helping the uninsured buy coverage in 36 states.

Read more: http://www.businessinsider.com/r-us-healthcare-executives-say-obamacare-is-not-going-anywhere-2015-1#ixzz3OzLtKp5B

Demeter

(85,373 posts)These tin-plated, self-annointed gods are going to be very surprised in the 4th quarter.

Demeter

(85,373 posts)...many observers believe that ObamaCare’s success, such as it is, is due to the expansion of the existing Medicaid program, not the, er, innovative Marketplace, so it’s time to take a look at the Medicaid state of play...I’ll quickly cover three topic areas: The usual random variations in coverage, waivers, and the impending loss of Medicaid’s temporary subsides for doctors. And, because I’m lucky enough to be a little bit new to Medicaid, I’ll welcome reader commentary even more than usual, especially from those with personal experience with the program.

The Usual Random Variations in Coverage

As we showed in perhaps overmuch detail in “ObamaCare’s Relentless Creation of Second-Class Citizens” (one, two, three, four, five, six) ObamaCare creates random variations in access to care via income, age, jurisdiction, employment status, marital status, and other personal characteristics. ObamaCare, then, is in no sense and has never been, and is not designed to be, a program that provides “universal coverage.” In no sense does ObamaCare consider health care as a right. Rather, ObamaCare is a program designed to deliver health insurance to certain market segments along certain channels, some of them pre-existing, and all of them designed to reinforce the position of the private health insurance industry in the health care system. Random variation by jurisdiction is especially evident in Medicaid:

So, if you live in the wrong state, tough luck, pal. Pain City for you!

Here’s a splendid example of the luck of the draw from Pennsylvania. The Philadelphia Inquirer:

The chaos and the logjam of applicants waiting for approval are partly due to the Department of Human Services’ asking people to supply detailed personal financial information – bank account statements, life insurance statements, vehicle value, and retirement account statements – that is not required under Medicaid expansion.

For example, the letter from the state requesting the financial information also says that supplying the information is optional, said Kyle Rouse, a navigator with the Health Federation of Philadelphia.

[Kyle Rouse, a navigator with the Health Federation of Philadelphia] said a client brought the letter to him because she was confused. “It confused me as much as it confused her, because in the same letter it said the information was optional but they were requesting it.” …

What Rouse and other navigators and advocates have learned is that if their clients don’t supply that information, their application gets stalled or denied.

“The value of your bank account is irrelevant to your eligibility under the extension category,” said Kyle Fisher, a staff attorney for the Pennsylvania Health Law Project. “But practically, to get an eligibility decision as soon as possible, I would suggest that you have that information.”

Leave aside the partisan change or at least shift from a Republican governor to a Democrat in November 2014, which may improve this absurd and degrading situation where the optional is mandatory; what conceivable justification is there for a United States citizen to be subjected to this situation — where the bottom line, for some, must be the denial of needed care — because they live in Pennsylvania, and not New York or California? None that I can see. But the random variations is, in fact nationwide, grossly obvious, and a consequence of ObamaCare’s system architecture. The Hill:

Entirely justified skepticism, as we will see when we get to Medicaid fees.

Colorado’s Democratic Gov. John Hickenlooper, who serves as NGA president, also said Tuesday that the waiver process should be streamlined.

“Lets make it easier to get those waivers done, and in many cases, make them permanent,” Hickenlooper said during a “State of the States” address, calling for “flexible federalism.”

“Flexible federalism” means giving local oligarchies the power to screw their locals as hard as they can. Just so we’re clear.

Last month, Tennessee Gov. Bill Haslam (R) took a major step toward making his state the first in the deep South to approve the expansion.

Again, what justification is there for this? Are citizens from the deep South lesser human beings, and less deserving of access to health care, than citizens in other states?

Fun and Games with Waivers

And so we come to “Section 1115.” Kaiser Health Foundation explains:

Ah yes, “politically viable.” Too bad the Democrats blew it — assuming good faith — in 2008 – 2009, but perhaps they will figure out how not to suck in 2016. There’s always hope! Anyhow, waiver proposals vary from the merely mischievous, like Utah’s workhouse requirement, to the truly dangerous, like Tennessee’s proposal. Vox:

The Volunteer Plan is what is especially different about Haslam’s proposal: it would use Medicaid dollars to help low-income workers who qualify for Medicaid buy private coverage through their employer instead. Instead of having the worker contribute a premium, the state would step in to cover all or part of the monthly premium….

This is not something any other state has proposed to the Obama administration, and it could be controversial. It’s probable that the employer plans would cover fewer benefits than Medicaid [profit; administration, CEO bonuses] typically does (Medicaid, for example, often covers transportation to the doctor, a benefit that does not turn up in private coverage). Tennessee says it wants permission to put Medicaid enrollees in plans, then, that do not cover all Medicaid benefits. It’s not clear that the Obama administration would be on board with this.

The second program, the Health Incentives Plan, tries to make the public Medicaid program look more like private insurance. It adds in co-payments and premiums (the lowest-income Tennesseans would be exempt, and there are caps on how much an enrollee could spend). Plan members could also lower their costs by participating in “healthy behaviors.”

So, in essence, Tennessee wants to privatize and crapify Medicaid as much as it can, and is asking for a waiver to do it. Since that is perfectly aligned with the Obama administrations larger goals, not to say worldview, no doubt the waiver will be granted. Yay!

Loss of Temporary Medicaid Subsidies

The mind reels at this one. Here’s the set-up. Forbes:

“Only for two years.” Shenanigans like this is why Red State governors aren’t utterly insane not to trust the Feds never to cut their subsidies.

So how low the lower reimbursement rates go? How bad are the cuts? They are very bad. Urban Institute:

And cuts in reimbursement will almost certainly lead to cuts in the delivery of care:

I’m just shaking my head at this. New York Times:

Dr. George J. Petruncio, a family physician in Turnersville, N.J., described the cuts as a “bait and switch” move. “The government attempted to entice physicians into Medicaid with higher rates, then lowers reimbursement once the doctors are involved,” he said.

Again, shaking my head. Democrats get doctors and patients into the program — and go all triumphalist at the enrollment numbers! — and then after two years, they pull the rug out. Sorry, no more Medicaid for you! What conceivable justification for this cruel bait and switch[1] can there be? I can’t even come up with a Machiavellian one.

Conclusion

It’s almost as if the Obama administration was bound and determined to prove that government can’t do anything right (except shovel loot into the coffers of the 1% as fast as they can, of course. But that’s bipartisan).

NOTES

[1] To be fair, the entire Obama administration has been a bait and switch of colossal proportions. So there’s that.

Demeter

(85,373 posts)http://www.nakedcapitalism.com/2014/02/consumer-reports-shills-obamacare-pooh-poohs-medicaid-clawbacks-bizarre-assumption-theyll-waived.html

YOU HAVE TO READ IT TO BELIEVE IT. AND I STILL CAN'T BELIEVE IT

Demeter

(85,373 posts)AS USUAL, KRUGMAN SKIPS THE FINE PRINT...

http://krugman.blogs.nytimes.com/2014/01/10/the-medicaid-cure/?_r=0

xchrom

(108,903 posts)Here come the oil-related job cuts.

In its fourth quarter earnings announcement on Thursday, oilfield services company Schlumberger announced that it will cut 9,000 jobs, or about 8% of its workforce.

The company said the job cuts come, "In response to lower commodity pricing and anticipated lower exploration and production spending in 2015."

Schlumberger is a provider of equipment and services to oil and gas companies, and over the last six months shares of the $100 billion company have declined more than 30% amid the crash in oil prices.

Read more: http://www.businessinsider.com/schlumberger-cuts-9000-jobs-2015-1#ixzz3OzMmahTQ

xchrom

(108,903 posts)KEEPING SCORE: Britain's FTSE 100 edged was up 0.1 percent to 6,507.44 and Germany's DAX was flat at 10,033.74. France's CAC 40 was 0.4 percent higher at 4,340.44. Futures showed that Wall Street would extend its losses. S&P 500 and Dow futures both fell 0.5 percent.

GOLDMAN EARNS: Investment bank Goldman Sachs reported a 10 percent drop in fourth-quarter earnings Friday. The bank earned $4.38 a share for the three-month period ending in December. While that was better than the $4.32 a share analysts had been expecting, the earnings report showed the bank was making less money across a range of trading activities.

SWISS SHOCK: The Swiss National Bank, or SNB, said Thursday that it decided to ditch an increasingly expensive policy to cap the rise of the Swiss franc. After the announcement, the Swiss franc spiked against the euro and the dollar while Swiss stocks tanked. The SNB had prevented the euro from trading below 1.20 francs. But the cost of retaining the policy for the central bank by buying euros or selling francs has risen as the outlook for the euro darkened. On Friday, the franc was stable, but Swiss stocks were down again, by 4 percent.

ANALYST'S TAKE: "At least for the short term the Swiss bank action has opened up a new front of financial markets risk," said Ric Spooner, chief market analyst at CMC Markets. "The Swiss bank's move last night is a reminder to investors and traders that central bank action is a source of market risk given the scale of their activities in recent years and its impact on economic activity."

BROKERS BROKE: Global Brokers NZ Ltd., a currency trading house in New Zealand, was among the first to say that it was closing its doors as the global economy felt the fallouts from the Swiss National Bank's abrupt policy reversal. The majority of clients in a franc position sustained losses amounting to far greater than their account equity, the company said. In London, Alpari said it was also going out of business and in New York, shares in brokerage FXCM were down 74 percent in pre-market trading.

jakeXT

(10,575 posts)..

Goldman bankers, who are expecting to hear about their bonuses on Friday, are likely bracing for smaller paychecks than last year.

The bank has reduced its compensation ratio while increasing its staff about 3 percent, meaning that there’s less to go around for many bankers.

Goldman’s compensation and benefits expenses were $12.7 billion for its 34,000 employees last year, Schwartz said during the call.

That’s an average compensation of $373,235 per person. The figure includes salaries, bonuses and deferred awards.

http://nypost.com/2015/01/16/goldman-bankers-bracing-for-smaller-bonuses/

xchrom

(108,903 posts)WASHINGTON (AP) -- Two problems stemming from the 2008 financial crisis - heavy government borrowing and high unemployment - still pose challenges to the global economy and require bold action, the head of the International Monetary Fund said.

Christine Lagarde, IMF managing director, said Thursday that cheaper oil and strong U.S. growth aren't enough to counter those threats.

"We believe that global growth is still too low, too brittle and too lopsided," she said in remarks before the Council on Foreign Relations.

Europe and Japan potentially face years of slow growth and ultra-low inflation, she said, while the United States "is the only major economy that is likely to buck that trend this year."

xchrom

(108,903 posts)The euro dropped toward an 11-year low against the dollar after the Swiss National Bank roiled financial markets by unexpectedly scrapping the franc’s cap.

The shared currency headed for its biggest weekly loss versus the yen since May 2011 as a report confirmed consumer prices in the region fell in December, strengthening the case for the European Central Bank to buy government bonds. The franc fell about 4 percent today versus the dollar and euro after surging as much as 38 percent and 41 percent, respectively, against the currencies yesterday. A gauge of foreign-exchange volatility climbed to the highest in more than a year.

“It’s more of a negative euro story,” Thu Lan Nguyen, a strategist at Commerzbank AG in Frankfurt, said of the SNB’s move. “Obviously they are assuming that the ECB is going to be ultra expansionary for a very long time and they don’t want to follow this monetary policy. It was a bomb they dropped there.”

The euro fell 0.4 percent to $1.1589 at 6:59 a.m. in New York. It touched $1.1568 yesterday, the weakest level since November 2003. The single currency was little changed at 135.29 yen, having lost 3.6 percent this week.

xchrom

(108,903 posts)Oil advanced in New York, paring an eighth weekly decline, as the International Energy Agency lowered forecasts for supplies from outside OPEC and said prices could recover.

West Texas Intermediate futures climbed as much as 3.6 percent. The grade is heading for a loss of 1.8 percent this week, capping the longest run of weekly declines since March 1986. Non-OPEC oil producers will increase output this year at a slower rate than previously forecast, aiding a recovery in crude prices, the IEA said in its monthly market report.

“The market is very over-sold and has been looking for signs for a pick-up,” Amrita Sen, chief oil analyst at consultants Energy Aspects Ltd., said by phone from London. “The IEA has very clearly come out and said there will be an impact from price. They’ve lowered Canada, Colombia production-wise, they’ve talked about shale as well.”

Demeter