Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 9 October 2015

[font size=3]STOCK MARKET WATCH, Friday, 9 October 2015[font color=black][/font]

SMW for 8 October 2015

AT THE CLOSING BELL ON 8 October 2015

[center][font color=green]

Dow Jones 17,050.75 +138.46 (0.82%)

S&P 500 2,013.43 +17.60 (0.88%)

Nasdaq 4,810.79 +19.64 (0.41%)

[font color=red]10 Year 2.10% +0.06 (2.94%)

30 Year 2.94% +0.07 (2.44%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]http://editorialcartoonists.com/cartoons/Rose,J/2015/Rose,J20151008_low.jpg

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)I am beyond all usual emotions.

Warpy

(111,299 posts)That's the reason everything is up and rosy right now. The next time the Fed burps, it will all go south again.

Demeter

(85,373 posts)The International Monetary Fund cut its global growth forecasts for a second time this year on Tuesday, citing weak commodity prices and a slowdown in China and warned that policies aimed at increasing demand were needed. The Fund, whose annual meeting starts in Peru this week, forecast that the world economy would grow at 3.1 percent this year and by 3.6 percent in 2016. Both new forecasts are 0.2 percentage point below its July forecast and are 0.4 percentage point and 0.2 percentage point below its April outlook, respectively.

The downgrades come after central banks in major industrial economies have cut rates to near zero and spent around $7 trillion in quantitative easing programs in the seven years since the global financial crisis. Despite these measures, investment, growth and productivity are stuck below pre-crisis levels and there is a lack of consumer demand.

Among major economies, the United States is expected to grow by 2.6 percent in 2015 and by 2.8 percent in 2016, the Eurozone is forecast to grow by 1.5 percent and 1.6 percent, respectively, with Japan seen at 0.6 percent and 1.0 percent. The Fund sees growth in China slowing to 6.8 percent this year and 6.3 percent in 2016. The biggest hit to growth will come in emerging economies where the IMF cut its growth forecast to 4 percent in 2015, due to a sharp slide in commodity prices.

"The distribution of risks to global growth remains tilted to the downside," the Fund said in its World Economic Outlook publication. It said that "downside risks to growth for emerging market and developing economies have increased, given the risks to China's growth transition, more protracted commodity market rebalancing, increased foreign exposure of corporate balance sheets and capital flow reversals associated with disruptive asset price shifts."

MONETARY POLICY CAN'T DO IT ALONE

The Fund expects the Federal Reserve to start raising rates this year, although it expects the central bank to stay its hand until it sees signs of inflation rising towards its two percent target. The Fed was criticized for failing to communicate effectively at its September rate meeting when comments prior to the event indicated that liftoff from zero rates was possible. Markets are now pricing in a first move in March 2016. Greater transparency by the Fed would ease possible disruptions to other economies, particularly emerging markets, which are more vulnerable to changes in U.S. policy. The Fund has also warned the Fed not to hike prematurely.

"Regardless of the timing of the initial policy move, the data would suggest that the subsequent rate increases should be gradual," the IMF said.

MORE

Demeter

(85,373 posts)The 500 largest American companies hold more than $2.1 trillion in accumulated profits offshore to avoid U.S. taxes and would collectively owe an estimated $620 billion in U.S. taxes if they repatriated the funds, according to a study released on Tuesday.

The study, by two left-leaning non-profit groups, found that nearly three-quarters of the firms on the Fortune 500 list of biggest American companies by gross revenue operate tax haven subsidiaries in countries like Bermuda, Ireland, Luxembourg and the Netherlands.

Citizens for Tax Justice and the U.S. Public Interest Research Group Education Fund used the companies' own financial filings with the Securities and Exchange Commission to reach their conclusions.

- Technology firm Apple was holding $181.1 billion offshore, more than any other U.S. company, and would owe an estimated $59.2 billion in U.S. taxes if it tried to bring the money back to the United States from its three overseas tax havens, the study said.

- The conglomerate General Electric has booked $119 billion offshore in 18 tax havens, software firm Microsoft is holding $108.3 billion in five tax haven subsidiaries and drug company Pfizer is holding $74 billion in 151 subsidiaries, the study said.

- "At least 358 companies, nearly 72 percent of the Fortune 500, operate subsidiaries in tax haven jurisdictions as of the end of 2014," the study said. "All told these 358 companies maintain at least 7,622 tax haven subsidiaries."

- Fortune 500 companies hold more than $2.1 trillion in accumulated profits offshore to avoid taxes, with just 30 of the firms accounting for $1.4 trillion of that amount, or 65 percent, the study found.

- Fifty-seven of the companies disclosed that they would expect to pay a combined $184.4 billion in additional U.S. taxes if their profits were not held offshore. Their filings indicated they were paying about 6 percent in taxes overseas, compared to a 35 percent U.S. corporate tax rate, it said.

"Congress can and should take strong action to prevent corporations from using offshore tax havens, which in turn would restore basic fairness to the tax system, reduce the deficit and improve the functioning of markets," the study concluded.

DemReadingDU

(16,000 posts)there are more taxes assessed here, another fee there, increases in healthcare, there is not much left.

The corporations need to pay their fair share in this country.

Ghost Dog

(16,881 posts)Thomson-Reuters report.

So, nothing British mentioned...

Demeter

(85,373 posts)Sellers of credit-default swaps on Ukraine may have to pay 19.375 cents on the dollar to settle insurance contracts covering bonds in the country’s $18 billion debt restructuring, according to auction results.

Traders set a final price of 80.625 percent of face value for the 14 sovereign and state-backed notes in Ukraine’s debt overhaul, according to administrators Markit Group Ltd. and Creditex Group Inc. The final price is 1 percentage point higher than the initial price set at the first round of bidding earlier in the day and compares with bond prices as low as 38 cents on the dollar in March, before Ukraine started negotiations with its creditors.

The auction clears the way for investors holding Ukraine’s CDS and dealers selling the contracts to settle obligations by Thursday, allowing bondholders to decide if they want to participate in the restructuring by a mid-Oct. vote deadline. Ukraine triggered insurance contracts by failing to redeem a bond maturing Sept. 23 by the end of a 10-day grace period, the International Swaps & Derivatives Association said Monday.

"It’s good that they managed to get the auction out of the way before the bond exchange," said Dmitri Petrov, a London-based analyst at Nomura Holdings Inc. "The final auction price is in the upper bound, which is fair, given where the bonds have been trading."

SOME NON-EUROZONE NATIONS ARE MORE EQUAL THAN EUROZONE ONES...

Demeter

(85,373 posts)Not long ago, if the U.S. Department of Justice wanted information you’d stored electronically, all its agents needed to do was get a court order and seize your computer. Law enforcement doesn’t have it so easy anymore. In the cloud era, if the FBI or investigators from any other government want to get at your e-mail, Skype calls, or transaction records, the requests—or demands—have to go through corporate legal departments, wherever they may be. Archiving companies’ and individuals’ data is big business for the likes of Microsoft, Google, Apple, and Amazon.com, which have invested billions to create immense clouds of servers to keep your information organized, secure, and confidential.

Overseas judgments could chill business. On Oct. 6, for example, the European Court of Justice (ECJ) invalidated a data-transfer agreement between the European Union and the U.S. Many big tech companies had taken extra steps to comply with the eventuality, but thousands of businesses were still left confused about the legality of moving information electronically from one continent to the other.

The complexity of that case, however, pales against the potential of other legal disputes. Microsoft and its fellow tech superpowers have installed their storage capacity around the world, further complicating the question of national jurisdiction. The record of a Skype call between a user in the U.S. and another in Germany, stored on a server in South Africa, might be the object of a request from the government of Singapore. Whose laws prevail? “These are the most far-fetched law school hypotheticals you could ever come up with,” says Nuala O’Connor, head of the Center for Democracy and Technology in Washington. “Except they are coming true.” Existing statutes don’t help. The U.S. law that usually applies to such situations was enacted in 1986, three years before the invention of the World Wide Web.

Since December 2013, Microsoft has been engaged in a pivotal battle with the U.S. government over e-mail stored on one of its company servers in Ireland. The government’s attorneys say the U.S. simply wants evidence linked to a narcotics case. Microsoft says if it loses the case, the consequences will resound well beyond the fate of an alleged drug dealer. “At the core of this case is the protection of personal communications and the reach of U.S. law,” says Craig Newman, head of privacy and data security at Patterson Belknap Webb & Tyler. He and others warn that a decision against Microsoft could affect civil liberties as well as the profits of the U.S. cloud-computing industry, forecast to reach $98.6 billion in revenue this year, according to market-research firm Gartner. “The implications of what we do here are obviously broad,” said U.S. Circuit Judge Gerard Lynch, one of the three justices presiding over the latest appeal, which opened in New York in early September.

The legal showdown is the first of its kind about corporate privacy since Edward Snowden’s 2013 revelations about U.S. government spying. It hasn’t gone well for Microsoft: The company already lost two lower-court decisions when judges agreed with the government that the feds had the rights to data stored by a U.S. corporation. If the losing streak continues, cloud-computing companies such as Microsoft will have a harder time selling their services to foreign customers—particularly governments—because they won’t be able to promise to keep data from the prying eyes of U.S. intelligence. According to a June report by the Information Technology and Innovation Foundation, the U.S. technology industry will lose more than $35 billion in sales by next year from customers who no longer trust it to keep their data private and safe...

THIS IS HUGE! WE COULD SAVE THE 4TH AMENDMENT, BECAUSE PROFITS! READ THE WHOLE THING!

Demeter

(85,373 posts)Nasdaq Chief Executive Officer Bob Greifeld says governance of dark pools is still too murky.

The trading pools, which keep demand private and only publicly disclose executed trades, still don’t have enough transparency in their rules, Greifeld said in a talk with TIAA-CREF CEO Roger Ferguson on risks and weakness in U.S. market structure at the Bloomberg Markets Most Influential Summit in New York.

“The customers don’t know who’s in the dark pool," said Greifeld. “They don’t know what the rules of engagement are."

Dark pools make up almost one-fifth of trading in the $23 trillion U.S. equities market. The primary advantage of these private trading venues, Greifeld said, is to enable investors to make large orders without markets moving against them.

“The controversy with dark pools right now is not so much the trading per se, but the fact the governance is dark," said Greifeld, who oversees the largest U.S. stock exchange...

AND THAT'S ALL THEY ARE WORRIED ABOUT? THE MIND BOGGLES

Demeter

(85,373 posts)Bill Gross sued Pacific Investment Management Co. and parent Allianz SE for “hundreds of millions of dollars,” claiming he was wrongfully pushed out as the bond giant’s chief investment officer by a “cabal” of executives seeking a bigger slice of the bonus pool.

“Driven by a lust for power, greed, and a desire to improve their own financial position and reputation at the expense of investors and decency, a cabal of Pimco managing directors plotted to drive founder Bill Gross out of Pimco in order to take, without compensation, Gross’s percentage ownership in the profitability of Pimco,” according to a complaint filed Thursday in California state court. The complaint alleges that Pimco executives’ “improper, dishonest, and unethical behavior must now be exposed.”

“This lawsuit has no merit and our legal team will be responding in court in due course,” Michael Reid, a spokesman for Pimco, wrote in an e-mail. “Our focus remains on our clients and their investment portfolios.” Petra Brandes, a spokeswoman for Allianz, declined to comment.

The complaint presents a detailed account of the events leading up to Gross’s departure on Sept. 26 last year, a move that rattled bond markets and prompted record redemptions at what once was the world’s largest mutual fund. It portrays Gross as an advocate for lower fees and traditional, lower-risk bond investments who was pushed out gradually by other executives seeking to expand into riskier assets and higher-fee products...

MORE POPCORN, AND BEER, PLEASE!

Demeter

(85,373 posts)I WOULDN'T USE THAT PARTICULAR ADJECTIVE, MYSELF

http://www.bloomberg.com/news/articles/2015-10-08/college-students-are-graduating-into-an-incredible-job-market

College students can look forward to another massive year in hiring, a new report shows.

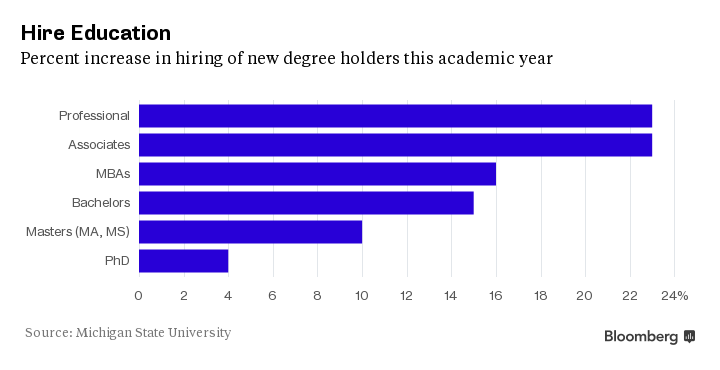

Employers said they expected to hire 15 percent more college graduates in the 2015-2016 academic year, according to a survey published on Thursday by Michigan State University.

“Most signs point to another explosive year of growth in the job market for college graduates,” said Phil Gardner, the Michigan State professor who wrote the report. The report also projected a 23 percent bump in the hiring of associate’s degree grads and a 16 percent increase for new MBAs. The 4,700 recruiters and hiring managers surveyed said they planned to take on 115,000 new graduates.

The frenetic pace of hiring is a product of the strongest corporate growth since the recession, the report said. Sixty-eight percent of employers said growth was driving their plans for talent acquisition, the highest level since 2008. Michigan State has administered this survey for 45 years.

Companies were also much more likely than in the past to say they were affected by employees leaving their posts. Fifty-six percent said they sought to bring on new people because of turnover, compared to just 38 percent in 2013...

Demeter

(85,373 posts)"A win could be dangerous for the government" REALLY? HOW SO?

http://www.bloomberg.com/news/articles/2015-10-08/this-court-case-could-unshackle-americans-from-student-debt

When Robert Murphy said he wanted to try to get his student loan debt erased, the person overseeing his bankruptcy case told him he had a better shot of getting hit by a bus. Now he’s closer than ever to victory.

The unemployed 65-year-old, acting as his own attorney, spent three years appealing his way to the Boston federal court that is now considering his case. A win for Murphy would relieve him of hundreds of thousands of dollars in student debt—and could fundamentally change the way U.S. bankruptcy courts handle borrowers who can't repay college loans.

At the center of Murphy’s battle are federal rules that make it nearly impossible for borrowers to get rid of student loans. Most consumer debt goes away in bankruptcy, which was designed to give Americans and companies a fresh start. But in the 1970s, Congress added new rules to the law that excluded most student debt from that relief. Anyone aiming to discharge student debt in bankruptcy must prove that repaying it would constitute an “undue hardship." Lawmakers never defined an undue hardship, though, so it has been left to the courts to decide just how destitute someone needs to be in order to qualify for relief.

“The opportunity here is significant,” said John Rao, a lawyer with the National Consumer Law Center who submitted an outside brief (PDF) supporting Murphy in the case. A judgment in favor of debtors, he said, “could have a really significant impact on other courts, which have not looked at this issue in a long time.”

Murphy’s appeal seems to have pushed the First Circuit Court of Appeals to reconsider its definition of hardship. Judges have been tinkering with the criteria used to determine whether a borrower deserves relief in recent years, but their efforts have not broadly affected the law. Murphy’s case could mark the first time a federal court weighs in on changing the standards in a decade.

A more lenient standard would make it easier for desperate borrowers to earn a reprieve on student debt, said Rafael Pardo, a law professor at Emory University who filed a brief in Murphy's case.

“Creditors have been able to stack the deck in their favor as they have litigated what undue hardship means,” said Pardo. Regardless of the outcome, Pardo said, the case may well be appealed to the Supreme Court, which has never looked at the issue.

While the case is crucial for students, they aren’t the only ones with a stake in its outcome. Through a loan servicer called ECMC, the Department of Education has spent several years battling student borrowers who want bankruptcy relief. ECMC, which has an exclusive agreement with the government, has aggressively advocated that judges use the harsh standards to decide when it's appropriate to forgive student debt. Lawyers for ECMC declined to comment.

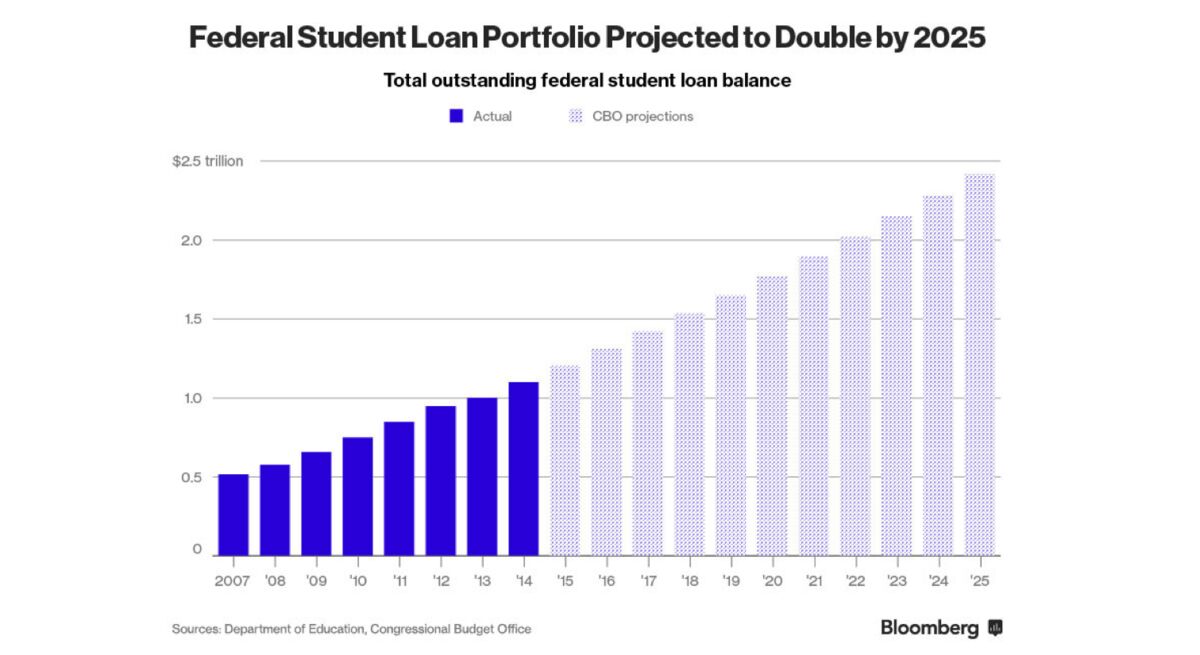

The federal student loan bill stands at $1.2 trillion, making it the largest source of consumer debt outside mortgages, and that figure is expected to double in the next 10 years. Some 7.5 million student debtors are severely behind in paying the government back.

“It could be a really dangerous thing for them if the First Circuit announces a rule for debtors to discharge their loans in bankruptcy,” said Pardo, referring to the Department of Education. “That would call into question how much of this $1.2 trillion in student debt is collectable.”

WORDS FAIL ME--MORE AT LINK

Demeter

(85,373 posts)“The idea of bankruptcy is to give people respite and relief,” said Pardo, the law professor. “The question is a really simple one: can you pay back your debts in the future? And if the answer is no, then why aren’t you giving relief to a person?"

Demeter

(85,373 posts)Oil surged above $50 a barrel in New York for the first time since July on speculation that demand is picking up...

AND US PUMPS ARE SHUTTING DOWN....

Demeter

(85,373 posts)Customers’ digital data is lifeblood for companies like Google Inc. and Facebook Inc., and the European Union’s highest court just made it more difficult for them to make money off the information.

The EU Court of Justice struck down a 15-year-old pact that allowed companies to transfer data -- such as social-network profiles -- from Europe to the U.S., where Silicon Valley analysts use it to improve products or target ads or develop marketing campaigns. With the so-called safe harbor agreement annulled, “you have to move back in time,” said Mark Thompson, head of the privacy practice at KPMG in the U.K.

While tech companies described alternative mechanisms for smooth data-transferring, Digital Europe, a trade group whose members include Microsoft Corp. and Apple Inc., said safe harbor’s demise “will cause immediate harm to Europe’s data economy and will negatively impact countless consumers, employees and employers.” The group called on the European Commission and the U.S. to negotiate new rules governing the trans-Atlantic flow of Internet users’ private information as soon as possible.

But Facebook said in a statement that it, “like many thousands of European companies, relies on a number of the methods prescribed by EU law to legally transfer data to the U.S. from Europe, aside from safe harbor.” Amazon.com Inc. and Microsoft said they also have EU-approved systems in place so that data-transfers would be uninterrupted. “Customers can continue to run their global operations,” Amazon said.

The EC allows data exporters in Europe to ship information to importers in the U.S., with a company able to send a user’s information to a data center in Ireland, for instance, and then from there to the U.S. as long as the user is properly informed this is happening, said Tanguy Van Overstraeten, a partner for Linklaters who leads the law firm’s data protection practice in Brussels...

NOBODY SHOULD MAKE MONEY OF YOUR PERSONAL DATA. THAT'S NOT WEALTH-CREATION. THAT'S NOT PROVIDING SERVICE TO THE OWNER OF THE DATA. IT'S A COMBINATION OF INFLUENCE-PEDDLING, THEFT, FRAUD, AND EVERY OTHER WHITE-COLLAR CRIME COMBINED IN ONE FOUL ACT.

Demeter

(85,373 posts)LET US ALL DROP A SYMPATHETIC TEAR ON POOR GERMANY, A NATION THAT WOULDN'T HURT A FLY, LET ALONE ENTIRE NATIONS...

http://www.bloomberg.com/news/articles/2015-10-08/german-exports-slump-most-since-2009-recession-in-sign-of-risks

The euro area’s pillar of economic strength is starting to show cracks.

Germany’s manufacturing industry is taking a hit from cooling demand in emerging markets. Two of its icons -- Deutsche Bank AG and Volkswagen AG -- are in turmoil. And refugees are flooding across its borders at a rate of 10,000 a week.

The strains are putting the resilience of Europe’s economic powerhouse to the test after exports in August fell the most since the height of the 2009 recession, and factory orders and industrial output unexpectedly declined. The flood of bad news is all the more troubling as the 19-nation euro area strives to sustain an economic revival that remains fragile.

“Germany is the canary in the mine for Europe,” said Pau Morilla-Giner, chief investment officer at London & Capital Asset Management in London. “It is the most exposed country to what happens outside of the continent.”

SCHADENFREUDE--IT'S WHAT'S FOR DINNER, BREAKFAST, AND SNACKS!

MORE AT LINK AND VIDEO

Demeter

(85,373 posts)IS THERE A GOOD MONTH? OR IS IT RATHER LIKE CRAPS?

http://www.bloomberg.com/news/articles/2015-10-08/why-october-is-the-worst-month-for-investors

Here’s some advice for investors hoping for some calm after the recent stock market volatility: “Expect the unexpected, and get yourself used to bigger swings,” says Julian Emanuel, executive director of U.S. equity and derivatives strategy at UBS. “Even though the market has a positive bias and we’re looking for a fourth-quarter rally, it’s going to remain volatile.”

Over the past 20 years, October has been the choppiest month for stocks. This year may follow the pattern of 2011, 1998, and 1990, when steep declines in August were followed by further downdrafts in October. “We are in an important seasonal stretch, a time in history when the August and October period is very volatile,” says Chris Verrone, head of technical analysis at Strategas Research Partners. “We’re not done with the correction quite yet. The repair process takes many months, and part of that repair process is going back and undercutting initial lows.”

In 2011, Europe’s sovereign debt crisis dragged down the Standard & Poor’s 500-stock index 7.2 percent in the first week of August. By mid-October the index had gone through six rallies and five pullbacks, falling as much as 6.7 percent in one day. In a six-week rout that began in August 1998, the S&P 500 experienced four rallies and four declines as it coped with the collapse of Long-Term Capital Management and slowing economies in Asia, Russia, and parts of Latin America. A similar pattern occurred in the autumn slump of 1990. In each case, stocks resumed their upward climb a month or so later, after dropping under the low reached in August.

This time around, the summer volatility began in response to China’s devaluation of the yuan and uncertainty about when the Federal Reserve would start to raise interest rates. In August the S&P 500 plunged 10 percent in four days, the first drop of that size since 2011. Since then there have been daily rallies of as much as 4 percent and declines as deep as 3.5 percent. Yet after a five-day decline that ended on Sept. 28, the gauge reversed and began its longest rally of the year, gaining 5.6 percent in the five days through Oct. 5.

Amid the turmoil, 12 of the 21 strategists surveyed by Bloomberg have lowered their yearend estimates for the stock market. Their average guess now is that the S&P 500 will finish the year at 2,142. That would be a gain of 4 percent for the year and 8.2 percent from the Oct. 6 close, which is not that much bigger than the average 6.7 percent rally that has occurred in the fourth quarter since 2009...

MORE AUGURY AT LINK

Demeter

(85,373 posts)Brazil's Federal Accounts Court on Wednesday ruled President Dilma Rousseff doctored the budget and urged Congress to reject the government accounts from last year, paving the way for a potential impeachment against the embattled leader.

In a unanimous vote the court, known as TCU, ruled that Rousseff manipulated the budget to cover a widening fiscal deficit last year. It is the first time the court rejected the accounts of a head of state in nearly 80 years.

Although the ruling is not legally binding it could be used by the opposition to build a case for Rousseff's impeachment in a Congress increasingly hostile to the unpopular leftist leader. Congress has the final word on Rousseff's accounts.

Opposition lawmakers at the court clapped and hugged each other after the ruling, saying the decision was the beginning of the end for the Rousseff administration...MORE

Demeter

(85,373 posts)Yves here. This post assumes that the Trans-Pacific Partnership gets past Congress; let’s not take that as a given. My DC sources think the odds of it getting done are only a bit above 50/50, and even if Hillary is (as expected) making only a show of opposition, that makes it safer for others to stand against the deal. The more the deal looks to be contested, the better the odds of derailing it.

A SURVEY BY CFA INSTITUTE PUTS THE POSSIBILITY OF TPP NOT PASSING WORLD-WIDE AT 7%...DEMETER

By Alicia Garcia Herrero a non-resident research fellow at Real Instituto El Cano. She is also Chief Economist for Asia Pacific at NATIXIS, adjunct professor at City University of Hong Kong and Hong Kong University of Science and Technology (HKUST) and visiting faculty at China-Europe International Business School (CEIBS). Originally published at Bruegel

After five years of struggle, a massive trade pact has been signed among the US, Japan and 10 other economies (mostly in Asia but also Latin America): the Trans-Pacific Partnership (TPP). The winners are obvious: Obama and Shinzo Abe, arguably also the US and Japanese economies. Obama can leave office with a strong demonstration of the US pivot to Asia, and Abe can finally argue that the third arrow of his Abenomics program is not empty.

The losers are also obvious: China and Europe. China not only has been left out of the deal, but it has been left out on purpose. If anybody had any doubt (at some point China was invited into the negotiations and some still expect China to continue discussing membership in the future), Obama’s official statement on TPP yesterday makes it very clear: “when more than 95 percent of our potential customers live outside our borders, we can’t let countries like China write the rules of the global economy”. For China the issue is not only losing access to the US market but also the fact that its most important trading partners are in the deal, with the notable exception of Europe. Europe, which has spent years negotiating with the US on another major trade pact, the Transatlantic Trade and Investment Partnership (TTIP), may need to be more accommodating to reach a deal before Obama leaves, as the President’s interest has probably waned somewhat after this victory. On the other hand, many of the negotiation benchmarks reached by the US government for TPP will probably not be acceptable for Europe.

The fact that TPP has not yet being ratified by national parliaments still offers room for doubt as to TPP’s actual economic significance (exemptions from its coverage could spring out in every jurisdiction) but there is no doubt that it will be economically relevant. TPP covers 40 per cent of global trade and spans 800 million people. Not only will trade barriers be reduced to the minimum in virtually every sector (including generally protected ones such as agriculture) but also common standards will need to be used by all participants, be it for investment, environment or labour. In this regard, the primacy of the protection of brand names over the protection of geographical indications of agricultural products, or the priority of the protection of trade secrets over press freedom are cornerstones of the US success in its negotiations with TPP partners, which also shows the price that a country like Japan are willing to pay for US-led security. In the same vein, the high price to pay (in terms of US supremacy on the negotiation table) makes it all the more unlikely for China to seriously consider joining the bloc in the near future: the treatment of state-owned enterprises and data protection are two stumbling blocks. The latter is also a key deterrent for Europe’s TTIP negotiations.

The question, thus, is what should China and Europe do against the background of a huge economic block like TPP. Having lost hope of a multilateral process under the axis of the WTO, both areas have been piling up bilateral free trade agreements (FTA) with countries of interest, some of which are also part of TPP. As an example, China has recently closed a deal with Australia while Europe has done the same with Singapore and Vietnam. Aware of the fact that such bilateral FTAs will remain quite futile compared to TPP (both in terms of size and coverage), China is gearing towards a regional strategy, participating in talks on a Regional Comprehensive Economic Partnership (RCEP), which would link it to 10 Southeast Asian Nations, including Japan. It remains unclear whether these countries will have an interest to pursue such deal once TPP is up and running. Against this gloomy backdrop, China and Europe may finally look at each other and find some commonalities that they were unaware of before. The process will not be easy, but at least there is a starting point; Europe and China are negotiating a Bilateral Investment Agreement, following in the footsteps of the US. Now that the US and China seem to have lost the momentum for their own Bilateral Investment Agreement (a notable absence during Xi Jinping’s trip to the US), Europe could – for once – become a frontrunner in the negotiations with China and have the US follow if it so wishes.

Demeter

(85,373 posts)(In light of the Trans-Pacific Partnership Trade Deal, I have put this back to the top–originally published Nov. 23, 2013.)

The odd thing about free trade is that it is both meaningless and vastly important. Comparative advantage, which is supposed to be a straight win for both trading partners, is a rounding error even when it works–if you don’t have full employment; it’s essentially meaningless. However, the ways in which free trade (and the free capital flows that are part of what we call “free” trade) is used to systematically undercut wages and working conditions and destroy environmental safeguards, make trade, as we practice it, vastly important. The classic case for trade is comparative advantage: You do what you’re best at, I do what I’m best at, we trade, and we both wind up with more stuff. The math on this is impeccable, but it works in the real world only under very specific conditions. The most important part is this: If I have the extra resources (both material and labor), I’m better off producing the goods myself, rather than trading with you–even if my production methods are less efficient than yours. I’ll still wind up with more stuff. In short, if I don’t have full employment, then free trade is a rounding error. This is related to Ricardo’s Caveat, where the economist noted that, in his time, capital was not mobile. If it was not being used to do one thing in Britain or France, it would be redeployed to do something else in its own country. It would not be used to create jobs in another country. In our system, with mobile capital, there is no reason to employ either capital or people in the country of origin if higher profits can be made elsewhere. In this case, free trade can lead to an actual loss of jobs.

One standard argument made for free trade is that it produces cheaper consumer goods, and that makes people in a country better off, even if jobs are being off-shored. This is only marginally true. Most of the reduced cost of foreign goods is taken as profits, not passed on to consumers. The loss of jobs means that some people lose outright and completely: those who can’t find jobs or can only find low-paying, service jobs. But even those who keep their jobs are disadvantaged if trade means the labor market is not tight, because if the labor market is not tight, labor has no pricing power and gets almost no raises (this is why there have been no significant median wage raises since the mid-70s or so.)

The renunciation of tariffs and trade controls is a form of betrayal by in-country elites who have capital to deploy outside the country against everyone else in the country. If a foreign country has lower wages, worse environmental standards, horribly unsafe or coerced labor conditions, this is a comparative advantage. It is a comparative advantage even within countries, mind you. If I pay less, or I work my workers like dogs, or I dump effluent into rivers, or I don’t bother to pay for fire escapes and sprinklers, I have an advantage over anyone who does these things. The standard solution to this is to legally mandate that I must pay a decent wage, not dump effluent, and pay for a safe work space. If everyone is forced to do so, no one is at a disadvantage. This can only be done if there is a legal mandate over a territory and an enforcement mechanism. That means, usually, it can only be done within a single country. Anyone outside the country can betray and can do any of these noxious things which increase their productivity at the cost of the environment or the people. The standard response to this is to say: “Sure, you can do that, but if you do, we’ll just add it to the price of any goods you sell to us.”

Free trade agreements take the ability to do that off the table and force roundabout methods (like currency manipulation) which don’t work as well and instead of earning a government income, cost the government money. Alternatively, though it costs money, one can subsidize one’s own industry, but most free trade agreements make that illegal as well. Free trade is harmful to the economy of nations. It is also not necessary for industrialization–rather, the reverse is true. Every nation larger than a city-state, other than Russia, has industrialized behind trade barriers of some kind and that includes the United States, Japan, Britain, and China. (There is an argument that mercantilism requires one party to have trade barriers and another party to have no barriers. However, a country with full employment can allow free trade for things it doesn’t produce itself, thus allowing foreign mercantilism.)

As long as the capital of a country is deployed within that country and the country has some access to markets, protected trade works. Sub-Saharan African countries had higher GDP growth in the 50s and 60s, under managed trade, than they did when their markets were forced open. Often, the practical effect of free trade and free capital flows is to allow foreigners to buy out large parts of a nation’s economy, as when NAFTA was used to buy out Mexico’s major food producers. Foreign goods from other countries flood into whatever country is forced to, or agrees to, open its borders, destroying the local economy. This is most dangerous when food is involved. In Mexico, millions of farmers were forced off the land because of US subsidized agricultural products, post-NAFTA. African and Latin American countries forced their own farmers off the land so they could agglomerate agricultural land for cash crops, leading to food insufficiency, and because everyone was selling the same cash crops, they didn’t even get very much hard currency for it.

Once your country can’t feed itself, you are at the complete mercy of other countries and you have lost significant sovereignty–especially if you don’t generate sufficient hard currency to pay those who are selling you food (see Greece or Egypt). Internal elites are often happy to sign destructive trade agreements because they win, even if their country loses. They get to skim off money from the loans, they are the ones who run the cash-crop farms, they are the ones who are able to sell whatever it is that foreigners want to buy, in exchange for hard currency.

**********************************************MORE***************

Free trade is a bad idea. Free capital flows are a worse idea. Managed trade is a good idea and slow capital flows are a better idea (there is no evidence that foreign capital develops countries, as an aside, see Ha-Joon Chang on that).

Free trade, as we practice it, is about our country’s elites betraying their own populations.

Demeter

(85,373 posts)...The biggest regional trade and investment agreement in history is not what it seems. You will hear much about the importance of the TPP for “free trade.” The reality is that this is an agreement to manage its members’ trade and investment relations – and to do so on behalf of each country’s most powerful business lobbies. Make no mistake: It is evident from the main outstanding issues, over which negotiators are still haggling, that the TPP is not about “free” trade. New Zealand has threatened to walk away from the agreement over the way Canada and the US manage trade in dairy products. Australia is not happy with how the US and Mexico manage trade in sugar. And the US is not happy with how Japan manages trade in rice. These industries are backed by significant voting blocs in their respective countries. And they represent just the tip of the iceberg in terms of how the TPP would advance an agenda that actually runs counter to free trade.

For starters, consider what the agreement would do to expand intellectual property rights for big pharmaceutical companies, as we learned from leaked versions of the negotiating text. Economic research clearly shows the argument that such intellectual property rights promote research to be weak at best. In fact, there is evidence to the contrary: When the Supreme Court invalidated Myriad’s patent on the BRCA gene, it led to a burst of innovation that resulted in better tests at lower costs. Indeed, provisions in the TPP would restrain open competition and raise prices for consumers in the US and around the world – anathema to free trade. The TPP would manage trade in pharmaceuticals through a variety of seemingly arcane rule changes on issues such as “patent linkage,” “data exclusivity,” and “biologics.” The upshot is that pharmaceutical companies would effectively be allowed to extend – sometimes almost indefinitely – their monopolies on patented medicines, keep cheaper generics off the market, and block “biosimilar” competitors from introducing new medicines for years. That is how the TPP will manage trade for the pharmaceutical industry if the US gets its way...

International corporate interests tout ISDS as necessary to protect property rights where the rule of law and credible courts are lacking. But that argument is nonsense. The US is seeking the same mechanism in a similar mega-deal with the European Union, the Transatlantic Trade and Investment Partnership, even though there is little question about the quality of Europe’s legal and judicial systems. To be sure, investors – wherever they call home – deserve protection from expropriation or discriminatory regulations. But ISDS goes much further: The obligation to compensate investors for losses of expected profits can and has been applied even where rules are nondiscriminatory and profits are made from causing public harm...

Such provisions make it hard for governments to conduct their basic functions – protecting their citizens’ health and safety, ensuring economic stability, and safeguarding the environment. Imagine what would have happened if these provisions had been in place when the lethal effects of asbestos were discovered. Rather than shutting down manufacturers and forcing them to compensate those who had been harmed, under ISDS, governments would have had to pay the manufacturers not to kill their citizens. Taxpayers would have been hit twice – first to pay for the health damage caused by asbestos, and then to compensate manufacturers for their lost profits when the government stepped in to regulate a dangerous product.

Read more at https://www.project-syndicate.org/commentary/trans-pacific-partnership-charade-by-joseph-e--stiglitz-and-adam-s--hersh-2015-10#lZ5OuSMJg6ql4rS3.99

Demeter

(85,373 posts)By Lambert Strether of Corrente.

While doing the research for this morning’s work-up of TPP, I ran across this thirty-six page PDF, said to the the Japanese government’s summary of TPP (see translated headline here; link appears on page). During the Atlanta negotiations, I noticed that the Japanese were playing a much more forward role than usual, starting with all the leaks in the Japanese press that the deal was done (when in fact it wasn’t), and Trade Minister Amari serving as a constant source of quotes for the hungry press, threatening to leave at midnight because he had a plane to catch, and so forth. Frankly, I had expected Abe to throw Obama under the bus, once they had his permission to remilitarize, to protect Japanese agriculture for their upcoming elections.

So I shot the PDF off to NC contributor Clive, who knows Japanese, saying “The media is trumpeting “Agreement” but I’m not sure what kind of agreement we have.” Here’s how Japanese agriculture did get protected. Take it away, Clive!

* * *

That master negotiator USTR Froman has caved big time and handed Japan everything it asked for, certainly in terms of agriculture. To call it a sweetheart deal (Japan being the one who is being wooed, USTR Froman apparently being the Girl Who Just Can’t Say No) would be understating it. About the only concession from the Japan is the reduction to a small degree in agricultural tariffs. But as you’ll see, there’s no hurry to implementing them and plenty of get-out clauses.

Too much detail to quote the provisions detailed in the document in their entirety, but let’s take beef by way of example. Here from Section II “Conclusion of Market Access Negotiations” subsection 1 “Market Access for goods (Access to the Japanese Market)” is item 4, “Beef”:

(1) To avoid the elimination of tariffs while also reducing tariffs (but) with safeguards (the tariffs on beef will be reduced as follows).

38.5% (current) ? 27.5% (initially (at the enactment of the TPP)) ? 20% (after 10 years) ? 9% (16 years later)

(2) Safeguards:

trigger quantity (this is an annual “anti-dumping” limit that, once imports rise above a set level mean an additional import surcharge is made):

590,000 t (initially) ? 696,000 t (after 10 years) ? 738,000 t (after 16 years) (Also for the 5 years after year 11 from the enactment of the TPP there will be a 20% cut in the quarterly trigger level*)

safeguard tax rate:. 38.5% (initially) ? 30% (4 years) ? 20% (11-year) ? 18% (15 years)

From Year 16 (since the TPP became enacted) the Safeguard tariff tax will be reduced by 1% every year. But if the Safeguard tax is invoked (i.e. if the anti-dumping trigger is reached) the Safeguard tax will not be reduced the following year. However, if the Safeguard tax (threshold) level is not reached for four (consecutive) years then the Safeguard tax will be abolished.

If imports have been substantially reduced due to an outbreak of livestock disease for more than three years, these tariff changes will not be applied for a period of time of up to five years starting from a substantial lifting of the ban (this provision will not be applied to the U.S. and Canada until after the end of January 2018).

* I must add that I have no idea what this clause means at all! I’m guessing that it is trying to say that between years 11 and 16 (inclusive) following the TPP enactment, the trigger quantity has to be smoothed out over the year as beef sales have seasonal variations, but someone who knows more about how the current beef import anti-dumping measures work would need to tell me what this change would do.

So, Japan gets to keep not only its beef import quotas with the additional “safeguard” special anti-dumping tax but also the regular tariffs which only reduce (and aren’t eliminated) over 16 years. The other agricultural tariff terms are similarly bad for the U.S. and stunningly good for Japan. Japan, in return, gets everything it wanted on auto imports. My best advice to Japan’s ministerial negotiator Amari is to run from the building as quickly as you can before Froman realises he’s been had.

* * *

Well, that’s interesting. I’d comment only that I question “caving”; I don’t accept Democratic narratives of weakness. If we think of TPP as a trade deal, then “caving” to the Japanese, the second largest economy at the table, on every conceivable agricultural issue would seem to make the ratio of benefit to cost uncomfortably even.

However, if what the people Obama (and hence Froman) work for want — better, what the trans- and post-national squillionaire parasitroids who have injected their controlling, neoliberal, TINA-flavored ideological venom into the hive mind of our political class really want — is the destruction of national sovereignty in favor of global rule by the corporations they own, then the ratio of benefit to cost is still enormously high; Japanese beef is trivial from the elite’s commanding heights, although Texas, Nebraska, Kansas, California, Oklahoma, Missouri, and Iowa might not like it very much. But no doubt their local oligarchies will come around, if only the right inducements can be found.

Demeter

(85,373 posts)Demeter

(85,373 posts)...Of course, nothing has been “signed,” and the deal has neither been “reached”, “sealed,” “struck,” or “agreed.” At best, what we have is a deal to try to make a deal; these headlines, and the mentality of the writers and editors, are all profoundly anti-democratic. As the BBC sheepishly admits:

The Financial Times contradicts its own headline:

Nice spin on “formally.” And what are the lawmakers? Chopped liver? (For grins, here are the official texts that we do have: The “joint statement” from the trade ministers after the Atlanta meeting; The “summary” on the USTR’s website; and “Statement by the President” at the White House site. Needless to say, these should all be regarded as propaganda, just as much as the memes that the White House Internet operation has been assiduously pumping out since Monday morning.)

In this post, I want to first look at the exact status of the deal we do not yet have; that is, the text that will, at some point, be presented to lawmakers. Then I want to look at what the deal, or at least the dealings, are really about; and it’s not trade. NC readers already know this, of course; but it’s good to have more confirmation come out of the negotiation process. (In this post, I’m not going to look at the sausage-making[1] or who said what[2]; frankly, I’m not certain that’s the only method to examine — or, more importantly, disrupt — the TPP process, though it is necessary to be informed if only to refute or recontextualize in conversation.[3]) In conclusion, there’s hope: Deals like TPP have been defeated before...

MUCH MORE AT LINK

One of the goals of these is to under cut labor and unions.

Otherwise, excellent and well written article. Thanks for posting as this will help me explain the economics of trade agreements to the clueless.

Demeter

(85,373 posts)The EU must restore a "practical relationship" with Russia and not let the US "dictate" that policy, the European Commission chief has said.

Jean-Claude Juncker criticised US President Barack Obama's description of Russia as merely "a regional power".

EU-US sanctions were imposed on Russia because of its intervention in Ukraine. Mr Obama had a frosty meeting recently with Russian President Vladimir Putin.

"Russia must be treated decently," Mr Juncker said in Germany. "We must make efforts towards a practical relationship with Russia. It is not sexy but that must be the case, we can't go on like this," he said, during a visit to Passau in southern Germany...

THE WORM IS TURNING...BUT IT'S STILL A WORM

MattSh

(3,714 posts)The EU has been America's poodle on a leash for a good two years now regarding Ukraine, and finally they decide start to understand that the USA should not dictate that policy!

From 2010!

'From Lisbon to Vladivostok': Putin Envisions a Russia-EU Free Trade Zone - SPIEGEL ONLINE

No more tariffs. No more visas. Vastly more economic cooperation between Russia and the European Union. That's the vision presented by Russian Prime Minister Vladimir Putin in an editorial contribution to the German daily Süddeutsche Zeitung on Thursday.

"We propose the creation of a harmonious economic community stretching from Lisbon to Vladivostok," Putin writes. "In the future, we could even consider a free trade zone or even more advanced forms of economic integration. The result would be a unified continental market with a capacity worth trillions of euros."

The proposal comes as Putin travels to Germany on Thursday for a two-day visit, including a Friday meeting with German Chancellor Angela Merkel. On Wednesday, Russia and the EU reached an important agreement on the elimination of tariffs on raw materials such as wood. The deal was an important prerequisite for the EU dropping its opposition to Russian membership in the World Trade Organization. Moscow is hoping to become a member in 2011.

Putin, though, as his Thursday proposal makes clear, envisions more. "The current state of cooperation between Russia and the EU is not consistent with the challenges that we face," he writes. "To transform the situation, we need to take advantage of the advantages which already exist and the possibilities for progress in the EU and Russia."

Complete story at - http://www.spiegel.de/international/europe/from-lisbon-to-vladivostok-putin-envisions-a-russia-eu-free-trade-zone-a-731109.html

And it doesn't take a genius to see how, if this plan came to fruition, that the USA would be on the outside looking in. In fact, it would be a big FU to the US. So the US decided to F*ck the EU before the EU could F*ck the US. And the EU went along with it...

Demeter

(85,373 posts)

Remember the dire threat posed by our financial dependence on China? A few years ago it was all over the media, generally stated not as a hypothesis but as a fact. Obviously, terrible things would happen if China stopped buying our debt, or worse yet, started to sell off its holdings. Interest rates would soar and the U.S economy would plunge, right? Indeed, that great monetary expert Admiral Mullen was widely quoted as declaring that debt was our biggest security threat. Anyone who suggested that we didn’t actually need to worry about a China selloff was considered weird and irresponsible.

Well, don’t tell anyone, but the much-feared event is happening now. As China tries to prop up the yuan in the face of capital flight, it’s selling lots of U.S. debt; so are other emerging markets. And the effect on U.S. interest rates so far has been … nothing.

Who could have predicted such a thing? Well, me. And not just me: anyone who seriously thought through the economics of the situation, with the world awash in excess saving and the U.S. in a liquidity trap, quickly realized that the whole China-debt scare story was nonsense. But as I said, this wasn’t even reported as a debate; the threat of Chinese debt holdings was reported as fact.

And of course those who got this completely wrong have learned nothing from the experience.

I THINK DR. KRUGMAN SUFFERS FROM SEVERE MYOPIA. AS THE OPTIMIST SAID, AS HE PASSED THE 50TH FLOOR WHILE PLUMMETING FROM THE EMPIRE STATE BUILDING:

"SO FAR, SO GOOD!"

Demeter

(85,373 posts)...All over the country, Wells Fargo is making headlines for launching a multimillion-dollar homeowner assistance program called HomeLIFT, which among other things offers $15,000 down payment grants to prospective home-buyers. Local mayors in big cities from one end of the country to the other are showing up at ribbon-cuttings and throwing rose petals at the bank for its generosity. Newspapers in turn are running breathless profiles of the low-income homeowners who will now get to buy dream homes thanks to the bank's beneficence.

Some knew, some didn't, but all are leaving out one key detail: Wells Fargo was forced to launch HomeLIFT.

To understand the background, we have to go back to July 25th of last year, when a federal judge in the Northern District of California approved a settlement in a case called City of Westland Police and Fire Retirement System v. Stumpf. The suit was brought on behalf of shareholders by Robbins Geller, the same firm featured in a story I wrote two years ago about the ratings agencies. For those who are fortunate enough to have forgotten, robo-signing was a common practice that devastated families during the foreclosure crisis. People all over the country found themselves booted out of their homes thanks to bogus affidavits signed by "vice presidents" and "regional managers," who were often scraggly kids just out of college blindly signing hundreds of documents a day, if not more. It was a kind of systematic perjury, and most of the major banks eventually copped to doing it.

Wells Fargo was one of those banks, joining JPMorgan Chase, Bank of America, Ally Financial, Citigroup and others in a sweeping $25 billion settlement with state and federal regulators finalized in 2012.

However, the road to that settlement was not smooth. According to some stockholders, the company's board of directors failed to cooperate with investigators throughout the process. A court later found that the Wells board "opposed discovery requests, filed motions to quash, and refused to provide details concerning the Company's policies," which made it hard for investors and shareholders to know what to do about the scandal. So those shareholders sued Wells, essentially for failing to cooperate with the government over its robosigning practices. After a long battle, the bank finally agreed to settle last year. The terms mandated that the bank spend $67 million on a series of measures to repair its reputation in communities hit the hardest by foreclosures and robosigning. Enter HomeLIFT.

Read more: http://www.rollingstone.com/politics/news/wells-fargos-master-spin-job-20151002#ixzz3o4ZxJHq6

Follow us: @rollingstone on Twitter | RollingStone on Facebook

DemReadingDU

(16,000 posts)Hotler

(11,431 posts)I have no hope. I see no future. Sometimes music helps.

DemReadingDU

(16,000 posts)I am reminded again by the flooding in South Carolina, the devastation caused by rising and rushing waters..hundreds of roads have been wiped out, 18 bridges breached, homes destroyed, and people died. The same can be said with any natural disaster though.

We need to reflect what is truly important.

Demeter

(85,373 posts)He hasn't said what his theme is, but I'm sure it will be spectacular, as usual.

Meanwhile, Reality is dragging me away by the hair....try to keep it all together, and we'll meet on the WEE!