Economy

Related: About this forumWeekend Economists Piece for Peace April 3-5, 2015

Since I'm still a bit under the weather (even though the weather has improved), there will be no fire and brimstone on this Weekend. Instead, we will seek inner peace, outer peace, utter peace (which must be the peace of the grave, I suppose), and quietly celebrate the Season, whichever season you like, in your own way. Me, I'm going to go for pastoral music...

Did I offer peace today? Did I bring a smile to someone's face? Did I say words of healing? Did I let go of my anger and resentment? Did I forgive? Did I love? These are the real questions. I must trust that the little bit of love that I sow now will bear many fruits, here in this world and the life to come.--Henri Nouwen, Dutch Clergyman; oeuvre at Amazon: http://www.amazon.com/s?ie=UTF8&index=blended&keywords=Henri%20Nouwen&link_code=qs&tag=brainyquote-20

Gratitude makes sense of our past, brings peace for today, and creates a vision for tomorrow.

---Melody Beattie, American author: The Language of Letting Go: Daily Meditations for Codependents (Hazelden Meditation Series) and other self-help books

Demeter

(85,373 posts)...Over the years, I have struggled with allowing people to get close to me for fear of losing them the way I had lost so many before.

After an adoption, the unexpected death of my adopted mother, my best friend, several family members, and the smattering of broken relationships, I built a solid wall against anyone who looked like they wanted to be near me.

I finally came to terms with the fact that in the end, most people who come into our lives will leave in some way or another—sometimes by choice and sometimes not, but their presence is what matters, not their absence.

What’s important is realizing that each moment we have with those we love is of infinite value, and we must enjoy the time we have with them while we have it instead of being so afraid we’ll lose them that we’re never really with them even when they are here.

If we’re so engulfed in the potential for loss, we’ll not only miss the lessons each experience can bring to our lives, but the joy it has to offer. Our happiness will sit in front of us waiting for us to recognize its face and we’ll look past it like a stranger.

People spend an exorbitant amount of time, energy, and resources on attempting to hold back aging as it is a reminder of our mortality. It reminds us that there is no permanence, so we frantically fight to find ways to extend the length of our lives, but how many focus on deepening the quality?

Why not slow down and realize we are immortal only in the moment we are in—this moment we inhabit contains our entire past and all of our potential and possibility for the future that may or may not arrive...

Demeter

(85,373 posts)So a deal was apparently reach in Lausanne. It is not quite final, and there might be zig-zags, but it looks likely that a deal will be reached between Iran and the AngloZionist Empire. Except for in this case, the Anglos appear to be distinctly happier than the Zionist. So what is going on here?

First and foremost, and I have sad that innumerable times on this blog, this is not about some putative Iranian nuclear weapons program. I will not repeat all the arguments in detail here (those interested can look into the archives), but here is a short summary of why Iran never intended to have a nuclear weapon:

1) Iranians are very smart, not stupid. They fully understand that a few nuclear weapons would make absolutely no difference in a war against Israel or the US or anybody else. If used aggressively they would trigger a massive response and if used defensively, in response to an attack, they would not be here in the first place because any attack would begin by a counter-force disarming strike, possibly a nuclear one. Any putative Iranian nuclear forces lacks both the survivability and flexibility needed to be used or even to deter.

2) Acquiring a military nuclear capability would instantly turn Iran into a pariah state. We saw the sanctions against Iran against an imaginary nuclear program, you can imagine what they would be against a real one.

3) Iran is uninvadable as a country – it is too big, the terrain too complex, the population too big and, frankly, its armed forces too strong. Compared to Iran, both Afghanistan and Iraq are an easy target (there is a reason why the US has not even attempted to invade Iran since 1979!). Iran can, however, be very heavily bombed by missiles and airstrikes. This is not the kind of threat a nuclear capability can deter. In other words, Iran does not even need nukes.

4) The US intelligence community has agreed that Iran has no military nuclear program. All they could claim is that Iran had one in the past. Considering the pressure the US intelligence community was under at the time, this is as exculpatory a report as can be realistically expected.

5) The Iranian spiritual leaders have gone on the record multiple times and most officially declared that nuclear weapons are immoral, un-Islamic and forbidden. Secularists tend to believe that religious folks are always liars, I tend to believe that they do follow the principles which they believe in.

6) It is most definitely not about anybody wanting to get (or prevent) and “Islamic bomb” as Pakistan already has just that.

So if this not about nukes, what is it?

Simple!

1) It is about not allowing the Islamic Republic of Iran to become a viable, vibrant and prosperous alternative to the Wahabi and Zionist client-states in the region.

2) Is is about showing that even Iran can and will be bullied into submission to the Axis of Kindness.

3) It is about preventing Iran from acquiring its own civilian nuclear research program which is a source of technology and pride.

4) It is a pretext to impose vicious sanctions on Iran

5) It is a pretext to attack Iran militarily

6) It is about subverting the Iranian society

Now that we have listed the real stakes of the apparent agreement in Lausanne, we can also explain why Obama is pushing the deal while Netanyahu is appalled by it. The US deep state apparently came to the realization that a war with Iran would be a disaster for the USA and its Empire and the US might even be considering reaching some kind of modus vivendi with Iran before the entire Middle-East explodes because of the multiple foreign policy mistakes of the USA in the region. We are not talking about a US-Iranian love fest, at least not quite yet, but rather a way from freeing the USA from this exhausting and useless confrontation with the key regional superpower. With now three major potential wars possible (Ukraine, Yemen, Iran), the US wants at least one put back on the back burner to free resources for the other two.

For the Israelis, this is very bad news indeed, not because Iran is about to “commit another Holocaust” (sic), but because they put all their power, prestige, influence and, last but not least, hysterics into whipping up a crazy anti-Iranian panic and they have failed. These feelings of failure and fear will now also be shared by the Saudis...

MORE ANALYSIS AT LINK

Demeter

(85,373 posts)The headlines out of Yemen really say it all:

U.S. pulling last of its Special Operations forces out of Yemen (and destroy their equipment in the process)

Russia’s Yemen consulate damaged amid Saudi-led airstrikes – embassy source

Russian evacuation plane denied landing in Yemen, diverts to Cairo

Chinese military disembark in port of Aden, Yemen, to guard evacuation – official

Yemen crisis: Foreigners’ tales of escape

Saudi Arabia, Yemen won’t hamper Russians’ evacuation from Sanaa SEE POST FOR LINKS

All this can be summarized like so: the US made an unholy mess of yet another country, was the first to run, and now everybody runs, except for Russian and Chinese forces who try to evacuate their nationals. Yet another major foreign policy success for Obama who had presented Yemen as the shining example of anti-terrorism done right.

In the meantime, the local al-Qaeda franchise is using the Saudi-lead aggression to liberate its members from prison, the US continues to pretend to bomb al-Qaeda in Iraq while supporting the same al-Qaeda in Syria and Yemen, Saudi Arabia and Israel are jointly bombing the Shia in Yemen and Iran is accused of interfering in Yemeni affairs. How utterly crazy AngloZionist policies have become?!

This would all be outright hilarious if people were not dying. And it is going to get a whole lot worse if the Wahabi crazies in Riyadh go ahead with their plans for a suicidal and fully illegal land invasion of Yemen. My hope is that the Saudis follow the typical American strategy and just bomb from high altitudes a country with only primitive air defenses (the Yemenis still managed to shoot down at least 2, possibly 3, “coalition” aircraft and one drone!).

So now we have yet another “gangster mob” ganging up against one small country: Saudi Arabia, United Arab Emirates, Bahrain, Kuwait, Qatar, Jordan, Morocco, Sudan, Egypt and, of course, the USA and Israel, supported by al-Qaeda, all together against the Yemeni Shia. And, of course, fighting the Yemeni Shia objectively means supporting al-Qaeda in Yemen. Thus, it would be fair to say that Saudi Arabia, United Arab Emirates, Bahrain, Kuwait, Qatar, Jordan, Morocco, Sudan, Egypt, the USA and Israel are all supporting al-Qaeda...

...I will repeat this again and again, here we’re faced with yet another example of how the AngloZionist Empire is finally showing its true face: not the gentle face of human rights, democracy, international law and progress, but the ugly, brutal and stupid face of ignorant violence, support for the scum of the planet (Nazis, Zionists and Wahabis) and imperialism. The period of “capitalism with a human face” is now clearly over and we are now living exactly what Lenin had predicted: imperialism as the highest stage of capitalism (and no, I am neither a Leninist nor a Marxist but, in the words of Malcolm X, “I am for truth, no matter who tells it”).

MORE

Demeter

(85,373 posts)The United States military will deploy a new special force for Latin America, revealed the website Defensa.com on Wednesday. The 250-troop force will be deployed to the U.S. military base Soto Cano in Palmerola, Honduras.

The deployment includes 4 armed helicopters and the JHSV Spearhead amphibian vessel. The special force will work in a similar way as the U.S. African task force Special Purpose Marine Air-Ground Task Force-Crisis Response, a combat unit designed to intervene in critical situations.

The new unit is expected to become operational between June and November this year.

The announcement comes after Ernesto Samper, UNASUR's Secretary General, requested that the forthcoming Summit of the Americas considers banning U.S. military bases in Latin America.

Earlier this year, it was announced that over 3,000 U.S. marines would be deployed to Peru in September, to participate in joint operations.

This content was originally published by teleSUR at the following address:

http://www.telesurtv.net/english/news/US-Military-to-Launch-Special-Force-for-Latin-America-20150401-0037.html. If you intend to use it, please cite the source and provide a link to the original article. www.teleSURtv.net/english

DEMETER SECONDS THE BAN!

Demeter

(85,373 posts)HOW CONVENIENT! ONE-STOP ESPIONAGE!

http://fortruss.blogspot.mx/2015/04/russian-consulate-bombed-and-looted-in.html

The Shiite rebels attacked and looted the Russian Consulate in Aden. They broke down the door of the Consulate building, and looted the consulate property and office equipment. The militants loaded the equipment and documents into cars and fled in an unknown direction. At the time of the attack there were no workers in the Russian Consulate.

Earlier the Russian Consulate in Aden was damaged in the bombing of the largest city in the South of Yemen by Arab coalition led by Saudi Arabia. This was reported by the Russian Embassy in Yemen.

The source admitted that there was not a single window left in the building. He added that the Russian Consulate may be closed and Russian citizens evacuated.

MORE

Demeter

(85,373 posts)Over the weekend, Juan Cole laid out how, if nuke negotiations with Iran fail this week, Europe is likely to weaken or end its sanctions anyway: http://www.juancole.com/2015/03/guaranteed-european-sanctions.html

Arguably, Iran has simply substituted China, India and some other countries, less impressed by the US Department of Treasury than Europe, for the EU trade. Iranian trade with the global south and China has risen by 70%, Tirone says, to $150 billion. Indeed, at those levels Iran did more than make a substitution. It pivoted to Asia with great success before the phrase occurred to President Obama.

China is so insouciant about US pressure to sanction Iran’s trade that it recently announced a plan to expand Sino-Iranian trade alone to $200 billion by 2025. (It was about $52 billion in 2014). And Sino-Iranian trade was only $39 bn. in 2013, so the rate of increase is startling.

Cole notes — and quotes a British diplomat strongly suggesting — that the US may lack credibility because of the stunts by people like Tom Cotton.

Meanwhile, Dan Drezner assigned blame to both a an obstinate Congress and Obama for losing its allies to China’s Asian Infrastructure Investment Bank (the first domino of which I noted here).

So, no contest, the executive branch screwed this up. But it would be selfish for the Obama administration to hog all of the credit on this policy failure. No, one of the main drivers behind China’s push for the AIIB has been frustration that Beijing’s clout at the IMF and World Bank has not matched its economic rise. The way to fix that has been quota reform to give China more power. As it turns out, the Obama administration negotiated that very thing five years ago. All that was needed was for the U.S. Congress to pass it. And as I wrote two years ago:

If Congress stalls this quota reform measure that the executive branches from both parties have negotiated , they will be weakening a U.S.-friendly international institution and inviting potential rivals to set up or bolster alternatives. Which, if you think about, is a really stupid way to run U.S. foreign economic policy.

And hey, what do you know, Congress did that stalling thing.

These are just two straws on a still very big camel’s back. But slowly, US financial hegemony is getting weighed down by our hubris.

Demeter

(85,373 posts)Small farmers are being marginalized and excluded thanks to corporate-friendly regulations.

A battle is currently being waged over Africa's seed systems. After decades of neglect and weak investment in African agriculture, there is renewed interest in funding African agriculture. These new investments take the form of philanthropic and international development aid as well as private investment funds. They are based on the potentially huge profitability of African agriculture - and seed systems are a key target.

Right now ministers are co-ordinating their next steps at the 34th COMESA (Common Market for Eastern and Southern Africa) Intergovernmental Committee meeting that kicked off 22nd March, in preparation for the main Summit that follow on 30th and 31st March 2015. COMESA's key aim is to pave the way for a "Continental Free Trade Area (CFTA) in 2017 under the auspices of the African Union" with uniform regulations, including on agricultural products, seeds and GMOs. A recent meeting on biotechnology and biosafety was held to establish a "COMESA biotechnology and biosafety policy implementation plan" (COMBIP) to roll out from 2015-2019, "leading to increased biotechnology applications and agricultural commodity trade in the region."

But read between the lines and its real purpose was to facilitate the planting and commercialization of GMO crops in Africa all at one go, instead of country by country. USAID Regional representatives for East Africa, based in Nairobi, were present to monitor the process and ensure the desired outcome. And on the agenda for the main COMESA Summit next week is the approval of a 'Master Plan' for the implementation of the COMESA Harmonised Seed Trade Regulations agreed last year in Kinshasa. The regulations, according to the Alliance for Food Sovereignty in Africa, "will greatly facilitate agricultural transformation in the COMESA member states towards industrialization of farming systems based on the logic of the highly controversial, failed and hopelessly doomed Green Revolution model of agriculture."

They "promote only one type of seed breeding, namely industrial seed breeding involving the use of advanced breeding technologies. The entire orientation of the seed Regulations is towards genetically uniform, commercially bred varieties in terms of seed quality control and variety registration."

No place for small farmers!

"What is very clear is that small farmers in Africa, seeking to develop or maintain varieties, create local seed enterprises or cultivate locally adapted varieties are excluded from the proposed COMESA Seed Certification System and Variety Release System, because these varieties will not fulfill the requirements for distinctness, uniformity and stability (DUS).

"Land races or farmers' varieties usually display a high degree of genetic heterogeneity and are adapted to the local environment under which they were developed. In addition, such varieties are not necessarily distinct from each other."

COMESA's key agricultural objectives are to raise production by 6% per year, "integrate farmers into the market economy", make Africa a "strategic player in agricultural science and technology development". To this end USAID is funding COMESA programmes for 'Coordinated Agricultural Research and Technology Interventions' and 'A Regional Approach Towards Biotechnology' - in other words, to create uniform corporation-friendly regulations for seeds, agro-chemicals and GMOs across the region.

More than 80% of Africa's seed supply currently comes from millions of small-scale farmers recycling and exchanging seed from year to year. This seed meets very diverse needs in very diverse conditions. Farmers know the quality of 'recycled' seed, selected and saved from their own crops. It is cheap and readily available. New varieties can be introduced through informal trade within villages and beyond. This system may not be perfect, but it has been broadly functional for generations. The so-called 'formal' seed sector is a relatively new addition in Africa and has a narrow focus on commercial crops, especially hybrid maize. This commercial seed may offer yield advantages, but only in the right conditions, e.g. when coupled with continuous use of synthetic fertilizer, irrigation, larger pieces of land and mono-cropping - the Green Revolution package.

MUCH MORE

Demeter

(85,373 posts)There is an inverse relationship between utility and reward. The most lucrative, prestigious jobs tend to cause the greatest harm. The most useful workers tend to be paid least and treated worst.

I was reminded of this while listening last week to a care worker describing her job. Carole’s company gives her a rota of, er, three half-hour visits an hour. It takes no account of the time required to travel between jobs, and doesn’t pay her for it either, which means she makes less than the minimum wage. During the few minutes she spends with a client, she may have to get them out of bed, help them on the toilet, wash them, dress them, make breakfast and give them their medicines. If she ever gets a break, she told the BBC radio programme You and Yours, she spends it with her clients. For some, she is the only person they see all day.

Is there more difficult or worthwhile employment? Yet she is paid in criticism and insults as well as pennies. She is shouted at by family members for being late and not spending enough time with each client, then upbraided by the company because of the complaints it receives. Her profession is assailed in the media as the problems created by the corporate model are blamed on the workers. “I love going to people; I love helping them, but the constant criticism is depressing,” she says. “It’s like always being in the wrong.”

Her experience is unexceptional. A report by the Resolution Foundation reveals that two-thirds of frontline care workers receive less than the living wage. Ten percent, like Carole, are illegally paid less than the minimum wage. This abuse is not confined to the UK: in the US, 27% of care workers who make home visits are paid less than the legal minimum...

EXCELLENT EXPOSITION...MUST READ!

Demeter

(85,373 posts)The U.S. Commodity Futures Trading Commission on Wednesday charged Kraft Foods Group Inc and Mondelez Global LLC, respectively, with manipulation and attempted manipulation of cash wheat and wheat futures prices.

The regulator said it was seeking a permanent injunction from future violations by the two companies, as well as disgorgement and civil monetary penalties.

AND NOW WE KNOW THE "WHY" OF THE MERGER OF KRAFT & HEINZ!

Demeter

(85,373 posts)...President Obama signed an executive order that authorizes the Secretary of the Treasury, in consultation with the Attorney General and the Secretary of State, to impose sanctions on individuals or entities believed to be involved in "malicious cyber-enabled activities" that could pose "a significant threat to the national security, foreign policy, economic health, or financial stability of the United States."

"Starting today, we're giving notice to those who pose significant threats to our security or economy by damaging our critical infrastructure, disrupting or hijacking our computer networks, or stealing the trade secrets of American companies or the personal information of American citizens for profit," Obama said in a statement.

One of the country's biggest challenges, according to cybersecurity coordinator Michael Daniel, special assistant to the president, is to develop the right tools to respond to malicious attacks.

"In many cases, diplomatic and law enforcement tools will still be our most effective response," Obama said. "But targeted sanctions, used judiciously, will give us a new and powerful way to go after the worst of the worst."

What type of activity might trigger sanctions? Compromising services by government entities, running a distributed denial-of-service attack, pilfering data for commercial or financial gain, using cyber-stolen trade secrets, and providing material support for any of these actions could land you in hot water....

http://www.reuters.com/article/2015/04/01/us-usa-cybersecurity-idUSKBN0MS4DZ20150401

Reuters) - President Barack Obama launched a sanctions program on Wednesday to target individuals and groups outside the United States that use cyber attacks to threaten U.S. foreign policy, national security or economic stability. In an executive order, Obama declared such activities a "national emergency" and allowed the U.S. Treasury Department to freeze assets and bar other financial transactions of entities engaged in destructive cyber attacks.

The executive order gave the administration the same sanctions tools it deploys to address other threats, including crises in the Middle East and Russia's aggression in Ukraine. Those tools are now available for a growing epidemic of cyber threats aimed at U.S. computer networks.

"The Obama administration is really getting serious now. This order brings to bear the economic might of the United States against people who are robbing us blind and putting us in danger," said Joel Brenner, who headed U.S. counterintelligence during President George W. Bush's second term.

The effort to toughen the response to hacking follows indictments of five Chinese military officers and the decision to “name and shame” North Korea for a high-profile attack on Sony. Officials said they hoped U.S. allies would follow suit. U.S. lawmakers and security and legal experts welcomed the move as an encouraging step after a steady stream of cyber attacks aimed at Target, Home Depot and other retailers, as well as military networks.

But they said the executive order was surprisingly broad, which could result in a compliance nightmare for companies, and warned that it remained difficult to definitively "attribute" hacking attacks and identify those responsible.

Obama said in a statement that harming critical infrastructure, misappropriating funds, using trade secrets for competitive advantage and disrupting computer networks would trigger the penalties.

Companies that knowingly use stolen trade secrets to undermine the U.S. economy would also be targeted. MORE

Demeter

(85,373 posts)Petroleo Brasileiro SA, the world’s most indebted oil producer, is bolstering ties to China as a corruption scandal has shut the company out of international bond markets.

Petrobras, as Brazil’s state-run producer is known, signed a finance contract with the China Development Bank for $3.5 billion, the first part of an accord to be implemented this year and in 2016, according to a regulatory filing Wednesday. That follows the entrance of two Chinese oil companies in Petrobras’s biggest project in 2013 and a $10 billion cash-for-oil agreement in 2009.

Petrobras is slashing investments, selling assets and seeking financing options as it searches for ways to book corruption losses in financial statements. Delays in reporting earnings have all but shut out the company from bond markets at a time of slumping crude prices.

“The Chinese are seizing on their opportunities worldwide and the fact that Petrobras has another funding option is very positive,” Marcelo Lima, a fixed-income trading manager at INTL FCStone Securities Inc. in Miami, said in an e-mail.

MORE

Demeter

(85,373 posts)Franklin Templeton and four other leading Ukraine creditors have set up a committee to negotiate debt-restructuring terms with a government struggling to avert a default, according to a person close to the talks.

The group is being advised by Blackstone and Weil, Gotshal & Manges LLP, according to the person, who asked not to be identified because the details are private. A representative of Lazard Ltd., which Ukraine hired for the negotiations, declined to comment when contacted by Bloomberg News on Wednesday.

Government bonds rose as the committee’s formation paved the way for talks to start with Ukraine, which needs to reach new terms on 29 bonds and enterprise loans before the next review of a $17.5 billion International Monetary Fund aid agreement at the end of May. Franklin Templeton is the biggest bondholder with about $7 billion, followed by Russia, which bought a $3 billion Eurobond from the country in December 2013.

“Templeton and one or two other big shots should be enough to reach an agreement,” Andreas Rein, a money manager who helps oversee $470 million in assets, including Ukrainian Eurobonds, at Uniqa Capital Markets GmbH in Vienna, said by e-mail. “There is still nothing clear on the $3 billion Russian bond and that still complicates the story.”

MORE

Demeter

(85,373 posts)Yves here. As strange as it may seem, most economists loudly disputed the notion that the rise in commodity prices, particularly in the first half of 2008, was in large measure due to financial speculation. More and more analytical work (such as comparisons of price action in commodities trades on futures exchanges with ones that have large markets but are not exchange-traded, like eggplant, a staple in India, and cooking oil) have dented the orthodox view.

By Manisha Pradhananga, Assistant Professor of Economics at Knox College. Originally published at Triple Crisis

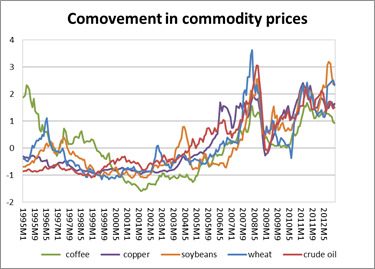

Remember the 2008-11 food price spike? It led to food riots in many parts of the world and increased the number of malnourished people by 80 million worldwide (USDA 2009). What many people don’t know about the price spike is that besides the rise in magnitude, it was distinctive for the breadth of commodities affected. Prices of a wide range of commodities including agricultural (wheat, corn, soybeans, cocoa, coffee), energy (crude oil, gasoline), and metals (copper, aluminum), all rose and fell together during this period.

Source: IFS, commodity prices. Normalized by demeaning and dividing by standard deviation of each series

It is not unusual for prices of related commodities to move together; if two commodities are either complements or substitutes in production or consumption, then a demand or supply shock in one commodity market may be transmitted to the other. For example, prices of certain industrial metals may move together if they are jointly used to produce alloys. Similarly, prices of grains such as corn, wheat, rice, and barley may move together if they are substitutes in consumption. However, commodity-specific shocks cannot explain co-movement of unrelated commodities, like the one observed in 2008-11 (Gilbert 2010, Frankel and Rose 2009). Many of the factors that were initially given as explanations for the price spike—such as drought, or the use of corn and oil-seeds to produce biofuels—are thus unable to explain this rise in comovement between commodity prices. Only factors that can affect many commodity markets simultaneously can be considered as explanations. In a recent paper, I focus on one of these factors, financialization of the commodities futures market, and explore the links between financialization and comovement.

The term financialization has been used in the broader literature to loosely describe a range of developments related to the rising dominance of financial markets, institutions, and interests in the U.S. economy since the 1970s. (Epstein and Jayadev 2005, Orhangazi 2008). This concept of financialization has been extended to the commodities futures markets, where financial actors and interests have similarly played an increasingly dominant role in the functioning of the market. Financialization in the commodities futures market refers to the massive inflow of investment in the market, and the rise of commodities as an investment asset. Futures contracts of commodities like oil, wheat, corn, soybeans, etc., are now considered a financial asset like stocks and bonds. The number of open contracts in U.S. exchange-traded commodity derivatives market increased six-fold between 2001 and June 2008, from around 6 million to 37 million in June 2008 (BIS). These new investors are neither producers nor direct consumers of the underlying commodities, and they increasingly control a large share of the market. Between 1995-2001 “bonafide” hedgers, who are producers and consumers of commodities, controlled 70% of the market in crude oil; by 2006-09 they controlled less than 43%.

This financialization of commodity futures markets may cause comovement between unrelated commodities in three ways. First, if commodity futures are bought and sold not based on expectations of future demand and supply of the particular commodity, but based on other portfolio considerations or herd behavior. This is especially true for financial traders who buy and sell commodity derivatives not individually, but as a group of securities based on pre-set weights of commodity indices like the Standard and Poor’s-Goldman Sachs commodity index (S&P GSCI). If a large portion of “investment” in the commodities derivatives market are controlled by such passive index trading (like they were in 2008), then it is likely that prices of commodities will move together. Second, if commodity speculators trade in two or more commodity markets, a fall in the price of one commodity may cause the price of other commodity to also fall. For example, if price of commodity A falls, speculators might have to sell commodity B to cover margin calls in the market for commodity A (in which they have a long position), thus leading B to move with A. Finally, as weight of energy commodities like crude oil is high in commodity indices like the S&P GSCI, so shocks (supply or speculative bubbles) in energy markets might be transmitted to other commodity markets, even if there are no changes in the fundamentals of those specific commodities.

In my recent Political Economy Research Institute (PERI) working paper, Financialization and the Rise in Comovement of Commodity Prices, I examine whether financialization of the commodity futures market can explain the remarkably synchronized rise and fall of commodity prices in 2008. For the empirical analysis, I extract common factors that explain trends in prices of 41 commodities and study the correlation between this common factor and the flow of money into the futures market. Results show that financialization can explain the rise in comovement between commodity prices after accounting for other macroeconomic variables such as demand from emerging markets and depreciation of the U.S. dollar. These results imply that as financialization of the commodities futures market proceeded and more traders entered the futures market, market liquidity increased. Much of the rise in liquidity was due to increasing investment in commodity indices, which meant that futures of unrelated commodities were being bought and sold together as parts of portfolios. This increase in liquidity across different commodity markets led to the synchronized rise (and fall) in commodity prices.

RAMIFICATIONS AT LINK

Demeter

(85,373 posts)ANOTHER INTERPRETATION...EQUALLY STUNNING, AND A BETTER QUALITY OF RECORDING

Demeter

(85,373 posts)Tiny principality has been rocked by allegations of money laundering in its oversized banking sector... The country has for many years enjoyed the benefits of European borders without the restrictions of EU membership, allowing light-touch regulation that has brought in tourism and wealthy expats from its bordering countries. However, in the last three weeks, the state has been gripped by a banking crisis that threatens to take it to the brink. Bankers have been thrown in jail, savers’ deposits have been restricted, and the country’s government is scrambling to convince powerful regulators thousands of miles away that the country is not a haven for tax evasion.

On Tuesday March 10, the US Treasury Department’s financial crime body, FinCEN, accused Banca Privada d’Andorra (BPA), the country’s fourth-largest bank, of money-laundering. The authority said “corrupt high–level managers and weak anti–money-laundering controls have made BPA an easy vehicle for third–party money-launderers”. Three senior managers at the bank accepted bribes to help criminals in Russia, Venezuela and China, to funnel money through the Andorran system, according to FinCEN....The next day, the state took charge of BPA, dismissing three directors. On the Friday, the bank’s chief executive, Joan Pau Miquel, was arrested and detained. Mr Miquel remains in a jail cell in La Comella, the country’s only prison, with a capacity of 145. At BPA, the Andorran authorities have installed new management. After international banks cut off links, withdrawals were capped at €2,500 (£1,830) a week, a limit many people are maxing out.

Banco Madrid, the Spanish subsidiary of BPA acquired as part of an expansion spree in recent years, filed for administration on Wednesday. The Andorran government insists that BPA is an isolated case, saying it is committed to transparency and that the rest of the sector is clean. For its sake, it had better be right, but many experts fear this is not the case.

The state’s banks have assets under management 17 times bigger than the economy, and the sector accounts for a fifth of GDP – almost all of the rest is from tourism. Were its banks to get into trouble, Andorra, which is not a member of the eurozone but uses the single currency on an informal basis, would have no way of bailing them out. In short, the country faces a catastrophe if its banks fall apart. The crisis is a classic example of how countries seeking to welcome financial services by promising a hands-off approach to regulation, can become dangerously vulnerable to them.

Andorra’s exposures to its banks provoke echoes of Iceland and Cyprus – both of which suffered painful economic crises when their lenders fell into trouble. But unlike Cyprus, which received a last-minute bail-out, Andorra has no central bank to act as a lender of last resort: if its banks go under, it goes under...The crisis has now led Standard & Poor’s, one of the three major ratings agencies, to downgrade the value of the principality’s sovereign debt.

AND THERE'S STILL MORE

Demeter

(85,373 posts)It’s tough to keep up with the conspiracy theories that run rampant from day to day in the hallowed halls of Congress. But one that is gaining traction is that the U.S. Treasury Department’s Financial Stability Oversight Council (whose acronym is pronounced F-SOC) is the handmaiden of an international finance cabal and is obediently marching to its beat instead of the mandates of Congress. These suspicions were on display at the Senate Banking Committee hearing last Wednesday and the House Financial Services Committee hearing the week before where U.S. Treasury Secretary Jack Lew, who Chairs F-SOC, was pummeled with thinly veiled, and not so thinly veiled, accusations.

F-SOC was created under the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. It is charged with the early identification of emerging risks to the financial system. Every major regulator of Wall Street banks has a seat...The conspiracy theory that foreign hot shots are really controlling decisions at F-SOC is not without roots. The international equivalent of F-SOC is the Financial Stability Board, which is run by a Plenary of central bankers and finance ministers from around the globe, along with organizations like the International Monetary Fund (IMF), World Bank and Basel Committee on Banking Supervision. The United States has three members on the Plenary: Nathan Sheets, the Undersecretary for International Affairs at the U.S. Treasury; Daniel Tarullo, a member of the Board of Governors of the Federal Reserve; and Mary Jo White, Chair of the SEC. Mark Carney, the Governor of the Bank of England is the current Chair of the Financial Stability Board.

The simmering conspiracy took wings on February 5 of this year when Mark Carney issued what appeared to be marching orders from the Financial Stability Board to G20 members, which includes the United States. One portion of the document reads as follows:

This certainly sounds like the FSB is calling the shots. At the Senate Banking hearing on Wednesday, it became clear that the conspiracy theory has spread to at least one trade group, the American Council of Life Insurers. Gary Hughes, the Executive Vice President and General Counsel of the trade group submitted written testimony that included this excerpt:

“The U.S. Department of Treasury and the Federal Reserve Board are both important participants in the FSB, which in 2013, issued an initial list of insurance companies that the organization considered to be ‘global systemically important insurers.’ AIG, Prudential, and MetLife were all on the FSB’s list. Those companies’ designations as SIFIs should have been based on the statutory requirements of the Dodd-Frank Act, which differ meaningfully from the standards FSB has said it applies. Yet, there is ground for concern that leading participants in FSOC were committed to designating as systemic under Dodd-Frank those companies that they had already agreed to designate as systemic through the FSB process. FSOC should not be outsourcing to foreign regulators important decisions about which U.S. companies are to be subject to heightened regulation…”

The conspiracy theory that an international financial cabal is supplanting the legislative will of Congress has an important competing theory. That is, that a Wall Street cabal of lobbyists, deep-pocketed bank CEOs and hedge fund billionaires are pulling the strings in our Congress behind a dark curtain. The fact that Citigroup was able to gut a key portion of Dodd-Frank’s reform of derivatives recently by sneaking the measure into a critical funding bill to keep the government operating, would appear to prove the point.

And there is yet a third theory. This one goes like this: Wall Street is perceived by our foreign allies to so completely control Congress that foreign financial markets simply do not trust U.S. regulators to rein in Wall Street abuses or prevent another systemic financial collapse. The Financial Stability Board feels it must look over Wall Street’s shoulder because it can’t trust Congress or the Federal Reserve to do their job.

Demeter

(85,373 posts)Kristi Culpepper is a state government official with the Commonwealth of Kentucky. She handles the structuring and sale of bonds for schools across the state among other things. This post originally appeared on Kristi's excellent Tumblr. You can also follow her on Twitter.

(Editor’s note: The City of Chicago Mayor's office did not respond to multiple calls and emails seeking comment on the matter.)

This article explains that the City of Chicago has concealed how it has dealt with its budget gap over the past decade. The city failed to cut its recurring expenditures to match its recurring revenues after it blew through its reserve funds. Instead, two administrations have:

- Used long-term debt to finance everyday expenses and maintenance;

- Used long-term debt to finance judgments and settlements, including police brutality cases, and retroactive wage increases and pension contributions for its unionized employees;

- Restructured the city’s existing debt to extend the maturities on its bonds far out into the future in order to avoid having to pay the debt as it was coming due;

- Borrowed more money than it needed in order to make payments on the bonds its was issuing to avoid debt service expenses, essentially using debt to pay debt; and

- Possibly used the city’s portfolio of interest rate derivatives as an ATM.

State and local governments typically issue bonds to finance the construction of buildings and infrastructure that will benefit residents for generations. This article explains how Chicago residents have billions of dollars of debt and nothing to show for it.

***

Chicago made headlines at the end of February after Moody’s downgraded the city’s general obligation bond rating to Baa2. Moody’s has cut Chicago’s rating five notches in less than two years. This downgrade, however, placed the city’s credit below the termination triggers on some of its outstanding interest rate swaps. The city has been working to renegotiate the terms of those contracts with its counterparties. If Chicago’s general obligation rating falls below investment grade, the city’s credit deterioration will become a self-fulfilling prophesy. The city risks nearly $400 million of swap termination payments and the acceleration of its $294 million of outstanding short-term debt. Unsurprisingly, some of Chicago’s bonds are already trading at junk levels... That said, the rating agencies and most other market participants still appear to be light years away from understanding the true scope of Chicago’s financial problems. The city has a very — well, let’s just call it unconventional — approach to borrowing money and probably should not be considered investment grade.

Some budget history

In order for you to follow my discussion of Chicago’s borrowing shenanigans, it is necessary to understand the fiscal machinery behind its bond issues. Please be patient with me here. This story will blow your mind shortly...Chicago’s budget is divided into seven different fund classifications, but only three funds are relevant to our narrative: the Corporate Fund, Property Tax Fund, and Reserve Funds.

There has been a structural gap in Chicago’s Corporate Fund budget since at least 2003. Although most governments are required to balance their budgets on a cash flow basis each fiscal year, a structural budget gap can arise when recurring expenditures are greater than recurring revenues. Some of the city’s offering documents suggest that this gap is a legacy of the last economic downturn, but in reality the gap pre-dates the economic downturn by several years. The impact of economic downturns on tax collections tends to have a considerable lag anyway...So, Chicago’s structural budget gap is a political, not economic, creature. Rather than cut expenditures to a level that could be supported by recurring revenues, the city mostly used non-recurring resources to fill the gap from one fiscal year to the next. This is not surprising. Most of Chicago’s Corporate Fund budget goes to salaries and benefits for its employees, and 90% of the city’s employees belong to around 40 different unions. Attempts to adjust expenditures tend to have well organized opposition.

Between fund transfers and drawing down its reserves, the city blew through its financial cushioning quickly. The $326 million budget stabilization fund was exhausted by 2010. From 2009 to 2011, the city used $320 million from the Metered Parking Reserves. The city’s budget gap was at its widest in the wake of the last economic downturn, at over $600 million.

Chicago’s dysfunctional debt program

Now things start to get interesting. Transfers from reserves and other funds have not been the only means Chicago officials (across administrations) have devised to subsidize the city’s Corporate Fund. The city has effectively been using its general obligation bond offerings and interest rate derivatives to accomplish the same thing.

AND IT GOES ON AND ON AND ON....LIKE DETROIT, WITHOUT KWAME.

Demeter

(85,373 posts)Startups and tech companies will sometimes offer Stanford students as much as $500,000 in compensation right out of school. But all the Stanford students we spoke with insisted that they would never take a job just because it pays more. Hired.com CMO Tyler Willis says that 80% job applicants don’t end up accepting the highest offer. So if it isn’t money, what do Stanford students care about?

Here’s what they told us:

MattSh

(3,714 posts)to have those types of choices.

It took me a good couple of years before I got something that resembled the beginnings of a career. Didn't help that I graduated into the Reagan recession.

DemReadingDU

(16,000 posts)Oh, it is the Friday before Easter, silly me.

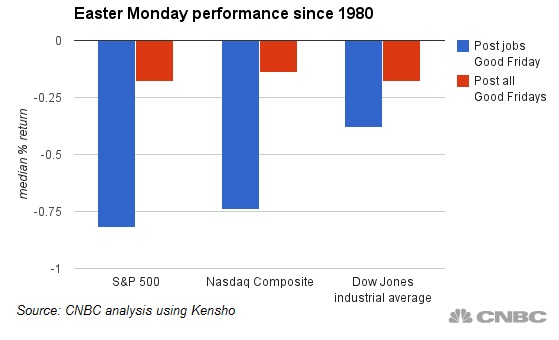

4/2/15

Markets are closed on Good Friday, and the Monday afterwards is historically the S&P 500's worst post-holiday trading session. When the key monthly jobs report comes out on that Friday, stocks perform even more poorly.

more...

http://www.cnbc.com/id/102558165

MattSh

(3,714 posts)forgot all about that. But in my part of the world, Easter comes on the 12th this year. Better than last year, though. Last year it was May 4th!

![]()

Demeter

(85,373 posts)See you in the morning!

Demeter

(85,373 posts)Consider the following scenario, one that has played out time and again in emerging-market countries. Local banks and firms go on a borrowing binge and pile up dollar-denominated debt – debt that pundits consider perfectly sustainable, as long as the local currency is strong. Suddenly, something (an increase in United States interest rates, a drop in commodity prices, a domestic political conflict) causes the local currency to drop in value against the dollar. The debt burden, measured in domestic currency, is now much higher. Some borrowers miss interest payments; others are unable to roll over principal. Financial mayhem ensues.

This is how the Latin American debt crisis of the 1980s, the Mexican Tequila crisis of 1994, the Asian debt crisis of 1997, and the Russian crisis of 1998 unfolded. It was also how the financial crisis of 2008-2009 transmitted itself to emerging markets. Every time, borrowers and lenders claimed to have learned their lesson.

Not only could it happen again today; it could happen on a much larger scale than in the past. Taking advantage of ultra-low interest rates in advanced countries, emerging-market banks and firms have been borrowing like never before. A recent paper by the Bank of International Settlements shows that since the global financial crisis, outstanding dollar credit to non-bank borrowers outside the US has risen by half, from $6 trillion to $9 trillion.

The bulk of that debt is in Asia, with China alone accounting for approximately $1 trillion. Other big dollar borrowers include Brazil (over $300 billion) and India ($125 billion). Countries such as Malaysia, South Africa, and Turkey, plus Latin America’s more financially open economies, also have rising foreign-currency debts.

Read more at http://www.project-syndicate.org/commentary/emerging-market-debt-crisis-by-andres-velasco-2015-03#pOxbSKFKGXzXCqfB.99

MattSh

(3,714 posts)I think I’ve never understood the American – and international – fascination with money, with gathering wealth as the no. 1 priority in one’s life. What looks even stranger to me is the idolization of people who have a lot of money. Like these people are per definition smarter or better than others. It seems obvious that most of them are probably just more ruthless, that they have less scruples, and that their conscience is less likely to get in the way of their money and power goals.

America may idolize no-one more than Warren Buffett, the man who has propelled his fund, Berkshire Hathaway, into riches once deemed unimaginable. For most people, Buffett symbolizes what is great about American society and its economic system. For me, he’s the symbol of everything that’s going wrong.

Last week, Buffett announced a plan to merge a number of ‘food’ companies in a deal he set up with Brazilian 3G Capital. For some reason, they all have German names (I’m not sure why that is or what it means, if anything): Heinz, Kraft, Oscar Mayer. Reuters last week summed up a few of the ‘foods’ involved:

His move on Wednesday to inject Velveeta cheese, Jell-O, Lunchables, Oscar Mayer wieners, and Kool-Aid into his portfolio, stuffs an already amply supplied larder. The additions came from the acquisition of Kraft Foods Group Inc by H.J. Heinz Co, which is controlled by 3G Capital and Buffett’s Berkshire Hathaway. His larder already included everything from Burger King’s Triple Whopper burgers, Coca-Cola soft drinks and Tim Horton donuts to See’s Candies and Dairy Queen icecream Blizzards, as well as such Heinz brands as Tomato Ketchup, Ore-Ida fries, bagel bites and T.G.I. Friday’s mozzarella sticks.

Isn’t it curious to see that once people have more than enough to eat, they sort of make up for that by drastically lowering the quality of their food, like there’s some sort of balance that needs to be found? Give them more than plenty, and they’ll start using it to poison themselves.

Complete story at - http://www.theautomaticearth.com/2015/04/warren-buffett-is-everything-thats-wrong-with-america/

Oh oh. Attacking the Wizard of Wichita. Or is it the Oracle of Omaha?

Demeter

(85,373 posts)I think the changing food market is reflected in this merger.

A new independent grocery just opened up in Yuppieville Ann Arbor.

Half the store is "nutraceuticles" the latest fads in health/nutrition. None of these can be classified as food or medicine...but, whatever.

Then there's the buffet...for those that don't-can't-won't cook for themselves.

Then there's some actual groceries--off brands and prices--and produce.

And an extensive wine selection!

I didn't buy a thing, and I won't be back. Like this town needs another Trader Joe's, Whole Foods, Plum Market (and we have several of each already). I give it a year, maybe two.

And the reason all the brands are "German" is that the US is/was dominated by people from Germany, especially in the Midwest, so they developed food processing and put their German names on it... good solid food for farm work....

MattSh

(3,714 posts)Jerk from Joisey is a rotating position. And you don't have to be from Joisey to qualify for the position.

I know. I spent many years in Joisey!

Demeter

(85,373 posts)A hotel owner in Arkansas fired an employee after she spoke to the Washington Post's Chico Harlan about the state's 25 cent wage hike last month.

Harlan writes this week that Shanna Tippen, who at the time of the original story worked at a Days Inn in Pine Bluff, Arkansas, notified him that she had been fired from her job after she told Harlan that "the minimum wage hike would bring her a bit of financial relief, but it wouldn’t lift her above the poverty line."

The worst part? Tippen's boss, Herry Patel, reportedly spoke to Harlan and asked Tippen to also speak with him. But when the Post story came out, Patel fired Tippen for what she said. From Harlan's article Monday:

Several days later, after I’d spent additional time with Tippen, Patel called me and threatened to sue if an article was published. Tippen, though, felt it was important to tell her story; she said many people shared her experience earning the minimum, and she had nothing negative to say about her employer.

Tippen is now living off her tax refund and desperately seeking employment, according to Harlan.

Read more: http://www.businessinsider.com/worker-fired-for-talking-about-the-minimum-wage-2015-3#ixzz3WFBmw3FY

Demeter

(85,373 posts)...US consumers stayed indoors February, and in much of the country, no one would blame them. Still, a disappointing showing for the largest segment of the US economy can’t be all chalked up to weather.

Consumer spending crept up just 0.1 percent in February, slightly more disappointing than the 0.2 percent uptick analysts were expecting, according to data released Monday by the Commerce Department. It was the first positive reading in two months; January and December both recorded a 0.2 percent slide.

When adjusted for inflation, it was the first overall decline in consumer spending in nearly a year, setting up a disappointing first quarter of the year after a very strong end to 2014. The results were “indicative of a very slow rate of gain in consumer spending in the quarter as a whole even if there is a rebound in March due to February (presumably) having been affected by extremely harsh weather in many areas,” MFR Inc. economist Josh Shapiro wrote in an e-mailed analysis...

Demeter

(85,373 posts)Is the foreclosure crisis over? Yes and no. Since 2007, about six million homes have been sold at foreclosure sales (Foreclosures Public Data Summary Jan 2015). Today, about one million homes are still somewhere in the foreclosure process. Homeowners behind in their payments have declined from 15% at the 2010 peak of the crisis to less than 8% now (MBAA delinquent plus in foreclosure at 12/31/14). Most of the still-troubled loans were originated before 2007. The best news is that new foreclosure starts are now down to pre-crisis levels, at less than one-half of one percent of all mortgages, if we take 2006 to be the pre-crisis level.

So new home loans, those made since 2008, are doing very well, and what remains is the legacy of those bad loans that triggered the crisis, right? Not exactly.

THE COMMENTARY IS NOT SO CONFIDENT...MORE AT LINK

Demeter

(85,373 posts)Demeter

(85,373 posts)Iceland's government is considering a revolutionary monetary proposal - removing the power of commercial banks to create money and handing it to the central bank. The proposal, which would be a turnaround in the history of modern finance, was part of a report written by a lawmaker from the ruling centrist Progress Party, Frosti Sigurjonsson, entitled "A better monetary system for Iceland"....The report, commissioned by the premier, is aimed at putting an end to a monetary system in place through a slew of financial crises, including the latest one in 2008.

According to a study by four central bankers, the country has had "over 20 instances of financial crises of different types" since 1875, with "six serious multiple financial crisis episodes occurring every 15 years on average". Mr Sigurjonsson said the problem each time arose from ballooning credit during a strong economic cycle. He argued the central bank was unable to contain the credit boom, allowing inflation to rise and sparking exaggerated risk-taking and speculation, the threat of bank collapse and costly state interventions. In Iceland, as in other modern market economies, the central bank controls the creation of banknotes and coins but not the creation of all money, which occurs as soon as a commercial bank offers a line of credit. The central bank can only try to influence the money supply with its monetary policy tools.

Under the so-called Sovereign Money proposal, the country's central bank would become the only creator of money. Banks would continue to manage accounts and payments, and would serve as intermediaries between savers and lenders.

Mr Sigurjonsson, a businessman and economist, was one of the masterminds behind Iceland's household debt relief programme launched in May 2014 and aimed at helping the many Icelanders whose finances were strangled by inflation-indexed mortgages signed before the 2008 financial crisis.

"Crucially, the power to create money is kept separate from the power to decide how that new money is used," Mr Sigurjonsson wrote in the proposal.

"As with the state budget, the parliament will debate the government's proposal for allocation of new money," he wrote.

Demeter

(85,373 posts)Greece has decided to up the ante in its negotiations with the Troika. The open question is whether the latest move, the press leak via Ambrose Evans-Pritchard at the Telegraph that Greece will miss its April 9 payment to the IMF so that it can continue to make pension payments, and has started to make plans to issue the drachma, are game-changers that Greece hopes they will be. The sources that spoke to Evans-Pritchard said that the government would be out of funds on April 9, the IMF due date. Note this is earlier than the most recently leaked drop-dead date of April 20. The Greek government cannot make that payment and also make pension and government salary payments due April 14. Keep this in mind:

Investors have recognized that a Grexit was a possible outcome; indeed, the financial press was treating it as a far more likely outcome than the political press. With Greece running out of money, discussion of that possibility increased last week, with Warren Buffett even saying a Grexit could be good for the eurozone versus serious pundits like Martin Wolf warning that a Grexit would pave the way for other countries to leave. But even Wolf held out the option of a managed Grexit so as to reduce the dislocation. So the idea that Greece might leave is hardly news. And Greece has made veiled threats officially, along the lines of, “We can only be pushed so far.” The question is whether the markets have really priced that in, since an adverse market reaction would give Greece more leverage. Despite the dramatic sound of invoking the “d” words, so far, this is a bluff. Read the first paragraph of the Telegraph account:

If you read the article, Greece has yet to take a single concrete step towards issuing drachma, the most important being to impose capital controls.

Market reactions will be influenced by Eurocrat actions and messaging. Here Greece has given the officialdom a full four days, since Friday and Monday are holidays in non-Christian Orthodox Europe, to plan a response. No developed economy has defaulted on the IMF, but the flip side is IMF payment dates are loose. In fact, the Telegraph reports that it is a full six weeks after a non-payment before Greece would be declared to be in technical default, so the April 9 date is not an event horizon. Moreover, Greece was already up against an end-of-month deadline to conclude its bailout fund negotiations, so missing the payment in and of itself does not change the overall timing parameters. Note some analysts worry that there could be more serious knock-on effects. For instance, we have this dire take in the Ambrose Evans-Pritchard account:

Since it highly unlikely operationally, given the long weekend, for the Troika to approve the reforms and then get Eurogroup approval to release the bailout funds, it seems more likely that the IMF would determine what sort of short-term fudge it needed to engage in so as not to trigger a default under the EFSF. Again, since there were doubts that Greece would be able to make all of its March IMF payments, it may well be that some “extend and pretend” gambit has already been pre-planned...The leak will accelerate the bank run. One correspondent pointed out in February that anyone who was keeping deposits in Greek banks was a fool. Those who relied on the government statements that they were committed to remaining in the Eurozone will be forced to reassess, and if they have an operating brain cell, will drain their accounts.

MORE ANALYSIS, BUT NO CONCLUSIONS, AT LINK

Demeter

(85,373 posts)One of the things we’ve stressed is that the Greek government’s repeated claims that it is submitting an anti-austerity reform package is untrue. The Greek government committed to achieving a fiscal surplus of 1.0% to 1.5% and has separately said it will always run a fiscal surplus. We have stressed that running a fiscal surplus is an economic dampener, and is even more damaging in a severely depressed economy like Greece.

One could argue that Greece still got a win in the Eurogroup memo of February, in which the agreement stated that the fiscal surplus target for 2015 would be reassessed in light of current conditions. Most observers took that to mean that the scheduled increase to 3.0% was officially off the table, and that that was an important success for Greece. Mind you, the 3.0% goal was widely recognized as unrealistic, but Greece was relieved of the need to make concessions to have it reassessed. But is also important to recognize that this was a qualified gain, since the 1.0%-1.5% target is still austerian.

Greece submitted a new version of its structural reform package yesterday. Peter Spiegel of the Financial Times received a copy and reported on it. His article focused on the state of play, that while the working relations between the two sides is improving, the creditor side still sees the draft as needing a lot of work before anyone can make a decision. The International Business Times reports that its sources say Spiegel’s recap of the latest document is accurate.

From my perspective, Spiegel held a real stunner back till close to the close of his article:

So if the Greeks are negotiating in good faith, they are committing themselves to more austerity within 48 hours of Tsipras telling the Greek parliament he would not agree to recessionary measures. I suppose that it technically accurate. He’s volunteered to implement them instead...

Demeter

(85,373 posts)Inside the five-month-old union between monetary policy and financial oversight at the European Central Bank, nerves are beginning to fray.

As officials under ECB President Mario Draghi seek to replace deposits fleeing Greek banks without blatantly financing the state, the efforts of the institution’s new Single Supervisory Mechanism to do its part are riling the old guard. Central bankers say they are concerned that overly-strict orders to lenders could worsen the Greek turmoil.

After building an institutional pillar that has supervised the euro area’s largest banks since November, the ECB is now facing one of the worst flare-ups in six years of sovereign-debt crisis. Officials must work out how to align their two policy arms in a way that can find a path through the Greek turmoil and set a template for handling banking turbulence to come.

Just as those U.S. policy makers in the 2008 financial crisis had to choose between the moral hazard of bailing out banks and the economic chaos of watching them fail, European officials are trapped between giving in to Greek cash demands and the political debacle of letting the country leave the euro...

Demeter

(85,373 posts)Just when it seemed that worries about debt and deficits were fading, the geniuses in Washington, D.C., are chomping at the bit to undo the little progress we’ve made.

President Obama and Congressional Republicans both have proposed budgets that would circumvent spending limits imposed after the 2011 debt-ceiling crisis.

Throw in an October deadline for a fiscal 2016 budget and another proposed increase in that very same debt limit, and Chris Krueger, senior policy analyst for Guggenheim Partners in Washington, warns we could have a full-blown “fiscal fiasco” by fall — just as the 2016 presidential election heats up.

“Any one of these issues is going to be complicated,” Krueger told me in a telephone interview. “You’re going to be adding all these [complications] to a situation that’s going to be very volatile.”

This could mark the end of a brief fiscal hiatus during which deficits have dropped dramatically...

MORE

EVIDENTLY, THE ZOMBIE "SEQUESTER" STILL LIVES...

Demeter

(85,373 posts)Fannie Mae will begin bulk auctions of mortgages, including some sales targeted for non-profit groups and small investors, as the company moves to cut the number of non-performing loans on its books.

“These transactions are intended to reduce the number of seriously delinquent loans that Fannie Mae owns, to help stabilize neighborhoods and to offer borrowers access to additional foreclosure prevention options,” Fannie Mae Senior Vice President Joy Cianci said in a statement Thursday. “Our goal is to market these loans to a diverse range of buyers.”

The Federal Housing Finance Agency, which has overseen U.S. conservatorship of Freddie Mac and Fannie Mae since 2008, is requiring the companies to reduce the number of severely delinquent loans on their books this year. In March, the agency released a set of new rules for the sale of troubled mortgages. Freddie Mac has auctioned about $2 billion in defaulted debt in three separate sales since last year. Fannie Mae’s first sale will happen “in the near future,” the company said. FHFA will require prospective investors to prove they’ve retained a loan servicer with a track record of handling delinquent debt, the agency said in a March 2 statement. Servicers also will have to offer aid to avoid foreclosures as a condition of sale.

Demand for soured mortgages has been increasing as Wall Street firms compete to buy loans at a discount after a real-estate market rebound. Investment firms including Lone Star Funds, Bayview Asset Management LLC and Selene Finance LP have been some of the biggest buyers of delinquent home loans.

MattSh

(3,714 posts)[url=https://flic.kr/p/9B7MDM][img] [/img][/url][url=https://flic.kr/p/9B7MDM]

[/img][/url][url=https://flic.kr/p/9B7MDM]

Easter Eggs, Kiev[/url] by [url=https://www.flickr.com/people/76583692@N00/]Matt. Create.[/url], on Flickr

[url=https://flic.kr/p/nekTBM][img] [/img][/url][url=https://flic.kr/p/nekTBM]

[/img][/url][url=https://flic.kr/p/nekTBM]

Easter Color Explosion[/url] by [url=https://www.flickr.com/people/76583692@N00/]Matt. Create.[/url], on Flickr

[url=https://flic.kr/p/e5XvHc][img] [/img][/url][url=https://flic.kr/p/e5XvHc]

[/img][/url][url=https://flic.kr/p/e5XvHc]

Big Eggs (2)[/url] by [url=https://www.flickr.com/people/76583692@N00/]Matt. Create.[/url], on Flickr

The first two were taken, not surprisingly, right around Easter. The third one was taken in September (!).

My Photostream @ Flickr: https://www.flickr.com/photos/mattsh/

Demeter

(85,373 posts)Last edited Fri Apr 3, 2015, 01:41 PM - Edit history (1)

I have the equipment (primitive) but have never had the time...

Is there a significance for the blue dye? I haven't ever seen so much blue before...

MattSh

(3,714 posts)is that blue is one of the colors of the Ukrainian flag.

Of course, pysanky predates the current Ukrainian flag by many many years...

DemReadingDU

(16,000 posts)I have no patience to create such beautiful art

MattSh

(3,714 posts)“Those who fail to learn from history are doomed to repeat it”? Sure, I knew you could!

On Hitler's Birthday, US to Begin Openly Training Neo-Nazi Integrated Forces in Ukraine

Posted on April 2, 2015 by Robert Barsocchini

The US has long be openly coordinating with, advocating for, and supporting neo-Nazi and neo-Nazi integrated forces in Ukraine.

.....

In 2012, the EU officially designated Svoboda, the militant group led and co-founded by Tyahnybok, as an anti-democratic, “racist”, “anti-Semitic” group, and the World Jewish Congress designated it a “neo-Nazi” group.

In a leaked phone call, Nuland was caught determining who should assume the post of prime minister after the Ukrainian coup d’etat was completed, or, in Nuland’s term “midwifed”. She picked Yatsenyuk, and, indeed, he took the position after the coup. Nuland suggested that he should meet with Tyahnybok “four times a week”.

For his part, also exhibiting a Nazi-influenced outlook, Yatsenyuk later wrote on a government website:

“They lost their lives because they defended men and women, children and the elderly who found themselves in a situation facing a threat to be killed by invaders and sponsored by them subhumans. First, we will commemorate the heroes by wiping out those who killed them and then by cleaning our land from the evil”

Complete story at - http://www.washingtonsblog.com/2015/04/hitlers-birthday-us-begin-openly-training-neo-nazi-integrated-forces-ukraine.html

Demeter

(85,373 posts)http://www.cnbc.com/id/102559607

U.S. stocks will likely plummet on Monday, especially with the disappointing March jobs report. Markets are closed on Good Friday, and the Monday afterwards is historically the S&P 500's worst post-holiday trading session. When the key monthly jobs report comes out on that Friday, stocks perform even more poorly.

More downward momentum will likely come from the March nonfarm payrolls report that showed an increase of just 126,000 jobs, far below Reuters' expectations of 245,000.

Futures turned sharply negative, with the Dow futures off more than 160 points, after the data release.

Analysis using the quantitative tool Kensho showed the three major indices declined much more on Mondays following the release of jobs numbers on a Good Friday.

MORE HAND-WRINGING AT LINK

http://www.cnbc.com/id/102559806

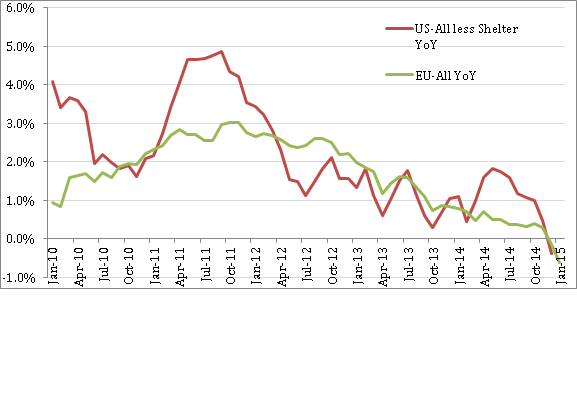

We can probably all agree that the U.S. economy has not been growing like gangbusters in the first quarter of 2015. Some have tried to find a silver lining in the jobs data in recent months, but in March the nonfarm payrolls report emerged as the most lackluster indicator of all.

Despite calls for the Federal Reserve to start normalizing monetary policy by hiking interest rates this year, the data indicates maybe the Fed shouldn't be so trigger happy.

This week has been a real doozy for U.S. data. The personal savings rate hit multi-year highs at 5.8 percent in February, showing that Americans are not spending the savings that they are accruing at the pump. The ISM Manufacturing index reached 51.5 in February, reflecting the slowest growth in the manufacturing sector we've seen since mid-2013. The Federal Reserve's current favorite metric of inflation, core PCE (personal consumption expenditure minus oil and food) was up 0.1 percent in February compared with January, but it was down 0.1 percent on a real basis (in chained 2009 dollars).

Nothing surprised more on the downside than this morning's jobs data though. One data point does not make a trend, but looking through the headline figure for the number of jobs we've been adding in the U.S. over the past few months, I'm still hugely underwhelmed. If we continue to mainly add low-wage jobs, then we're just throwing a handful of sand into the lake and expecting a big splash. Most of the jobs that we are adding have been in the services sectors, where wages tend to be much lower than in goods-producing industries. As long as we are adding new low-wage jobs, there will be little upward pressure on wages. Giving workers at McDonald's owned stores, Target and TJMaxx a raise looks nice back at headquarters and helps on the margins, but is not enough to move the dial on overall wage growth across the country....

In fact, if one were to calculate inflation via the consumer price index (CPI) in the United States using the same methodology used in the European Union, prices are falling, not rising (See Figure 1). For all the panic about deflation in Europe, it turns out the U.S. isn't all that far behind.

MORE

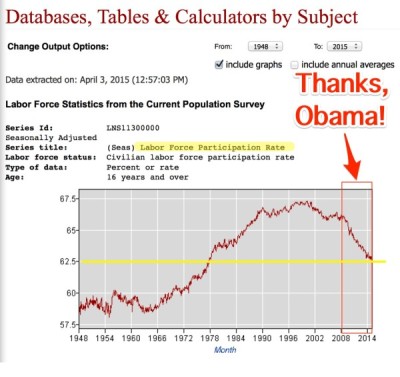

Demeter

(85,373 posts)Corresponding with the national increase in Americans not in the workforce the number of women, African Americans, and Asians not in the workforce also experienced an increase in March. According to data released Friday by the Bureau of Labor Statistics, 56,131,000 million women were not in the labor force last month, an increase of more than 100,000 from February when 56,023,000 women were not in the workforce. The level is a record high, and the labor force participation for the month of March at 56.6 percent is a 27-year low, according to CNS News. In February that rate for women was 56.7 percent.

People not in the labor force are defined as those 16 years and older who are not employed and have not “made specific efforts to find employment sometime during the 4-week period ending with the reference week.” The unemployment rate for women did decline, from 5.4 percent to 5.3 percent.

The number of African Americans not in the labor force also experienced a slight increase in March to 12,202,000 from 12,122,000 in February. And the labor force participation rate also took a slight dip from 61.2 percent to 61.0 percent. African American unemployment also remained high at 10.1 percent, but did decline from 10.4 percent in February.

Asians experienced a slight uptick in the population not in the work force as well, with 5,363,000 in March, compared to 5,253,000 in February. And their participation rate also declined from 63.2 percent in February to 62.5 percent in March. Asian unemployment was down to 3.2 percent in March, from 4.0 percent in February.

The Latino population was one group that saw a decline in the number of people not in the workforce, with 13,236,000 in March, compared to 13,282,000 in February. The participation rate increased as well, with 66.3 percent in March compared to 66.2 percent last month. The unemployment rate increased from 6.6 percent to 6.8 percent in March.

And the unemployment rate for teens, ages 16-19, also experienced an increase in March up 17.5 percent, from 17.1 percent in February. Teenage males had a higher unemployment rate than their female counterparts 19.8 percent to 15.2 percent respectively. Indeed while teenage male unemployment jumped in March from 17.8 percent in February, females experienced a dip in employment from 16.4 percent in February.

Nationally number of people not in the labor force also reached a record high of of 93,175,000 and the unemployment rate remained at 5.5 percent.

Demeter

(85,373 posts)The U.S. job market is on the mend but boomer workers are probably being left behind. Workers aged 45 to 70 who lose a job face steep challenges in finding new work — and even when they do find a job, it’s often at lower pay and with fewer benefits than they enjoyed before, according to a new survey by AARP, published Monday. Fully 50% of the people surveyed — respondents were 45- to 70-years old and had been unemployed at some point in the past five years — were still unemployed or had dropped out of the workforce, according to the survey of 2,492 people.

Twenty percent of those surveyed had two spells of unemployment in the previous five years and 23% had three or more bouts of unemployment in that time. (AARP didn’t release data on income and occupation.) “Long after the Great Recession, too many 50-plus workers who want to work are still unemployed, and once unemployed it takes them longer on average to find jobs than younger job seekers,” said Jo Ann Jenkins, president of AARP, in a news conference in Washington. That’s despite a relatively strong labor market. In 2014, job growth hit its fastest pace since the late 1990s, with the U.S. economy adding an average of about 250,000 jobs each month, according to data cited by Heidi Shierholz, chief economist with the U.S. Labor Department, in a presentation at the AARP conference.

Older workers do enjoy a lower unemployment rate: 4.4% for workers age 65 and over, compared with 5.5% for the U.S. market overall, according to February data from the Bureau of Labor Statistics. The problems start if and when they lose their jobs.

“Older workers are less likely to become unemployed, but if they are unemployed they are more likely to get stuck in unemployment for long periods,” Shierholz said. “We are potentially seeing the fingerprints of age discrimination here.”

When asked about barriers to finding work, 57% of the job seekers surveyed by AARP said “employers think I am too old.” But 71% pointed to a lack of available jobs and 60% said that being tied to a specific geographic area hampered their job search. Other factors also are in play, Shierholz said. “Older workers spend a long time developing specific skills and experience” — that means it can take them longer to find a match. Even if they find work, often it’s not as good a job as they left behind, according to the AARP survey. Fully 48% of the job seekers who had found work said they were earning less money than before. And older job seekers who found work were twice as likely to be working part time than older workers who had not been hit by recent unemployment. Among the re-employed older workers, 34% were working part time, compared with 16% among all workers age 45 to 70.

“A lot of these folks, although they are working which is certainly better than not working, they are doing so at jobs that are not as good as the jobs they had before they became unemployed,” said Gary Koenig, a co-author of the report and vice president of the AARP Public Policy Institute.