Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 18 December 2015

[font size=3]STOCK MARKET WATCH, Friday, 18 December 2015[font color=black][/font]

SMW for 17 December 2015

AT THE CLOSING BELL ON 17 December 2015

[center][font color=red]

Dow Jones 17,495.84 -253.25 (-1.43%)

S&P 500 2,041.89 -31.18 (-1.50%)

Nasdaq 5,002.55 -68.58 (-1.35%)

[font color=green]10 Year 2.22% -0.03 (-1.33%)

30 Year 2.93% -0.03 (-1.01%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)until that one, today.

After yesterday's migraine and today's final, I am wiped.

Proserpina

(2,352 posts)A criminal lawyer representing Turing Pharmaceuticals chief Martin Shkreli has informed his client that he is raising his hourly legal fees by five thousand per cent, the lawyer has confirmed.

Minutes after Shkreli’s arrest on charges of securities fraud, the attorney, Harland Dorrinson, announced that he was hiking his fees from twelve hundred dollars an hour to sixty thousand dollars.

Shkreli, who reportedly received the news about the price hike while he was being fingerprinted, cried foul and accused his attorney of “outrageous and inhumane price gouging.”

“This is the behavior of a sociopath,” Shkreli was heard screaming.

For his part, Shkreli’s lawyer was unmoved by his client’s complaint. “Compared to what he pays for an hour of Wu-Tang Clan, sixty thou is a bargain,” he said.

Proserpina

(2,352 posts)In her first article, A Revolving Door Helps Big Banks’ Quiet Campaign to Muscle Out Fannie and Freddie, Morgenson showed, in gory detail, how Wall Street had labored mightily to take over the activities of the mortgage behemoths for their fun and profit. Mind you, it’s not as if they already take a big proportion of the savings from the mortgage guarantee for themselves now; you can see that in refis, where much of the benefit of the interest rate reduction is chewed up in fees and other charges. Her second article, Fannie and Freddie’s Government Rescue Has Come With Claws, discusses in depth how the Administration flagrantly violated the terms of its own bailout deal to hoover up the earnings from Fannie and Freddie for Treasury, rather than give shareholders the proportion they were due, and took other punitive measures that were contrary to the 2008 legislation that set forth how a conservatorship of Fannie and Freddie would work.

These pieces provide insight into the state of play with government sponsored enterprise “reform” and also as a case study of how banks influence government policy, and how eager the Obama Administration has been to take up their cause (not that a Republican or Clinton Administration would behave any differently).

Cynics may regard these two stories as a bit moot, since the banks appear to have lost the fight to take over the operations of the government sponsored enterprises, and the case over the alleged mistreatment of Fannie and Freddie shareholders is being adjudicated. But don’t mistake the fact that the story (save for Morgenson’s recap) is out of the headlines for the notion that the banks aren’t continuing to move forward. As Morgenson points out, they are working to see how much they can get the regulators to cede to them through administrative processes, meaning without getting legislation passed. And as a Congressional staffer stressed, the big financial firms are moving their game pieces into place so they can take up the fight again after the 2016 elections.

But Morgenson’s focus on the machinations of the banks and their allies in government resulted in her not incorporating the policy issues. And without an understanding the policy problems, it’s easy to draw the wrong conclusions about how we got where we are and what might be the best approaches going forward.

At the core is an issue that no one wants to ‘fess up to: that the wildly popular 30 year fixed rate mortgage, which in most cases a borrower can refinance at any time, is a product that would not exist absent government support. It does not exist in any other advanced economy mortgage market (at least in any size). The reason is that it is extremely unattractive to lenders. The lender is potentially exposed to a very long term credit risk*, and he is also exposed to the worst sort of interest rate risk. A long term fixed rate bond is already risky, and is particularly unattractive in a low-yield environment). But even worse, the refi option in US mortgages means that the mortgage disappears (as in gets refinanced) when it turns out to be a winner for the borrower, that is, when interest rates fall.**

A Short History of the Evolution of the Mortgage Market and the GSEs follows: see link

Warpy

(111,336 posts)but bankers who had never offered home buyers decent terms just couldn't cope with seeing all that interest money going to the government, not even with the fat loan service fees they were being paid. So they pitched a fit and got conservatives in both parties to privatize it, then create Freddie Mac shortly thereafter to give the illusion of competition.

And no, no one will fess up to banker greed screwing up a fantastic system that worked, either.

Proserpina

(2,352 posts)Ally Financial Inc. is reentering the mortgage business just two years after it stopped making new home loans.

Ally, whose defunct GMAC Mortgage unit was one of the biggest lenders of subprime mortgages in the run-up to the 2008 housing bust, will inch back into direct home loan originations next year, the bank’s Chief Executive Officer Jeffrey Brown said this week at a Goldman Sachs Group Inc. financial conference in New York.

“Don’t think of this as Ally going down the road of the old GMAC,” Brown said, referring to the home lending unit that brought Ally to the brink of collapse.

The bank has no plans to securitize its originations, and it won’t keep any servicing rights or build out a servicing operation, Ally spokeswoman Gina Proia said in an e-mail. The bank will detail new product offerings, including a new credit card, at its investor conference in February...more

At the height of the housing boom in 2006, GMAC’s Residential Capital, ranked 12th among U.S. subprime lenders, according to trade publication Inside Mortgage Finance. When Ally exited home lending in 2013, former CEO Michael Carpenter said mortgages were in its “rear-view mirror.” That ended an almost 30-year foray that led to more than $10 billion in losses and a $17.2 billion U.S. bailout...

Proserpina

(2,352 posts)The mortgage interest tax deduction is a garbage policy.

It's hugely regressive: 52 percent of the benefit goes to the richest 10 percent of Americans, and only 0.1 percent of the benefit goes to the poorest 20 percent. The deduction is supposed to encourage homeownership, but economists Edward Glaeser and Jesse Shapiro have found that it overwhelmingly goes to rich people who'd own homes anyway, so there's "almost no effect" on the number of people owning. It does, however, make people buy bigger houses, which is bad for carbon emissions, encourages low-density, sprawling housing construction, and discourages living in cities. As if that weren't enough, it gives housing an edge over alternative investments, which prevents investment in more productive areas. And its cost dwarfs spending on housing programs actually meant to help the poor.

But the mortgage interest deduction is also hugely popular with people in the top 40 percent or so of the income distribution, and those people have an outsize voice in our democracy. So outright repeal seems like a pipe dream. But a new report from the Tax Policy Center confirms that even milder policies could do a lot of good. Chenxi Lu, Joseph Rosenberg, and Eric Toder consider three options:

- Only make interest on the first $500,000 of a mortgage deductible (currently the cap is $1 million)

- Turn the deduction into a nonrefundable 15 percent credit, which even people not itemizing their taxes can claim

- Doing both 1 and 2

They then evaluate how the changes would affect taxpayers across the income scale:

graph at link...

Unsurprisingly, the changes are all progressive: They involve significant tax hikes for the rich. But the credit option has the bonus of actually being a small tax cut for some low- and middle-income families. That's because bringing the credit out of the itemization process means that millions of families taking the standard deduction can now benefit. It also means that families in the 10 percent tax bracket will get a bigger break than they would've before.

Just converting to a credit and not adding a cap, Lu et al. write, means "the number of tax units who benefit would rise by 14.6 million, to a total of 48.4 million— approximately 28 percent of all tax units. The number of tax units with incomes less than $50,000 who benefit would more than double from 2.4 million to 5.1 million."

These policies would also raise a fair bit of revenue. Over 10 years, the cap would raise $94.9 billion, the credit would raise $156.1 billion, and both combined would raise $212.9 billion. That's money that could go to any number of better uses, but in particular could be used to bolster America's housing safety net.

The National Low Income Housing Coalition (which funded the Tax Policy Center report) proposes using mortgage interest deduction reform to fund the National Housing Trust Fund, an entity established amid the economic crisis in the summer of 2008 that spends at least 90 percent of its funds on building or operating affordable rental housing, and is by law targeted at "extremely low-income households," which must get at least 75 percent of the money.

That trade — raise taxes on rich people's housing, spend a lot more giving the extremely poor homes — would do a lot to redirect America's housing subsidies to where they're needed most.

Proserpina

(2,352 posts)Despite a ceaseless propaganda campaign declaring all is well with the U.S. economy, the Status Quo is fragile–and voters know it.

Not only do they know the economy–and their financial security–is one crisis away from meltdown, they’re also fed up with all the official gerrymandering of data to make the economy appear healthy.

The American Dream–characterized by plentiful jobs offering living wages, security and opportunities to get ahead–is over, and voters know this, too.

People are realizing the U.S. economy has changed qualitatively in the past 20 years, and claims that it’s stronger then ever ring hollow to people outside Washington D.C., academic ivory-towers and ideologically driven think-tanks...

Proserpina

(2,352 posts)The Federal Reserve raised the interbank borrowing rate today by one quarter of one percent or 25 basis points. Readers are asking, “what does that mean?”

It means that the Fed has had time to figure out that the effect of the small “rate hike” would essentially be zero. In other words, the small increase in the target rate from a range of 0 to 0.25% to 0.25 to 0.50% is insufficient to set off problems in the interest-rate derivatives market or to send stock and bond prices into decline.

Prior to today’s (12/16/15) Fed announcement, the interbank borrowing rate was averaging 0.13% over the period since the beginning of Quantitative Easing. In other words, there has not been enough demand from banks for the available liquidity to push the rate up to the 0.25% limit. Similarly, after today’s announced “rate hike,” the rate might settle at 0.25%, the max of the previous rate and the bottom range of the new rate.

However, the fact of the matter is that the available liquidity exceeded demand in the old rate range. The purpose of raising interest rates is to choke off credit demand, but there was no need to choke off credit demand when the demand for credit was only sufficient to keep the average rate in the midpoint of the old range. This “rate hike” is a fraud. It is only for the idiots in the financial media who have been going on about a rate hike forever and the need for the Fed to protect its credibility by raising interest rates.

Look at it this way. The banking system as a whole does not need to borrow as it is sitting on $2.42 trillion in excess reserves. The negative impact of the “rate hike” affects only smaller banks that are lending to businesses and consumers. If these banks find themselves fully loaned up and in need of overnight reserves to meet their reserve requirements, they will need to borrow from a bank with excess reserves. Thus, the rate hike has the effect of making smaller banks pay higher interest expense to the mega-banks favored by the Federal Reserve. A different way of putting it is that the “rate hike” favors banks sitting on excess reserves over banks who are lending to businesses and consumers in their community. In other words, the rate hike just facilitates more looting by the One Percent.

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts' latest books are The Neoconservative Threat To International Order: Washington’s Perilous War For Hegemony, The Failure of Laissez Faire Capitalism and Economic Dissolution of the West and How America Was Lost.

Proserpina

(2,352 posts)A French court has ordered IMF boss Christine Lagarde to face trial over the part she played in the Tapie Affair, regarding a €400m (£291m, $433m) transfer to French business tycoon and entrepreneur Bernard Tapie.

In September, France's main prosecutor recommended magistrates at the Cour de Justice de la Republique, which deals with crime allegations against government officials, drop the investigation. The magistrates were probing Lagarde's alleged negligence in regards to the affair when she was finance minister of the country.

In 2008, when Lagarde served under Nicolas Sarkozy's government, she approved a three member arbitration panel that awarded the payment from the taxpayers' pockets. Lagarde and Sarkozy have both been under fire since then for approving the panel...The payment followed Tapie's accusation that French bank Credit Lyonnais defrauded him when it handled the businessman's sale of his majority stake in German sports retailer Adidas in 1993. Tapie alleged the bank of deliberately undervaluing the company after it sold the stake for a higher sum. Because the now bust Credit Lyonnais was partly state owned, at least some of the money came from French taxpayers. Tapie sold his Adidas shares to become a cabinet minister. He backed and supported Sarkozy in his bid for presidency in 2007.

"It's incomprehensible," Yves Repiquet, the IMF head's lawyer told French TV channel iTele. "I will recommend Mrs Lagarde appeal this decision."

and there's more...incomprehensible

Proserpina

(2,352 posts)...Previously, Lagarde was seen as all but a lock to be reappointed as managing director when her term ends next July. At the fund’s annual meeting in Lima in October, Lagarde said she’d be open to serving another term. While she’s still the front-runner and analysts said the case is unlikely to derail her reappointment, the prospect of a politically charged trial in her home country may still complicate her future at the Washington-based IMF.

The fund’s 188 member countries will be keen to avoid adding to the negative publicity generated by the legal troubles of former IMF heads Dominique Strauss-Kahn and Rodrigo Rato, said Andrea Montanino, who served as an executive director at the fund until last year.

“If the trial goes ahead, it could be difficult to seek a second mandate,” said Montanino, now director of the global business and economics program at the Atlantic Council in Washington...

it's just 1%R Elite high spirits, that's all...

Proserpina

(2,352 posts)Vulture investors have descended on the commonwealth, taking advantage of a debt crisis that has impoverished citizens and created massive unemployment...

“This is a distress call from a ship of 3.5 million American citizens that have been lost at sea,” Puerto Rico Governor Alejandro García Padilla said on December 1, begging the Senate Judiciary Committee to help protect his homeland from an unspooling disaster. After issuing bonds for over a decade on everything not nailed down, Puerto Rico now carries $73 billion in debt, a sum that García Padilla had termed “not payable” in June. Successive governments have enacted punishing austerity measures to service the debt, despite a stubbornly depressed economy and poverty rates near 50 percent. Now, after defaulting on smaller loans, it’s likely that much of the $957 million due January 1 will go unpaid, bringing more chaos and suffering at the hands of Puerto Rico’s creditors.

In many ways, the Puerto Rico situation is sui generis, resulting from a patchwork of laws and obligations on an entity that is not really a country and not really a U.S. state. But looked at another way, Puerto Rico is just the latest battlefield for a phalanx of hedge funds called “vultures,” which pick at the withered sinews of troubled governments. In Greece, Argentina, Detroit, and now Puerto Rico, vultures have bought distressed debt on the cheap, and then used coercion, threats, and legal action to secure a massive windfall, compounding the effects on millions of citizens.

The legal wrangling masks an irony: As creditors demand that Puerto Rico pay back everything it owes, hedge fund managers have used the island as a tax haven to avoid their own responsibilities. Wealthy investors don’t just want to make money in Puerto Rico; they want to use their leverage to effectively buy an island playground. PUERTO RICO HAS LABORED under colonial rule since Christopher Columbus arrived in 1493 and claimed it for Spain. After the Spanish-American War in 1898, the United States acquired Puerto Rico in the Treaty of Paris, and ruled it as a territory. Since then, Puerto Ricans are considered natural-born citizens, but must abide by U.S. laws without a voting member in Congress.

For decades, the island was a jewel of the Caribbean, with the highest per capita income in Latin America. But in his December 1 testimony, García Padilla pinpointed the beginning of Puerto Rico’s troubles: 1996, when a Republican Congress and the Clinton administration agreed to a ten-year phase-out of Section 936, a tax exemption for U.S. manufacturing on the island. Clinton supported it as a deficit reduction measure, promising it would save the federal Treasury $10.5 billion over ten years. But Congress did not replace Section 936 with an economic development plan for Puerto Rico to offset the impact. Nelson Torres-Ríos, an attorney and professor at the City University of New York’s Hostos Community College, believes that letting Section 936 go was a political gambit. Puerto Rico’s political parties are aligned with options for future status, with pro-commonwealth and pro-statehood parties being the dominant factions. In the 1990s, the pro-statehood party then in power thought shedding Section 936 would eliminate the economic viability of the commonwealth arrangement and increase support for their position.

“In actuality, the opposite happened,” says Torres-Ríos. Washington had no interest in taking on a 51st state, especially one in economic crisis. In an era of massive offshoring to destinations with even cheaper labor, Section 936's expiration led to recession, as manufacturers fled Puerto Rico, leaving few job-creating industries behind. According to World Bank data, after Section 936 was established in 1976, Puerto Rico enjoyed 28 out of 29 years of economic growth. Since 2005, as the tax credit faded away, the island has experienced negative growth eight out of ten years, with its gross national product falling 10 percent. The recession, combined with the broader economic downturn (Puerto Rico, like warm-weather U.S. states, experienced a housing bubble and collapse), exposed structural problems derived from the island’s unique status. Though Puerto Ricans pay the same payroll taxes as mainland workers, the island receives sharply lower reimbursement rates for Medicare and Medicaid. Its poorest citizens are ineligible for the Earned Income Tax Credit. A monopolized power company derives nearly all its electricity from diesel fuel, despite trade winds and sun being the most plentiful resources on the island. With few exploitable natural resources, Puerto Rico has to import oil (giving it some of the highest electricity rates in the United States and loads of unpaid bills) and most of its goods. And a 1920 law called the Jones Act restricts cargo carriage between two U.S. ports with a foreign-flagged ship. This means that foreign ships carrying U.S.-bound goods must stop at a U.S. port, transfer goods headed to Puerto Rico to a separate U.S. ship, and send them along. These shipping costs result in an exorbitant cost of living. The Virgin Islands, a U.S. territory near Puerto Rico, have an exemption from the Jones Act; Puerto Rico doesn’t.

As unemployment soared and the economy crashed, Puerto Rico papered over problems by issuing debt. Wall Street asset managers and investors egged them on, because Puerto Rican municipal bonds are free from federal, state, and local taxes. Usually Americans must reside in the state whose bonds they purchase to get “triple tax-exempt” status. But anyone from Arizona to Maine can buy triple tax-exempt Puerto Rican bonds. Wall Street also covets the bonds because of a 1984 congressional amendment denying Puerto Rico’s municipalities access to Chapter 9 bankruptcy protection. Plus, under the territorial constitution, general obligation debt gets a senior position above virtually all other items in the budget. So investors receive all the upside benefit of tax-free bonds with little downside risk—except, of course, the risk of default.

The commonwealth’s government created 18 different vehicles to issue Puerto Rican debt. They linked bonds to nearly every available revenue source, from the Highway and Transportation Authority to the Electric Power Authority (PREPA) to the Aqueduct and Sewer Authority to a government-owned corporation called COFINA, which links bonds to sales-tax receipts. “They [the government] haven’t come up with any solutions besides issuing more debt for the past 15 years,” says Carla Minet, a reporter with the Center for Investigative Journalism in Puerto Rico.

Public debt increased every year since 2000, according to a government report from former World Bank Chief Economist Anne Krueger. Debt levels expanded from $25 billion in 2000 to $73 billion today, totaling more than 100 percent of the island’s gross national product. One-third of all Puerto Rican revenue now goes to debt service.

To pay back the debt, Puerto Rico has delayed tax refunds and payments to suppliers, cut back on health care and public transportation services, fired 30,000 public-sector workers, closed 100 schools, increased the sales tax by more than 50 percent, and even forced community credit unions to take IOUs in exchange for cash. The poverty rate on the island is around 45 percent, and only 40 percent of the labor force has a job. Trapped in an economic death spiral, the tax base has eroded, amid massive out-migration to the U.S.: Puerto Rico has lost 300,000 citizens since 2006. “In Puerto Rico today, the hardest thing to find is a suitcase,” says Eric LeCompte of the faith organization Jubilee USA. “They can’t keep them on the shelves.”

then the vultures came, and the political corruption...more at link

Proserpina

(2,352 posts)As world leaders seek to negotiate a global agreement on climate change in Paris, the U.S. House of Representatives today passed a Customs Bill that undermines effective U.S. action in response to global warming. The Trade Facilitation and Enforcement Act of 2015 (H.R. 644) would explicitly prevent the United States Trade Representative from seeking to address climate change in trade agreements. Earlier this year environmental organizations sent up a letter opposing the provisions.

Bill Waren, senior trade analyst at Friends of the Earth - U.S., issued the following statement:

The Republican leaders of the U.S. Congress, with the help of President Obama, are expediting passage of a Customs Bill that explicitly excludes consideration of climate change when the United States negotiates international trade agreements. Contrary to his stated goals for the Paris climate agreement, President Obama’s push for trade deals like the Trans Pacific Partnership would encourage more fossil fuel extraction. President Obama must stop allowing trade to trump effective action on climate change. He should reverse course and veto the climate-denying Customs Bill when it comes to his desk.

Proserpina

(2,352 posts)Wall Street was set to continue the downbeat trading on Friday, with investors carefully watching developments in commodity prices and after a highly volatile session in Asia that saw the yen jump against the dollar.

Futures for the Dow Jones Industrial Average YMH6, -0.47% dropped 88 points, or 0.5%, to 17,268, while those for the S&P 500 index ESH6, -0.44% lost 9.20 points, or 0.5%, to 2,015.25. Futures for the Nasdaq 100 index NQH6, -0.16% dropped 12 points, or 0.3%, to 4,557.50....

Fuddnik

(8,846 posts)Proserpina

(2,352 posts)The Federal Reserve succeeded in nudging borrowing costs higher Thursday after its first interest-rate increase since 2006, and policy makers only needed to siphon $105 billion from money-market funds to achieve their goal.

Led by Chair Janet Yellen, the Fed lifted the federal funds rate from near zero, where it had been since the financial crisis unfolded in 2008. Thursday, the quarter-point rate boost rippled through money markets that are awash in nearly $3 trillion in excess cash that the Fed injected through bond purchases. For all the talk of the challenge facing officials as they orchestrate higher rates with so much money sloshing around, Thursday’s market operations weren’t much different in scale than previous days. And the benchmark rate rose 0.2 percentage point, or 20 basis points -- practically to the middle of the Fed’s intended range. Trading in the fed funds market went "extremely smoothly," said Bill List, capital markets manager at the Federal Home Loan Bank of Pittsburgh. "The whole fed funds market seemed to adjust with relative ease this morning and everything just set at a higher level."

While the Fed is sticking to the funds rate as its main method of communicating its policy stance, the burden of lifting rates fell elsewhere. That’s because with so much cash in the system, interbank lending has fallen almost 90 percent since 2008. This time, the Fed turned to the repurchase -- or repo -- market to tighten policy. The central bank conducted its first post-liftoff overnight borrowing operation in that market Thursday afternoon. The Fed drained $105 billion through reverse repos at a 0.25 percent rate, up from the $102 billion it borrowed Wednesday at the old 0.05 percent rate. Yet it was ready to do more -- potentially as much as $2 trillion.

Before Wednesday’s announcement, in testing the program, the Fed limited itself to $300 billion of daily borrowings through reverse repos. With that cap, policy makers risked not being able to keep market rates elevated if investors offered to lend more than the limit and were forced to take money elsewhere. Officials removed that limit Wednesday, and still didn’t see a big boost in demand for reverse repos...

egads! more

Proserpina

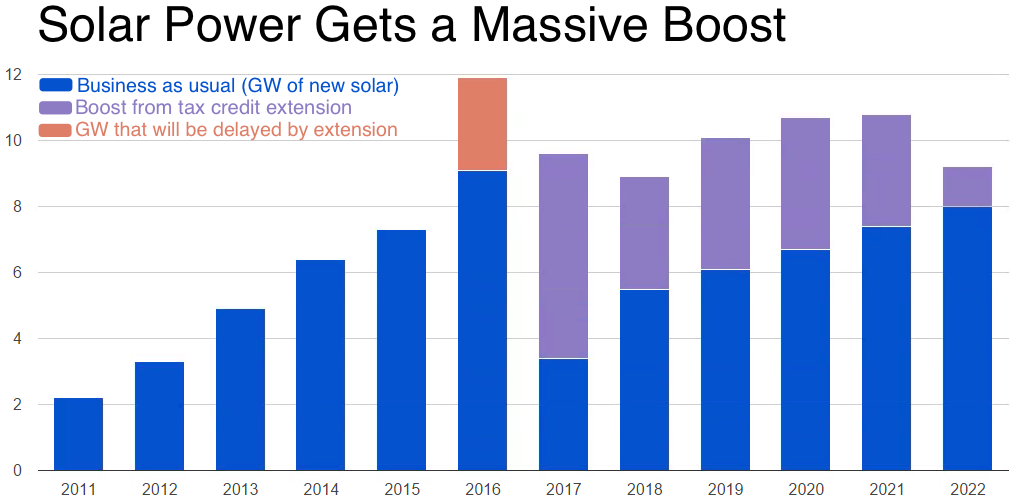

(2,352 posts)The clean-energy boom is about to be transformed. In a surprise move, U.S. lawmakers agreed to extend tax credits for solar and wind for another five years. This will give an unprecedented boost to the industry and change the course of deployment in the U.S.

The extension will add an extra 20 gigawatts of solar power—more than every panel ever installed in the U.S. prior to 2015, according to Bloomberg New Energy Finance (BNEF). The U.S. was already one of the world's biggest clean-energy investors. This deal is like adding another America of solar power into the mix.

The wind credit will contribute another 19 gigawatts over five years. Combined, the extensions will spur more than $73 billion of investment and supply enough electricity to power 8 million U.S. homes, according to BNEF.

"This is massive," said Ethan Zindler, head of U.S. policy analysis at BNEF. In the short term, the deal will speed up the shift from fossil fuels more than the global climate deal struck this month in Paris and more than Barack Obama's Clean Power Plan that regulates coal plants, Zindler said.

more

Proserpina

(2,352 posts)Ukraine defaulted on a $3 billion bond payment due to Russia, deepening a dispute over the debt as the two sides move closer to legal action.

Prime Minister Arseniy Yatsenyuk said Kiev is imposing a moratorium on the note due Dec. 20, which Russian President Vladimir Putin bought two years ago to bail out Ukraine’s former president just months before he was toppled. Russia said as recently as last week it would take Ukraine to court if the payment was missed.

The default comes after Russia refused to participate in an $18 billion restructuring with commercial creditors earlier this year, arguing it should receive better terms since it’s a sovereign lender. The two sides indicated this month that they’re open to negotiations to restructure the debt and have been using German officials to mediate indirect talks.

Yatsenyuk announced the payment freeze at a government meeting in Kiev on Friday, saying the step was needed after Russia "refused to sign an agreement on restructuring." Payments are frozen "until our propositions on restructuring are accepted or until a relevant court decision is made," he said.

The moratorium also applies to about $507 million owed to Russian banks by two state-run companies, according to Yatsenyuk.

more

Proserpina

(2,352 posts)The self-driving car, that cutting-edge creation that’s supposed to lead to a world without accidents, is achieving the exact opposite right now: The vehicles have racked up a crash rate double that of those with human drivers.

The glitch?

They obey the law all the time, as in, without exception. This may sound like the right way to program a robot to drive a car, but good luck trying to merge onto a chaotic, jam-packed highway with traffic flying along well above the speed limit. It tends not to work out well. As the accidents have piled up -- all minor scrape-ups for now -- the arguments among programmers at places like Google Inc. and Carnegie Mellon University are heating up: Should they teach the cars how to commit infractions from time to time to stay out of trouble?

“It’s a constant debate inside our group,” said Raj Rajkumar, co-director of the General Motors-Carnegie Mellon Autonomous Driving Collaborative Research Lab in Pittsburgh. “And we have basically decided to stick to the speed limit. But when you go out and drive the speed limit on the highway, pretty much everybody on the road is just zipping past you. And I would be one of those people.”

Last year, Rajkumar offered test drives to members of Congress in his lab’s self-driving Cadillac SRX sport utility vehicle. The Caddy performed perfectly, except when it had to merge onto I-395 South and swing across three lanes of traffic in 150 yards (137 meters) to head toward the Pentagon. The car’s cameras and laser sensors detected traffic in a 360-degree view but didn’t know how to trust that drivers would make room in the ceaseless flow, so the human minder had to take control to complete the maneuver.

“We end up being cautious,” Rajkumar said. “We don’t want to get into an accident because that would be front-page news. People expect more of autonomous cars.”

more

they could always fix the stupid laws, but then the ticket revenues would plummet...

Proserpina

(2,352 posts)Global developments in finance and geopolitics are prompting a rethinking of the structure of banking and of the nature of money itself. Among other interesting news items:

* In Russia, vulnerability to Western sanctions has led to proposals for a banking system that is not only independent of the West but is based on different design principles.

* In Iceland, the booms and busts culminating in the banking crisis of 2008-09 have prompted lawmakers to consider a plan to remove the power to create money from private banks.

* In Ireland, Iceland and the UK, a recession-induced shortage of local credit has prompted proposals for a system of public interest banks on the model of the Sparkassen of Germany.

* In Ecuador, the central bank is responding to a shortage of US dollars (the official Ecuadorian currency) by issuing digital dollars through accounts to which everyone has access, effectively making it a bank of the people.

Developments in Russia

In a November 2015 article titled “Russia Debates Unorthodox Orthodox Financial Alternative,” William Engdahl writes:

Engdahl notes that the financial sanctions launched by the US Treasury in 2014 have forced a critical rethinking among Russian intellectuals and officials. Like China, Russia has developed an internal Russian version of SWIFT Interbank payments; and it is now considering a plan to restructure Russia’s banking system. Engdahl writes:

On September 15, 2013, Sergei Glazyev, one of Vladimir Putin’s economic advisers, presented a a series of economic proposals to the Presidential Russian Security Council that also suggest radical change is on the horizon. The plan is aimed at reducing vulnerability to western sanctions and achieving long-term growth and economic sovereignty. Particularly interesting is a proposal to provide targeted lending for businesses and industries by providing them with low-interest loans at 1-4 percent, financed through the central bank with quantitative easing (digital money creation). The proposal is to issue 20 trillion rubles for this purpose over a five year period. Using quantitative easing for economic development mirrors the proposal of UK Labour Leader Jeremy Corbin for “quantitative easing for people.”

William Engdahl concludes that Russia is in “a fascinating process of rethinking every aspect of her national economic survival because of the reality of the western attacks,” one that “could produce a very healthy transformation away from the deadly defects” of the current banking model.

Iceland’s Radical Money Plan

Iceland, too, is looking at a radical transformation of its money system, after suffering the crushing boom/bust cycle of the private banking model that bankrupted its largest banks in 2008. According to a March 2015 article in the UK Telegraph:

“The findings will be an important contribution to the upcoming discussion, here and elsewhere, on money creation and monetary policy,” Prime Minister Sigmundur David Gunnlaugsson said. The report, commissioned by the premier, is aimed at putting an end to a monetary system in place through a slew of financial crises, including the latest one in 2008.

Under this “Sovereign Money” proposal, the country’s central bank would become the only creator of money. Banks would continue to manage accounts and payments and would serve as intermediaries between savers and lenders. The proposal is a variant of the Chicago Plan promoted by Kumhof and Benes of the IMF and the Positive Money group in the UK.

Public Banking Initiatives in Iceland, Ireland and the UK

A major concern with stripping private banks of the power to create money as deposits when they make loans is that it will seriously reduce the availability of credit in an already sluggish economy. One solution is to make the banks, or some of them, public institutions. They would still be creating money when they made loans, but it would be as agents of the government; and the profits would be available for public use, on the model of the US Bank of North Dakota and the German Sparkassen (public savings banks).

more

Proserpina

(2,352 posts)we will be below freezing for 2.5 days, but the sun is shining, for once. Since the energy companies are whining about the unusual warmth destroying demand for heating, they should be happy.

Mother is grumbling about changing out the 40 year old, crap-to-begin-with windows, now...

Renovation: it's a disease! An itch without a cure...

I suppose I have to invent a WEE. Argh! Any suggestions?

I have it! WEE are throwing a Holiday Office Party!

Raunchy, areligious songs, hors d'oeuvres, too much booze and bad jokes...go crazy!

Proserpina

(2,352 posts)