Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 20 January 2016

[font size=3]STOCK MARKET WATCH, Wednesday, 20 January 2016[font color=black][/font]

SMW for 19 January 2016

AT THE CLOSING BELL ON 19 January 2016

[center][font color=green]

Dow Jones 16,016.02 +27.94 (0.17%)

S&P 500 1,881.33 +1.00 (0.05%)

[font color=red]Nasdaq 4,476.95 -11.47 (-0.26%)

[font color=green]10 Year 2.05% -0.01 (-0.49%)

30 Year 2.82% -0.02 (-0.70%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Proserpina

(2,352 posts)Punx

(446 posts)MORE DEBT!

"Under a President Jeb Bush, students wouldn’t be able to go to college debt-free, but they would have access to a $50,000 line of credit provided by the federal government.

The cornerstone of Bush’s plan is a revamp of the student loan system that would allow high school graduates to pay for college through a $50,000 line of credit provided through their Educative Savings Account — his version of the tax-advantaged college savings vehicles known as 529 accounts that families could use to save for pre-K through college. For every $10,000 students use for college or job training, they would be required to pay back 1% of their income for 25 years. Families wouldn’t have to save themselves to have access to the $50,000 line of credit."

I have a better suggestion. Why don't we raise taxes on crap like you and reinvest it in education instead? There was a time when one could go to a decent school without ending up with a mortgage sized mountain of debt.

More drivel here: http://www.marketwatch.com/story/how-jeb-bush-would-fix-the-student-debt-crisis-2016-01-19

Fuddnik

(8,846 posts)I used to think Jeb was the dangerous Bush because he's smarter. He's rapidly proving me wrong.

Punx

(446 posts)But he's making "Shrub" look good, and that says a whole hell of a lot.

Proserpina

(2,352 posts)Big Food’s greatest fear is materializing. A critical mass of educated consumers, food and natural health activists are organizing a powerful movement that could well overthrow North America’s trillion-dollar junk food empire. Savvy and more determined than ever, activists are zeroing in on the Achilles heel of Food Inc. -- labeling.

But as consumers demand truth and greater transparency in labeling, it isn’t just Big Food whose empire is vulnerable. The biotech industry, which makes billions supplying junk food manufacturers with cheap, genetically engineered (GE) ingredients, has even more to lose. Monsanto knows that if food producers are forced to label the genetically modified organisms (GMOs) in their food products, they’ll reformulate those products to meet consumer demand for GMO-free alternatives. That’s why companies like Monsanto, DuPont and Dow, along with Coca-Cola and Pepsi, last year spent more than $46 million to defeat Proposition 37, California’s GMO labeling initiative.

The junk food and biotech industries narrowly (48.5% - 51.5%) prevailed in California, but they know it’s only a matter of time before one or more states pass a mandatory GMO labeling law. More than 30 state legislatures are now debating GMO labeling bills. And consumers have broadened the fight beyond just labeling. Five counties and two cities in California and Washington have banned the growing of GE crops. In addition, given the near total absence of FDA regulation, 19 states have passed laws restricting GMOs.

How is the biotech industry fighting back? By attacking democracy. Experts say the laws are on the side of consumers. But consumers will no doubt still have to defend democracy against an increasingly desperate, and aggressive, industry bent on protecting the highly profitable business of genetically engineered food...

Hence, the TPP and its illegitimate siblings

Proserpina

(2,352 posts)Democratic Presidential hopeful Bernie Sanders took a break from yelling at clouds long enough to release his tax plan today, and it’s, how should I put this…aggressive. Sanders proposes a top rate on individual income of a whopping 52%, which would be the highest since 1980, when tax rates topped out at 70% under Jimmy Carter.

While the 52% rate is reserved for those earning in excess of $10 million, less wealthy taxpayers are not immune to increases under the Sanders plan. For example, the top rate on someone earning $250,000 would increase from 33% under current law to 37% under Sanders, while someone earning $500,000 would see his top rate jump from 39.6% to 43%.

In addition, Sanders would do away with the preferential treatment long afforded capital gains and dividends, meaning those types of income would be taxed at the same rates as ordinary income for taxpayers earning in excess of $250,000. Under current law, the top rate on such income is 23.8%; as a result, a taxpayer who, for example, sells a business for $5 million of gain would pay $1.19 million in federal tax under current law, but would pay $2.4 million in federal tax under the Sanders plan (a rate of 48%).

Sanders would also limit the benefit of all itemized deductions to a 28% rate, meaning a taxpayer who earned $500,000, and was thus in Sanders’ 43% bracket would effectively pay a 15% tax on deductions such as mortgage interest, state and local taxes, and charitable contributions. These changes, when added to the revenue Sanders would generate by increasing the tax rate on the top 0.3% of estates, would raise an additional $235 billion in tax revenue annually...

comparative tax bills vs. income at link

Proserpina

(2,352 posts)... two hedge fund mavens, two immensely successful internet investment services, a closely-followed fixed income adviser and two journalists met to hash over the economic and market controversies of our day...there was just about unanimous opinion that Ben Bernanke’s 4 years of quantitative easing (QE) had for the most part benefited only the nation’s wealthiest cohort– without doing much practically to create more jobs for ordinary people.

At least one participant was strident about phasing out QE and letting interest rates begin to rise, arguing vociferously that QE was just the most recent terrible major policy making mistake for America. The yelling across the table rose several pitches at this moment. One closely followed blogger of sharp wit and tongue was clear that Messrs. Bernanke, Paulson and Geithner should have let the insolvent giant banks fail rather than stabilizing them with cheap money. There was more consensus about he likelihood of another financial crisis emanating from the Too Big To Fail banking giants...The controversy over QE (Quantitative Easing) brought forth this pithy bit of tartness from the quick-witted chap just opposite me, who exclaimed that “QE is supply side economics for central bankers,” just like cutting taxes was the crux of the supply-side clique that ruled the economics of the Reagan administration in the 1980s. “Interest rates,” quipped my neighbor, ” are the traffic lights of economics today– and there are NO traffic lights,” meaning that zero interest rates are no cautionary obstacle to potential bubbles, I imagine.

What’s more, QE was judged to have created a possible “bubble” in common stocks– and had as well pushed bond prices to peak historical prices, though I didn’t hear the concept of “bubble” bonds used derogatively. As to the possible inflation from QE, there was sharp divisive debate, with no clear resolution. The quick-witted investment blogger with a cool million followers across the table from me was adamant about Bernanke reversing QE now, reducing the amount of money supply by $3 billion a month, and letting the stimulus run off before it caused some terrible denouement. I didn’t hear the rest of the group sign on to this radicalism...As we parted to get to the championship basketball game I asked for a raising of hands for my obsessive fantasy that it just may be that the denizens of Wall Street were more or less in charge of the governing of these United States of America. I got the clear impression all participants impulsively signed on to that sentiment. Wow! Comes the revolution. Their emotional instincts strengthened my resolve to have a more concerted go at proving this supposition.

And yes, I got the feeling my cohort last night felt to varying degrees that we could well experience another meltdown in the financial markets since major banking institutions had not truly reformed themselves into stalwart institutions. Some wickedly irreverent comments were offered about the pathetic level of oversight by the guardians of financial propriety. If you have not learned the lessons of financial history, you are doomed to repeat them.

Nothing good is done for the average person when it comes to economic policy here in the land of debt slaves. But we all know that here.

Proserpina

(2,352 posts)For more than three decades, Wal-Mart ruled the US retailing industry. Its large stores and everyday low prices were too much for smaller neighborhood stores and supermarkets that ended belly-up shortly after Wal-Mart invaded their turf. That’s how Wal-Mart ended with close to a half-trillion in sales, dwarfing the economies of smaller countries.

But in recent years, Wal-Mart’s business model seems to have headed for the graveyard, and the company has closed scores of stores. Apparently, what used to be an asset for Wal-Mart has turned into a liability.

Who killed Wal-Mart’s business model? There is a long list of suspects.

Proserpina

(2,352 posts)...Some blame Wal-Mart’s leadership which succeeded the company’s legendary founder Sam Walton.

“Sam’s own children killed them,” writes one commentator. “Sam had a business model even an idiot could follow. KEEP THE CUSTOMERS HAPPY. He said a happy customer was a customer for life. Then the kids started cutting associates to pad lower sales, which lowered sales even more. Then they started part-time only hiring, which cut back on the quality of the people they could hire. In the 20 years I worked there, not one thing was done for the customer. NONE! All changes were to pad the stock so the Walton kids could make more money on less sales. To think anything else is not only ignorant, but dishonest, too…”

“The heirs tried to go upscale,” writes another commentator. “Walmart was the place to buy what you could not find elsewhere at a low price. In the last year it has been returning to the low price roots. It is not easy to win back customers. Walmart needs to understand that for some items the customer will go out of their way and then buy something else while shopping. Online shopping allows for items that there really is not enough shelf space for. Amazon’s advantage is that products that are difficult to find in any store are there.”

Others blame poor pay vis-a-vis competing retailer Costco.

“Wal-Mart killed their own business model when they decided that Costco’s plan of paying for quality employees was not for them. Poor employees = unhappy customers. Failing to retain the better employees (by paying them more) and pleasing the customer will bite one in the arse every time.”

“The problem with Wal-mart is they have lost touch with the needs of the customers. More often than not, finding someone to help you is impossible because they are trying to please stock holders by trimming costs. While I understand that, without customers there are no costs to cut!”

The last sentence summarizes it all. I couldn’t agree more. A sound business doesn’t begin with profits, but with customers.

Proserpina

(2,352 posts)Income inequality, earning potential, and education are connected. The higher someone’s education, the more they’re likely to earn over a lifetime. The higher the earning potential, the less likely someone will be hurt by income inequality.

That’s why we hear many politicians, reformers, theorists, and those with particular philosophical axes to grind agree that people must attain higher levels of education for the economy to raor. Here are 2014 data from the Bureau of Labor Statistics that shows those with stronger education see lower rates of unemployment and higher incomes than the rest of the population.

Few will claim that more education is bad. Oh, many people don’t like sitting in a traditional classroom, and not everyone necessarily has the aptitudes for all areas of study. But a richer intellectual life and experience is a generally good thing. However, there’s a significant public policy mistake that happens when we move from “education is good” to “education will fix income inequality” or otherwise charge the economy.

Deeply embedded in that claim are three fundamental assumptions:

- There is a way to pay for everyone going to college.

- There is enough room in college for everyone to attend.

- There are enough jobs that make natural use of higher education...Assuming for a moment that the higher paying jobs education is supposed to ready one for are the same as those that actually require higher education. According to the Bureau of Labor Statistics, two-thirds of all jobs in the country require a high school education or less:

...To really address the issue of jobs and economic inequality, we must start by acknowledging the reality of work and what more education can, and cannot, do. Solutions of any sort will need significant social changes. Perhaps as a country we forgo much of what automation could do. Maybe the answer is a higher minimum wage, recognition that many people will need income assistance, apprentice programs (maybe you’ll finally be able to find a plumber when the sink leaks before your dinner party), or even a considerable reduction in population over time. But chanting that education is the answer won’t fix anything.

bread_and_roses

(6,335 posts)Not to toot my own horn, since it's stunningly obvious to anyone who thinks about it for 10 seconds. This nonsense started with Bill Clinton, I believe - it infuriated me then and still does. WHERE ARE THE JOBS????????????????? And the appalling disrespect for those that do hard, necessary work - road crews, nursing home and home-health aides, agricultural workers, and and and.

It's similar to the fixation on early-childhood education: a good thing in itself, yes - BUT WHAT ABOUT ALL THE CHILDREN ALREADY IN SCHOOL??????????????????????????????????? What about the schools NOW, with not enough books or desks or teachers? With hungry kids? Homeless kids?

Sorry for the shouting. I just get angrier by the day.

Proserpina

(2,352 posts)Take a break, you earned it. I gotta go.

Punx

(446 posts)I've seen so many jobs here shipped overseas in the last couple of decades that it makes me sick. If Hillary wins, expect that to continue.

DemReadingDU

(16,000 posts)Proserpina

(2,352 posts)

...Australia has a publicly-mandated private pension scheme in which employers are required to set aside 9% of wages into a “superannuation” fund (workers are encouraged to contribute as well). Of course, we do have a higher level of military spending than the other countries on the list (although if you check the World Bank rankings, some small countries have a bigger proportion of GDP in military expenditures, such as Saudi Arabia). Nevertheless, the overall picture is striking.

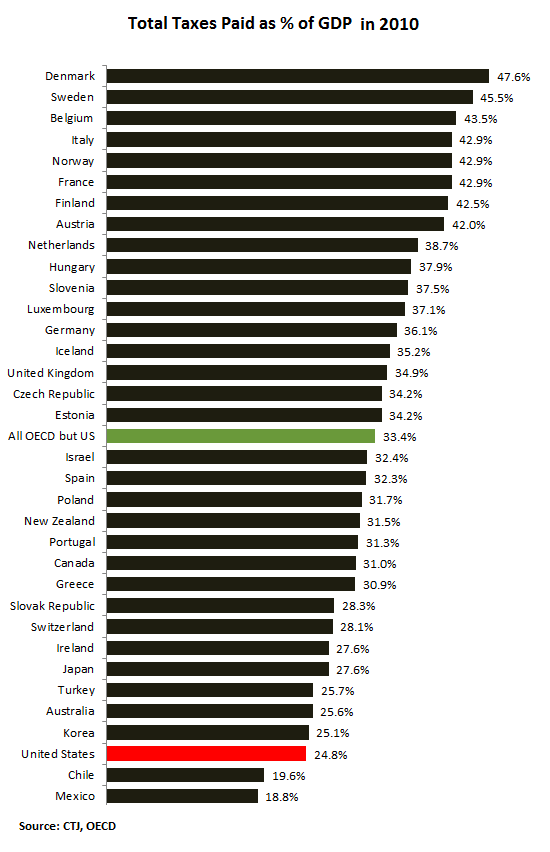

I’m using Wolf Richter’s version of this chart, since it’s easier to scan than the original from the Center for Tax Justice. Note that this chart captures total taxes, meaning Federal, state, and local. CTJ also points out how America has always been low tax, but has become relatively even lower taxed. In 1979, the total level of taxation in the US was 26% of GDP versus 24.8% now. That means the vaunted Reagan Revolution served mainly to shift taxation from progressive income taxes (hitting the rich harder) and corporate taxes to regressive sales taxes, rather than lower the level. But our tax level has fallen while they’ve grown in other advanced economies. Tax burdens in OECD countries excluding the US were 31.7% of GDP in 1979 and have risen to 33.4% in 2010. So the US ranking has fallen from 16 out of 24 to 32 out of 34. Any wonder why our infrastructure is crumbling and our educational attainment is falling?

Americans have been trained to resent taxes even though we are trying to run an advanced economy Walmart-style. My impression is that the citizens of many other countries are far less exercised about higher tax levels because they perceive they are getting value for money (medical services, good public transportation, etc). By contrast, we’ve had a 30 year campaign to make government incompetent by running it on the cheap and demonizing people who work in government jobs, and the result is less service and more corruption. This experiment is working just fine for those wealthy enough to be effectively stateless or to otherwise isolate themselves. And it will probably take at least a generation for the costs (such as public health problems) to afflict even them. Nicely played...

Proserpina

(2,352 posts)President Obama and Senate Democrats have presented deficit reduction plans that would rely on both spending cuts and increased tax revenues, but Republicans continue to insist that the U.S. has only a “spending problem” and that deficit reduction does not require new revenues.

The premise of the argument from Republicans is that Americans already face an extraordinarily heavy tax burden. Citizens for Tax Justice, however, compared levels of taxation in 2010 in the other industrialized countries that make up the Organization for Economic Cooperation and Development (OECD) and found that the U.S. not only collects far less in tax revenues than the average OECD country, but that it also collects less in taxes as a share of its economy than all but two other OECD nations, as the chart (PREVIOUS POST) shows.

The U.S. share of taxes has likely increased slightly since 2010, the latest year for which OECD data is available, because of tax increases from Obamacare and from the fiscal cliff deal that restored Clinton-era tax rates on all incomes above $450,000. Those increases likely won’t push the U.S. up the chart and would leave it well short of the OECD average. Similar data for corporate taxes shows that the U.S. collects less than all but one other OECD countries.

The U.S. has historically collected less in taxes and spent less than the majority of its OECD counterparts, in part because it operates such a stingy social safety net that doesn’t assist the least fortunate in society as well as programs in other countries do. Still, the chart shows that the U.S. is far from a high-tax country, and Democratic offers to raise modest amounts of revenues in the budget process would hardly send the nation’s level of taxation through the roof.

Hotler

(11,445 posts)DU has a bug in the system ever since they worked on the servers. This the ONLY website that I go to that locks up, and shuts down. It doesn't do it on YOUTUBE, Craigslist, CycleNews and a host of others. I think it all the ads and the tracking cookies it is trying to load. The problem is not your browser it is DU.

Fuddnik

(8,846 posts)I've had a few new sites lock up and crash on me, particularly cleveland.com. And it's always in Firefox, never chrome. And that was happening with my old computer, and my new build with fresh installs on everything.

I've also noticed, that the pages hardly ever stop loading, so the ads probably have a lot to do with it too.

And, I just got a refurbished laptop, with fresh installs, and I'm having the same problems with IE, which I never use anywhere else, just haven't downloaded a new browser for that one yet.

![]()

![]()

![]()

Roland99

(53,342 posts)Dow 15,742 -274 -1.71%

Nasdaq 4,402 -75 -1.67%

S&P 500 1,850 -31 -1.67%

GlobalDow 2,079 -51 -2.41%

Oil 27.84 -0.62 -2.18%[/font]

Gold 1,100 +11 +1.00%

Fuddnik

(8,846 posts)How's things in Orlando?

Roland99

(53,342 posts)My wife and I both lost our fathers last year

But, now my stepmom is in FL (close on her new house, 2 min away, in two weeks) and then my sister and brother-in-law will move down from RI to move in w/her and help take care of her. Will be nice having family close by again!

Have a new job (tourism industry...you can probably guess who given my locale!) and going well so far. Just wish it would warm up some. Car read 44F this morning! BRRRR!

How's life your way?

DemReadingDU

(16,000 posts)wind chills -20, otherwise staying in watching the markets crash

![]()

Roland99

(53,342 posts)but only for another week! ![]()

Fuddnik

(8,846 posts)But better. I moved my dad down here from SC a year ago, and he's in an assisted living facility about a mile away. He's got a new girlfriend in there, so he's happier than a clam. And he quit talking about going back to SC every other week.

I'm working a few evenings a week for a few hours, just for extra beer and golf money. Everything is good.

Proserpina

(2,352 posts)antigop

(12,778 posts)Roland99

(53,342 posts)antigop

(12,778 posts)Roland99

(53,342 posts)Roland99

(53,342 posts)Nasdaq 4,349 -128 -2.86%

S&P 500 1,831 -49 -2.62%

GlobalDow 2,063 -67 -3.16%

Oil 27.03 -1.43 -5.02%[/font]

Gold 1,101 +12 +1.09%