Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 10 July 2015

[font size=3]STOCK MARKET WATCH, Friday, 10 July 2015[font color=black][/font]

SMW for 9 July 2015

AT THE CLOSING BELL ON 9 July 2015

[center][font color=green]

Dow Jones 17,548.62 +33.20 (0.19%)

S&P 500 2,051.31 +4.63 (0.23%)

Nasdaq 4,922.40 +12.64 (0.26%)

[font color=red]10 Year 2.32% +0.04 (1.75%)

30 Year 3.12% +0.06 (1.96%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)sigh. My delete button gets a lot of workout.

antigop

(12,778 posts)Demeter

(85,373 posts)Two historical parallels are playing out simultaneously on the world market stage - in Greece and in China. Greece may very well suffer the fate of Germany in the inter-war years, battling depression and hyperinflation at the same time, if it ultimately exits the euro and starts printing drachmas to pay off its heavy debts. China's recent meteoric stock market rise, and 30 percent decline in the last three weeks, resembles Japan in late 1989 and the early 1990s: A meteoric rise fueled by the belief in a superior economic system that, in the end, was just as vulnerable to decline as any other speculative bubble in market history. Neither scenario is pretty.

While suffering some serious, self-inflicted economic wounds, Greece has also been operating under the harshest of terms in order to qualify for an on-going series of bailouts from the European Union , the International Monetary Fund and the European Central Bank.

Those austerity measures, demanded by the so-called Troika, came in exchange for fresh bailout funds to keep Greece afloat as it struggled with a $271 billion debt load to creditor nations...French Economy Minister, Emmanuel Macron, likened the austerity measures being imposed on Greece to the Treaty of Versailles, which, in 1919, demanded that Germany pay extraordinary war reparations for the damage inflicted on Europe in World War I. Famed economist John Maynard Keynes, not yet known for his work on the Depression, warned in "The Economic Consequences of the Peace," that the burden of reparations would have both unintended, and undesirable, consequences for Germany and the rest of Europe. He was spot on. Germany suffered both hyperinflation and depression and Europe was plunged into World War II, partly as a result of Germany's political and economic humiliation. Greece, of course, cannot reprise Germany's political and military actions in Europe, but further unenlightened responses to the deepening crisis in Greece could lead to further instability in the European economy; weaken the other peripheral economies of Portugal, Ireland, Italy and Spain; and someday, destroy the ideal of maintaining Europe's single currency, the euro.

Dire consequences need not arise solely from war.

In China, its vaunted economy is in danger of falling meaningfully short of its growth targets while its stock market is in danger of experiencing a full-blown crash. Despite the efforts of Beijing to stabilize the market, Shanghai shares had only a modest response to government intervention, while the more speculative Shenzhen market declined further. China's stock-market capitalization has plunged by over $3 trillion in three weeks - that's more than 10 times the size of Greece's GDP! As is the case with China now, Japan, in 1989, was said to be invincible as an economic rival to the USA. My late friend, Michael Crichton, popularized the ascendancy of Japan, with his best-selling novel, "Rising Sun." In it, Japan had learned to become a manufacturing powerhouse by focusing on quality and efficiency, adopting "Total Quality Management" that had been rejected by U.S. manufacturers. Japan's auto makers were the envy of the world, as was its entire manufacturing economy, a mercantilist system that, it was claimed, was a higher form of government-guided capitalism. Tokyo's stock market became the world's most valuable, as did the property values of the city. Japanese investors bought up landmark U.S. assets, and other properties, as its mercantile economy was lauded as a model for the future, while leveraging the stock-market holdings with massive amounts of borrowed funds and interlocking corporate holdings. Those interlocking ownerships of banks, manufacturers and consumer companies, known as keiretsu, became the benchmark for corporate behavior. The problem was that as each company's shares moved higher, the corresponding holders of those shares, think Mitsubishi Bank, Mitsubishi Heavy Industries, etc., rose in tandem. Once they started falling, the leverage worked in reverse ... and with a vengeance. Japan's Nikkei 225 index was grossly overvalued, as were Japanese property prices. When the Bank of Japan began to raise rates in 1990, the stock and property markets spiraled lower and have yet to revisit their 1989 highs.

We have heard similar things about China's state-run economy. Its command-and-control model is superior. Its state-owned enterprises compete well with independent U.S. corporations. But, like Japan, China is also bumping up against the limits of "limitless potential." China has spent nearly $6 trillion on infrastructure in the last six years. Much of it is already deteriorating. Its ability to prop up the stock market with easier money, relaxed regulations and the suspension of new stock offerings, is merely a Band-Aid on an overvalued, and over-leveraged, market that probably can't be controlled by the government, despite its best efforts. Individual investors, full and willing participants in this historic rally, have levered themselves to the hilt to buy stocks, just as was done in Japan in 1989, or the U.S. in 1999.

John Kenneth Galbriath, the noted American economist, pointed out in his book on the "The Great Crash 1929," that whether it is the U.S., Japan or China, policy makers anywhere cannot easily let the air out of a bubble without going too far.

Thus, world markets may not be repeating history exactly, but it's awfully familiar.

The question for us, here at home, is that if it is 1923 in Greece, and 1989 in China, will the U.S. look good by comparison and avoid financial shocks? I can say this: Our markets, economy and political environment are far more stable than anywhere else in the world, making the U.S. far more attractive for investors.

AND I CAN SAY THAT THE AUTHOR'S JINGOISM AND SELECTIVE BLINDNESS ARE NOT GOING TO DO ANYBODY ANY GOOD.

Demeter

(85,373 posts)By Nathan Tankus, a writer from New York City. Follow him on Twitter at @NathanTankus

An economy is not just an aggregation of a category of transactions. An economy is an aggregation of transactions that happen in a set of locations that are geographically located and connected through space and time. The fewer legal and de facto barriers there are for the movement of people, legal entities, financial investment and physical capital between locations, the more geographic disparities in unemployment (of both labor, physical capital and space) and economic growth emerge. Without regional and national institutions for balancing out these disparities (or when they are not designed well enough to manage the task at hand) these disparities become self reinforcing. Recessions accelerate disparities between locations because as the unemployment rises and businesses start to fail (or at least close local branches), the drive to find the most economically prosperous location you can rises. Leaving your city where the unemployment rate is 6% to find a place where the unemployment rate is 4% is not as compelling as when your city’s unemployment rate is 13% and somewhere else there is an unemployment rate of 11%. Even worse, recessions hit certain geographic areas much harder than others, so the pressure to leave is increased. All this leads me to my topic today: Puerto Rico, a geographic region that is part of the United States and has suffered uniquely from these dynamics.

Labor

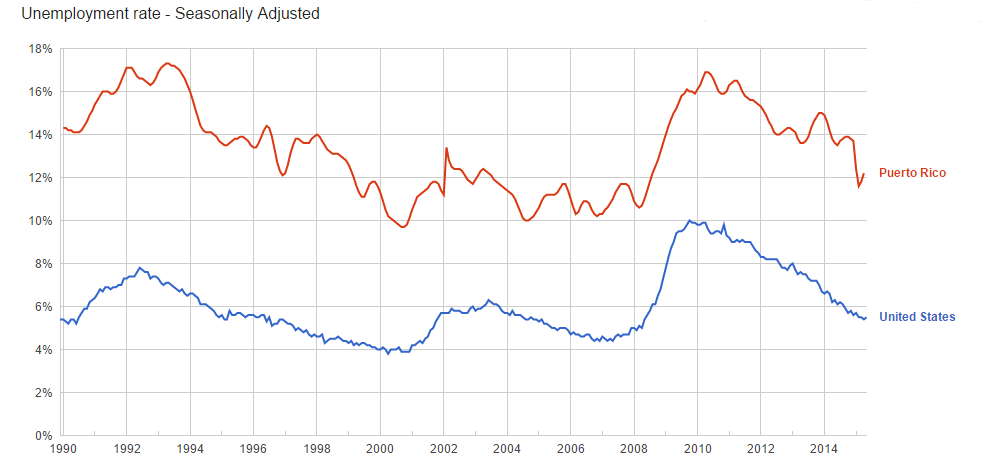

According toe the Bureau of Labor Statistics, unemployment has stayed above 10% in Puerto Rico for at least 25 years. This is a shocking indictment of American economic policy in the region. Whatever your position on the acquisition of Puerto Rico by the United States over a century ago, the United States has utterly shirked its duty to foster employment. Moreover, Puerto Rico’s unemployment rate has stayed above 10% despite redefinitions intended to present a rosier picture. A broader measure of unemployment would probably be on the order of 25-30%, similar to the official youth unemployment rates. The youth unemployment rate is especially important because young people are the people most likely and able to emigrate.

Superficially it is tempting to think that emigration would alleviate Puerto Rico’s problems. The people who leave would largely be unemployed people and thus reduce the burdens on the local economy’s support system. But unemployed people (i.e., people still actively seeking work) tend to be young and those who truly need employment, ie those that are supposed to support the rest of the population. Additionally, despite their status they still need to consume and use basic necessities (often supported by federal transfer payments). Their exit, to quote Paul Krugman, “tends to increase the size of the market wherever they go, decrease it where they come from.“ Five million Puerto Ricans now live in the mainland of the United States. I’m sure some would have left for other opportunities but I’m also sure many would have liked to stay home if there was an economy to stay a part of. Further, the emigration has only hurt the local economy more and the high unemployment rate has been preserved. The process may be much less brutal and may involve mostly emigration rather than starvation, but the logic is the same as the wealthy land magnates of England who demanded that the population shrink more and more to deal with the “overpopulation problem”. How many people gone would satisfy our modern-day equivalents? I guess a population of zero is technically fully employed.

Industry

Despite what you may have read in the press, Puerto Rico really does have an economy. Its issue is lack of public investment and unemployed resources. Because Congress has for over a century been unwilling to settle Puerto Rico’s status, it has rewarded (and thus attempted to quiet outrage against) its status to make it a tax haven for corporations. These tax incentives combined with general prosperity in the post-war era have developed Puerto Rico’s economy and shifted it from being mostly agricultural, but they have not done very much for ordinary Puerto Ricans. As the National Puerto Rican Chamber of Commerce commented:

In other words, production had been happening there but profits and income have been repatriated elsewhere more and more. In the 1970s changes in tax incentives led to very strong growth in wholly-owned subsidiaries in Puerto Rico. However, those same incentives tended to encourage pharmaceutical and other very capital intensive companies to come to Puerto Rico, but they had limited employment gains. Even that meager gruel served to Puerto Rico was taken away in the mid 1990s. Since these companies were very capital intensive, the tax cuts were merely phased out over the next decade and their ability to divest from Puerto Rico by that time was relatively small, it didn’t cause a huge jump in unemployment (relative to the trend) but it has been a persistent drag on its economy ever since and will continue to be in the future. To the extent that corporate tax benefits have provided any benefit, it is federal corporate tax benefits that create an incentive to move without dragging away other spending. Corporate tax benefits provided by specific geographic regions come at the expense of social spending and tax cuts that would do more to attract business than “supply side” benefits, to speak nothing of the cost savings infrastructure spending delivers to business. This leads the larger point that a federal spending program of a similar dollar amount would have done much more for their economy than these tax incentives.

Of course, the larger story of Puerto Rico is an economy that has suffered the loss of real economic resources (largely people) because of a lack of demand. It benefited, albeit unequally and to a much smaller extent than the mainland, from the prosperity brought by the the post-war period but suffered much more in the persistent downturns since the collapse of the Bretton Woods era. Due to its geographic isolation, downturns tend to stop orders from the mainland earlier, and start them up again later. This means that a recession in the rest of the United States hits the economy harder and longer. Transfer payments such as food stamps (which only reached Puerto Rico in the 1970s) have stemmed the bleeding but not healed the wounds coming from persistent recessions. Of course, they also suffered from Clinton era welfare reforms which reduced transfer payments again. The history of federal intervention in Puerto Rico has been a history of haphazard and at best uneven benefits.

So is Puerto Rico “Like Greece”?

In a word? No. As others have commented, Federal counter-cyclical stabilizers (shortly falling federal tax receipts and rising social insurance expenditures) have stabilized their economy and kept it limping along for decades but it hasn’t been able to provide an adequate economy for its citizens or stem the outflow of people. There are also interesting legal differences between EU member states and American states highlighted by the tenuous position of Puerto Rico. However, simply not being a society that is about to or near collapse is not the standard that Puerto Rico should be judged. What Puerto Rico needs above all other things is an economy developed to serve the population, not tourists or multinational corporations who are at best fair weather friends. In short, it needs what the rest of the United States needs: a Reconstruction Administration financed by the federal government, similar to the one it had during the New Deal. Since the United States took control of Puerto Rico, the minimum obligation it had was to provide employment and rising living standards to at least the United States average. It has defaulted wholesale on that debt and needs to start paying up.

TO WHICH I CONTRIBUTE A HEARTY "AMEN!"

tclambert

(11,087 posts)John Oliver did a segment on U.S. Territories, with THREE news clips saying Supreme Court Justice Sonia Sotomayor's parents immigrated from Puerto Rico. Oliver pointed out her parents did no such thing, since Puerto Ricans are already American citizens.

If they became the 51st state, they would get about 5 representatives in the House, more than Nevada or New Mexico or Kansas. (Our new flag could be just like the one with 45 stars, except with one more star per row. http://www.usflag.org/history/the45starflag.html)

Demeter

(85,373 posts)If some mindless diversion helps, I'll post some of it....I try to filter out the hysteria and craziness, but it takes time to read through.

Demeter

(85,373 posts)In Greece, with one in four unemployed, the people have voted (once again) for an end to self-defeating austerity imposed from abroad. In Brussels and in Berlin, officials and ministers declare their loyalty to a 'European' vision of monetary and fiscal rectitude that might have borrowed its name from Foucault ('discipline and punish') or Dostoyevsky ('crime and punishment'). Across the whole southern half of the continent — from the Pillars of Hercules to the outer approaches to the Hellespont — unemployment has robbed a generation of a future.

Only a decade ago, Europe was mostly remarkable as a place where history had stopped. Nothing symbolized this more than the euro. Today, the single currency is the emblem of a crisis not just in Europe's stagnant economy but in the whole idea of European political unification.

How did we get here? Greece's sins — and there are many — have been endlessly detailed. Cooked books. Corruption. Waste. In Denmark, where I live, the story stops here: profligate Greeks. But Greece has not imposed a depression on itself. If Athens' economic position in 2010 was parlous, by 2012 it was catastrophic. What brought this about was not Greece's failure to stick to the medicine meted out to it, but the medicine itself. We now know that even the IMF questioned the remedies ceaselessly recommended.

But Germany, above all, insisted. In the middle of a global recession unprecedented in severity since the 1930s, there would be drastic cuts to pensions and welfare spending; an admittedly bloated public sector would lose thousands of jobs; the rights and conditions of those still in work would be dramatically eroded; national assets would be sold off at fire-sale prices. What's more, Berlin would do nothing to stimulate demand at home or elsewhere in the Eurozone to compensate for its collapse in the Aegean. On the contrary, Germany, with a trade surplus greater than China's, would make a budget surplus a requirement under federal law.

What explains Germany's behaviour? The first part of the answer can be found in the personality of its chancellor...Merkel is on record as saying that she never considered Greece fit to join the euro. The punishment for Athens' profligate dishonesty should be so tough that, in her words, 'nobody else will want this'. Usually praised for her foresight, Merkel has led Greece and Europe to the brink by failing to see what should have been obvious from her much-vaunted reading of German history: that cutting public spending in the middle of a global recession to satisfy the demands of foreign creditors would create the depression-like conditions that have ever been a boon for political extremists; and that, if such measures were forced upon Greece by a foreign government, the principles of democratic politics on which the EU is built would be flagrantly undermined.

But what matters to Merkel is not Europe but Germany. She can (and does) take Europe for granted. As Merkel's predecessor Helmut Kohl is quoted as saying in the New Yorker, she is interested in power, and Germany is its base...thinking like a European doesn't come at all naturally to her. And the crisis has shown it. In Germany, her policies are wildly popular...On Greece, it is clear that Merkel has failed the test of statesmanship.

WELL DESERVED SLAM...AND THERE'S MORE!

Demeter

(85,373 posts)Demeter

(85,373 posts)...Greece is only the latest and starkest example of the democracy mismatch in public debt crises, which affects political units from sovereign states to U.S. municipalities. Members of the crisis-stricken polity cede control to some mix of creditors, experts and more-or-less neutral arbiters. These outsiders become the “adults in the room,” charged with making unpopular decisions to restore solvency. Democracy gives way to “ownership,” a squishy term for popular buy-in of outside policies. Putting outsiders in charge might make eminent sense in corporate bankruptcy. Shareholders and managers lose their right to govern when they run up unpayable debts. They yield to judges and creditors, especially those who lend in bankruptcy, when no one else would. In exchange, new lenders get a senior claim and the right to tell the debtor how to run its business. Giving crisis lenders repayment priority and a hand in policy design also makes sense for international organizations such as the IMF, which has fought debt crises since the 1980s, and for the European institutions new to this line of work. If they are to advance taxpayer funds to revive a grossly mismanaged economy, shouldn’t they call the shots?

Not necessarily.

One way to mitigate the democracy mismatch would be to link debt repayment at the outset to the achievement of agreed policy objectives, so that creditors designing the policies would share some of the risk with the debtor. The debtor would get a modicum of financial relief if its economy fails to recover, though any such relief would be too small to justify sabotaging its own recovery. The amount of outcome-contingent debt can be small because the principal goal of risk-sharing is political accountability for the creditors. If they can no longer promise unconditional repayment to their own constituents, the adults in the room would have “skin in the game.” The reverse is the norm in sovereign debt: multilateral lenders do not restructure, while more and more bilateral lenders, from Russia in Ukraine to euro area members in Greece, are balking at debt relief. If a small fraction of their investment were tied to policy success, creditor officials would have to defend their policy advice more vigorously up front to their own stake-holders, and might be less inclined to take policy risks.

Requiring creditors to share in the risk of their prescriptions might mean less crisis lending, or less ambitious policy conditions. Either would be welcome. A government that cannot agree on credible policy reform with its creditors should not borrow more; it should restructure sooner. At the other extreme, lighter conditions would reflect creditors’ appreciation for the debtor’s domestic political challenge, so that there is no need for an eleventh-hour referendum.

Demeter

(85,373 posts)

http://www.thisismoney.co.uk/money/comment/article-3137783/How-spot-Greek-euro-note-damning-indictment-eurozone-crisis.html

So are some euro notes worth more than others?

The short answer is no. The longer answer involves just quite how unlikely it would be that if Greece left the eurozone, the European Central Bank would then started cancelling its notes. This would be an almost impossible task. Notes may have a country of origin but as a common currency they are spread far and wide across the eurozone. The Greek ones will be owned by Germans, Italians, Spanish and Irish people - in fact here in Britain we've probably got a few too. No one would be particularly happy about some of the cash in their wallet being cancelled.

And it would be completely unnecessary, that euro note still serves its function regardless of where it originally came from...

BUT SCHAEBEL IS CRAZY ENOUGH TO INSIST UPON IT...

...However, the ECB could offer a short term exchange period on all "Y" notes, rendering them worthless after a certain date. That would be a practical solution, especially in light of the following practical math...

Unnamed Parallel Currencies Now in Use

There is no name for the parallel currencies, but corporations are already issuing them... There is no official scrip currency, yet.

Demeter

(85,373 posts)I owe you thanks from the bottom of my heart! In the last couple of years, you have given me the opportunity to teach you how the Eurozone works (or does not work) and you have been an outstanding student! But more than anything else: I have to thank you for appointing me as your Finance Minister. This has been, and will continue to be even more so in the future, a catapult for my career (and, I should add, for my income!).

It's hard to remember that only 5 years ago I was a fairly unknown university professor. Not even a trained economist, as I have had to point out on many occasions. As I introduced myself at the INET Conference in Berlin back in April 2012: "Until this crisis erupted, I used to be a fairly decent second rate economist. The implosion of my country bestowed upon me the dubious honor and title of being a first class Greek economist." Frankly, I had expected a big laugh from the audience but it didn't come. That was probably due to the fact that I was quite tense, if not so say nervous. After all, that had been my first truly international appearance and George Soros was sitting on the podium with me (or rather: I sat with him). So I didn't come across at my best and instead of the expected standing ovation, I only got polite applause.

It's not only you, though, Alexis, that I have to thank but also previous Greek governments for having pursued policies which would make the country implode. Had these governments not been so incompetent, I might still be considered a decent, second-rate economist, but no more.

I discovered quite a few things about myself in the last 5 years. I had always been very popular with my students but those were rather small groups. Through twitter, I noticed my remarkable ability to build up a following. Those were the days when I was proud to have crossed the level of 10.000 followers. As the crisis dragged out, my following increased to 70.000. But I owe it to you and your appointing me as your Finance Minister that my following now exceeds half a million. And you know something? Most of my followers are truly followers, almost in the biblical sense. I feel that I can move their minds and spirits.

And then I discovered my talent for handling the media. That was a total surprise to me because, as you know, the Greek media had more or less ignored me for quite a long time. I guess they considered me a smart alleck; someone who thought he was smarter than they (which, honestly, I thought I was and still am). But then I discovered my talent for dealing with international media. That was no easy feat because, in the beginning, I was not so sure of myself...

MUCH MORE, INSIGHTFUL AND GLEEFUL

mother earth

(6,002 posts)You know, Alexis, I have often wondered whether John Maynard Keynes would have become the economic giant that he was if he had not been appointed the financial representative for the UK Treasury to the Versailles Peace Conference back in 1919. The world's best actor will not succeed if he is not given a stage. You, Alexis, have given me that stage and I will be grateful for that forever. In all modesty, I think I lived up to historical challenge very well. Just like Keynes, I discovered that the most powerful weapon is the written and spoken word when it is based on intellect. Just like Keynes, I discovered that charmismatic eloquence, combined with a high degree of provocation and non-conventionalism, will attract followers in great numbers. Just like Keynes, I discovered that non-convential conduct and private life are fertile ground for legend building.

I will never believe for one moment that these two men were divided, nor will I believe that Tsipras was ready to cave. The battle won was huge, and it goes on.

I am in awe of Varoufakis, he is indeed a force, and may well be a man who when we look back, will all see as the voice that changed us all for the better.

Demeter

(85,373 posts)I think it's a satire.

mother earth

(6,002 posts)attempt at sarcasm? Except for the writing books part, though I imagine Yanis will have much to do, he's not going away into the sunset.

I am always astounded by the ignorance surrounding the haters of YV. They just don't get that people actually do want democracy, it's like a big joke that there are those who truly aspire to such.

Though I can see after checking a bit at that site, that he is not a fan. Sad to be him, to be filled with such cynicism that visions need to kicked and ridiculed. Though, he failed, from what I can see. I think the joke is on him.

magical thyme

(14,881 posts)We always said that we would have to draw the socalled negotiations out as long as possible in order to increase the cost of a default to our partners. As I had literally guaranteed you, the ECB did not cut the lifeline for our banks until the very, very last moment and our partners are now beginning to realize that they increased their Greek exposure phenomenally during the last months so that Greeks could rescue their savings.

Yup. Bought them many months to pull as much savings as they could. Hopefully they didn't put them in safe deposit boxes. Better off buried in the garden... ![]()

Demeter

(85,373 posts)Demeter

(85,373 posts)VIDEO REPORT

About a million people in Japan, mostly men, have locked themselves in their bedrooms and won't come out, with a condition that's shattering families and threatening the country's economy.

LEIGH SALES, PRESENTER: One of the biggest social problems in Japan is that about a million people, mostly men, but also some women, have fully withdrawn from society. They've literally locked themselves in their bedrooms and won't come out. Japanese health professionals are scrambling to arrest the problem that's not only shattering families, but also threatening the country's economy. North Asia correspondent Matthew Carney reports.

MATTHEW CARNEY, REPORTER: For nearly three years, Yoto Onishi's world was his bedroom. He slept during the day and lived at night, trawling the internet and reading manga or comics. Yuto refused all contact with friends and family, sneaking out only in the dead of night to eat. The Japanese call the condition hikikomori.

YOTI ONISHI (voiceover translation): Once you experience the hikikomori lifestyle, you lose reality. I knew it was abnormal, but I didn't want to change. It felt safe here.

MATTHEW CARNEY: In junior high, Yuto had failed as a class leader, and to cope with the shame and judgment from others, he withdrew into his room. For Yuto and as many as a million Japanese, the pressure from family and society is too much to bear.

TAKAHIRO KATO, HIKIKOMORI EXPERT, KYUSHU UNI. (voiceover translation): In Western societies, if one stays indoors, they're told to go outside. In Japan, they're not. Our play has changed. It's all on screens and not real-life situations anymore. There's cultural reasons also: a strong sense of embarrassment and emotional dependence on the mother.

MATTHEW CARNEY: Doctor Kato wants to stop the next generation of Japanese boys locking themselves in and he's well-equipped to help. As a student, he was hikikomori himself.

TAKAHIRO KATO (voiceover translation): They're often extremely intelligent, capable people. It's a waste and it's hurting the economy.

MATTHEW CARNEY: The causes and treatment are little understood, but Dr Kato has gathered a team from all disciplines to decipher the condition.

The road to recovery for hikikomori can be a long one. This 23-year-old has been in therapy for a year. He says a domineering mother and pressure to perform at school caused him to drop out and barricade himself in his room.

HIKIKOMORI PATIENT (voiceover translation): I just wanted to suppress everything, put a lid on everything. I didn't want to think. I didn't want to feel.

MATTHEW CARNEY: Dr Kato says recovery can only be successful if the dynamics of family interactions change and that means the whole family has to be involved in counselling.

This group of hikikomori have just come out of their rooms. They're in therapy to rebuild communication and trust.

THERAPIST (voiceover translation): At first, I just get them speaking, whatever they want, so they can get over their fear of other people.

MATTHEW CARNEY: Some have been in their rooms for a decade, so just to talk is a major achievement. And there are small victories here. This woman bought her first T-shirt. But the prognosis is not good for most. The longer they've been in their rooms, the less likely it is they'll get back into society. This 28-year-old woman is a rare success story. She was hikikomori for 10 years and now has a job. She says finding the right support network was the key.

HIKIKOMORI PATIENT II (voiceover translation): Since I started coming here, knowing about this place, it made me go outside.

MATTHEW CARNEY: Critically, her mother was supportive. And realised she was part of the problem.

MOTHER (voiceover translation): Our relationship was intense and dependent and we were stuck. It took the counsellors here to do something about it, and for that, I'm forever grateful.

kickysnana

(3,908 posts)Demeter

(85,373 posts)The flip side of tiger momma and the inhuman standards that a rigid society imposes on its young.

Demeter

(85,373 posts)A Socialist Surge in the U.S.? Bernie Sanders Draws Record Crowds, Praises Greek Anti-Austerity Vote

RICHARD WOLFF: Well, she’s the old. She is the staid, do it by the books, the old rules, as Paul said so nicely.

She is playing the game the way the game has been played now for decades.

Bernie Sanders is saying the unthinkable, saying it out loud, saying it with passion, putting himself forward, even though the name “socialist,” which was supposed to be a political death sentence—as if it weren’t there. And he’s showing that for the mass of the American people, it’s not the bad word it once was. It’s sort of a kind of position in which the conventional parties are so out of touch with how things have changed, that they make it easy for Mr. Sanders to have the kind of response he’s getting. And my hat’s off to him for doing it.

AMY GOODMAN: Explain what socialism means.

http://www.democracynow.org/2015/7/7/sen_bernie_sanders_self_described_socialist