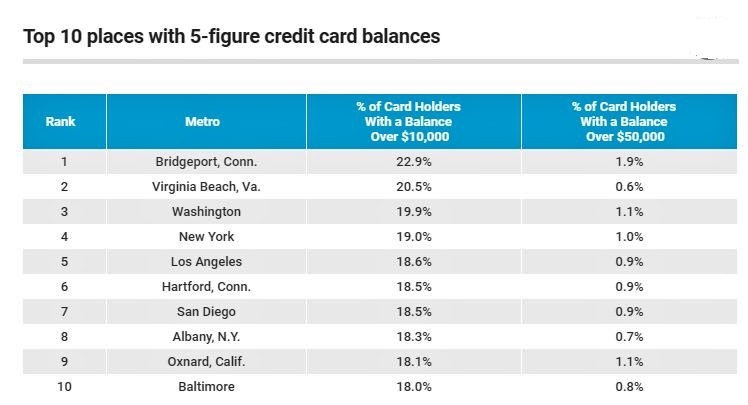

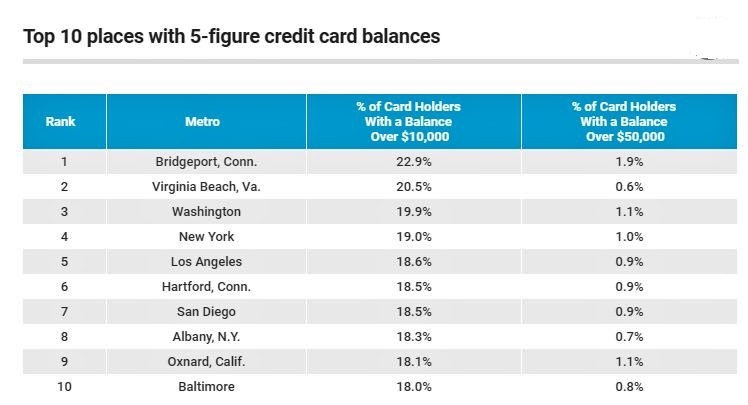

Places Where People Are Most Likely to Have 5-Figure Credit Card Balances

About 1 in 6 credit cardholders in America’s biggest cities carry a balance of $10,000 or more, according to a new report from CompareCards, and none of those cities has a higher percentage of these cardholders than Bridgeport, Conn.

CompareCards analyzed a representative sample of Americans to see which of the 100 largest metropolitan statistical areas have credit cardholders with five-figure credit card balances.

What we found is that most of the cities with the biggest percentages of people with five-figure credit card debt are clustered along the East Coast and West Coast. Often, it is the wealthiest cities — not the less affluent ones as one might expect — that carry the biggest credit card balances.

The five-figure credit debt capital of the U.S.:

Nearly 23% of credit cardholders in the Bridgeport metropolitan area owe more than $10,000 on their cards. Almost 2% of cardholders in Bridgeport owe more than $50,000, which is also the highest among the nation’s 100 biggest metros. Virginia Beach, Washington, D.C., and New York rounded out the top four, where 20.5%, 19.9% and 19% — respectively — of users have five-figure balances.

The five-figure credit card debt state:

Among the top 10 cities with the highest percentages of cardholders with five-figure card debt, three were in California. Los Angeles ranked fifth at 18.6%, San Diego placed seventh at 18.5% and Oxnard came in at ninth at 18.1%. Connecticut was a close runner-up in the state contest, with Bridgeport, Hartford and New Haven all ranking in the top 14.

Five-figure card debts rarer in the South:

Five of the seven cities among the 100 metros with the lowest percentage of cardholders with five-figure card debt were in the South. Only 12.4% of cardholders in Winston-Salem, N.C., and Indianapolis had more than $10,000 in card balances. Greensboro, N.C., Chattanooga and Knoxville, Tenn., and Jackson, Miss., were among the other cities near the bottom of the list, all having less than 13% of cardholders with five-figure card debts.

https://www.comparecards.com/blog/places-people-5-figure-credit-card-balances/