Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 11 November 2015

[font size=3]STOCK MARKET WATCH, Wednesday, 11 November 2015[font color=black][/font]

SMW for 10 November 2015

AT THE CLOSING BELL ON 10 November 2015

[center][font color=green]

Dow Jones 17,758.21 +27.73 (0.16%)

S&P 500 2,081.72 +3.14 (0.15%)

[font color=red]Nasdaq 5,083.24 -12.06 (-0.24%)

[font color=black]10 Year 2.34% 0.00 (0.00%)

[font color=red]30 Year 3.11% +0.01 (0.32%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,868 posts)Today is Veterans' Day, when we're supposed to honor our veterans for defending our freedoms.

Unfortunately, most of our recent -- and unwon -- wars have had very little to do with our freedoms and much more to do with corporate profits and power grabs.

Which is why the stock exchanges are open today.

Some honor.

Demeter

(85,373 posts)How many wars the United States have won since the end of WWII? In his new movie "Where to Invade Next", Michael Moore gives a straight answer: none. However, maybe the real question should be: what is of most importance, victory or war itself?

After the humiliating war in Vietnam, which cost the US a major influence in Southeast Asia, and led to the overheating of the US economy due to long-term government spending on weaponry, the military operations of the US can hardly be considered failed.

- The wars in Iraq and Afghanistan may have brought chaos in the wider Middle East but also led to the encirclement of Iran, while they redistributed the pie of oil fields and pipelines which were about to pass in the hands of European and Chinese companies.

- The bombing of Libya may have led even to the death of the American ambassador in Tripoli, but deprived Europe of an alternative energy source, increasing its dependence on the Americanized oil monarchies of the Persian Gulf - note that the same thing happened with the civil war in Ukraine, through which the geostrategic flirting between Berlin and Moscow was interrupted.

- Even the seemingly uncontrollable creation of jihadists, first in Libya and then in Iraq and Syria, still operates today as a benefit, rather than a loss - it allows the implementation of the "divide and rule" doctrine.

The most important effect, however, according to many analysts, is that the US economy is now so inextricably linked to the war - from the weapons companies and the research and development sector, to construction companies that undertake the reconstruction of devastated areas - so that the continuous state of war is prerequisite for its survival. War is no longer an end in itself, and victory or defeat, at least as defined in previous centuries, are of secondary importance. The actual defeat does not concern the US military. It concerns the US economy.

Demeter

(85,373 posts)Demeter

(85,373 posts)In an interview with Democracy Now!, author David Talbot talks about his latest book, "The Devil’s Chessboard: Allen Dulles, the CIA, and the Rise of America’s Secret Government," a biography of the former director of the CIA during the 1950s. He tells Amy Goodman that the U.S.' current policies surrounding intelligence and security could be traced back to Dulles' reign. "He was a man who felt he was above the law," says Talobot. "He felt that democracy was something that should not be left in the hands of the American people or its representatives. He was part of what the famous sociologist from the 1950s, C. Wright Mills, called the power elite. And he felt that he and his brother and those types of people should be running the country."

... Between 1953 and '61, under his watch, the CIA overthrew the governments of Iran and Guatemala, invaded Cuba, was tied to the killing of Patrice Lumumba, Congo's first democratically elected leader.

A new biography of Allen Dulles looks at how his time at the CIA helped shape the current national security state. Biographer David Talbot writes, quote, "The Allen Dulles story continues to haunt the country. Many of the practices that still provoke bouts of American soul-searching originated during Dulles’s formative rule at theCIA." Talbot goes on to write, "Mind control experimentation, torture, political assassination, extraordinary rendition, mass surveillance of U.S. citizens and foreign allies—these were all widely used tools of the Dulles reign."

INTERVIEW FOLLOWS...IF YOU WANT TO COMPLAIN, THIS IS THE PLACE TO START COLLECTING TALKING POINTS

Demeter

(85,373 posts)The timeline href=”http://blogs.cfr.org/lindsay/2015/11/05/next-steps-for-the-tpp/”>Council on Foreign Relations

The first is the ninety-day clock. TPA requires the president to wait ninety days after announcing his intent to sign a trade deal before actually signing it. So while the United States and its eleven negotiating partners announced exactly one month ago that they had struck a deal, it’s still awaiting signatures. Indeed, the text is still being translated into French (for Canada) and Spanish (for Chile, Mexico, and Peru), and the lawyers might still make some technical corrections.

The second timeline is a sixty-day clock. TPA requires that the terms of any trade deal be made public for at least sixty days before Congress can consider it. Because the administration released the text at the same time it announced its intent to sign the deal, the sixty-day clock has no practical effect.

Does this mean that Congress will be taking up the legislation needed to implement TPP come early-February? Not quite. With the sixty-day clock already satisfied by then, Congress certainly could begin considering TPP once Obama signed it. But TPA does not require it to. Instead, the decision on when to formally begin deliberations rests with congressional leaders. Once they introduce the implementing legislation, Congress will have at most ninety days to hold an up-or-down vote. The legislation can’t be filibustered or buried in committee, so the common ways in which legislation gets killed on Capitol Hill won’t apply in this case.

How quickly congressional leaders will move on TPP will depend partly on when the administration will have the implementing legislation ready. TPP is a big, complex document, and the implementing legislation likely will be as well. Even more important, congressional leaders (and the administration) will be looking to see if the votes are there to pass TPP.

On that score, TPP is heading into the stiff political winds of Campaign 2016. Hillary Clinton, who once championed TPP, now opposes it, at least in its current version. Many Democratic lawmakers are feeling pressure to follow her lead. That pressure will likely grow as we move closer to Election Day. Republicans historically vote overwhelmingly for trade deals. But several GOP presidential candidates oppose TPP and the enthusiasm in GOP ranks for giving Obama a major legislative victory is low.

So don’t be surprised if a vote on TPP gets kicked into a lame-duck session or even into next year and a new administration.

U.S.: “‘The question is: will the White House demonstrate as much political will and determination as they did with the TPA (fast track) vote?’ the trade lobbyist said” (Forbes). “This being Obama’s last big policy initiative, there’s no reason to think they won’t.” Yes, Obama cares about this, unlike, say, health care. And they wouldn’t do this in the middle of an election if they didn’t think they had the muscle could pass it. But they’ve been wrong before, and could well be wrong again.

U.S.: “But U.S. Senate Finance Committee Chairman Orrin Hatch, a Republican whose support will be crucial to passing the deal, said that although he reserved judgment on the fine print, negotiators might have to go back to the table” (Reuters). “While Hatch said he would carefully study the text, released on Thursday, he saw problems with provisions on tobacco, labor rules and dairy. ‘We’re losing votes as we speak for no good reason,’ he told reporters. ‘My suggestion is, get back to the bargaining table and let them know that this may not pass.'”

MORE AND SUPPORTING LINKAGE

DemReadingDU

(16,000 posts)11/10/15 Charges Announced in J.P. Morgan Hacking Case

Three men allegedly hacked 12 companies, including J.P. Morgan and Dow Jones

In one of the biggest cybercrimes in history, federal prosecutors say, three men stole data on more than 100 million people from a dozen companies’ computers and used a vast global network of accomplices to turn it into hundreds of millions of dollars in illegal profits.

Indictments unsealed Tuesday in Manhattan and Atlanta accused the men and hundreds of their accomplices of carrying out last year’s big data breach at J.P. Morgan Chase & Co. and a host of other crimes around the world—involving computer networks in South Africa and Brazil, money laundered through Cyprus and illegal credit-card payments processed in Azerbaijan.

Manhattan U.S. Attorney Preet Bharara on Tuesday said this “diversified criminal conglomerate” was “breathtaking” in the size and scope of its hacking.

The indictments allege the three defendants and their associates hacked into banks and other companies to obtain customer information that they later used in a pump-and-dump stock scheme. Meanwhile, the computer-hacking operation made possible a network of other criminal activity, including illegal Internet casinos, a payment processing service for other criminals and an unlicensed bitcoin exchange, prosecutors alleged.

Among the most lucrative was a pump-and-dump scheme, where the men would artificially inflate prices of penny stocks and then trick investors into buying them by sending spam to the email addresses they had stolen during the hacks. To further the scheme, the defendants sometimes engineered mergers with shell companies to create publicly traded stocks that could be manipulated, prosecutors said.

The mastermind of the enterprise, prosecutors allege, was Gery Shalon, a 31-year-old Israeli citizen and resident. The indictment described moments where he bragged about the success of his schemes, including the pump-and-dump one, which he allegedly called “a small step towards a large empire.”

When asked by a co-conspirator whether buying stocks in America was popular, Mr. Shalon allegedly responded: “It’s like drinking freaking vodka in Russia.”

more...

http://www.wsj.com/articles/prosecutors-announce-charges-in-connection-with-j-p-morgan-hack-1447169646

11/10/15 CBS video, appx 2.5 minutes

http://www.cbsnews.com/videos/arrests-made-in-largest-ever-bank-hacking/

Demeter

(85,373 posts)"because that's where the money is."

In Sutton's 1976 book Where the Money Was, Sutton denies having said this.

The irony of using a bank robber's maxim as an instrument for teaching medicine is compounded, I will now confess, by the fact that I never said it. The credit belongs to some enterprising reporter who apparently felt a need to fill out his copy. I can't even remember where I first read it. It just seemed to appear one day, and then it was everywhere.

If anybody had asked me, I'd have probably said it. That's what almost anybody would say ... it couldn't be more obvious.

Or could it?

Why did I rob banks? Because I enjoyed it. I loved it. I was more alive when I was inside a bank, robbing it, than at any other time in my life. I enjoyed everything about it so much that one or two weeks later I'd be out looking for the next job. But to me the money was the chips, that's all.

********************************************************************

This underlying concept was developed into the study of medicine's Sutton's law, which states that when diagnosing, one should first consider the obvious. It suggests that one should first conduct those tests which could confirm (or rule out) the most likely diagnosis. It is taught in medical schools to suggest to medical students that they might best order tests in that sequence which is most likely to result in a quick diagnosis, hence treatment, while minimizing unnecessary costs. It is also applied in pharmacology, when choosing a drug to treat a specific disease you want the drug to reach the disease. It is applicable to any process of diagnosis, e.g. debugging computer programs. Computer-aided diagnosis provides a statistical and quantitative approach.

A more thorough analysis will consider the false positive rate of the test and the possibility that a less likely diagnosis might have more serious consequences. A competing principle is the idea of performing simple tests before more complex and expensive tests, moving from bedside tests to blood results and simple imaging such as ultrasound and then more complex such as MRI then specialty imaging. The law can also be applied in prioritizing tests when resources are limited, so a test for a treatable condition should be performed before an equally probable but less treatable condition.

A similar idea is contained in the physician's adage, "When you hear hoofbeats behind you, think horses, not zebras."

(Sherlock Holmes might quibble. After all, he said: "Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth."

A corollary, the "Willie Sutton rule," used in management accounting, stipulates that activity-based costing (in which activities are prioritized by necessity, and budgeted accordingly) should be applied where the highest costs occur, because that is where the biggest savings can be found.

*****************************************

William Francis "Willie" Sutton, Jr. (June 30, 1901 – November 2, 1980) was a prolific American bank robber. During his forty-year criminal career he stole an estimated $2 million, and eventually spent more than half of his adult life in prison and escaped three times. For his talent at executing robberies in disguises, he gained two nicknames, "Willie the Actor" and "Slick Willie." Sutton is also known as the namesake of Sutton's law, though he denied originating it. SO THAT'S WHERE THE INSULT TO CLINTON COMES FROM!

Sutton was born into an Irish-American family in a Polish neighborhood in Greenpoint, Brooklyn. He was the fourth of five children, and did not go beyond the 8th grade of school.

He turned to crime at an early age, though throughout his professional criminal career, he did not kill anyone. Described by Mafioso Donald Frankos as "a little bright-eyed guy, just 5'7" and always talking, chain-smoking ... cigarettes with Bull Durham tobacco." Frankos stated also that Sutton "dispensed mounds of legal advice" to any convict willing to listen. Inmates considered Sutton a "wise old head" in the prison population. When incarcerated at "The Tombs" (Manhattan House of Detention) he did not have to worry about assault because Mafia friends looked after him. In conversation with Donald Frankos he would sadly reminisce about the violent and turbulent days in the 1920s and 1930s while he was most active in robbing banks and would always tell fellow convicts that in his opinion, during the days of Al Capone and Charles Lucania, better known as Lucky Luciano, the criminal underworld was the bloodiest. Gangsters from the time period, and many incarcerated organized crime mafia family leaders and made Mafiosi, loved having Sutton around for companionship. He was always a gentleman, witty and non-violent. Frankos declared that Sutton made legendary bank thieves Jesse James and John Dillinger look like amateurs.

Sutton was an accomplished bank robber. He usually carried a pistol or a Thompson submachine gun. "You can't rob a bank on charm and personality," he once observed.

HMMM...ASK MADOFF HOW HE DID IT

In an interview in the Reader's Digest published shortly before his death, Sutton was asked if the guns that he used in robberies were loaded. He responded that he never carried a loaded gun because somebody might get hurt. He stole from the rich and kept it, though public opinion later turned him into a perverse type of Robin Hood figure. He allegedly never robbed a bank when a woman screamed or a baby cried.

Sutton was captured and recommitted in June 1931, charged with assault and robbery. He did not complete his 30-year sentence, escaping on December 11, 1932, using a smuggled gun and holding a prison guard hostage. With the guard as leverage, Sutton acquired a 13.5-meter (45 ft) ladder to scale the 9-meter (30 ft) wall of the prison grounds.

On February 15, 1933, Sutton attempted to rob the Corn Exchange Bank and Trust Company in Philadelphia, Pennsylvania. He came in disguised as a postman, but an alert passerby foiled the crime. Sutton escaped. On January 15, 1934, he and two companions broke into the same bank through a skylight.

The FBI record observes:

Sutton was apprehended on February 5, 1934, and was sentenced to serve 25 to 50 years in the Eastern State Penitentiary in Philadelphia, Pennsylvania, for the machine gun robbery of the Corn Exchange Bank. On April 3, 1945, Sutton was one of 12 convicts who escaped the institution through a tunnel. Sutton was recaptured the same day by Philadelphia police officer Mark Kehoe.

Sentenced to life imprisonment as a fourth time offender, Sutton was transferred to the Philadelphia County Prison, Holmesburg section of Philadelphia, Pennsylvania. On February 10, 1947, Sutton and other prisoners dressed up as prison guards. The men carried two ladders across the prison yard to the wall after dark. When the prison's searchlights hit him, Sutton yelled, "It's okay!" No one stopped him.

On March 20, 1950, Sutton was the eleventh listed on the FBI's brand new FBI Ten Most Wanted Fugitives, created only a week earlier, on March 14.

In February 1952, Sutton was captured by police after having been recognized on a subway and followed by Arnold Schuster, a 24-year-old Brooklyn clothing salesman and amateur detective. Schuster later appeared on television and described how he had assisted in Sutton's apprehension. Albert Anastasia, Mafia boss of the Gambino crime family, took a dislike to Schuster because he was a "squealer." According to Mafia turncoat and government informant, Joe Valachi, Anastasia ordered the murder of Schuster, who was then shot dead outside his home on March 9, 1952.

Judge Peter T. Farrell presided over a 1952 trial in which Sutton was convicted of the 1950 robbery of $63,942 (equal to $626,773 today) from a branch of the Manufacturers Trust Company in Sunnyside, Queens. He received a sentence of 30 to 120 years in Attica State Prison.

In December 1969, in response to a motion by Sutton's attorneys, Farrell ruled that Sutton's good behavior in prison and his deteriorating health due to emphysema justified commutation of his sentence to time served. At the hearing Sutton responded, "Thank you, your Honor. God bless you" and wept as he was led out of the court building. In 1970 separate 30-years-to-life sentence handed down in Brooklyn in 1952 was also commuted, on similar grounds, and he was released on parole.

After his release Sutton delivered lectures on prison reform and consulted with banks on theft deterrent techniques. He made a television commercial for New Britain Bank and Trust Company in Connecticut for their credit card with picture ID on it. His lines were, "They call it the 'face card.' Now when I say I'm Willie Sutton, people believe me."

Personal life and death

Sutton married Louise Leudemann in 1929. She divorced him while he was in jail. Their daughter Jeanie was born the following year. His second wife was Olga Kowalska, whom he married in 1933. His longest period of (legal) employment lasted for 18 months.

A series of decisions by the United States Supreme Court in the 1960s led to his release on Christmas Eve, 1969, from Attica State Prison. He was in ill health at the time, suffering from emphysema and in need of an operation on the arteries of his legs.

Sutton died in 1980 at the age of 79; before this he had spent his last years with his sister in Spring Hill, Florida. He frequented the Spring Hill Restaurant where he kept to himself. After Sutton's death, his family arranged a quiet burial in Brooklyn in the family plot.

DemReadingDU

(16,000 posts)The scammers sent the people info to invest in cheap stocks. The scam was to pump up the stock price, then dump the price such that the scammers profited. Watch this short video

11/10/15 CBS video, appx 2.5 minutes

http://www.cbsnews.com/videos/arrests-made-in-largest-ever-bank-hacking/

magical thyme

(14,881 posts)A similar idea is contained in the physician's adage, "When you hear hoofbeats behind you, think horses, not zebras."

(Sherlock Holmes might quibble. After all, he said: "Once you eliminate the impossible, whatever remains, no matter how improbable, must be the truth."![]()

Zebras do escape from zoos on occasion.

Demeter

(85,373 posts)H-1B visas are designed to bring foreign professionals with college degrees and specialized

skills to fill jobs when qualified Americans cannot be found. But in recent years, global

outsourcing companies have dominated the program, winning tens of thousands of visas

and squeezing out many American companies, including smaller start-ups.

13 outsourcing companies took nearly one-third of all H-1B visas in 2014.

Congress set a limit of 85,000 visas annually, and more than 10,000 companies applied in 2014. But just 20 companies received more than 32,000 visas, according to Ronil Hira, a professor at Howard University who studies visa programs and analyzed federal H-1B data. The top 20 included several large outsourcing firms that provided temporary workers for businesses like Disney and Toys “R” Us.United States Citizenship and Immigration Services approves the visas on a first-come-first-served basis, beginning each year on April 1. Federal officials allow only one application for each foreign worker, but companies can submit an unlimited number of applications for their employees, so global outsourcing giants can, and do, submit many requests.

The outsourcing companies dominate the visa program by flooding the system with applications.

H-1B visas are granted by a computer-run lottery if the number of applications exceeds the annual quota in the first week, which has happened in recent years.To prepare an H-1B visa application, employers must first submit a public document, known as a labor condition application, to the Department of Labor. Companies can apply for more than one employee based on one labor condition application, and many outsourcing firms use one application to apply for 10 or more workers. The more labor condition applications a company gets approved, the more H-1B applications it can submit. Because H-1B visa applications are not public record, the labor condition applications are an indicator of how many applications a company intends to file.

BUT WAIT! THERE'S MORE! SEE LINK; ESPECIALLY BECAUSE THE GRAPHICS DON'T COPY

Demeter

(85,373 posts)NOW, THAT'S A LEADER...THINK HE WILL RUN FOR PRESIDENT?

http://www.nytimes.com/2015/11/11/nyregion/andrew-cuomo-and-15-minimum-wage-new-york-state-workers.html

Gov. Andrew M. Cuomo plans to unilaterally create a $15 minimum wage for all state workers, making New York the first state to set such a high wage for a large group of public employees.

The increase, which Mr. Cuomo will announce on Tuesday, would place New York’s public employees far ahead of other states on minimum wage, and at the vanguard of a national movement to address stagnant wages for tens of millions of American workers.

Using executive authority, Mr. Cuomo, a Democrat, would gradually increase the hourly rate: State workers in New York City would earn $15 an hour by the end of 2018; state workers outside of New York City would also see wages rise, though more slowly, with rates climbing to $15 by the end of 2021. All told, some 10,000 workers would see a bump in pay, according to the governor’s office, with the vast majority of those living upstate or outside the city.

The governor’s action comes on a day when fast-food workers across the country are striking for a uniform $15 hourly wage, a movement that Mr. Cuomo has championed in New York and even as a growing number of cities have acted to raise wages. But Mr. Cuomo’s action is the first time a governor has raised wages to $15 for so many state employees...

Demeter

(85,373 posts)Job Bytes:October Job Growth Pushes Unemployment Rate Down to 5.0 Percent By Dean Baker

Manufacturing wages have risen by just 2.0 percent over the last year.

The Labor Department reported the economy added 271,000 jobs in October, with all but 3,000 of these jobs in the private sector. This is a sharp bounce back from the prior two months when private sector job growth averaged just 137,000. This job growth was sufficient to push the unemployment rate down slightly to 5.0 percent. While the employment-to-population ratio edged up slightly to 59.3 percent, it is still below the 59.4 percent high for the recovery. The labor force participation rate is actually down 0.4 percentage points from its year-ago level.

The job growth was led by health care (44,900), retail (43,800), restaurants (42,000), construction (31,000), business and technical services (26,900), and temp help (24,500). The rise in health care employment is in line with the 41,000 average for the last year. The strong retail growth follows two months in which reported growth averaged less than 5,000. The restaurant number is slightly better than recent growth rates.

On the negative side, mining shed another 4,500 jobs due to continuing fallout from the plunge in oil prices. Employment in the sector is down by 12.6 percent from its year-ago level. Manufacturing employment was flat in October, after having dropped by 28,000 over the prior two months.

Average weekly hours were unchanged at 34.5, although they edged up by 0.1 hours for production workers. The average hourly wage jumped 9 cents, but this was primarily a sampling error. The average hourly wage was reported as rising just 1 cent last month. Over the last three months, wages have risen at a 2.70 percent annual rate, a slight increase from the 2.48 percent rate over the last year. For production and non-supervisory workers, wages are up just 2.22 percent over the last year.

On the household side, there were few notable changes in employment or unemployment rates by demographic group. The unemployment rate for black teens fell by 5.9 percentage points to 25.6 percent, but this number is highly erratic and likely to be reversed in future months. The duration measures of unemployment showed little change. The average duration rose by 1.7 weeks, but this followed a reported drop of about two weeks for September. The median duration edged down by 0.2 weeks, while the share of long-term unemployed rose by 0.2 percentage points.

On the positive side, the number of people working part-time for economic reasons fell sharply in October, following a sharp reported drop in September. It now stands 1,245,000, below its year-ago level. By contrast, the number choosing to work part-time is up by 380,000 from its year-ago level and by 1,462,000 from its level of two years ago. This is a predictable result of the Affordable Care Act (ACA), since workers are no longer dependent on employers for insurance.

On the down side, the percentage of unemployment due to people voluntarily quitting their jobs remained at recession levels of 9.9 percent. The percentage of unemployment due to voluntary quits bottomed out at 8.6 percent as a result of the 2001 recession and 9.5 percent following the 1990-91 recession. It peaked at 15.2 percent in April of 2000 and crossed 17.0 percent in May of 1989. The low percentage of quits among the unemployed indicates workers do not feel comfortable leaving a job without a new job lined up.

This fits with the story of weak wage growth. The sharp drop in oil prices over the last year has led to strong growth in real wages over this period, but there has been little change in the pace of nominal wage growth over the last five years. It is difficult to find any major sector with a clear pattern of accelerating wage growth. In manufacturing, where employers often complain about the difficulty in finding good workers, wages have risen by just 2.0 percent over the last year.

In short, this is a much positive report than we saw in the prior two months. However, there is much in the report that indicates there is a still a large amount of slack in the labor market.

This work is licensed under a Creative Commons Attribution 4.0 International License

Another Phony Payroll Jobs Number — Paul Craig Roberts

http://www.paulcraigroberts.org/2015/11/06/another-phony-payroll-jobs-number-paul-craig-roberts/

The Bureau of Labor Statistics announced today that the US economy created 271,000 jobs in October, a number substantially in excess of the expected 175,000 to 190,000 jobs. The unexpected job gain has dropped the unemployment rate to 5 percent. These two numbers will be the focus of the financial media presstitutes.

What is wrong with these numbers? Just about everything. First of all, 145,000 of the jobs, or 54%, are jobs arbitrarily added to the number by the birth-death model. The birth-death model provides an estimate of the net amount of unreported jobs lost to business closings and the unreported jobs created by new business openings. The model is based on a normally functioning economy unlike the one of the past seven years and thus overestimates the number of jobs from new business and underestimates the losses from closures. If we eliminate the birth-death model’s contribution, new jobs were 126,000.

Next, consider who got the 271,000 reported jobs. According to the Bureau of Labor Statistics, all of the new jobs plus some—378,000—went to those 55 years of age and older. However, males in the prime working age, 25 to 54 years of age, lost 119,000 jobs. What seems to have happened is that full time jobs were replaced with part time jobs for retirees. Multiple job holders increased by 109,000 in October, an indication that people who lost full time jobs had to take two or more part time jobs in order to make ends meet.

Now assume the 271,000 reported jobs in October is the real number, and not 126,000 or less, where are those jobs? According to the BLS not a single one is in manufacturing. The jobs are in personal services, mainly lowly paid jobs such as retail clerks, ambulatory health care service jobs, temporary help, and waitresses and bartenders...If the US economy were actually in economic recovery, would half of the 25-year-old population be living with parents? The real job situation is so poor that young people are unable to form households. See: http://www.paulcraigroberts.org/2015/10/29/us-on-road-to-third-world-paul-craig-roberts/

MORE

The seasonally-adjusted SGS Alternate Unemployment Rate reflects current unemployment reporting methodology adjusted for SGS-estimated long-term discouraged workers, who were defined out of official existence in 1994. That estimate is added to the BLS estimate of U-6 unemployment, which includes short-term discouraged workers.

The U-3 unemployment rate is the monthly headline number. The U-6 unemployment rate is the Bureau of Labor Statistics’ (BLS) broadest unemployment measure, including short-term discouraged and other marginally-attached workers as well as those forced to work part-time because they cannot find full-time employment.

October Employment and Unemployment, Money Supply M3

• Any FOMC Rate-Boost “Certainty’ Resulting from October Jobs Reporting, Remains More Hype than Reality, with Meaningfully-Weak Data Ahead

• Except for Even-Softer September Annual Growth, in Revision, October Payroll Growth Was at a 17-Month Low

• Unusual, Unstable and Invisible Shifts in Seasonal Factors Helped to Boost or Skew Headline Payrolls

• Headline Decline in Unemployment from 5.1% to 5.0% Was a Decline from 5.05% to 5.04%

• October 2015 Unemployment: 5.0% (U.3), 9.8% (U.6), 22.8% (ShadowStats)

• Broad Annual Money Supply Growth Continued to Slow

http://www.shadowstats.com/

Demeter

(85,373 posts)The release Thursday of the 5,544-page text of the Trans-Pacific Partnership—a trade and investment agreement involving 12 countries comprising nearly 40 percent of global output—confirms what even its most apocalyptic critics feared.

“The TPP, along with the WTO [World Trade Organization] and NAFTA [North American Free Trade Agreement], is the most brazen corporate power grab in American history,” Ralph Nader told me when I reached him by phone in Washington, D.C. “It allows corporations to bypass our three branches of government to impose enforceable sanctions by secret tribunals. These tribunals can declare our labor, consumer and environmental protections [to be] unlawful, non-tariff barriers subject to fines for noncompliance. The TPP establishes a transnational, autocratic system of enforceable governance in defiance of our domestic laws.”

The TPP is part of a triad of trade agreements that includes the Transatlantic Trade and Investment Partnership (TTIP) and the Trade in Services Agreement (TiSA). TiSA, by calling for the privatization of all public services, is a mortal threat to the viability of the U.S. Postal Service, public education and other government-run enterprises and utilities; together these operations make up 80 percent of the U.S. economy. The TTIP and TiSA are still in the negotiation phase. They will follow on the heels of the TPP and are likely to go before Congress in 2017.

These three agreements solidify the creeping corporate coup d’état along with the final evisceration of national sovereignty. Citizens will be forced to give up control of their destiny and will be stripped of the ability to protect themselves from corporate predators, safeguard the ecosystem and find redress and justice in our now anemic and often dysfunctional democratic institutions. The agreements—filled with jargon, convoluted technical, trade and financial terms, legalese, fine print and obtuse phrasing—can be summed up in two words: corporate enslavement.

The TPP removes legislative authority from Congress and the White House on a range of issues. Judicial power is often surrendered to three-person trade tribunals in which only corporations are permitted to sue. Workers, environmental and advocacy groups and labor unions are blocked from seeking redress in the proposed tribunals. The rights of corporations become sacrosanct. The rights of citizens are abolished.

MORE

Demeter

(85,373 posts)...Russia, under constant attack by the US, Germany, France and Britain in the war to overthrow President Vladimir Putin, is now the only European country to show more, not less voter support for the incumbent leadership. It is also the only one with the capability to repel unwanted migration; convert its economy to domestically sustainable growth; and defeat its foreign enemies by force. The war to defend Europe from Russia is destroying Europe, fast.

When there is international war, international capital is obliged to become national. Historically, this transformation has been enforced by Elizabethan-type naval privateering, Napoleonic-type blockades, Trading with the Enemy statutes, or US-type sanctions. During these episodes international capitalism ceases to exist except as black marketeering or smuggling. The regulation (reform) of international markets becomes subordinated to national capital interests, so national cronies are bound to win over international reformers.

US and EU sanctions of the type introduced since March 2014 (individual, sectoral, scalpel, stealth) represent one front in the US-EU war against Russia. This form of warfare puts a stop to the internationalization of capital, such as US dollar pricing in commodity trade; the clearing role of US banks; and money transfer systems like SWIFT, Visa, and Mastercard. It requires Russia (China, India too) to nationalize their capital institutions, instruments, and apparatchiki.

The introductory justification for US sanctions as an attack on the “crony circle” around Putin was camouflage for a strategy of regime change, not a campaign for the clean-up of international capital abuses, tax avoidance, corruption. Extra-territorial prosecution by the US of corruption and crony capitalists is a warfighting tactic, not a business policy nor a jurisprudential doctrine. It is applied against “enemies”, such as Dmitry Firtash, but not against “friends”, such as Yulia Tymoshenko...

OBAMA COULDN'T WIN A GAME OF CHECKERS AGAINST ANYONE, LET ALONE INTERNATIONAL CHESS AGAINST PUTIN

Demeter

(85,373 posts)An economy built on a violent system of unpaid forced labor, replaced by a violent system of underpaid exploitative labor.

...The American economy was built on the wealth created by a violent system of free labor. The economic motivation for that system was most apparent in the agricultural South, and so people in this region went to increasingly great lengths over time to preserve it in spite of contradictions with American ideals of equality. The narrative of racial difference that was created to justify that system is still with us.

Our region's history of economic dependence on free, forced labor, and then later on cheap, exploitative labor, meant there were minimal opportunities for wealth creation for those outside the economic elite, and particularly for people of color, and there has been unequal investment in community resources that are beneficial to the entire population, like schools, transportation, and health care. Centuries of slavery ended only to usher in an era of racial terrorism and legal segregation. With restricted economic opportunity and nonexistent political power, black Southerners had limited capacity to invest in community institutions like schools to ensure their children received quality education (although there are many notable exceptions). Even as the policies and systems that overtly and legally segregated communities were dismantled, the emergence of new ways of drawing lines has concentrated affluence in some places and poverty in others. These policies and behaviors are often developed without consciously racist intentions, but they have served to reinforce the importance of place in determining opportunity...

Slavery, and the racist beliefs that were constructed to support slavery's endurance until the Emancipation Proclamation, was not an inevitable economic system. And, even though we understand its roots, the structural racism and segregation that followed were not inescapable. When we understand the history of racism in the U.S. — how the design of our economy and our policies created these current conditions, rather than seeing them as accidents of fate or unknowable mysteries — then we understand that poverty, a lack of opportunity, and inequality are not intractable. Because we do not know that history, we are perplexed by the situation we have found ourselves in ("What went wrong in the South? No one really knows!"

We need to stop reacting to dramatic regional or group differences in outcomes as baffling idiosyncrasies and start digging into them for information about how well our society as a whole is functioning. We should focus our efforts on the people and communities that appear to be outliers, because those are the places where the failures of our system are most apparent, according to Rosanne Haggerty. "What would work for those outliers is actually something that would work for anyone," says Haggerty. A community's Infrastructure of Opportunity must be designed to provide reliable options for all young people, regardless of family wealth and background. The places that have better outcomes for low- and middle-income young people also tend to have better outcomes for high-income young people, too (see Equality of Opportunity Project), indicating that the types of resources, systems, and investments that matter for the economic and educational success of young people are beneficial across the board...

GOOD ANALYSIS...READ THE REST!

Demeter

(85,373 posts)AN EXCELLENT QUESTION!

http://www.theguardian.com/commentisfree/2015/nov/09/married-people-wealthier-why-give-them-tax-breaks?CMP=ema_565a

The US government should remove some of the benefits attached to marriage and give them to those who need them the most

THINK OF HOW MANY WOULD BE FREE TO DIVORCE AT LAST!

Marriage can help reduce economic inequality when it serves as a vehicle for people to cross class boundaries. But if wealth marries wealth, as it often does, it serves as a mechanism to accumulate capital and redistribute it upward. That’s just one reason why the state subsidization of marriage in the United States makes so little sense.

Conservatives often say that married couples and their children fare better than their counterparts in a variety of measures – and thus the US government should continue to promote marriage. As Senator Marco Rubio put it, marriage is “the greatest tool to lift children and families from poverty”.

But is it?

In the United States today, marriage serves primarily as a mechanism for upward distribution of wealth. Since the 1960s, there has been a rise in the number of individuals who marry people with similar educational and economic backgrounds (a phenomenon called “assortative mating”). The percentage of college graduates who marry other college graduates has doubled since then.

MORE

Demeter

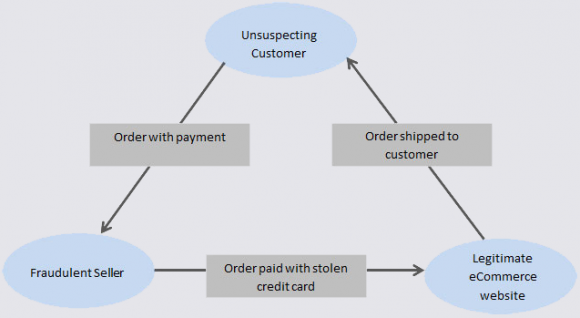

(85,373 posts)“How do fraudsters ‘cash out’ stolen credit card data? Increasingly, they are selling in-demand but underpriced products on eBay that they don’t yet own. Once the auction is over, the auction fraudster uses stolen credit card data to buy the merchandise from an e-commerce store and have it shipped to the auction winner. Because the auction winners actually get what they bid on and unwittingly pay the fraudster, very often the only party left to dispute the charge is the legitimate cardholder”. Amazingly intelligent, especially (I assume) for the non-credentialled...NAKED CAPITALISM LAMBERT STRETHER

http://krebsonsecurity.com/2015/11/how-carders-can-use-ebay-as-a-virtual-atm/

...So-called “triangulation fraud” — scammers using stolen cards to buy merchandise won at auction by other eBay members — is not a new scam. But it’s a crime that’s getting more sophisticated and automated, at least according to a victim retailer who reached out to KrebsOnSecurity recently after he was walloped in one such fraud scheme.

The victim company — which spoke on condition of anonymity — has a fairly strong e-commerce presence, and is growing rapidly. For the past two years, it was among the Top 500 online retailers as ranked by InternetRetailer.com.

The company was hit with over 40 orders across three weeks for products that later traced back to stolen credit card data. The victimized retailer said it was able to stop a few of the fraudulent transactions before the items shipped, but most of the sales were losses that the victim firm had to absorb...

Demeter

(85,373 posts)The Powys tax rebellion, led by traders including the town’s salmon smokery, local coffee shop, book shop, optician and bakery, could spread nationwide

When independent traders in a small Welsh town discovered the loopholes used by multinational giants to avoid paying UK tax, they didn’t just get mad.

Now local businesses in Crickhowell are turning the tables on the likes of Google and Starbucks by employing the same accountancy practices used by the world’s biggest companies, to move their entire town “offshore”.

Advised by experts and followed by a BBC crew, family-run shops in the Brecon Beacons town have submitted their own DIY tax plan to HMRC, copying the offshore arrangements used by global brands which pay little or no corporation tax.

Read more: http://www.walesonline.co.uk/news/wales-news/crickhowell-traders-take-town-offshore-10424580

Demeter

(85,373 posts)A significant change made last year to the Dodd-Frank financial overhaul law produced new risks to investors by allowing banks to keep nearly $10 trillion in certain derivatives trades on their books, according to a study released Tuesday by two Democratic lawmakers.

The results were released by Sen. Elizabeth Warren of Massachusetts, a leading proponent of tough regulations on Wall Street, and Rep. Elijah Cummings of Maryland, the top Democrat on the House Overnight and Government Reform Committee. The two had asked financial regulators earlier this year to assess the impact of the change and the risks it created for taxpayers. The change curtailed a requirement that banks push certain high-risk swaps trading activities out of bank holding companies that enjoy access to the government safety net.

The Federal Deposit Insurance Corp. said in a letter to the lawmakers that the 15 banks currently registered as swap dealers along with their subsidiaries hold up to $9.7 trillion of the types of derivatives affected by the change, about 4.4% of all outstanding derivatives contract holdings at federally insured banks. The amount included about $6.1 trillion in credit derivatives, $1 trillion in commodity derivatives and $2.6 trillion in equities derivatives, according to the FDIC letter published by the lawmakers.

http://blogs.wsj.com/moneybeat/2015/11/10/warren-dodd-frank-rollback-kept-10-trillion-in-swaps-on-banks-books/

Demeter

(85,373 posts)There’s a growing segment of the American population that earns a decent salary but lives paycheck-to-paycheck: the income-rich and asset-poor.

Empty bank balances are often associated with those on the lowest rungs of the income ladder. But many members of America’s upper-middle class have almost no emergency cushion and are woefully unprepared for retirement. And years into the recovery, they are still struggling, leaving the entire economy vulnerable.

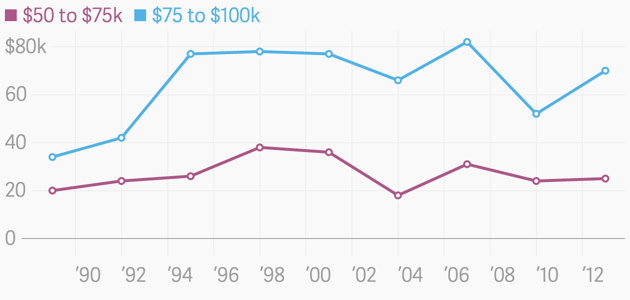

The median household income in America is about $55,000. To earn more than that is to do relatively well, particularly in low-cost areas. That’s what they bring in, but what do they really have? The figure below plots financial assets held by members of the upper-middle class aged 40 to 55. (Financial assets are any assets a household owns that isn’t a house, car, or business, which means it includes all retirement funds.)

Even a relatively high earner who has been working many years typically only has $70,000 in financial assets, which isn’t even a year’s salary for a high earner. That’s just the average—about 25 percent of upper-middle-class 40- to 55-year-olds have less than $17,500 in financial assets. Financial assets trended up in the 1990s, and have nearly recovered since the financial crisis. But one reason asset balances went up is the increased popularity of 401(k) plans. In the 1980s, companies saved for their employees through defined-benefit pensions. Now, people do it for themselves.

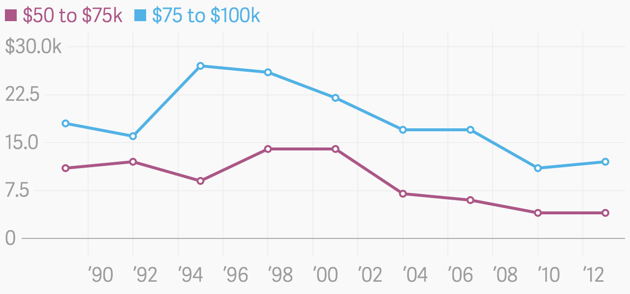

The figure below represents financial assets without retirement accounts. And it looks like the upper-middle class has fewer assets than ever.

Of course, 401(k) savings probably displaced other forms of saving. That is, after putting money into their retirement accounts, people don’t have much left over to save in other ways or don’t feel the need to do so. But this could also lead people to rely on those accounts in a pinch, which is a bad strategy since retirement accounts have penalties for early withdrawal. The fact that the average upper-middle-class household has just $12,200 in non-pension financial wealth is disturbing. Even worse, within that group, about 25 percent of the higher-earning population had only $3,200 in 2013. It’s no wonder one-quarter of all American households couldn’t come up with $2,000 if they faced an emergency—it’s not just low earners.

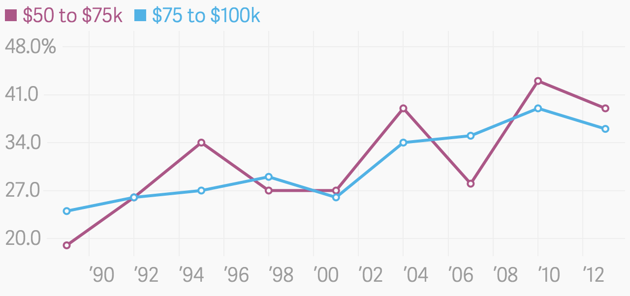

The financial picture gets even darker when factoring in how much debt the upper-middle class has. Below is the leverage ratio (similar to how people assess bank health), which represents how much debt someone has relative to their assets.

MORE BAD NEWS AT LINK

Demeter

(85,373 posts)

I'M OFF TO DO MY TWO: THE IMPOSSIBLE AND THE POINTLESS.

HAVE A HAPPY HUMP DAY, EVERYONE! TRY SUPER HARD!

HEAVY FROST AGAIN...33F AT 6:45, WITH SUN JUST BELOW HORIZON