Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 24 July 2015

[font size=3]STOCK MARKET WATCH, Friday, 24 July 2015[font color=black][/font]

SMW for 23 July 2015

AT THE CLOSING BELL ON 23 July 2015

[center][font color=red]

Dow Jones 17,731.92 -119.12 (-0.67%)

S&P 500 2,102.15 -12.00 (-0.57%)

Nasdaq 5,146.41 -25.36 (-0.49%)

[font color=green]10 Year 2.27% -0.06 (-2.58%)

30 Year 2.97% -0.07 (-2.30%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,868 posts)Silver is below $15.

Gold is below $1100.

Oil is below $50 and plunging.

But I won't get my hopes up.

Demeter

(85,373 posts)or if I were to be fussy and pendantic: For what do you hope?

Demeter

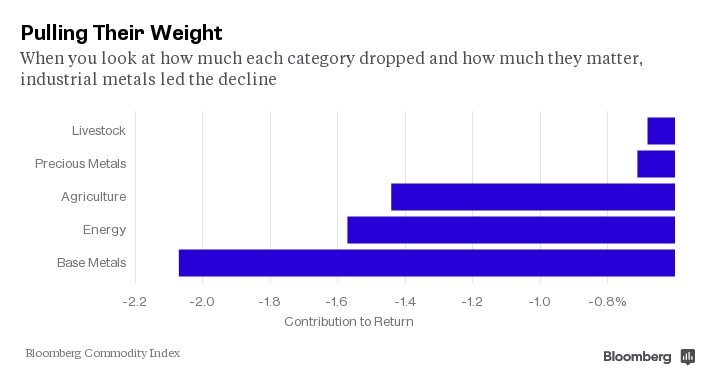

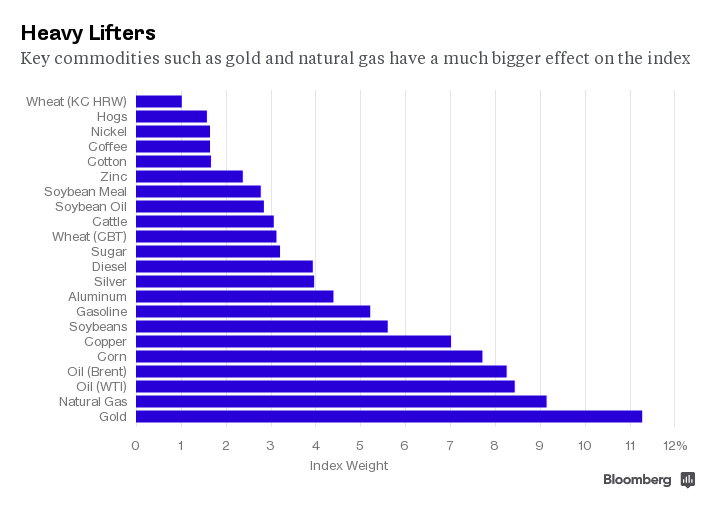

(85,373 posts)Clearly it hasn’t been commodities’ week, month or year. But focusing on the worst-performers doesn’t tell the full story.

The Bloomberg Commodity Index fell 7.2 percent this month, touching a 13-year low on July 22.

The biggest losers are crops such as coffee and sugar, each down 27 percent. They’ve fallen because of a weak currency in the most important producer, Brazil, and abundant inventories after years of surpluses, according to Commerzbank. (They’re also very weather-driven.)

But those aren’t actually the reasons driving down the whole index. The biggest contributor to the index’s decline has been industrial metals such as copper and nickel, down 12 percent and 23 percent this year, respectively. They’re falling because of concerns that the tumbling Chinese stock market betrays sapping demand from the world’s biggest consumer.

What’s behind the discrepancy? More valuable commodities like oil and gold (down 12 percent and 6.8 percent) have heavier weightings in the index (and most exchange-traded products and other portfolios). As it happens, there’s a lot of overlap between the smallest members and the biggest nominal declines.

Demeter

(85,373 posts)Earlier this week, China reported better-than-expected gross-domestic-product growth in the second quarter, growing 7% against expectations for a 6.9% expansion. But even this growth rate is China's slowest in over two decades.

And now Apple's disappointing quarter may be confirmation that China's economy is not only slowing, but slowing more dramatically than markets expect...

...Everyone worried about an economic slowdown in China and the impact it could have on the US economy should read that again: "... evidence of a widespread demand reset from China is mounting ..."

On Tuesday, the defense giant United Technologies cut its full-year sales outlook for, among other reasons, "a slowing China." And in June, Chinese auto sales declined over the prior year for the first time in over two years.

Decidedly negative signals from the world's second-largest economy.

In the past few months we've seen a huge sell-off in the Chinese stock market, which has been viewed as either a harbinger of assured global economic doom or not a big deal because the Chinese economy isn't as financialized (meaning the actual economy won't be greatly affected by big swings in the stock market) as, say, the US economy.

But as Cowen notes, whether the impact on US companies is related to the recent stock-market action or not, there appears to be something off about the Chinese economy. At least as it appears to some of the biggest US companies...

Demeter

(85,373 posts)Around World

- U.S. Mint sees highest monthly gold eagle sales in over two years

- Indians take advantage of low price in a season not typically known for gold buying

- Chinese investors, disillusioned with stock market, are buying gold in large volumes

- Demand for coins from Perth Mint 37% higher in June and even higher for July

The manipulative smash on the gold price on Sunday night has once again led to a surge of buying of gold coins and bars across the globe. Both the Wall Street Journal and Reuters report on how bullion dealers are seeing a spike in demand for gold coins and bars in India and China and indeed Europe, Australia and the U.S.

The article goes on to quote an Indian jeweller:

With the price of gold being determined by paper contracts - often regardless of the supply and demand fundamentals of the actual metal itself - spot gold prices today are no longer a barometer of perceived risk in the system. However, It is clear that many investors in the East and West are accumulating physical gold, the main benefit of which is financial insurance. This would suggest that a great many more people are cautious about the health of the financial system and indeed the global economy than the gold price may indicate.

The experience of the Greek people in not being able to access bank accounts and even cash in safety deposit boxes is also making nervous and leading to gold buying and diversification...

Must-read guide to bail-ins: Protecting Your Deposits From Confiscation

Demeter

(85,373 posts)The oil market continues to be oversupplied and barrel prices remain low. It’s mostly the Saudis’ doing, and its part of their strategy to replace OPEC with a new Global Corporate Oil Board. Their newest tactic is a boost in domestic refining and growth in their refined product exports. Where does everyone else stand, and where will this go?

In what seems to be becoming an on-going series on Policies of Scale, I’m writing again about Saudi Arabia’s long game strategy in maintaining its dominance over the global oil market. Part 1 explored the Kingdom’s overall strategy of creating a new “Global Corporate Oil Board” to replace the antiquated OPEC

http://www.economonitor.com/policiesofscale/2015/04/07/the-saudi-re-engineering-of-the-global-corporate-oil-board/

, and Part 2 gave an update on their progress.

http://www.economonitor.com/policiesofscale/2015/05/20/battle-royale-saudi-v-american-oil/

This piece focuses on a new tactic in the Saudi strategy: shifting some crude from export to refineries. This especially shrewd development is helping keep the Royal Family out front of market developments and in control of the emerging Global Corporate Oil Board...

Hotler

(11,445 posts)show "19 And Counting" has been canceled. I say GOOD! Now get your asses out there in the real world and support your family like regular people. Maybe it would help if you prayed harder. Pull yourselves up by your own bootstraps Mr. and Mrs. dugger.

Fuddnik

(8,846 posts)They should join those other loons who took off to the spaceship on the other side of Hale-Bopp.

Demeter

(85,373 posts)Sales of previously owned U.S. homes climbed to an eight-year high in June as momentum in the residential real estate market accelerated.

Closings on existing homes, which usually occur a month or two after a contract is signed, climbed 3.2 percent to a 5.49 million annualized rate, the most since February 2007, the National Association of Realtors said Wednesday. Prices rose to a record amid tight supply.

The housing market has picked up in recent months as more jobs, historically low mortgage rates and greater household formation boost demand. Faster wage growth will be needed to help housing continue its recovery and become a bigger contributor to growth this year.

“The housing market is on fire,” said Thomas Costerg, a senior economist at Standard Chartered Bank in New York, who projected sales would rise to a 5.48 million pace. “The strength in housing could offset some of the weakness we are seeing elsewhere.”

http://www.bloomberg.com/news/articles/2015-07-22/sales-of-existing-u-s-homes-climb-to-highest-level-in-8-years

Demeter

(85,373 posts)

The median rent for a three-bedroom single-family house increased 3.3 percent, to $1,320, during the second quarter, according to data compiled by RentRange and provided to Bloomberg by franchiser Real Property Management. Median rents are up 6.1 percent over the past 12 months. Even that kind of increase would have been welcome in 13 U.S. cities where single-family rents increased by double digits.

It’s more evidence that rising rents have affected a broad scope of Americans. Sixty percent of low-income renters spend more than 50 percent of their income on rent, according to a report in May from New York University’s Furman Center. High rents have also stretched the budgets of middle-class workers and made it harder for young professionals to launch careers and start families.

“You’re finding that people who wouldn’t have shared accommodations in the past are moving in with friends,” says Don Lawby, president of Real Property Management. “Kids are staying in their parents’ homes for longer and delaying the formation of families.”

There were 14.8 million households living in single-family rentals in 2013, according to Census data, up 28 percent from 2004. Compared with renters who live in apartment units, single-family tenants are more likely to be white and middle-aged, a report last month from Harvard’s Joint Center on Housing Studies said. Single-family renters are likelier to live in center cities than owners who occupy their own homes, who are more likely to live in the suburbs.

Demeter

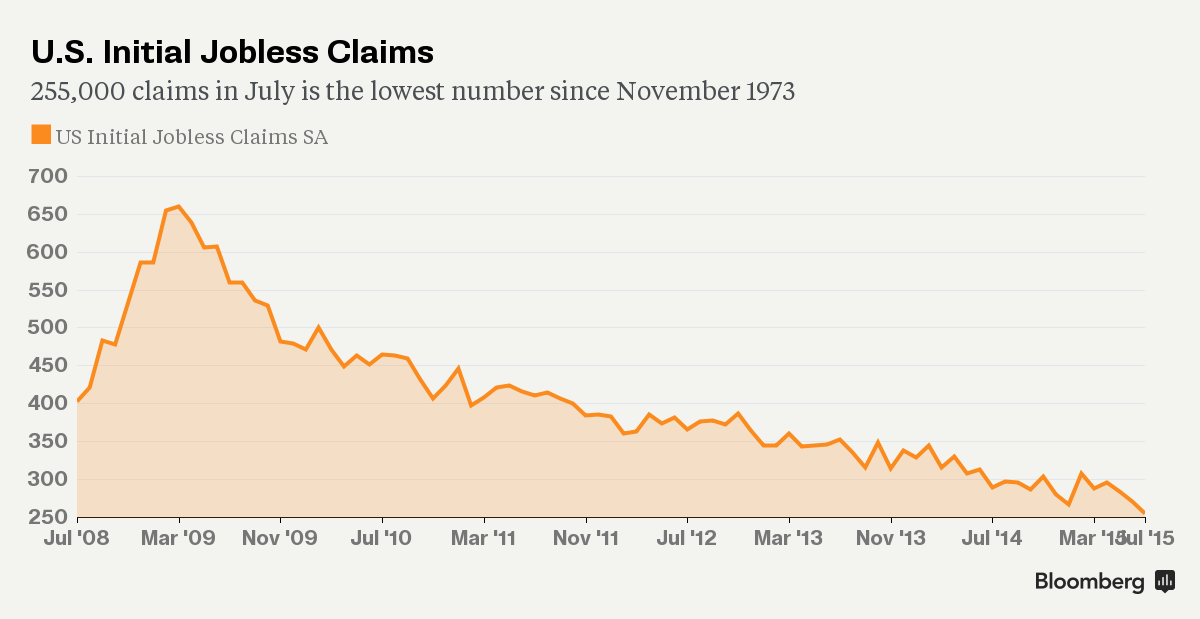

(85,373 posts)The fewest Americans in four decades filed applications for unemployment benefits last week, continuing to unwind an early-July surge that was probably tied to mid-year factory shutdowns and school vacations.

Jobless claims plunged by 26,000 to 255,000 in the week ended July 18, the fewest since November 1973, a report from the Labor Department showed on Thursday in Washington. The median forecast of 47 economists surveyed by Bloomberg called for 278,000. Volatility is typical for this time of year as auto plants retool for the new model year and school staff varies with summer holidays, a department spokesman said as the data was released to the press.

Claims continue to hover near historically low levels as employers are retaining workers to cater to a pickup in demand following a slump in early 2015. Combined with steady hiring across states, the improvement will help sustain household spending, the biggest part of the economy.

“Companies are holding on to employees because they’re needed not just to satisfy current demand but also for growth initiatives,” said Russell Price, a senior economist at Ameriprise Financial Inc. in Detroit, who is among the best claims forecasters over the past two years, according to data compiled by Bloomberg. “It’s yet another sign we’re likely to see solid economic expansion in the second half.”

AS REGULAR READERS OF THIS THREAD WILL KNOW, IT'S NOT HOW MANY FILE FOR UNEMPLOYMENT, IT'S HOW MANY ARE EMPLOYED THAT COUNTS. MORE EMPLOYMENT, MORE MONEY CIRCULATING THROUGH THE ECONOMY....

LATEST EMPLOYMENT NUMBERS? "The Employment Situation for July 2015 is scheduled to be released on August 7, 2015, at 8:30 A.M. Eastern Time. " http://www.bls.gov/ces/

Demeter

(85,373 posts)The sharing economy for chickens is nothing to gobble at.

The price of a dozen eggs has soared more than 30% in just one month to $2.57 in June from $1.96 in May, according to the Bureau of Labor Statistics. The price rise in recent months is due to an outbreak of avian influenza virus H5N1; around 48 million turkeys, chickens and hens have either died from the flu or have been euthanized. No new cases of the virus have been detected for more than a month, but U.S. Agriculture Secretary Tom Vilsack said this week that he was not ready to declare the crisis over.

And while there have been no reported cases of H5N1 transferring to humans during this outbreak across 20 states, many consumers are more concerned about the provenance of their eggs than the price per dozen. “No human infections with these viruses have been detected at this time,” the Centers for Disease Control and Prevention stated. “However, similar viruses have infected people in the past. It’s possible that human infections with these viruses may occur.”

Some Americans prefer to eat eggs from chickens they’ve raised themselves rather than buy eggs from their local store, at least for now. But the overhead investment on a backyard flock can be steep. And it’s a big commitment. What’s a sustainability-minded omelet lover to do? How about renting a chicken?

?uuid=2c01e73a-314d-11e5-999d-0015c588dfa6

?uuid=2c01e73a-314d-11e5-999d-0015c588dfa6

...It might give you peace of mind to know where your eggs come from, but — even accounting for the recent surge in egg prices — it still works out to be six times more expensive than buying a dozen eggs at a supermarket. It costs $400 to rent two chicken or $600 for four chickens for six months, including a coop, food and water dish. There’s free delivery within 50 miles of one of the company’s locations. The first plan works out at around $16 for a dozen eggs, assuming you get around a dozen eggs a week (the weekly average is between eight and 14). “If they’re paying so much at the store and they don’t know where they come from, why not pay a little more?” Tompkins asks. And customers can return chickens at any time....

Demeter

(85,373 posts)and 21 days in the shell before that....a short-term problem that the egg farms will milk for all it's worth (if the chickens will pardon the expression"to milk" when used to describe their generative abilities...)

Fuddnik

(8,846 posts)You can have chicken and dumpings every now and then.

mother earth

(6,002 posts)Demeter

(85,373 posts)The active versus passive debate just got a new wrinkle, and one analyst thinks he knows why.

Exchange-traded funds, which are the primary vehicle for passive management, now have assets under management greater than hedge funds, according to a count from research firm ETFGI. ETFs primarily follow market indexes, while hedge funds use a mix of strategies to beat those same benchmarks.

Tim Edwards, senior director of index investment strategy at S&P Dow Jones Indices, set up an experiment that put a blend of low-cost ETFs against their more expensive hedge fund brethren.

What he found essentially was that his effort to mimic hedge fund strategy using indexes—half focused on international stocks, the other half on bonds—easily beat out a popular gauge of hedge industry overall performance, the HFRI Fund Weighted Composite Index. However, the results changed when he factored in the fees.

Most ETFs charge fees less than 0.5 percentage point. Most hedge funds still follow the "2 and 20" structure, or a 2 percent annual fee and 20 percent of returns. Edwards was generous, though, and only charged 1 and 15.

MORE

Demeter

(85,373 posts)TRANSLATION: WE HIRED A TOTALLY INEXPERIENCED, UNEDUCATED AND UNTRAINED PERSON--WONDER WHO HE'S RELATED TO?

http://blogs.wsj.com/cfo/2015/07/23/new-bofa-cfo-faces-steep-learning-curve/?mod=yahoo_hs

Bank of America Corp.'S newly named chief financial officer, Paul Donofrio, will have to quickly come up to speed on new bank regulatory requirements and managing the sprawling bank’s finance operations, say analysts who cover the bank. “It’s a lot of stuff to learn,” said Glenn Schorr, banking analyst for Evercore ISI.

Mr. Donofrio will officially become the Charlotte, N.C.-based bank’s finance chief on August 1. Brian Moynihan, the CEO, made the surprise appointment Wednesday night in an internal memo for employees. The current CFO, Bruce Thompson, is stepping down, but will stay on the management team to advise Mr. Donofrio for the rest of the year. Mr. Thompson’s departure caught BofA observers off guard, but Mr. Donofrio seems to have the background needed to take over, said Mr. Schorr.

Mr. Donofrio, 55, was a flight operator for the U.S. Navy. He has been with Bank of America since 1999, joining the firm as a healthcare investment banker. He has since led the bank’s investment banking, corporate banking and transaction and treasury services units. He is widely seen inside the bank as instrumental in helping integrate Merrill Lynch into BofA after their $50 billion merger in 2008.

In April, Mr. Donofrio became CFO of BofA’s consumer banking and wealth management divisions, where he supervised the teams that did the financial forecasting and analysis for the units, according to a bank spokesman...

I HAVE A BAD FEELING ABOUT THIS...

Demeter

(85,373 posts)Hey, employers, don’t even think about reimbursing your workers’ health-insurance premiums.

Beginning this month, the IRS can levy fines amounting to $100 per worker per day or $36,500 per worker per year, with a maximum of $500,000 per firm.

This Internal Revenue Service penalty is not written into the Obamacare law. The amount is over 12 times the statutory amount in the Affordable Care Act of $3,000 per worker per year. That is what an employer is charged when one of its employees gets subsidized care on one of the health-care exchanges. It’s 18 times the $2,000 penalty for not offering adequate health insurance.

The $100 fine is applicable not only to large firms, but also those with fewer than 50 workers that are exempt from the $2,000 and $3,000 employer penalties. Firms with one worker are exempt. The penalty for S-corporations will take effect on Jan. 1, 2016. The new rule is broad, sweeping and overly punitive.

This new IRS penalty does not assist in the ACA’s stated goal of expanding health insurance in the United States. Rather, it does the opposite. It discourages people from finding and purchasing the insurance that suits them. It also discourages companies from hiring. Consider that 14% of businesses that do not offer group health insurance have some sort of arrangement to reimburse their employees for insurance costs, according to the National Federation of Independent Business....

Demeter

(85,373 posts)Almost everyone who addresses this question assumes that the answer is pretty simple: if either of the Social Security Trust Funds goes to zero than benefits will automatically drop from ‘Scheduled’ to ‘Payable’ which translates to a 22-25% overnight cut depending on which Trust Fund we are talking about. But I had an interesting conversation with Andrew Biggs some years back. Andrew is a very prominent advocate of Social Security ‘reform’ which he sells on the basis that the system is ‘unsustainable’. As such he and I and Coberly and he have had some vigorous debates over the years, and mostly he is firmly in the ‘bad guy’ category on policy. For all that he is a nice guy and really, really knows the numbers and laws in play. Not least because he spent some time as the Principal Deputy Commissioner of Social Security (the no. 2) during the Bush Administration.

With that as background Biggs told me that the situation at Trust Fund Depletion was not as clear-cut as almost everyone assumed and had been the topic of some high end discussion at SSA. And their conclusion as related by Biggs to me mirrored that of the Congressional Research Service in this Report from last year.

If a trust fund became exhausted, there would be a conflict between two federal laws. Under the Social Security Act, beneficiaries would still be legally entitled to their full scheduled benefits. But the Antideficiency Act prohibits government spending in excess of available funds, so the Social Security Administration (SSA) would not have legal authority to pay full Social Security benefits on time.

It is unclear what specific actions SSA would take if a trust fund were exhausted. After insolvency, Social Security would continue to receive tax income, from which a majority of scheduled benefits could be paid. One option would be to pay full benefit checks on a delayed schedule; another would be to make timely but reduced payments. Social Security beneficiaries would remain legally entitled to full, timely benefits and could take legal action to claim the balance of their benefits.

The Report proceeds to outline the possible responses and is interesting for that alone. More important for my purposes though is the suggestion that the “conflict between two federal laws” precludes the option of Congress just sitting back and letting “automatic” cuts happen. Because as Biggs some years back and CRS last year point out, there is nothing automatic about this at all.

2015 Social Security Report:

http://www.ssa.gov/oact/tr/2015/index.html

http://www.ssa.gov/OACT/tr/2015/tr2015.pdf

Demeter

(85,373 posts)

First, when a “private” group’s chief individuals flow back and forth constantly between government and that group, the group can be said to be “part” of government, or to have “infiltrated” government, or to have been “folded into” government. (Your phrasing will be determined by who you think is the instigator.)...For example, a network of private “security consulting” firms does standing business with the (Pentagon’s) NSA, and by some accounts performs 70% of their work. Are those firms part of the NSA or not? Most would say yes, to a great degree. It’s certain that the NSA would collapse without them, and many of these firms would collapse without the NSA (though many have other … ahem, international … clients, which starts an entirely different discussion)...As another example, the role of mega-lobbying firms as a fourth branch of government was explored here. Same idea. In the case of the security firms, one might say they have been “folded into” government. In the case of the lobbying firms, one might say they have “infiltrated” government. I hope you notice the difference; both modes of incorporation occur.

Second, consider how in general the “world of money” and the parallel world of “friends of money” — its enablers, adjuncts, consiglieri and retainers — flow in and out of the world of government, of NGOs, of corporate boards, of foundation boards, attends Davos and the modern Yalta (YES) conference, and so on. Now consider how someone like Hillary Clinton — not money per se, though she has a chunk, but certainly a “friend of money” — ticks off most of those boxes (foundation board, corporate board, government, Davos, Yalta, and so on). There are many people like Hillary Clinton; she’s just very front-and-center at the moment. What we’re about to see is the infiltration of “friends of money” into key positions in the eurozone, and in particular, the infiltration of friends of money from one huge repository of money and guardian of its perquisites — the megabank Goldman Sachs — into those governmental positions.

“Goldman Sachs Conquers Europe”

I stole the subhead above from the U.K. paper The Independent. I’m not sure it’s a metaphor. Check the chart at the top and notice how many Goldman Sachs alumni are actually in charge of economic policy in Europe, much like GS alumni are in charge (literally) of economic policy in the U.S. government.

Which suggests the questions:

Where are the current loyalties of these Goldman Sachs employees?

Does Goldman Sachs run economic policy in the U.S.?

Does Goldman Sachs run economic policy in the eurozone?

A fascinating piece. I’m guessing the authors think the answers above are:

To global banking, to “rich take all” economics, and to Goldman Sachs.

Yes.

Yes.

Now the piece from The Independent (my emphasis). Note that it was written in 2011.

The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count. By replacing the scandal-surfing Silvio Berlusconi, Italy has dislodged the undislodgeable. By imposing rule by unelected technocrats, it has suspended the normal rules of democracy, and maybe democracy itself. And by putting a senior adviser at Goldman Sachs in charge of a Western nation, it has taken to new heights the political power of an investment bank that you might have thought was prohibitively politically toxic.

This is the most remarkable thing of all: a giant leap forward for, or perhaps even the successful culmination of, the Goldman Sachs Project.

It is not just Mr Monti. The European Central Bank, another crucial player in the sovereign debt drama, is under ex-Goldman management, and the investment bank’s alumni hold sway in the corridors of power in almost every European nation, as they have done in the US throughout the financial crisis. Until Wednesday, the International Monetary Fund’s European division was also run by a Goldman man, Antonio Borges, who just resigned for personal reasons.

Even before the upheaval in Italy, there was no sign of Goldman Sachs living down its nickname as “the Vampire Squid”, and now that its tentacles reach to the top of the eurozone, sceptical voices are raising questions over its influence. The political decisions taken in the coming weeks will determine if the eurozone can and will pay its debts – and Goldman’s interests are intricately tied up with the answer to that question.

Simon Johnson, the former International Monetary Fund economist, in his book 13 Bankers, argued that Goldman Sachs and the other large banks had become so close to government in the run-up to the financial crisis that the US was effectively an oligarchy. At least European politicians aren’t “bought and paid for” by corporations, as in the US, he says. “Instead what you have in Europe is a shared world-view among the policy elite and the bankers, a shared set of goals and mutual reinforcement of illusions.”

This is The Goldman Sachs Project. Put simply, it is to hug governments close. Every business wants to advance its interests with the regulators that can stymie them and the politicians who can give them a tax break, but this is no mere lobbying effort. Goldman is there to provide advice for governments and to provide financing, to send its people into public service and to dangle lucrative jobs in front of people coming out of government. The Project is to create such a deep exchange of people and ideas and money that it is impossible to tell the difference between the public interest and the Goldman Sachs interest.

Mr Monti is one of Italy’s most eminent economists, and he spent most of his career in academia and think-tankery, but it was when Mr Berlusconi appointed him to the European Commission in 1995 that Goldman Sachs started to get interested in him. First as commissioner for the internal market, and then especially as commissioner for competition, he has made decisions that could make or break the takeover and merger deals that Goldman’s bankers were working on or providing the funding for. Mr Monti also later chaired the Italian Treasury’s committee on the banking and financial system, which set the country’s financial policies.

With these connections, it was natural for Goldman to invite him to join its board of international advisers. The bank’s two dozen-strong international advisers act as informal lobbyists for its interests with the politicians that regulate its work. Other advisers include Otmar Issing who, as a board member of the German Bundesbank and then the European Central Bank, was one of the architects of the euro.

http://www.independent.co.uk/news/business/analysis-and-features/what-price-the-new-democracy-goldman-sachs-conquers-europe-6264091.html

Part of the story involves the former attorney general of Ireland, former voice in Ireland’s finances, and current chair of Goldman U.K. broker-dealer operations:

I’d love to know what he did as a public official and advisor to government to grease his skid into Goldman, or what Goldman did with him while he was AG to grease his slide to them.

Now notice current ECB head Mario Draghi:

These men are not alone. This is a well-trod two-way street. But that’s not the worst of Goldman’s sins, in the view of many. This kind of thing is…

How Goldman Sachs Screwed Greece

There’s a special place in hell, though, for what Goldman did, and through its “alumni” is doing, to Greece. This has been much covered (if not much read), so I’ll quote The Independent, then send you to other sources.

The bank’s traders created a number of financial deals that allowed Greece to raise money to cut its budget deficit immediately, in return for repayments over time. In one deal, Goldman channelled $1bn of funding to the Greek government in 2002 in a transaction called a cross-currency swap. On the other side of the deal, working in the National Bank of Greece, was Petros Christodoulou, who had begun his career at Goldman, and who has been promoted now to head the office managing government Greek debt. Lucas Papademos, now installed as Prime Minister in Greece’s unity government, was a technocrat running the Central Bank of Greece at the time.

Quoting Matt Taibbi from my own 2012 examination of how Goldman screwed Greece and also Jefferson County, Alabama:

Operations like the Greek swap/short index maneuver were easy money for banks like Goldman and Chase – hell, it’s a no-lose play, like cutting a car’s brake lines and then betting on the driver to crash – but they helped create the monstrous European debt problem that this very minute is threatening to send the entire world economy into collapse, which would result in who knows what horrors.

http://americablog.com/2012/01/what-chase-goldman-sachs-did-to-greece.html

BUT WAIT! THERE'S MORE! SEE LINK

Demeter

(85,373 posts)APOLOGIA FROM AN IMF INSIDER...FROM 2009

The crash has laid bare many unpleasant truths about the United States. One of the most alarming, says a former chief economist of the International Monetary Fund, is that the finance industry has effectively captured our government—a state of affairs that more typically describes emerging markets, and is at the center of many emerging-market crises. If the IMF’s staff could speak freely about the U.S., it would tell us what it tells all countries in this situation: recovery will fail unless we break the financial oligarchy that is blocking essential reform. And if we are to prevent a true depression, we’re running out of time...

...Becoming a Banana Republic

In its depth and suddenness, the U.S. economic and financial crisis is shockingly reminiscent of moments we have recently seen in emerging markets (and only in emerging markets): South Korea (1997), Malaysia (1998), Russia and Argentina (time and again). In each of those cases, global investors, afraid that the country or its financial sector wouldn’t be able to pay off mountainous debt, suddenly stopped lending. And in each case, that fear became self-fulfilling, as banks that couldn’t roll over their debt did, in fact, become unable to pay. This is precisely what drove Lehman Brothers into bankruptcy on September 15, causing all sources of funding to the U.S. financial sector to dry up overnight. Just as in emerging-market crises, the weakness in the banking system has quickly rippled out into the rest of the economy, causing a severe economic contraction and hardship for millions of people.

But there’s a deeper and more disturbing similarity: elite business interests—financiers, in the case of the U.S.—played a central role in creating the crisis, making ever-larger gambles, with the implicit backing of the government, until the inevitable collapse. More alarming, they are now using their influence to prevent precisely the sorts of reforms that are needed, and fast, to pull the economy out of its nosedive. The government seems helpless, or unwilling, to act against them.

Top investment bankers and government officials like to lay the blame for the current crisis on the lowering of U.S. interest rates after the dotcom bust or, even better—in a “buck stops somewhere else” sort of way—on the flow of savings out of China. Some on the right like to complain about Fannie Mae or Freddie Mac, or even about longer-standing efforts to promote broader homeownership. And, of course, it is axiomatic to everyone that the regulators responsible for “safety and soundness” were fast asleep at the wheel.

But these various policies—lightweight regulation, cheap money, the unwritten Chinese-American economic alliance, the promotion of homeownership—had something in common. Even though some are traditionally associated with Democrats and some with Republicans, they all benefited the financial sector. Policy changes that might have forestalled the crisis but would have limited the financial sector’s profits—such as Brooksley Born’s now-famous attempts to regulate credit-default swaps at the Commodity Futures Trading Commission, in 1998—were ignored or swept aside...

Demeter

(85,373 posts)It’s becoming a common theme of the more intelligent end of criticism of the Eurogroup to identify the 2010 bailout as the real error. Triangulating between Karl Whelan, Mark Blyth, Simon Wren-Lewis, Steve Waldman and Martin Sandbu, for example, we can identify the following argument (which of course doesn’t do justice to any of them — do please read the links rather than assuming I’ve summarised anything accurately!):

1. The 2010 bailout was mainly directed at stabilising European financial markets, so either

2a. The actual amount of financing available for the Greek fiscal deficit was smaller than it might otherwise have been, or

2b. Greece would have benefited more in the long term from a program with the same deficit financing but a face value debt writedown

3. So, most of Greece’s economic problems today would have been better if it had defaulted in 2010 rather than accepting the Eurogroup’s program.

There’s some truth in these points — as I say, it’s the most intelligent critique of the Eurogroup — but in my view the conclusion is wrong and the 2010 bailout was not a mistake. It’s worth relitigating in detail though, because in going through the choices made in 2010 we can learn a lot about how bailouts in general operate, and how the development of the programs since 2010 could end up generating serious errors going forward. This is going to have to be (at least) a two-part series because I want to get quite detailed — this part deals with point 1 above and the question of “Who was the 2010 bailout meant to benefit?”.

MUCH MORE, OF COURSE AT LINK

Demeter

(85,373 posts)...Greece is the second largest recipient and host (after Italy) of trans-Mediterranean refugees to whom the northern ultra-neoliberal fascist European countries attempt to close their borders. Greece and possibly soon also Italy and Spain, is strangled blue by the fascist embrace endorsed by the mainstay of Europe, the vassals of Washington, the Zionist-run Wall Street and the FED. Yet, Greece has abstained from sending these refugees from war torn countries in Africa and the Middle East back to their miseries. Despite their own misery, a sense of solidarity prevails – a sense of humanity, the rest of the western world has lost.

Mind you and always remember, because nobody will tell you – these wars and conflicts producing the flood of migrants, were and are created and sustained by Washington and its European vassals for control of resources and hegemony – and not least for the maintenance of the hugely profitable global war industrial complex, of which 60% is dominated by the US. The abject and perpetual misery that creates the refugee crisis is the direct product of those who refuse to receive and accommodate them. EU solidarity never existed – but today western greed and egocentricity has eradicated even the shred of notion of what solidarity might be.

Back to today’s Greek parliament vote of deception – it is totally illegal, as well pointed out by Prof Michel Chossudovsky . The Greek Parliament cannot override the people’s decision. That is unconstitutional.

In addition, there is a little known caveat in contract law applicable to international as well as locally concluded agreements. “Contracts formed under duress, or fraud by one party, or where one party was clearly unequal in bargaining power can be set aside;” says renowned international criminal lawyer and specialist in Human Rights, Christopher Black.

He adds that each side has to give consideration … for the other to form a contract. In circumstances where one side has gained a disproportionate advantage through deceit or through other illegal means, i.e. bribery, a contract would not be considered valid. These conditions apply to any kind of contracts, such as mineral and hydrocarbon concessions, telecommunications – as well as banking. In other words, the initial ‘bail-outs’ contracted by previous governments with the troika were imposed under proven foul play and therefore would be illegal.

Furthermore, Chris says, “There is also the issue of force majeure. That is when circumstances change beyond the parties control so much that the contract cannot be fulfilled or should not be fulfilled; then the contract is null and void.” Usually such ‘force majeure’ clauses are part of every contract. If they are not in the case of Greek debt, their omission was deliberate and would not hold up in a court of law.

“In Greece, the argument can be made that the original loans made to [the Government] by the various banks and IMF were obtained under duress, by bribery of government officials (or by Goldman Sachs ‘cooked’ balance sheets – observation by the author) are invalid because of fraud; and, ultimately, if circumstances have changed so much that one party simply can’t through no fault of their own, fulfill their part [of the contract]. No court would hold that party bound to that contract.”

Chris Black concludes that a “court would also have to consider whether the contract was ever valid in the first place; that is – did both sides get real consideration for their part in the bargain….It is clear that the moneys lent did not actually flow into the Greek economy but were nominal loans to the Greek nation, but actually went from one lenders bank to another and back again, so that it was really a scam to steal the wealth of the Greek people…. The Greek could legally argue their way out of all these contracts and loans, but of course behind the contracts sits the German army and behind them the US army – and so it not (so much) a legal matter but a political one. Argentina and Iceland made a political decision and repudiated these contracts. Greece can do the same.”

Is it perhaps for that reason that the IMF has come out lately calling for restructuring the Greek debt or canceling it altogether? – Is it that the IMF is fully aware of these contract clauses of fraudulent debt and ‘force majeure’ and that they – the clauses – would be respected in an international court even if they were not spelled out in the specific loan contracts?

The IMF probably prefers to be the initiator of debt-forgiveness rather than being caught red-handed as debt perpetrator. The IMF has in full memory the Ecuador carrying out an independent debt audit, concluding that two thirds of it has been contracted fraudulently.

Greece has the right to present their case to an international court. Considering the circumstances described above, chances are high that they may stand tall. So, there is hope for a rescue without debt!

Peter Koenig is an economist and geopolitical analyst. He is also a former World Bank staff and worked extensively around the world in the fields of environment and water resources. He is the author of Implosion – An Economic Thriller about War, Environmental Destruction and Corporate Greed – fiction based on facts and on 30 years of World Bank experience around the globe. He is also a co-author of The World Order and Revolution – Essays from the Resistance.

WELL, IT'S WORTH A TRY

Demeter

(85,373 posts)The Greek government extended the shutdown of its financial markets at least through Monday as it prepared to welcome creditors for negotiations on a third bailout program.

A decision on when and under what conditions Greek markets will reopen was deferred to next week, a government official told reporters on Thursday, asking not to be named in line with policy. The Athens Stock Exchange, multilateral trading facility and electronic secondary market for bonds have been closed since June 29, when the government issued a decree imposing capital controls and a forced bank holiday.

Greek officials setting the ground rules for a reopening of the Athens exchange need to decide whether to exempt investors from capital controls and risk more money heading for the exit, or safeguard scarce liquidity and get further isolated from global markets. MSCI Inc. is considering a downgrade of the country and FTSE will decide whether to keep Greek securities its its global indexes on Friday.

The nation is seeking a return to normality as the government begins new bailout talks. The first representatives of Greece’s official creditors are due to arrive in Athens on Friday. Greek bankers will meet officials from of the Single Supervisory Mechanism in Frankfurt on Friday...

Demeter

(85,373 posts)Greece's creditors prepared on Thursday for the start of bailout talks in Athens, after lawmakers adopted a second package of reform measures before dawn despite a left wing rebellion that may bring early elections.

In a sign of how the goal of coming to grips with the country's debt is swiftly sliding even further away, Greece's most influential think tank predicted a sharp drop back into recession.

That adds to the headwinds facing leftwing Prime Minister Alexis Tsipras, who must negotiate a bailout worth up to 86 billion euros with sceptical lenders while struggling to hold his divided Syriza party together.

After another marathon session that ended in the early hours of Thursday, the Greek parliament voted overwhelmingly to approve the second package of reform measures. But 36 Syriza lawmakers rebelled, forcing Tsipras to rely on opposition votes...

Demeter

(85,373 posts)It’s never been more obvious that Greece has been sold out to the banks. Like many countries before, their nation has been scheduled to endure poverty and chaos, followed by a firesale of their assets. The latest evidence of their nation’s capture by the banks, is the selling of their numerous islands to wealthy buyers.

The newspaper says the deal was made in partnership with Italian real estate magnate, millionaire Alessandro Proto.

The two men closed the deal for a reported 15 million euros last Thursday. The businessmen released a joint statement saying that they intended to invest in the island of Agios Thomas, also referred to as St. Thomas, located on the northwestern side of the island of Egina in the Saronic Gulf.

They plan to “build property in an effort to help the wider region develop.”

The island, 300 acres in size, was earlier available for sale over the internet at 15 mln euro.

If confirmed, this is yet another purchase of a Greek island by a foreign celebrity. Earlier this week Hollywood star Johnny Depp purchased an uninhabited Greek island of Stroggilo for 4.2 mln euro.

Of course, the value of these islands is hardly enough to pay down their massive debt, and that’s kind of the point. When the banks own your country, they’re not interested in liberating you from your financial slavery. Before you ever get around to repaying those debts, or defaulting, they’ll use austerity to bring your country to the brink of chaos, and buy up everything for pennies on the dollar, and make a handsome profit as the country recovers on their terms.

Prime Minister Tsipras has sold out to these financial interests; and the firesale of all Greek assets, not just their paltry islands, is well on its way.

Eurozone leaders demanded that Greek public assets be transferred to a Treuhand-like fund – a fire-sale vehicle similar to the one used after the fall of the Berlin Wall to privatize quickly, at great financial loss, and with devastating effects on employment all of the vanishing East German state’s public property.

This Greek Treuhand would be based in – wait for it – Luxembourg, and would be run by an outfit overseen by Germany’s finance minister, Wolfgang Schäuble, the author of the scheme. It would complete the fire sales within three years. But, whereas the work of the original Treuhand was accompanied by massive West German investment in infrastructure and large-scale social transfers to the East German population, the people of Greece would receive no corresponding benefit of any sort.

This is how the sovereignty and prosperity of a nation is sucked away by the financial elites of the world. But Greece isn’t the only bank owned nation. The USI (United States Incorporated) has been thoroughly captured by the banking class, and once its usefulness as a war-fighting machine is finished; austerity, riots, and firesales won’t be far behind.

Demeter

(85,373 posts)The amount of money withdrawn from Greek banks last month was unprecedented, according to Greece's central bank.

The Bank of Greece said Monday that the value of bank notes in circulation reached 50.5 billion euros by the end of June -- an increase of 5 billion euros from a month earlier.

Further, the bank said most of this cash did not leave the country, suggesting that Greek citizens are choosing to stash their savings at home, HuffPost Greece reported.

The data confirms just how precarious the situation was with Greek banks before the country limited individual cash withdrawals to 60 euros per day on June 29. In the days before the capital controls were introduced, long lines formed at Greek banks and many ATMs ran out of cash as people grew fearful of the possibility of an economic collapse...

Demeter

(85,373 posts)57% of Americans see the US economy "getting worse," according to Gallup's latest survey, sending 'hope' to its lowest since September. Overall economic confidence slipped once again, despite the Greek deal, now at its lowest since October. It appears rising gas prices trump the rising stock prices when it comes to the average joe in America.

CHART AT LINK

Americans More Negative About Economic Outlook Than Current Conditions

Gallup's Economic Confidence Index is the average of two components: how Americans rate the current economy and whether they feel the economy is getting better or getting worse. As has been the case since March, Americans rated the outlook for the economy worse than they rated current economic conditions for the week ending July 19.

The current conditions score was essentially unchanged from the week prior at -5. This was the result of 25% of Americans saying the economy is "excellent" or "good" and 30% saying it is "poor." Meanwhile, 39% of Americans said the economy is "getting better," while 57% said it is "getting worse."

This resulted in an economic outlook score of -18, slightly below the -16 from the week prior, and the lowest weekly average since the week ending Sept. 21, 2014.

Demeter

(85,373 posts)U.S. authorities arrested four people in Israel and Florida Tuesday, some of whom are believed to be tied to computer hacks of JPMorgan Chase and other financial institutions.

Tuesday’s spate of seemingly unrelated arrests weren't publicly tied to JPMorgan's 2014 computer breach, which compromised tens of million accounts. But a federal law enforcement official told USA TODAY that some of the suspects in the schemes, outlined in court papers Tuesday, are also suspects in the hack.

The official, who was not authorized to speak publicly, said the suspects — rounded up over an alleged pump-and-dump scheme and an alllegedly illegal bitcoin operation — initially surfaced in the government’s investigation of last year's bank breach.

In all, Department of Justice officials Tuesday arrested four men across Florida and Israel and charged five through one indictment and two criminal complaints. A spokesman for Manhattan U.S. Attorney Preet Bharara's office, which issued both the two bitcoin complaints and the pump-and-dump indictment, declined to comment...

DETAILS FOLLOW, BUT IT'S MURKY

Demeter

(85,373 posts)