Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 31 July 2015

[font size=3]STOCK MARKET WATCH, Friday, 31 July 2015[font color=black][/font]

SMW for 30 July 2015

AT THE CLOSING BELL ON 29 July 2015

[center][font color=red]

Dow Jones 7,745.98 -5.41 (-0.03%)

[font color=green]S&P 500 2,108.63 +0.06 (0.00%)

Nasdaq 5,128.79 +17.05 (0.33%)

[font color=green]10 Year 2.26% -0.03 (-1.31%)

30 Year 2.94% -0.02 (-0.68%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)A bill passed by the U.S. House of Representatives would allow the government to restrict Americans’ travel through the revocation of passports based upon mere suspicions of unscrupulous activity. This bill represents another dangerous step forward in the war on terror and the disintegration of American due process.

H.R. 237, the “FTO (Foreign Terrorist Organization) Passport Revocation Act of 2015,” will allow the U.S. Secretary of State the unchecked authority to prohibit individuals from traveling internationally. According to the bill, the Secretary may unilaterally revoke (or refuse to issue) a passport from “any individual whom the Secretary has determined has aided, assisted, abetted, or otherwise helped an organization the Secretary has designated as a foreign terrorist organization pursuant to section 219 of the Immigration and Nationality Act (8 U.S.C. 1189).” The bill did not bother to define what the terms “aided, assisted, abetted, or otherwise helped” actually mean, in legal terms. The power has been left open-ended so that it can mean whatever the secretary wants it to mean. Needless to say, a bill like this would be easily abused.

The travel restriction requires no presumption of innocence for the targeted individual; no explanation; no public presentation of evidence; no opportunity for a defense; no checks and balances on the power. The bill does not outline any appeals process for the targeted individual. The only stipulation is that the Secretary of State must issue a report to the Senate Committee on Foreign Relations and the House Committee on Foreign Affairs — “classified or unclassified.” The bill does not state that either committee can reverse the secretary’s decisions.

H.R. 237 passed the House on July 21, 2015, on a voice vote (meaning no accountability for its Congressional supporters). It is being sold as a necessary measure to stop “turned Americans,” as the bill’s sponsor, Rep. Ted Poe (R-TX), calls them.

“The House has now acted to locate and contain these traitors,” Rep. Poe said in a press release. “These Benedict Arnold traitors who have turned against America and joined the ranks of foreign radical terrorist armies should lose all rights afforded to our citizens.”

Poe’s statement about “losing all rights” is rather startling, considering that about half of the Bill of Rights is explicitly written to protect people suspected of crimes from being abused by overzealous government! The dangers of a government wantonly revoking the rights of citizens just because the a bureaucrat puts them on a list would be severe indeed; fitting of a police state. Recall that these individuals can be targeted without even facing official charges of wrongdoing.

The FTO Passport Revocation Act must pass the U.S. Senate before it reaches the president. Readers are advised to contact their senators to oppose this overreaching executive power.

I THOUGHT WE ALREADY HAD SUCH A POWER, SEEING AS HOW EDWARD SNOWDEN WAS DEPRIVED OF HIS PASSPORT...

Demeter

(85,373 posts)TSIPRAS IS FORCED TO HEAL HIS PARTY, BECAUSE HE DESTROYED HIS NATION...

Greece: Tsipras Says Referendum Needed to Fix Split in Party

This content was originally published by teleSUR at the following address:

http://www.telesurtv.net/english/news/Greece-Tsipras-Says-Referendum-Needed-to-Fix-Split-in-Party-20150730-0013.html. If you intend to use it, please cite the source and provide a link to the original article. www.teleSURtv.net/english

The ruling Syriza party has been split since Prime Minister Tsipras accepted a controversial bailout package that would force Greece to adopt austerity measures. Greek Prime Minister Alexis Tsipras Thursday called for an emergency congress next month for the Syriza party, in order to overcome major divisions. He also added that if members wanted a faster solution, a snap party referendum would also be acceptable. A rift has been growing within the ruling Syriza party since July 13, when the prime minister accepted a controversial bailout package from European creditors that would force the country to adopt strong austerity measures or face leaving the euro zone.

“I propose to the central committee to hold an emergency congress to discuss being in power as leftists, our strategy in the face of bailout conditions,” Tsipras told the 200-strong decision-making Syriza committee. “There is another view, which is respected, that doesn't accept the government's analysis and believes there was an alternative available in the early morning hours of July 13. If this is the case … then I suggest the party hold a referendum on this crucial question,” added the prime minister.

MORE

http://www.rt.com/business/311143-tsipras-bailout-deal-creditors/

The deal with creditors was “not of our choice,” Prime Minister Alexis Tsipras has said, adding that Greece faced the dilemma between a difficult compromise and disorderly default.

Speaking to the Syriza committee in Athens Thursday, Tsipras tried to defend Greece’s €86 billion bailout deal with the international creditors, saying that Grexit was not a choice. It would have forced Athens into devaluation and going back to the IMF for support, he added.

“If someone believes another government could have brought back a better deal they should say so,” Kathimerini newspaper quoted Tsipras as saying.

READY THE TORCHES, SHARPEN THE PITCHFORKS!

Demeter

(85,373 posts)By Sigrún Davídsdóttir, an Icelandic journalist, broadcaster and writer. Her coverage of Iceland’s financial crisis and subsequent recovery can be found at her Icelog. Together with Professor Þórólfur Matthíasson she has earlier written at A Fistful of Euros on what Icelandic lessons could be used to deal with the Greek banks.

The word “trust” has been mentioned time and again in reports on the tortuous negotiations on Greece. One reason is the persistent deceit in reporting on debt and deficit statistics, including lying about an off market swap with Goldman Sachs: not a one-off deceit but a political interference through concerted action among several public institutions for more then ten years...As late as in the July 12 Euro Summit statement “safeguarding of the full legal independence of ELSTAT” was stated as a required measure. Worryingly, Andreas Georgiou president of ELSTAT from 2010, the man who set the statistics straight, and some of his staff, have been hounded by political forces, including Syriza. Further, a Greek parliamentary investigation aims to show that foreigners are to blame for the “odious” debt. But there is no effort to clarify a decade of falsifying statistics.

In Iceland there were also voices blaming its collapse on foreigners. But the report of the Special Investigation Committee silenced these voices. As long as powerful parts of the Greek political class are unwilling to admit to past failures it might prove difficult to deal with the consequences: the profound lack of trust between Greece and its creditors...In Iceland, this was a common first reaction among some politicians and political forces following the collapse of the three largest Icelandic banks in October 2008. Allegedly, foreign powers were jealous or even scared of the success of the Icelandic banks abroad or aimed at taking over Icelandic energy sources. In April 2010 the publication of a report by the Special Investigation Committee, SIC, effectively silenced these voices. It documented that the causes were domestic: failed policies, lax financial supervision, fawning faith in the fast-growing banking system and thoroughly reckless, and at times criminal, banking.

As the crisis struck, Iceland’s public debt was about 30% of GDP and it had a budget surplus. Though reluctant to seek assistance from the International Monetary Fund (IMF) the Icelandic government did so in the weeks following the collapse. An IMF crisis loan of $2.1bn eased the adjustment from boom to bust. Already by the summer of 2011 Iceland was back to growth and by August 2011 it completed the IMF programme executed by a left government in power from early 2009 until spring 2013. Good implementation and Iceland’s ownership of the programme explains the success. For Ireland it was the same: it entered the crisis with strong public finances and ended a harsh Troika programme late 2013. Ireland’s growth in 2014 was 4.8%.

For Greece it was a different story. From 1995 to 2014 it had an average budget deficit of 7%. Already in 1996, government debt was above 100% of GDP, hovering there until the debt started climbing worryingly in the period 2008 to 2009 – far from the prescribed Maastricht criteria of budget deficit not exceeding 3% and public debt no higher than 60% of GDP. But Greece’s chronically high budget deficit and public debt had one exception: both figures miraculously dived, in the case of the deficit number to below the Maastricht limit, to enable Greece to join the Euro in 2001...Greece had an extra problem not found in Iceland, Ireland or any other crisis-hit EEA countries. In addition to dismal public finances for decades there is the even more horrifying saga of deliberate hiding and falsifying economic realities by misreporting the Excessive Deficit Procedure (EDP) and hiding debt and deficit with off market swaps.* This is not a case of just fiddling the figures once to get into the Euro but a deceit stretching over more than ten years involving not only the National Statistical Service of Greece (NSSG) but the Greek Ministry of Finance (MoF), the Greek Accounting Office (GAO) and other important institutions involved in the compilation of EDP deficit and debt statistics – in short, the whole political power base of Greece’s public economy.

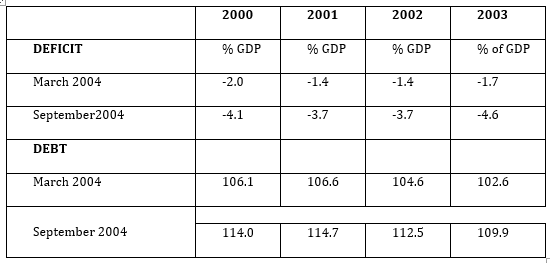

2004: The First Greek Crisis of Unreliable Statistics

The first Greek crisis did not attract much attention although it was indirectly a crisis of deficit and debt. It was caused by faulty statistics, already unearthed by Eurostat in 2002. Eurostat’s 2004 Report on the revision of the Greek government deficit and debt figures rejected the original figures put forward by the Greek authorities. After revision the numbers for the previous years looked drastically different – the budget deficit, which should have been within 3%, moved shockingly:

The institutions responsible for reporting on the debt and deficit figures were NSSG, the MoF through the GAO as well as MoF’s Single Payment Authority and the Bank of Greece. Specifically, NSSG and the MoF were responsible for the deficit reporting; the MoF was fully responsible for the debt figures. Eurostat drew various lessons from the first Greek crisis. Legislative changes were made to eradicate the earlier problems – not an entirely successful exercise as could be seen when the same problems re-surfaced. But the most important result of the 2004 crisis was a set of statistical principles known as the European Statistics Code of Practice, which was adopted in February 2005 and revised in September 2011 following the next Greek crisis of statistical data. Unfortunately, NSSG drew no such lessons.

2009: The Second Greek Crisis of Unreliable Statistics

Following the 2004 report, Eurostat had NSSG in what can best be described as wholly exceptional and intensive occupational therapy. Of the ten EDP notifications 2005-2009 Eurostat expressed reservations about five of them, more than for any other country. No country other than Greece received “methodological visits” from Eurostat. The Greek notifications which passed did so only because Eurostat had corrected them during the notification period, always increasing the deficit from the numbers originally reported by the Greek authorities. But in spite of Eurostat’s efforts the pupil was unwilling to learn, and in 2009 there was a second crisis of statistics. In January 2010, a 30-page report on Greek Government Deficit and Debt Statistics from the European Commission bluntly stated that things had not improved. In fact what had been going on at Greek authorities had no parallel in any other EU country. This second crisis of Greek statistics in 2009 was set off by the dramatic revisions of the deficit forecast for 2009. As in 2004, this new crisis led to major revisions of earlier forecasts: the April forecast was revised twice in October. What happened between spring and October was that George Papandreou and PASOK ousted New Democracy and prime minister Kostas Karamanlis from power. The new government was now beating drums over a much worse state of affairs than the earlier data and forecast had shown.

After first reporting on October 2nd 2009, NSSG produced another set of figures on October 21st which revised the earlier reported deficit for 2008 from 5% of GDP to 7.7% and the forecasted deficit for 2009 from 3.7% of GDP to 12.5% (as explained in footnote, numbers for current year are a forecast, whereas numbers for earlier years should be actual data). This was not all. In early 2010, Eurostat was still not convinced about the actual EDP data from the years 2005 to 2008. The earlier 2009 deficit forecast of 12.5% had risen to an actual deficit of 13.6% by April 2010. The final figure was confirmed as 15.4% in late 2010.

The European Commission’s report detected common features with events in 2004 and 2009: a change of government. In March 2004, Kostas Karamanlis and New Democracy came to power, ending eleven years of PASOK rule; in October 2009, George Papandreou and PASOK won back power. The EC noted that in both cases:

In other words, the problem was not statistics but politics. As politics is well outside its remit, Eurostat could not get to the core of the problem:

Political interference could be deduced from the fact that reservations expressed by Eurostat between 2005 and 2008 on specific budgetary issues, which had then been clarified and corrected, resurfaced in 2009 when earlier corrections were reverted and the figures were once more wrong.

Good Faith versus Fraud

The EC’s 2010 report identified two different but in some cases linked sets of problems. The first was due to methodological weaknesses and unsatisfactory technical procedures, both at the NSSG and the authorities that provided data to the NSSG, in particular the GAO and the MoF.

The second set of problems stemmed:

Eurostat’s extra scrutiny and unprecedented effort had clearly not been enough:

The EC’s report further pointed out that:

The EC concluded that there was nothing wrong with the quality assurance system in place at Eurostat. The shortcomings were peculiar to Greece:

And the rarity of revisions of such magnitude was underlined:

The EC’s report spells out the interplay between authorities, dictated by political needs. Against these concerted actions by Greek authorities, the efforts of European institutions were bound to be inadequate. “The situation can only be corrected by decisive action of the Greek government,” the report said.

The Goldman Sachs 2001 Swaps – Part of the Greek Statistics Deceit Saga

In early 2010, international media was reporting that Greece had entered into a certain type of swap – off market swaps – with Goldman Sachs in 2001 in order to bring its debt to a certain level so as to be eligible for euro membership...In Council Regulation (EC) No 2223/96 swaps were classified as “financial derivatives,” with a 2001 amendment making it clear that no “payment resulting from any kind of swap arrangement is to be considered as interest and recorded under property.” However, at that time off market swaps were not much noted. By the mid-2000s it became evident that the use of off market swaps could have the effect of reducing the measured debt according to the existing rules. Eurostat took this into account and issued guidelines to record off market swaps differently from regular swaps. Further, Eurostat rules specify that when in doubt national statistical authorities should ask Eurostat.

In 2008, Eurostat asked member states to declare any off market swaps. The prompt Greek answer was: “The State does not engage in options, forwards, futures or FOREX swaps, nor in off market swaps (swaps with non-zero market value at inception).” In its Report on the EDP Methodological Visits to Greece in 2010, Eurostat scrutinised the 2001 currency off-market swap agreements with Goldman Sachs, using an exchange rate different from the spot prevailing one that the Greek Public Debt Agency (PDMA) had made with the bank. It turned out that the 2008 answer was just the opposite of what had happened: the Greek state had indeed engaged in swaps but kept it carefully hidden from the outer world, including Eurostat...After having been found to be lying about the swaps, Greek authorities were decidedly unwilling to inform Eurostat about their details. Not until after the fourth Eurostat visit, at the end of September 2010 – after Andreas Georgiou took over at ELSTAT – did Eurostat feel properly informed on the Goldman Sachs swap.

The GS off market swaps were in total thirteen contracts with maturity from 2002 to 2016, later extended to 2037. As Eurostat remarked, these transactions had several unusual aspects compared to normal practices. The original contracts have been revised, amended and restructured over the years, some of which have resulted in what Eurostat defines as new transactions. The GS swaps hid a debt of $2.8bn in 2001; after later restructuring the understatement of the debt was $5.4bn. The swap transaction, never before reported as part of the public accounts, was part of the revisions in the first ELSTAT reporting after Georgiou took over. This actually increased the deficit by a small amount for every year since 2001, as well as increasing the debt figure. The swap story is a parallel to the Greek data deceit in the sense that it was not a single event but a deceit running for years, involving several Greek authorities. Taken together, both the swap deceit and the faulty reporting of forecasts and statistics by Greek authorities show a determined and concerted political effort to hide facts and figures, which did not change when new governments came to power.

A Thriller of Statistical Data and Mysteriously Acquired Emails

NOW IT GETS UGLY, WONKY, AND WORSE--SEE LINK

********************************

When the European Union created a single currency the Euro countries in effect embarked on a journey all on the same ship. By now, it is evident that the crew – the European authorities – did not have the necessary safety measures to keep discipline among the passengers. Nor have the passengers kept an eye on each other. In the summer of 2011, Mario Monti, sorely tried by his experience as EU Commissary, formulated what had gone wrong:

A successful monetary union demands more than the countries being just fair-weather friends. The crisis countries, most notably Greece, can only learn from the past if they understand what happened. In Greece these failures were, among others, the basic function in a modern state of truthfully reporting statistics.

Truth or Politically Suitable Truth

In December 2008, while Iceland was still in shock after the banking collapse, its parliament set up a Special Investigation Committee, SIC, which operated wholly independently of parliament. The three SIC members were Supreme Court Justice Páll Hreinsson (the chairman), Parliament’s Ombudsman Tryggvi Gunnarsson and lecturer in economics at Yale University Sigríður Benediktsdóttir. Together, they supervised the work of about 40 experts. Their report of 2600 pages was published on April 10th 2010. The report buried politically-motivated explanations of the collapse being caused by foreigners and instead recounted what had actually happened, based on both documents and hearings (private, not public hearings). One benefit of the SIC report is that no political party or anyone else can now tell the collapse saga as suits their interest: the documented saga exists and this effectively ended the political blame game. Importantly, the report points out lessons to learn.

Sadly, nothing similar has been done in Greece. The two committees set up by the Greek parliament do not seem entirely credible, because the allegations of ELSTAT misconduct and manipulation under Georgiou are being recycled. Further, their scope seems myopic, as no effort is made to explain what went on at the institutions that from before 2000 until 2010 were reporting faulty statistics and forecasts and lying about the GS swaps. All of this taken together shows a political class, including within Syriza, not only unwilling to face the past but actively fighting any attempt to clarify things in a battle where even national statistics are a dangerous weapon. The fact that leading Greek political powers are still fighting the wrong fight on statistics is unfortunately symptomatic of political undercurrents in Greece. And this, in part, explains why the Troika and the EU member states find it so hard to trust Greece.

--------------------------------------------------------------------------------

*A note on EU statistics: twice a year, before end of March and August, statistical authorities in the EU countries report forecasts of debt and deficit numbers for the current year, i.e. what the planned deficit and debt is and then statistical data for earlier years, i.e. the real debt and deficit, according to strict Eurostat procedure, in order to produce comparable statistics. This reporting, called Excessive Deficit Procedure (EDP) is published by Eurostat in April and October every year.

Demeter

(85,373 posts)The situation in Greece is not about Greece at all. It is about enforcing an economic framework onto all Eurozone countries. And because the policy goal is primarily about enforcing this economic framework everywhere in the eurozone, there is less policy space available for compromise. It is this fact that makes the Greece government debt bailout negotiations so difficult.

In January, just after Syriza came to power I outlined where a deal was possible. I wrote at that time, “Herein lies the only area for agreement then:

“Back-loaded austerity: although stimulus is the opposite of austerity, Syriza could still get some stimulus in the short-term if they commit to reforms and a plan that has the deficit and debt numbers moving toward the Maastricht criteria over time.”

The crux here however is that in getting to a longer-term deal, the eurozone negotiators are most concerned about Greece as a precedent and example for other countries in terms of so-called reforms. We’re talking about pension reforms, labor reforms, privatization and so forth. German Finance Minister Schäuble has been quite explicit about this. In Mid-April, he gave a talk at the Brookings Institution in which he said that the French wish they had a Troika program the way Spain had one, in order to make structural reforms easier to implement. The French government denied Schäuble’s comments were true because they smacked of anti-democratic fiat from above.

But the incident made clear what is happening in Europe. Individuals in Europe who want less socialism – for lack of a better word – are using this crisis to force their agenda. And in some ways, they have exacerbated the crisis in order to make this agenda stick. With Greece, then, there is less room to compromise than meets the eye, particularly because the Greeks have been the most deviant from the desired model of structural reform. The thinking, therefore, is “if we let Greece off the hook on these issues, the others won’t implement the necessary reforms either. And France isn’t even in a program. The socialist government there has much less political pressure to comply with this agenda. Unless we get reforms, there will not be economic harmonization and we will be back in crisis in short order.”

And this is exactly the area where Greece’s red lines are most important. The Greeks are not going to bend all the way to the Troika position on pensions, on labor markets or on privatization. And these are deeply held views. On pensions, the Greek view is that the pensions are less generous than meets the eye and that due to the recession an excessive number of people near retirement age have been pushed out of the work force and would be indigent unless they received an early pension. On labor markets, the Greeks are saying that minimum wages are not deleterious in the face of asymmetric market power and that even the German grand coalition has implemented a minimum wage, which is relatively high in real terms. So the Greeks want collective bargaining at least at the sectoral level, something the Germans still have. And finally, on privatization, the Greeks are not opposed; they just want to delay privatizations because they believe they should not sell off state assets when their value is diminished.

All of these positions by the Greeks are reasonable. And for the Troika to expect them to give in on them while also meeting the backloaded austerity and no debt writedown provisions will be a complete capitulation politically. I just don’t see it happening. I believe, therefore, that default is likely. There is no blackmail here from either side. What there is is a lack of common ground on some very important bargaining points. And at this point, I don’t think there is nearly enough time to find common ground on these issues to prevent default, and potentially worse.

The fact is that European nations will never have a harmonised view of macroeconomic policy. It is folly to expect this. And the eurozone will thus have to accept differing economic models within the single currency or try -as they are now doing – to force a single model on the the whole of the eurozone in an undemocratic away that risks splintering the eurozone entirely. The weakest link amongst the periphery is Italy because it is large enough to matter economically, and cannot be broken like Greece. If Italy gets into trouble and the same methods are applied, the eurozone will break apart.

Edward Harrison is the founder of Credit Writedowns and a former career diplomat, investment banker and technology executive with over twenty years of business experience. He is also a regular economic and financial commentator on BBC World News, CNBC Television, Business News Network, CBC, Fox Television and RT Television. He speaks six languages and reads another five, skills he uses to provide a more global perspective. Edward holds an MBA in Finance from Columbia University and a BA in Economics from Dartmouth College. Edward also writes a premium financial newsletter.

Demeter

(85,373 posts)One of the so-called Plan B's allegedly called for a take-over of the Bank of Greece so that its reserves could be used to finance the transition from Euro to Drachma. Good plan! However, it might be worthwhile to look at the BoG's balance sheet before embarking on that plan (see the table at the end of this post).

The BoG shows total assets of 176 BEUR. Of those, 127 BEUR are claims against domestic financial institutions, hardly of any value to the government. Then the BoG owns about 8 BEUR of Greek government bonds. Unlikely that they would be a useful source of transition financing. Neither would domestic securities of 6 BEUR be.

When it comes down to it, the BoG has the following assets which could be of value for transition financing:

27 BEUR - securities of foreign issuers

4 BEUR - gold, gold receivables, SDR's and foreign bank notes

The key question is where those assets are being held. I had once suggested that the BoG should open accounts with Central Banks of friendly countries, such as Russia, in order to hold those assets there. I presume, however, that most of those assets are being held in accounts with the ECB and other national Central Banks of the Eurozone.

Picture this: Greece has just unilaterally declared default and the intention to Grexit; it has put a stop on all foreign debt service; and it has repudiated bonds held by the ECB. And now Greece wants to sell some of the above assets to create liquidity for paying governmental bills.

Message from the ECB to the BoG: "Given the unilateral actions you have taken, we have to advise you that we have blocked all balances in your accounts with the Eurosystem until clarification of the current situation".

Answer from the BoG to the ECB: "Gee, we hadn't thought of that. Sorry. Didn't mean it. Please disregard our actions".

Balance Sheet of the Bank of Greece (BoG)

Assets (outstanding amounts at end of period in EUR millions)

End of period Jun 15

Claims on MFIs 128.552

Domestic 126.671

Other euro area countries 1.357

Other countries 524

Claims on non MFIs 7.704

Domestic 7.704

General Government 7.297

of which Central Government 7.297

Other sectors 407

Other euro area countries 0

General Government 0

Other sectors 0

Other countries 0

General Government 0

Other sectors 0

Securities other than shares and derivatives 32.626

Domestic 6.018

MFIs 420

General Government 5.598

of which Central Government 5.598

Other sectors 0

Other euro area countries 23.559

MFIs 3.054

General Government 17.842

Other sectors 2.663

Other countries 3.049

MFIs 152

General Government 824

Other sectors 2.073

Money market fund units 0

Shares and other equity excluding money market fund units 597

Domestic 11

MFIs 0

Other sectors 11

Other euro area countries 565

MFIs 565

Other sectors 0

Other countries 21

MFIs 21

Other sectors 0

Fixed assets 806

Gold, gold receivables, SDRs and foreign banknotes 4.155

Remaining assets 1.893

Total Assets 176.333

Demeter

(85,373 posts)By Paul Buchheit, a college teacher, a member of US Uncut Chicago, and the editor and main author of American Wars: Illusions and Realities (Clarity Press). He can be reached at paul@UsAgainstGreed.org.

Corporations have reaped trillion-dollar benefits from 60 years of public education in the U.S., but they’re skipping out on the taxes meant to sustain the educational system. Children suffer from repeated school cutbacks. And parents subsidize the deadbeat corporations through increases in property taxes and sales taxes.

Big Companies Pay about a Third of their Required State Taxes

An earlier report noted that 25 of our nation’s largest corporations paid combined 2013 state taxes at a rate of 2.4%, a little over a third of the average required tax. Many of these companies play one state against another, holding their home states hostage for tax breaks under the threat of bolting to other states.

Without Corporate Taxes, K-12 Public Education Keeps Getting Cut

Overall spending on K-12 public school students fell in 2011 for the first time since the Census Bureau began keeping records over three decades ago. The cuts have continued to the present day, with the majority of states spending less per student than before the 2008 recession.

It’s Getting Worse

Total corporate profits were about $1.8 trillion in 2013 (with other estimates somewhat higher or lower). The $46 billion in total corporate state income tax in 2013, as reported by both Ernst & Young (Table 3-A) and the Census Bureau, amounts to just 2.55% of the $1.8 trillion in corporate profits, a drop from the 3% paid in the five years ending in 2012.

The Worst Offenders

The most recent Pay Up Now analysis for 2014 shows some of the biggest and the worst offenders among U.S. corporations in 2014. Twenty companies with total U.S. profits of over $150 billion paid just 1.4% in state taxes. Some of the lowlights:

Texas has a modest franchise tax instead of a state tax, but two giant firms (Exxon and AT&T) still managed to claim sizable state tax credits. Exxon, which has almost 80% of its productive oil and gas wells in the U.S., declared only 17% of its income here, while using a theoretical tax to account for 83% of its smallish federal income tax bill. On the state side, the company received hundreds of millions in subsidies for its refineries in Louisiana.

In Illinois, a state beleaguered by pension woes and the nation’s worst per-student spending cuts in 2011-12, lost nearly a billion dollars in tax revenue to just six companies (Boeing, Archer Daniels, Walgreen’s, Caterpillar, Exelon, Abbott Labs), which paid just 1.9% of their profits in state taxes, about a quarter of the required amount.

New York’s most notorious tax avoider is Pfizer, which had nearly half of its sales in the U.S. over the past three years, yet claimed $50 billion in foreign profits and losses in the U.S.

How Taxpayers Subsidize the Tax Avoiders

All of our technology, securities trading, medicine, infrastructure, and national security have their roots in public research and development. The majority (57 percent) of basic research, the essential startup work for products that don’t yet yield profits, is paid for by our tax dollars.

But big business apparently views its tax responsibility as a burden to be avoided at the expense of the rest of us.

Demeter

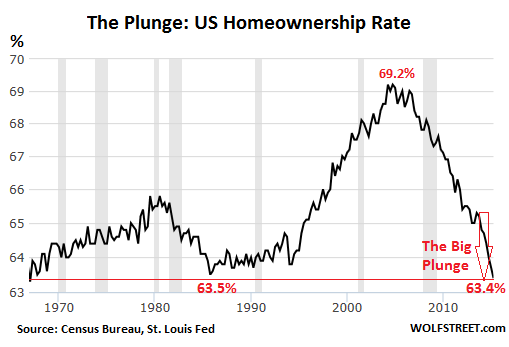

(85,373 posts)...Housing Bubble 2 has bloomed into full magnificence: In many cities, the median price today is far higher, not just a little higher, than it was during the prior housing bubble, and excitement is once again palpable. Buy now, or miss out forever! A buying panic has set in...The fact that Housing Bubble 2 is now even more magnificent than the prior housing bubble, even while real incomes have stagnated or declined for all but the top earners, is another sign that the Fed, in its infinite wisdom, has succeeded elegantly in pumping up nearly all asset prices to achieve its “wealth effect.” And it continues to do so, come heck or high water. It has in this ingenious manner “healed” the housing market.

But despite the current “buying panic,” the soaring prices, and all the hoopla round them, there is a fly in the ointment: overall homeownership is plunging. The homeownership rate dropped to 63.4% in the second quarter, not seasonally adjusted, according to a new report by the Census Bureau, down 1.3 percentage points from a year ago. The lowest since 1967!

The process has been accelerating, instead of slowing down. The 1.2 percentage point plunge in 2014 was the largest annual drop in the history of the data series going back to 1965. And this year is on track to match this record: the drop over the first two quarters so far amounts to 0.6 percentage points. This accelerated drop in homeownership rates coincides with a sharp increase in home prices. Go figure.

The plunge in homeownership rates has spread across all age groups, but to differing degrees. Younger households have been hit the hardest. In the age group under 35, the homeownership rate in Q2 saw a slight uptick to 34.8%, from the dismal record low of 34.6% in the prior quarter. Either a feeble ray of hope or just one of the brief upticks, as in the past, to be succeeded by more down ticks on the way to lower lows.

This chart by the Economics and Strategy folks at National Bank Financial shows the different rates of homeownership by age group. The 35-year and under group is where the first-time buyers are concentrated; and they’re being sidelined, whether they have no interest in buying, or simply don’t make enough money to buy (represented by the sharply descending solid black line, left scale). Note how the oldest age group (dotted blue line, right scale) has recently started to cave as well:

The bitter irony? In the same breath, the Census Bureau also reported that the rental vacancy rate dropped to 6.8%, from 7.5% a year ago, the lowest since 1985. America is turning into a country of renters...

MORE

Demeter

(85,373 posts)When we think of militarism, Prussians in spiffy uniforms goose-stepping down Unter den Linden probably comes to mind. Prussia’s fixation on her army was less an “ism” than a product of her geography, which stranded the country between two great land powers, France and Russia, with no natural defenses on her borders. Nonetheless, a cartoon from the Kaiser’s time depicts such militarism well. It shows a Berlin street full of people in various uniforms, all staring pop-eyed at a man in a suit. The caption reads, “A civilian! A civilian!”

A book a friend recommended offers a supplementary definition of militarism, one that touches closer to home for Americans. The work, A History of Militarism by Alfred Vagts, was first published in 1937. Vagts makes an important distinction at the outset:

Modern militarism has … specific traits … modern armies … are more liable to forget their true purpose, war, and the maintenance of the state to which they belong. Becoming narcissistic, they dream that they exist for themselves alone … perpetuating themselves for the purpose of drawing money.

This definition of militarism is alive, well, and running the show on Capitol Hill and in the Pentagon. As Vagts warns, the result is not merely the waste of some hundreds of billions of dollars. Much of that money is spent in ways that work against military effectiveness, against the ability of our armed forces to win. Vagts reminds us: “The acid test of an army is war—not the good opinion it entertains of itself. …War is the criterion, and war only. The rest is advertisement.”

YOU KNOW WHERE THIS IS GOING--F35 FIASCO---ONE IN A SERIES OF STUPID THINGS DONE IN THE NAME OF DEFENSE....

Republicans in Congress continually call for reducing the federal deficit. Sloughing off this albatross would save a neat trillion. At the very least, congressional budget hawks should demand a fly-off, where the F-35 would have to prove it is a better fighter than our existing F-15s, F-16s, and F-18s. Will they? No. Some of those nice men in expensive suits standing at their office doors, checkbooks in hand, might go away.

The shape of American militarism is the enormous shadow cast by the F-35.

William S. Lind is author of the Maneuver Warfare Handbook and director of the American Conservative Center for Public Transportation.

Demeter

(85,373 posts)The General Assembly will now vote on legislation that seeks to stop ‘vulture’ funds

The establishment of a new legal framework for sovereign debt restructuring is now a step closer to becoming a reality as the United Nations Ad Hoc Committee on Sovereign Debt Restructuring Processes approved yesterday a set of principles that seek to limit the actions of “vulture” funds worldwide. After six months of meetings and summits, the UN committee agreed on nine principles that sum up the main points to be included in the framework. The document will now be put to a vote in the General Assembly in September, according to Bolivia’s Ambassador to the UN and chair of the committee Sacha Llorenti.

“Many countries still did not attend the committee meetings but then call and ask for the records. They care about the issue but they don’t want to discuss it,” the Foreign Ministry’s International Economic Relations Secretary Carlos Bianco said after the meeting. “We believe the best solution can be reached at the UN but that doesn’t mean we reject other alternatives. Even the IMF said there’s a loophole regarding the ‘vultures.’”

Sovereign immunity from jurisdiction and execution regarding sovereign debt restructurings is a right of states before foreign domestic courts and exceptions should be restrictively interpreted, according to the committee. Argentina has long argued that stance during its legal battle with holdout creditors and in response to the United States District Judge Thomas Griesa’s rulings. According to the principles that were signed off on yesterday by the Ad hoc committee, sovereigns also have the right to design their macroeconomic policy, including restructuring its sovereign debt. That principle extends to restructurings, which should not be frustrated or impeded by any abusive measures, and that should take place as a last resort for the country. At the same time, there must be “good faith” by the country and by all its creditors to engage in “constructive” debt restructuring negotiations, according to the committee, with the goal of a “prompt and durable reestablishment of debt sustainability and debt servicing” as well as achieving the support of a critical mass of creditors through a constructive dialogue regarding the restructuring terms.

The resolution also notes that transparency should be promoted to enhance the accountability of the actors involved in the negotiation, which could be achieved by sharing data related to the debt workouts. Meanwhile, states should treat their creditors equally, unless a different treatment is justified under law. The committee also concluded that sovereign debt restructuring agreements approved by a majority of a state’s creditors can’t be affected by other states or a non-representative minority of the creditors such as the “vulture” funds, who must respect the decisions adopted by the majority, according to the last principle. States should also be encouraged to include collective action clauses in their sovereign debt to be issued in the future.

“The current international debt restructuring system suffers from problems of fragmentation, inefficiencies and protracted negotiations, which lead to a lack of growth oriented solutions to the debt problems of developing countries and challenges to developed countries,” the committee concluded. “The activities of non-cooperative litigating creditors continue to add to the uncertainty of post-debt restructuring outcomes.”

A long debate

The UN’s General Assembly voted in September 2014 overwhelmingly in favour of a proposal to create the framework, a move that was sparked by Argentina’s debt battle with its holdout creditors. The resolution was approved by 124 countries, while only 11 voted against it and 41 abstained. The draft was presented by Bolivia on behalf of the Group of 77 (G-77) developing nations and China. The United States accompanied by the United Kingdom, Japan, Canada, Australia and Germany voted against the measure. The 41 abstentions were mostly drawn from European countries and included the South Korea, New Zealand and perhaps surprisingly, Iceland. Iceland is often cited as an example of rebellion in the face of international finance as it voted in a 2010 referendum to reject the terms of debt deal after a severe banking crisis.

In voting against the resolution, the United States said a statutory mechanism for debt restructurings would sow uncertainty in financial markets, and several states said the International Monetary Fund (IMF) was the more appropriate venue for discussing the issue over the United Nations.

Argentina refused last year to heed Griesa’s orders to pay the holdout hedge funds, led by NML and Aurelius, at the same time as it pays bondholders who participated in the debt exchanges following the country’s historic 2001 default. That order came after the US Supreme Court declined to hear Argentina’s appeal of Griesa’s ruling and settlement talks went nowhere. The move led US credit rating agencies to declare Argentina was in partial default...

BASED ON WHO OBJECTED, GOLDMAN SACHS IS NOT PLEASED WITH THE NOTION...

Demeter

(85,373 posts)It's time to call Beijing's aggressive stock-market intervention what it really is: quantitative easing, Chinese style.

With deflation pressures mounting, China's central bank would seem to have plenty of incentive to follow counterparts in Japan, the U.S. and Europe down to zero rates and beyond. Governor Zhou Xiaochuan has held off because of two overriding fears. First, an unknown number of companies might default on dollar debts if a full-fledged QE program depressed the value of the yuan. Second, that kind of stealth devaluation might scuttle Beijing's hopes of adding the renminbi to the ranks of the world's reserve currencies.

Instead of intervening in debt markets as the Fed, Bank of Japan and ECB have, China has thus targeted stocks directly. The goal -- to commandeer assets as a transmission mechanism to gin up growth and confidence -- is the same. Indeed, in some ways the Chinese strategy is even more direct about its aims.

This is the worrying part, though: Just as those other nations have, China is going to have a very hard time exiting from its easing program. And its difficulties are going to compound the challenges faced in Washington, Brussels and Tokyo...

MORE, AND IT'S NOT LOOKING GOOD

Demeter

(85,373 posts)WHAT WAS THEIR FIRST CLUE?

http://www.bloomberg.com/news/articles/2015-07-30/u-s-asks-supreme-court-to-review-insider-trading-ruling

Just when Wall Street thought it was safer to trade on illicit tips, the U.S. government is pushing to reverse what it calls a harmful and unprecedented court ruling on insider trading. U.S. Solicitor General Donald Verrilli on Thursday asked the Supreme Court to review a federal appeals court decision from New York that he said will encourage corporate insiders to pass confidential information to friends, relatives and business acquaintances.

Verrilli may be taking a chance in seeking the high court review as the justices have been skeptical of government arguments in some recent criminal appeals. The justices are likely to be “concerned about the rights of the accused to fair notice that their actions are insider trading,” said Sam Lieberman, a lawyer who has represented individuals and investment advisers in civil and criminal investigations. “That is particularly so given the court having five conservative votes that favor limited government.”

Four of the nine Supreme Court justices must vote to hear the case before it can be considered. The court won’t be in session until October.

The lower court said prosecutors must prove that a person who traded on an illegal tip knew that the source received a personal benefit for violating a duty to keep it secret. And the benefit has to be something more than just friendship, the court said. It’s the latter ruling that the government is attacking in its request to the Supreme Court...

VIOLATING A DUTY ISN'T SUFFICIENT EVIDENCE OF A CRIME?

Demeter

(85,373 posts)INTERESTING DISCUSSION ON VIDEO AT LINK

http://www.bloomberg.com/news/articles/2015-07-30/u-s-economy-picked-up-in-second-quarter-after-better-2015-start

The world’s largest economy expanded at a faster pace in the second quarter and managed to eke out a gain at the start of the year, painting a picture of incremental progress consistent with the Federal Reserve’s view.

Gross domestic product rose at a 2.3 percent annualized rate, and a revised 0.6 percent advance in the first quarter wiped out a previously reported contraction, Commerce Department data showed Thursday in Washington. The median forecast of 80 economists surveyed by Bloomberg called for a 2.5 percent gain. Consumer spending grew more than projected, and price increases accelerated.

The economy has moved beyond some of the early 2015 constraints including weather and port delays, while cooling global markets, a strong dollar and insufficient wage gains may continue to limit growth. Fed officials, considering when to begin raising rates this year, concluded on Wednesday that the U.S. is making progress.

“We had better growth and better inflation in the first half,” said Eric Green, head of U.S. economic research at TD Securities in New York. “This should make the Fed feel more comfortable about raising rates this year.”

Demeter

(85,373 posts)If the Fed had a clue as to what it will do in September, it likely would have said so. Instead, it reiterated the same hash we have been hearing for years.

Here is the complete text of today's FOMC Press Release.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate. The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced. Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of earlier declines in energy and import prices dissipate. The Committee continues to monitor inflation developments closely.

To support continued progress toward maximum employment and price stability, the Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen some further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities and of rolling over maturing Treasury securities at auction. This policy, by keeping the Committee's holdings of longer-term securities at sizable levels, should help maintain accommodative financial conditions.

When the Committee decides to begin to remove policy accommodation, it will take a balanced approach consistent with its longer-run goals of maximum employment and inflation of 2 percent. The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.

Voting for the FOMC monetary policy action were: Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Charles L. Evans; Stanley Fischer; Jeffrey M. Lacker; Dennis P. Lockhart; Jerome H. Powell; Daniel K. Tarullo; and John C. Williams.

Charades

I suspect the Fed is concerned about retail sales, sentiment, housing, China, Greece, oil, Canada, the US dollar, and a host of other things. At this stage in the charades game, the Fed cannot possibly come out and say any of that. Nor can the Fed hint at a September hike, even though it wants to, because retail sales may continue to slump and auto sales could easily collapse. The Fed expects "further improvements" in the labor market, but what if all these inane minimum wages hikes kill jobs?

JOBS WORTH KILLING, IF YOU ASK ME

MORE AT LINK

Demeter

(85,373 posts)Pacific Rim trade ministers neared the final spurt of negotiations on an ambitious free trade pact on Thursday, but differences over farm exports and monopoly periods for next-generation drugs kept them short of an elusive final deal. Ministers from the 12 countries negotiating the Trans-Pacific Partnership (TPP), which would cut trade barriers and set common standards for 40 percent of the world economy, are meeting in Hawaii to try to hammer out a deal. But major issues are still unresolved, including dairy exports and exclusivity periods for biologic drugs. The United States is pushing for 12 years but Australia and other countries worried about the impact on medicine prices want five...A final news conference is scheduled for 1:30 p.m. on Friday (7.30 p.m ET). Ministers appeared relaxed as they were garlanded with leis for an official photo...About 650 officials from 12 nations are taking part in the negotiations on the Hawaiian island of Maui, with numerous lobby groups and stakeholders also attending. Negotiators have stressed they are doing their utmost to close the deal this week but also warned that not all industries will get what they want, amid a flurry of last-minute appeals.

TOBACCO TALKS

U.S. lawmakers, including from tobacco-growing states such as North Carolina, renewed warnings against excluding tobacco from rules allowing foreign companies to sue a host government. An official briefed on the talks said there was discussion of a U.S.-initiated exception in Maui. It would be narrower than the broad exclusion for health and environmental policy sought by Australia, which is being sued by Marlboro maker Philip Morris (PM.N) over tobacco plain packaging laws. Australian Trade Minister Andrew Robb said on Tuesday that countries were "well down the track" on securing protection from litigation over health and environment policy. He said on Thursday investment rules and sugar remained open. Australia's bid to export more sugar to the United States has the backing of U.S. confectioners and beverage companies.

"The United States needs to grant Australia commercially meaningful access," Sweetener Users Association chairman Perry Cerminara, who also handles sugar for chocolate maker The Hershey Co (HSY.N), wrote in a letter to U.S. Trade Representative Michael Froman. U.S. canegrowers oppose more imports, and Mexico is keen to safeguard its preferential access to the U.S. sugar market.

Dairy is another tricky issue, with New Zealand, Australia and the United States frustrated with Canada, and New Zealand and Australia also looking for more access to U.S. and Japanese markets. Robb said dairy was moving in "very tiny steps." Australian Dairy Industry Council chairman Noel Campbell said discussions had gone backwards in some cases and he had hoped for more progress.

Canada hit back at complaints that it is holding up a deal. "To say that one particular issue is a sticking point to a potential deal just isn’t based in reality. A number of very serious issues remain for countries to negotiate," said Rick Roth, spokesman for Trade Minister Ed Fast.

Demeter

(85,373 posts)Carly for America, the super PAC backing former Hewlett-Packard CEO Carly Fiorina’s presidential campaign, invited supporters to join a conference call on Thursday with -- Carly Fiorina. Think this required any "coordination" between the supposedly independent super PAC and the candidate?

The email invite from the super PAC informs supporters that "Special Guest Republican Candidate for President Carly Fiorina" will be joining them. At the same time, it contains the necessary legal notice that Carly for America "is an independent expenditure committee and not authorized or coordinated with any federal candidate or candidate's committee."

The problem is that federal campaign coordination laws ban only certain types of cooperation and association between candidates and supposedly independent groups. A candidate cannot have input on the content -- text, video, imagery or other materials -- or the conduct -- strategy, timing or payment -- of a communication. This leaves a lot of other activity open to the interpretation of the Federal Election Commission, which rarely enforces the anti-coordination rules in particular and at this moment is deeply divided on how to enforce its regulations overall.

FEC gridlock is just one of many reasons why the 2016 presidential campaign has seen a complete meltdown of the notion that candidates don't work with the super PACs and nonprofits supporting them.

Few have gone as far as Fiorina, whose campaign is essentially being run out of the super PAC...

Demeter

(85,373 posts)A big problem in economic life is that mostly you want the things you own to be worth as much as possible, but sometimes you don't. You want them to be worth a lot if you're going to sell them, or report on them to the investors for whom you manage them, or generally sit around and gloat about how rich you are. You don't want them to be worth a lot, mainly, if you are going to pay taxes on them, though there are other important cases. It can be tempting just to say that they're worth different amounts in different situations: Tell the buyer of your thing that it's worth $100, but tell the IRS that it's only worth $20. But, you know. Sometimes they check!

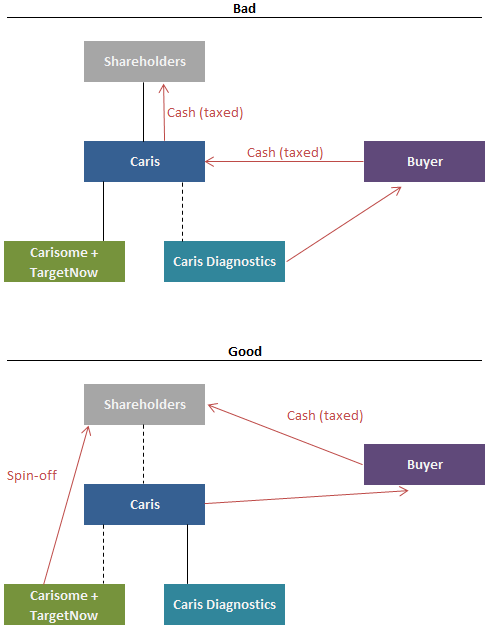

Here is a story from Tuesday's delightful opinion in Fox v. CDX Holdings by Delaware Vice Chancellor J. Travis Laster. There once was a company called Caris Life Sciences. Caris was a private company mostly owned by its founder David Halbert (70.4 percent) and by a private equity fund called JH Whitney VI LP (26.7 percent), with employee stock options making up most of the other 2.9 percent. Caris had three businesses: Caris Diagnostics, which was profitable; TargetNow, which wasn't yet; and Carisome, a blood-test cancer-screening business that "was in the developmental stage": It had launched two unsuccessful products, but "a successful Carisome product 'would be the largest product launch in the history of mankind,'" if Halbert did say so himself. (He did, in court.)

TargetNow and Carisome needed money, so Caris hired Citigroup to find it. The plan that Citi and Caris settled on was to sell Caris Diagnostics, the stable profitable business, and reinvest some of the money back into the earlier-stage Carisome and TargetNow. (The investors would keep the rest.) So they went out and shopped Caris Diagnostics and found a few potential buyers, some of whom were also interested in TargetNow. So Citi and Caris went and shopped TargetNow, too, seeking a value for it somewhere in the "couple of hundred million" range based on five-year earnings projections. Caris's chief financial officer, Gerard Martino, "testified that he did not believe any of the projections that Caris gave to the bidders. Halbert said the same thing." O ... kay?

Perhaps no one else did either. Ultimately they sold Caris Diagnostics to Miraca, another medical diagnostics company, and kept Carisome and TargetNow. Miraca paid $725 million in cash for Caris Diagnostics; Halbert and the JH Whitney fund kept most of the money (about $560 million), but reinvested $100 million of it into Carisome and TargetNow. The deal closed in November 2011. Since then, "TargetNow did not reach profitability, and Carisome did not develop a marketable product." Oh well. At least they got the $560 million. They also saved some taxes. Instead of selling the Caris Diagnostics business directly to Miraca, Caris spun out Carisome and TargetNow to its shareholders, and then those shareholders sold their stock in the remainder of Caris (i.e. Caris Diagnostics) to Miraca. If Caris had sold the diagnostics business for cash, it would have paid tax on the proceeds, and then the shareholders would pay tax again on any money that Caris distributed to them. But by spinning out Carisome/TargetNow first, they avoided the double tax: Caris the company had no gain on the sale of itself, so the shareholders just had to pay taxes on the cash they received for their stock....

See? Only one layer of taxes.

But while Caris the company didn't owe taxes on the cash sale, it did owe taxes on the value of what it spun off to its shareholders:

Under Section 355(e) of the Internal Revenue Code, RemainCo would recognize taxable gain from the Spinoff as if it had sold TargetNow and Carisome to Caris's stockholders for the fair market value of those businesses on the date when the Spinoff occurred. See 26 U.S.C. § 355(e)(1). If the fair market value of those businesses exceeded their tax basis, then RemainCo would owe tax on the difference.

And Miraca, as the new owner, quite reasonably didn't want to pay taxes on the stuff that was staying with the old shareholders. "But if the value of TargetNow and Carisome was less than Caris's basis in those entities, then the Spinoff would result in zero corporate-level tax."

So ... you know. What was the value of TargetNow and Carisome? They weren't publicly traded; they were early-stage speculative businesses that ultimately came to not much. It was pretty much up to Caris -- and Miraca, and their respective accountants (PricewaterhouseCoopers and Grant Thornton for Caris, Deloitte for Miraca) -- to decide what they were worth. The number they ultimately came up with was $62 million ($47 million for TargetNow and $15 million for Carisome), conveniently below Caris's tax basis. "We are at zero tax," Caris's accountant said, when he got to that number. Yay!

So everything worked out great for everyone, besides the IRS. Except that they forgot one little thing. Remember those option holders, who represented about 2.9 percent of Caris's stock? The deal cashed them out, and it had to cash them out at a price, and that price had to be for the full value of the company. The value of Caris Diagnostics was easy enough to calculate -- it was the merger price -- but then you have to add the value of Carisome and TargetNow. Which, Caris just got through calculating, was $62 million.

The option holders sued, saying that that value was too low. And so there was a trial, and testimony, and it came out that, at least in Vice Chancellor Laster's opinion, that value was totally fake...

IF YOU DON'T HAVE A HEADACHE BY NOW, YOU REALLY AREN'T PAYING ATTENTION.

BUT THAT'S ALL RIGHT. I'M JUST GRUMPY BECAUSE I HAD A NIGHTMARE ABOUT TRYING TO HOUSEBREAK A RHINOCEROS. NOT SURE WHY, EITHER.

STILL MORE AT LINK

Demeter

(85,373 posts)The European Union faces a regulatory spat with the United States after the bloc's securities watchdog said it could not give U.S. hedge funds a "passport" to operate across the EU.

The European Securities and Markets Authority (ESMA) advised the EU's executive European Commission that hedge funds from Jersey, Guernsey and Switzerland should be allowed to operate across the 28-country bloc.

This would avoid the current more costly route of needing authorisation in each EU state they want to market their funds. Authorised EU hedge funds get a passport automatically.

ESMA said it could not recommend giving a passport to hedge funds from the United States, one of the world's top centres for the sector, because it risked creating uneven competition...

WILL AMERICA TAKE THIS LYING DOWN?

MORE AT LINK

THE EU MORE AND MORE RESEMBLES A CHAIN GANG

Demeter

(85,373 posts)LATEST NEWS FROM LONDON, DONCHA KNOW

IN OTHER WORDS, DON'T EXPECT THIS TO APPEAR IN US MEDIA ANY TIME SOON

http://www.theguardian.com/lifeandstyle/2015/jul/29/baby-boomers-feeding-america-aarp-food-insecurity-health

The baby boomer generation was supposed to be the one that slid into its twilight years with everything sorted out – health, financial stability and long life expectancy. But that may not be the case. According to a new study, boomers – defined by the authors as people between the ages of 50 and 64 – are facing a host of health and economic challenges.

The study, released last week by Feeding America – a nonprofit network of food banks – with funding from the AARP Foundation, a lobbying group for older adults, found that roughly 8 million baby boomers are going hungry and are turning to charity for food. According to the report, which surveyed 60,000 people, the main challenges fueling the crisis were unemployment, housing shortages and poor health.

“Our network serves 13 million older adults and we expect that number to rise,” said Matt Knott, president of Feeding America. “This is absolutely the right time to be taking a hard look at the data to determine the challenges our mature clients face.”

The AARP report uses the US Department of Agriculture’s definition of food insecurity, which is “a household-level economic and social condition of limited or uncertain access to adequate food”. According to the study of the older adults relying on the services of Feeding America, 62% were baby boomers...

CONSIDERING THE AGE OF BOOMERS, THIS IS NOT SIGNIFICANT. BOOMERS ARE THE ELDERLY, NOW. MORE THAN HALF THE BOOMERS ARE EITHER DEAD OR OVER 60.

WHAT IS SIGNIFICANT IS THE MAGNITUDE--THE NUMBERS OF THE ENDANGERED.

A FEW MORE DATA POINTS AT LINK

Demeter

(85,373 posts)PRETTY MUCH EVERY WAY...THERE WAS NO RECOVERY, NOT EVEN ON PAPER

http://www.dailykos.com/story/2015/07/27/1406096/-The-ways-in-which-the-economy-never-recovered-from-2008

The headline economic numbers are far better now than in 2008-2009. The unemployment rate, the GDP, the national deficit, the stock market, etc. have all improved.

Yet many of us can't shake the feeling that things are still stuck in 2008. Well, you aren't crazy.

Many areas of the economy have never recovered from the 2008, and some are even worse today.

Does this mean things aren't better than in 2008? No. But it does mean that most comparisons between this "recovery" and recoveries in the past are flawed. This one is different...

MOST SIGNIFICANT IS THE PHONY STATISTICS THAT CLAIM IMPROVEMENT...

MUCH MORE DATA AT LINK

Demeter

(85,373 posts)This is one of those things that at first gets ascribed to sampling error or a statistical fluke or the weather or something, but then it wobbles lower month after month, in crass defiance of all rosy scenarios that had been so carefully laid out, and confirmations are hailing down from other directions, and suddenly it’s serious.

In early January, the economic confidence of Americans had reached the highest level in the Economic Confidence Index since Gallup started tracking the data in 2008. At +5 in January, the index wasn’t particularly high. But most Americans don’t live in the glorious Fed-goosed Wall-Street economy. They live in the real economy. And there, things have been tough.

Crummy as it was, January was practically glorious compared to the low of the Financial Crisis, when the Economic Confidence Index hit -65. That must have been at about the time when Treasury Secretary Hank Paulson told Congress that the world would end unless he got unlimited means and power to bail out certain big financial outfits, such as his former employer Goldman Sachs.

But in February, economic confidence began to zigzag lower. The index for the week ending July 26, released today, dropped another 2 points from last week, to -14, the worst level since September. This is what “gradually” (as Gallup called it) swooning economic confidence looks like:

The index is a composite of two sub-indices: one tracks how Americans perceive current economic conditions; the other tracks how Americans see future economic conditions.

Last week, I fretted over the deterioration of Americans’ economic outlook since January, which had plunged 25 points from +7 in January to -18 now, and I wondered what dark clouds Americans were seeing in the future that would impact their own lives, clouds that the ebullient stock market has remained blind to.

Today, the future conditions index remained at this dreary level, with 39% of Americans saying the economy is “getting better,” while 57% – that’s well over half – saying it is “getting worse.”

But in terms of current conditions, as of last week, Americans had not yet thrown in the towel: that index had been down “only” 8 points from +3 in January to -5 last week. But today, Americans’ view on current conditions caved, and the index plunged 4 points in one fell swoop to -9, with only 23% of Americans saying the economy is “excellent” or “good” and 32% saying it is “poor.”

MORE HAND-WAVING AT LINK

Demeter

(85,373 posts)I HAVE ONLY TWO WORDS TO SAY: BERNIE SANDERS

https://firstlook.org/theintercept/2015/07/28/2-years-white-house-finally-responds-snowden-pardon-petition/

The White House on Tuesday ended two years of ignoring a hugely popular whitehouse.gov petition calling for NSA whistleblower Edward Snowden to be “immediately issued a full, free, and absolute pardon,” saying thanks for signing, but no.

“We live in a dangerous world,” Lisa Monaco, President Obama’s adviser on homeland security and terrorism, said in a statement.

More than 167,000 people signed the petition, which surpassed the 100,000 signatures that the White House’s “We the People” website said would garner a guaranteed response on June 24, 2013.

In Tuesday’s response, the White House acknowledged that “This is an issue that many Americans feel strongly about.”

BUT THE AMERICAN PEOPLE HAVE NO SAY--DO THEY?