Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 26 June 2015

[font size=3]STOCK MARKET WATCH, Friday, 26 June 2015[font color=black][/font]

SMW for 25 June 2015

AT THE CLOSING BELL ON 25 June 2015

[center][font color=red]

Dow Jones 17,890.36 -75.71 (-0.42%)

S&P 500 2,102.31 -6.27 (-0.30%)

Nasdaq 5,112.19 -10.22 (-0.20%)

[font color=red]10 Year 2.41% +0.02 (0.84%)

30 Year 3.17% +0.01 (0.32%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)YVES SMITH'S COMMENTARY ON THE FOLLOWING ARTICLE: The U.S. computer industry is dying and I’ll tell you exactly who is killing it and why

... American management has become virtually incapable of building successful, durable enterprises...Cringley correctly focuses on the single worst management idea evah to gain legitimacy: the idea that the job of executives is to maximize shareholder value. That catchphrase is widely presented as if it were a legal obligation. It isn’t. It’s an idea made up by economists that got traction because it was useful to the capital-owning classes. As we wrote in 2013:

Directors and officers, broadly speaking, have a duty of care and duty of loyalty to the corporation. From that flow more specific obligations under Federal and state law. But notice: those responsibilities are to the corporation, not to shareholders in particular…Shareholders are at the very back of the line. They get their piece only after everyone else is satisfied. If you read between the lines of the duties of directors and officers, the implicit “don’t go bankrupt” duty clearly trumps concerns about shareholders…

So how did this “the last shall come first” thinking become established? You can blame it all on economists, specifically Harvard Business School’s Michael Jensen. In other words, this idea did not come out of legal analysis, changes in regulation, or court decisions. It was simply an academic theory that went mainstream. And to add insult to injury, the version of the Jensen formula that became popular was its worst possible embodiment.

Cringley simplifies, and arguably oversimplifies how the “maximize shareholder value” myth took hold. Its father was Milton Friedman, in New York Times op ed noteworthy for its internal incoherence in 1970. Cringley is correct to point out a 1976 paper by the University of Rochester’s Michael Jensen and William Meckling, Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure, as officially putting this thesis on the map. But what gave it real impetus was the leveraged buyout wave of the 1980s. Swashbuckling takeover artists who gobbled up companies (typically overdiversified firms trading at conglomerate discounts) magically created fortunes by breaking them up and selling off the pieces for more than they’d paid for them. Their success was depicted as proof of the Jensen/Meckling theory, that company executives had bad incentives, and “aligning” theirs with those of shareholders would produce better outcomes…well, certainly for shareholders, right?

Cringley points out that there were plenty of other remedies for the problem that Jensen and Meckling were pretending to solve, that the interests of managers and shareholders weren’t aligned. And he stresses that as CEO pay has skyrocketed by virtue of granting them more equity linked-pay, which in turn puts them in the business of goosing the stock price rather than running the business, underlying economic performance has deteriorated:

And he really gets rolling on how greedy and destructive the executive classes have become:

First is the lemming effect where several businesses in an industry all follow the same bad management plan and collectively kill themselves…

The IT services lemming effect has companies promising things that can not be done and still make a profit. It is more important to book business at any price than it is to deliver what they promise. In their rush to sign more business the industry is collectively jumping off a cliff.

This mad rush to send more work offshore (to get costs better aligned) is an act of desperation. Everyone knows it isn’t working well. Everyone knows doing it is just going to make the service quality a lot worse. If you annoy your customer enough they will decide to leave.

The second issue is you can’t fix a problem by throwing more bodies at it. USA IT workers make about 10 times the pay and benefits that their counterparts make in India. I won’t suggest USA workers are 10 times better than anyone, they aren’t. However they are generally much more experienced and can often do important work much better and faster (and in the same time zone). The most effective organizations have a diverse workforce with a mix of people, skills, experience, etc. By working side by side these people learn from each other. They develop team building skills. In time the less experienced workers become highly effective experienced workers. The more layoffs, the more jobs sent off shore, the more these companies erode the effectiveness of their service. An IT services business is worthless if it does not have the skills and experience to do the job.

The third problem is how you treat people does matter. In high performing firms the work force is vested in the success of the business. They are prepared to put in the extra effort and extra hours needed to help the business — and they are compensated for the results. They produce value for the business. When you treat and pay people poorly you lose their ambition and desire to excel, you lose the performance of your work force. It can now be argued many workers in IT services are no longer providing any value to the business. This is not because they are bad workers. It is because they are being treated poorly. Firms like IBM and HP are treating both their customers and employees poorly. Their management decisions have consequences and are destroying their businesses.

At this point some academic or consultant will start talking about corporate life cycles and how Japan had to go from textiles to chemicals to automobiles to electronics to electronic components simply because of limited real estate that had to produce more and more revenue per square foot so it was perfectly logical that Korea would inherit the previous generation of Japanese industry. But that’s not the way it works with services, which have no major real estate requirements. There is no — or should be no — life cycle for services.

So evolution is not an option because there’s no place to evolve to… You can’t succeed by merely saying you will solve your problems by selling more. You have to run your business a lot smarter. The way for an IT company to succeed is by being being smarter than the competition, not sneakier, dirtier, or less empathetic.

Even though I’ve highlighted some of the really good parts, there’s plenty more. Go read the entire article, now, and circulate it. And I hope some of you will come back and chat it about it here.

antigop

(12,778 posts)DemReadingDU

(16,000 posts)I don't recall reading this guy's articles. He has a website, http://www.cringely.com/ that has a couple more articles about the H-1B visas. These visas were a big issue 15 years ago when I was working.

mother earth

(6,002 posts)DemReadingDU

(16,000 posts)Just ask Disney workers who have been displaced by those with H-1B visas...after having trained them to do their jobs.

mother earth

(6,002 posts)Gotta link?

DemReadingDU

(16,000 posts)6/3/15 Pink Slips at Disney. But First, Training Foreign Replacements.

The employees who kept the data systems humming in the vast Walt Disney fantasy fief did not suspect trouble when they were suddenly summoned to meetings with their boss.

While families rode the Seven Dwarfs Mine Train and searched for Nemo on clamobiles in the theme parks, these workers monitored computers in industrial buildings nearby, making sure millions of Walt Disney World ticket sales, store purchases and hotel reservations went through without a hitch. Some were performing so well that they thought they had been called in for bonuses.

Instead, about 250 Disney employees were told in late October that they would be laid off. Many of their jobs were transferred to immigrants on temporary visas for highly skilled technical workers, who were brought in by an outsourcing firm based in India. Over the next three months, some Disney employees were required to train their replacements to do the jobs they had lost.

“I just couldn’t believe they could fly people in to sit at our desks and take over our jobs exactly,” said one former worker, an American in his 40s who remains unemployed since his last day at Disney on Jan. 30. “It was so humiliating to train somebody else to take over your job. I still can’t grasp it.”

more...

http://www.nytimes.com/2015/06/04/us/last-task-after-layoff-at-disney-train-foreign-replacements.html?_r=2

6/10/15 ‘You’re Fired – Now Train Your Much Cheaper Foreign Replacement’

If you were laid off from your job, would you be willing to train your replacement if your company threatened to take away your severance pay if you didn’t do it? And how would you feel if your replacement came from India, and the only reason your company was replacing you was because the foreign worker was a lot less expensive? Sadly, this is happening all over America – especially in the information technology field. Huge corporations such as Disney and Southern California Edison are coldly firing existing tech workers and filling those jobs with much cheaper foreign replacements. They are doing this by blatantly abusing the H-1B temporary worker visa program. Workers that had been doing a solid job for decades are being replaced without any hesitation just because it will save those firms a little bit of money. There is very, very little loyalty left in corporate America today. Even if you have poured your heart and your soul into your company for years, that ultimately means very little. The moment that your usefulness is over, most firms will replace you in a heartbeat these days.

When I learned that Disney was doing this, I was absolutely outraged. Talk about a company that is going down the toilet.

more...

http://theeconomiccollapseblog.com/archives/youre-fired-now-train-your-much-cheaper-foreign-replacement

6/12/15

Disney has been in the news recently for firing its Orlando-based IT staff, replacing them with H-1B workers primarily from India, and making severance payments to those displaced workers dependent on the outgoing workers training their foreign replacements. I regret not jumping on this story earlier because I heard about it back in March, but an IT friend in Orlando (not from Disney) said it was old news so I didn’t follow-up. Well now I am following with what will eventually be three columns not just about this particular event but what it says about the U.S. computer industry, which is not good.

more...

http://www.cringely.com/2015/06/12/disneys-it-troubles-go-beyond-h-ibs/

mother earth

(6,002 posts)We need these as reminders, Thank you, DemReadingDU.

tclambert

(11,087 posts)http://www.democraticunderground.com/10026587783

http://www.democraticunderground.com/11176997

http://www.democraticunderground.com/111668183

The last one has a cartoon about it:

Here's a NYT article about it:

http://www.nytimes.com/2015/06/04/us/last-task-after-layoff-at-disney-train-foreign-replacements.html?_r=0

(OK, DemReadingDU, you beat me to the links, but I should get an extra half a point for digging up the cartoon.)

DemReadingDU

(16,000 posts)mother earth

(6,002 posts)antigop

(12,778 posts)The Justice Department hit IBM for allegedly violating the anti-discrimination provision of the Immigration and Nationality Act, when it posted online job openings for software and apps developers.

In the job postings, IBM allegedly stated a preference for F-1 and H-1B visa holders. F-1 visas are issued to foreign students and H-1B visas to foreign nationals with technical experience in a specialized field.

“Although IBM’s job postings were for positions that would ultimately require the successful candidate to relocate overseas, the anti-discrimination provision of the INA does not permit employers to express or imply a preference for temporary visa holders over U.S. workers, such as U.S. citizens and lawful permanent residents, for any employment opportunity in the United States,” the Justice Department stated.

antigop

(12,778 posts)The firm made this point in a letter to U.S. Sen. Chuck Grassley (R-Iowa), the Judiciary Committee chairman, in response to a query from the senator on IBM's use of the H-1B visa.

Grassley, in his letter, said that IBM applied for approximately 5,800 petitions for H-1B visas on April 1, which was the first day that firms could apply for visas for 2016. IBM said it expected only a fraction of the visa applications would be approved. Competition is fierce: The U.S. received 233,000 H-1B visa petitions for 85,000 visas and awards them to applicants via a lottery.

mother earth

(6,002 posts)That's why this huge shortage of skills can be filled with temp visa workers? Oh yeah...![]()

![]()

The sweet little lies told that the DINOs and GOP are happy to entertain and oblige for their corporate owners.![]()

antigop

(12,778 posts)mother earth

(6,002 posts)to all of us wondering why can't Americans be trained here at home...why, indeed. Why bother, they'd want too much money, and the others are temporary and far cheaper to import. TY, antigop, we do need to be fair, I just wish there were less rhetoric and more action and a mighty condemnation of this here at home.

Is that too much to ask for, my friend? ![]()

I long for the day when the citizens, the human beings, override the personhood of big money, as it once was, of the people, by the people, for the people...![]()

Certainly this is a dated video, certainly HRC will come out against such practices and update her stance. ![]()

antigop

(12,778 posts)as recently as Spring, 2014:

http://politicalticker.blogs.cnn.com/2014/04/08/hillary-clinton-on-2016-im-thinking-about-it/

In closing the event, Clinton blended her answers on immigration and Russia. After being thanked by Fernandez for talking about visas and Putin, Clinton joked, "Don't give him an H-1B."

So nice of her to joke about it.

mother earth

(6,002 posts)mouth. She is the ultimate politician with a grand political machine, but I can't back a woman like that.

Every day I am more thankful for Bernie Sanders.

Demeter

(85,373 posts)The tech industry used to think big. As early as 1977, when personal computers were expensive and impractical mystery boxes with no apparent utility or business prospects, the young Bill Gates and Paul Allen were already working toward a future in which we would see “a computer on every desk and in every home.” And in the late 1990s, when it was far from clear that they would ever make a penny from their unusual search engine, the audacious founders of Google were planning to organize every bit of data on the planet — and make it available to everyone, free.

These were dreams of vast breadth: The founders of Microsoft, Google, Facebook and many of the rest of today’s tech giants were not content to win over just some people to their future. They weren’t going after simply the rich, or Americans or Westerners. They planned to radically alter how the world did business so the impossible became a reality for everyone.

Whatever happened to the tech industry’s grand, democratic visions of the future?

We are once again living in a go-go time for tech, but there are few signs that the most consequential fruits of the boom have reached the masses. Instead, the boom is characterized by a rise in so-called on-demand services aimed at the wealthy and the young.

With a few taps on a phone, for a fee, today’s hottest start-ups will help people on the lowest rungs of the 1 percent live like their betters in the 0.1 percent. These services give the modestly wealthy a chance to enjoy the cooks, cleaners, drivers, personal assistants and all the other lavish appointments that have defined extravagant wealth. As one critic tweeted, San Francisco’s tech industry “is focused on solving one problem: What is my mother no longer doing for me?”

No, no, say the start-ups that, today, look as if they’re targeting the rich. The nature of the tech business is that costs come down. Through repeated innovation and delivery at scale, the supercomputers of the 1960s became the PCs of the 1980s, which in turn became the smartphones of the 2010s. The rich subsidize the rest of us — were it not for the suckers who spent more than $10,000 on early versions of the Mac, Apple might not have survived to build the iPhone, in turn begetting an era of affordable pocket supercomputers.,,,

MORE

Joe Chi Minh

(15,229 posts)Demeter

(85,373 posts)Yves here. I hate the generational meme, since it’s an age cohort invented by marketers, and is therefore stereotyped as feeling and acting in certain ways, just as, say, women and Hispanics are also targeted demographically for products...So if you can put aside the frequent (mis)use of the millennial label, young people have a terribly insecure financial future, unless they managed to get on an elite career path (and even those are uncertain and the fall is far if you slip off it). This article describes how millennials are making perfectly logical decisions in light of the conditions they see. This post doesn’t weigh heavily on the lousy job market, but even those who manage to find decently-paid work still are subject to short job tenures, making it well nigh impossible to save, much the less invest. Their behavior is a part of the New Normal that the officialdom would like to ignore.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

Turns out, to the greatest consternation of some folks on Wall Street, millennials are smart.

“They don’t trust the stock market,” Goldman Sachs determined in a survey. Only 18% thought that the stock market was “the best way to save for the future.” It’s a big deal for Wall Street because millennials, having surpassed the baby boomers, are now the largest US generation – and the future source of bonus checks for Wall Street.

“Millennials will become the most important financial generation in America, and the industry will have to adapt to meet their needs,” the report warned.

The older ones in the cohort have seen the market soar, collapse, re-soar, re-collapse, re-soar…. They’ve seen what amount of monetary gyrations the Fed undertook to re-inflate stocks this time around. They’ve read about the stock market scandals and manipulations, high-frequency trading, dark pools, and spoofing. They’ve seen that the little guy gets mauled, that you can make a ton of money if you get in at the right time and get out before it’s too late. They’ve seen hard-working people get wiped out. They’d rather play with their apps than mess with that infernal machine.

But they do have a problem, smart as they are: they’re carrying on their shoulders a good part of the $1.2 trillion of student debt outstanding. In 2004, Americans under the age of 30 had $146 billion in student loans, according to Equifax. By 2014, in just ten years, the student-debt burden of the under-30 cohort had skyrocket by 152% to $369 billion. Delinquencies are rising. Some of the millennials have gotten caught up in the for-profit-college scandals that have left them with lots of debt and little education. Now they’re waiting for a taxpayer bailout. It has been the school of hard knocks for them. But there are consequences. Equifax determined in its analysis that millennials aren’t borrowing money to buy homes like their predecessors a decade ago did – “a trend that may have as much to do with high levels of student debt and poor job prospects as it has to do with trauma from the housing bust….”

The analysis also confirmed our suspicions that those earning less than $30,000 per year – so for example, lawyers working as bar tenders – face the highest risk of delinquency. Then with each $10,000 increase in income, the delinquency rate drops by 20%. A “phenomenon that demonstrates the strain student debt puts on young consumers starting their careers,” as Equifax put it. Unlike their predecessors, millennials still have trouble staying current on their student loans as late as four years into a job, which is where the delinquency rates of their predecessors began to improve. And given these realities, millennials are establishing a new trend: they’re not piling on mortgages. In 2006, 33.2% of their predecessors under 30 who had student debt also had mortgage debt. By 2014, just eight years later, the number plunged to 20.9%...But it’s not just the additional burden of student loans; even Millennials who don’t have student loans aren’t borrowing to buy a home: In 2006, 29.6% of Americans under 30 without student loans had mortgage debt. By 2014, their number dropped to 21.7%.

When the New York Fed asked renters in its Survey of Consumer Expectations why they hadn’t bought a home yet, for crying out loud, 55.7% responded: “too much debt/not saved enough.” The problem is only getting worse. With rents rising sharply, with incomes nearly stagnant, and with home prices soaring, renters won’t be able to save up enough money for even a puny 3% down payment. Just one of the many distortions Housing Bubble 2 is leaving behind in its wake.

So they don’t trust the stock market, and they’re not borrowing money to buy overpriced homes either, even with interest rates at historic lows. They’d rather rent, remain flexible, live in urban centers rather than distant suburbs, and do their thing. The perfect nightmare generation for Wall Street.

UNFORTUNATELY, IT'S NOT JUST THE MILLENNIAL GENERATION THAT'S SUFFERING...THEIR PARENTS AND GRANDPARENTS HAVE ALSO BEEN KNIFED BY WALL ST.

GREECE ISN'T THE ONLY NATION WHERE THREE GENERATIONS ARE LIVING OFF SOCIAL SECURITY...

mother earth

(6,002 posts)will remain until there is such a thing called stability in the employment arena which won't come about unless there's an actual recovery. We all know the ones truly thriving, that 1%, during this time are not the job creators, they aren't the backbone of this country, the MIDDLE CLASS is. They are the canaries in the coal mine. When we see the middle class thrive, or at least start making a comeback, we won't have to be told we are in a recovery.

We live the state of the economy, we feel the effects.

People aren't stupid. They know when a "recovery" is genuine.

We are losing more each day, all to the real power in this country, the corporations who own OUR gov't.

Nothing will change or be for the better until this coup d'état is ended.

I know millennials are smart, that's because they were raised by smart boomers. ![]()

TY, Yves, too.

Demeter

(85,373 posts)http://www.salon.com/2015/06/23/europe_wants_greece_to_suffer_the_truth_about_the_never_ending_financial_crisis_the_cult_of_extreme_austerity/

Greece's financial nightmare has lasted five years now. There's no sign of real relief—for a very specific reason...For someone who writes about economics, the situation in Greece offers two enticing elements: the ability to spin out moments of high drama, and the probability it will endlessly repeat forever. We’ve experienced five years (really, here’s one of my first stories on Greece, from April 2010) of wondering whether the deeply indebted country will exit the euro or submit to more painful conditions from its European creditors. Two governments – the center-right and the center-left – took the latter option, and paid dearly for it. Now the far-left Syriza appears poised to do the same, after delivering a new proposal to unlock bailout funds.

Meanwhile, the prospects for ordinary Greek citizens never changes, adding a nightmarish “Groundhog Day” touch to the proceedings. Regardless of whether the country is spiraling into near-default or praising a debt deal, unemployment has remained over 25 percent for the past three years. Half a decade into the Great Depression, there was at least some semblance of a brighter day; in Greece there are only gradations of misery. And what could break this terrible cycle is the only thing the political system and the public imagination cannot seem to contemplate: leaving the euro.

What has been happening in Greece has been a long exercise in sadism by European elites, who care only about keeping their political project alive, regardless of how those who must deal with the consequences are affected. Three governments ago, Greece rang up a series of debts that they have no practical ability to pay back. The structure of the eurozone, 19 countries sharing a common currency, encouraged this debt buildup, which manifested through capital flows from the wealthier north to the southern periphery. With a single currency, investors chased higher returns in countries where capital was scarcer; this was part of the core euro design. When the investors pulled out and the debts came due, the northern states, led by Germany, pretended this didn’t happen and demanded their money back.

The European Union, the European Central Bank and the International Monetary Fund – the “troika” for short – forced Greece and other debtor nations into a bailout program, where they would run budget surpluses, even in the midst of a depression, and repay debts over the long-term. But the troika had another mission. They wanted to suck the oxygen out of any anti-austerity movement in Europe, and knuckle every country under their dictates. Therefore, the troika’s entire goal with Syriza, who entered office in January, has been not only to grant them concessions in negotiations, but to directly humiliate them and force them into a series of bad choices, as a lesson to all other Eurozone countries.

MORE

mother earth

(6,002 posts)pretense with others in their fold...a great downgrade for the working class is underway. Shall the working minions work for free? And would that be enough?

The corruption, greed and laziness they accuse Greece of is nothing more than a mirrored assessment of themselves. They knew full well Greece would sink in debt, they fully intended it, knowingly, while today they further torture their "example", they whip the debt slave in front of the others to show them they had better mind the masters and their manners lest they suffer the same fate. The owners don't understand this uprising against austerity isn't going away. Men were not meant to be slaves.

Demeter

(85,373 posts)Now that the Supreme Court has ruled that health insurance consumers can receive federal subsidies regardless of their state’s role in running their insurance market, fewer states may stay in the game. When the Affordable Care Act passed in 2010, most people expected that each state would want to run its own health insurance marketplace. That never really happened, as many states opted to let the federal system, HealthCare.gov, do the work for them. Many of those states that did try running their own marketplaces are starting to think twice. Now, with the Supreme Court ensuring that every state’s consumers will have equal access to federal subsidies, it is becoming clear that more of those states will revert to a federal system for enrolling people in health insurance.

“There may be a little bit of buyers’ remorse going on in some state capitals right now,” said Sabrina Corlette, the director of the Center on Health Insurance Reforms at Georgetown University. She said states underestimated the difficulty and expense of building and maintaining state marketplaces. Now, she said, many officials are asking: “What did we get ourselves into?”

WHAT INDEED?

As the law envisioned, state exchanges would provide an opportunity for state insurance regulators to oversee their markets, a role they have long performed. The state exchange system would also allow a greater degree of policy flexibility and control, so state officials could customize the marketplaces for local conditions. What few people grasped was the technical and logistical challenge of building a complex website and customer service operation from scratch.

“Certainly, one of the lessons learned was that it is much more difficult than was expected,” said Joel Ario, who ran the office in the Department of Health and Human Services devoted to building the exchanges after the law passed. He is now a managing director at Manatt Health Solutions, a consulting firm that is assisting several states.

In the first year of operation, three state exchanges — Nevada, New Mexico and Oregon — had technology failures so profound that they handed the bulk of their operations to the federal government. Other states managed to rebound from a troublesome first year by rebuilding their systems, but only with substantial effort and expense. Both Massachusetts and Maryland essentially started from scratch in 2015. As my colleague Abby Goodnough reported this month, state struggles continue. The Hawaii exchange is collapsing, while Vermont’s looks shaky. Even some exchanges that have performed relatively well — including Washington and Minnesota — are experiencing substantial information technology problems. And the expense of managing an exchange is also climbing in many places as federal start-up funding diminishes. The Washington Post reported in May that nearly half of the states are suffering from financial difficulties.

“There is no new money now to build new infrastructure, and there are no grants available to fix these systems if they’re struggling,” said Heather Howard, the director of the State Health Reform Assistance Network at Princeton University, which was set up to advise states on exchange building. “So the only path forward may be to use HealthCare.gov.”

Lawrence Miller, chief of health care reform in Vermont, who reports to the governor, said his state was still working hard to try to repair its exchange architecture — and he hopes he succeeds. But he said he also took some solace in the court’s decision.

“It’s now a viable alternative,” he said of HealthCare.gov. “Still, not a good alternative. But we’re certainly very glad that that question has been resolved the way it is.”

Ms. Howard says the future for many states may be something along the lines of the New Mexico system. That state performs some of the functions envisioned for a state exchange, including selecting the health plans that will be sold on the state’s marketplace, and collecting fees from insurers. But it uses the federal government’s HealthCare.gov infrastructure to determine people’s eligibility for insurance and sign them up for health plans. The National Association of State Health Policy, an organization closely watched by state officials, recently published a paper describing how states can transition to the New Mexico model. People working closely with state governments say they expect the template to become increasingly popular.

If the court had ruled for the health law’s challengers, we would have seen more states adopting the state-based model to preserve subsidies for their residents. Now that the government has won, movement is likely to be in the other direction.

WHAT ABOUT UNIVERSAL SINGLE PAYER? THE EASIEST, CHEAPEST, MOST EQUITABLE AND EFFECTIVE SYSTEM FOR HEALTHCARE POSSIBLE, HMMM?

Demeter

(85,373 posts)IS THE POPE CATHOLIC? DOES A BEAR SHIT IN THE WOODS? DO FOOLS FALL IN LOVE?

WOULD THE DANCING SUPREMES RULE IN FAVOR OF THE CONSTITUTION? DON'T MAKE ME LAUGH...IT WOULD HURT TOO MUCH. I'M POSITIVE THE FIX IS IN...

http://www.theatlantic.com/politics/archive/2015/06/tpp-isds-constitution/396389/

Provisions that allow foreign investors to bypass the federal courts could undermine U.S. legal protections...THAT'S NOT A BUG, THAT'S A FEATURE!

It is January 2017. The mayor of San Francisco signs a bill that will raise the minimum wage of all workers from $8 to $16 an hour effective July 1st. His lawyers assure him that neither federal nor California minimum wage laws forbid that and that it is fine under the U.S. Constitution.

Then, a month later, a Vietnamese company that owns 15 restaurants in San Francisco files a lawsuit saying that the pay increase violates the “investor protection” provisions of the Trans-Pacific Partnership (TPP) agreement recently approved by Congress. The lawsuit is not in a federal or state court, but instead will be heard by three private arbitrators; the United States government is the sole defendant; and the city can participate only if the U.S. allows it.

It is not a far-fetched scenario. The TPP reportedly includes such provisions, as a means of solving a thorny problem. In the United States, the courts are, by and large, independent and willing to fairly decide challenges to arbitrary government laws and rulings, no matter who the plaintiff is. The same is not consistently true in less developed countries.

SO, WE WILL RACE TO THE BOTTOM...AS USUAL AUTHOR CONCLUDES OPTIMISTICALLY

...As it presses for the passage of TPP, the administration needs to explain how the Constitution allows the United States to agree to submit the validity of its federal, state, and local laws to three private arbitrators, with no possibility of review by any U.S. court. Otherwise, it risks securing a trade agreement that won’t survive judicial scrutiny, or, even worse, which will undermine the structural protections that an independent federal judiciary was created to ensure.

Demeter

(85,373 posts)Daniel Bell has written a new book making the case that "Chinese-style meritocracy is, in important respects, a better system of governance than western liberal democracy." That's possible, I suppose. Tyler Cowen noodles over the arguments and tosses out a few thoughts. Here's one:

I know Cowen is just throwing out some ideas to be provocative, not seriously backing any of them. Still, I think you have to take a pretty blinkered view of "most humans" to throw this one out at all. It's true that humans are hairless primates who naturally gravitate to a hierarchical society, but there's little evidence that "most humans" prefer non-democratic societies. There's loads of evidence that powerful elites prefer elite-driven societies, and have gone to great lengths throughout history to maintain them against the masses. Whether the masses themselves ever thought this was a good arrangement is pretty much impossible to say.

Of course, once the technologies of communication, transportation, and weaponry became cheaper and more democratized, it turned out the masses were surprisingly hostile to elite rule and weren't afraid to show it. So perhaps it's not so impossible to say after all. In fact, most humans throughout history probably haven't favored "meritocratic" rule, but mostly had no practical way to show it except in small, usually failed rebellions. The Industrial Revolution changed all that, and suddenly the toiling masses had the technology to make a decent showing against their overlords. Given a real option, it turned out they nearly all preferred some form of democracy after all.

Which brings us to the real purpose of democracy: to rein in the rich and powerful. Without democracy, societies very quickly turn into the Stanford Prison Experiment. With it, that mostly doesn't happen. That's a huge benefit, even without counting free speech, fair trials, and all the other gewgaws of democracy. It is, so far, the only known social construct that reliably keeps powerful elites from becoming complete jackasses. That's pretty handy.

mother earth

(6,002 posts)Final Vote on "TPP" could come in 2016, in the Middle of Election Season--Causing Backlash

Supporters of the TPP hoped that they could get Congress to sign off on the pact before the notion of global trade gets caught in the inevitable election-year backlash against Wall Street, corporations and low-wage economies overseas that have syphoned jobs from rust belt swing states in the Midwest and elsewhere.

But now, lawmakers will be asked to take a tough vote that could expose them to attacks from opponents of the deal.

TPP nations may ink a final agreement at a ministerial meeting this summer and could present the deal as the highlight of the Asia Pacific Economic Cooperation (APEC) forum later this year.

But there's no guarantee the fragile coalition assembled by Obama and McConnell -- mostly Republican but bolstered by pro-trade Democrats -- will survive. And the clock is ticking.

"I am very doubtful we can have a ratification vote before the end of this year," said Mireya Solis, a specialist on Japanese economic policy at the Brookings Institution. "We are thinking this is going to spill over to 2016 and this opens up all kinds of interesting possibilities."

Between now and then, Obama must work hard to repair ties with Democrats on Capitol Hill. More mastery of Senate procedure will also likely be required from McConnell, who secured support for the fast-track authority only after promising to adopt a workers' assistance bill Republicans largely disparaged but Democrats demanded.

The wily Senate leader's normal antipathy to Obama's priorities was overcome because Republicans generally still firmly back free trade -- and he was keen to use the fast-track vote to convince voters in 2016 that the GOP has delivered results and deserves to keep its slim Senate majority.

http://www.cnn.com/2015/06/24/politics/trade-bill-obama-clinton-mcconnell/index.html

(TY, KoKo, this is good news...and I do believe the quote by Solis is right on....interesting possibilities...and all while a nation ponders if they should vote the corporate candidate or the real deal...WHILE they are educated en masse on the new "trade" agreement, TPP.)

mother earth

(6,002 posts)http://www.democraticunderground.com/1016125588#post10

(TY, BlueMTexPat!!!)

mother earth

(6,002 posts)Will there be backlash to TPP? Oh it comes...right smack dab during campaign season.

(TY, KoKo!!!)

Demeter

(85,373 posts)I think our ruling and wealthy elite are worried that they are stuck in their own ponzi scheme or bubble and are suffering from the general problem of all ponzis and bubbles – how to get out...You see, bubbles and Ponzi’s are fine as long as they keep going. As long as there are ever more suckers to recruit and as long as enough of those already in, remain confident and choose to stay in, there is no real reason a ponzi cannot go on and on. A perfect example is Madoff’s scheme. The weakness of all bubbles, ponzi or otherwise, is that all it takes is a rumour that it might be time to get out, that it might soon get difficult to get out, or that someone ‘in the know’ wants out, and a ponzi scheme pops like a soap bubble. They are notoriously unstable.

So if you are in one how do you get out?

I think this question is worrying our wealthy Over Class because stock markets around the world are over-valued and its their wealth which is most tied up in the markets. I think some of them are now rather worried that they have built themselves a luxury tower of paper wealth from which, when it catches fire, they will not all escape. I think they are right.

So, first, are the markets a bubble or ponzi?

Well if we look at the real economies of the West and then at the stock markets, the later have the look of a ponzi. I’m certainly not alone in thinking this. In Europe, the U.S. and Japan, over the last 6 years, in what we might call the ‘real economy’ of people making things, earning money and spending it to buy things other people have made, we have had either anaemic growth, no growth or outright contraction. And yet all the time the stock markets have roared ever higher....

And yet, its share price is $86 not far off its record highs, up from a low of $23 to which it fell in March 2009. $86 or thereabouts ever since 2010 despite 28 months of declining sales.

Is this supply and demand? I think not. Part of an explanation for this levitating share price is, as the ZeroHedge article points out, that the corporation has been buying back its own shares.

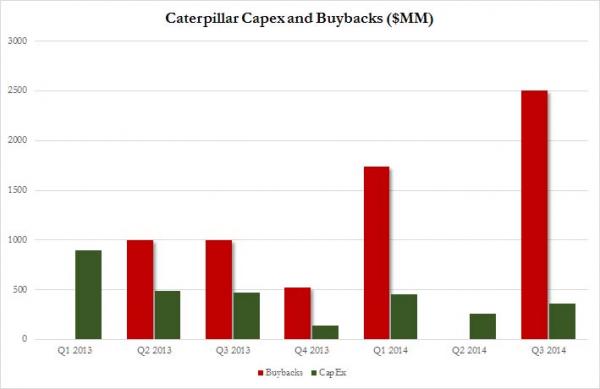

CAT had been using more and more of its cash (the red bar) to buy back its own shares inflating the apparent demand for them and therefore their price. It’s not illegal, but what does it do for the idea that share price indicates what a company is worth? And where was CAT getting the money with which to buy those shares? I doubt it was from profits given the long cumulative decline in sales. More likely it was from selling bonds i.e. using borrowed money. And indeed that seems to be the case. In May of 2014 CAT sold $2 billion of debt some of it dated as long as 50 years....So let’s take a look at what we have. In May of 2014, despite having already suffered a year of declining sales, CAT shares were the second best performing shares on the Dow Jones. Who was so keen to buy all their shares? Who knows. But CAT itself had just spent 175 million in buying their own shares in the first quarter (when it was the second best performing share on the DOW) and in the last quarter of the year went on to buy another 250 million dollars worth. In fact, and perhaps most critically, in January the CAT board had authorized $12 billion for buy-back. So the market know that a lot of shares were going to be bought up…by CAT. And not at bargain basement price either. Take a look at the record of their share price above and you’ll see that the board had authorized using borrowed money to buy their shares at around the highest price they had ever been. Hmm. Did buying all those shares encourage others to do likewise, especially knowing that CAT had a war chest of $12 billion earmarked for buying shares? Any ‘investor’ would know there was a buyer in the market who would be ready and willing to buy them back from him. The upshot would be a guaranteed buoyant market in CAT shares at a time when without such a buoyant demand a year of declining sales might just possibly have led to a steep decline in share price. Of course the official rationale for taking on debt to buy back shares is that debt costs are now low so its a good time to do it. The problem is that while in the short term it improves the look of the company’s share price and things like return on equity, it locks CAT, and any company that does the same, in to paying out interest on debt over the long term.

The systemic problem

If CAT were alone in being the only company whose share price looks to be over-valued based on actual profitability it wouldn’t matter and we’d be fine. But it isn’t. Here is what a recent note from Goldman Sachs chief equity strategist, David Kostin says – as reported at Zerohedge.

In other words almost everything looks over valued. Mr Kostin goes on to suggest one reason for the inflated prices is that

The key for me is he puts share buy back and returning money to investors together. Companies buy back their shares. This keeps their share price inflated in a market that has forgotten to worry about underlying profit and is fixated instead on short term ‘what someone will pay me for this bit of paper’. So the share price remain high and the experts tell us all is good. Wonderful in fact. But the money, some of it alt least, is being sucked out and given to those ‘investors’ who sold and cashed out. Now who are those people? Well we know that the wealthiest 10% own about 75% of all measured wealth and that the bulk of that wealth is not physical stuff but held in the form of financial products So it looks to me that as share prices are being kept high some are cashing out. Those who stay in are feeling happy because their shares keep going up in ‘value’. But of course its not that simple because someone has to keep buying in the market. So I suspect much of the cashed out money is still flowing back in to other shares to keep the market buoyant. Plus people will look at even a rigged market and say to themselves – “hey I’m missing out if I duck out of this bull market too early.” So they stay in even knowing the risks of a rigged market. Telling themselves there will be a better time later to cash out. And therein lies their danger. As Mr Kostin notes,

Seems like this was a strategy they tried before. And it is not just CAT and a few others it is market wide. Mr Kostin one more time

I think that is a systemic problem. $600 billion keeping stock prices buoyant and above any profit based valuation. And I’m not alone. Nobel laureate economist Robert Shiller of Yale University in a recent interview said, referring to the persistent bubble-like pricing in not just property but in stocks and various commodities,

The fact that Schiller thinks this bubble is driven by anxiety is, to me, very significant. I think he is right of course. I do think there is a palpable anxiety driving this bubble rather than the exuberant ‘animal spirits’ that Greenspan so famously identified as the cause of bubbles. Schiller goes on to say,

I agree with all those sources of anxiety. But I think he is missing out on possibly the major source which, as I’ve argued, is the anxiety of keeping your money in the market so as to maintain the inflated share prices, while at the same time trying to figure out how to get out, again, without popping the bubble. So – maintain and get out at the same time – no wonder they’re anxious. Round and round. Up and up. If you can’t get out and you are afraid there are not enough new buyers to keep your ponzi/bubble going what do you do? I think the answer is you and your friends do the buying yourself. If you and your friends are big enough players with enough to lose that defecting is really dangerous, then you actually have a workable incentive to keep playing. You buy the shares I sell and I buy yours (It doesn’t just have to be just buy-backs as per the CAT example). And I think this is what has been happening. Of course it only works of you are able, as a group, to have a really serious effect on the over all market. But if you think of the top 10% they certainly have that. I buy your shares and pay you your asking price. You do the same for me. Tomorrow we do it again and each time we ramp the price a little. The limiting factor, of course, is that we will not have enough money to buy all the shares as their price goes up and up. But that little problem can be easily solved if we have a friendly banker who will accept our shares as collateral for a loan. If our banker will extend us a loan and increase that loan periodically in line with the increase in value of the shares then all is good. Because the bank can just magic new money in to existence.

And if anyone get a creeping feeling that the banks are getting stretched a little thin or their margins – the interest they charge us for our loans above what they pay for borrowing – are too small for their comfort, then we all just tell the central bank that some new very low interest money is needed to juice the whole system. And since most of them are former us (bankers and financiers) they will understand. Plus they don’t want a systemic crash. It’s bad for their reputation and their personal wealth. So with help from bankers and central bankers our cash supply will keep pace with the bubble inflation. Let’s be clear the markets tell central bankers what is needed not the other way around. It is a myth that central bankers call the tune. They don’t. Certainly central bankers sit in their central banks board rooms and ‘make’ their decisions but it is what the private banks do, how much they loan, how much they inflate the credit supply, that has the whip hand in dictating what the central banks are obliged to do in order to keep the music playing.

Of course if everyone knows the whole thing is a bubble it might seem insane. But if your alternative is to see the bubble burst then its still a rational decision to keep playing. It will pop one day and all that paper will turn to ash. But if, in the mean time you have been siphoning off some wealth to buy up actual stuff then when the ash settles you will still own stuff. So keep playing. I wonder if this is why there is such a political push in the US and Europe to privatize anything and everything still in public hands? And this argument doesn’t even take in to account that the vast preponderance of the wealth of the top 10% is tied up in even more remote-from-reality paper. Certainly the wealthiest 10%, 5%, 1% 0.1% and 0.01% own mines and factories and land. But even those things are dwarfed by how much of the wealth is tied up in the paper wealth of derivatives, securities, loans, bonds piled on top of the inflated asset and share prices. You just have to think, for example, of the size of the OTC derivatives markets whose gross market value is somewhere around $21 trillion. A figure that is itself based upon the larger value of outstanding contracts which is about $630 Trillion. All of this would be dust, in a collapse that was not bailed out.

Is this actually happening?

Well price inflation certainly is. According to an article from AP a few days ago,

How bad is it?

At the same time leverage is again creeping up to unwise levels. Not in the banks this time (not officially at least) but in Hedge funds where it is up to 2004 levels. It is a truism that risk never goes away it just migrates to where the regulators can’t see it or have no power to do anything about it. Even the slowest guys in the room, the regulators, are beginning to be worried...The point, however, is that there is an air of conspiracy about it. The companies (which includes financial ones) are playing around on the border between creative accountancy and fraudulent misrepresentation and the analysts and auditors are not correcting them. Much as we saw in the figures for all the banks in the run up to the crash. All of the big 4 accountancy firms were signing off on the robust financial health of banks sometimes mere weeks before said bank then collapsed. All of the big 4 auditors subsequently found themselves in court. So to suggest that companies, analysts and auditors might be not just allowing and enabling dangerous misrepresentations but even endorsing them is not really conspiracy theory, more painful experience...

A BIT MORE

Demeter

(85,373 posts)GIVEN THE STATE OF CALIFORNIA'S WATER SUPPLY, IT SHOULDN'T EVEN TAKE THAT LONG

http://www.independent.co.uk/environment/climate-change/society-will-collapse-by-2040-due-to-catastrophic-food-shortages-says-study-10336406.html

A scientific model has suggested that society will collapse in less than three decades due to catastrophic food shortages if policies do not change.

The model, developed by a team at Anglia Ruskin University’s Global Sustainability Institute, does not account for society reacting to escalating crises by changing global behaviour and policies.

However the model does show that our current way of life appears to be unsustainable and could have dramatic worldwide consequences.

Dr Aled Jones, the Director of the Global Sustainability Institute, told Insurge Intelligence: "We ran the model forward to the year 2040, along a business-as-usual trajectory based on ‘do-nothing’ trends — that is, without any feedback loops that would change the underlying trend.

"The results show that based on plausible climate trends, and a total failure to change course, the global food supply system would face catastrophic losses, and an unprecedented epidemic of food riots.

"In this scenario, global society essentially collapses as food production falls permanently short of consumption."

MORE

Demeter

(85,373 posts)U.S. President Barack Obama’s proposed ‘Trade’ deals are actually about whether the world is heading toward a dictatorial world government — a dictatorship by the hundred or so global super-rich who hold the controlling blocks of stock in the world’s largest international corporations — or else toward a democratic world government, which will be a global federation of free and independent states, much like the United States was at its founding, but global in extent. These are two opposite visions of world government; and Obama is clearly on the side of fascism, an international mega-corporate dictatorship, as will be documented here in the links, and explained in the discussion.

Also as a preliminary to the discussion here is the understanding that if Obama wins Fast Track Trade Promotion Authority, then all of his ‘trade’ deals will be approved by Congress and then be able to be considered seriously by other governments, and that if he fails to receive this Authority, then none of them will.

“Fast Track,” as will be explained in depth here, is, indeed, the “open Sesame” for Obama, on the entire matter. Without it, his deals don’t stand even a chance of passage.

I previously wrote about why it’s the case that “‘Fast Track’ Violates the U.S. Constitution.” The details of the case are presented there (and specific court-case references will be cited in what follows here); but, to summarize the core of the case: “Fast Track Trade Promotion Authority,” which was introduced by the imperial President Richard M. Nixon in the Trade Act of 1974, violates the U.S. Constitution’s Treaty Clause — the clause that says “The President … shall have power, by and with the advice and consent of the Senate, to make treaties, provided two thirds of the Senators present concur.” (In other words: otherwise, the President simply doesn’t have that power, the President cannot “make treaties.” Nixon wanted to make treaties without his needing to have two-thirds of the Senate vote “Yea” on them.) Fast Track abolishes that two-thirds requirement and replaces it by a requirement such as that for normal laws, of only a majority of the Senate approving, 50% (+1, which would be Vice President Joe Biden, so all that will actually be needed would be just that 50%). Obama’s ‘trade’ deals don’t stand a chance of receiving the approval of two-thirds of the U.S. Senate.

What follows here will continue from that case, by providing the history of the U.S. Constitution’s Treaty Clause, and of the successful modern movement, during the Twentieth Century, for its legislative overthrow, something (the legislated overthrow of a provision that’s in the Constitution) that in-itself is prohibited by the U.S. Constitution — an Amendment, or else a Constitutional convention, is instead required, in order to overthrow any provision of the U.S. Constitution) — but which the Trade Act of 1974 said can be done by means of a mere “Legislative-Executive Agreement,” to carve out an exception to the Constitution’s Treaty Clause (“The President … shall have power, by and with the advice and consent of the Senate, to make treaties, provided two thirds of the Senators present concur.”), whenever the President and 50%+1 members of the Senate decide to do so.

Now, of course, each and every formalized international agreement, including agreements about “trade,” is a treaty and therefore it falls under this two-thirds rule. Furthermore, until 1974, every nation in the world, including the United States, accepted and did not challenge the view that every international agreement is a treaty, and that every treaty is an international agreement. In fact, even right up to the present day, every dictionary continues to define “treaty” as “an international agreement.” An international agreement is a treaty, and a treaty is an international agreement. Throughout the world, except in the United States starting long after the Constitution was written (i.e., starting in 1974), “treaty” = “international agreement.” It was always quite simple, until recently. However, after the Trade Act of 1974, starting in 1979, five such treaties have been set by the President and the Senate’s Majority Leader on “Fast Track Trade Promotion Authority” under the Trade Act of 1974, which provision of that law requires only 50%+1 Senators to vote “Yea” in order for the proposed treaty to be able to become U.S. law. The question is whether that’s Constitutional. (We’ll show: It’s not.)

SEE LINK FOR REST--LENGTHY BUT WORTHY READ

Investigative historian Eric Zuesse is the author, most recently, of They’re Not Even Close: The Democratic vs. Republican Economic Records, 1910-2010, and of CHRIST’S VENTRILOQUISTS: The Event that Created Christianity, and of Feudalism, Fascism, Libertarianism and Economics.

Demeter

(85,373 posts)JPMorgan Chase & Co (JPM.N) is in talks with the U.S. Securities and Exchange Commission to settle a probe by the agency on whether the bank inappropriately advised its private-banking clients toward its own investment products, the Wall Street Journal reported, citing people familiar with the matter.

A settlement may come as early as this summer and could include a fine, the size of which was not known, WSJ said, citing people familiar with the matter.

JPMorgan Chase & Co disclosed in May that it received subpoenas from the Securities and Exchange Commission over how it sells its mutual funds.

Other government authorities and a self-regulatory organization, apart from the SEC, have also sought information about the bank's use of proprietary products in its wealth-management business, JPMorgan said in a regulatory filing last month.

Representatives at JPMorgan and the Securities and Exchange Commission were unavailable for comment outside regular business hours.

Demeter

(85,373 posts)It's time we signed this petition to our representatives and senators:

If you don't oppose and vote against the Trans-Pacific Partnership, I will oppose and vote against you in every future primary and general election in which you are a candidate.

Please sign it here.

The House and Senate have rammed through Fast Track.

Here are the senators who voted for Fast Track:

http://1.usa.gov/1GtAdTH

And the House members who voted for Fast Track:

http://1.usa.gov/1GAl1TT

We always said this would virtually guarantee passage of the Trans-Pacific Partnership. But it doesn't absolutely guarantee it.

One way to stop it would be to pull out a seldom-used tactic in the United States that is indispensible in other nations. We could threaten consequences at the polling place for TPP supporters.

Yes, yes, yes, yes, I know -- No, not kidding, I actually know -- that in some small percentage of cases this could end up meaning that you've committed to voting against someone who faces in a future election someone else who looks even worse. But fear of that has in fact produced a pattern of, in fact, worse candidates followed by even worse candidates for years now. How, pray tell, do you propose to ever get any better candidates?

The TPP is a disaster that towers over considerations of gentility and lesser-evilism. This is Congress, as our supposed representatives, giving the power to overturn its own laws to corporations. Why would you care whom you elect to a body that no longer has the power to make laws? It's already given up the power to stop wars.

The TPP is NAFTA on steroids, economically and environmentally destructive at home and abroad. Most of it has nothing to do with trade, but is rather about empowering banks and corporations with powers that couldn't be passed separately or transparently because they're too terrible and unpopular.

It's time we take a stand against wrecking the world, even with corrupt politicians who can find someone slightly more corrupt to run against.

It's time we signed this petition:

If you don't oppose and vote against the Trans-Pacific Partnership, I will oppose and vote against you in every future primary and general election in which you are a candidate.

Please sign it here.

Sign up for these emails at http://davidswanson.org/signup.

David Swanson via WarIsACrime.org

Demeter

(85,373 posts)I got nothing....any ideas? Burning issues? Nostalgic delights? Anything?

A D-I-Y thread? I'm straining, folks. Gonna have a perfectly awful day today. Help me out.

DemReadingDU

(16,000 posts)Log Cabin Day?

This is annually celebrated on the last Sunday in June in Michigan with a series of old timey festivities and, presumably, lots of Lincoln Logs.

http://mentalfloss.com/article/64580/12-offbeat-holidays-you-can-celebrate-june

mother earth

(6,002 posts)shoot off the fireworks?

U.S. Route 66 (US 66 or Route 66), also known as the Will Rogers Highway and colloquially known as the Main Street of America or the Mother Road, was one of the original highways within the U.S. Highway System. Route 66 was established on November 11, 1926, with road signs erected the following year.[4] The highway, which became one of the most famous roads in America, originally ran from Chicago, Illinois, through Missouri, Kansas, Oklahoma, Texas, New Mexico, and Arizona before ending at Santa Monica, California, covering a total of 2,448 miles (3,940 km).[5] It was recognized in popular culture by both the hit song "

Route 66 served as a major path for those who migrated west, especially during the Dust Bowl of the 1930s, and it supported the economies of the communities through which the road passed. People doing business along the route became prosperous due to the growing popularity of the highway, and those same people later fought to keep the highway alive in the face of the growing threat of being bypassed by the new Interstate Highway System.

Route 66 underwent many improvements and realignments over its lifetime, and it was officially removed from the United States Highway System on June 27, 1985,[6] after it had been replaced in its entirety by the Interstate Highway System. Portions of the road that passed through Illinois, Missouri, New Mexico, and Arizona have been designated a National Scenic Byway of the name "Historic Route 66", which is returning to some maps.[7][8] Several states have adopted significant bypassed sections of the former US 66 into the state road network as State Route 66.

If you ever plan to motor west,

Travel my way, take the highway that is best.

Get your kicks on Route sixty-six.

It winds from Chicago to LA,

More than two thousand miles all the way.

Get your kicks on Route sixty-six.

Now you go through Saint Looey

Joplin, Missouri,

And Oklahoma City is mighty pretty.

You see Amarillo,

Gallup, New Mexico,

Flagstaff, Arizona.

Don't forget Winona,

Kingman, Barstow, San Bernandino.

Won't you get hip to this timely tip:

When you make that California trip

Get your kicks on Route sixty-six.

Won't you get hip to this timely tip:

When you make that California trip

Get your kicks on Route sixty-six.

Get your kicks on Route sixty-six.

Get your kicks on Route sixty-six.

mother earth

(6,002 posts)Couldn't resist. ![]()

DemReadingDU

(16,000 posts)What else are they waiting for:

unemployment is low

jobs reports are good

confidence is up

health care won in the supreme court

same-sex marriage won in the supreme court

TPP trade agreement passed

Obama sending additional troops to Iraq

maybe waiting on Greece decision whether to default?

mother earth

(6,002 posts)which is a great lead into our musical interlude...