Environment & Energy

Related: About this forumOil prices keep plummeting as OPEC starts a price war with the US

Oil prices have been dropping sharply over the past three months — a huge energy story with major repercussions for dozens of countries, from the United States to Russia to Iran.

But on Friday, prices went into serious free-fall. The reason? OPEC — a cartel of oil producers that includes Saudi Arabia, Iran, Iraq, and Venezuela — had a big meeting in Vienna on November 27. Before the gathering, there was speculation that OPEC countries might cut back on their own oil production in order to prop up prices. But in the end, the cartel couldn't agree on how to respond and did nothing.

...

For all intents and purposes, OPEC is now engaged in a "price war" with the United States. What that means is that it's very cheap to pump oil out of places like Saudi Arabia and Kuwait. But it's more expensive to extract oil from shale formations in places like Texas and North Dakota. So as the price of oil keeps falling, some US producers may become unprofitable and go out of business. The result? Oil prices will stabilize and OPEC maintains its market share.

The catch is that no one quite knows how low prices need to go to curb the US shale boom. According to the International Energy Agency, about 4 percent of US shale projects need a price higher than $80 per barrel to stay afloat. But many projects in North Dakota's Bakken formation are profitable so long as prices are above $42 per barrel. We're about to find out how this all shakes out — and which numbers are correct.

Fairly long article with a lot of background. Shale is here. And it's here to stay. OPEC can try to slow its expansion but it's inevitable. If OPEC was smart it would signal that it will lower production in exchange for petro-states pledging to go energy self-sufficient.

eggplant

(3,913 posts)Leopolds Ghost

(12,875 posts)PS -- President of Shell Oil on CNN the other day saying we are still running out of oil and shale is essential because energy self-sufficiency will allow the US to continue to burn oil while everyone else simply burns.

OnlinePoker

(5,725 posts)This is very expensive oil to pull out of the ground. The companies may decide to suspend operations until prices improve.

Leopolds Ghost

(12,875 posts)Rah rah America, I guess? We're running out of oil and we no longer need to worry about Arab oil or global warming if we build our own stockpile!

joshcryer

(62,276 posts)I've been predicting this for years. Just Google my name and shale oil.

Leopolds Ghost

(12,875 posts)

joshcryer

(62,276 posts)It's easing Bakken production which the Saudi's are afraid will open up even more shale resources, thus rendering US dependence on the middle east moot. They're just delaying the inevitable.

Bakken producers will definitely be feathering operations and laying people off.

Leopolds Ghost

(12,875 posts)But we all knew that, it's just that most Americans are ignorant and don't know what the area looks like, they haven't been there.

joshcryer

(62,276 posts)

Leopolds Ghost

(12,875 posts)It won't even be a moon-scape, because...

Plans to strip mine the moon may soon be more than just science-fiction

http://www.theecologist.org/News/news_analysis/962678/plans_to_strip_mine_the_moon_may_soon_be_more_than_just_sciencefiction.html

Texas-based Shackleton Energy Company has already begun operations aimed at mining the Moon within the next few years.

The company’s plans for mining and refining operations would involve melting the ice and purifying the water, converting the water into gaseous hydrogen and oxygen, and then condensing the gases into liquid hydrogen, liquid oxygen and hydrogen peroxide, all potential rocket fuels.

Shackleton CEO Dale Tietz says the water extracted would be used almost exclusively as rocket fuel to power operations both within Low Earth Orbit (LEO) – such as space tourism and the removal of space-debris – on the Moon, and further out into space.

‘We are a for-profit business enterprise moving forward, and so we are only going there really for one reason and that is to mine, prospect mine and harvest water for rocket propellant production,’ says Tietz.

Leopolds Ghost

(12,875 posts)joshcryer

(62,276 posts)

Due to flaring the oil rigs (there's no economical way to capture the gas so it's burned off).

Leopolds Ghost

(12,875 posts)Whatever you do, don't read the short story in my previous post. It's sort of like Blade Runner dystopia stuff, but worse.

We seem to be headed in that direction minus the bizarre cyber-fetishism. (I think someone pointed out that both Paul Verhoeven's stuff and the book Brave New World aren't as cynical anymore because they mostly came true.) But what do you think about the Prez of Shell Oil admitting on TV that we'll run out of oil and the US wants this outcome anyway because we'll once again have a monopoly on oil and be the new Saudi Arabia, continuing to survive on oil while the Second World sinks back into economic rivalry or dependence? The goal seems to be to counteract China's lock on all the (US corporate) jobs by having the US market be powered by financial instruments backed on oil -- the petroleum dollar.

Odin2005

(53,521 posts)joshcryer

(62,276 posts)And it will exploit the rest of the world to get to that point, because the oil will dry up. Don't get me started on the ramp up of coal exports.

This is more a mistake on OPEC's part because they need to realize that as an organization, they are doomed. They need to essentially diversify, who cares what the US is doing. The US is very quick to adapt to various price mechanisms.

Oil goes back up by, say, 2016, the US will be ramping out just as it did from 2009-2014.

OPEC's move is simply to delay, not to actually do any long term strategy.

Leopolds Ghost

(12,875 posts)there's no such thing as "Energy independence" in a world of multinational oil companies, btw.

joshcryer

(62,276 posts)Coal consumption is on a decline, once electric cars take off (5-10 years) then oil will be not used nearly as much.

It, however, doesn't result in decreased production. The US will export coal and oil by 2015, and will likely be at the same level as the Saudi's since the US doesn't want to export intellectual property. In fact, the TPP is designed to make Asian states respect US intellectual property, boxing China and Russia in more in that they won't have access to it.

Look at this utterly terrifying image:

Now imagine a world that isn't allowed the technology to make their own renewables or buy renewables but are forced to instead build cheap coal plants.

Spider Jerusalem

(21,786 posts)EIA predicts a shale peak by 2020 and most likely 2017.

joshcryer

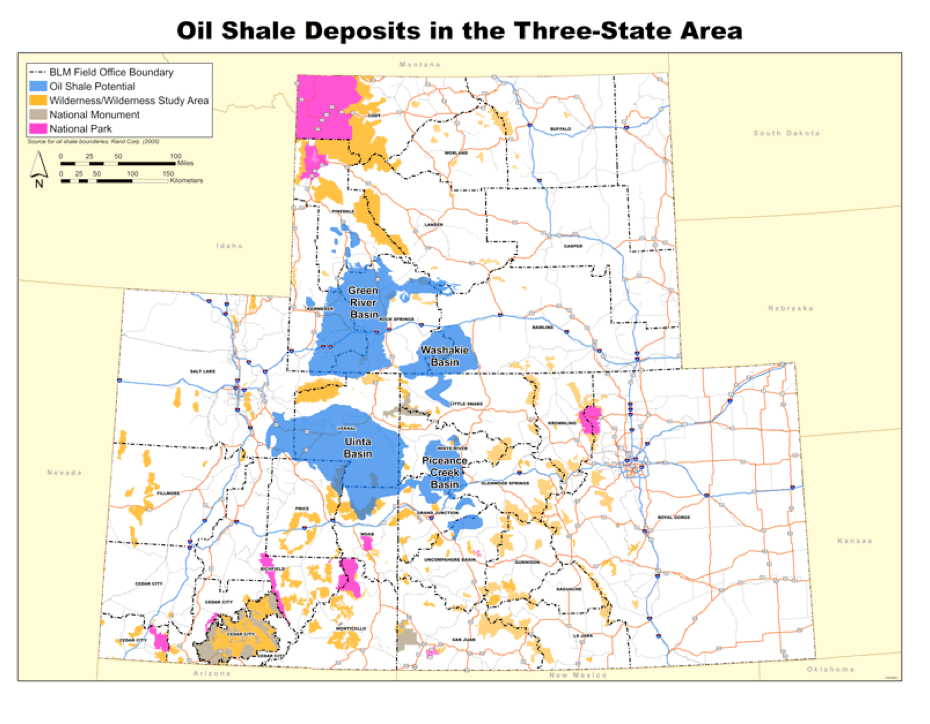

(62,276 posts)The question is whether Green River shale gets exploited in the intrim.

OPEC is making this move to keep Green River shale from being produced.

Spider Jerusalem

(21,786 posts)And another shale play coming online wouldn't be enough to offset the decline in the other two, in any case.

joshcryer

(62,276 posts)Many Bakken and Eagle Ford projects are profitable at around $50 a barrel. $100 a barrel allows R&D, $50 pays workers and CEOs.

If you can do Green River profitably, then you can take that technology and use it in Bakken and Eagle Ford as well. The big oil companies are sitting on hundreds of square miles of leases just waiting for the opportunity.

Champion Jack

(5,378 posts)FBaggins

(26,757 posts)This is the same rationale that has told us that fracking gains would be short-lived for years now... and each prediction has been wrong (and not just by a little bit).

EIA predicts a shale peak by 2020 and most likely 2017.

True enough... but their predictions from prior years (as it relates to shale gas and oil production) have also been way off. It's also worth noting that they make multiple predictions; The high end of their production estimates goes well out beyond that point.

The decline rate that's most relevant to the discussion is not a geological debate... it's the one caused by price action. That will tell us a great deal more about the future for US oil production.

cantbeserious

(13,039 posts)upaloopa

(11,417 posts)DeSwiss

(27,137 posts)...then we're only fighting with ourselves.

- It's not called a ''PetroDollar'' for nothing. The U.S. is pissed-off that Russia, China and the BRICs don't love dollar-green like they're supposed to! Doing business in one's own currency isn't allowed in the ''FREE TRADE'' world of planet Earth. This kind of behavior screws with the transition over to New World Order international currency. After the central banks crash, of course.

- It's not called a ''PetroDollar'' for nothing. The U.S. is pissed-off that Russia, China and the BRICs don't love dollar-green like they're supposed to! Doing business in one's own currency isn't allowed in the ''FREE TRADE'' world of planet Earth. This kind of behavior screws with the transition over to New World Order international currency. After the central banks crash, of course.

So we'll show 'em! Even if it KILLS US!!!

K&R

The Price Of Oil Exposes The True State Of The Economy

quadrature

(2,049 posts)SaudiArabia has already cut production.

apparently, that is it.

greymattermom

(5,754 posts)That will make interesting politics, IMO

joshcryer

(62,276 posts)Believe it or not the tar sands are getting shipped one way or another, Keystone XL is meant to tap into Bakken.

Leopolds Ghost

(12,875 posts)delrem

(9,688 posts)Champion Jack

(5,378 posts)Response to Champion Jack (Reply #8)

delrem This message was self-deleted by its author.

delrem

(9,688 posts)Odin2005

(53,521 posts)snappyturtle

(14,656 posts)The reason I wonder is because of all the independence talk from foreign oil. I am under the assumption that most shale oil goes off shore after refinement. If this is true, it really pisses me off that our country is torn up to make the oil producers rich with really no effect on becoming independent. ![]()

Spider Jerusalem

(21,786 posts)The US exports refined petroleum products, most of which are refined from oil that was imported in the first place. NB that US imports are around ten million barrels a day.)

snappyturtle

(14,656 posts)this way: Does the U.S. export all refined petro products from U.S. shale oil?

Spider Jerusalem

(21,786 posts)and the volume of refined product exported is still significantly less than net total crude imports. It wouldn't matter if the USA were exporting five million barrels a day of refined product if it's still IMPORTING eight million barrels a day.

snappyturtle

(14,656 posts)of keeping all refined petro products from U.S. shale in the U.S.

Spider Jerusalem

(21,786 posts)snappyturtle

(14,656 posts)joshcryer

(62,276 posts)As it stands now we import about 2.8 billion barrels. At that rate we'd be off of oil imports in 14-28 years. Well within the 2030-2050 energy independent road-map. Doesn't consider electric cars or any other renewables energy technologies (wind, solar; solar which is about to be cheaper than any other power source).

Spider Jerusalem

(21,786 posts)and your ignorance of the decline rate of shale doesn't really help your assertions.

joshcryer

(62,276 posts)No doubt OPEC's attempts have stuttered it.

Either way you want to spin it, the US, as a capitalist economy, will adapt rather quickly. Let oil become $300 a barrel and tell me then that shale won't be exploited.* A joke.

*assuming electric cars aren't dominant by then, of course.

Spider Jerusalem

(21,786 posts)You're making it pretty clear that you don't know what you're talking about.

FBaggins

(26,757 posts)You're making it pretty clear that you haven't been paying attention as the last 3-4 years proved that wrong.

Spider Jerusalem

(21,786 posts)I'm not sure why you don't understand the difference between the decline rate of individual wells and overall total production. The decline rate of 50-90% in the first year of production is pretty consistent across all shale plays; maintaining overall production rates requires bringing more new wells into production (and indeed that's what's been happening, to an extent that new production coming onstream has more than offset the decline rate in already-producing wells). The fact that more wells are coming onstream doesn't change the underlying observed decline rates per well (and total production is likely to see a decline if oil prices stay lower, as bringing new shale into production ceases to be economical with a sub-$80 per barrel price).

FBaggins

(26,757 posts)Only one of us was using those individual decline rates to make a judgment about what that meant for future production from shale plays in general.

The decline rate of 50-90% in the first year of production is pretty consistent across all shale plays;

Assuming a comparable starting point, a well that declines 50% in the first year is producing five times as much in the second year as a well that declined by 90%... so I'm not sure how you can put "pretty consistent" in that sentence... but again, it isn't relevant to the conversation. I haven't questioned whether individual wells decline quickly in the first year. What I've said is that the conclusions that have been drawn from that fact have not been accurate (or even close), yet you continue to repeat them as truisms.

and total production is likely to see a decline if oil prices stay lower

Obviously. But that doesn't have anything to do with the peakist argument that individual decline rates force an impending production peak independent of price action.

Spider Jerusalem

(21,786 posts)You do realise that fossil fuels are a limited, non-renewable resource whose production will inevitably peak, and decline, no? The question is not whether shale production is going to decline, the question is when. (And most reasonable assessments agree that "before 2020" is the most likely answer to that question.)

FBaggins

(26,757 posts)Of course. So?

The peakist argument has never been merely that fossil fuels will eventually decline... someday. It's always that the day is upon us... or has already passed... or will hit any time now. In the case of shale plays, the argument usually goes like this:

* The resource is finite

* The most productive spots are naturally developed first

* The remaining sites will be progressively less productive

* They'll also be more expensive to exploit

* Production decline rates are catastrophic

* This means that every increase in production requires not just more drilling, but ever-increasing amounts of drilling

* The higher price per well combined with the lower productivity is about to hit a cliff where production cannot be maintained. To make things worse, the follow-on decline will be more precipitous than the normal post-peak declines in gas/oil.

most reasonable assessments agree that "before 2020" is the most likely answer to that question.

"Most reasonable" is not a viable claim. The ones that are currently saying that have a terrible track record on their prior predictions for shale output (for both gas and oil).

OPEC is certainly not acting as though they expect US shale production to decline (for geological reasons) any time soon. Any oil production can be expected to decline if price expectations fall below their cost of production, but that has nothing at all to do with shale resources being "finite".

Spider Jerusalem

(21,786 posts)The peak in conventional crude oil production has already occurred. Current production levels are the result of exploitation of unconventional sources including shale and tar sands. The size of those resources is reasonably well-known; the most likely rate of production can be extrapolated from the data we have on current production trends, the size of the resource, and estimates on ultimate recovery. (And given what we know of the decline rates for conventional oilfields, the expectation that shale and tar sands will fill the gap to such a degree as to maintain current levels of production seems like wishful thinking.)

FBaggins

(26,757 posts)Just wondering.

upaloopa

(11,417 posts)We removed the ban on oil exports this year.

FBaggins

(26,757 posts)They slightly lifted the ban for a couple companies' exports of condensate... not crude in general.

That doesn't really impact SJ's answer re: whether the US exports oil from shale.

Spider Jerusalem

(21,786 posts)The Republican senator has fought to relax the ban all year by issuing a series of papers detailing how such exports have been allowed in the past, holding a private meeting on the subject with Commerce Secretary Penny Pritzker, and hinting that 2015 could be the time to introduce ban-ending legislation.

When it became clear on Tuesday night that her fellow Republicans had won control of the Senate, Murkowski, at a party in Anchorage, gleefully held a chair over her head, proclaiming she was the chairman of the energy committee.

But upon taking the reins, Murkowski's first steps to roll back the ban, imposed by Congress after the Arab oil embargo in the 1970s, are expected to involve holding hearings, pressuring Obama administration officials, and testing the level of support from party leadership.

http://www.reuters.com/article/2014/11/07/us-usa-elections-oil-exports-analysis-idUSKBN0IR25420141107

2naSalit

(86,765 posts)a price war might facilitate the transition away from fossil fuels to some degree, if it manages to do enough "damage" to the petrodollar.

I realize there will be some pain for all involved... but if we don't go through detox soon, we deserve the miserable demise we are facing.

Just sayin'

![]()

FBaggins

(26,757 posts)There's much more to it than that. This is a battle within OPEC more than anything else.

We've seen the game played out more than once in the past... but the in-fighting within the cartel largely disappeared over the last decade or so as world supply had trouble keeping up with demand (so members could produce all that they wanted to without hurting profits for other members)

It's also a "war" with other non-OPEC exporting states (e.g., Russia) that are hurting far more than the US. Not more than US oil companies perhaps... but far more than the US itself (for whom low oil prices aren't a bad thing).

joshcryer

(62,276 posts)I think OPEC's actions are akin to Horse and Buggy people deciding to increase Horse Production to lower the price of Horse and Carriage rides, in response to the car.* It might work in the intrim, for a few years, but it's not a long term strategy.

That's why I argued in my OP that OPEC is going about it the wrong way. Reduce production, let the profits from reduced production be funneled into energy independent / renewable / sustainable technologies. OPEC can't last forever. We may not be "peakists" but we know a finite resource when we see it. We just recognize market mechanisms.

*for this analogy fracking would be the new oil production technology that would be like the car, replacing easy to get oil with harder to get oil; or easy to breed horses with harder to manufacture cars.

upaloopa

(11,417 posts)pollutes our water supply. Let's hope the fracking companies go belly up. The oil gotten from fracking is exported and we also export refined gasoline so the energy self sufficient to argument os bogus on it's face.

louis-t

(23,297 posts)"Buy, buy, buy!!!" ![]()