Economy

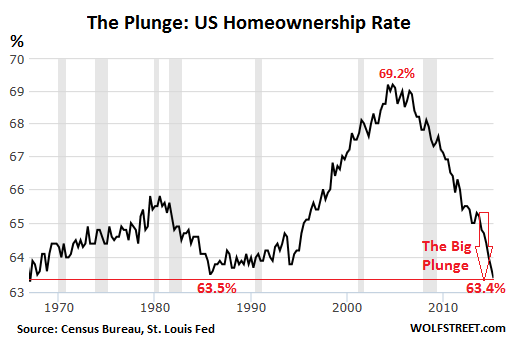

Related: About this forumThe rise and fall of the American homeowner: Current homeownership rate is back to where it was--

--50 years ago.

http://www.doctorhousingbubble.com/rise-and-fall-homeownership-rate-housing-real-estate-ownership-over-time/

Historically low interest rates and artificially low inventory has helped to boost home prices but the homeownership rate is in perpetual decline it would seem. There is a tendency to forget that the rise in home values was largely driven by uncharacteristic investor demand for many years. This multi-year buying has resulted in many homes being taken off the market only to be turned into rental units. The numbers are staggering but they are worth repeating: we have added 10 million renter households over the last decade while being neutral on actual homeowner households. The math is derived from the grim reality that since the crisis unfolded we have witnessed 7 million Americans undergo the process of foreclosure. This flies in the face of the constant drum beating that somehow buying a house is a sure bet. With most things financial, you have this survivorship bias where those that got smoked out of the market are silent while those that got lucky or timed the market correctly constantly voice their perspective. Yet things are good until they are not.

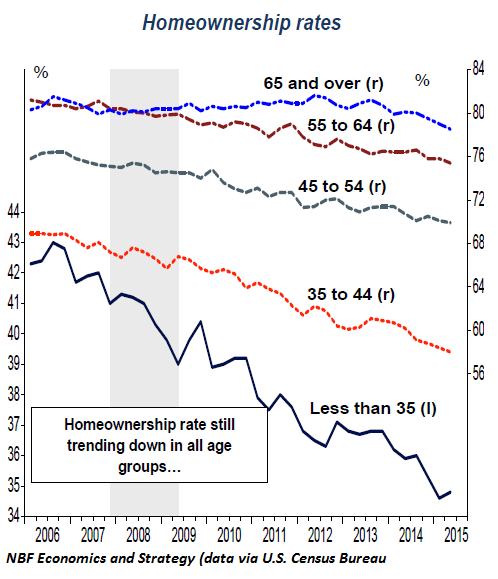

The current homeownership rate is back to where it was in 1965. We have erased a half-century of gains in this category. The growth in homeownership usually is pushed by young households in family forming ages. But things have changed with Millennials being saddled with massive student loan debt and many earning much less than their parents at similar ages adjusting for inflation. This is why we have many young adults living at home.

Hoyt

(54,770 posts)Renting has some advantages as well.

Midnight Writer

(21,780 posts)Tough to make a 15 or 30 year mortgage commitment when you don't know what your employment status will be a year from now.

And if your wage will not keep up with inflation.

I spoke yesterday with a co-worker whose 58 year old husband just lost his job because of downsizing. They will likely lose their home since he is having a problem finding a job that pays more than a fraction of what he was earning in the job he had invested over 20 years of service to.

Hoyt

(54,770 posts)InkAddict

(3,387 posts)We have been renters at the same complex since 2005 while we wait out our bankruptcy penalty years and slide into our senior years. Here is thenext wrinkle. The new owners of our apartment complex think we need an updated townhouse; so we can completely move out for two weeks and sign a new higher leaseupon move in or find another apartment when our current lease is up. Then the new tenants will get the benefit of the updated unit for which the rent will be greater than our current $1300 for 2bd 2bath -1300 sq ft. Our never married millennial daughter with crazy scoop loan debt currently lives with us but wishes she didn't. We've been thinking to use DH's veteran home loan benefit to buy another small home to avoid increases in rent as we further age. Good or bad idea? Our credit is only fair to good after all the crap we've been through. Rent on our townhouse has gone up from 950 to 1300 over those years. DH is 66+ and currently working an IT gig at one of the Wall Street devils dens. Really confusing as to where we should go from here???

PatrickforO

(14,586 posts)it looks like the Millenial generation can say goodbye to the American Dream. Or at least the home ownership part of it.

C Moon

(12,219 posts)Just deal with my credit being destroyed.

eridani

(51,907 posts)Not sure if this is an option for you, but it's worth considering.

C Moon

(12,219 posts)I'm sure ulcers would ensue at some point during that year.

One unit (we're in a townhouse) has a half-a-dozen signs posted on the windows, warning the previous owners of re-entering the home. I'm sure they did the same thing, and walked away.

It's still happening. And now with the threat of interest rates going up, and with the dumb people like me who signed up for bad loans....there are going to be more.

JDPriestly

(57,936 posts)In certain circumstances in California, a homebuyer can walk away from a house that is underwater without ruining his/her credit.

Don't count on this. Even though it is possible, it depends on the facts.

People need to call lawyers. Note the plural of lawyer. Call around and see if someone who is well qualified, an expert, wants to talk to you about your mortgage.

Owning land, a home, is the American dream.

The early settlers came here because they could own land that they could not own in Europe or where they came from.

Land ownership is the reason for America in a way.

So losing the American dream of owning property, of owning land, is a really serious problem.

Our country is to some extent based on the concept of protecting the ownership of private property. What happens when property ownership, ownership of land or a home is possible for only the most secure and prosperous Americans?

I think we have a crisis in our country when that happens because the vast majority of people who cannot obtain or won property themselves will have no personal interest in safeguarding the rights of property owners to their property.

Tzarist Russia comes to mind. Medieval Europe, especially England, comes to mind.