Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 19 March 2012

[font size=3]STOCK MARKET WATCH, Monday, 19 March 2012[font color=black][/font]

SMW for 16 March 2012

AT THE CLOSING BELL ON 16 March 2012

[center][font color=red]

Dow Jones 13,232.62 -20.14 (-0.15%)

[font color=green]S&P 500 1,404.17 +1.57 (0.11%)

[font color=red]Nasdaq 3,055.26 -1.11 (-0.04%)

[font color=green]10 Year 2.29% -0.04 (-1.72%)

30 Year 3.40% -0.05 (-1.45%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Hate the full-body scans, pat-downs and slow going at TSA airport security screening checkpoints? For $100, you can now bypass the hassle.

The Transportation Security Administration is rolling out expedited screening at big airports called "Precheck." It has special lanes for background-checked travelers, who can keep their shoes, belt and jacket on, leave laptops and liquids in carry-on bags and walk through a metal detector rather than a full-body scan. The process, now at two airlines and nine airports, is much like how screenings worked before the Sept. 11 attacks.

To qualify, frequent fliers must meet undisclosed TSA criteria and get invited in by the airlines. There is also a backdoor in. Approved travelers who are in the U.S. Customs and Border Protection's "Global Entry" program can transfer into Precheck using their Global Entry number.

"It's a completely different experience than what you're used to," said Matt Stegmeir, a platinum-level Delta Air Lines Inc. DAL frequent flier who was invited into Precheck when it opened at his home airport, Minneapolis-St. Paul. Besides zipping through security screening quickly and easily, Mr. Stegmeir noticed another difference: TSA agents at the Precheck lane are usually smiling...

ALL ANIMALS ARE EQUAL, BUT SOME ANIMALS ARE MORE EQUAL THAN OTHERS

Demeter

(85,373 posts)There's a general view out there that with private creditors having agreed their 50pc haircut, the "Greek problem" has been solved, at least for now. Unfortunately, it has not. According to Reuters, an unpublished "Compliance Report" by EU executives has concluded that Greece will have to impose a further fiscal squeeze in 2013/14 amounting to some 5.5pc of GDP in order to meet the targets that underpin the second international bailout. The chances of Greece being able to do this are about zero, though that is my conclusion, not that of the report.

According to the report, the austerity measures already adopted by Athens should be enough to bring the primary deficit down to the agreed 1.5pc this year. However, "current projections reveal large fiscal gaps in 2013-14". The projected shortfall is reckoned to be about 5.5pc of GDP. All this, of course, assumes that Greece achieves the output levels forecast by the Troika, the chances of which are again about zero. So in fact, the required squeeze will be even larger, further undermining growth and digging an even deeper hole. Unabashed, the report states that "substantial additional expenditure cuts will have to be announced and adopted by Greece in the coming months, in particular when Greece updates its medium-term budget in May 2012".

Where is Greece expected to find these cuts? Further savings in welfare payments, pharmaceutical spending, defense and restructuring of central and local administration are said to be under discussion. Has anyone told the Greek electorate, which is due to go the polls next month, about this? Apparently not.

Menacingly, the report adds that continuation of international financial assistance can only be expected if policy implementation improves...A second bailout from the eurozone and the International Monetary Fund worth €130bn was finally agreed on Monday, which in theory should keep Athens financed through to the end of 2014. However, the money is to he drip fed, with later tranches dependent on meeting the troika programme. Spain has had its deficit target for this year reduced, so the eurozone has shown itself to be flexible. But Spain isn't in the programme. The treatment meted out to those in receipt of financial assistance may be somewhat harsher.

This is what Citigroup had to say about developments in a note published on Tuesday morning:

Actually, I'd put the chances at way above 50pc. The only question is when. Regrettably, it looks as if the whole miserable mess is going to keep us in column inches for quite a few more months yet.

Demeter

(85,373 posts)WELL, NOW WE KNOW WHOSE OX GOT GORED

http://www.reuters.com/article/2012/03/01/us-greece-bonds-pimco-idUSTRE8201D920120301

Bill Gross, co-chief investment officer at PIMCO, on Thursday took issue with a derivative panel's decision that the restructuring of Greek debt does not trigger a payout on insurance protection, even after his firm backed the move.

Bond giant PIMCO was one of 15 banks, hedge funds, and asset managers in the International Swaps and Derivatives Association that voted on Thursday against declaring the restructuring a credit event that would trigger a payout on credit default swaps.

"If I were a buyer of protection on Greece and have seen the result this morning in terms of no protection, then I would be upset," Gross, manager of the world's largest bond fund, said on CNBC television of the ISDA's decision.

The decision prevents credit default swap insurance payments from being triggered. The net worth of these contracts is $3.25 billion....

Po_d Mainiac

(4,183 posts)On March 9, 2012 the EMEA Credit Derivatives Determinations Committee resolved that a Restructuring Credit Event occurred in respect of The Hellenic Republic and subsequently resolved that an Auction would be held.

This page contains details of the DC Resolutions, auction documentation and other items relating to the auction for The Hellenic Republic. Further documentation relating to the auction will be added as it becomes available.

Please note that ISDA has published a Uniform Settlement Agreement to facilitate the orderly settlement of transactions that are subject to the above Credit Event announcement. This is below, together with a Frequently Asked Questions document for reference.

All ISDA voting members agreed....lots of lings to porn below

http://www.isda.org/companies/HellenicRepublicCDS/HellenicRepublicCDS.html

Demeter

(85,373 posts)why do complex societies/civilizations collapse?

One of interesting working theories we have is that while complex societies can be in decay for a long period of time, they only collapse when its favored elites abandon it/betray it.

Here's an example from Roman history written by Joseph Tainter:

One outcome of diminishing returns to complexity is illustrated by the collapse of the Western Roman Empire.

As a solar-energy based society which taxed heavily, the empire had little fiscal reserve.

When confronted with military crises, Roman Emperors often had to respond by debasing the silver currency (Figure 4.2) and trying to raise new funds.

In the third century A.D. constant crises forced the emperors to double the size of the army and increase both the size and complexity of the government. To pay for this, masses of worthless coins were produced, supplies were commandeered from peasants, and the level of taxation was made even more oppressive (up to two-thirds of the net yield after payment of rent).

Inflation devastated the economy. Lands and population were surveyed across the empire and assessed for taxes. Communities were held corporately liable for any unpaid amounts.

While peasants went hungry or sold their children into slavery, massive fortifications were built, the size of the bureaucracy doubled, provincial administration was made more complex, large subsidies in gold were paid to Germanic tribes, and new imperial cities and courts were established.

With rising taxes, marginal lands were abandoned and population declined. Peasants could no longer support large families.

To avoid oppressive civic obligations, the wealthy fled from cities to establish self-sufficient rural estates.

Ultimately, to escape taxation, peasants voluntarily entered into feudal relationships with these land holders.

A few wealthy families came to own much of the land in the western empire, and were able to defy the imperial government. The empire came to sustain itself by consuming its capital resources; producing lands and peasant population (Jones 1964, 1974; Wickham 1984; Tainter 1988, 1994b).

The Roman Empire provides history's best-documented example of how increasing complexity to resolve problems leads to higher costs, diminishing returns, alienation of a support population, economic weakness, and collapse. In the end it could no longer afford to solve the problems of its own existence.

A more recent example of this is how the bureaucratic elites of the former Soviet Union, turned on the system and quickly gutted it through privatization, when their privileges were reduced. An accelerant of the process was the availability of an external financial system to deposit the newly looted wealth.

The big question for those of us in the US/EU is whether we are seeing this process at work in our system. Are the government/business elites turning against the system?

OTHER QUESTIONS: IS THE POPE CATHOLIC? DOES A BEAR SHIT IN THE WOODS? AND IS WATER WET?

Demeter

(85,373 posts)This "empire" of ours is suffering from self-inflicted crises generated by a completely corrupted "elite" pulling all the wrong strings for all the wrong reasons.

The collapse of our "elites' empire" doesn't have to take down anyone but the "elite", and it must do so in the most rigorous and thorough way. There can be no mercy, no fixes, no exceptions. Steps taken must include:

And maybe, after that, the rest of the world will forgive us.

Demeter

(85,373 posts)tim302 said...

A significant chunk of the elite turned against the American system post-1965 Voting Rights Act. You go through the South and you can see it very clearly-- the decline of spending or interest in common infrastructure such as schools, public pools etc. Basically, when the white settler elite (the former slaveholders) realized they would have to share the commons with African Americans they decided to withdraw from the commons. But this is true throughout the United States, not just the South. It is only most obvious in the South, and since Southern politicians have succeeded in dominating the federal system, they have also been able to cripple the central government as well. Look at the huge fight over federal funding for high speed rail in California, which is embarrassing. Even Japan's right-wing one party government could see the benefits of high speed rail-- during the 1950s.

Withdrawing from the commons has worked fine for the top of the income bracket. But their less well off foot soldiers didn't realize, however, is that we all live side-by side, and that systematically destroying the nation-state would also hurt them. Eventually the predator state prison complex gun would point at the white working class too-- and this has happened, they've found out that no one gives a shit about them either. You may go to church every Sunday, profess your undying belief in America, and work ass off at your construction gig, never accept welfare and look down on non-whites as shifty dope using profligate embracers of promiscuity,but ultimately the people whose economic program you supported for 30 years don't care about you and now they are going to destroy your life by privatizing what is left of the commons and leaving you to race to the bottom.

On the left, people decided that the idea of the nation-state was déclassé, and that patriotism was embarrassing, and they retreated, into the self-referential intellectual masturbation of post-modernism, where everybody is right and nobody is wrong. Of course, that's nonsense. They don't actually believe that, it's just a convenient cover for people who lack the courage of their convictions. Ironically, these people often embrace the Che cult, and the cult of ''third world liberation" generally, while never realizing that what drove those movements was not some embrace of an international ideal, but of localized, nationalistic sentiment. Carefully ensconced in academia, they have cushy jobs, retirement plans and insurance benefits, and enjoy regular international travel to mostly irrelevant conferences where other people just like them deliver talks on the post-Lacanian cultural analysis of the cultural identity of transnational non-traditional shamanistic sexuality participants (aka furries), followed by cliched calls to solidarity with striking workers in Greece. You can sneer at the nation state all you want, but you exist in a bubble of academic privilege that is paid for by federal student loans and defense department grants, and the multicultural diversity that you so prize exists only because there is still, just barely, a common American identity holding it all together. If the United States ever fell apart, no one is going to protect your precious, diverse, non-traditional gender role-loving community, as the US will look more like the Balkans after the end of Communism.

There is a way out of this situation, but the answers most certainly will not be found among an elite that long ago turned its back on America.

Demeter

(85,373 posts)rajamma said...

The elite are a Trans National class with NO loyalty to any nation-state as such; They merely use the political and the bureaucratic class of each nation to their advantage

The elite international bankers (Rothschilds, Rockefellers, etc) and their cronies have siphoned out trillions of dollars (created in the federal reserve system )from US/EU to collapse their economies.

The elite seem to have departed to make China their new head quarters; Chinese Military will be used to control the world order in the future instead of US and NATO

The author is quite right that decline has been taking place over decades by moving manufacturing and sensitive military technology to China; The financial crisis of 2008 was the end game by the departing elite.

Demeter

(85,373 posts)HERE'S YOUR HAT, WHAT'S YOUR HURRY?

Demeter

(85,373 posts)HOPE THE "ELITE" LIKE GETTING SCREWED BY THE CHINESE....WHOSE MEMORIES SPAN MILLENIA, AND WHOSE GREED HAS BEEN TEMPERED BY POPULATION CRUSH. IT WILL MAKE THE FRENCH REVOLUTION LOOK LIKE A PICNIC AT VERSAILLES.

Po_d Mainiac

(4,183 posts)A) Stuck to jet propelled aircraft

&

B) Showered before taking that last flight

(Deciding to wash up on shore was a poor choice)

Demeter

(85,373 posts)BBC Documenary on 'The Business Plot' of 1933 in which a powerful group of wealthy Americans attempted to set up an organization patterned on the French fascists and German Storm Troopers and overturn democracy and the Constitution. If they had succeeded, and formed an alliance with the industrialists and bankers backing the corporatism of Mussolini and Hitler, then the world might appear very differently than it does today.

The history of man is the history of crimes, and history can repeat. So information is a defence. Through this we can build, we must build, a defence against repetition.

What connects two thousand years of genocide? Too much power in too few hands.

Simon Wiesenthal

&feature=player_embedded

Demeter

(85,373 posts)At the very moment William Bryan Jennings should have been climbing into bed at his sumptuous Connecticut mansion, the high-ranking executive at Morgan Stanley was sprinting through back roads a mile away. He was exhausted, scared and - detectives would later allege - had just stabbed a taxi driver in a dispute over a fare....The day, December 21, 2011, had started out normally as he left the kind of home - sweeping curved staircase, perfectly plumped chintz pillows, backyard swimming pool and a Ferrari in the garage - that makes many New Yorkers deeply jealous, and headed to the steel-and-glass tower in midtown Manhattan where he directed the firm's bond business.

In the afternoon, he hosted a charity auction in the city to benefit sick children. That night, he attended a Morgan Stanley holiday party at the swanky rooftop bar at Ink48 Hotel. When he left the party, he looked for the black town car that was supposed to take him to his $2.7 million mansion in the wealthy enclave of Darien. He couldn't find the car, so he hailed a yellow cab. In less than two hours, what allegedly began as a tussle over a cab fare, which the taxi driver said was $204, led to a struggle that could cost Jennings his career.

On March 9, Jennings walked quietly into a Stamford courtroom and pleaded not guilty to charges of assault, larceny for not paying the fare and intimidation with racial slurs against Mohamed Helmy Ammar, an American citizen who was born in Egypt. The proceedings took just a few seconds. Jennings, dressed in a navy blazer, white shirt and royal blue patterned tie, left swiftly afterwards with his lawyer, Eugene Riccio, followed by a noisy throng of reporters and photographers.

If convicted of all three charges, Jennings, Morgan Stanley's head of fixed income for North America, could face up to 11 years in prison. First-time offenders rarely face such stiff sentences but the charges are serious, and both Jennings' job and reputation are at stake. Morgan Stanley has already placed him on leave. The firm's spokesman declined to comment, other than to say no decision has been made regarding Jennings' longer-term status at the firm. One top-ranking Morgan Stanley executive, though, said he "does not stand a chance of getting his job back." Jennings may also face a civil suit for damages from the taxi driver. Ammar's attorney, Hassan Ahmad, says no settlement discussions are taking place, but his client is talking about such a suit.

"Our client wants justice,'' Ahmad said. "He wants Mr. Jennings to be prosecuted to the full extent of the law."

A pre-trial hearing is set for April 12.

Hotler

(11,421 posts)Demeter

(85,373 posts)...In addition to lobbying, big financial players have another potential weapon in their battle against safety and soundness. This one is more hidden from view and comes from, of all places, the World Trade Organization in Geneva....Back in the 1990s, when many in Washington — and virtually everyone on Wall Street — embraced the deregulation that helped lead to the recent crisis, a vast majority of W.T.O. nations made varying commitments to what’s called the financial services agreement, which loosens rules governing banks and other such institutions. Many countries, for instance, said they would not restrict the number of financial services companies in their territories. Many also pledged not to cap the total value of assets or transactions conducted by such companies. These pledges also appear to raise trouble for any country that tries to ban risky financial instruments.

According to the W.T.O., 125 of its 153 member countries have made varying degrees of commitments to the financial services agreement. Now, these pledges could easily be used to undermine new rules intended to make financial systems safer. What would happen if a country flouted the rules in an attempt to reduce risks in its financial system? Possibly nothing. Then again, that country could find itself subject to a challenge by the W.T.O. So far, no countries have asked the organization to challenge rule changes like those made in the United States under the Dodd-Frank law. But rumblings of such an objection emerged in late December, in a comment letter sent to United States banking regulators. That letter criticized elements of the Volcker Rule, which is intended to prevent financial companies from making bets for themselves with deposits backed by taxpayers.

The letter was written by the Investment Industry Association of Canada. It called the proposal “an unprecedented reach of extra-territorial regulation.” The letter went on: “As a result, the Volcker Rule may contravene the Nafta trade agreement,” a reference to the North American Free Trade Agreement, which has a broadly similar set of rules to the financial services agreement under the W.T.O. While countries must ask the W.T.O. to mount a challenge under its rules, companies can do so directly under Nafta.

Some countries that are trying to reregulate their financial systems worry that they may run afoul of trade commitments. The delegation for Barbados, for example, wrote last year about the trouble it might encounter imposing new rules while trying to abide by trade agreements.

“The notion of ‘too big to fail’ has been a concern even prior to the crisis, but the financial crisis realized banking regulators’ worst fears,” Barbados wrote to a W.T.O. committee in early 2011.

Yet nations that committed to the agreement in the 1990s “may find restrictions on size are contrary to the commitments given to limit adverse affects on financial service suppliers,” the Barbados letter said.

MORE WIGGLING AND WHINING

Demeter

(85,373 posts)We celebrated St. Patrick with the traditional New England Boiled Dinner: corned beef, cabbage, turnips, carrots, potatoes, and a quasi-Irish soda bread (I cheated this year, and tried Bisquick; never again!) The ravenous horde went through 15 lb corned beef, 3 lb each carrots, turnips and cabbage, and 6 lbs potatoes.

And after the food disappeared, people stayed and talked! This is what I'd hoped to see when I started this quixotic effort many years ago...the conversation amongst the members of the community, to build community.

I am tired, though. The weather continues beautiful, which makes overworking much more feasible.

Demeter

(85,373 posts)In case you missed this saga (it wasn’t one we posted on till now) in June last year, AARP’s board approved supporting Social Security cuts. That followed a multi million dollar ad campaign against the very same stance. They planned to sell the future of old people living off dog food to the membership via a series of town hall meetings. The backlash from the membership led to the purge of the policy chief John Rother, who was made a scapegoat. The latest development, reported in the Huffington Post, shows the housecleaning didn’t go far enough. AARP members need to demand resignation of all directors who are behind this scheme, which is probably all of them. Protests at their homes might be necessary to rein in an board which is so insistently defying its members wishes and interests.

And to add insult to injury, the AARP plans a “listening tour” which is of course not at all about listening but selling a “Grand Bargain” which is more Newspeak, in this case the idea of a budget deal that includes retirement program cuts. The Huffington Post does a great job of exposing how the leadership of the AARP is flat out lying to its members about its conduct:

The list of invitees to the salon event includes a gallery of powerful Washington establishment figures who are on record favoring cuts to Social Security and Medicare. The only firm opponent of Social Security or Medicare benefit cuts on the list, the Economic Policy Institute’s Larry Mishel, said he wasn’t planning to go and wasn’t sure why he was listed as a featured guest. (AARP also responded to the request for comment by inviting HuffPost to attend the off-the-record gathering, an offer we plan to accept.)

Other listed invitees included business leaders and deficit hawks who have long argued for the cuts, including Tom Donohue of the U.S. Chamber of Commerce, John Engler of the Business Roundtable group for corporate CEOs, and David Walker, a noted deficit alarmist and former head of the Government Accountability Office.

Yet the AARP wants its members to believe this sort of tripe:

This isn’t even a good con. The AARP has no business “hearing from all sides.” Its mission is to represent its members, and they’ve made it clear they have no interest in having their benefits cut. Indeed, having the AARP stand firm would serve to put focus on the right issues which is that the real problem is Medicare, not Social Security, and the problem with Medicare is a broad social problem, that health care costs have and continue to rise much faster than inflation. Determined pushback from seniors and other parties could put focus on the real issue and serve as an important counterweight to the health care lobby.

The HuffPo article points out the fallacy of the leadership’s turncoat logic:

If you are a member of the AAPR or have relatives who are members, send this article on and tell them to call or write and tell the organization that you aren’t standing for this. Nor should you. You are about to be sold out by incompetent lobbyists unless you make a stink. You can also join the campaign at Firedoglake to cancel the event:

http://my.firedoglake.com/bsonenstein/2012/03/16/tell-aarp-ceo-barry-rand-to-end-back-room-strategy-sessions-with-safety-net-opponents/

Demeter

(85,373 posts)...Remember that the Administration also trumpeted that enforcement would be tough, even as Abigail Field has shown that idea to be a joke. For instance, the servicing standards allow for the astonishing concept of an acceptable error rate. Banks aren’t permitted to make errors with your checking account and ding you an accidental $10,000 and get away with it. But with people’s most important asset, their homes, servicers are allowed a certain level of reportable errors, and many of them can be serious as far as borrowers are concerned. This is one example from her post:

Since most people don’t pay more than what they owe each month, posting less than you paid would seem to make you delinquent when you’re not. How can that be ok? What are the consequences? The servicing standards say the banks have to take your payment if you’re within $50, (See page A-5 at 3.a) but if your mortgage payment is $2000/month, 3% is $60. What if you start facing fees? What if you were trying to bring your account current and the bank screws up the data entry and starts foreclosing? Why isn’t that potentially devastating error reportable?

And again, it gets worse because of Column D. Again, reportable error has to happen 5% of the time to matter. There’s more than 50 million mortgages in the country. 5% of 50 million is 2.5 million. In a single year the banks can tell their computers that 2.5 million people paid so much less than they in fact paid that it’s reportable error, and still the bankers won’t get in trouble.

Most plainly, the bankers can tell 2.5 million people:

“Hey, you didn’t make your payment this month, your check’s short and we’re putting it in the no man’s land of a “suspense account” triggering delinquency and fees, even though you really did pay in full and have the canceled check to prove it. And guess what? No one but you cares; law enforcement won’t even consider dinging us for it.

I’m struggling with the same level of disbelief I had when I first learned that banks were systematically committing forgery.

She also points out that wrongful foreclosures at a 1% rate are acceptable. Procedures around real estate are deliberate because any error of this magnitude has devastating consequences. But this new provision means that 1%, or over 33,000 erroneous foreclosures since 2008 would be perfectly OK as far as the authorities are concerned.

Field also points out in a separate post that this deal is in no way done. Key points remain to be resolved, in particular, how the Monitor will supervise the pact. That’s a huge item, and leaving it unresolved shifts the power to the banks (if you don’t believe me, I refer you to what is happening to Dodd Frank).

But while these are important, notice the media silence about the release? Go have a look and you’ll see why. In the Bank of America example, as with the rest, it’s Exhibit F. It’s really long and not at all pleasant to try to parse. But you actually don’t have to in too much detail to discern what is wrong with it....MORE

Po_d Mainiac

(4,183 posts)Lame Street Media to carry a couple high profile stories and the muppets start to see how bad this settlement really was.

Hmm, what else will be going on in 8 months?

Demeter

(85,373 posts)Except pregnancy.

If it takes a woman 9 months to produce a baby, what happens if you put nine women on the job?

Po_d Mainiac

(4,183 posts)A lesbian orgy?

![]()

![]()

![]()

![]()

![]()

![]()

Demeter

(85,373 posts)At least nine babies, barring any miscarriages....

Po_d Mainiac

(4,183 posts)November = 11

March = 3

11

-3

8

or I'm just a lost soul

Demeter

(85,373 posts)and no interruption, one hopes

Demeter

(85,373 posts)Oil prices are again on the rise – will this derail the economic recovery? And what if there is an oil shock on the horizon? This column presents an overview of the oil market and its possible effects on the global economy. It argues that if there is a shock, the list of casualties will have Europe at the top with the US close behind.

Demeter

(85,373 posts)...On 12 February 1981, Mr Murdoch was allowed to double the number of national newspapers he owned, by adding The Times and The Sunday Times to The Sun and the News of the World. It was normal practice for any bid for a national newspaper to be held up while the Monopolies Commission investigated, but in this case Margaret Thatcher's government overrode objections from Labour and waved it through. Mrs Thatcher reaped the political rewards for the remainder of her time in office....

....Mrs Thatcher needed the media mogul's support because she was so desperately unpopular. Her subsequent success has obscured the extent to which her government was peering over the abyss in 1981. Chris Collins, editor of the Margaret Thatcher Foundation website, describes the documents, which will be accessible at margaretthatcher.org as "the personal archive of a person under great stress."

THERE ARE NO WORDS

Demeter

(85,373 posts)OUR FOUNDING MOTHER SPEAKS

girl gone mad

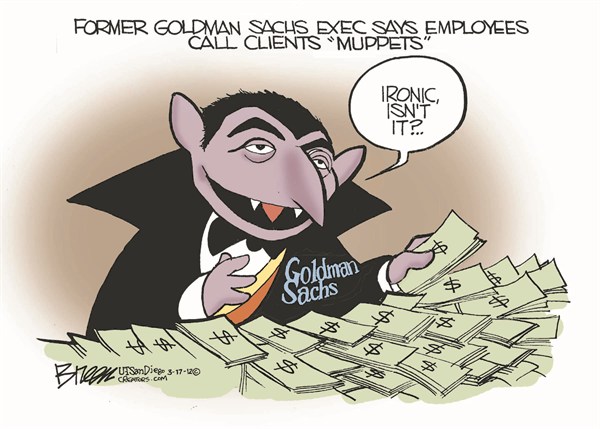

(20,634 posts)In the wake of Goldman Sachs émigré Greg Smith’s op-ed, any doubts you may have had about the deep desire of Wall Street to strip you of your money should be erased. Every one has heard about boiler rooms like the one described in CFTC v. Crown Colony Commodity Options, Ltd, 434 F.Supp. 911 (S.D.N.Y. 1977), where the boss roamed the room telling the sellers “the mooch has your money in his pocket”. At Goldman Sachs, which has a long history of screwing its clients, investors aren’t mooches, they’re “muppets”, but the goal is the same, to get their hands on your wallet.

So, why is the Fed pursuing policies that push people into the arms of these wolverines? Interest rates are near zero after inflation, and the Fed plans to keep them that way for years to come. All those people who scrimped and saved for decades to support their retirements are screwed. Sarah Bloom Raskin, a member of the board of governors of the Fed, addressed this issue in a speech earlier this month. She admits that low interest rates harm savers. Interest income is down by 25% since the recession began. She offers two justifications. Some families benefit from low interest rates, she said, because they can borrow cheaply, or refinance their mortgages at low rates. But who wants to borrow? And who says that banks are lending, or permitting refinancing?

Second, Raskin says it isn’t a big deal about those stupid savers, because only 7% of household assets are held directly in bank accounts, money market funds or bonds. I’d estimate that figure at about $13 trillion, based on recent figures from the Fed’s Flow of Funds report, page 106 (.pdf). That is a huge pile of money producing next to nothing in returns.

Won’t people be discouraged from savings? No, says Raskin. People need to save and they know it. They don’t have any choice but to take the rates that are available. She says it’s good that these rates are low...

read more: http://firedoglake.com/2012/03/18/savers-screwed-to-save-rich-people

Po_d Mainiac

(4,183 posts)Since 2001 every time Greenscum or the Bernank spoke, I went in search of a rape kit ![]()

Demeter

(85,373 posts)I've repeatedly pointed out that it appears that loans were pledged multiple times in various securitizations, which incidentally is black-letter fraud on two counts. Well, now we have a nice attorney in Hawaii who has run some of these down.

The winner so far is a NEW YORK condo, loan number WaMu loan # 714934858, appeared in 6 DIFFERENT trusts from May through November 2006…

Ah, I see.

Let's count who gets screwed by this.

The MBS buyer. He bought.... nothing. You see, there's no interest there if the same loan is in more than one security. Only one of those is valid; the other five are, from a legal perspective, counterfeit since the homeowner only promised to pay once. If I run off duplicates of a $100 bill we call that counterfeiting, right? Well?

The homeowner. He has no idea who is the correct holder. He is paying a note but who's getting the money? The correct noteholder or a pretender? There's no way for him to know. And if he stops paying and the putative noteholder forecloses, it may not be the actual noteholder, in which case the debt is not extinguished at all!

Isn't this nice?

But remember, nobody committed any crimes according to Barack Obama and, I note carefully, Gary Johnson.

If you or I were to make up our own stock certificates or bonds, say much less our own $100 bills, we'd go straight to prison -- and we should. But when a bank does it as appears to be the case here, and not just one either -- more than 500 times -- they keep the loot!

MORE DISGUSTING DOINGS AT LINK

Demeter

(85,373 posts)America’s economy is a mosaic of puzzles and contradictions that has economists and bloggers scrambling for explanations and scrutinizing the data for quirks and flaws. Lately, I’ve been thinking dark thoughts: what if all it takes is a single explanation that assumes all the data are correct?

There are myriad, credible explanations for these puzzles; at one time or another I have advanced all of them: GDP has been held back by bad luck and the usual headwinds of post-crisis deleveraging (a point discussed here in this week’s print edition.) Unemployment is simply correcting for an earlier overshoot. The divergence between employment and GDP may be due to weather, seasonal adjustment, a temporary productivity reversal, or one of the two sets of data being wrong, most likely GDP, which will be revised up. Core inflation has been underpinned by extremely stable expectations, the pass-through of high energy prices, and the anomalous behavior of rents. Tim Duy nicely notes here how often Okun’s Law breaks down....Or you could go with a simpler but more pessimistic explanation: both the level and growth rate of American potential output is much lower than we think. This would resolve all these puzzles: GDP growth of 2.5% is above, not at, trend, the output gap is closing, and it was probably smaller than we thought to begin with. That would explain why unemployment is falling so quickly, and why core inflation hasn’t fallen further. The excess supply of workers and products that ought to be holding back prices and wages is not as ample as we thought. So this explanation has the merit of simplicity; is it plausible? Adam Posen likes to dismiss supply-side explanations for Japan’s economic underperformance by saying the Japanese did not one day wake up and find their left arms had fallen off. I have long agreed with the American analogue: while the crisis and recession have set back America’s output, its productive capacity remains largely intact. The rise in unemployment does not seem to be sectorally concentrated. The ratio of unemployed to job vacancies is falling, but not by much more than is typical at this stage of the cycle.

That’s still my view. But lately, it is starting to look more like some left arms have gone missing.

Labour force participation seems to have settled at 64%, two percentage points lower than its pre-recession level. If that drop is permanent, it would alone entail a significant decline in the level of potential output. What about productivity? My colleague notes there’s a healthy debate going on about whether trend productivity has slowed. I don’t know the answer, but it’s clear that actual productivity has been pretty unimpressive for this stage of recovery (see the nearby chart from Barclays), and certainly compared to a decade ago. For all the talk of social media IPOs, Apple’s market capitalisation and the money pouring into alternative energy, none of these represent transformative technologies with much impact on productivity.

AN EVEN SIMPLER EXPLANATION: THE NUMBERS ARE LIES CREATED FOR THE PURPOSE OF CONCEALING THE CRIMES.

Demeter

(85,373 posts)The most depressing moment on TV today came on my man Chuck Todd's program this morning when he gathered a panel to discuss yesterday's New York Times op-ed in which a former Goldman Sachs executive named Greg Smith pretty much lit the place on fire on his way out the door. The panel consisted of Charles Blow of mother Times herself, "Willie" Geist of the MSNBC morning-zoo crew, and a CNBC host named Becky Quick. The discussion by the panel consisted primarily of bullshit.

"Willie" informed us of the following: "If the headline is that Wall Street is greedy, Chuck, that's not much of a headline, is it? Goldman or any other Wall Street firm is not running a charity or a civic organization. They're in the business of making money. The details of how they do it may be unpleasant to many people, but it shouldn't be news that there's greed on Wall Street." ...Well, thanks, "Willie." Apparently, any organization except the Red Cross and the Knights of Columbus can swindle as many people as possible, bankrupting small businesses, wrecking half of the economy while stealing most of the rest and do so full in the knowledge that what they are doing is "not news." Some of the people who found the way Goldman made its money "unpleasant" were congressional investigators but that wasn't news, either.

Blow admitted that, "You're not going to find many defenders of Wall Street outside of New York. People want to demonize Wall Street and be validated in their opinion. This piece feeds into that rationale." In this, Blow was playing off my man Chuck, who began the segment by talking about the whole financial debacle in the binary context of the Tea Party and the Occupy movement, and how everybody wants their own opinions to be the right one, and on and on and on, as though the objective facts of how the entire world financial system came a short step from chaos are just another right-left slanging match.

Ah, but the real prize was Ms. Quick, who spent the entire segment making sure that her dinner plans were solid for the rest of her career. First, she talked about "conspiracy theorists" about what happened in 2008. (She also seemed surprised that newspapers have different parts to them. She kept calling Smith's column a "letter to the editor." Nobody tell her about the comics.)

"I think it's been overplayed," she said. "And I think it's unfortunate that it got out there in this was.

"It sounds to me like a disgruntled employee, and I know that's the Wall Street spin."

Nothing gets by Ms. Quick. She's so... quick.

"I would feel very differently about this if it had been something that had been leaked to a reporter for the Times, who then went out and did a lot of confirming, and finding both sides of the story and reporting it out. I don't know a lot about this gentleman. I never heard of him before. I don't know what happened there. Taking it just as a letter itself, it seems like a disgruntled employee."

And, as we know, no reporter engaged in "reporting things out" never has gotten anything worthwhile from a disgruntled employee. But Ms. Quick was not finished sweetening the old beat. She came back later, to explain, after Chuck sort of sidled up on the notion that the incestuous relationship between Goldman and the U.S. government has, maybe, perhaps, who really knows, not worked out too well, that she was very sad that people thought that way.

"You could say that. To Charles's point about how the rest of the country's going to read this, it's probably true and it's probably unfortunate, because they're not going to go back and look at the actual details, and back again to why was this a letter to the editor, instead of a fully reported piece that gives you both sides of the story. (Ed. Note: BECAUSE IT'S A COLUMN ON THE OPINION PAGE, YOU DUNCE! Sorry, I held it in as long as I could.) And I hate to say that this is just a disgruntled employee, because I don't know enough about it. I wish I knew more about it. I wish I could tell you about what was happening on the inside."

Yes, if this country only had, say, a television network the sole function of which was to, you know, report on the financial industry, we would be much better off.

Read more: http://www.esquire.com/blogs/politics/goldman-sachs-op-ed-daily-rundown-7358893#ixzz1pYiqDtqw

SEE VIDEO AT LINK

xchrom

(108,903 posts)

Demeter

(85,373 posts)You'll frighten the little birds building their nests.

dixiegrrrrl

(60,010 posts)All I want to do is hide under the bed until ...if....when.....the chips fall where they may, the pendulum swings to the other side, whatever.

I am on total overload from the constant stream of crimes committed on so many levels, by the banks and the $$

system, each revelation worse than the last and NO accountability at ANY level.

There is no joy in Mudville anywhere I look.

![]()

Demeter

(85,373 posts)I feel like I'm heat-stroking out when it gets up to 68F. The body can't adjust that fast.

bread_and_roses

(6,335 posts)(can't recall if I heard him say this on a radio program - he's sometimes on Alternative Radio - or read it in one of his essays). At any rate, his point was that the crimes of the 1%, of the MIC, are all out in the open for anyone with time and eyes to see them with. And this was years and years ago - I've just always remembered it, because it was a startling notion to my at the time rather naive ears.

all we can hope is that a few more eyes and ears are being opened.

Demeter

(85,373 posts)Greg Smith's resignation op-ed from Goldman Sachs Wednesday raised a zillion questions. What was the back-story? What was with the ping pong? And what's wrong with being a muppet? But the biggest question would have to be: What happened to Goldman Sachs? Smith wrote that the culture at Goldman had shifted during his 12 years there from valuing teamwork and "always doing right by clients" to one where people "callously ... talk about ripping customers off." That sounds bad. So what are we to make of it?

...A more popular line of reasoning is that Goldman (and other Wall Street firms) were always about ripping customers off. It's no mistake that one of the classic books about Wall Street is called Where Are the Customers' Yachts? Didn't Smith get that when he joined? Was he that naive? But something did change on Wall Street and at Goldman in particular over the past few decades. Goldman did have a reputation for looking out for its clients — and inspiring great loyalty in them. This was largely a product of the firm's near-death experience after the 1929 crash. It had spawned a closed-end fund, the Goldman Sachs Trading Corp., run by a charismatic would-be visionary named Waddill Catchings. As Charley Ellis tells it in his history of Goldman Sachs:

It was Catchings' No. 2 at Goldman Sachs Trading, Sidney Weinberg, who wound the thing down and succeeded in at least paying off all its debts (its share price dropped from $326 to $1.75) — at huge cost to the parent firm. Before long the Sachs family had put one-time office boy Weinberg in charge of bringing their enterprise back to health. Over the course of the next two decades, he did. The Weinberg trademarks, which became the Goldman trademarks, were (1) hard-nosed prudence, (2) an extreme emphasis on the partnership, with partners generally able to make serious money only after decades at the firm, and (3) the long-term cultivation of relationships with business executives and politicians. Weinberg was one of the only Wall Street chieftains who supported Franklin Delano Roosevelt, which resulted in all sorts of status-enhancing opportunities during the 1930s, and the opportunity during the war years, as assistant to the chairman of the War Production Board, to get to know just about every promising young business executive in the country. Weinberg was self-interested, sure. But he was long-term self-interested. And so was Goldman Sachs, well into the 1990s at least.

So back to the question: What changed? The most obvious answer is simply that Goldman stopped being a partnership. It was the last of the major Wall Street firms to switch over, in 1999 (right around when Greg Smith arrived), to being a publicly traded corporation. Upstart Donaldson, Lufkin & Jenrette had been the first, in 1970, followed by biggie Merrill Lynch the next year. Andrew Haldane, the Bank of England official whose speeches I recently praised to the heavens, has an excellent explanation of why highly leveraged financial institutions probably shouldn't be controlled by shareholders with limited liability:

For banks, equity is a vanishingly small fraction of their balance sheet. Worse still, equity-holders often have risk-taking incentives out of line with the interests of other bank stakeholders, much less society. But Goldman succeeded in managing its risks before and during the financial crisis better than almost any other financial firm. That may just be because some of the partnership ethos lived on nine years after the IPO, meaning that the firm is unlikely to do so well in the next financial crisis. It's also certainly true that Goldman hasn't been great about managing its reputational risk. But it feels like the end of the partnership can't be the whole answer.

Noah Millman, a former equity derivatives trader, offers up another explanation: that there's just too much money for the taking in the over-the-counter derivatives business not to drive short-term greedy, customer insensitive behavior:

At Goldman, where investment banking for corporate clients had driven the resurgence of the firm in the 1950s and 1960s, this shift in where money is made is quite apparent in the financial statement. In 2011 — a bad year for trading — investment banking generated just $4.6 billion of Goldman's $28.81 billion in net revenue. The firm's long-standing balance of power between bankers and traders is broken, which has big implications for the firm's overall culture. For one thing, it means Goldman's most important customers are no longer nonfinancial corporations out to build real-world businesses, but hedge funds, banks, and other financial players who are often out to put one over on Goldman. I can see having far fewer qualms about taking advantage of the latter than the former. Also, as Mihir Desai argues in this month's HBR, it means Goldman is playing in a talent market where the terms are set by hedge funds — making it impossible to maintain the wait-till-you-retire-to-get-rich pay structure that long defined Goldman.

Finally, there's the wonderful explanation for Wall Street's woes that Calvin Trillin offered up in a New York Times op-ed three years ago: Smart people started working there. Wall Street had long attracted the bottom third of the class; decent enough folks with modest ambitions. Then the combination of bigger paychecks and higher college and grad school tuition began driving the best students into finance. Quoting a possibly imaginary (but possibly not) grizzled veteran of his generation, Trillin wrote:

"Did you ever hear the word 'derivatives'?" he said. "Do you think our guys could have invented, say, credit default swaps? Give me a break! They couldn't have done the math."

It's a joke. But not entirely. Goldman was the world's gold-standard employer, able to recruit from the very top of the top of the class. And the culture of an organization composed entirely of people who are really, really smart and know they are really, really smart may be bound to turn toxic eventually. (Watch out, Google!) That's probably especially true in a pay environment where the rewards to long-term loyalty to the organization are low.

LET US REVIEW THE DEFINITION OF PSYCHOPATHY, SHALL WE? OH, THIS IS HARVARD BUSINESS SCHOOL....NEVER MIND!

Demeter

(85,373 posts)Morgan Stanley (MS) Chief Executive Officer James Gorman said he told staff not to circulate a Goldman Sachs Group Inc. (GS) employee’s op-ed criticizing that firm and that it wasn’t fair for a newspaper to publish it.

“I was surprised that anyone would run an op-ed piece based upon the view of a single employee,” said Gorman, speaking at an event in New York hosted by Fortune magazine. “To pick a random employee, I just don’t think it’s fair, and I didn’t think it was balanced.”

GORMAN MUST BE CONFUSING THE NYTIMES WITH FOX NEWS...AN UNDERSTANDABLE FAUX PAS...

Gorman joins JPMorgan Chase & Co. CEO Jamie Dimon in warning executives not to take advantage of the op-ed, which has opened a public debate over how New York-based Goldman Sachs treats customers. Goldman Sachs’s shares lost $2.15 billion in value on March 14, the day it was published.

“At any point in time, somebody’s unhappy with me, with the organization, with the board, with the direction of the firm,” Gorman said. “There but for the grace of God go us.”

IS THAT A CONFESSION, MR. GORMAN?

Demeter

(85,373 posts)OK, so who do we believe? In a cover story in New York magazine last month melodramatically headlined "The Emasculation of Wall Street," journalist Gabriel Sherman made the case that the big financial firms were engaged in "something that might be called soul-searching" about their many sins and their wildly overcompensated contribution to the U.S. economy. Wall Street, under the whip of the giant Dodd-Frank law, was learning to behave. Reduced compensation packages and increased capital requirements were going to tame or snuff out some of the riskier and most reckless practices that brought the nation to the edge of a second Great Depression, Sherman wrote. Best of all, the domestication of Wall Street would redirect the best minds in the nation back into useful things like real engineering rather than financial engineering. Cool!

Now comes Greg Smith, an apparently conscience-stricken renegade from Goldman Sachs, who tells us that not only has nothing changed in the firm's culture but he "can honestly say that the environment now is as toxic and destructive as I have ever seen it."

Can these two things both be true?

Actually, maybe yes. But the larger point is: we need to pay a lot more attention to Greg Smith than to Gabriel Sherman. There is, first of all, every reason to think Smith was telling the truth.

MORE

Demeter

(85,373 posts)Goldman Sachs Group Inc (GS.N) scored at least one victory in an otherwise tough week - this one against a coalition of religious groups. The bank has been in the spotlight since a mid-level executive resigned and fired off a blistering attack on the firm in a New York Times op-ed on March 14, describing a "toxic and destructive" culture motivated by greed. For the past two years, a group of religious institutions that hold Goldman shares has asked the investment bank to review executive compensation packages and has been successful in getting its proposal taken up at regular shareholders' meetings. This year, the group, including the Sisters of St. Francis of Philadelphia, again sought to have its proposal voted on by shareholders. But for the first time, the U.S. Securities and Exchange Commission sided with Goldman, which argued it had already complied with the request. A CLEAR SIGN OF CAPTIVE REGULATORS

The SEC's letter of rejection was emailed to the religious groups' leaders on Thursday, the day after the former Goldman executive, Greg Smith, published his scathing op-ed piece in the Times. An official at the Nathan Cummings Foundation, a Jewish group that is the lead filer of the proposal, said she was somewhat surprised that the agency rejected its request given that the op-ed touched on exactly the issues it had hoped to address.

The 2012 proposal would have asked for an independent board to review the risks, including reputational risks, associated with high executive compensation levels and disclose the findings to shareholders.

"We were asking for an examination of whether Goldman's pay levels were appropriate," said Laura Campos, director of shareholder activities at the Nathan Cummings Foundation. "If people are only motivated by extremely high compensation, it focuses them on the wrong things and can be harmful to the culture."

Goldman CEO Lloyd Blankfein's base salary was tripled to $2 million in 2011, up from $600,000 the prior year. His share bonus was worth $12.6 million, a 42 percent increase from the year before.

Each annual proposal by the religious group has been worded slightly differently, but all urge the same thing: Goldman needs to curb and better disclose how it determines executive pay. The SEC sided with Goldman this year because it felt the company had "substantially implemented" the proposal, an SEC spokesman said. "If the company's actions effectively moot the proposal, then we permit exclusion." In its January 11 letter to the SEC, Goldman described a number of processes that the firm has in place that it says address the religious group's concerns.

For example, the company has an independent committee that reviews executive compensation packages, and it discloses the compensation principles in proxy reports to shareholders, according to the letter. A Goldman spokesman declined to comment beyond the letter.

...Goldman's win may be short-lived, said Charles Elson, director of the Weinberg Center for corporate governance at the University of Delaware.

"It's a victory in a sense that it's kept off the proxy this year, but it doesn't make the issue go away," he said. "Getting those groups comfortable with what you're doing - that's the real victory."

Demeter

(85,373 posts)If he hasn’t already done so, Lloyd Blankfein should dash off a thank-you note to Robert Shiller.

What other Ivy League economist would have dared, amid the sound and fury over Goldman Sachs Group Inc. (GS) in recent years, to stick his neck out by publishing a book that says finance is good and Goldman has no incentive to be deliberately evil?

Yet that is what the influential Yale University professor does in “Finance and the Good Society,” a provocative primer on how financial capitalism promotes prosperity.

“People think that the wealthy in our society -- among them the financiers -- have a real and genuine incentive to use devious means to attack and subjugate, economically, the majority of the population,” he writes. This is “an illusion,” he says.

xchrom

(108,903 posts)The head of the International Monetary Fund has warned that the outlook for the global economy remains uncertain following meetings in China with the country's communist party leadership.

Christine Lagarde congratulated Beijing for its stewardship of the world's second largest economy and said "China remains a bright spot" in the global growth league.

But she warned the situation could still deteriorate if the world's major powers failed to react with policies to stimulate growth and spread prosperity among all their citizens.

"While the global economic outlook is certainly less gloomy than when I was here last November, there are still major economic and financial vulnerabilities we must confront. There is not a great deal of room for manoeuvre and no room for policy mistakes," she said.

xchrom

(108,903 posts)

Evangelos Venizelos has resigned as Greece's finance minister after becoming the new leader of the Pasok party. Photograph: Alexandros Vlachos/EPA

11.03am The first stage of the auction to set Greek credit default swaps (and thus the level of payments to CDS holders) has just finished.

It set the value of Greece's debt at 21.75 cents in the euro. As explained at 10.23am, a second round of bidding will now take place to finalise the payout.

Live blog: news flash newsflash

10.45am: Just in -- Evangelos Venizelos has formally resigned as Greece's finance minister, clearing the way to run for the office of prime minister in the upcoming general election.

Venizelos made the announcement after meeting with president Karolos Papoulias this morning, telling reporters he had given the orders in the Greek Treasury for the last time:

We have elections ahead and I had this morning the opportunity in a farewell meeting at the finance ministry to give my last instructions.

Venizelos won the Pasok leadership ballot with 97% of the vote (well, he was the only candidate). Pasok, though, will not manage such a landslide when Greeks cast their votes in last April or May. The most recent polling shows that Pasok's support has dropped to just 11%, behind New Democracy with 25% of the vote, and ahead of a swarm of smaller parties.

Live blog - Ireland flag

10.32am:An Irish Cabinet minister has given the strongest hint yet that the Republic's referendum on the EU fiscal pact will take place early this summer.

This referendum must be held because the Irish Attorney General ruled last month that Irish sovereignty is directly affected by the changes in the pact. It is another hurdle for Europe to clear.

Demeter

(85,373 posts)First there was Harrisburg, Pennsylvania. Then, Jefferson County, Alabama. Now, hold onto your hats folks -- we could be just days away from seeing the biggest municipal bankruptcy in U.S. history.

In California, the city of Stockton boasts a population of almost 300,000 ... and a fiscal emergency. The first number means that if Stockton winds up filing for Chapter 9 bankruptcy protection, as its officials are threatening to do, it will be the most populous U.S. municipality ever to declare bankruptcy. And the fiscal emergency? Such problems are going to become increasingly common as city after city follows the downward path that Harrisburg, Jefferson Co., and Stockton have blazed....

FarCenter

(19,429 posts)The 450 million in unfunded pensions undoubtedly results from pension funds assuming a rosy 8% return on investment that would grow fund contributions at a fast enough rate to cover the future pension costs. 8% doubles your money every 9 years.

Now return on investment is a lot lower than that. Bonds are at 3% and the stock market has been moribund for a decade.

The federal government has a huge debt. The only reason that the federal budget can withstand the debt load is that they are only paying 3% on debt.

So take your pick: Raise interest rates to 8% again and bankrupt the federal government, or keep them at 3% and bankrupt local governments with unfunded pension costs.

Demeter

(85,373 posts)U.S. gasoline prices jumped 6% in February, and market experts predict they will climb higher because critical refining operations in the Northeast are shutting down.

From New York to Philadelphia, refineries that turn oil into gasoline have been idled or shut permanently because their owners are losing money on them. Sunoco Inc. is expected to close the region's largest refinery in July, taking another 335,000 barrels per day in production capacity off the market.

The East Coast refineries are getting squeezed by the soaring cost of crude oil, the major component in gasoline. ...Refineries in the Northeast are under financial pressure for two reasons. They have limited access to cheaper, high-grade crude oil produced in the middle of the U.S. because there are not enough pipelines, which is forcing them to pay more for oil from elsewhere, most of it from overseas. And many of their facilities aren't set up to process lower-grade crude that is cheaper...As Northeastern refining capacity declines, it will force distributors in the region to buy gasoline from elsewhere, pushing up prices across the country and increasing the likelihood of price spikes, government officials and analysts warn.

"There's now going to be a question if we can get enough gasoline into the East Coast for summer," said David Greely, an energy analyst at Goldman Sachs Group Inc. The U.S. Energy Department has warned a shortfall could develop as early as July.

A SQUEEZE PLAY ON THE NORTHEAST...WHAT A REALLY BAD IDEA

Demeter

(85,373 posts)Britain is poised to cooperate with the United States on a release of strategic oil stocks that is expected within months, two British sources said, in a bid to prevent fuel prices choking economic growth in a U.S. election year. A formal request from the United States to the UK to join forces in a release of oil from government-controlled reserves is expected "shortly" following a meeting on Wednesday in Washington between President Barack Obama and Prime Minister David Cameron, who discussed the issue, one source said. Britain would respond positively, the two sources said, and Cameron said a release was worth considering.

"We didn't make any decision, this has to be discussed broadly. We've got to look at this issue carefully, it's something worth looking at. Short-term should we look at reserves? Yes, we should," Cameron said during a meeting with students in New York.

"We'd both like to see global oil prices at a lower level than they are."

Details of the timing, volume and duration of a new emergency drawdown have yet to be settled but a detailed agreement is expected by the summer, one of the sources said. Other countries may also be approached by Washington to contribute, a further source said, Japan among them.

..................................

Previous emergency oil releases have been coordinated by the Paris-based IEA to meet its mandate to cover substantial supply disruptions on the world oil market. The IEA has declined to coordinate a broader release among its 28 industrialized members, but says that countries may legitimately decide to release oil unilaterally.

"The Obama administration can only take so much political pain from rising gasoline prices, which pose a serious threat to the economy and the president's re-election," said Bob McNally, a former White House energy adviser and head of U.S. energy consultancy Rapidan.

"SPR (Strategic Petroleum Reserve) use is more a matter of when than if. The administration strongly desires international support and coordination from other strategic stock holders, but is encountering stiff resistance from some IEA members who think strategic stocks should only be used for severe supply disruptions," McNally said.

Top U.S. officials including Energy Secretary Steven Chu and Treasury Secretary Timothy Geithner have said publicly in recent weeks that a U.S. oil release is among the options the government is considering.

While there is no significant disruption of world oil supplies at the moment, sanctions on Iran are expected to cut its output when a European Union embargo takes effect from July. Minor stoppages from South Sudan, Yemen and Syria also have contributed to the rise in oil prices.

........................................

"There is no real supply disruption, this is just price management", said Olivier Jakob from Vienna-based consultancy Petromatrix.

MORE

Demeter

(85,373 posts)SO THE BFEE WASN'T JUST THERE FOR THE COCAINE....

http://www.economist.com/node/21550304

IT HAS attracted much less attention than the big deep-sea oil finds in Brazil, but Colombia is also enjoying an oil boom. Its output of crude has nearly doubled in the past six years, from 525,000 b/d in 2005 to a daily average of 914,000 last year. But as exploration pushes deep into the country’s eastern lowlands, oil companies face a familiar problem in rural Colombia: security.

Emerald Energy, a British subsidiary of China’s Sinochem, has endured repeated attacks by the FARC guerrillas on its small Ombú field in Caquetá. Security officials in the area say the FARC is demanding $10 for each barrel of oil. Because the company refused to pay, three of Emerald’s Chinese staff, together with their translator, were kidnapped last June. After a bomb attack on a well, Emerald announced on March 6th that it would suspend operations “until security conditions improve”. After receiving assurances from military commanders, production resumed the next day, but six days later oil tankers carrying crude from Ombú came under guerrilla fire, leaving two civilians dead.

Although Colombia is generally a much safer country than it was a decade or more ago, attacks on oil infrastructure more than doubled between 2008 and 2011, according to the Centre for Security and Democracy at Bogotá’s Sergio Arboleda University. In January and February there were 13 separate attacks on the country’s main pipeline, from Caño Limón to Coveñas, which was able to pump oil for only 20 days in that period. The trans-Andean pipeline in the south was attacked 51 times last year. In February the ELN, a smaller guerrilla group, kidnapped 11 men in Casanare who were building the Bicentenario, a big new pipeline. Officials say that guerrillas are behind some disruptive protests by local people in oil areas, demanding more money and jobs.

The spike in violence “has us worried”, says Alejandro Martínez, president of the Colombian Petroleum Association, which groups together private oil companies operating in the country. But he adds that the industry’s security problems are in part a consequence of its own success. It offers a much bigger target nowadays....MORE

xchrom

(108,903 posts)

Demeter

(85,373 posts)Last edited Mon Mar 19, 2012, 09:11 AM - Edit history (1)

Chief executive Tim Cook hints at proposals for disciplined way of spending cash with hopes raised for a reinstatement of dividends

Read more >>

http://link.ft.com/r/4RNQTT/L908FP/EKRAI/KQ1EO1/II84K7/W1/t?a1=2012&a2=3&a3=19

Apple unveils dividend and $10bn buyback

Apple on Monday announced that it would begin making regular dividend payments to shareholders and spend $10bn on buying back its shares, as it took the first steps towards eating into a giant cash hoard estimated to amount to more than $100bn.

The US consumer technology company said it would pay a quarterly dividend of $2.65 a share sometime in its fourth quarter, which begins in July. The payment is equivalent to a dividend yield of 1.8 per cent, below the level paid by tech concerns like Microsoft and IBM.

Read more >>

http://link.ft.com/r/LVA6WW/5VJ9HY/GYN7Q/7AYV0T/B5UA0I/1G/t?a1=2012&a2=3&a3=19

Demeter

(85,373 posts)Job advertisement hints at plan for banking group which is likely to be hit hardest by new regulations barring trading for own accounts

Read more >>

http://link.ft.com/r/4RNQTT/L908FP/EKRAI/KQ1EO1/SPMSFM/W1/t?a1=2012&a2=3&a3=19

THIS ISN'T GOOD

Demeter

(85,373 posts)Banking quintet unite for hedging tool

Derivatives will be used to offset risks of holding UK government bonds or short-term loans as part of efforts to comply with Basel III rules

Read more >>

http://link.ft.com/r/4RNQTT/L908FP/EKRAI/KQ1EO1/HYG5XM/W1/t?a1=2012&a2=3&a3=19

Demeter

(85,373 posts)Court case to examine whether Fred Wilpon and Saul Katz were “wilfully blind” to $17.3bn fraud as franchise battles financial difficulties

Read more >>

http://link.ft.com/r/4RNQTT/L908FP/EKRAI/KQ1EO1/309H84/W1/t?a1=2012&a2=3&a3=19

GIVING NEW LIFE TO THE DEFINITION OF "VINDICTIVE"

Demeter

(85,373 posts)Papademos says political leaders will unite to implement reforms and that ‘positive growth rates should be achieved within less than two years’

Read more >>

http://link.ft.com/r/0QSDPP/ZGYW61/FDFZE/GDNKBQ/SPMJU4/50/t?a1=2012&a2=3&a3=19

PAPA'S BEEN OVERDOING THE FUMES AT DELPHI....

xchrom

(108,903 posts)

Ed Miliband is among those challenging the idea that the only answer to market failure is more markets. Photograph: Kerim Okten/EPA

We are going to hear a lot this week about how to face up to the economic challenges of the future and put Britain back on the road to recovery. There will be a blizzard of competing ideas about the best way to rebalance our economy, increase exports, boost investments and create the right partnership between government and industry. But the change Britain needs is not just to the structure of our political and economic institutions; it is also to their moral and ideological foundations.

The new right seized the initiative in the 1980s by popularising the idea that a society is strongest when its members pursue their own self-interest to the exclusion of everything else. They argued that "private vice leads to public virtue". From this moral standpoint, selfishness was not selfishness at all but an advanced form of social work. Free of all constraints, unregulated markets and profit-maximising entrepreneurs would increase growth, expand opportunity and allow new wealth to trickle down.

These rightwing tropes are still heard today in the debate about the budget and the top rate of tax, but on every measure this ideological experiment has been a failure. Since the end of the 1970s, growth has declined, unemployment has increased, wages have lagged behind productivity, social mobility has shrivelled and wealth has trickled up, not down.

The social imbalances caused by this redistribution fed the economic imbalances that have become so painfully evident since the start of the global financial crisis. The squeeze on incomes left Britain with a growth model too dependent on financial services, credit growth and public spending as consumers borrowed to keep up and taxpayers were forced to subsidise poverty pay and meet the bills of social failure.

Demeter

(85,373 posts)Central bank finds that $4.6bn was flown out of Kabul last year, and officials believe drug lords or criminal cartels owned much of the currency

Read more >>

http://link.ft.com/r/0QSDPP/ZGYW61/FDFZE/GDNKBQ/7AFOZQ/50/t?a1=2012&a2=3&a3=19

WELL, THEY DIDN'T LEARN THAT TRICK FROM THE US, FOR SURE!

DRUG LORDS FLY THEIR MONEY INTO THE US, FOR SAFETY.

Demeter

(85,373 posts)Team to start its five-day mission with talks about the proposals with Islamist party that is expected to lead next government

Read more >>

http://link.ft.com/r/0QSDPP/ZGYW61/FDFZE/GDNKBQ/5VJ82K/50/t?a1=2012&a2=3&a3=19

xchrom

(108,903 posts)In his latest weekly note, fund manager John Hussman is... bearish on the market.

This has been his stance for a couple years now, and this week he looks at a technical indicator showing signs of excessive optimism:

As of Friday, the S&P 500 was within 1% of its upper Bollinger band at virtually every horizon, including daily, weekly and monthly bands. The last time the S&P 500 reached a similar extreme was Friday April 29, 2011, when I titled the following Monday's comment Extreme Conditions and Typical Outcomes . I observed when the market has previously been overbought to this extent, coupled with more general features of an "overvalued, overbought, overbullish, rising yields syndrome", the average outcome has been particularly hostile:

"Examining this set of instances, it's clear that overvalued, overbought, overbullish, rising-yields syndromes as extreme as we observe today are even more important for their extended implications than they are for market prospects over say, 3-6 months. Though there is a tendency toward abrupt market plunges, the initial market losses in 1972 and 2007 were recovered over a period of several months before second signal emerged, followed by a major market decline. Despite the variability in short-term outcomes, and even the tendency for the market to advance by several percent after the syndrome emerges, the overall implications are clearly negative on the basis of average return/risk outcomes."

As it happened, April 29, 2011 turned out to mark the exact high of the S&P 500 for the year, and was followed by a steep intermediate market plunge. My impression is that despite the recent run of speculation the market has enjoyed - largely reflecting a reprieve in European debt concerns and what appears to be a drawing-forward of jobs into the first quarter due to unseasonably favorable weather - the extended implications of present market conditions remain decidedly negative.

What is the aforementiond Bollinger Band?

Per Investopedia: "A band plotted two standard deviations away from a simple moving average."

Some traders see these bands as indicators of guide-markers of the market getting extreme in one direction or another.

Here's a chart, via Stockcharts.com, showing that the S&P 500 is indeed at the high end of the Bollinger Band," as it was last Spring.

Read more: http://www.businessinsider.com/hussman-the-market-is-now-exactly-like-the-last-time-the-market-crashed-2012-3#ixzz1pYvTqFIT

Demeter

(85,373 posts)bread_and_roses

(6,335 posts)Tansy_Gold

(17,860 posts)Demeter

(85,373 posts)The top U.S. securities regulator is determined to implement a new round of money market fund reforms, despite facing strong resistance from many of the biggest industry players who say more regulations are unnecessary.

Securities and Exchange Commission Chairman Mary Schapiro says further steps are needed to help prevent another run by panicked investors, like the one seen in 2008 when the Reserve Primary Fund "broke the buck" with its net asset value falling below $1.

"As a regulator who saw the damaging effects of the 2008 run on money market funds, I find it hard to remain on the sidelines despite calls to declare victory on this issue," Schapiro said in a speech on Thursday to the Society of American Business Editors and Writers.

Currently, staff at the agency are drafting two potential courses of action. One plan would impose a capital buffer and a hold-back on redemption requests. The other would implement a floating fund valuation to help curb investor complacency over the stable $1-per-share value that funds currently quote. So far, though, Schapiro's proposals have met with major resistance, both from many in the $2.6 trillion industry and even some fellow commissioners.

Demeter

(85,373 posts)WELL, THAT'S A DIFFERENT OPINION FROM LAST WEEK

http://www.bloomberg.com/news/2012-03-19/imf-s-zhu-says-china-set-for-soft-landing-as-property-cools-1-.html

An International Monetary Fund official said China will avoid an economic hard-landing as government data showed property prices falling in most of the nation’s biggest cities,

“China’s heading for a soft-landing,” Zhu Min, a deputy managing director at the IMF, said at a conference in Hong Kong today, citing strength in investment. Prices of new apartments fell in 45 of 70 cities in February, the statistics bureau said in Beijing yesterday.

Premier Wen Jiabao has prolonged a crackdown on real-estate speculation to reduce the risk of asset-price bubbles and make housing affordable, saying last week that prices remain far from “reasonable.” A government program to build millions of low- cost homes may help to support growth in the world’s second- biggest economy and moderating inflation means policy makers have more room to add stimulus.

Zhu said that inflationary pressures are a long-term challenge for the nation, while investment remains too large as a proportion of gross domestic product...

...............................................................

Adrian Mowat, JPMorgan Chase & Co.’s chief Asian and emerging-market strategist, said March 14 that China is already experiencing “a hard landing,” visible through weakness in car sales and cement and steel production.

Demeter

(85,373 posts)

BEEN THERE, DONE THAT FOR MY FELLOW MAN

DemReadingDU