Economy

Related: About this forumDemeter

(85,373 posts)Demeter

(85,373 posts)A new report shows that U.S. bank loans to nondepository financial companies have jumped more than 230 percent over the past three years

http://www.bloomberg.com/news/articles/2015-06-30/normal-banks-are-helping-shadow-banks-grow-a-lot

It's no secret that financial companies without government-backed deposits—often dubbed shadow banks—have been growing as a result of post-financial crisis regulations imposed on actual banks.

But what's often overlooked is just how much the "normal" kind of banks are helping to power that growth.

U.S. banks' loans to nondepository financial companies, or shadow banks, have jumped more than 230 percent over the past three years, according to the semiannual risk perspective report released by the Office of the Comptroller of the Currency on Tuesday. They were the fifth-largest category of commercial-loan holdings at banks at the end of last year, up from the 11th spot at the end of 2011.

Here's an OCC chart showing the trend:

And since it's a long list, here's how the OCC described what kind of companies are actually in this category:

To be sure, banks being involved with shadow banks isn't new. During the crisis, loans to subprime mortgage lenders, managers of collateralized debt obligations, and hedge funds created all sorts of trouble for banks, along with the sort of softer relationships they had with such things as the mortgage-backed securities they issued and SIVs.

Yet banks never really backed away from being a key cog in the shadow-banking system, as Bloomberg News reporter Donal Griffin laid out in an article in 2012 about how Citigroup was involved with collateralized loan obligations, money-market funds, and mortgage real estate investment trusts, even as the bank's then-chief executive officer, Vikram Pandit, was vocally criticizing how regulations were shifting risk toward exactly such things.

It's not just banks that are offering nonbanks a helping hand.

Another report released Tuesday, from the overseer of Fannie Mae and Freddie Mac, shows that those companies may also be playing a role, as they increase the fees they charge lenders to guarantee mortgages.

Over the past two years, the mortgage giants have been charging small lenders less (on a risk-adjusted basis) to guarantee loans than they charge large ones, in a switch from the past, according to the report. And many of those small lenders are nonbanks.

In other words, if you push risk down in one place, it can pop up in another place that may not be so far removed from the first.

I ASK YOU, IS THIS STUPID? OR IS IT CRIMINAL?

Demeter

(85,373 posts)June's typically a month when millions of people enter the labor force...The size of the labor force tanked last month, helping to make for a very mixed June jobs report.

Though payrolls climbed at a healthy clip, some 432,000 people left the workforce, Labor Department data showed. That sent the participation rate — which tracks the share of working-age people who are either employed or looking for work — to 62.6 percent, the lowest level since October 1977. While the rate has been trending down ever since baby boomers started retiring in droves, the decrease last month was the sharpest in more than a year.

The decline was made all the more surprising by the fact that June tends to be a month where the U.S. sees loads of people moving into the labor force — think teenagers snagging lifeguard gigs, recent college graduates scouring the internet for job postings and teachers taking up summer work. That "just did not happen," said Karen Kosanovich, an economist at the Bureau of Labor Statistics in Washington.

In the last decade, an average 1.35 million workers have entered the labor force every June on a not seasonally adjusted basis. This year, the gain was 564,000. That translates into a decline for the seasonally adjusted data, since the monthly increase was much less than it usually is.

There could be a couple explanations for this. The BLS gets its labor force data from Current Population Survey, in which households say whether they were employed, unemployed and looking for work, or neither during the Sunday-to-Sunday period that includes the 12th day of the month. Last month, this reference period occurred earlier than normal, and as a result a smaller share of the labor force gains were captured, according to Betsey Stevenson, a member of the President Barack Obama’s Council of Economic Advisers. This discrepancy could account for 500,000 people missing from the labor force, she wrote in a blog post.

Economists are also considering whether this year's severe winter weather is to blame for yet another disappointing data point. A high number of snow days could have extended the school year in some locations, limiting the normal flow of people into the workforce.

"If that hypothesis is true, then we could see a substantial seasonally adjusted pop in labor force participation in July and likely a rebound in the unemployment rate,'' Stephen Stanley, chief economist at Amherst Pierpont Securities LLC, wrote in a note to clients. "I have my doubts about this hypothesis, but it makes more sense than to believe that the labor force collapsed in June because potential workers felt that there were no job prospects."

Certain demographic groups also showed significant drops. Some 402,000 men left the labor force on a seasonally adjusted basis, accounting for 93 percent of the overall decline. Looking at age groups, the labor force participation rate for workers 45 to 54 years old declined to 79.2 percent, the lowest since December 2013, from 79.6 percent. For 16- to 19-year-olds, it declined to 34.3 percent from 35 percent. When there's no one clear cause as to what's responsible for labor force fluctuations, it's better to wait for more data before making a call, BLS's Kosanovich said. And parsing this trend will be increasingly important in the months to come, as Federal Reserve policy makers try to time their first interest rate increase since 2006. Gauging how much room for improvement is left in the labor force will be key to that decision.

Combined with the weakness in wage growth, the low labor force participation rate "will bolster the arguments of those on the Federal Open Market Committee who think that there is still a lot of slack in the labor market," Nariman Behravesh, chief economist at IHS Inc. in Lexington, Massachusetts, wrote in a note to clients.

Demeter

(85,373 posts)FROM FEBRUARY

VIDEO AT LINK

Gallup CEO Jim Clifton told CNBC he might “suddenly disappear” for telling the truth about the Obama unemployment rate.

The real Obama unemployment rate has never recovered and is still above 10%.

Demeter

(85,373 posts)- Negotiations have stalled because Greece’s creditors (a) refused to reduce our un-payable public debt and (b) insisted that it should be repaid ‘parametrically’ by the weakest members of our society, their children and their grandchildren

- The IMF, the United States’ government, many other governments around the globe, and most independent economists believe — along with us — that the debt must be restructured.

- The Eurogroup had previously (November 2012) conceded that the debt ought to be restructured but is refusing to commit to a debt restructure

- Since the announcement of the referendum, official Europe has sent signals that they are ready to discuss debt restructuring. These signals show that official Europe too would vote NO on its own ‘final’ offer.

- Greece will stay in the euro. Deposits in Greece’s banks are safe. Creditors have chosen the strategy of blackmail based on bank closures. The current impasse is due to this choice by the creditors and not by the Greek government discontinuing the negotiations or any Greek thoughts of Grexit and devaluation. Greece’s place in the Eurozone and in the European Union is non-negotiable.

- The future demands a proud Greece within the Eurozone and at the heart of Europe. This future demands that Greeks say a big NO on Sunday, that we stay in the Euro Area, and that, with the power vested upon us by that NO, we renegotiate Greece’s public debt as well as the distribution of burdens between the haves and the have nots.

Demeter

(85,373 posts)FROM 6 JUNE 2015

ENGLISH TRANSCRIPT AT LINK http://www.informationclearinghouse.info/article42085.htm

Demeter

(85,373 posts)

Demeter

(85,373 posts)So now they do it. Now the IMF comes out with a report that says Greece needs hefty debt restructuring...Mind you, their numbers are still way off the mark, in the end it’s going to be easily double what they claim. Not even a Yanis Varoufakis haircut will do the trick...But at least they now have preliminary numbers out. The reason why they have is inevitably linked to the press leak I wrote about earlier this week in "Troika Documents Say Greece Needs Huge Debt Relief". If that hadn’t come out, I’m betting they would still not have said a thing. It’s even been clear for many years to the IMF that debt restructuring for Greece is badly needed, but Lagarde and her troops have come to the Athens talks with an agenda, and stonewalled their own researchers.

Which makes you wonder, why would any economist still want to work at the Fund? What is it about your work being completely ignored by your superiors that tickles your fancy? How about your conscience? Why go through 5 months of ‘negotiations’ with Greece in which you refuse any and all restructuring, only to come up with a paper that says they desperately need restructuring, mere days after they explicitly say they won’t sign any deal that doesn’t include debt restructuring?

By now I have to start channeling my anger about the whole thing. This is getting beyond stupid. And I did too have an ouzo at the foot of the Acropolis, but I’m not sure whether that channels my anger up or down. The whole shebang is just getting too crazy. For five whole months the troika refuses to talk debt relief, and mere days after the talks break off they come with this? What then was their intention going into the talks? Certainly not to negotiate, that much is clear, or the IMF would have spoken up a long time ago.

At the very least, all Troika negotiators had access to this IMF document prior to submitting the last proposal, which did not include any debt restructuring, and which caused Syriza to say it was unacceptable for that very reason. Tsipras said yesterday he hadn’t seen it, but the other side of the table had, up to and including all German MPs. This game obviously carries a nasty odor...It’s insane to see even Greeks claim that this is Alexis Tsipras’ fault, but given the unrelenting anti-Syriza ‘reporting’ in western media as well as the utterly corrupted Greek press, we shouldn’t be surprised.

The real picture is completely different. Tsipras and Varoufakis are the vanguard of a last bastion of freedom fighters who refuse to surrender their country to an occupation force called the Troika. Which seeks to conquer Greece outright through financial oppression and media propaganda. Tsipras and Varoufakis should have everyone’s loud and clear support for what they do. And not just in Greece. But where is the support in Europe? Or the US, for that matter? There’s no there there. Europeans are completely clueless about what’s happening here in Athens. They can’t see to save their lives that their silence protects and legitimizes a flat out war against a country that is, just like their respective countries, a member of a union that now seeks to obliterate it.

Europeans need to understand that the EU has no qualms about declaring war on one of its own member states. And that it could be theirs next time around. Where people die of hunger or preventable diseases. Or commit suicide. Or flee.

****************

The July 5 referendum here in Greece is not about whether the country will remain in the EU, or the eurozone, no matter what any talking head or politician tries to make of it. The narrow question is about whether Greeks want their government to accept a June 26 Troika proposal that Tsipras felt he could not sign because it fell outside his mandate...

I FIND IT DELICIOUSLY IRONIC, THAT THE NEXT REVOLUTION FOR DEMOCRACY WILL BE FOUGHT IN THE BIRTHPLACE OF DEMOCRACY, AGAINST THE BANKSTERS WHO PROFIT FROM AND OPPOSE DEMOCRACY...AND ON THE 4TH OF JULY WEEKEND.

Demeter

(85,373 posts)John Perkins, author of Confessions of an Economic Hit Man, discusses how Greece and other eurozone countries have become the new victims of "economic hit men."

John Perkins is no stranger to making confessions. His well-known book, Confessions of an Economic Hit Man, revealed how international organizations such as the International Monetary Fund (IMF) and the World Bank, while publicly professing to "save" suffering countries and economies, instead pull a bait-and-switch on their governments: promising startling growth, gleaming new infrastructure projects and a future of economic prosperity - all of which would occur if those countries borrow huge loans from those organizations. Far from achieving runaway economic growth and success, however, these countries instead fall victim to a crippling and unsustainable debt burden.

That's where the "economic hit men" come in: seemingly ordinary men, with ordinary backgrounds, who travel to these countries and impose the harsh austerity policies prescribed by the IMF and World Bank as "solutions" to the economic hardship they are now experiencing. Men like Perkins were trained to squeeze every last drop of wealth and resources from these sputtering economies, and continue to do so to this day. In this interview, which aired on Dialogos Radio, Perkins talks about how Greece and the eurozone have become the new victims of such "economic hit men."

John Perkins: Essentially, my job was to identify countries that had resources that our corporations want, and that could be things like oil - or it could be markets - it could be transportation systems. There're so many different things. Once we identified these countries, we arranged huge loans to them, but the money would never actually go to the countries; instead it would go to our own corporations to build infrastructure projects in those countries, things like power plants and highways that benefitted a few wealthy people as well as our own corporations, but not the majority of people who couldn't afford to buy into these things, and yet they were left holding a huge debt, very much like what Greece has today, a phenomenal debt.

And once they were bound by that debt, we would go back, usually in the form of the IMF - and in the case of Greece today, it's the IMF and the EU [European Union] - and make tremendous demands on the country: increase taxes, cut back on spending, sell public sector utilities to private companies, things like power companies and water systems, transportation systems, privatize those, and basically become a slave to us, to the corporations, to the IMF, in your case to the EU, and basically, organizations like the World Bank, the IMF, the EU, are tools of the big corporations, what I call the "corporatocracy."

And before turning specifically to the case of Greece, let's talk a little bit more about the manner in which these economic hit men and these organizations like the IMF operate. You mentioned, of course, how they go in and they work to get these countries into massive debt, that money goes in and then goes straight back out. You also mentioned in your book these overly optimistic growth forecasts that are sold to the politicians of these countries but which really have no resemblance to reality.

Exactly, we'd show that if these investments were made in things like electric energy systems that the economy would grow at phenomenally high rates. The fact of the matter is, when you invest in these big infrastructure projects, you do see economic growth, however, most of that growth reflects the wealthy getting wealthier and wealthier; it doesn't reflect the majority of the people, and we're seeing that in the United States today.

For example, where we can show economic growth, growth in the GDP, but at the same time unemployment may be going up or staying level, and foreclosures on houses may be going up or staying stable. These numbers tend to reflect the very wealthy, since they have a huge percentage of the economy, statistically speaking. Nevertheless, we would show that when you invest in these infrastructure projects, your economy does grow, and yet, we would even show it growing much faster than it ever conceivably would, and that was only used to justify these horrendous, incredibly debilitating loans.

Is there a common theme with respect to the countries typically targeted? Are they, for instance, rich in resources or do they typically possess some other strategic importance to the powers that be?

Yes, all of those. Resources can take many different forms: One is the material resources like minerals or oil; another resource is strategic location; another resource is a big marketplace or cheap labor. So, different countries make different requirements. I think what we're seeing in Europe today isn't any different, and that includes Greece.

What happens once these countries that are targeted are indebted? How do these major powers, these economic hit men, these international organizations come back and get their "pound of flesh," if you will, from the countries that are heavily in debt?

By insisting that the countries adopt policies that will sell their publicly owned utility companies, water and sewage systems, maybe schools, transportation systems, even jails, to the big corporations. Privatize, privatize. Allow us to build military bases on their soil. Many things can be done, but basically, they become servants to what I call the corporatocracy. You have to remember that today we have a global empire, and it's not an American empire. It's not a national empire. It doesn't help the American people very much. It's a corporate empire, and the big corporations rule. They control the politics of the United States, and to a large degree they control a great deal of the policies of countries like China, around the world.

John, looking specifically now at the case of Greece, of course you mentioned your belief that the country has become the victim of economic hit men and these international organizations . . . what was your reaction when you first heard about the crisis in Greece and the measures that were to be implemented in the country?

I've been following Greece for a long time. I was on Greek television. A Greek film company did a documentary called "Apology of an Economic Hit Man," and I also spent a lot of time in Iceland and in Ireland. I was invited to Iceland to help encourage the people there to vote on a referendum not to repay their debts, and I did that and encouraged them not to, and they did vote no, and as a result, Iceland is doing quite well now economically compared to the rest of Europe. Ireland, on the other hand: I tried to do the same thing there, but the Irish people apparently voted against the referendum, though there's been many reports that there was a lot of corruption.

In the case of Greece, my reaction was that "Greece is being hit." There's no question about it. Sure, Greece made mistakes, your leaders made some mistakes, but the people didn't really make the mistakes, and now the people are being asked to pay for the mistakes made by their leaders, often in cahoots with the big banks. So, people make tremendous amounts of money off of these so-called "mistakes," and now, the people who didn't make the mistakes are being asked to pay the price. That's consistent around the world: We've seen it in Latin America. We've seen it in Asia. We've seen it in so many places around the world.

This leads directly to the next question I had: From my observation, at least in Greece, the crisis has been accompanied by an increase in self-blame or self-loathing; there's this sentiment in Greece that many people have that the country failed, that the people failed . . . there's hardly even protest in Greece anymore, and of course there's a huge "brain drain" - there's a lot of people that are leaving the country. Does this all seem familiar to you when comparing to other countries in which you've had personal experience?

Sure, that's part of the game: convince people that they're wrong, that they're inferior. The corporatocracy is incredibly good at that, whether it is back during the Vietnam War, convincing the world that the North Vietnamese were evil; today it's the Muslims. It's a policy of them versus us: We are good. We are right. We do everything right. You're wrong. And in this case, all of this energy has been directed at the Greek people to say "you're lazy; you didn't do the right thing; you didn't follow the right policies," when in actuality, an awful lot of the blame needs to be laid on the financial community that encouraged Greece to go down this route. And I would say that we have something very similar going on in the United States, where people here are being led to believe that because their house is being foreclosed that they were stupid, that they bought the wrong houses; they overspent themselves.

The fact of the matter is their bankers told them to do this, and around the world, we've come to trust bankers - or we used to. In the United States, we never believed that a banker would tell us to buy a $500,000 house if in fact we could really only afford a $300,000 house. We thought it was in the bank's interest not to foreclose. But that changed a few years ago, and bankers told people who they knew could only afford a $300,000 house to buy a $500,000 house.

"Tighten your belt, in a few years that house will be worth a million dollars; you'll make a lot of money" . . . in fact, the value of the house went down; the market dropped out; the banks foreclosed on these houses, repackaged them, and sold them again. Double whammy. The people were told, "you were stupid; you were greedy; why did you buy such an expensive house?" But in actuality, the bankers told them to do this, and we've grown up to believe that we can trust our bankers. Something very similar on a larger scale happened in so many countries around the world, including Greece.

In Greece, the traditional major political parties are, of course, overwhelmingly in favor of the harsh austerity measures that have been imposed, but also we see that the major business and media interests are also overwhelmingly in support. Does this surprise you in the slightest?

No, it doesn't surprise me and yet it's ridiculous because austerity does not work. We've proven that time and time again, and perhaps the greatest proof was the opposite, in the United States during the Great Depression, when President Roosevelt initiated all these policies to put people back to work, to pump money into the economy. That's what works. We know that austerity does not work in these situations.

We also have to understand that, in the United States for example, over the past 40 years, the middle class has been on the decline on a real dollar basis, while the economy has been increasing. In fact, that's pretty much happened around the world. Globally, the middle class has been in decline. Big business needs to recognize - it hasn't yet, but it needs to recognize - that that serves nobody's long-term interest, that the middle class is the market. And if the middle class continues to be in decline, whether it's in Greece or the United States or globally, ultimately businesses will pay the price; they won't have customers. Henry Ford once said: "I want to pay all my workers enough money so they can go out and buy Ford cars." That's a very good policy. That's wise. This austerity program moves in the opposite direction and it's a foolish policy.

In your book, which was written in 2004, you expressed hope that the euro would serve as a counterweight to American global hegemony, to the hegemony of the US dollar. Did you ever expect that we would see in the European Union what we are seeing today, with austerity that is not just in Greece but also in Spain, Portugal, Ireland, Italy, and also several other countries as well?

What I didn't realize during any of this period was how much corporatocracy does not want a united Europe. We need to understand this. They may be happy enough with the euro, with one currency - they are happy to a certain degree by having it united enough that markets are open - but they do not want standardized rules and regulations. Let's face it, big corporations, the corporatocracy, take advantage of the fact that some countries in Europe have much more lenient tax laws, some have much more lenient environmental and social laws, and they can pit them against each other.

What would it be like for big corporations if they didn't have their tax havens in places like Malta or other places? I think we need to recognize that what the corporatocracy saw at first, the solid euro, a European union seemed like a very good thing, but as it moved forward, they could see that what was going to happen was that social and environmental laws and regulations were going to be standardized. They didn't want that, so to a certain degree what's been going on in Europe has been because the corporatocracy wants Europe to fail, at least on a certain level.

You wrote about the examples of Ecuador and other countries, which after the collapse of oil prices in the late '80s found themselves with huge debts and this, of course, led to massive austerity measures . . . sounds all very similar to what we are now seeing in Greece. How did the people of Ecuador and other countries that found themselves in similar situations eventually resist?

Ecuador elected a pretty remarkable president, Rafael Correa, who has a PhD in economics from a United States university. He understands the system, and he understood that Ecuador took on these debts back when I was an economic hit man and the country was ruled by a military junta that was under the control of the CIA and the US. That junta took on these huge debts, put Ecuador in deep debt; the people didn't agree to that. When Rafael Correa was democratically elected, he immediately said, "We're not paying these debts; the people did not take on these debts; maybe the IMF should pay the debts and maybe the junta, which of course was long gone - moved to Miami or someplace - should pay the debts, maybe John Perkins and the other economic hit men should pay the debts, but the people shouldn't."

And since then, he's been renegotiating and bringing the debts way down and saying, "We might be willing to pay some of them." That was a very smart move; it reflected similar things that had been done at different times in places like Brazil and Argentina, and more recently, following that model, Iceland, with great success. I have to say that Correa has had some real setbacks since then . . . he, like so many presidents, has to be aware that if you stand up too strongly against the system, if the economic hit men are not happy, if they don't get their way, then the jackals will come in and assassinate you or overthrow you in a coup. There was an attempted coup against him; there was a successful coup in a country not too far away from him, Honduras, because these presidents stood up.

We have to realize that these presidents are in very, very vulnerable positions, and ultimately we the people have to stand up, because leaders can only do a certain amount. Today, in many places, leaders are not just vulnerable; it doesn't take a bullet to bring down a leader anymore. A scandal - a sex scandal, a drug scandal - can bring down a leader. We saw that happen to Bill Clinton, to Strauss-Kahn of the IMF; we've seen it happen a number of times. These leaders are very aware that they are in very vulnerable positions: If they stand up or go against the status quo too strongly, they're going to be taken out, one way or another. They're aware of that, and it behooves we the people to really stand up for our own rights.

You mentioned the recent example of Iceland . . . other than the referendum that was held, what other measures did the country adopt to get out of this spiral of austerity and to return to growth and to a much more positive outlook for the country?

It's been investing money in programs that put people back to work and it's also been putting on trial some of the bankers that caused the problems, which has been a big uplift in terms of morale for the people. So Iceland has launched some programs that say "No, we're not going to go into austerity; we're not going to pay back these loans; we're going to put the money into putting people back to work," and ultimately that's what drives an economy, people working. If you've got high unemployment, like you do in Greece today, extremely high unemployment, the country's always going to be in trouble. You've got to bring down that unemployment, you've got to hire people. It's so important to put people back to work. Your unemployment is about 28 percent; it's staggering, and disposable income has dropped 40 percent and it's going to continue to drop if you have high unemployment. So, the important thing for an economy is to get the employment up and get disposable income back up, so that people will invest in their country and in goods and services.

In closing, what message would you like to share with the people of Greece, as they continue to experience and to live through the very harsh results of the austerity policies that have been implemented in the country for the past three years?

I want to draw upon Greece's history. You're a proud, strong country, a country of warriors. The mythology of the warrior to some degree comes out of Greece, and so does democracy! And to realize that the marketplace is a democracy today, and how we spend our money is casting our ballot. Most political democracies are corrupt, including that of the United States. Democracy is not really working on a governmental basis because the corporations are in charge. But it is working on a market basis. I would encourage the people of Greece to stand up: Don't pay off those debts; have your own referendums; refuse to pay them off; go to the streets and strike.

And so, I would encourage the Greek people to continue to do this. Don't accept this criticism that it's your fault, you're to blame, you've got to suffer austerity, austerity, austerity. That only works for the rich people; it does not work for the average person or the middle class. Build up that middle class; bring employment back; bring disposable income back to the average citizen of Greece. Fight for that; make it happen; stand up for your rights; respect your history as fighters and leaders in democracy, and show the world!

Demeter

(85,373 posts)By now it should be clear to all that the only reason why Germany has been so steadfast in its negotiating stance with Greece is because it knows very well that if it concedes to a public debt reduction (as opposed to haircut on debt held mostly by private entities such as hedge funds which already happened in 2012), then the rest of the PIIGS will come pouring in: first Italy, then Spain, then Portugal, then Ireland.

The problem is that while it took Europe some 5 years to transfer a little over €200 billion in Greek private debt exposure to the public balance sheet (by way of the ECB, EFSF, ESM and countless other ad hoc acronyms) at a cost of countless summits and endless negotiations, which may or may not result with the first casualty of the common currency which may prove to be reversible as soon as next week, nobody in Europe harbors any doubt that the same exercise can be repeated with Italy, or Spain, or even Portugal. They are just too big (and their nonperforming loans are in the hundreds of billions).

And yet, today, in a stunning display of the schism within the Troika, it was the IMF itself which explicitly stated that Greece is no longer viable unless there is both additional funding provided to the country, which can only happen if there is another massive debt haircut.

This is what the IMF said:

And the kicker:

Bingo, because that is, in a nutshell, precisely what Tsipras and Varoufakis have been claiming since day one. As expected, a Greek government spokesman promptly said that the IMF report is in line with the Greek government's view on debt.

What makes the IMF report even more odd, is not so much its content and position which have been largely known for quite some time now, but its timing: just three days before the Sunday referendum, Tsipras now has prima facie evidence to wave in front of the Greek people and say "see, we were right all along." It is exactly the case that only a "No" vote at this point would allow Greece to continue a negotiation which has already seen one of the three Troika members side with the Greek position. Should Greece vote "Yes", it will make any future negotiation with the Troika impossible, and while the country will get a few months respite the resultant bank run after the bank reopen with the ECB's blessing will mean that all Greece will do is buy itself a few months time. Only this time all the debt will still be due. And, should they vote "Yes", this time the Greeks will only have themselves to blame for all the future pain, pain which will continue well after the mid-point of this century.

But ignoring Greece for a minute, what the IMF's "debt sustainability analysis" has just done is open the door for every single other comparably insolvent peripheral European nation to knock on Christine Lagarde's door and politely ask: "Mme Lagarde, if Greece is unsustainable, then why aren't we?" Because as the chart below shows, the debt situations of all the other peripheral European nations is just as "unsustainable."

In this way, while the outcome of the Greek situation is currently unknown, it has also become moot, because at this very moment, politicians from Spain's Podemos to Italy's Five Star movement are drafting memos demanding that the IMF evaluate their own debt sustainability. Or rather unsustainability. Perhaps more importantly, these same politicians will now dangle the prospect of an IMF admission that they, too, deserve a haircut as the catalyst to be elected into power. After all who can refuse that their life would be made so much better if only the country was permitted to selectively "default" on €50, €100, €200 billion or more in debt? Just elect this politician, or that, and watch your living standard soar...And since the IMF has no choice but to agree that just like Greece all these nations are accordingly drowning in debt, Syriza's sacrifice (assuming Tsipras fails to outnegotiate Merkel) will not have been in vain. In fact, it may very well end up that today the IMF opened up the Pandora's box, one which, more than a Grexit, will destroy Merkel's "united Europe" legacy.

tclambert

(11,086 posts)Without naming any names, he just thanks the financial powers of Germany, the Eurozone, and the IMF, then congratulates the Greek people on their courage and urges them to new hope. The whole thing would be a lie, but who could contain it? If the European financial powers claim they didn't forgive the debt, Tsipras accuses them of trying to renege on their generous deal and refuses to discuss their attempt to take it back. "You should not be ashamed of your generosity, and you should not yield to those power and money hungry interests pressuring you to deny your better natures," he could say. Portray the imaginary generous bankers who forgave the loans as courageous heroes and accuse them of cowardice if they give in to the not-so-imaginary venal, stingy, hard-hearted people who have visited misery on Greece and the rest of Europe.

I wonder if he could make the lie become real? It might be easier than trying to make it real first.

Demeter

(85,373 posts)Such a plot device will not work....unless the US propaganda machine gave its blessing.

And the State Dept. has so abused our propaganda machine that it has no credibility save the US Armed Forces, which have also been cruelly abused by the State Dept.

Most likely means of success would be bribing the banksters with another $13T in handouts....

But personally, I think they should all fail, go under, collapse under the weight of their WMD.

bread_and_roses

(6,335 posts)hoping somehow the Greek people hold out - just saw somewhere (here?) headline that medicine and food are short - people will be frightened....

And so furious that the MSM - even our worthless PBS - refers to "austerity" without a word about what it means for the people.

and while I'm at it , fuck Paul Krugman with his offhand sanctimonious remark that Greek pensions were "indeed, far too generous" or whatever his exact words. Far too generous for who, Paul? I'll bet no better than your own retirement is cushioned? But OF COURSE, you are among the elite, you worthless boot-licking LIBERAL . And he is - advocating for scraps for us while the vampires suck the life out of everything, including our mother, the earth herself.

Demeter

(85,373 posts)CrowdFunding a bailout fund for Greece. By the people, for the people.

Demeter

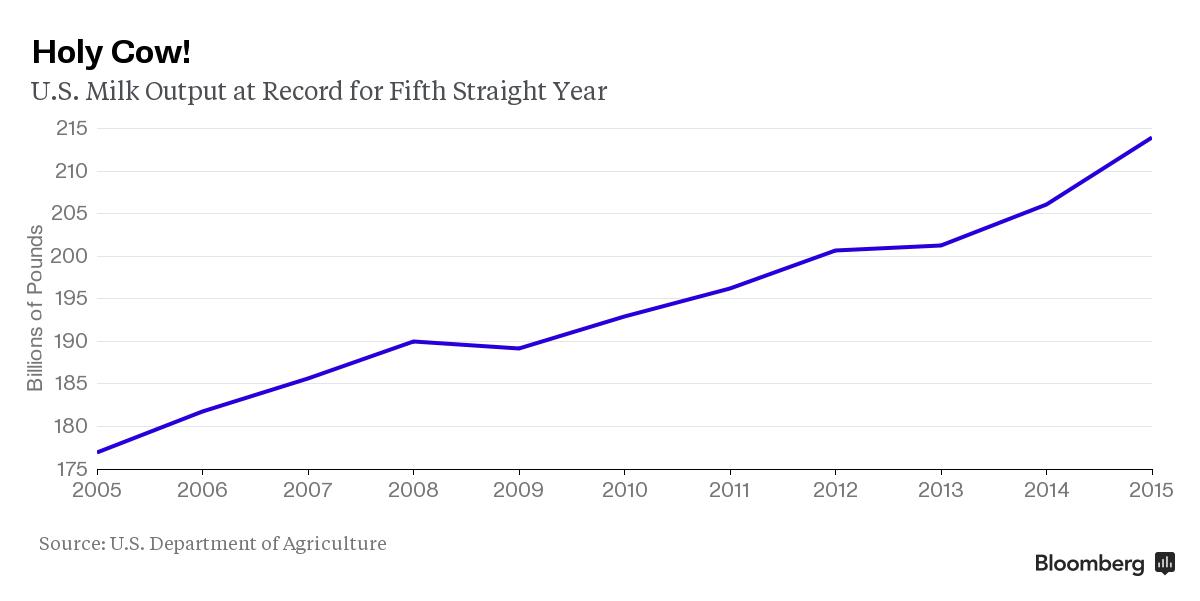

(85,373 posts)There’s so much milk flowing out of U.S. cows these days that some is ending up in dirt pits because dairies can’t find buyers. Domestic output is set to be the highest ever for a fifth straight year. Farmers are still making money as prices tumble because of cheaper and more abundant feed for their herds. Supplies of raw milk are topping capacity at processing plants in parts of the U.S. and compounding a global surplus even with demand improving.

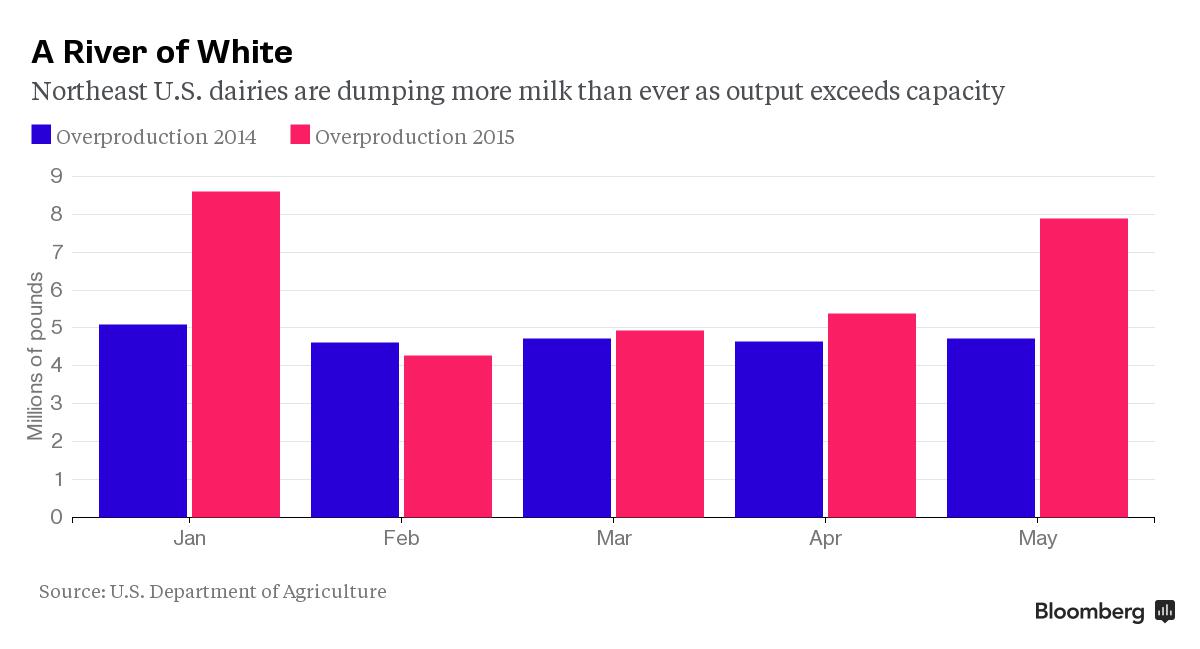

Agri-Mark, a 1,200-dairy cooperative in New England that had $1.1 billion of sales last year, started pouring skim milk last month into holes used for livestock manure. It was the first time in five decades, and farmers so far have unloaded 12 truckloads, or 600,000 pounds (272 metric tons). While having small amounts of milk spoil or go unsold isn’t unusual, Northeast dairies dumped 31 percent more this year through May than the same period of 2014, government data show.

“Usually we’d find someone to buy it at a reduced price, or ship it to the Midwest,” said Bob Wellington, a senior vice president at Andover, Massachusetts-based Agri-Mark, which was founded in 1913. “But those plants are full. There’s no way to process it in the time needed for a perishable product.”

Global Glut

Domestic output in May reached 18.4 billion pounds, the most in any month, and is on pace to reach a record 208.7 billion pounds this year, the U.S. Department of Agriculture said June 18. Globally, production will rise 2.1 percent to a record 582.52 million tons as top exporter New Zealand sells the most ever and the European Union ends limits on dairies that had been in place since 1984, the USDA said. U.S. farmers expanded after futures on the Chicago Mercantile Exchange surged to a record in September, fueled partly by rising cheese demand and a jump in purchases by China. Since then, warmer weather has brought a seasonal increase in supply, demand slowed from importers, and a stronger dollar eroded exports.

Record Output

“The world needs less milk,” said Eric Meyer, president of HighGround Dairy, a Chicago-based broker.

Global dairy prices have dropped 39 percent from an all-time high in February 2014 and are the lowest in five years, United Nations data show. In Chicago, benchmark Class III milk futures, used in cheese making, are down 36 percent to $16.11 per 100 pounds from a record $25.30 in September. Prices may fall to $14.41 by the end of the year before recovering in 2016, said Tom Bailey, a New York-based analyst at Rabobank International. New Zealand’s dollar has tumbled to a five-year low as falling milk prices amplified speculation the nation’s central bank will cut interest rates this month. The kiwi slid against almost all of its 16 major peers this year. The milk slump has been a boon to buyers including processor Dean Foods Co. and retailer Supervalu Inc., contributing to a slowdown in the pace of food inflation.

At the same time, the dollar’s rally against most of the world’s currencies helped to spur a 10 percent drop in U.S. milk exports in the first four months of 2015, while imports rose 12 percent, compounding the domestic surplus, government data show. The bear market has been no barrier to more supply. At Mitch Breunig’s farm in Sauk City, Wisconsin, he’s still profitable even as the value of his milk fell 26 percent. Costs have dropped for things like fuel, and wet spring weather left an abundant alfalfa harvest, providing higher-quality hay for his 420 cows to eat. The animals are producing 3 percent more milk than last year.

Feed Profitability

“I just have way more feed than a year ago,” Breunig said, adding that his eight grain silos are full. “In terms of profitability, boy, that has a huge effect.”

Demand remains strong, with Americans eating more dairy products than ever, especially cheese and butter, said Bill Brooks, a Dearborn, Missouri-based dairy economist at INTL FCStone. Futures may reach $17.57 in the fourth quarter, he said June 18. The USDA estimates global milk demand will rise for a sixth straight year to a record 582.7 million tons. There’s also concern output is dropping in California, the largest U.S. producer. A four-year drought may be eroding feed quality and cutting into profit, said Bill Schiek, an economist at the Dairy Institute of California in Sacramento.

Shrinking Profit

Dairy profits may not last much longer. Income over feed costs will fall 38 percent to average $8.90 per 100 pounds of milk in 2015, from a record last year, FCStone’s Brooks said. Profit margins below $7.50 usually signal output will drop, according to Matt Gould at the Dairy & Food Market Analyst newsletter. For now, there’s more than enough incentive to produce more milk. Breunig, the Wisconsin farmer, estimates his alfalfa costs will drop 26 percent to $70 a ton this year, while corn will be down 10 percent. He’s also getting top dollar from the slaughterhouse for calves and old cows at the end of their productive life, because wholesale-beef prices are near the highest ever. Dairies in the Northeast dumped 31 million pounds of milk in the first five months of 2015, including 7.9 million in May, which was 67 percent more than the same month last year, USDA data show. Farmers are saying it is the most ever, according to the dairy newsletter’s Gould. The 1,950 cows at Majestic Crossing Dairy in Sheboygan Falls, Wisconsin, are still making money for co-owner Dean Strauss even after revenue sank 40 percent from last year.

“There’s ebbs and flows,” Strauss said. “We have to be prepared and put money away when the times are good, for when poor markets come.”

THIS IS JUST CRAZY.

Demeter

(85,373 posts)Caracas, June 8, 2015 (venezuelanalysis.com) - Venezuela was recognized today by the United Nations Food and Agriculture Organization (FAO) for meeting the UN millennium goal of halving malnutrition.

The recognition was awarded during the 39th FAO conference in Rome which will last until June 13. It counts among its attendees representatives of 190 countries, including 130 ministers and 12 heads of state.

Attending on behalf of Venezuela, Bolivarian Vice-President Jorge Arreaza highlighted his nation's achievements in eradicating hunger under the socialist governments of Hugo Chavez and Nicolas Maduro.

"Under the Revolution, children are now served breakfast, lunch, and snacks in schools ... We've seen a miracle in school nutrition, whereas in the past children were served only one glass of milk a day," stated the socialist vice-president in reference his country's School Food Program.

According to Arreaza, Venezuela has over the last decade invested $142 billion in food programs that have distributed over 25 million tons of food items to 65% of the population. Today, 95.4% of Venezuelans eat three meals a day.

Venezuela was also recognized for its role in providing technical assistance to other nations striving to similarly meet millennium targets for eradicating hunger...MORE

Demeter

(85,373 posts)The media celebrates "economic growth," while new data shows most Americans are barely surviving.

Happy Monday! S&P 500 now up 10% for year --CNN Money

Third-quarter U.S. economic growth strongest in 11 years --Reuters

The U.S. economy is on a tear --Wall Street Journal

Half of our nation, by all reasonable estimates of human need, is in poverty. The jubilant headlines above speak for people whose view is distorted by growing financial wealth. The argument for a barely surviving half of America has been made before, but important new data is available to strengthen the case.

1. No Money for Unexpected Bills

A recent Bankrate poll found that almost two-thirds of Americans didn't have savings available to cover a $500 repair bill or a $1,000 emergency room visit. A related Pew survey concluded that over half of U.S. households have less than one month's income in readily available savings, and that ALL their savings -- including retirement funds -- amounted to only about four months of income. And young adults? A negative savings rate, as reported by the Wall Street Journal. Before the recession their savings rate was a reasonably healthy 5 percent.

2. 40 Percent Collapse in Household Wealth

Over half of Americans have good reason to feel poor. Between 2007 and 2013 median wealth dropped a shocking 40 percent, leaving the poorest half with negative wealth (because of debt), and a full 60% of households owning, in total, about as much as the nation's 94 richest individuals. People of color fare the worst, with half of black households owning less than $11,000 in total wealth, and Hispanic households less than $14,000. The median net worth for white households is about $142,000.

3. Cost of Living Surges as Income Falls

Official poverty measures are based largely on the food costs of the 1950s. But food costs have doubledsince 1978, housing has more than tripled, and college tuition is eleven times higher. The cost of raising a child increased by 40 percent between 2000 and 2010. And despite the gains from Obamacare, health care expenses continue to grow. As all these essential costs have been going up, median household income has been going down since 2000, with the greatest drop occurring since 2009, as 95 percent of the post-recession income gains have gone to the richest 1%.

4. Lots of New Jobs (Below Living Wage)

'Amazing' jobs report, apart from wages --Marketwatch

Amazing at the top and at the bottom. According to the Federal Reserve Bank, there have been job gains at the highest paid level -- engineering, finance, computer analysis; and there have been job gains at thelowest paid level -- personal health care, retail, and food preparation. But the jobs that kept the middle class out of poverty -- education, construction, social services, transportation, administration -- have seen a decline since the recession, especially in the northeast. At a national level jobs gained are paying 23 percent less than jobs lost. Worse yet, the lowest paid workers, those in housekeeping and home health care and food service, have seen their wages drop 6 to 8 percent (although wages overall rose about 2 percent in 2014).

5. Our Greatest Shame: Half of the Children Feeling Poverty

Over half of public school students are poor enough to qualify for lunch subsidies. There's been a stunning70 percent increase since the recession in the number of children on food stamps. State of Working America reported that almost half of black children under the age of six are living in poverty. The celebratory quotes about a booming economy seem so far away.

Paul Buchheit teaches economic inequality at DePaul University. He is the founder and developer of the Web sites UsAgainstGreed.org, PayUpNow.org and RappingHistory.org, and the editor and main author of "American Wars: Illusions and Realities" (Clarity Press). He can be reached at paul@UsAgainstGreed.org.

bread_and_roses

(6,335 posts)I'm not coming up with it on a search and wanted to send it to someone

thanks!

Demeter

(85,373 posts)Demeter

(85,373 posts)Former Goldman Sachs Group Inc director Rajat Gupta failed to persuade a U.S. judge to overturn his insider trading conviction for passing tips about the bank's financial results and a crucial investment from Warren Buffett's Berkshire Hathaway Inc. U.S. District Judge Jed Rakoff in Manhattan on Thursday rejected Gupta's argument that his tips to Galleon Group hedge fund founder Raj Rajaratnam were not illegal because his longtime friend gave him nothing valuable in return.

Gupta, 66, who is also a former McKinsey & Co global managing director, is serving a two-year prison term, and eligible for release next March. Evidence against him included a Sept. 23, 2008 phone call during the financial crisis, minutes before Goldman announced a $5 billion investment from Berkshire, in which Rajaratnam told a trader that "something good might happen to Goldman," based on a source whom prosecutors said was Gupta.

Gary Naftalis, a lawyer for Gupta, was not immediately available for comment.

In seeking to void his conviction, Gupta cited a Dec. 10 ruling by the 2nd U.S. Circuit Court of Appeals that overturned the insider trading convictions of hedge fund managers Todd Newman and Anthony Chiasson.

That court said insider trading required knowledge that insiders who passed confidential tips did so in exchange for personal benefits "of some consequence."

It also said that if close friends are involved, there must be evidence of an exchange that is "objective, consequential, and represents at least a potential gain of a pecuniary or similarly valuable nature."

Rakoff concluded that the Newman ruling addresses the liability of tippees like Rajaratnam, not tippers like Gupta. And even if it did cover tippers, Rakoff said the necessary benefit existed because Gupta and Voyager Capital Partners Ltd, in which Gupta held a $10 million stake, invested in Galleon and stood to benefit if Rajaratnam traded successfully.

"It is thus clear even on Gupta's own reading of Newman, let alone on the reading this court gives it, that Gupta cannot satisfy any part of his claim," Rakoff wrote.

Rajaratnam also invoked the Newman ruling in trying to throw out a $92.8 million penalty in a related U.S. Securities and Exchange Commission civil case. He is also trying to void part of his conviction and shorten his 11-year prison term. The U.S. Department of Justice is weighing whether to appeal the Newman ruling to the U.S. Supreme Court.

Demeter

(85,373 posts)Good heavens, the going rate for malaprops has soared.

Yes, fools and their money continue to be pretty easily parted.

Good god, 175-G's for "Bowling is fun"? I am so in the wrong racket.

And give props to Mike Kruse, Tiger Beat On The Potomac's best hire ever, for the finest in deadpan humor.

Plus there are no pesky extradition problems in Vegas.

Fuddnik

(8,846 posts)Just knowing he might show up.

Demeter

(85,373 posts)This column contains everything there is to know about economics. Hereafter it will be possible to shut down university departments and stop talking about Keynes and the Austrian School, to the great relief of mankind. In gratitude you can send me your childrens' college funds.

In 1850 people all lived on farms and grew food, which they ate. Eating was really important to them. They liked eating. There was in 1850 tremendous demand for refrigerators and cars, but people didn’t know they wanted these things because they hadn’t been invented. Anyway, they didn’t have any money to buy them with. Yet the demand was there, crouched to spring. Much demand for almost everything, but little supply.

Then farming automated and people all went to cities to work in factories to make refrigerators and cars, which had been invented. These weren’t as important as food, but they were pretty important. People had a little money now, and bought them. You don’t need advertising to sell what people actually want. There was lots of demand and getting to be pretty good supply.

Soon the factories were spitting out more than anyone could use of everything that anyone could reasonably want. A family needs only so many refrigerators. Here we encounter the first crucial problem of the modern economy: too much supply and not enough demand. Yet the factories had to make stuff so people would have jobs, and the people had to buy the stuff so they could keep having factories. Economics is thus the study of the squirrel wheel...To keep people working and buying, the economy began making things that nobody really needed or would think to want, such as nail salons, electronic gadgets, and designer jeans. To get people to buy these things, the supply of demand had to increase. Advertising came about to manufacture demand for things that, without advertising, no one would buy. Consequently society now depends for existence on pop-ups, singing commercials at twenty minutes to the hour on television, billboards, and Google ads. Advertising thus became more important to the economy than anything it advertised.

Labor

Labor followed a similar pattern. When factories came, they needed lots of people to make the refrigerators and cars. Most work involved digging holes or lifting heavy objects, so the workers didn’t have to be smart or know much.

Automation

Then came the rolling disaster that economists don’t seem to have anticipated: automation. As factories produced the increasingly trivial goods that supported the economy, they needed fewer and fewer workers to make the trivial goods. This raised two questions: Who was going to buy the $450 running shoes that nobody needed except that advertising told them they did, and how were the workers who didn’t have work making them any longer going to get money to buy them? Or to eat? It became obvious, except to economists, that automation could do just about everything people were paid to do. Just now, someone has invented a burger-maker machine that will presumably replace hundreds of thousands of burger-flippers who aren’t needed anywhere else. Self-driving vehicles approach practicality, and will first replace long-haul truckers and then cabbies and delivery truck drivers. Much worse is in the offing. Here is the second crucial problem of modern economics: Where to put unnecessary people?

The Theory of Increasing Uselessness

A search continues, long quietly underway but now intensified, for ways to keep off the work force people for whom there is no work, or no real work. These are not necessarily lazy, shiftless, or parasitic. They just don’t have anything to do. Child-labor laws and requirements that people finish high school helped diminish the labor force. Then society told the young that they all needed to go to college, when most of them didn’t, and since the universities served chiefly as holding pens, the quality of education dropped. Universities did however employ professors and administrators. Here was another example of selling at high price something that no one really needed, namely the appearance of education.

Swollen bureaucracies popped up to provide the appearance of work while the purported workers did little that would not better have been left undone. Military enterprise soaked up more people doing nothing that should be done. Exotic fighter planes that would never do anything to justify their existence but bomb remote goat-herds absorbed thousands of engineers and hundreds of billions of dollars. The engineers could as well have been paid for digging holes and filling them in, but this was judged unduly candid.

Finally even these measures ceased to be enough. College graduates began living with their parents and lining up for jobs a Starbucks because there was no need for them anywhere else. Resort was had to outright charity. Thus food stamps, Section Eight housing, free lunches at school, AFDC, and all the other disbursements of free money. Those receiving the free money no longer had any incentive to work even if the opportunity offered. In the cities generation after generation now lived on charity, largely illiterate and in what is never called custodial care. They are simply unnecessary. There is nothing for them to do. So they don’t do anything.

Poverty

In America this is usually a state of mind rather than an economic condition. The allegedly poor have all their time free, a luxury not available to the indentured drones who pay for this leisure. The poor have enough to eat—gobbling Cheetos instead of real food is their choice—and they have access to libraries and parks and museums. Graduate students at the same economic level used to live a life of books, music, illicit substances, and good conversation. The recipients of charity are not economically poor, but mentally empty.

Cognitive Stratification

Meanwhile an elaborate and highly effective system developed for sucking the very bright young from every cranny in the country and sending them to the remaining good universities: SATs, GREs, National Merit, ACT, and suchlike. Here the top two percent in intelligence partied, married, and made babies, not always in that order, and went into brain-intensive trades like Silicon Valley, i-banking, and medicine. As the middle class sank into the lower-middle, the brain babies increasingly formed a thin layer of dominant if not always morally impressive intellects at the top of society.

Increasingly aware of each other thanks to list-serves and web sites for the very smart, they foregathered internationally with their own kind, eschewing contact with the surrounding sea of slugs. (I will bet you are not reading this on a site where the comments are misspelled.) They prospered. Nobody else did. The battle lines were being drawn. Which brings us to:

The Minimum Wage

Conservatives harbor the curious notion that people will work if they don’t have to. This is because to them work, real actual work, is an abstraction with which they have no familiarity. Real work is usually unpleasant or boring. But to economic theorists, work means being a cardiac surgeon, talking head, columnist, or CEO. Thus they say that if we eliminate the minimum wage, black youth (these are always given as examples) will rush to labor for a dollar an hour, learn the trade, rise, and become CEOs. Horatio Alger and all that.

This implies two things: First, that anyone in his right mind would spend eight hours a day flipping burgers for a pittance when he could live on charity in leisure at the same standard, and second, that any employer in his right mind would want to hire semi-literates with bad work habits when, given our current endemic unemployment, he has a choice of much more educated and dependable workers. In short, if the minimum wage were abolished, the bottom rungs of society would remain unemployed because their labor isn’t worth enough for them to live on, or worth anything at all. The bottom rungs creep upward. When almost everybody is unemployed, we will have to institute communism manque: "To each according to his needs and, from each, nothing much. I will then write The Theory of the Leisure Classes: A Study in Urban Chaos."

There you have it, all of economics in a small package. Buy survival gear.

Demeter

(85,373 posts)Yesterday over coffee, a friend of mine leaked the news that JP Morgan’s private banking division here in Singapore is going to start charging negative interest rates...I almost fell out of my chair. He’s a successful hedge fund manager and one of their best customers. So when he received the notice, he rang up his private banker and demanded to know why. Between ridiculously low interest rates (banks are closing loans here for 0.9% or lower) and the increasing costs of compliance, “we can’t make money anymore…” was the response.

It certainly paints a clear picture of how screwed up the entire financial system is. Compliance is a major component in this. Bankers around the world are buried up to their eyeballs in paperwork and regulations now. They can’t make a move or approve a single transaction without first doing anti-money laundering, terrorist financing, and tax evasion due diligence. Imagine it like this: your banker rings you up tomorrow and says,

“The government of China requires us to have all of our depositors fill out this paperwork. So I need you to send this form back to me ASAP…”

You’d probably think it was a joke.

Or at a minimum think, “Wait, what? I’m not Chinese. You’re not a Chinese bank. Who cares about some stupid Chinese regulation?”

And you’d be right. Except that’s precisely what the United States is doing right now. All over the world, bankers are contacting their customers and forcing them to fill out paperwork to comply with idiotic US government regulations. Even when there’s no connection to the US. Here in Singapore, the bankers are completely miserable about it. They’re so angry for having to call customers and say, “Yes I know you’re in India, and I know we’re in Singapore, and I know you’ve been a customer for 10 years. But you still have to fill out this US government form or else we’ll close your account.” It’s ridiculous– all of this because the US government is bankrupt.

A few years ago they passed the Foreign Account Tax Compliance Act (FATCA)– a major part of their crusade to stamp out tax evasion and bring in more tax revenue. FATCA is now in full force. Banks all over the world have been forced to enter into information sharing agreements with the IRS, meaning that they have to report on all of their customers and force them to fill out meaningless forms. Needless to say, this costs a lot of money. If you own a business, you can just imagine how frustrating and expensive it would be to have your employees toil away on senseless paperwork instead of… you know, doing real business. The US government tells us that all of these disclosure programs have brought in about $6.5 billion in tax revenue. Yet the costs of compliance are estimated to cost at least $8 billion, with some estimates over 10x higher.

Now that’s a neat trick. Uncle Sam gets the money and passes off the costs to everyone else. And those who don’t comply with America’s rules are destroyed. The most blatant example of this was last year, when a French bank was fined $9 billion for doing business with countries that Uncle Sam didn’t like. Bear in mind, this was a French bank, not an American bank. They violated no French laws. Yet they had to pay the US government $9 billion for doing business with places like Cuba. (Ironically, Cuba is now BFFs with the United States, but it’s not like the bank is going to get a refund.)

More recently, the US government destroyed an Andorran bank that was accused of weak anti-money laundering controls. And a few years ago they took down the oldest private bank in Switzerland. Every bank in the world has seen these incidents, and they’re scared. They could be next. And that’s why you can’t get a single financial transaction done anymore without first submitting a mountain of paperwork to prove that you’re not a terrorist. Or financing terrorists. Or laundering money. Or doing business with the Axis of Evil. Even outside of banking it has become utterly ridiculous.

The refiner said, “Sure no problem. I just need you to send us some compliance documentation before we get started.”

Then he sent a list of no fewer than 22 items that he needed to submit– copies of licenses, passports, certificates, etc.

22 items. Just to have a refiner make some gold bars. Ridiculous.

So obviously they’re not going to waste their time. Which means there’s some business that could have been done, but won’t, simply because of the compliance costs. The US government has really screwed the world on this. Paperwork is the priority. Not business. And all because America is bankrupt.

This trip to Singapore has been very eye-opening for me as I’m just now starting to understand how much people within the financial system despise the US government. They feel like they’re being forced at gunpoint to be volunteer spies and tax collectors, simply because US politicians have been financially irresponsible. And to me, it’s the biggest sign yet that America’s financial dominance is coming to an end. They’ve essentially engineered it themselves by alienating the whole world. The transition isn’t going to be smooth. And it won’t happen overnight. But there will come a time, and likely soon, when the United States gets displaced.

And the rest of the world can hardly wait.

Demeter

(85,373 posts)1. Banks don't "make" money...unless they are inflating the money supply, which is essentially counterfeiting. They do not produce wealth in the form of goods....they steal it in the guise of "services".

2. Jamie's run out of pockets to pick. That's why they are squeezing the lemons in Europe, and hammering on the doors of China and Russia, and India, although the pickings are pretty slim, there.

tclambert

(11,086 posts)Or is it Hugh Manatee?

Demeter

(85,373 posts)but I'll work on it....

Fuddnik

(8,846 posts)They're much cuter, and better tempered.

Demeter

(85,373 posts)As I noted yesterday, the Fuse on the Global Debt Bomb has been lit. We are now officially in the Crisis to which the 2008 Meltdown was just the warm up. The process will take time to unfold. The Tech Bubble, arguably the single biggest stock market bubble of all time, was both obvious to investors AND isolated to a single asset class: stocks. In spite of this, it took two years for stocks to finally bottom. In contrast, the current Crisis that we are facing involves bonds… the bedrock of the financial system. Every asset class in the world trades based on the pricing of bonds. So the fact that bonds are in a bubble (arguably the biggest bubble in financial history), means that EVERY asset class is in a bubble.

And what a bubble it is. All told, globally there are $100 trillion in bonds in existence today. A little over a third of this is in the US. About half comes from developed nations outside of the US. And finally, emerging markets make up the remaining 14%. Over $100 trillion...the size of the bond bubble alone should be enough to give pause. However, when you consider that these bonds are pledged as collateral for other securities (usually over-the-counter derivatives) the full impact of the bond bubble explodes higher to $555 TRILLION.

To put this into perspective, the Credit Default Swap (CDS) market that nearly took down the financial system in 2008 was only a tenth of this ($50-$60 trillion).

What does all of this mean?

The $100 trillion bond bubble will implode. As it does, the financial system will begin to deleverage as debt is defaulted on or restructured (reducing the amount of US Dollars in the system, pushing the US Dollar higher). By the time it’s all over, I expect:

1) Numerous emerging market countries to default and most emerging market stocks to lose 50% of their value.

2) The Euro to break below parity before the Eurozone is broken up (eventually some new version of the Euro to be introduced and remain below parity with the US Dollar).

3) Japan to have defaulted and very likely enter hyperinflation.

4) US stocks to lose at least 50% of their value and possibly fall as far as 400 on the S&P 500.

5) Numerous “bail-ins” in which deposits are frozen and used to prop up insolvent banks.

This process has already begun in Europe. It will be spreading elsewhere in the months to come. Smart investors are preparing now BEFORE it hits so they are in a position to profit from it, instead of getting slaughtered

Demeter

(85,373 posts)and get started on the WEEKEND of all weekends!