Economy

Related: About this forumSTOCK MARKET WATCH -- Thursday, 10 December 2015

[font size=3]STOCK MARKET WATCH, Thursday, 10 December 2015[font color=black][/font]

SMW for 9 December 2015

AT THE CLOSING BELL ON 9 December 2015

[center][font color=red]

Dow Jones 17,492.30 -75.70 (-0.43%)

S&P 500 2,047.62 -15.97 (-0.77%)

Nasdaq 5,022.87 -75.38 (-1.48%)

[font color=green]10 Year 2.21% -0.03 (-1.34%)

30 Year 2.97% -0.01 (-0.34%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)You know your campaign is making progress when the GOP officials are trying to figure out how to remove you without calling on an assassin.

I'm trying to imagine the USA trumped....

Warpy

(111,300 posts)I preferred the wishful thinking one:

Tansy_Gold

(17,865 posts)I'm so sick of it.

And we have 11 more months of it.

As soon as it's over, the re-election campaign will start.

Or the impeachment hearings.

Fuddnik

(8,846 posts)Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-08/schaeuble-fights-eu-deposit-insurance-plan-in-clash-with-ecb

German Finance Minister Wolfgang Schaeuble lashed out at plans for joint European deposit insurance, saying the proposal threatens central-bank independence and may be illegal under European Union treaties. Schaeuble’s comments on Tuesday pitted him against officials from the European Central Bank, Italy and Ireland during a public discussion that underscored disputes holding up shared deposit backing, including how to address the risks of government bonds on banks’ balance sheets.

The ECB “strongly” supports the European Commission’s plan to introduce common deposit insurance over eight years, ECB Vice President Vitor Constancio said. Schaeuble countered that sovereign risk weighs down banks in too many nations, which shouldn’t benefit from more joint insurance until that’s been addressed. In addition, the ECB is breaching the barrier between monetary policy and its new bank-oversight goals, he said.

“There must be a clear Chinese wall or at least a division by primary law between banking supervision and monetary policy,” said Schaeuble, who called for a treaty change on the ECB’s role and questioned whether current treaties allow deposit insurance as envisaged.

As European banks are generally allowed to treat sovereign debt on their balance sheets as free of default risk, any move to add risk weighting or limit such holdings could cause shocks. In Tuesday’s debate, Constancio called for working globally to address the sovereign-risk question to avoid market disruptions. The European Commission’s proposal would apply to euro-area countries and any others that want to join.

Schaeuble’s calls for risk reduction won more allies than his legal questions about the EU proposal. Finnish Finance Minister Alexander Stubb said his view of the legal issues was “a little bit softer” than Schaeuble’s, though risks needed to be addressed before deposit insurance moves ahead. Dutch Finance Minister Jeroen Dijsselbloem called for concrete plans on how to limit banking risks...

NOW they're worried?

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-10/billions-of-barrels-of-oil-vanish-in-a-puff-of-accounting-smoke

In an instant, Chesapeake Energy Corp. will erase the equivalent of 1.1 billion barrels of oil from its books...Across the American shale patch, companies are being forced to square their reported oil reserves with hard economic reality. After lobbying for rules that let them claim their vast underground potential at the start of the boom, they must now acknowledge what their investors already know: many prospective wells would lose money with oil hovering below $40 a barrel.

Companies such as Chesapeake, founded by fracking pioneer Aubrey McClendon, pushed the Securities and Exchange Commission for an accounting change in 2009 that made it easier to claim reserves from wells that wouldn’t be drilled for years. Inventories almost doubled and investors poured money into the shale boom, enticed by near-bottomless prospects. But the rule has a catch. It requires that the undrilled wells be profitable at a price determined by an SEC formula, and they must be drilled within five years.

Time is up, prices are down, and the rule is about to wipe out billions of barrels of shale drillers’ reserves. The reckoning is coming in the next few months, when the companies report 2015 figures...The rule change will cut Chesapeake’s inventory by 45 percent, regulatory filings show. Chesapeake’s additional discoveries and expansions will offset some of its revisions, the company said in a third-quarter regulatory filing. Gordon Pennoyer, a spokesman for Oklahoma City-based Chesapeake, declined to comment further. Other examples include Denver-based Bill Barrett Corp., which will lose as much as 40 percent, and Oasis Petroleum Inc., based in Houston, which will erase 33 percent, according to filings. Larry Busnardo, a Bill Barrett spokesman, declined to comment. Richard Robuck of Oasis didn’t respond to questions.

The U.S. shale revolution, which brought the country closer to energy self-sufficiency than at any time since the 1980s, was built on money borrowed against the promises of future output. New wells that could be drilled when U.S. oil was selling for $95 a barrel -- last year’s price as calculated by the SEC’s formula -- simply don’t pay at today’s prices, and the revolution has stalled.

more

Proserpina

(2,352 posts)The breathtaking crash in oil prices has generated a new conventional wisdom: America’s shale oil industry has supplanted OPEC as the so-called “swing” producer, rendering the 55-year-old cartel powerless to affect the price of crude. Veteran oil analyst Daniel Yergin told Bloomberg TV this week that the emergence of U.S. shale companies as “the swing producer” contributes to oil price volatility “because you’re talking about the impact of decisions made by thousands of individual producers.”

With apologies to Yergin and others saying similar things, this is wrong on several levels. OPEC remains the only group that can meaningfully affect the price of oil by purposely raising or lowering output. American shale producers don’t coordinate their actions strategically the way the Vienna-based organization does; they must take whatever price the market gives them. To the degree that American shale producers do influence world oil prices by independently raising output when prices are high and cutting it when prices are low, they tend to stabilize the market, not add to volatility, as Yergin contends. (A spokesman for Yergin said he was traveling and not available for comment on this story.)

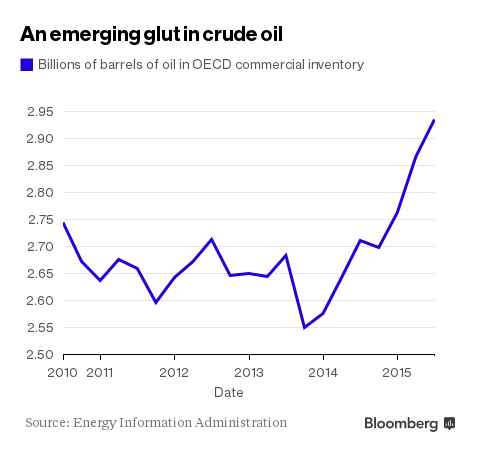

Oil is certainly volatile at the moment. The price of West Texas Intermediate, the U.S. benchmark, stood at slightly over $100 a barrel as recently as June 2014. But soft economic growth and rising production, including from American frackers, has pushed it steadily lower. It broke below $40 on Dec. 4, the day OPEC oil ministers meeting in Vienna announced that production levels would remain unchanged, and it continued to sag in the following days, reaching a six-year low of $37.23 on Dec. 9. Inventories in the Organization of Economic Cooperation and Development nations, up 11 percent since June 2014, are at the highest since at least 1996.

Notice that oil’s latest slide didn’t occur after a price-setting conclave of U.S. frackers in Houston—and that's because there is no such gathering. The drop came after a pivotal OPEC meeting in which the cartel’s most important member, Saudi Arabia, chose to maintain market share rather than to cut back production in hopes of pushing the price up for the good of the cartel as a whole. The point is: What OPEC does still matters...

and the speculators, must not forget their influence

Proserpina

(2,352 posts)The greatest monetary-easing cycle in the history of the U.S. has left a mind-boggling amount of cash floating around in the economy. Banks hold $2.5 trillion in excess reserves -- money they essentially don’t know what to do with -- at the Federal Reserve.

So as the Fed prepares to raise interest rates from near zero as soon as next week, bond investors are on edge. Beyond all the "is-this-the-right-move" questions that surround every increase, there’s a logistical concern: With so much cash sloshing around, will Fed officials be able to nudge rates as high as they want? Will the new-fangled tools they’ve created to engineer the move work, or instead sow the kind of confusion that can dent the Fed’s credibility and spur a broader market selloff?

Many investors are taking no chances.

They’re piling into the safest, most liquid securities available, or those that move them as far away from the epicenter of the U.S. financial system as possible. James Camp at Eagle Asset Management is buying Treasuries and unloading debt linked to credit, such as corporate bonds. Peter Yi, director of short-term fixed income at Northern Trust Corp. is stockpiling cash. Jerome Schneider, head of short-term strategies at Pacific Investment Management Co., is diversifying into securities such as debt in foreign currencies. In a sign of the search for liquidity, U.S. money funds have cut the average maturity of their assets to the lowest since 2006...At issue is the Fed’s balance sheet, which ballooned as it bought bonds to pump cash into the economy and support faltering growth. Policy makers need new methods to drain that money and push rates higher in an interbank lending market, known as fed funds, that has become harder to influence now that cash-heavy banks rely on it infrequently.

Proserpina

(2,352 posts)Analysts at JPMorgan Chase say the Federal Reserve has 670 billion reasons to deliver a "dovish hike" if it elects next week to raise interest rates for the first time in nine and a half years.

The consensus view is that the central bank will take care to avoid upsetting risk appetite at the time of liftoff by emphasizing a gradual glide path higher for rates, lowering the "dot plot" of preferred policy rates, or inserting language that ties additional hikes to actual increases in inflation. A return to robust monthly jobs growth and nascent signs of accelerating wage increases have, however, left more than a few economists doubting that a hike will be accompanied by overtly dovish messaging.

A report from JPMorgan's global quantitative and derivatives team, led by Marko Kolanovic, emphasizes the necessity of not roiling the markets. Extenuating circumstances in the options market could provoke a wave of selling pressure in equities precisely when the Fed seeks to ease markets into a new rate regime, Kolanovic warned.

"This important event falls at a peculiar time–less than 48 hours before the largest option expiry in many years," wrote Kolanovic, noting that $1.1 trillion worth of Standard & Poor's 500-stock index options–of which $670 billion are puts–will expire on Dec. 18. Roughly one-third of the puts poised to expire are at or near the money, with strike prices from 1,900 to 2,050.

"Clients are net long these puts and will likely hold onto them through the event and until expiry," the strategist wrote. "At the time of the Fed announcement, these put options will essentially look like a massive stop loss order under the market."

When a put is close to expiry, the writer of the option becomes a seller of the underlying security as it hits the strike price in order to mitigate the exposure. Thus, a negative reaction in the S&P 500 index to the Fed decision could trigger a wave of forced selling, potentially agitating markets...

it's madness, total madness

more

Proserpina

(2,352 posts)Janet Yellen’s U.S. Federal Reserve shouldn’t raise interest rates next week, because doing so could jeopardize economic growth and worsen inequality, said Nobel laureate Eric Maskin.

“The unfortunate thing is that if you raise interest rates there is a risk -- again, it may be small, but it’s a significant risk -- that you will slow down the recovery,” Maskin said in an interview in Moscow on Tuesday. “Maybe she knows something that I don’t know, and she sees signs of inflation I don’t see, but I really don’t understand why it’s so important to raise interest rates when there is so little to be afraid of.”

Yellen told lawmakers last week a rate increase at the Federal Open Market Committee’s Dec. 15-16 meeting was a “live option” given that the economy is “doing well,” and a move from the current near-zero level is widely expected. While the Fed hasn’t hit its inflation target for more than three years, a series of strong jobs reports are giving officials confidence that prices can pick up even as they raise borrowing costs for the first time since 2006.

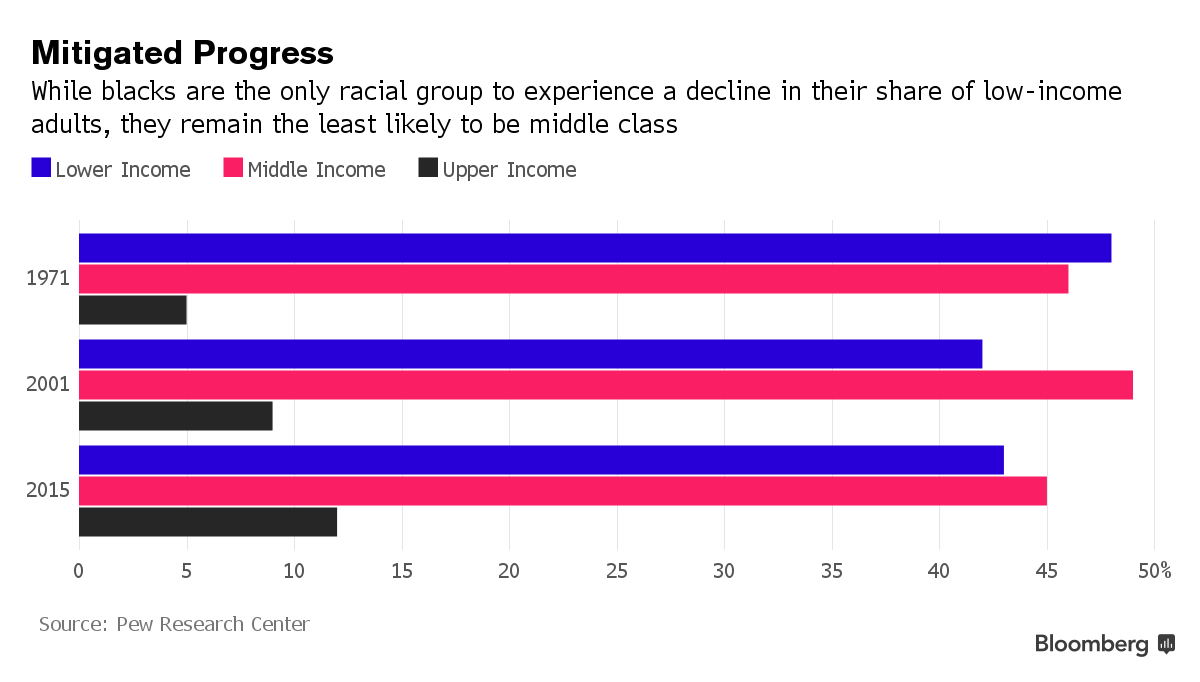

Maskin, who won the Nobel in economics in 2007, also said a move would also widen the divide between those who have savings and those who don’t. This isn’t just an academic issue for Yellen -- she was asked about income inequality at the same Dec. 3 congressional hearing, and said it was showing a “very disturbing trend” upward, though said the central bank can’t tackle the key factors behind this increase.

“I worry that raising interest rates is a move to increase inequality, not to decrease it,” Maskin said. “Most people don’t have much savings, most people rely on their wage income. And the problem with raising interest rates is that you make investment in businesses less profitable and so you make it more difficult for wage earners. You help savers, the investors, but you hurt people who rely on wage incomes.”

more

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-09/bitcoin-hits-highs-on-possible-unmasking-of-creator

Bitcoin climbed on Wednesday to hit its highest levels since early November, amid fresh speculation that the identity of Satoshi Nakamoto—the virtual currency's creator—may have finally been revealed.

Bitcoin's price hit $423 after Wired and Gizmodo published separate articles this week asserting that Craig Steven Wright, a businessman in Australia, was involved in the invention of the cryptocurrency. The more specific reason why this would cause a rally is because the reports included mention of a legal arrangement that keeps a very large chunk of 1.1 million bitcoins locked up in a trust until 2020. The view is that this removes the risk of a big supply hitting the market anytime soon and depressing prices, and boosts confidence in the value of bitcoin right now.

Such a development, if true, also "would be viewed by everyone as positive and legitimatizing" bitcoin, said Brendan O'Connor, chief executive officer at Genesis Global Trading, an institutional trading firm involved in bitcoin.

Still, it's unclear whether the publications got it right. Any controversy in bitcoinworld usually triggers heated discussion, and there are some who think the evidence cited by Gizmodo and Wired were faked...

whatever...more

Proserpina

(2,352 posts)http://www.bloomberg.com/news/articles/2015-12-09/bad-burgers-are-gold-to-kkr-as-china-scandals-yield-opportunity

China’s continual food safety scares haven’t spoiled the appetite of Julian Wolhardt, one of KKR & Co.’s top executives in the country. In fact, they’ve been good for deals. He spent more than two years trying to persuade the chairman of China’s largest chicken breeder and processor, Fujian Sunner Development Co., to accept an investment from KKR, arguing that private-equity backing could help the company take market share. Fu Guangming kept saying no, even after the outbreaks of avian flu in 2013 and early 2014 hurt the poultry industry.

Then, in July last year, Wolhardt got a break. News broke that the Chinese supplier to McDonald’s Corp. and Yum! Brands Inc.’s KFC had been repackaging old meat as new. Amid the outcry that followed, Wolhardt redoubled his efforts. Fu relented. The next month, KKR agreed to buy a $400 million stake in publicly traded Sunner, its biggest investment in China’s food sector.

More than any other buyout firm, KKR has wagered that China’s recurring food-safety scandals can yield windfalls for an investor willing to shoulder the risk. The New York-based firm has spent about $1 billion on five food-related investments in the world’s second largest economy since 2008, spanning everything from milk to fish feed. The aftermath of a food scandal is an opportune time to buy, according to Wolhardt: Owners are more willing to sell and rival companies are often battered by the event.

“If you’re a company, when a market incident happens, you want to work with an investor like us to really take advantage of the market downturn,” Wolhardt, 42, said in an interview last month.

*************************

"The crisis is actually a catalyst, because without the incident, people will never bother to tell good milk versus bad milk," Liu said. "When you had the melamine crisis happen, the biggest benefit to us is people are willing to pay a premium for quality milk."

more

Proserpina

(2,352 posts)Uber Technologies Inc. drivers seeking to be treated as employees won a ruling that adds tens of thousands of them to the case and may put hundreds of millions of dollars more at stake.

A judge’s decision Wednesday that will likely let the vast majority of Uber’s 160,000 drivers in California join the case as it heads toward trial in June expands the company’s liability exponentially, legal experts said. A victory for the drivers threatens to upend the ride share company’s business model and cut into its more than $60 billion valuation.

The drivers can now seek expense reimbursement, including as much as 57 1/2 cents for every mile driven, in addition to their claims for tips that are already part of the case, under the ruling by U.S. District Judge Edward Chen in San Francisco.

“A lot rides on this case,” Catherine Fisk, a law professor at the University of California at Irvine, said before the ruling was issued. “Uber’s business model rests on outsourcing to its employees the fixed costs of running a huge fleet of cars for hire." While reimbursing any individual driver for her expenses is small, “in the aggregate it appears to be a substantial amount of money,” she said.

Uber said it will appeal the ruling immediately.

“Nearly 90 percent of drivers say the main reason they use Uber is because they love being their own boss,” the company said in a statement. “As employees, drivers would lose the personal flexibility they value most -- they would have set shifts, earn a fixed hourly wage, and be unable to use other ridesharing apps.”

more

Proserpina

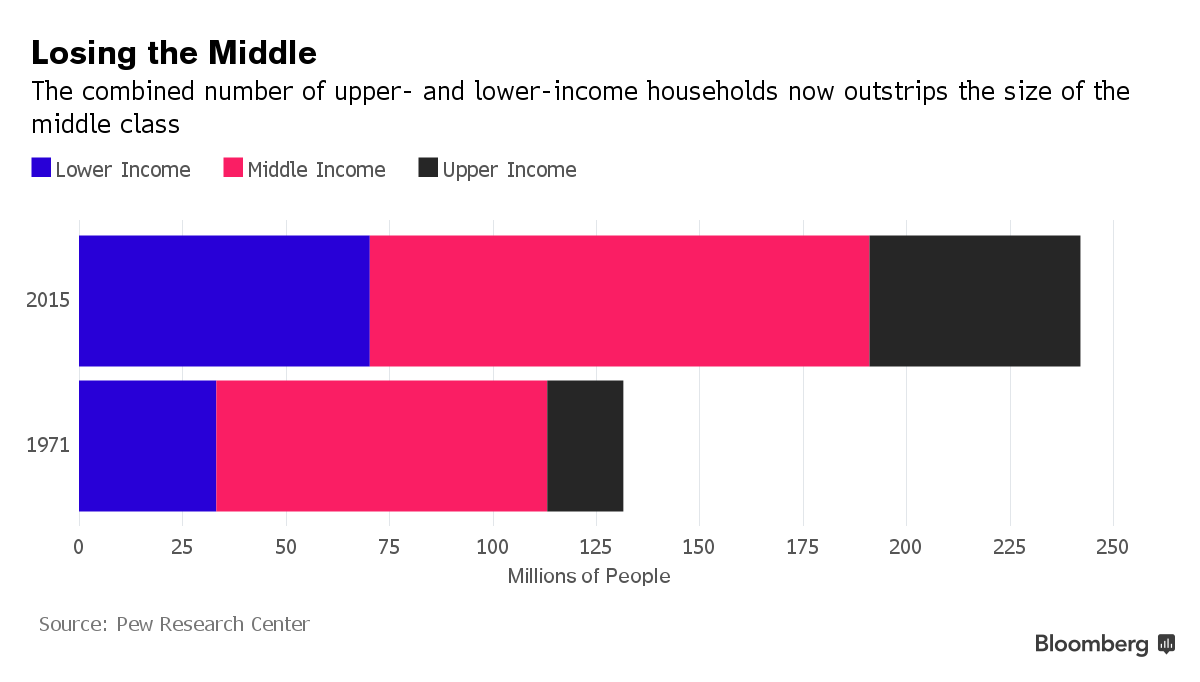

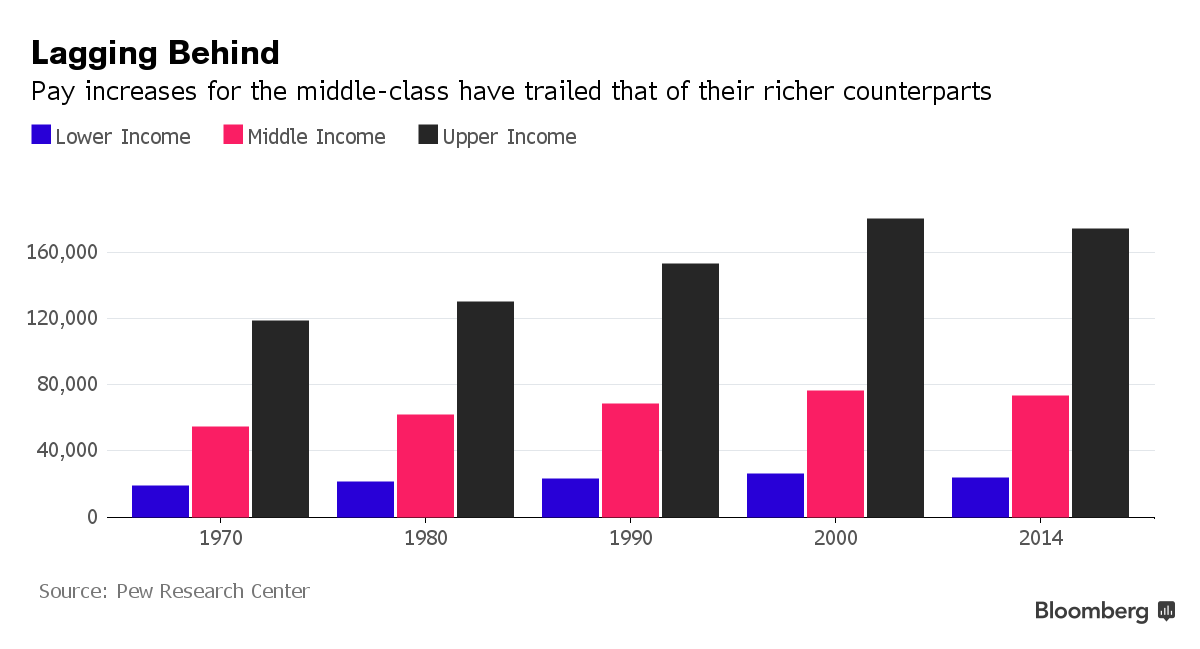

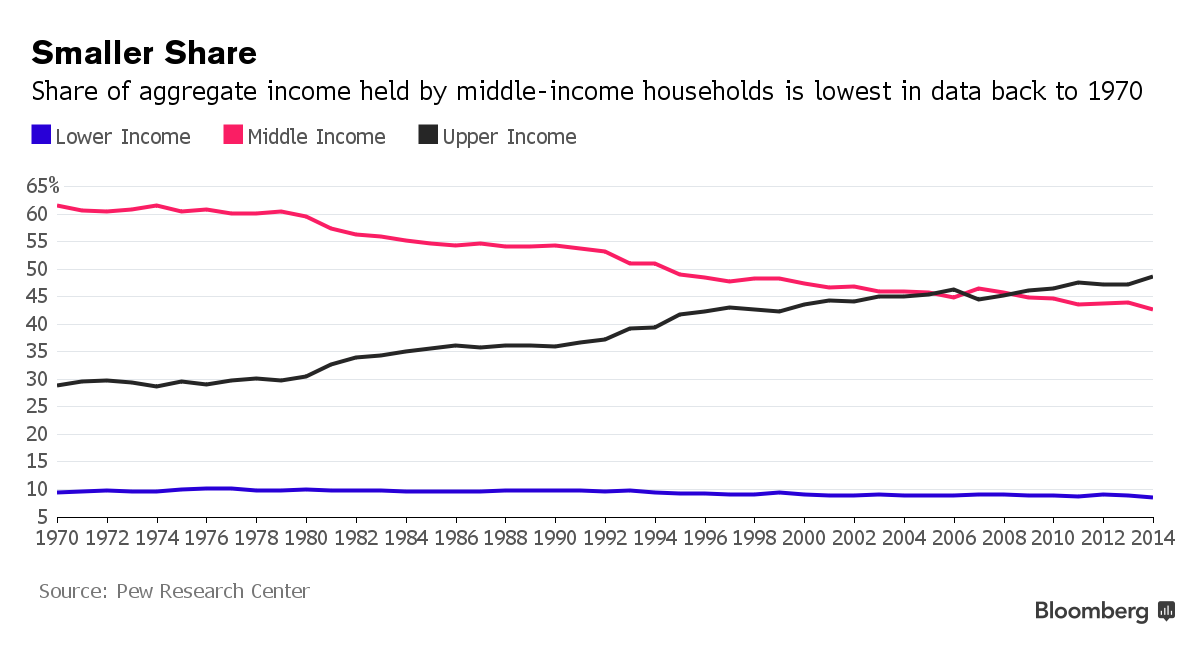

(2,352 posts)They're now outnumbered by the richest and poorest...In the age of rising income inequality, the task of preserving America’s middle class has been taken on by politicians across the ideological spectrum. A new report from Pew Research Center shows just how much the economic fortunes of this group have changed since the 1970s.

In every decade since then, the percentage of adults living in middle-income households has fallen, according to Pew, which is based in Washington. The share now stands at 50 percent, compared with 61 percent in 1971.

This matters because the "state of the American middle class is at the heart of the economic platforms of many presidential candidates ahead of the 2016 election," Pew researchers Rakesh Kochhar and Richard Fry wrote in their report. Meanwhile "a flurry of new research points to the potential of a larger middle class to provide the economic boost sought by many advanced economies."

Pew defines a middle-class household as one having income that is two-thirds to double that of the overall median household income. A family of three, for instance, would need to have a minimum income of $41,869 to qualify as middle-income...

Proserpina

(2,352 posts)The concentration of personal wealth has received a lot of attention since the publication of Thomas Piketty’s Capital in the 21st Century. This column investigates the UK and finds wealth distribution to be highly concentrated. The data seem to suggest that the top wealth share has increased in the UK over the first decade of this century.

The concentration of personal wealth is now receiving a great deal of attention after having been neglected for many years. The much discussed book by Thomas Piketty, Capital in the 21st Century, stirred up an astounding debate across the world due to his dystopic vision of a future world where wealth will be more and more concentrated within the hands of a small elite that will perpetrate its own power by passing on enormous fortunes and advantages to the select few of the following generation.

Piketty urged governments to take steps to prevent this from happening. As argued by Ravi Kanbur and Joseph Stiglitz in a recent Vox column (Kanbur and Stiglitz 2015), the increase in wealth we observe nowadays stems in part from the increase in rents which “once created will provide further resources for rentiers to lobby the political system to maintain and further increase rents”. The surge of interest in wealth distribution is additionally justified by the recognition that, in seeking to understand the determinants of rising income inequality, we need to look not only at wages and earned income but also at income from capital, particularly at the top of the distribution.1

But how much do we actually know about wealth concentration at the top and how it is changing today? In a new paper (Alvaredo et al. 2015), we look at the UK – a country where the wealth distribution has long been studied – and ask three questions:

• What is the share of total personal wealth that is owned by the top 1%?

• Is wealth much more unequally distributed at the top than income?

• How far is wealth concentration increasing in the 21st century?

Our central theme is that there are different sources of evidence about wealth concentration, each with strengths and weaknesses. To some extent they tell similar stories, but there are also key differences, and these differences explain in part the reasons why the subject has given rise to controversy...more

Proserpina

(2,352 posts)Adam Smith:

“The Labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

With more modern Capitalism it’s better hidden:

The Rothschild brothers of London writing to associates in New York, 1863:

“The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

mahatmakanejeeves

(57,539 posts)by Michelle Jamrisko

@mljamrisko

December 10, 2015 — 8:30 AM EST Updated on December 10, 2015 — 8:54 AM EST

Applications for U.S. unemployment benefits jumped last week to a five-month high, interrupting steady labor-market progress. ... Jobless claims rose by 13,000 to 282,000 in the week ended Dec. 5, the highest level since July 4, a Labor Department report showed Thursday. The median forecast in a Bloomberg survey was 270,000. Even with the increase, filings are holding close to four-decade lows.

The jump last week represents a departure from a more subdued level of dismissals and may reflect the difficulty adjusting the data during the year-end holidays. Employers in November hired at a faster pace than projected, highlighting headway in the job market that will probably convince Federal Reserve policy makers to raise borrowing costs next week.

“This is a time of the year when weekly readings can be volatile, due to a string of holidays and turn-of-the-year churn in the labor market,” Stephen Stanley, chief economist at Amherst Pierpont Securities LLC in Stamford, Connecticut, said in a note to clients. “As the November employment report confirmed, the labor market continues to steam ahead toward full employment with a historically low pace of layoffs.”

Estimates of 43 economists in the Bloomberg survey for jobless claims ranged from 260,000 to 285,000. The prior week was unrevised at 269,000. In July, filings dropped to 255,000, the lowest since the 1970s.

Unemployment Insurance Weekly Claims Report