Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 2 February 2016

[font size=3]STOCK MARKET WATCH, Tuesday, 2 February 2016[font color=black][/font]

SMW for 1 February 2016

AT THE CLOSING BELL ON 1 February 2016

[center][font color=red]

Dow Jones 16,449.18 -17.12 (-0.10%)

S&P 500 1,939.38 -0.86 (-0.04%)

[font color=green]Nasdaq 4,620.37 +6.41 (0.14%)

[font color=red]10 Year 1.95% +0.02 (1.04%)

30 Year 2.76% +0.02 (0.73%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

08/03/15 Former City (London) trader Tom Hayes found guilty of rigging global Libor interest rates. Each fo eight counts carries up to 10 yr. sentence.

08/21/15 Charles Antonucci Sr, former pres. Park Ave. Bank sentenced to 2.5 years in prison for bribery, fraud, embezzlement, and attempt to steal $11MM in TARP bailout funds, as well as $37.5MM fraud on OK insurance company. To pay $54MM in restitution and give up additional $11MM.

09/21/15 Volkswagen CEO Martin Winterkorn apologizes for VW cheating on air quality standards with emission testing avoidance device. Stock drops 20%, fines may total $18B.

09/22/15 Stewart Parnell, CEO Peanut Corp. of America, sentenced to 28 years in prison for selling salmonella-tainted peanut butter that killed nine.

12/17/15 Martin Shkreli, former CEO Turing Pharmaceuticals and notorious price gouger, arrested on securities fraud charges. Posted $5M bail, resigned as CEO.

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

antigop

(12,778 posts)I was stuck in a hotel room and made the mistake of turning on MSNBC.

They were interviewing a couple in their home and showed several campaign ads to the couple to get their opinion.

The couple claimed to be independent.

They showed the Bernie ad about income equality and the woman said something like, "Well, income equality may resonate with some people, but not with us."

![]()

Fuddnik

(8,846 posts)I quit watching MSNBC several years ago. About the time Rachel Maddow started with her Obama is God schtick.

Now, I found a better replacement. Big Bang Theory.

ErisDiscordia

(443 posts)Worked too hard today...feel like an accordion that needs oiling (you don't oil accordions, I know).

Spring-like weather, but no snowdrops blooming yet...just rows of buds. Waiting for the blizzard to blow down out of Iowa and bury us in 2 feet of it.

My friend has been watching the rallies for the Iowa caucuses since 8 AM. She likes sports, so I guess this is the February sport...

antigop

(12,778 posts)Hotler

(11,425 posts)beat my head against the wall like you.![]()

ErisDiscordia

(443 posts)Fudd, when the pool is dark, don't you need to clean the filter?

http://www.cnbc.com/2016/02/01/regulators-may-dislike-dark-pools-but-investors-love-them.html

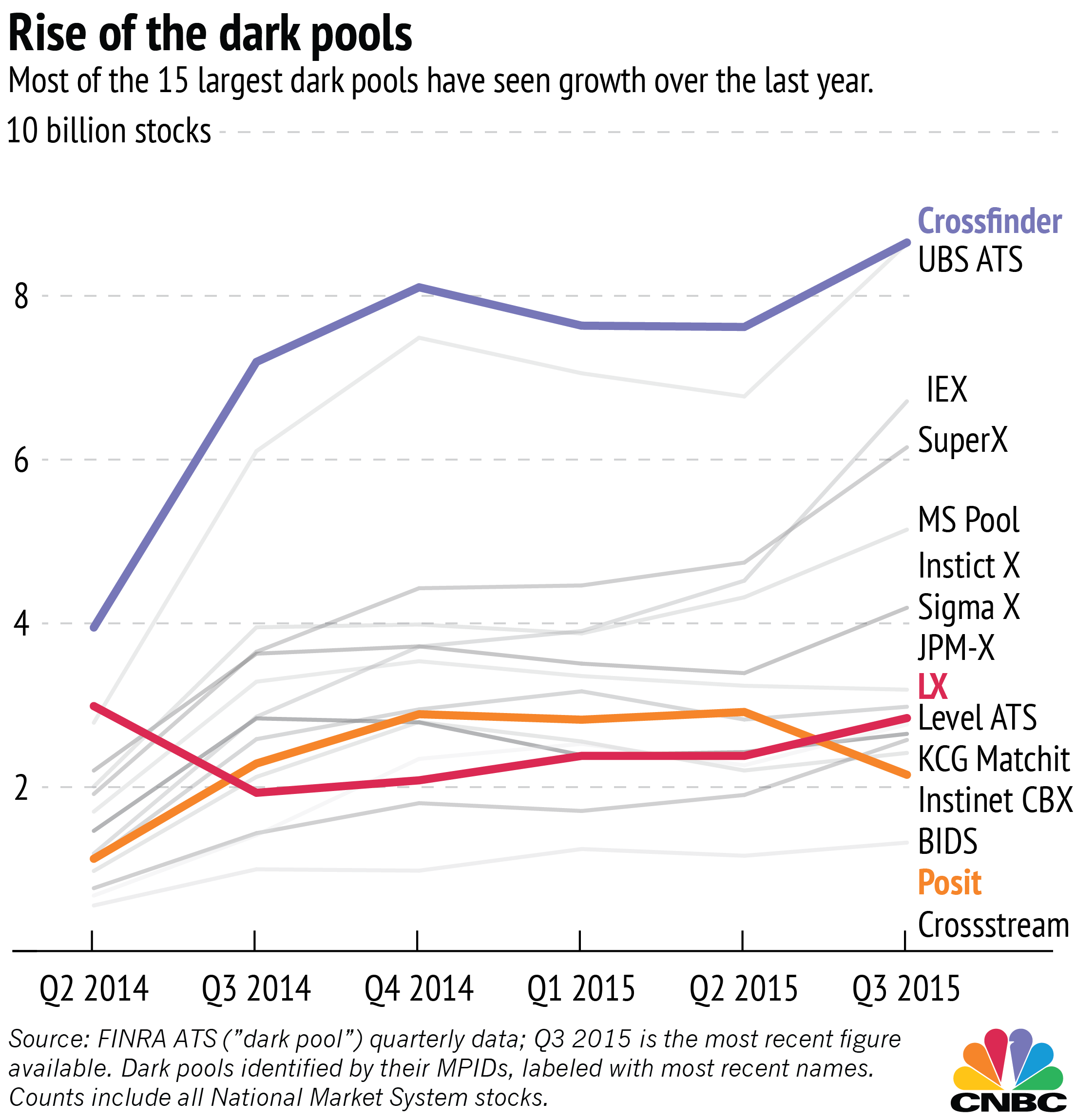

Regulators may have won about $150 million from Credit Suisse and Barclays for behavior in their dark pools, but the closed trading platforms are still wildly popular.

According to reports released by dark pool operators in January, dark pool trading in Europe was up 45 percent by value and 25 percent by volume in December compared to the previous year. Financial Industry Regulatory Authority data show a similarly large increase in stocks traded in dark pools — 22 percent more shares in the third quarter of 2015 than the same time in 2014.

Crossfinder, one of two Credit Suisse dark pools involved in the regulatory action, remains one of the most popular pools on the market, according to the most recent data from FINRA. Barclays' LX dark pool, which also has been targeted by regulators for over a year for allegedly misleading consumers, was one of the few dark pools not to see substantial growth.

The largest regulatory action against dark pools before Sunday's settlement was the $20.3 million fine leveled against Investment Technology Group in August after the firm profited off confidential consumer information by opening a secret trading desk within its own dark pool. The incident coincided with a reduced interest in the firm's Posit dark pool.

more

ErisDiscordia

(443 posts)For years, it has been a point of tension between the Obama Treasury Department and Republicans on Capitol Hill: If the nation hits the debt ceiling, can the U.S. government plan to avoid a technical default on its debt by using incoming funds to pay U.S. debtholders while slashing spending on nearly everything else the government does?

Republicans have argued that the government can do exactly that, and that the brinkmanship rhetoric of the Obama administration is overwrought and an attempt to force them to cut a debt deal they don't like.

The Obama administration, by contrast, has been vague about what exactly it would do if the debt ceiling were finally breached while publicly urging Republicans not to push the nation into uncharted financial waters. Now comes a trove of new documentation unearthed by congressional Republicans that seems to suggest that some staff of the New York Federal Reserve were deeply skeptical about the administration's "close hold" tactics as far back as 2013.

For years, it has been a point of tension between the Obama Treasury Department and Republicans on Capitol Hill: If the nation hits the debt ceiling, can the U.S. government plan to avoid a technical default on its debt by using incoming funds to pay U.S. debtholders while slashing spending on nearly everything else the government does?

Republicans have argued that the government can do exactly that, and that the brinkmanship rhetoric of the Obama administration is overwrought and an attempt to force them to cut a debt deal they don't like.

The Obama administration, by contrast, has been vague about what exactly it would do if the debt ceiling were finally breached while publicly urging Republicans not to push the nation into uncharted financial waters.

Now comes a trove of new documentation unearthed by congressional Republicans that seems to suggest that some staff of the New York Federal Reserve were deeply skeptical about the administration's "close hold" tactics as far back as 2013.

The oversight subcommittee of the House Financial Services Committee released the new report, entitled "The Obama Administration's Debt Ceiling Subterfuge," on Monday, alleging that "Treasury has sought to withhold from Congress and the American people information about the Administration's contingency plans, for the purpose of pressuring Congress to acquiesce to the Administration's position that any increase in the debt ceiling not be accompanied by spending constraints."..

more

ErisDiscordia

(443 posts)I just have to burst into song at this:

http://www.bloomberg.com/news/articles/2016-02-01/coeure-says-ecb-may-reconsider-policy-stance-at-march-meeting?cmpid=yhoo.headline&ref=yfp

European Central Bank officials, preparing to consider fresh stimulus for the euro area, warned governments to get moving with structural reforms and told investors to be realistic about any action monetary-policy makers might take.

Speaking at a conference in Budapest, Executive Board member Benoit Coeure reiterated that the ECB will “review and possibly reconsider” its policy stance at its March 10 meeting, while stressing that without economic reforms the region’s recovery won’t last. Governing Council member Ewald Nowotny said he hoped markets would be “more rational” than they were in December, when central-bank measures fell short of expectations and sent the euro and bond yields soaring.

Despite an unprecedented level of monetary stimulus, the ECB is struggling to revive inflation as oil prices slump and China’s slowdown drags on global trade. Factories in the euro area slashed prices of goods by the most in a year in January, a purchasing managers’ survey by Markit Economics showed on Monday, underscoring the risk that weak consumer-price pressures are becoming ingrained.

“We have always made it clear that we are ready and able to play our part,” Coeure said. “But for the recovery to become structural, and thus to increase growth potential and reduce structural unemployment, monetary policy does not suffice.”

more

(I'm sorry, I couldn't resist)

Warpy

(111,275 posts)as well as telling corporations to hire unemployed people to make things no one had the money to buy.

The financial wizards and masters of the universe learned nothing 80 years ago.

louis-t

(23,295 posts)Not in the '20s, not in the '80s, not in the '00s. And they'll do it again in a minute.

ErisDiscordia

(443 posts)JPMorgan Chase & Co. global equity strategist Mislav Matejka says technical and sentiment indicators have rebounded from extreme levels, showing that stocks are no longer in “buy” territory. Among the indicators, the American Association of Individual Investors Bull-Bear Index has bounced from a near three-year low reached in mid-January, while the Chicago Board Options Exchange Volatility Index has fallen back, Matejka wrote in a report Monday, with a sell recommendation on any rebounds in equities.

ErisDiscordia

(443 posts)Worries that a recession is in store for the world’s largest economy, if it hasn’t begun already, have dominated financial markets so far this year, and sluggish fourth-quarter growth has done little to assuage those fears.

But Deutsche Bank AG Chief International Economist Torsten Slok has some counterintuitive advice for his most pessimistic clients: Buy.

“I frequently hear clients express very negative comments about the U.S. economic outlook, including the statement that that economy is already in a recession,” he wrote. “The irony is that if you have the view that things are really bad at the moment and we are currently in a recession, then it is actually a good idea to buy risky assets today.”

Put simply, the U.S. leverage problem of today is peanuts compared with the Great Recession. The key factor informing Slok’s position that fallout from crashing oil prices won’t be a repeat of the subprime meltdown is the yawning gap between credit outstanding tied to mortgages circa 2006 and high-yield debt in 2016:

ErisDiscordia

(443 posts)...In fact, the power authority has been giving free power to all 78 of Puerto Rico’s municipalities, to many of its government-owned enterprises, even to some for-profit businesses — although not to its citizens. It has done so for decades, even as it has sunk deeper and deeper in debt, borrowing billions just to stay afloat.

Now, however, the island’s government is running out of cash, facing a total debt of $72 billion and already defaulting on some bonds — and an effort is underway to limit the free electricity, which is estimated to cost the power authority hundreds of millions of dollars.

But like many financial arrangements on the island, the free electricity is so tightly woven into the fabric of society that unwinding it would have vast ramifications and, some say, only worsen the plight of the people who live here...

ErisDiscordia

(443 posts)...With all else equal, then, a bank that uses more leverage will earn more money than a bank that uses less. Herein lies the first layer of the onion that explains why Bank of America isn't as profitable as JPMorgan Chase or Wells Fargo. As you can see in the table below, Bank of America leverages its common equity by a multiple of 9.3 compared to multiples of 11.2 and 10.4 at JPMorgan Chase and Wells Fargo.

Bank Leverage (Total Assets/Common Equity)

JPMorgan Chase 11.2

Wells Fargo 10.4

Bank of America 9.3

SOURCE: FOURTH-QUARTER EARNINGS RELEASES AND SUPPLEMENTS.

Sparing you the cumbersome math, if Bank of America was leveraged to the same extent as JPMorgan Chase, it would earn $4.2 billion more a year, holding all else equal. And if Bank of America was leveraged to the same degree as Wells Fargo, it would earn $3.1 billion more a year.

So, why isn't Bank of America more leveraged? In a nutshell, the Federal Reserve requires it to retain a larger share of its earnings each year than either JPMorgan Chase or Wells Fargo. This boosts Bank of America's retained earnings, which is a component of common equity -- the denominator in the return-on-equity calculation. The reason the Fed requires it to retain so much more than its peers stems from Bank of America's transgressions over the past decade. The regulators simply don't trust it as much as they do JPMorgan Chase or Wells Fargo...

ErisDiscordia

(443 posts)At this time of this writing, oil was trading at $31.62, U.S. crude futures dropped 6% on weak economic news from China and T. Boone Pickens was called oil's bottom (at $26, which it hit last month) and predicted a $50-60 per barrel price by year's end. Last week, John Kilduff of Again Capital, which specializes in energy and metals, said he expects oil to hit $18 per barrel, primarily because he believes no coordinated plan to cut supply will take place.

There are plenty of conflicting opinions on where oil is headed next. Those who think it’s heading higher fall into three camps: those with a vested interest, those who believe the economy is recovering, and those who are used to oil trading at higher prices.

That last group might sound simplistic, but that's the largest group of them all. Many investors and traders are buying stock in oil companies simply because they’re used to seeing oil at higher prices. They’re not realizing that oil was at higher prices for decades because of a booming economy when demand was high. That was also an inflationary environment. Today’s situation is much different.

Deflation

Today, we’re living in a deflationary environment if you remove central bank intervention. The economic boom we witnessed from 1982-2007 (and the artificial boom from 2009-2015) was the largest economic boom in history. These types of economic cycles don’t last forever. Today’s demographics, with falling consumer spending via retiring Baby Boomers and stagnant wage growth, don’t support stellar economic times over the next several years.

Read more

ErisDiscordia

(443 posts)http://www.alternet.org/news-amp-politics/war-whistleblowers-how-obama-administration-destroyed-thomas-drake-exposing

When Thomas Drake, then an official at the National Security Agency, realized that the agency’s decision to shut down an internal data analysis program and instead outsource the project to a private contractor provided the government with less effective analysis at much higher cost, he tried to do something about it. Drake’s decision to join three other whistleblowers in asking the agency’s inspector general to investigate ultimately made him the target of a leak investigation that tore his life apart.

In 2005, the inspector general of the Department of Defense, of which NSA is a part, confirmed the whistleblowers’ accusations of waste, fraud and security risk.

Earlier this year, former NSA Director Michael Hayden even conceded that TrailBlazer, the program for which the NSA paid over $1 billion to the Science Applications International Corporation, had failed. The agency, after killing its own program (called ThinThread) “outsourced how we gathered other people’s communications,” he said in response to a question from investigative journalist Tim Shorrock. “And that was a bridge too far for industry. We tried a moonshot, and it failed.”

Nevertheless, Drake’s efforts to expose that waste and abuse would ultimately lead to his being charged under the 1917 Espionage Act — a law intended for the prosecution of spies, not whistleblowers.

more

Edward Snowden started for Hong Kong on May 20, 2013. this article is from April 2013.

ErisDiscordia

(443 posts)When the Constitution was adopted, there were three federal crimes: treason, piracy, and counterfeiting. Now, there are more federal crimes than we can count — literally. The Congressional Research Service tried to tally the number of crimes sprinkled throughout federal codes, but gave up at 4,450. That does not include more than 10,000 regulations that carry criminal penalties. It’s a wonder anyone can survive 24 hours without violating some obscure statute or rule, so when the government sets out to get someone, it typically can come up with some obscure law that someone has broken.

Complicating this is the fact that most people involved in criminal justice in the United States these days, although they may not be full-fledged psychopaths or sociopaths, are at least some sort of characteropath. These are people who have an authoritarian bent and are in love with power and control. These trump justice, fairness and common sense, and what we find is that these people play fast and loose with the truth.

By unpinning criminal law from its moral roots, we now impose the harshest sentences on activities that are deemed improper by those with the loudest voices. Both sides of the political spectrum are equally guilty, and each side sees no foul when it is the other side which falls victim to the slowly expanding (well maybe it isn’t expanding so slowly anymore) US police state. This is government by whim, and these “whim” crimes are not based on evil intent. In fact, they require no intent at all. They are “strict liability” crimes — you don’t have to know you are acting unlawfully to be sent to prison.

Alexis de Tocqueville warned that the greatest danger to a democracy was “soft despotism”:

http://www.nakedcapitalism.com/2013/04/war-on-whistleblowers-how-the-obama-administration-destroyed-thomas-drake-for-exposing-government-waste.html

ErisDiscordia

(443 posts)Panic? Despair? Business as usual (not that it's been "usual" for quite some time now)?

Futures are down...less than 1% at 6 AM eastern.

Punx

(446 posts)The question is: "What would frighten Wall Street More? Bernie basically tying Hillary, or Ted Cruz winning?"

Ted Cruz scares the crap out of me, but then I'd like to believe I'm sane.

Or maybe it's oil slipping down again.

DemReadingDU

(16,000 posts)2/2/16 BP to cut 7,000 jobs after posting huge loss

More bad news for oil investors and workers: BP is cutting thousands of jobs after it sank to a huge loss in 2015. The company posted an annual loss of $5.2 billion, compared with a profit of $8.1 billion in 2014.

Much of the reversal was due to charges relating to the fallout from the 2010 Gulf of Mexico disaster, but the steep fall in oil and gas prices played a big part too. Stripping out one-off charges, profits slumped by 50% to $5.9 billion.

BP is the first big European oil company to report 2015 results after prices of crude dropped 35% last year. The earnings were worse than expected and shares in BP slumped more than 8% in London.

The company also announced plans to cut 7,000 jobs by the end of 2017, 3,000 more than it was expecting to shed just three weeks ago.

BP took a hit in the fourth quarter due to restructuring charges and writedowns in its oil and gas exploration and production business. It announced the job cuts because of the tumbling oil prices. BP took charges of $12 billion related to the Gulf of Mexico oil spill in 2015. This takes the total bill for the disaster to $55.5 billion.

http://money.cnn.com/2016/02/02/news/companies/bp-loss-jobs/index.html

Hotler

(11,425 posts)start some shit. Very thin skinned that group is. I guess I'll just sit back and watch some of them melt down.![]()

Woke up to 12" of snow this morning and got to work here early and now I'm thinking hot toddy.

antigop

(12,778 posts)Part of me wants to be happy that some people are waking up.

Part of me is angry that so many people haven't woken up.

We have a once in a lifetime opportunity here to try and rein in Wall Street.

Fuddnik

(8,846 posts)Thin skinned is an understatement. I got tossed for a very lame post.

At least it's 80 degrees here again, and I'm gonna jump on the motorcycle and have a spin.

tclambert

(11,087 posts)when it comes to calling coin tosses. And isn't that exactly what we need in a commander-in-chief, the ability to call heads or tails better than our opponents? Or to roll the dice better, anyway. According to the rules of war, a roll of the dice decides most battles, with ties going to the defender, of course. Or is that the rules of Risk?

Anyway, the Sanders campaign better get its staffers and volunteers some education on how to call coin tosses better. Losing six out of six just isn't acceptable if you want to win the nomination.

Seriously, coin tossing to decide the next President? What kind of mad world do we live in?

DemReadingDU

(16,000 posts)One of the most bizarre strategies I ever heard.

![]()