Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 28 August 2015

[font size=3]STOCK MARKET WATCH, Friday, 28 August 2015[font color=black][/font]

SMW for 27 August 2015

AT THE CLOSING BELL ON 27 August 2015

[center][font color=green]

Dow Jones 16,654.77 +369.26 (2.27%)

S&P 500 1,987.66 +47.15 (2.43%)

Nasdaq 4,812.71 +115.17 (2.45%)

[font color=green]10 Year 2.19% -0.01 (-0.45%)

30 Year 2.93% -0.02 (-0.68%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I wonder how many more like that I will personally have to endure. I'm going down to make coq au vin.

If the coq is lucky, there will be enough vin left for the recipe....

Warpy

(111,261 posts)if the vin needs to end up in your tummy instead of the pot.

One good thing about chicken, it always tastes like chicken.

Demeter

(85,373 posts)Malt does more than Milton can, to justify God's ways to Man. As for Woman, God hates us, I'm convinced of it.

Demeter

(85,373 posts)Atlanta Federal Reserve President Dennis Lockhart acknowledged on Monday that collapsing Chinese stock markets, plunging commodity prices, and an intensifying currency war have complicated the central bank's decision about whether to raise interest rates. There are more fundamental reasons, however, why the Fed should be resisting its instinct to tighten policy.

The Problem With Falling Prices

Wherever you look in financial markets -- whether its break-even rates in the U.S. government bond market (the yield gaps between vanilla Treasuries and those which compensate bondholders for faster inflation) or euro-denominated inflation swaps (a type of derivative used by pension funds to help ensure they have enough set aside to pay people's pensions) -- negative rates abound. That suggests consumer prices are more likely to slump than climb:

Source: Bloomberg

Moreover, there's accumulating evidence that monetary conditions in the world's biggest economy have already tightened. Paul Kasriel, the former chief economist at Northern Trust who now writes "The Econtrarian" blog, argues that "in recent months Fed monetary policy has become downright restrictive," even as the benchmark interest rate has remained at 0.25 percent.

As the Fed unwound its third round of quantitative easing, Kasriel argues, that tapering destroyed the "thin-air credit" that the central bank supplies to the financial system -- hence the shrinkage in the balance sheets of U.S. banks seen in the following chart.

Source: Haver Analytics

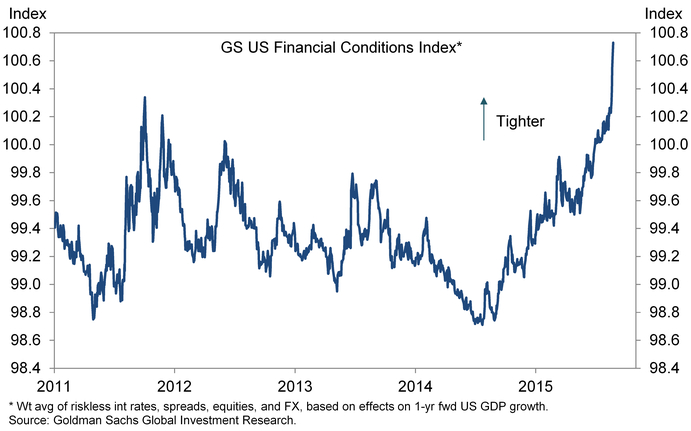

Goldman Sachs also sees evidence that U.S. monetary conditions have already tightened. Goldman compiles a financial conditions index that offers a snapshot of the monetary backdrop by blending market rates, and the spreads between them, with what's happening in equities and currencies markets. That index suggests conditions have rapidly tightened:

Source: Goldman

That's not good news for the U.S. economy. Goldman economist Sven Jari Stehn said in a research report on Tuesday that current market conditions could knock as much as 0.5 percentage points off U.S. growth, with the "drag" rising to as high as 0.8 point by the end of the year. And if market turmoil deepens, that could exacerbate the slowdown.

Bloomberg calculates a different financial conditions index which tracks how much stress there is in U.S. markets, with a negative value suggesting financial conditions are tightening. Here's what that index has done in the past few days:

Source: Bloomberg

"The balance of risks is toward more financial instability, slower growth, disinflation and deflation," Harvard University professor and former U.S. Treasury Secretary Lawrence Summers said this week. "That's not a time to be raising rates." I agree -- and it's got nothing to do with what's happening in the Chinese stock market.

Demeter

(85,373 posts)While the western mainstream media meme is that "this is all China's fault" - despite the fact that the real break happened after the FOMC Minutes last week - Xinhua reports that China central bank blames wide-spread expectations of a Fed rate hike in September for the global market rout... demanding The Fed "remain patient."

As Xinhua reports,

Yao Yudong, head of the People's Bank of China's Research Institute of Finance, said the expected Fed rate hike next month had been the "trigger" for the wild market swings.

Analysts worried that the Fed rate hike could accelerate the plunge of U.S. stocks and trigger a sell-off of assets worldwide and even a new global credit crisis.

Yao said the Fed should remain patient before the U.S. inflation reaches 2 percent.

Earlier, analysts said the devaluation of Chinese currency the Renminbi triggered the plunge and the weakening of bulk commodities and currencies in other countries.

China's benchmark Shanghai Composite Index sank 7.63 percent to close at 2,964.97 points on Tuesday. It has lost 26 percent in the past six trading days.

Overnight, the Dow tumbled 588 points, or 3.58 percent, to 15,871, after sliding more than 1,000 points, or 6 percent at the opening.

Li Qilin, analyst with Minsheng Securities, said the small devaluation of Renminbi could have slightly weighed on stock markets, but it could not explain the huge sell-off in the United States and other countries.

Li said the liquidity crunch is a bigger culprit.

The global rout has little to do with economic fundamentals and the Asian financial crisis would not be repeated, Capital Economics said in a research note.

But it said if the market plunge continues worldwide, the Fed might postpone its rate hike.

* * *

Which of course is supremely ironic since Goldman Sachs explains the biggest reason for the China rate cut overnight is the market rout, implying PBOC only cut because of The Fed's expected hike actions.

Demeter

(85,373 posts)The last 12 months has seen a sharp shift in tone regarding criticism of the Fed. Up until 2014, the mainstream financial media’s view of the Fed and its policies was that they had saved the financial system in 2008 and generated an economic "recovery."

Anyone with a working brain knew this was bogus: you cannot solve a debt crisis by issuing more debt. But because the financial media makes its money from financial firms’ advertising Dollars, it (the media) was happy to promote the narrative that the Fed was omniscient and expertly adept at managing the economy.

Then things began to change.

First in the summer of 2014, Congress moved to introduce new oversight of the Fed’s policies, particularly regarding its control of interest rates. Then the Fed was ensnared in a “leak” scandal indicating it had been providing insider information to key individuals before the public (the Fed has been leaking information for years... but the fact it became common knowledge was new). And then a growing number of commentators began to point out that the Fed’s QE programs didn’t actually do anything for the general economy, but did increase wealth inequality. It is this last item that has proven to be the most problematic for the Fed… particularly now that the markets are collapsing with interest rates already at zero. The Fed has openly stated that QE was a success because it pushed stocks higher. However, it’s hard to swallow this when stocks erase ALL of their post-QE 3 gains in a matter of four days.

In simple terms, the market collapse of the last week has proven point blank that the Fed’s theories are bogus and not based on reality. Moreover, now that the financial media has begun to promote the narrative that QE creates wealth inequality, any new QE program would be seen as a bailout of the wealthy. This means the Fed will be unable to directly intervene to prop the markets up. We get evidence of this from the fact that NO Fed officials appeared yesterday to provide verbal intervention for the markets. Every other time the markets has broken down in the last six years, a Fed President appeared to talk about some new policy to prop the markets up.

NOT THIS TIME. The Fed's silence signals that things have changed in a big way. Smart investors should start preparing now. This mess is not over by any stretch.

Demeter

(85,373 posts)The 2.62-carat diamond Calvin Mills bought his fiancée in November is a stunner. Pear-shaped and canary-yellow, the gem cost $22,000. A bargain. Mills, the chief executive officer of CMC Technology Consulting in Baton Rouge, La., says he could have spent tens of thousands more on a comparably sized diamond mined out of the earth, but his came from a lab. “I got more diamond for less money,” says the former Southern University football player, who proposed last year at halftime during one of his alma mater’s games at the Superdome in New Orleans.

While man-made gems make up just a fraction of the $80 billion global diamond market, demand is increasing as buyers look for stones that are cheaper—and free of ethical taint. Human-rights groups, with help from Hollywood, have popularized the term “blood diamonds” to call attention to the role diamond mining has played in fueling conflicts in Africa.

Unlike imitation diamonds such as cubic zirconia, stones that are “grown” (the nascent industry’s preferred term) in labs have the same physical characteristics and chemical makeup as the real thing. They’re made from a carbon seed placed in a microwave chamber with methane or another carbon-containing gas and superheated into a glowing plasma ball. That creates particles that crystallize into diamonds, a process that can take 10 weeks. The technology has progressed to the point that experts need a machine to tell synthesized gems apart from those extracted from mines or rivers.

Retailers including Wal-Mart Stores and Warren Buffett’s Helzberg Diamonds are beginning to stock the artificial gems. “To a modern young consumer, if they get a diamond from above the ground or in the ground, do they really care?” asks Chaim Even-Zohar, a principal at Tacy, an industry consulting firm in Ramat Gan, Israel. In a survey by Gemdax, an Antwerp-based consultant, only 45 percent of North American consumers from 18 to 35 said they prefer natural diamonds. “Some substitution for natural diamonds is inevitable,” says Anish Aggarwal, a partner at the firm, which wouldn’t disclose who paid for the study. Gemdax says more research is needed to better gauge consumer attitudes...

THE ELITE WILL CARRY ON ABOUT PROVENANCE, AND THE 99% WILL SAY: "WHO CARES?"

Demeter

(85,373 posts)Just worth pointing out: Henry Paulson’s decision to let Lehman fail, on Sept. 14, may have delivered the White House to Obama.

http://krugman.blogs.nytimes.com/2008/09/29/politics-of-crisis/?_r=1

Demeter

(85,373 posts)Google has an enormous amount of power through its ability to manipulate search rankings.

The company can make or break a brand or website by making minor tweaks to its algorithms. There's an entire science devoted to interpreting every move Google makes because even subtle changes can make a huge difference.

Google has always maintained that the goal of its endless tinkering is delivering the best search results possible. That seems to be true and the search giant famously has a "you can make money without doing evil," policy, but just because it currently has good intentions does not mean it always will.

The company's success and its ability to control where people go on the Internet put it into a place where it could impact the next president of the United States. There's no reason to believe Google intends to rig the coming election, but it has that power according to a Politico essay written by Robert Epstein, senior research psychologist at the American Institute for Behavioral Research and Technology and the former editor-in-chief of Psychology Today...

AU CONTRAIRE--THERE IS EVERY REASON TO BELIEVE GOOGLE INTENDS TO RIG THE COMING ELECTION.

AS LORD ACTON SAID: POWER CORRUPTS, ABSOLUTE POWER CORRUPTS ABSOLUTELY.

Demeter

(85,373 posts)THE TEFLON PROGRAM....I'VE GIVEN UP WAITING FOR PEOPLE TO SMARTEN UP

http://qz.com/472040/obamacare-is-facing-another-big-threat-accounting/

Obamacare has survived computer glitches, the Supreme Court (twice), and Republican’s best efforts to destroy it. Now, it might face a threat from an unexpected place: a little noticed accounting standard for state and municipal pensions.

Earlier this summer the Governmental Accounting Standards Board (GASB) released new recommendations urging states and municipalities to include retiree health care when they calculate their liabilities. When private sector firms had to do the same thing in 1990, they ditched the health benefits for retired workers altogether. If state and local governments do the same, it could have serious consequences for Obamacare.

A key feature of the Affordable Care Act are the exchanges where people can buy health care directly from insurers and comparison shop. Insurance markets inherently face an adverse selection problem: The only people who want to buy lots of insurance are the ones most likely to need it. That’s why it was so important that the “young invincibles”—young, healthy people—buy insurance on the exchanges to balance out the high cost of older, sicker people. So far, the population appears sufficiently diverse. The government claims 11.7 million people enrolled through the exchanges and 4.1 million are under 35.

But the new accounting rules might change the group’s composition. Many state and municipal workers retire under the age of 65, when they qualify for Medicare. Since minimum retirement ages for these workers are below age 60, this can leave a significant coverage gap to fill. In addition, some pensions offer health care that subsidizes or supplements Medicare after retirees turn 65. All these benefits are extremely expensive—the total liabilities are estimated to total $1 trillion. State and local governments have almost no money put aside to pay for retiree health care. The average funding ratio—how much money is put aside relative to how much is owed—is only 6%. Compare that to state pensions, which are allegedly about 70% funded.

It’s unclear how states will react if they’re forced to recognize retiree health-care costs. Economists Josh Rauh and Robert Pozen think local governments will respond by putting money aside. But that would run counter to how private firms behaved when they had to record such costs in 1990. States could possibly follow suit because of a ruling by the Supreme Court earlier this year that said retiree health benefits can be modified or taken way. The case involved a private sector corporation, but Frances Rogers, a lawyer who specializes in municipal pensions at California law firm Liebert, Cassidy and Whitmore, believes the ruling applies to any agreement made under collective bargaining, which most public sector benefits are.

The creation of ACA health exchanges may be the final nail in the coffin for retiree health-care benefits. The exchanges make it easier for states to phase out health-care plans because pre-Medicare retirees now have other, affordable options. Paul Frostin of the Employee Research Benefits institute anticipates this will open the door to more plan terminations; he’s even found some evidence it’s already happening.

There are no precise numbers available on the number of public pension retirees who get health care and don’t qualify for Medicare yet (the potential population who will go on the exchange). There are 9.5 million public pension beneficiaries and their average age is about 70. About 70% of governments offer health benefits to retirees. That suggests it’s likely the state retiree population could be large enough—even 1 million could make a significant difference—to skew the exchange population older (and likely sicker) and increase premiums.

At this point, what will happen is speculation. Uniform health-care coverage is a laudable policy objective. But what makes good policy isn’t just intent, it’s robustness. From that view, the Affordable Care Act is less than great because it appears so fragile.

Demeter

(85,373 posts)This week’s Chinese stock market implosion has been widely viewed as a reaction to the Chinese government’s devaluing the yuan on Aug. 11—a move many presume was a frenzied bid to lower export prices and strengthen the economy.

This interpretation doesn’t stand up to scrutiny. First, Chinese investors haven’t been investing based on how the economy is doing, but rather, based on what they think the government will do to prop up the market. The crash, termed “Black Monday,” was more likely a reaction to the central bank’s failure over the weekend to announce a widely expected cut to the bank reserve requirement since previous cuts in February and April had boosted stock prices. The government eventually caved and announced a cut on Tuesday (Aug. 25).

Second, the crash happened nearly two weeks after the devaluation, and the government only let the yuan depreciate by about 3% before swooping in and propping up its value again—which hardly helps exporters since the currency’s value effectively rose some 14% in the last year.

The devaluation probably had more to do with breaking the yuan’s tightly managed peg to the US dollar, an obligation that has been draining the economy of scarce liquidity as capital outflows swell.

Both moves—the government pulling back from its market bailout and the currency devaluation—stem from the same ominous problem: China’s leaders are scrambling to find the money to keep its economy running. To understand the broader forces that led to this predicament, here’s a chart-based explainer tracing its origins:

China used its exchange rate to stoke growth

China has long pegged its currency to the US dollar at an artificially cheap rate. Keeping the yuan cheaper than it should be, even as export revenues and foreign investment gushed in, allowed China to amass huge foreign exchange reserves, as we explain in more detail here:

http://atlas.qz.com/charts/V1gTftS2

A cheap currency has also powered China’s investment-driven growth model (more on this here). By paying more yuan than the market would demand for each dollar, the People’s Bank of China (PBoC) created extra money out of thin air, sending it sloshing around in the economy. (Meanwhile, the PBoC prevented from driving up inflation by setting its bank reserve requirements unusually high, as we explain here.)

http://atlas.qz.com/charts/NkgZcnU2

Easy money, easy lending, easy growth. This was especially true after the global financial crisis hit, when China pumped 4 trillion yuan ($586 billion in 2008 US dollars) into its economy to protect it from the fallout. The resulting double-digit growth attracted foreign investment and hot money inflows, raising demand for yuan. To buoy its faltering export industry, the PBoC had to buy even more dollars to prevent surging yuan demand from driving up the local currency’s value.

The government pumped the stock market

But growth is now slowing, making the $28 trillion in debt China racked up in the process even harder to pay off.

http://atlas.qz.com/charts/VyuKC9A_

About a year ago, the government turned to pumping up the stock market. The thinking behind this move, says Derek Scissors, economist at the American Enterprise Institute, was, “Hey, why not address our huge problems by replacing debt with equity?” In other words, a bull market would help indebted companies raise new capital and pay off overdue loans. But eventually the market tanked.

http://atlas.qz.com/charts/VJ50kZvn

So starting in early July, the government launched a sweeping stock market bailout, vowing to prop up the Shanghai Composite Index until it hit 4,500. The problem is, every time it has neared that target level, investors start selling in anticipation that the government will pull back its support. As a result, the Chinese government has now spent as much as $1 trillion to prop up stocks.

Hot money fled the country

While some investors were betting on stocks, others had seen the writing on the wall and were getting out—swapping their yuan for other currencies. Starting in late 2014, the influx of hot money reversed course, and speculative investment flooded out of China. One measure of that is the drop in (mostly) short-term trade finance from foreign banks, which started in Q4 2014:

http://atlas.qz.com/charts/Vykuf_l2

Another is the fall in foreign exchange that Chinese banks are holding:

http://atlas.qz.com/charts/4yOHPwZ3

Once people started selling the yuan, others began fearing that their yuan holdings would lose value—so they sold too. Lower demand for the yuan should have lowered the currency’s value relative to the dollar. But the PBoC had to keep the yuan’s value stable. Not only had it promised to do so as a requirement of joining the IMF’s basket of central bank reserve currencies; the yuan’s stability and gradual appreciation has long attracted foreign capital into China, says Carlo Reiter, an analyst at J Capital Research. To continue propping up the yuan’s value, the PBoC started selling dollars from its precious reserves in exchange for yuan:

http://atlas.qz.com/charts/EkKbftS2

AND IT GOES ON FOR CONSIDERABLY MORE...SEE LINK

Demeter

(85,373 posts)When Congress punted much of the rule-making for the Dodd-Frank Act to the financial regulatory agencies, they might as well have raised a white flag. As compromised as Congress is when it comes to dealing with their Wall Street donors, they have nothing on financial regulators who often end up later working for the people and companies they are supposed to be regulating.

Those working for the various financial regulatory agencies — SEC, CFTC, OCC — are in a prime position to cash in on their institutional knowledge and go work for Wall Street where they can make millions gaming the rules they themselves put in place. Though there has always been a “revolving door” between government and business, Wall Street has taken it to new levels and can offer the kind of money few other businesses can.

This revolving door dynamic between Washington and Wall Street leads to weaker loophole filled regulations that can easily be gamed by large financial firms. That’s exactly what is happening today thanks to regulators taking a dive on rules concerning derivatives trading.

According to an August 21 Reuters report, Wall Street firms successfully lobbied to have a huge loophole inserted into the Dodd-Frank Act that enables them to evade regulations on swap agreements. Now traders and firms can shift the location of the swaps to places like London and avoid the oversight that was supposed to be provided by Dodd-Frank.

The trades can no longer even be tracked by US regulators and, according to Reuters, “include some of the most widely traded financial derivatives in the world — such as interest rate swaps, where a bank takes a fee for exchanging a variable-rate interest payment for a fixed rate with a client, and credit default swaps, a sort of insurance where one party, often a bank, agrees to pay another party in the event of a bond default.”

Unregulated swap agreements caused AIG’s notorious collapse. Despite claims by AIG executive Joseph Cassano that it was difficult to “even see a scenario within any kind of realm of reason that would see us losing a dollar in any of those transactions,” AIG collapsed when its credit default swaps on mortgage-backed securities came due and the company could not pay because no one (like a regulator) forced them to be able to cover their bets.

According to an analysis from ProPublica, the total cost of the government bailout of AIG was $180 billion. And that’s not including the cost of the financial crisis AIG fueled with its reckless derivatives trading, which Better Markets calculated to be $20 trillion.

When the loophole was being inserted into the regulations at the Commodity Futures Trading Commission, Wall Street met with a set of 50 key CFTC staffers over ten times. In what is probably less than shocking news, 25 of those 50 staffers now work for Wall Street.

Apparently, we are going to run the deregulated derivatives trading experiment again and hope for different results.

WHAT IS THAT DEFINITION OF INSANITY, AGAIN?

Demeter

(85,373 posts)Many people are wondering how the selloff in equities will affect the Fed.

Goldman Sachs, which expects the first rate hike to come in December, took a look at how a 10 percent decline in equity prices has impacted the Fed in the past. According to Goldman's Alec Phillips, this type of decline typically results in a lower fed funds rate -- by 15 basis points -- at the following meeting.

He adds that the evidence is not straightforward, however, and previous studies have received mixed results due to complications in coinciding responses from "equity prices to policy decisions, policy decisions to market developments, and the reaction of both to other economic factors." The previous studies in the past have taken two approaches.

The first approach Goldman looked at measured the Fed's reaction "by estimating a forward looking Taylor Rule with and without stock returns." This approach generally found that monetary policy doesn't react to changes in the stock market once you control for other variables in the economy.

The second approach goes on the principle that "the effect of stock prices on policy can be seen more clearly when equity volatility is high but short-term interest rate volatility is low." These studies came to a different conclusion, where changes in stock prices actually do have an impact on expected policy rates, especially during times of high volatility.

However, Phillips also notes that many of the studies found there was a stronger reaction from the Fed before Alan Greenspan was the Chair from 1987 to 2006.

Demeter

(85,373 posts)This score is kind of insane.

Tesla Motors Inc.’s all-wheel-drive version of the battery-powered Model S, the P85D, earned a 103 out of a possible 100 in an evaluation by Consumer Reports magazine.

The combination of power and efficiency was so off-the-chart that the group had to recalibrate its ratings methods “to account for the car’s exceptionally strong performance,” according to a statement. Ultimately, the car was given a score of 100 that set a new standard for perfection.

The Tesla sedan is the quickest Consumer Reports ever tested, accelerating to 60 miles (97 kilometers) per hour from a stop in 3.5 seconds using the car’s “insane mode.” (Chief Executive Officer Elon Musk has since released an even-faster “ludicrous mode.”) The P85D is a high-performance, all-wheel-drive version of the all-electric Model S that achieved the equivalent of 87 miles per gallon of gasoline.

“This is a glimpse into what we can expect down the line, where we have cars with the performance of supercars and the comfort, convenience and safety features of a luxury car while still being extremely energy efficient,” Jake Fisher, the magazine’s head of automotive testing, said in an interview. “We haven’t seen all those things before.”

Based on the P85D’s scores, Consumer Reports had to reassess how much to weigh things like acceleration, where the Tesla is as much as twice as quick as other vehicles, Fisher said.

“Once you start getting so ridiculously fast, so ridiculously energy efficient, it didn’t make sense to go linear on those terms anymore,” he said.

Interior Materials

Tesla rose 8.1 percent to $242.99 at the close in New York for the biggest daily gain since October. The shares have climbed 9.3 percent this year. Tesla reported 11,532 Model S sales in the second quarter, and the company, based in Palo Alto, California, delivered 21,577 units in the first half. Because of production risks as it begins volume assembly of the Model X sport utility vehicle, Tesla said it now aims to deliver 50,000 to 55,000 autos this year, down from an original target of 55,000.

Despite the record score, the magazine criticized the $127,820 test vehicle for the quality of its interior materials compared with other luxury models, as well as a ride that is firmer and louder than the base Model S. The starting price for a P85D is $105,000. The Model S topped the magazine’s buyer survey last year for the second year in a row, scoring 98 out of a possible 100, after posting a 99 the previous year. The car was also the top overall pick for the second year in a row by the independent magazine testers.

Demeter

(85,373 posts)Ukraine agreed to a restructuring deal with creditors after five months of talks, giving President Petro Poroshenko some breathing room as he seeks to avert default and revive an economy decimated by a war with Russia-backed separatists.

Finance Minister Natalie Jaresko reached an accord with a Franklin Templeton-led creditor committee that includes a 20 percent writedown to the face value of about $18 billion of Eurobonds, the first of which matures in less than a month. In a joint statement announcing the initial agreement, the Finance Ministry and the creditor group said they are “pleased that a consensus on the best way forward for Ukraine has been found.” Bonds surged the most on record. Ukraine said it is offering the same terms to Russia, which holds a $3 billion bond due in December. Finance Minister Anton Siluanov reiterated that Russia won’t participate in the restructuring.

“It’s been a very difficult five months,” said Jaresko, a Chicago native who was given Ukrainian citizenship when Poroshenko appointed her finance minister last December. “I’m confident that the markets will receive this quite well,” she said in an interview on Wednesday. The agreement pushes back redemption dates by four years and sets interest at 7.75 percent on all maturities, above the current average, according to the joint statement. Securities will be exchanged for a share in a set of new bonds, Jaresko said on a conference call.

Poroshenko is seeking to meet the conditions of emergency assistance from the International Monetary Fund, which says debt restructuring should save Ukraine $15.3 billion through 2018, while trying to end a recession expected to bring a contraction of 8.7 percent this year, forecasts compiled by Bloomberg show.

Financing Challenges

Ukraine still faces severe financing challenges, including working out a compromise with Russia over its bond before the end of the year. Some analysts also warned that the restructuring also could prove inadequate, given Kiev’s remaining economic challenges.

“It’s just kicking the can down the road,” said Vitaly Sivach, a Kiev-based bond trader at Investment Capital Ukraine. “The deal appears to be a short-term solution and won’t solve the problem of unsustainable debt levels.”

Investors welcomed the deal, whose terms were less painful than some had expected. Ukraine $2.6 billion of notes due in July 2017 jumped 14.9 cents to 70.50 cents on the dollar at 5:44 p.m. in Kiev, the highest level in more than eight months.

Christine Lagarde, IMF managing director, said in an e-mailed statement that the deal would “help restore debt sustainability” and “substantially meet the objectives set under the IMF-supported program.” The European Bank for Reconstruction and Development said the agreement is a “very significant milestone.” It will help reduce economic uncertainty and spur investment, Francis Malige, the London-based lender’s managing director for the region, said by phone.

Payment Suspension

Ukraine will temporarily suspend a $500 million principal payment due on Sept. 23 and a 600 million-euro ($678 million) payment due on Oct. 13, Jaresko said. The country has another $4 billion of payments scheduled by year’s end, including to Russia.

A final agreement requires the approval of 75 percent of bondholders of each note at a meeting in which at least two-thirds of them are represented. Ukraine’s debt contains cross-default clauses that mean missing a payment on one results in default on all. The government earlier threatened to declare a debt moratorium to push negotiations along.

Franklin Templeton, which owns about $7 billion of Ukrainian bonds, was joined in the talks by fellow creditors BTG Pactual Europe LLP, TCW Investment Management Co. and T. Rowe Price Associates Inc. Some bondholders, including Yerlan Syzdykov, who helps oversee $254 billion, including Ukrainian Eurobonds, at Pioneer Investments, have already said they will back a deal.

Russian Resistance

Russian President Vladimir Putin’s government bought $3 billion of two-year, 5 percent bonds from Ukraine to support his longtime ally, then-President Viktor Yanukovych, in December 2013. Protests in the capital Kiev turned deadly a month later, eventually forcing Yanukovych to flee to Russia and Putin to end what would have been a $15 billion aid package.

“I’m offering Russia a restructuring opportunity that is the same as everyone else’s,” Jaresko said in the interview. “I’m hopeful that they will participate in this. It’s the best way to depoliticize this.”

Siluanov, the Russian finance minister, said in an interview with Rossiya 1 state television, “We won’t agree to a restructuring.” He added, “we will insist the funds are returned in full in December.”

Ukrainian officials say they expect to get $3.4 billion of International Monetary Fund financing over the next four months, on top of the roughly $6.7 billion received so far under the program.

Cease-Fire Sought

The IMF said earlier this month that the biggest threat to Ukraine’s economic outlook remains the continuing fighting with pro-Russian rebels in the east. Ukraine reported seven soldiers were killed over the last 24 hours, the highest daily toll in more than a month. Ukraine and the Kremlin-backed separatists its army has been battling for more than a year said Wednesday that they’d seek a “total cease-fire” starting Sept. 1. The leaders of Ukraine, Germany and France met this week in Berlin to discuss renewed violence.

Demeter

(85,373 posts)If you thought Ukraine’s five-month debt-restructuring battle with Franklin Templeton was tough, just wait until the country starts negotiating with its second-biggest creditor, Russia.

There’s a $3 billion Eurobond due in December that former President Viktor Yanukovych sold to Russia shortly before his ouster in February 2014 and Vladimir Putin’s annexation of Crimea a month later.

Paying this bond in full is "not an option" and Ukraine wants Russia to accept the same terms as other creditors, Finance Minister Natalie Jaresko said in an interview conducted hours before the country on Thursday revealed its main bondholders agreed to a 20 percent principal writedown.

Her peer in Moscow, Anton Siluanov, swiftly knocked down the offer, saying Russia won’t take part and will demand Ukraine pay back the entire sum. The country deems itself an official rather than a commercial creditor, according to the minister, who added Russia will invest the $3 billion in infrastructure.

Where negotiations go from here is likely to be guided by the International Monetary Fund, which has yet to decide how to categorize the bond, and with which Ukraine is engaged on a $40 billion bailout. The situation is further complicated by strained diplomatic relations with Russia, which Ukraine accuses of supporting a smoldering insurgency in its easternmost regions.

Below are three scenarios Ukraine faces with the bond and the reasons they may or may not work: SEE LINK

Demeter

(85,373 posts)New Defense Department guidelines allow commanders to punish journalists and treat them as "unprivileged belligerents" if they believe journalists are sympathizing or cooperating with the enemy.

The Law of War manual, updated to apply for the first time to all branches of the military, contains a vaguely worded provision that military commanders could interpret broadly, experts in military law and journalism say. Commanders could ask journalists to leave military bases or detain journalists for any number of perceived offenses.

"In general, journalists are civilians," the 1,180 page manual says, but it adds that "journalists may be members of the armed forces, persons authorized to accompany the armed forces, or unprivileged belligerents."

A person deemed to be an "unprivileged belligerent" is not entitled to the rights afforded by the Geneva Convention. A commander could restrict from certain coverage areas or even hold indefinitely without charges any reporter considered an "unprivileged belligerent."

The manual adds, "Reporting on military operations can be very similar to collecting intelligence or even spying. A journalist who acts as a spy may be subject to security measures and punished if captured." It is not specific as to the punishment or under what circumstances a commander can decide to "punish" a journalist.

Defense Department officials said the reference to "unprivileged belligerents" was intended to point out that armed group members or spies could be masquerading as reporters. The designation was also made to warn against someone who works publications like Al-Qaeda's "Inspire" magazine that can be used to encourage or recruit adherents.

Another provision says that "relaying of information" could be construed as "taking a direct part in hostilities." Officials said that is intended to refer to passing information about ongoing operations, locations of troops or other classified data to an enemy.

Army Lt. Col. Joe Sowers, a Pentagon spokesman, said it was not the Defense Department's intent to allow an overzealous commander to block journalists or take action against those who write critical stories.

"The Department of Defense supports and respects the vital work that journalists perform," Sowers said. "Their work in gathering and reporting news is essential to a free society and the rule of law." His statement added that the manual is not policy and not "directive in nature."

But Ken Lee, an ex-Marine and military lawyer who specializes in "law of war" issues and is now in private practice, said it was worrisome that the detention of a journalist could come down to a commander's interpretation of the law.

If a reporter writes an unflattering story, "does this give a commander the impetus to say, now you're an unprivileged belligerent? I would hope not," Lee said.

Defense officials said the manual describes the law for informational purposes and is not an authorization for anyone to take any particular action regarding journalists. The manual also notes that journalists captured by the enemy are supposed to be given the rights of prisoners of war under the Geneva Convention.

Demeter

(85,373 posts)I'M STILL WAITING FOR MY APOLOGY....EVEN A FORM LETTER, OR A SPAM EMAIL....

http://www.theguardian.com/us-news/2015/aug/26/obama-calls-japan-regret-for-wikileaks-spying

Obama told prime minister Shinzo Abe he thought the trouble the revelations that the US had spied on senior Japanese officials caused was regrettable...Barack Obama has called Japan’s leader to express regret over recent WikiLeaks allegations that the US had spied on senior Japanese officials. Obama told prime minister Shinzo Abe that he thought the trouble the revelations caused Abe and his government was regrettable, a Japanese government spokesman told reporters. The 40-minute call took place Wednesday morning Japan time.

Japanese officials faced questioning from the media and in parliament after WikiLeaks posted online what appeared to be five US National Security Agency reports on Japanese positions on international trade and climate change. They date from 2007 to 2009. WikiLeaks also posted what it says was an NSA list of 35 Japanese targets for telephone intercepts.

Abe told Obama that the allegations could undermine trust between the countries, and reiterated his request for an investigation of the matter.

The comments from both sides seemed to echo the exchange between Abe and US vice president Joe Biden in a similar call earlier this month.

The two leaders also discussed the global economic turmoil, North Korea and climate change.

Demeter

(85,373 posts)The crime itself was ordinary: Someone smashed the back window of a parked car one evening and ran off with a cellphone. What was unusual was how the police hunted the thief.

Detectives did it by secretly using one of the government’s most powerful phone surveillance tools — capable of intercepting data from hundreds of people’s cellphones at a time — to track the phone, and with it their suspect, to the doorway of a public housing complex. They used it to search for a car thief, too. And a woman who made a string of harassing phone calls.

In one case after another, USA TODAY found police in Baltimore and other cities used the phone tracker, commonly known as a stingray, to locate the perpetrators of routine street crimes and frequently concealed that fact from the suspects, their lawyers and even judges. In the process, they quietly transformed a form of surveillance billed as a tool to hunt terrorists and kidnappers into a staple of everyday policing.

The suitcase-size tracking systems, which can cost as much as $400,000, allow the police to pinpoint a phone’s location within a few yards by posing as a cell tower. In the process, they can intercept information from the phones of nearly everyone else who happens to be nearby, including innocent bystanders. They do not intercept the content of any communications.

Dozens of police departments from Miami to Los Angeles own similar devices. A USA TODAY Media Network investigation identified more than 35 of them in 2013 and 2014, and the American Civil Liberties Union has found 18 more. When and how the police have used those devices is mostly a mystery, in part because the FBI swore them to secrecy....

MORE

Hotler

(11,424 posts)MattSh

(3,714 posts)but that doesn't mean we won't do it again.

Demeter

(85,373 posts)In The Matrix in which Americans live, nothing is ever their fault. For example, the current decline in the US stock market is not because years of excessive liquidity supplied by the Federal Reserve have created a bubble so overblown that a mere six stocks, some of which have no earnings commiserate with their price, accounted for more than all of the gain in market capitalization in the S&P 500 prior to the current disruption. In our Matrix existence, the stock market decline is not due to corporations using their profits, and even taking out loans, to repurchase their shares, thus creating an artificial demand for their equity shares. The decline is not due to the latest monthly reporting of durable goods orders falling on a year-to-year basis for the sixth consecutive month. The stock market decline is not due to a weak economy in which after a decade of alleged economic recovery, new and existing home sales are still down by 63% and 23% from the peak in July 2005. The stock market decline is not due to the collapse in real median family income and, thereby, consumer demand, resulting from two decades of offshoring middle class jobs and partially replacing them with minimum wage part-time Walmart jobs without benefits that do not provide sufficient income to form a household.

No, none of these facts can be blamed. The decline in the US stock market is the fault of China.

What did China do? China is accused of devaluing by a small amount its currency. Why would a slight adjustment in the yuan’s exchange value to the dollar cause the US and European stock markets to decline? It wouldn’t. But facts don’t matter to the presstitute media. They lie for a living. Moreover, it was not a devaluation...When China began the transition from communism to capitalism, China pegged its currency to the US dollar in order to demonstrate that its currency was as good as the world’s reserve currency. Over time China has allowed its currency to appreciate relative to the dollar. For example, in 2006 one US dollar was worth 8.1 Chinese yuan. Recently, prior to the alleged “devaluation” one US dollar was worth 6.1 or 6.2 yuan. After China’s adjustment to its floating peg, one US dollar is worth 6.4 yuan. Clearly, a change in the value of the yuan from 6.1 or 6.2 to the dollar to 6.4 to the dollar did not collapse the US and European stock markets. Furthermore, the change in the range of the floating peg to the US dollar did not devalue China’s currency with regard to its non-US trading partners. What had happened, and what China corrected, is that as a result of the QE money printing policies currently underway by the Japanese and European central banks, the dollar appreciated against other currencies. As China’s yuan is pegged to the dollar, China’s currency appreciated with regard to its Asian and European trading partners. The appreciation of China’s currency (due to its peg to the US dollar) is not a good thing for Chinese exports during a time of struggling economies. China merely altered its peg to the dollar in order to eliminate the appreciation of its currency against its other trading partners.

Why did not the financial press tell us this? Is the Western financial press so incompetent that they do not know this? Yes. Or is it simply that America itself cannot possibly be responsible for anything that goes wrong. That’s it. Who, us?! We are innocent! It was those damn Chinese!

Look, for example, at the hordes of refugees from America’s invasions and bombings of seven countries who are currently overrunning Europe. The huge inflows of peoples from America’s massive slaughter of populations in seven countries, enabled by the Europeans themselves, is causing political consternation in Europe and the revival of far-right political parties. Today, for example, neo-nazis shouted down German Chancellor Merkel, who tried to make a speech asking for compassion for refugees. But, of course, Merkel herself is responsible for the refugee problem that is destabilizing Europe. Without Germany as Washington’s two-bit punk puppet state, a non-entity devoid of sovereignty, a non-country, a mere vassal, an outpost of the Empire, ruled from Washington, America could not be conducting the illegal wars that are producing the hordes of refugees that are over-taxing Europe’s ability to accept refugees and encouraging neo-nazi parties.

The corrupt European and American press present the refugee problem as if it has nothing whatsoever to do with America’s war crimes against seven countries. I mean, really, why should peoples flee countries when America is bringing them “freedom and democracy?” Nowhere in the Western media other than a few alternative media websites is there an ounce of integrity. The Western media is a Ministry of Truth that operates full-time in support of the artificial existence that Westerners live inside The Matrix where Westerners exist without thought. Considering their inaptitude and inaction, Western peoples might as well not exist. More is going to collapse on the brainwashed Western fools than mere stock values.

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West and How America Was Lost.

Demeter

(85,373 posts)Demeter

(85,373 posts)— John P. Hussman, Ph.D. “Debt-Financed Buybacks Have Quietly Placed Investors On Margin“, Hussman Funds

“This year feels like the last days of Pompeii: everyone is wondering when the volcano will erupt.”

— Senior banker commenting to the Financial Times

Last Friday’s stock market bloodbath was the worst one-day crash since 2008. The Dow Jones dropped 531 points, while the S&P 500 fell 64, and the tech-heavy Nasdaq slid 171. The Dow lost more than 1,000 points on the week dipping back into the red for the year. At the same time, commodities continued to get hammered with oil prices briefly dropping below the critical $40 per barrel mark. More tellingly, the market’s so called “fear gauge” (VIX) skyrocketed to a 2015 high indicating more volatility to come. The VIX has remained at unusually low levels for a number of years as investors have grown more complacent figuring the Fed will intervene whenever stocks fall too far. But last week’s massacre cast doubts on the Central Bank’s intentions. Will the Fed ride to the rescue again or not? To the vast majority of institutional investors, who now base their buying decisions on Fed policy rather than market fundamentals, that is the crucial question.

Ostensibly, last week’s selloff was triggered by China’s unexpected decision to devalue its currency, the yuan. The announcement confirmed that the world’s second biggest economy is rapidly cooling off increasing the likelihood of a global slowdown. Over the last decade, China has accounted “for a third of the expansion in the global economy,… almost double the contribution of the US and more than triple the impacts of Europe and Japan.” Fears of a slowdown were greatly intensified on Friday when a survey showed that manufacturing in China shrank at the fastest pace since the recession in 2009. That’s all it took to put the global markets into a nosedive. According to the World Socialist Web Site:

(“Panic sell-off on world financial markets”, World Socialist Web Site)

While a correction was not entirely unexpected following a 6-year long bull market, the sudden drop in equities does have analysts rethinking the effectiveness of the Fed’s monetary policies which have had little impact on personal consumption, retail spending, wages, productivity, household income, or economic growth all of which remain weaker than they have been following any recession in the post war era. For all intents and purposes, the plan to inflate asset prices by dropping rates to zero and injecting trillions in liquidity into the financial system has been an abject failure. GDP continues to hover at an abysmal 1.5% while signs of a strong, self sustaining recovery are nowhere to be seen. At the same time, government and corporate debt continue to balloon at a near-record pace draining capital away from productive investments that could lay the groundwork for higher employment and stronger growth.

What’s so odd about last week’s market action is that the bad news on China put shares into a tailspin instead of sending them into the stratosphere which has been the pattern for the last four years. In fact, the reason volatility has stayed so low and investors have grown so complacent is because every announcement of bad economic data has been followed by cheery promises from the Fed to keep the easy-money sluicegates open until the storm passes. That hasn’t been the case this time, in fact, Fed chair Janet Yellen hasn’t even scrapped the idea of jacking up rates some time in September which is almost unthinkable given last week’s market ructions. Why? What’s changed? Surely, Yellen isn’t going to sit back and let six years of stock market gains be wiped out in a few sessions, is she? Or is there something we’re missing here that is beyond the Fed’s powers to change? Is that it?

My own feeling is that China is not the real issue. Yes, it is the catalyst for the selloff, but the real problem is in the credit markets where the spreads on high yield bonds continue to widen relative to US Treasuries. What does that mean? It means the price of capital is going up, and when the price of capital goes up, it costs more for businesses to borrow. And when it costs more for businesses to borrow, they reduce their borrowing, which decreases the demand for credit. And when the demand for credit decreases in a credit-based system, then there’s a corresponding slowdown in business investment which impacts stock prices and growth. And that is particularly significant now, since the bulk of corporate investment is being diverted into stock buybacks. Check out this excerpt from a post at Wall Street on Parade:

Now, with commodity prices resuming their plunge and currency wars spreading, concerns of financial contagion are back in the markets and spreads on corporate bonds versus safer, more liquid instruments like U.S. Treasury notes, are widening in a fashion similar to the warning signs heading into the 2008 crash. The $2.2 trillion junk bond market (high-yield) as well as the investment grade market have seen spreads widen as outflows from Exchange Traded Funds (ETFs) and bond funds pick up steam.” (“Keep Your Eye on Junk Bonds: They’re Starting to Behave Like ‘08 “, Wall Street on Parade)

As you can see, the nation’s corporations don’t borrow at zero rates from the Fed. They borrow at market rates in the bond market, and those rates are gradually inching up. And while that hasn’t slowed the stock buyback craze so far, the clock is quickly running out. We are fast approaching the point where debt servicing, shrinking revenues, too much leverage, and higher rates will no longer make stock repurchases a sensible option, at which point stocks are going to fall off a cliff. Here’s more from Andrew Ross Sorkin at the New York Times:

You can see the game that’s being played here. Mom and Pop investors are getting fleeced again. They’ve been lending trillions of dollars to corporate CEOs (via bond purchases) who’ve taken the money, split it up among themselves and their wealthy shareholder buddies, (through buybacks and dividends neither of which add a thing to a company’s productive capacity) and made out like bandits. This, in essence, is how stock buybacks work. Ordinary working people stick their life savings into bonds (because they were told “Stocks are risky, but bonds are safe”.) that offer a slightly better return than ultra-safe, low-yield government debt (US Treasuries) and, in doing so, provide lavish rewards for scheming executives who use it to shower themselves and their cutthroat shareholders with windfall profits that will never be repaid. When analysts talk about “liquidity issues” in the bond market, what they really mean is that they’ve already divvied up the money between themselves and you’ll be lucky if you ever see a dime of it back. Sound familiar?

Of course, it does. The same thing happened before the Crash of ’08. Now we are reaching the end of the credit cycle which could produce the same result. According to one analyst:

(“Credit: Magical Thinking“, Macronomics)

In other words, the good times are behind us while hard times are just ahead. And while the end of the credit cycle doesn’t always signal a stock market crash, the massive buildup of leverage in unproductive financial assets like buybacks suggest that equities are in line for a serious whooping. Here’s more from Bloomberg:

“Credit is the warning signal that everyone’s been looking for,” said Jim Bianco, founder of Bianco Research LLC in Chicago. “That is something that’s been a very good leading indicator for the past 15 years.”

Bond buyers are less interested in piling into notes that yield a historically low 3.4 percent at a time when companies are increasingly using the proceeds for acquisitions, share buybacks and dividend payments. Also, the Federal Reserve is moving to raise interest rates for the first time since 2006, possibly as soon as next month, ending an era of unprecedented easy-money policies that have suppressed borrowing costs….

So if you’re very excited about buying stocks right now, just beware of the credit traders out there who are sending some pretty big warning signs.” (“U.S. Credit Traders Send Warning Signal to Rest of World Markets”, Bloomberg)

It’s worth noting that the above article was written on August 14, a week before the stock market blew up. But credit was “flashing red” long before stock traders ever took notice.

But that’s beside the point. Whether the troubles started with China or the credit markets, probably doesn’t matter. What matters is that the system about to be put-to-the-test once again because the appropriate safeguards haven’t been put in place, because bubbles are unwinding, and because the policymakers who were supposed to monitor and regulate the system decided that they were more interested in shifting wealth to their voracious colleagues on Wall Street than building a strong foundation for a healthy economy. That’s why a simple correction could turn into something much worse.

NOTE: As of posting time, Sunday night, the Nikkei Index is down 710, Shanghai down 296, HSI down 1,031. US equity futures are all deep in the red

Demeter

(85,373 posts)ANOTHER ONE OF THE BRICS GETS CHISELED OUT OF THE WALL...

http://news.yahoo.com/south-africas-rand-tumbles-time-low-152332140.html

South Africa's rand plunged to an all-time low on Monday, breaching 14 to the dollar on the back of a global drop in commodity prices. The currency of the continent's most developed economy tumbled to 14.0682 against the greenback before midday, an 8.5 percent drop, before it pulled back to 13.33 by mid-afternoon. The currency has been under sustained pressure lately and is one of the worst hit out of 25 emerging market peers as jittery investors dispose of high-risk assets in the wake of slowing economic growth in China.

South Africa's central bank issued a statement saying it would consider intervening in the foreign exchange market "to ensure orderly market conditions".

"Developments in South African markets in recent days are largely a response to external factors," it added.

"This is an emerging market risk event," said Nedbank economist Isaac Matshego.

"Currencies of other emerging markets are under pressure too, but the volatility that we saw this morning was a bit overdone."

The rand is likely to remain under pressure as long as global factors are unfavourable, economists warn.

"What's happening at the moment is basically due to world factors, very little to do with the domestic economy although domestic fundamentals are not supportive either," said Matshego.

The currency movement is likely to push inflation up beyond the South Africa's six percent target ceiling, as the country struggles with low growth and high unemployment.

Demeter

(85,373 posts)SO TURKEY BOMBS AND GASES THE KURDS...

http://www.middleeasteye.net/news/majority-israeli-oil-imports-may-kurdistan-reports-1773332757

Iraq's federal government is likely to be upset about the high volume of Kurdish crude oil sales to Israel...More than two-thirds of Israel's oil in the past five months has been imported from the Kurdistan Regional Government, according to a Financial Times report.

From early May through August, 77 percent of Israeli oil - or 19mn barrels worth an estimated $1bn - came from the semi-autonomous region, according to the report. The reported figures have emerged a little more than a year after the first tanker of Iraqi Kurdish crude was delivered to Israel.

The Kurdistan Regional Government has repeatedly denied that it deals directly or indirectly with Israel, with KRG officials pointing out that oil cargoes often change hand several times before reaching its final destination.

Analysts have also told MEE that tankers stopping in Israel often turn off their satelite transponders as they near the country's ports, making it hard to track when and where cargoes move....MORE

Demeter

(85,373 posts)MAP

...Not only does the US defense budget equal about half the world's total military spending, but a huge chunk of the rest of the total is spent by close American allies. Russia's military spending, for example, is dwarfed by the combined commitments of the UK, France, and Germany. North Korea's military spending looks like a tiny pimple sitting on the top of South Korea's head....

tclambert

(11,086 posts)Seems like we could organize that a little better and manage to project power around the globe with only, say, 200.

And we still have 50,000 troops in Japan because . . . um, Remember Pearl Harbor!

DemReadingDU

(16,000 posts)8/27/15 Lies You Will Hear As The Economic Collapse Progresses by Brandon Smith

.

.

The establishment has made every effort to hide the fundamentals from the public through far reaching misrepresentations of economic stats. However, the days of effective disinformation in terms of the financial system are coming to an end. As investors and the general public begin to absorb the reality that the global economy is indeed witnessing a vast crisis scenario and acknowledges real numbers over fraudulent numbers, the only recourse of central bankers and the governments they control is to convince the public that the crisis they are witnessing is not really a crisis. That is to say, the establishment will attempt to marginalize the collapse signals they can no longer hide as if such signals are of “minimal” importance.

Just as occurred during the onset of the Great Depression, the lies will be legion the closer we come to zero hour. Here are some of the lies you will likely hear as the collapse accelerates...

The Crisis Was Caused By Chinese Contagion

China's Rate Cuts Will Stop The Crash

It's Not A Crash, It's Just The End Of A “Market Cycle”

The Fed Will Never Raise Rates

Get Ready For QE4

It's Not As Bad As It Seems

much more at the link...

http://www.alt-market.com/articles/2678-lies-you-will-hear-as-the-economic-collapse-progresses

Demeter

(85,373 posts)They have to invent new ones, fast! The public has a short attention span, and intolerance for repetition that isn't supported by events.

That's a powerful article, with the call to repentance and reality.

Nothing prescriptive, though.

Fuddnik

(8,846 posts)I saw this on the news last night, and found this article with a link to the settlement page. You can file online in about 30 seconds, and have your choice of $25 in cash or $50 in free tuna. I took the tuna.

Sorry Charlie.

-----------------------------------------------------------------------

CLEVELAND, Ohio -- If you bought a can of StarKist tuna in recent years, you may have netted less fish than promised.

Thanks to a recent legal settlement, you can convert that tiny loss into a small fortune in tuna. Though StarKist Co. denies any wrongdoing, it settled the suit by offering to pay consumers either $25 in cash or $50 in fish.

The settlement applies to customers who bought even one 5-ounce can of chunk light or solid white tuna, in oil or in water, between Feb. 19, 2009 and Oct. 31, 2014. Recognizing that most people would not keep tuna receipts for more than five years, the settlement allows for a kind of honor-system filing, via the Web site tunalawsuit.com.

Filing a false claim would be perjury. All claims must be filed by Nov. 20. According to the lawsuit, the federal government sets standards for how much of various kinds of tuna must be contained in a "5-ounce" can.

The plaintiff in the lawsuit, Patrick Hendricks, of Oakland, California, had samples tested to see whether they met that standard.

For Chunk Light Tuna in Water, the standard is 2.84 ounces of pressed cake tuna. StarKist provided an average of only 2.34 ounces, the suit says. That's a difference of only half an ounce, but it's 17.3 percent below the legal standard.

For solid white tuna in water, there was a 6.83 percent shortfall; for solid white tuna in oil there was a 3.7 percent shortfall; and for chunk light tuna in vegetable oil the shortfall was 1.1 percent, the suit alleged.

http://www.cleveland.com/business/index.ssf/2015/08/starkist_settles_canned_tuna_l.html#incart_most-read_

Demeter

(85,373 posts)I have to keep my mercury levels up, or horrible things happen.

Seriously, this is a windfall!

Fuddnik

(8,846 posts)When my mercury levels get too low, I start acting like Marsha in the Snickers commercials.

Just put a can on a bed of spinach.

I'll repost it on the WEE for those who didn't see it.

oystrich

(4 posts)Regular hours for the New York Stock Exchange (NYSE) are Monday through Friday, 9:30 a.m. to 4:00 p.m. EST. However, the stock market observes U.S. holidays, so below you will find the NYSE holidays for 2015 and 2016.

Stock Market Holidays