Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 4 May 2015

[font size=3]STOCK MARKET WATCH, Monday, 4 May 2015[font color=black][/font]

SMW for 1 May 2015

AT THE CLOSING BELL ON 1 May 2015

[center][font color=green]

Dow Jones 18,024.06 +183.54 (1.03%)

S&P 500 2,108.29 +22.78 (1.09%)

Nasdaq 5,005.39 +63.97 (1.29%)

[font color=red]10 Year 2.11% +0.04 (1.93%)

30 Year 2.83% +0.04 (1.43%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,862 posts)

I'll also be watching to see how Bernie Sanders' candidacy affects the politico-economic comic scene. It may get very interesting.

Hugin

(33,162 posts)So, it's a wash.

Demeter

(85,373 posts)Anyone hoping the recovery in oil prices is here to stay could be in for a rude awakening, as prices could fall below $50 a barrel on a glut of supply, a commodities expert warned on Monday.

U.S. West Texas Intermediate (WTI) and Brent crude oil hit six-year lows in January, but have recovered somewhat on the back of a decline in U.S. rig counts and geopolitical tensions in the Middle East, which has taken supply out of the market.

Eugen Weinberg, head of Commodity Research at Commerzbank, told CNBC Monday that while he wouldn't rule out further price rises, the rally in oil prices was "premature." He added that the price of U.S. crude could fall below $50 should the rally stall. "I wouldn't be surprised if we saw the current $59 go even below $50, should this rally stall and should we come to this correction," Weinberg told CNBC on Monday. "I think it's more hopes driving the market rather than the real facts. I wouldn't be surprised to see a short-term correction, a strong correction because of all the fundamental data," he said, adding "I think the rally is premature and would be probably looking for the prices (to go more) below $60 in a month's time than above $70, for Brent."

Oil prices came under pressure earlier on Monday, after the latest data from China showed its vast manufacturing sector continued to contract in April, potentially hitting demand from the country for oil.

JUST THE USUAL BLEED-THE-PEOPLE MEMORIAL DAY GASOLINE PRICE PUSH...NOTHING TO SEE, HERE

mother earth

(6,002 posts)Fuddnik

(8,846 posts)May the Fourth be with you!

Demeter

(85,373 posts)And since it's 60F at 7 am, there's a good chance of at reaching at least that high a temperature. Supposedly it was 78F yesterday...I was not out, so I cannot say.

Tomorrow is an election: there are exactly 2 questions on the ballot: raise the state sales tax and approve a local school millage. The polls say opposition to the sales tax is 61%, the millage will probably pass.

But, I will be out of range of a keyboard, so see you all on Weds. Tray not to break anything in my absence (but if you must, make it worth breaking!)

Demeter

(85,373 posts)Even though it's been seven years since the onset of the financial crisis, Americans still haven't forgiven the banks most responsible for the worst economic downturn since the Great Depression.

To be fair, sentiment toward banks in general has improved. In its latest survey of the U.S. retail banking industry, J.D. Power found that customer satisfaction with lenders is at a "record high as banks improve experiences for their customers, reduce problems, and create a better understanding of fees."

The performance of JPMorgan Chase (NYSE: JPM ) serves as a case in point. The nation's biggest bank by assets scored better than the average bank across all nine of the regions in which it operates. It had a particularly strong showing in Florida, where customers gave it a score of 826 out of 1,000, making it the best-performing bank in the Sunshine State.

But despite this general improvement, some banks continue to "fall far short in meeting customer needs," says Jim Miller, director of banking services at J.D. Power. At the top of this list is Bank of America...

MORE

Demeter

(85,373 posts)BLOOMBERG HAS THE MOST CRYPTIC HEADLINES

http://www.bloomberg.com/news/articles/2015-05-03/draghi-starting-euro-bond-buying-turns-out-not-to-be-one-way-bet

The last of the gains made after the start of the European Central Bank’s bond-buying program vanished from the euro-area’s sovereign market last week. In the three months before the quantitative easing started on March 9, Portugal’s bonds earned three percentage points more than the mean for the region as a whole. Portugal, along with its Mediterranean neighbors, then underperformed the group, which on April 30 gave up the last of its QE-fueled gains.

ECB purchases didn’t quite make euro-area debt a one-way bet. A sudden rise in German bond yields last week showed the vulnerability of its euro peers. Investors didn’t like Portugal seeking to lock in lower borrowing costs by selling longer-dated bonds, a strategy that also led to higher yields when Italy attempted it in March.

“Since the ECB started buying bonds, we’ve seen some signs of opportunistic behavior on the part of governments, so generally we’ve seen more supply than expected,” said Elwin de Groot, senior euro-area strategist at Rabobank in Utrecht, Netherlands. “More supply in the periphery, extending maturities and flight to quality because of Greece. This all together has shaped the market.”

The reversal by Europe’s higher-yielding nations came after plenty of bullish momentum. Last month, only four years after getting an international bailout, Portugal’s two-year yields dropped below zero. That meant it had joined an elite group of European nations who charge investors for the privilege of buying their debt today and getting back less when they hold to maturity...Italian 30-year yields dropped to a record 1.78 percent in March, which is about 44 basis points less than the 2015 low on similar-maturity U.S. Treasuries. That was due to abundant liquidity resulting from ECB President Mario Draghi’s effort to pour cash into the real economy via the buying of 1.1 trillion-euro ($1.2 trillion) assets through September 2016.

A danger on the horizon for euro-area bond investors, particularly for the highest-yielding debt, is the ECB reducing asset purchases as the outlook for growth and inflation improves. Draghi has said the program won’t be curtailed before the ECB’s target date...

SNAFU IN THE EUROZONE

Demeter

(85,373 posts)Negotiations between Greece and its international lenders over reforms to unlock remaining bailout aid have made headway and an agreement could be closer this month, a government official said on Sunday. Prime Minister Alexis Tsipras's three-month-old government is under growing pressure at home and abroad to reach an agreement with European and IMF lenders over reforms to avert a national bankruptcy. Talks have been painfully slow as the leftist-led government is resisting cuts in pensions and labour reforms that would clash with its campaign pledges to end austerity.

"There were very important steps made at the Brussels Group (talks) which bring an agreement nearer," the official said, declining to be named.

"All sides aim for an agreement at a Brussels Group level within May."

The talks between technical teams from Athens and EU/IMF/ECB lenders are expected to resume on Monday, the official said after the country's chief negotiators met with Prime Minister Alexis Tsipras. A euro zone official also said there was convergence on some issues but sticking points remained and that talks were expected to continue through Wednesday.

Athens hopes that a successful conclusion of the negotiations at the so-called Brussels Group could lead to recognition of the progress by the Eurogroup of euro zone finance ministers and bring some liquidity relief.

Demeter

(85,373 posts)It’s painful to watch the Greek ruling coalition unwittingly do the creditors’ work by wringing Greece dry of cash more aggressively than Pasok or New Democracy would have dared to. In a desperate bid to buy more time to reach an agreement, the central government has borrowed pension cash and ordered local governments and universities to turn over their deposits to the central bank, ostensibly to serve as short-term borrowings to make IMF payments. But as anyone with an operating brain cell must recognize, if the Greek negotiators fail to come to terms with their creditors to unlock €7.2 billion in bailout funds, this begged and borrowed money will never be coming back. Greece will default in even more desperate straits than it would have otherwise. As we’ve pointed out, the best strategy for the creditors was to keep Greece in the sweatbox. Syriza fails to realize that they are playing right into their counterparties hands.

Even the ruling coalition’s extreme measures appear to be buying only a few days of breathing room. The latest report is that Greece will be able to make a May 6 IMF payment, but the government’s body language is that it really, really, really needs the Eurogroup to approve the release of funds at its May 11 meeting, prior to the next IMF payment date of May 12. But Eurogroup chief Jeoren Djisselbloem ruled that possibility out at the last Eurogroup meeting. And even if the Eurogroup ministers were to have a miraculous change of heart, the need for many of the member countries, particularly Germany, to obtain parliamentary approvals, separately would seem to make it impossible for Greece to get funds in time to make May 12 IMF payment.

Mind you, a default may not be quite as earthshaking as it seems. Rating agencies have indicated they would not lower Greece’s bond ratings to default levels even if Greece misses IMF and/or ECB payments. In theory, that gives the ECB the ability to keep the banking system life support of the ELA going, However, members of the ECB’s governing board have been bloodthirsty noises for some time. Indeed, the ECB has made a new threat, whether to increase the haircuts it makes on the collateral that Greek banks provide to obtain cash under the ELA. The ECB will make a decision on May 6. Given the central bank’s desire not to appear to be the one that decided to strike a fatal blow, it seems more likely that the ECB would instead find a way to tighten the choke chain further, say by issuing strict conditions that Greece would have to meet in order not to have the haircuts increase rather than raise them now and push Greece over the edge.

With this background, it’s hard to fathom the latest public pronouncements of Greek officials. For instance, consider this report from ekathimerini:

As we’ve written, there is no common ground on Syriza’s “red line” issues, such as pension and labor market “reforms” that were part of the old structural reform program that Syriza has made clear it wants to renounce. There’s no reason, given the Greek government’s obviously dire straits, for the Troika and Eurogroup to give an inch...the more Syriza goes all in by extracting every Euro it can find to keep its creditors at bay, the more it commits itself to getting a deal done, no matter how terrible that deal is. If the new government had any thought of defaulting or trying to win an orderly exit, then it would have been much better served, as we’ve argued all along, to impose capital controls and conserve cash. In the wake of the crisis, mortgage borrowers in the US figured out that it was smarter to default with enough funds on hand to be able to put down a deposit on a rental and pay moving costs than to drain all their bank accounts in a futile effort to keep a house they were almost sure to lose, and then find them unable to contend with the consequences. And even the quixotic effort to try to get the Troika and Eurogroup to relent has come at a high cost, independent of the raiding of any and every source of official funds. From the Guardian:

“We are not at the point of outright panic yet but people are clearly very worried,” said Mouriki, a sociologist. “Close to €30bn has been withdrawn by depositors and firms from bank accounts since December which is more that at the height of the crisis in mid 2012.”

But shades of panic have arrived and, indelibly, have begun to reveal themselves in other ways: from the government sequestering the funds of public bodies to help pay bills; to Greek borrowing costs soaring on fears of insolvency; to savers stuffing their freezers with cash and ever more parents encouraging their children to move abroad. “I have come round to accepting that my daughter’s generation is a lost generation,” lamented Panaghiota Mourtidou, sitting in the food pantry she helps run in central Athens. “At 30 there is no chance that she will have any of the certainties that we enjoyed but maybe my grandchildren will. That, now, is my great hope.”

MORE

Demeter

(85,373 posts)Herve Falciani, a former HSBC (HSBA.L) employee who leaked information on the bank's clients and tax situation, told Spanish newspaper El Mundo he had knowledge of other cases and could act again, adding his "work was not done". Falciani previously said that media leaks on HSBC accounts held in Switzerland, which unleashed a public storm around the British bank, were "only the tip of the iceberg", and that tax authorities had access to a lot more data. The former information technology worker at HSBC's Swiss subsidiary hinted in the interview published on Sunday that he could be moved to make more revelations.

"My work is still not done. We're not in a hurry. It's possible that at the end of the year, we'll have the opportunity to act," he said, asked by El Mundo whether he would lift the lid on further tax cases if Spanish authorities did not.

Several high-profile Spaniards have been affected by the Falciani leaks. The International Consortium of Investigative Journalists, which in February coordinated the media release of details of leaked client data, said account-holders included ex-Santander (SAN.MC) Chairman Emilio Botin, who died last year. Spanish authorities are also coming under pressure from opposition parties to reveal which public figures feature on a list of people who signed up to a recent tax amnesty, especially as a general election nears. They have so far said the information is confidential.

"It's only a question of political will to uncover that there is 10 times more than what we discovered at HSBC," Falciani is quoted as saying in the interview.

Falciani told El Mundo he had never worked alone in trying to uncover tax data at HSBC.

"From the beginning, I did everything with the help of others," he said. He added that there were several people within the bank who shared his views and that he had asked for help from contacts he had among police and customs specialists in Montecarlo.

Falciani did not specify what kind of help they had provided.

mother earth

(6,002 posts)the money laundering from outer space (wish I would've copied & saved that line)...it was a helluva statement...it just gets bigger and more outrageous...and it's everywhere.

Demeter

(85,373 posts)TIME TO BREAK OUT THE PITCHFORKS IN NEBRASKA

http://www.bloomberg.com/news/articles/2015-05-02/buffett-says-minimum-wage-increase-isn-t-answer-to-income-gulf

Billionaire Warren Buffett said the level of income inequality in the U.S. is “extraordinary” but that raising the minimum wage isn’t the best solution.

“I don’t have anything against raising the minimum wage but I don’t think you can do it in a significant enough way without creating a lot of distortions,” Buffett, 84, Berkshire Hathaway Inc.’s chief executive officer, said Saturday at the company’s annual shareholders meeting in Omaha, Nebraska. Those distortions “would cost a whole lot of jobs,” Buffett said.

Answering questions alongside Buffett, Charles Munger, 91, Berkshire’s vice chairman, said raising the federal minimum wage, which has been $7.25 an hour since July 2009, “would hurt the poor.”

Some large companies have recently announced plans to raise wages for their lowest-paid workers...MORE

FINE, LET'S RAISE THE TAXES ON THE RICH, BACK TO THE 90% LEVELS OF WWII.

Demeter

(85,373 posts)Posted on May 4, 2015 by Yves Smith

http://www.nakedcapitalism.com/2015/05/ilargi-sucking-spoilt-milk-bloated-dead-sow.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

YVES...the problem isn’t that we don’t have a recovery, it’s that the people who are doing well are politically more powerful than those that aren’t and also are increasingly isolated from the have-nots, so they don’t see or can pretend not to see what is happening on the other end of the food chain...

By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

... both Albert Edwards and Ambrose Evans-Pritchard (not exactly a pair of Siamese twins) remarked this week; that is, excluding the “biggest inventory build in history, the economy contracted sharply”, it’s time for everyone to at long last change the angle from which they view the world, if not the color of their glasses. But ‘everyone’ will resist, refuse and refute that change, leaving precious few people with an accurate picture of the – economic – world. Still, for you it’s beneficial to acknowledge that very little of what you read holds much, if any, truth or value. This is true when it comes to politics, geopolitics and economics. That is, the US is not a democracy, it is not the supreme leader of the world, and the American economy is not in recovery. Declining business investment, a record inventory build and extreme borrowing to hold share prices above water through buybacks, it all together paints a picture of a very unhealthy if not outright dying economy, and certainly not one in which anything at all is recovering. But how are you supposed to know? The entire financial media should change its angle of view, away from the recovery meme (or myth), but the media won’t because the absurd one-dimensional focus on that perpetuated myth is the only thing that makes the present mess somewhat bearable, palatable and, more importantly, marketable, to the general public. This has the added simultaneous benefit of keeping that same general public from understanding how sinister the myth really is; it can only be upheld by greatly increasing the debt levels which burden their shoulders, in hidden ways. If the media can no longer keep the consequences of the debt increases hidden, the game is up.

And there are undoubtedly many people who find it more important right now to profit from the whole scale distortion by central banks of what were once the financial markets, than they find it to know the truth and understand the system they owe their gains to. But that may no be all that smart; they risk losing their gains again overnight. You can’t rely on what you don’t understand. So here are notes:

1 – There are no markets anymore (and therefore no investors either).

There are ways to make money, but that’s not the same thing. Markets must of necessity reflect – the performance of – underlying economies, and to even pretend today’s markets do that is preposterous. Financial markets these days exclusively reflect central banks’ pumping money into their respective bankrupt banking systems, a practice poetically known as QE. Markets need to be functional in order to be called markets and if they don’t we should find another term to label them with.

Or, in other words, present day western economies – and their former markets – are being artificially propped up by either making already poor people poorer today, making them poorer tomorrow, or both. It’s the only way left to make things look passable. And those who still desire in these non-markets to call themselves ‘investors’ are merely little piglets sucking spoilt milk oozing from the teats of their mother sow’s long-dead bloated corpse.

2 – You have no idea what anything is truly worth.

Central bank stimulus across the globe has fully demolished price discovery. And whether you like it or not, financial markets can not and do not function without it. Lots of people try to make us believe that central bank announcements have momentarily taken the place of price discovery, but that is nonsense. And if you don’t know what any asset is really worth, how can you be sure you want to own it other than for myopic short-term reasons?

3- There is no recovery now, and there’s not one around the corner.

The weight of our debt, just to name one thing, has kept us from turning that corner for 7-8 years now, and the weight is getting more forbidding, not less. Publishing falling unemployment numbers while out-of-labor-force data rise (to a record 93 million working age Americans today) is an insult to everyone’s intelligence, not a sign of economic health. Whatever is seen as recovery or expansion is a testament to the power of illusion and propaganda, not the power of the economy. If you choose to look at the world from a point of view that focuses only on recovery, you’re not going to understand what is happening, because there is no recovery anywhere in sight.

4- You can’t trust anything your government and media say.

The entire apparatus is geared towards selling you a doctored image of the world you live in, instead of presenting you with reality. Not because as Jack Nicholson said “You can’t handle the truth”, but because you knowing the truth is not in the interest of those who run governments, nations and supranational organizations. You’re caught in a trap somewhere between Goebbels and Orwell, and it takes a lot of energy to escape it, energy you will be inclined and tempted to instead use to improve your position inside the trap. Just like everyone else does. We are social animals, we are disposed to do as those around us do.

• The US is not a democracy. You can’t have a democracy and SuperPacs at the same moment. For the hundredth time: if you allow money into your political system, it will end up buying the entire system. And if you allow endless amounts of money to enter it, that process is greatly accelerated.

• The US is not the supreme leader of the world. Today’s world doesn’t allow for a supreme leader. Neither does it need one. Countries like Russia and China will not tolerate American supremacy to dictate what they do. Not economically, and not militarily. This is very hard to stomach for parts of American society, but they’re going to have to get used to it. Going to war over these issues is pointless. Unfortunately, it increasingly looks like the entire globe will have to find that out the hard way. The very hard way.

• The American economy is not in recovery. I already mentioned the creative jobs numbers accounting. Also, without Fed intervention, asset prices (bonds, stocks, real estate..) would be much lower. This would have been a lot healthier for everyone, except for banks and their shareholders. But once QE is unleashed, there is no smooth exit possible. It will need to continue until it self-implodes.

At present, Japan is leading the way to economic self-immolation, but the US and Europe must inevitably follow. The only thing that helps is what the banks most resist: restructuring, cutting the leverage from the debt. But all we get is fantasy stories about how the crisis was left behind. Stories that of course all 42 million or so Americans on foodstamps and tens of millions of otherwise underpaid can confirm...we strive to make individuals richer, and fail to see that this makes communities and societies poorer...MORE

Demeter

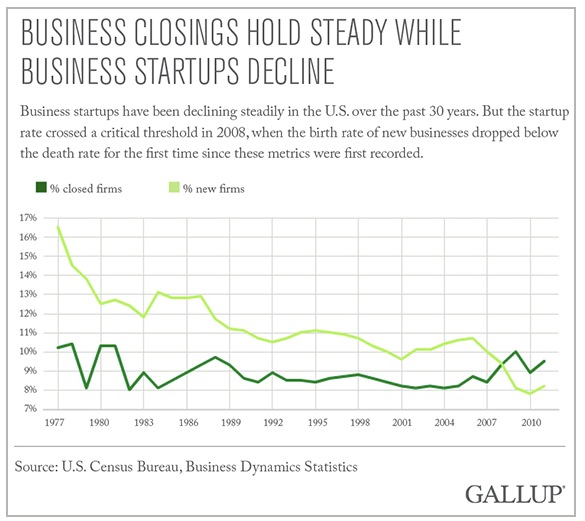

(85,373 posts)Since it conflicts with Americans’ widely-held image of self-reliance, the fact that new business creation has fallen to the point that even Hungary has a higher rate of starting new ventures than the US hasn’t gotten the attention it warrants in the mainstream media.

Unfortunately, many of the explanations for why that happened are more than a bit off.

The original report came in Gallup last week (JANUARY). Key section:

We are behind in starting new firms per capita, and this is our single most serious economic problem. Yet it seems like a secret. You never see it mentioned in the media, nor hear from a politician that, for the first time in 35 years, American business deaths now outnumber business births.

...Business startups outpaced business failures by about 100,000 per year until 2008. But in the past six years, that number suddenly reversed, and the net number of U.S. startups versus closures is minus 70,000.

This change is critically important because small and medium sized businesses are the creators of new jobs. Large corporations have in aggregate been in liquidation mode for well over a decade, net saving and net shedding employees. You can see this behavior in the regularity with which the business press reports on headcount-cutting exercises, as if they are mere cost cutting exercises, as opposed to a sign of how deeply unwilling large corporations are to invest in their workers and their futures.

MUCH MORE AND COMMENTARY

Demeter

(85,373 posts)Yves here. This post makes an important and simple point about one big source of the fall in the relative importance of corporate income as a source of Federal tax revenue that is often ignored in official discussions: the rise in the use of pass-through entities. An older theory was that, generally speaking, you could get the benefits of limited liability and pass through treatment only if you were a small fry. The S corporation election was meant to promote entrepreneurial activity. If you want to be a partnership and get the tax bennies, fine, but you have to live with the risk of unlimited personal liability.

The use of limited liability corporations started to pick up steam in the later 1990s (I recall asking my regular attorney about converting to an LLC in 1997 and she though they were too untested legally to be worth the risk) and are now common. And the impact over time of this change, as well as the use of other tax-reduction strategies, has been significant. In 1952, corporate income tax provided 33% of total Federal tax receipts. By 2013, it had fallen to 10%.

By John Miller. Originally published at Triple Crisis

The effective corporate income tax rate is almost exactly the same in the United States as in other OECD countries. (While the U.S. statutory corporate tax rate is well above the OECD average, the many loopholes in the U.S. corporate tax bring the effective rate down substantially.) Then how is it that corporate taxes account for a much smaller share of GDP in the United States than in other high-income countries? The answer lies in forms of incorporation that allow U.S. corporate profits to be taxed at the lower individual income tax rate.

Two changes paved the way for more and more profit to escape the corporate income tax in the United States. The federal government extended limited legal liability, which protects owners from losing their personal assets if their business fails, to some partnerships and “pass through” corporations not subject to the corporate income tax. Then the tax reform of 1986 cut the top tax bracket of the individual income tax to 28%, well below the statutory corporate income-tax rate. That opened up a large tax advantage for owners who paid individual income taxes on their profits instead of corporate income taxes.

Pass-through businesses—-S-corporations (which afford up to 100 owners limited liability), partnerships (including limited liability partnerships in which all the partners enjoy limited liability), and sole proprietorships—-have flourished over the last three decades. In 1980, corporations subject to the corporate income tax (called “C-corporations”) generated nearly four fifths (78%) of business net income, a measure of a business’s profitability. By 2007, pass-through businesses’ share of net income surpassed that of C-corporations. In fact, partnerships, S-corporations, and sole proprietorships each outnumbered C-corporations.

That was not the case in other high-income countries. In 2004, for instance, nearly two-thirds of U.S. businesses with taxable profits over $1 million were not subject to the corporate income tax. Meanwhile the next-highest share among large, high-income countries belonged to the United Kingdom, with just 26%. The three-decade decline in the corporate share of net income, enabled by the rise in pass-through businesses with limited liability, has eroded the tax base for the U.S. corporate income tax. That explains how U.S. corporate income tax receipts as a share of GDP (2.3% in 2011) were able to drop well below OECD average (3.0% in 2011), even while the U.S. and OECD effective tax rates on corporate income were nearly identical. Today, the majority of business profits are taxed at an even lower rate than that imposed by a corporate code riddled with loopholes. A thorough-going reform of taxes on profits must therefore not only close loopholes in the corporate income tax but also no longer extend limited liability to businesses that don’t pay corporate income taxes. With the profits of S-corporations and limited liability companies added to its base, the corporate income tax would be extended to at least another one-fifth of business net income. No longer extending limited liability to millionaire owners of S-corporations and limited liability companies, by itself, would add more than one-tenth of business net income to the base of the corporate income tax.

Demeter

(85,373 posts)Martin Armstrong summarizes the headway being made to ban cash, and argues that the goal of those pushing a cashless society is to prevent bank runs … and increase their control:

***

In many nations, specific measures have already been taken demonstrating that the Rogoff-Buiter world of Economic Totalitarianism is indeed upon us. This is the death of Capitalism. Of course the socialists hate Capitalism and see other people’s money should be theirs. What they cannot see is that Capitalism is freedom from government totalitarianism. The freedom to pursue the field you desire without filling the state needs that supersede your own.

There have been test runs of this Rogoff-Buiter Economic Totalitarianism to see if the idea works. I reported on June 21, 2014 that Britain was doing a test run. A shopping street in Manchester banned cash as part of an experiment to see if Brits would accept a cashless society. London buses ended accepting cash payments from July 2014. Meanwhile, Currency Exchange dealers began offering debt cards instead of cash that they market as being safer to travel with. The Chorlton, South Manchester experiment was touted to test customers and business reaction to the idea for physical currency will disappear inside 20 years.

France passed another Draconian new law that from the police parissummer of 2015 it will now impose cash requirements dramatically trying to eliminate cash by force. French citizens and tourists will then only be allowed a limited amount of physical money. They have financial police searching people on trains just passing through France to see if they are transporting cash, which they will now seize. Meanwhile, the new French Elite are moving in this very same direction. Piketty wants to just take everyone’s money who has more than he does. Nobody stands on the side of freedom or on restraining the corruption within government. The problem always turns against the people for we are the cause of the fiscal mismanagement of government that never has enough for themselves.

In Greece a drastic reduction in cash is also being discussed in light of the economic crisis. Now any bill over €70 should be payable only by check or credit card – it will be illegal to pay in cash. The German Baader Bank founded in Munich expects formally to abolish the cash to enforce negative interest rates on accounts that is really taxation on whatever money you still have left after taxes.

***

Complete abolition of cash threatens our very freedom and rights of citizens in so many areas.

***

Paper currency is indeed the check against negative interest rates. We need only look to Switzerland to prove that theory. Any attempt to impose say a 5% negative interest rates (tax) would lead to an unimaginably massive flight into cash. This was already demonstrated recently by the example of Swiss pension funds, which withdrew their money from the bank in a big way and now store it in vaults in cash in order to escape the financial repression. People will act in their own self-interest and negative interest rates are likely to reduce the sales of government bonds and set off a bank run as long as paper money exists.

Obviously, government and bankers are not stupid. The only way to prevent such a global bank run would be the total prohibition of paper money. This is unlikely, both in Switzerland and in the United States because the economies are dominated there by a certain “liberalism” to some extent but also because their currencies also circulate outside their domestic economies. The fact that but the question of the cash ban in the context of a global conference with the participation of the major central banks of the US and the ECB will be discussed, demonstrates by itself that the problem is not a regional problem.

Nevertheless, there is a growing assumption that the negative interest rate world (tax on cash) is likely to increase dramatically in Europe in particular since it is socialism that is collapsing. Government in Brussels is unlikely to yield power and their line of thinking cannot lead to any solution. The negative interest rate concept is making its way into the United States at J.P. Morgan where they will charge a fee on excess cash on deposit starting May 1st, 2015. Asset holdings of cash with a tax or a fee in the amount of the negative interest rate seems to be underway even in Switzerland.

***

The movement toward electronic money is moving at high speed and this says a lot about the state of the financial system. The track record of the major financial institutions is nearly perfect – they are always caught on the wrong side when a crisis breaks, which requires their bailouts. The fact that we have already seen test runs with theory-balloons flying, the major financial institutions are in no shape to withstand another economic decline.

For depositors, this means they really need to grasp what is going on here for unless they are vigilant, there is a serious risk of losing everything. We must understand that these measures will be implemented overnight in the middle of a banking crisis after 2015.75. The balloons have taken off and the discussions are underway. The trend in taxation and reduction of cash seems to be unstoppable. Government is not prepared to reform for that would require a new way of thinking and a loss of power. That is not a consideration. They only see one direction and that is to take us into the new promised-land of economic totalitarianism.

People can’t pull cash out of their bank accounts – for political reasons, because they’ve lost confidence in the bank, or because “bail-ins” are enacted – if cash is banned. The Financial Times argued last year that central banks would be the real winners from a cashless society:

***

The introduction of a cashless society empowers central banks greatly. A cashless society, after all, not only makes things like negative interest rates possible, it transfers absolute control of the money supply to the central bank, mostly by turning it into a universal banker that competes directly with private banks for public deposits. All digital deposits become base money.

The Government Can Manipulate Digital Accounts More Easily than Cash

Moreover, an official White House panel on spying has implied that the government is manipulating the amount in people’s financial accounts. If all money becomes digital, it would be much easier for the government to manipulate our accounts. Indeed, numerous high-level NSA whistleblowers say that NSA spying is about crushing dissent and blackmailing opponents … not stopping terrorism. This may sound over-the-top … but remember, the government sometimes labels its critics as “terrorists“. If the government claims the power to indefinitely detain – or even assassinate – American citizens at the whim of the executive, don’t you think that government people would be willing to shut down, or withdraw a stiff “penalty” from a dissenter’s bank account? If society becomes cashless, dissenters can’t hide cash. All of their financial holdings would be vulnerable to an attack by the government.

This would be the ultimate form of control. Because – without access to money – people couldn’t resist, couldn’t hide and couldn’t escape.