Environment & Energy

Related: About this forumObama seeks to make renewable Production Tax Credit permanent

New Hampshire, U.S.A. -- The US Federal Government is making another pitch for business-tax reform, and within that thrust it is underscoring its support for renewable energy.

The proposed adjustments in the Framework for Business Tax Reform incorporate five themes, including lowering the corporate tax rate from 35 percent to 28 percent, and to 25 percent for manufacturing "and even lower for advanced manufacturing activities." The current Research and Experimentation (R&D) tax credit's lower option of 14 percent rate in excess of a base amount would be hiked to 17 percent and made permanent.

For renewable energy sectors, the key part of the President's proposal also includes making the temporary tax credits for renewable energy production permanent -- and making it refundable. Doing so will "provide a strong, consistent incentive to encourage investments in renewable energy technologies," according to the Treasury Department. (Here's the press release and full PDF of the proposed business tax reforms.)

[...] This Framework recognizes that, as we expand manufacturing in the United States, the tax code should encourage doing so in way that is sustainable and that puts the United States in the lead in manufacturing the clean energy technologies of the future. This will create jobs here at home and can also have important spillover benefits. Moving toward a clean energy economy will reduce air and water pollution and enhance our national security by reducing dependence on oil. Cleaner energy will play a crucial role in slowing global climate change, meeting the President's goal of producing 80 percent of our nation's electricity from clean sources by 2035.

...

http://www.renewableenergyworld.com/rea/news/article/2012/02/obama-proposes-tax-reform-making-renewables-credits-permanent?cmpid=WNL-Friday-February24-2012

kristopher

(29,798 posts)From the PDF of the proposals:

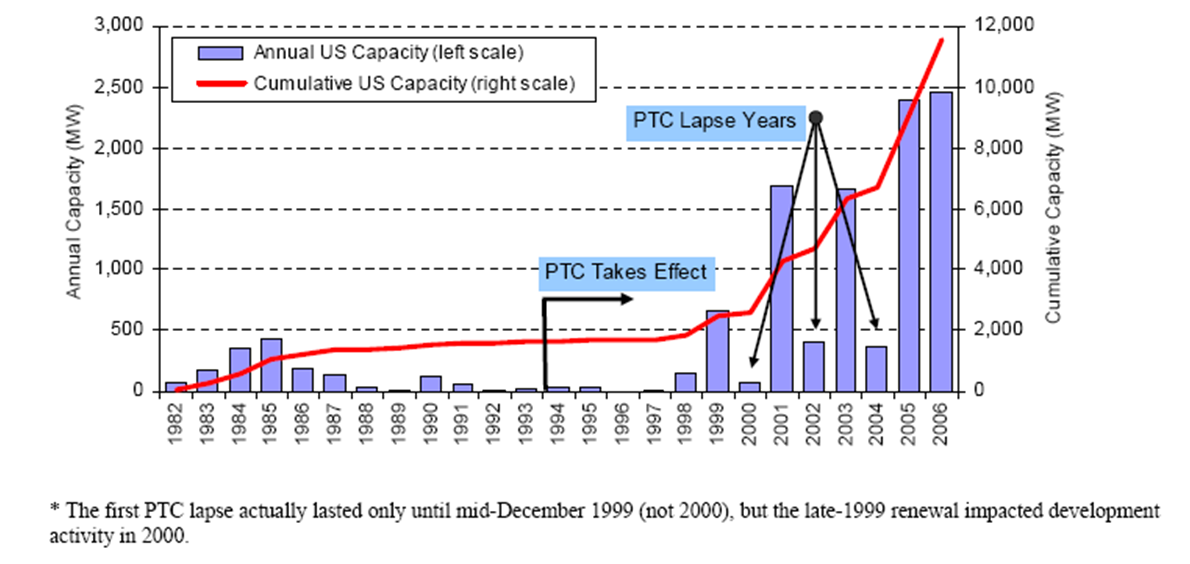

Extend, consolidate, and enhance key tax incentives to encourage investment in clean energy. The President’s Framework would make permanent the tax credit for the production of renewable electricity, in order to provide a strong, consistent incentive to encourage investments in renewable energy technologies like wind and solar. As with the R&E Tax Credit, the United States has to date provided only a temporary production tax credit for renewable electricity generation. This approach has created an uncertain investment climate, undermined the effectiveness of our tax expenditures, and hindered the development of a clean energy sector in the United States. In addition, the structure of renewable production and investment tax credits has required many firms to invest in inefficient tax planning through tax equity structures so that they can benefit even when they do not have tax liability in a given year because of a lack of taxable income. The President’s Framework would address this issue by making the permanent production tax credit refundable.

http://www.treasury.gov/resource-center/tax-policy/Documents/The-Presidents-Framework-for-Business-Tax-Reform-02-22-2012.pdf

See also the press release:

http://www.treasury.gov/press-center/press-releases/Pages/tg1427.aspx

malakai2

(508 posts)FERC's decision against Bonneville and by extension the Bonneville ratepayers on the PTC issue suggests otherwise. Does the proposal include ratepayer protection when wind generators face directed curtailment, or will ratepayers be directly subsidizing wind generators in the amount of the PTC under those circumstances?

kristopher

(29,798 posts)Wind isn't what will get curtailed, other sources of generation - like coal and nuclear - will be pushed to shut down.

Do you want to move to renewables or are you happy with a system built on nuclear and coal?

ETA: You might want to factor this into your evaluation.

...Michigan's 2008 renewable portfolio standard (RPS) law required the state commission to report on how the law was working in practice. The February 15, 2012 report was a report card on the remarkable success of that state's RPS law. It stands in marked contrast to many of the critics of state renewable laws like Grover Norquist who don't get their facts straight and claim that these laws raise rates, force ratepayers to buy more expensive renewable power, and don't create any economic benefits.

...

First, they said the law has generated over $100 million in investments in the state, spurred manufacturing, and created jobs.

Second, the law has led to more than 100 megawatts of new renewable capacity in the state, putting it on track to meet its 10% requirement. So the law is working.

Third, and this might be the most dramatic point made by the Commission, the cost of these new renewable projects -- including, wind, solar and hydro -- is less than the cost of a new coal plant.

That deserves to be repeated. In contrast to ...

Relevant section starts on page 22

http://www.michigan.gov/documents/mpsc/implementation_PA295_renewable_energy2-15-2012_376924_7.pdf