2016 Postmortem

Related: About this forumBernie Sanders Calls Federal Reserve "Socialism for the Rich" After $16 Trillion Secret Bail-Outs...

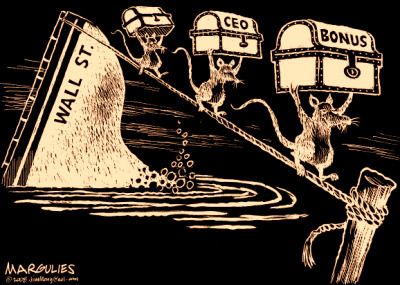

A little history for those wondering why the Banksters almost walked away blaming "the poor for buying big houses they couldn't afford" at the top of their lungs without anyone noticing their red hands.

Bernie Sanders Calls Federal Reserve "Socialism for the Rich" After $16 Trillion Secret Bail-Outs, Including Foreign Banks.

By Ralph Lopez, War Is a Crime | News Analysis

Truth-Out, Monday, 30 July 2012 14:27

After 89 Democrats in the House voted in a victory for bipartisanship for HR 459 to audit the Federal Reserve, some jaw-dropping numbers are emerging as a result of a partial audit conducted this year. It is no surprise that the news is dropping with a dull thud in the media. That's why you should get your news from the Internet and sites like this.

Senator Bernie Sanders at his official website reports:

The first top-to-bottom audit of the Federal Reserve uncovered eye-popping new details about how the U.S. provided a whopping $16 trillion in secret loans to bail out American and foreign banks and businesses during the worst economic crisis since the Great Depression. An amendment by Sen. Bernie Sanders to the Wall Street reform law passed one year ago this week directed the Government Accountability Office to conduct the study. "As a result of this audit, we now know that the Federal Reserve provided more than $16 trillion in total financial assistance to some of the largest financial institutions and corporations in the United States and throughout the world," said Sanders. "This is a clear case of socialism for the rich and rugged, you're-on-your-own individualism for everyone else."

Despite the wording of the Sanders press release the audit was not "top-to-bottom," with many areas excluded. HR 459 would remedy this.

The consortium of private banks collectively known as the Federal Reserve found itself in the crosshairs of Occupy Wall Street last fall. Created in 1913, the Fed holds a monopoly on the creation of the currency, which it lends to the US Treasury at interest, or to other banks.

Blogger Pierre Joris of the Department of English at SUNY Albany gleaned from the report:

"The Federal Reserve likes to refer to these secret bailouts as an all-inclusive loan program, but virtually none of the money has been returned and it was loaned out at 0% interest. Why the Federal Reserve had never been public about this or even informed the United States Congress about the $16 trillion dollar bailout is obvious — the American public would have been outraged to find out that the Federal Reserve bailed out foreign banks while Americans were struggling to find jobs."

CONTINUED w/links, sources...

http://www.truth-out.org/news/item/10609-bernie-sanders-calls-federal-reserve-socialism-for-the-rich-after-16-trillion-secret-bail-outs-including-foreign-banks

One of those foreign financial institutions the US taxpayer bailed out, by the way, is Swiss bank UBS.

PS: If the Congress and Bush and Obama administrations had followed Bernie Sanders' lead, the Banksters would be in jail, not spending bonus money on yachts, cars and dope.

tazkcmo

(7,300 posts)But not surprising. Yay Rich People! Yay Movers And Shakers! Yay Titans Of Industry! Boo Little People!

on edit: Buying yachts, hookers and dope are just actions that create jobs! (sarcasm)

Octafish

(55,745 posts)...I -- and you and everybody that's part of "We the People" -- got a problem with that.

To place $16 trillion into perspective, remember that GDP of the United States is only $14.12 trillion. The entire national debt of the United States government spanning its 200+ year history is “only” $14.5 trillion. The budget that is being debated so heavily in Congress and the Senate is “only” $3.5 trillion. Take all of the outrage and debate over the $1.5 trillion deficit into consideration, and swallow this Red pill: There was no debate about whether $16,000,000,000,000 would be given to failing banks and failing corporations around the world.

-- Pierre Joris http://www.pierrejoris.com/blog/?p=6684

I'm getting ready to go to church where several families I know and love lost their homes in 2009, thanks to the Banksters. And all the nice stuff that was supposed to happen, like help, failed to materialize.

VulgarPoet

(2,872 posts)Detroit looks like a fucking war zone-- AND WE'RE SUPPOSED TO SUPPORT SOMEONE WHO SUPPORTED A BAILOUT?

If this is supposed to be the Democratic Party, it deserves to be binned.

FreakinDJ

(17,644 posts)The REAL Headline should have been "While Obama directs IRS to go after Swiss Banks Hillary as SOS helps them evade prosecution

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

Octafish

(55,745 posts)Like it was an accident.

Or sumpin', right?

Obama’s Foreclosure Relief Program Was Designed to Help Bankers, Not Homeowners

by David Dayen

Bill Moyers & Co., February 14, 2015 / The American Prosepect Winter 2015

EXCERPT...

Politicians, economists and commentators are debating the causes of the rise in inequality of income and wealth. But one primary cause is beyond debate: the housing collapse, and the government’s failure to remedy the aftermath. According to economists Emmanuel Saez and Gabriel Zucman, the bottom 90 percent of Americans saw one-third of their wealth wiped out between 2007 and 2009, and there has been no recovery since. This makes sense, as a great deal of the wealth held by the middle and working classes, particularly among African-Americans and Hispanics, is in home equity, much of which evaporated after the bubble popped. The effects have been most severe in poor and working-class neighborhoods, where waves of foreclosure drove down property values, even on sound, well-financed homes. Absent a change in policy, Saez and Zucman warn, “all the gains in wealth democratization achieved during the New Deal and the postwar decades could be lost.”

President Obama will carry several legacies into his final two years in office: a long-sought health care reform, a fiscal stimulus that limited the impact of the Great Recession, a rapid civil rights advance for gay and lesbian Americans. But if Obama owns those triumphs, he must also own this tragedy: the dispossession of at least 5.2 million US homeowner families, the explosion of inequality, and the largest ruination of middle-class wealth in nearly a century. Though some policy failures can be blamed on Republican obstruction, it was within Obama’s power to remedy this one — to ensure that a foreclosure crisis now in its eighth year would actually end, with relief for homeowners to rebuild wealth, and to preserve Americans’ faith that their government will aid them in times of economic struggle.

Faced with numerous options to limit the foreclosure damage, the administration settled on a policy called HAMP, the Home Affordable Modification Program, which was entirely voluntary. Under HAMP, mortgage companies were given financial inducements to modify loans for at-risk borrowers, but the companies alone, not the government, made the decisions on whom to aid and whom to cast off.

In the end, HAMP helped only about one million homeowners in five years, when 10 million were at risk. The program arguably created more foreclosures than it stopped, as it put homeowners through a maze of deception designed mainly to maximize mortgage industry profits. More about how HAMP worked, or didn’t, in a moment.

HAMP cannot be justified by the usual Obama-era logic, that it represented the best possible outcome in a captured Washington with Republican obstruction and supermajority hurdles. Before Obama’s election, Congress specifically authorized the executive branch, through the $700 billion bank bailout known as TARP, to “prevent avoidable foreclosures.” And Congress pointedly left the details up to the next president. Swing senators like Olympia Snowe (Maine), Ben Nelson (Nebraska) and Susan Collins (Maine) played no role in HAMP’s design. It was entirely a product of the administration’s economic team, working with the financial industry, so it represents the purest indication of how they prioritized the health of financial institutions over the lives of homeowners.

CONTINUED...

http://billmoyers.com/2015/02/14/needless-default/

Incredibly sad for us Democrats pull-out quote: [font color="green"]“It’s a terrible irony. This man who represents so much to people of color has presided over more wealth destruction of people of color than anyone in American history.”[/font color]

FreakinDJ

(17,644 posts)Ghost Dog

(16,881 posts)Funnels? Or Stovepipes?

Brother_Love

(82 posts)RiverLover

(7,830 posts)Response to Octafish (Original post)

PonyUp This message was self-deleted by its author.

Octafish

(55,745 posts)

Washington's Blog provides details n links:

The Government Lied When It Said It Only Bailed Out Healthy Banks … 12 of the 13 Big Banks Were Going Bust

Posted on January 11, 2013 by WashingtonsBlog

The Government’s Entire Strategy Was to Cover Up the Truth

We noted in 2011 that the Geithner, Bernanke and Paulson lied about the health of the big banks in pitching bailouts to Congress and the American people:

The big banks were all insolvent during the 1980s.

And they all became insolvent again in 2008. See this and this (busted link at WB).

The bailouts were certainly rammed down our throats under false pretenses.

But here’s the more important point. Paulson and Bernanke falsely stated that the big banks receiving Tarp money were healthy, when they were not. They were insolvent.

Tim Geithner falsely stated that the banks passed some time of an objective stress test but they did not. They were insolvent.

CONTINUED...

Without DU and a relatively few people around the Internet, most people would never hear about ANY of this stuff. For some reason, it hasn't been on America's television screens.

Octafish

(55,745 posts)Is great phrase:

Neil Barofsky, the former special inspector general for the Troubled Asset Relief Program, has published a new book, “Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street.” It presents a damning indictment of the Obama administration’s execution of the TARP program generally, and of HAMP in particular.

...

By delaying millions of foreclosures, HAMP gave bailed-out banks more time to absorb housing-related losses while other parts of Obama’s bailout plan repaired holes in the banks’ balance sheets. According to Barofsky, Treasury Secretary Tim Geithner even had a term for it. [font color="green"]HAMP borrowers would “foam the runway” for the distressed banks looking for a safe landing.[/font color] It is nice to know what Geithner really thinks of those Americans who were busy losing their homes in hard times.

CONTINUED w VIDEO and links and more letters...

http://washingtonexaminer.com/video-geithner-sacrificed-homeowners-to-foam-the-runway-for-the-banks/article/2502982

Millions of Americans used as foam for the Banksters.

vintx

(1,748 posts)Blaming the victim

FraDon

(518 posts)What did "they the people" of tiny Iceland do with their Banksters?

Octafish

(55,745 posts)

The guy is known around the world as a forensic economist, having put hundreds if not thousands of Savings & Loans crooks behind bars for their roles in the S&L looting of the late 80s and early 90s. "Control Fraud" by the CEOs and COOs and their underlings on behalf of themsleves and their connected cronies in the Mafia, CIA and Who's Who of big bucks across the nation. The S&L looting was, until 2008, the greatest rip off of all time.

After Eric Holder Resigns, A Look at His Record on Bank Prosecutions

Former financial regulator Bill Black says Holder's legacy on "too big to fail" is "too big to jail"

The Real News - October 3, 14, 2014

EXCERPT...

PERIES: So what raced through your mind as you heard the news this morning about Eric Holder's resignation?

BLACK: Well, I'll focus on the areas I know about. And in your introduction, the war on whistleblowers will be the most relevant part, along, of course, with the complete strategic failure, the greatest strategic failure in the history of the Department of Justice, which I once worked at, against elite white-collar crime epidemics.

And so Eric Holder has surprised me. I always predicted that he would at least find one token case to prosecute some bank senior executive for crimes that led to the creation of the financial crisis and the global Great Recession.

PERIES: Why did it surprise you, Bill?

BLACK: Well, he's actually going to leave without even a token conviction, or even a token effort at convicting. So, in baseball terms, he struck out every time, batting 0.000, but he actually never took a swing. So he was called out on strikes looking, as we would say in baseball. And I couldn't believe that he would leave without at least having one attempted prosecution against these folks. So he hasn't done the most--he never did the most elementary things required to succeed. He never reestablished the criminal referral process, which is from the banking regulatory agencies, who are the only ones who are going to do widescale criminal referrals against bank CEOs, because, of course, banks won't make criminal referrals against their own CEOs. Holder could have reestablished that criminal referral process in a single email on the first day in office to his counterparts in the banking regulatory agencies, and he's going to leave never having attempted to do so.

On top of that, if you're not going to have criminal referrals from the agencies, the only other conceivable way that you're going to learn about elite criminal misconduct of this kind is through whistleblowers. And as you mentioned, this administration, and Eric Holder in particular, are known for the viciousness of their war against whistleblowers. What the public doesn't know--and it doesn't know because of Eric Holder--is that in the three biggest cases involving banks--again, none of them, not a single prosecution of the elite bankers that drove this crisis--all three of those cases, against Citicorp, against JPMorgan, and against Bank of America, were made possible by whistleblowers. Eric Holder was the czar at the Department of Justice press conferences in each of these three cases, and he and the Justice Department officials, the senior Justice Department officials, at those press conferences, never mentioned the role of the whistleblowers--never praised the whistleblowers and never used those press conferences as a forum for asking whistleblowers to come forward. And so your viewers should take a look at the Frontline special on this, where the Frontline producers made clear that as soon as word got out that they were investigating the area, dozens of whistleblowers came forward, and each of them had the same story: the Department of Justice had never contacted them.

So, instead of going after the big guys--by the way, they didn't go after the small CEOs either. I keep talking about elite CEOs, for obvious reasons: they cause far greater damage. But there are all these CEOs of the not very big mortgage banks who are not prestigious, who are not politically powerful, and Eric Holder refused to prosecute them as well. What did he do instead? Well, he prosecuted several hundred mice. And so the saying in the savings and loan industry is true again: Holder was chasing mice while lions roam the campsite.

And most disgraceful of all, the official position of the Justice Department and the FBI, as I've written and quoted from their annual reports on mortgage fraud, is that mortgage fraud is largely supposedly an ethnic crime, with particular disfavored ethnic groups, like Russian Americans. This is (A) not true and (B) an obscenity, for the Department of Justice in particular, which is, after all, charged with preventing this kind of discrimination. Not only is the Justice Department and the FBI spreading this absolute lie about ethnic guilt, but they're following through, and they are disproportionately prosecuting folks of disfavored minorities. And that is a particular evil and disgusting thing that will be on the tombstone of Eric Holder when historians write about him.

CONTINUED...

http://therealnews.com/t2/index.php?option=com_content&task=view&id=31&Itemid=74&jumival=12433

And to think some may still wonder why We the People deserve austerity. Thankfully a few have noticed it's not what we deserve.

Major Hogwash

(17,656 posts)We depended on the federal government to protect our investments, not fritter them away.

![]()

Octafish

(55,745 posts)We certainly are the last to get paid.

Billionaire Bankster Penny Pritzker

Breaks into Obama's Cabinet

Thursday, May 2, 2013

By Greg Palast

EXCERPT...

Pritzker's net worth is listed in Forbes as $1.8 billion, which is one hell of a heavy magic wand in the world of politics. Her wand would have been heavier, and her net worth higher, except that in 2001, the federal government fined her and her family $460 million for the predatory, deceitful, racist tactics and practices of Superior, the bank-and-loan-shark operation she ran on the South Side of Chicago.

Superior was the first of the deregulated go-go banks to go bust - at the time, the costliest failure ever. US taxpayers lost nearly half a billion dollars. Superior's depositors lost millions and poor folk in Sen. Obama's South Side district lost their homes.

Penny did not like paying $460 million. No, not one bit. What she needed was someone to give her Hope and Change. She hoped someone would change the banking regulators and the Commerce Department so she could get away with this crap.

Pritzker introduced Obama, the neophyte state senator, to the Ladies Who Lunch (that's really what they call themselves) on Chicago's Gold Coast. Obama got lunch, gold and better - an introduction to Robert Rubin. Rubin is a former Secretary of the Treasury, former chairman of Goldman Sachs and former co-chairman of Citibank. Even atheists recognized Rubin as the Supreme Deity of Wall Street.

SNIP...

Geithner and Summers were the gents who, under Treasury Secretary Rubin, designed the deregulation of banking. In effect, they had decriminalized the kind of financial flim-flammery that brought the planet to its knees while bringing Rubin, Pritzker and the banksters loads of lucre.

CONTINUED...

http://www.gregpalast.com/billionaire-bankster-breaks-into-obamas-cabinet/

Imagine if everyone was treated equally? Why...why...(SHUDDERS VISIBLY)...What! We'd have a DEMOCRACY!

surrealAmerican

(11,360 posts)Surely our responsible media will be on it.![]()

Octafish

(55,745 posts)by MICHAEL HUDSON – CHRIS HEDGES

CounterPunch, April 1, 2016

EXCERPT...

HUDSON: Citibank, along with Countrywide Financial, was making junk mortgages. These were mortgages called NINJA. They were called liars’ loans, to people with no income, no jobs and no assets. You had this movie, The Big Short, as if some genius on Wall Street discovered that the mortgages were all going to go down. And you have the stories of Queen Elizabeth going to the economist …

HEDGES: “How come none of you knew?”

HUDSON: Right. The fact is, if everybody on Wall Street called these mortgages liars’ loans, if they knew that they’re made for NINJAs, for people who can’t pay, all of Wall Street knew that it was fraud.

The key is that if you’re a really smart criminal, you have to plan to get caught. The plan is how to beat the rap. On Wall Street, if you buy garbage assets, how do you make the government bail you out? That was what the president of the United States is for, whether it was Obama or whether it would have been John McCain …

HEDGES: Or Bush.

HUDSON: Or whether it would be Hillary today, or Trump. Their job is to bail out Wall Street and make the people pay, not Wall Street. Because Wall Street is “the people” who select the politicians – who know where their money is coming from. If you have a campaign contributor, no matter whether it’s Wall Street, or locally if it’s a real estate developer, you all know who your backers are.

The talent you need to have as a politician is to make the voters think that you’re going to be supporting their interests …

HEDGES: And what’s that great Groucho Marx quote?

HUDSON: The secret of success is sincerity. If you can fake that, you’ve got it made.

CONTINUED...

http://www.counterpunch.org/2016/04/01/the-lies-of-neoliberal-economics-or-how-america-became-a-nation-of-sharecroppers/

CrispyQ

(36,461 posts)Ferd Berfel

(3,687 posts)defending this suicidal anti-American behavior?

These people should be in Jail for decades - Just like Iceland.

...and I'm supposed to support this?

speaktruthtopower

(800 posts)they'll outlaw cash, which equates to requiring savers to make unsecured loans to private banks.

That's power.

Ghost Dog

(16,881 posts)Once you put your money in a bank it becomes the bank's property. Check out the small print.

JEB

(4,748 posts)amborin

(16,631 posts)In her book, It Takes a Pillage: Behind the Bailouts, Bonuses, and Backroom Deals from Washington to Wall Street, Nomi Prins uncovers the hush-hush programs and crunches the hidden numbers to calculate the shocking actual size of the bailout: $14.4 trillion and counting.

FreakinDJ

(17,644 posts)Better Cut Social Security to pay for it

Zynx

(21,328 posts)Do you actually know what the Commercial Paper Funding Facility was?

amborin

(16,631 posts)Zynx

(21,328 posts)By definition it's for terms less than 270 days to bridge short term cash flow issues. The credit card analogy is not necessarily a bad one, except that corporate interest rates are considerably lower.

During the financial crisis, literally basically none of it could be issued because no one was buying much of anything. This put corporations that relied on short-term financing in a bind because they could suddenly run out of cash despite not actually being insolvent.

The Fed, in order to keep the system liquid, decided to become the buyer of last-resort for these securities to ensure that corporate financing didn't utterly freeze up. It purchased the securities, though not with taxpayer funds. It did it through its own accounts. One could argue the taxpayer is technically ultimately on the hook should things go badly, but if the Fed somehow goes under we have bigger problems than worrying how to settle up those accounts.

As a point of fact, all of these funds were repaid along with interest payments. In other words, the Fed actually probably made a little money on this. If you look at the Fed's financial statements, and those of the federal government, you'd find that the Fed has been a profit center for taxpayers, returning tens of billions to the treasury that have helped to reduce the deficit.

This wasn't the Fed writing checks. This was a short term program that has long since expired because it is no longer needed. Thus, this wasn't a $1.8 trillion bailout. It was a $1.8 trillion temporary lending program to make sure that the ordinary functioning of the economy could proceed.

My question to you is would you have prohibited the Fed from doing it? If you would have, would you be willing to deal with the consequences?

amborin

(16,631 posts)Ghost Dog

(16,881 posts)By Joseph E. Stiglitz

http://www.democraticunderground.com/102411378

Hiraeth

(4,805 posts)Howard "bloodmoney" Dean.

Overseas

(12,121 posts)I think sometimes when the facts are so egregious, I just don't want to believe them and push them out of my mind. And corporate media helps me forget.

And perhaps since there were multiple bailouts, a candidate can say they paid them back by referring to the 700 billion, rather than the trillions of extra "financial assistance."

Holly_Hobby

(3,033 posts)Zynx

(21,328 posts)These were mainly very short term loans and basically all of them were repaid very rapidly.

http://www.nytimes.com/2011/04/01/business/economy/01fed.html

It isn't as though the Fed was just printing out unconditional grants to rich people and then writing them off as losses. Nothing at all in the flow of funds during the crisis suggests that's what happened. People look at the huge figure of $16 trillion and don't realize that most (and actually pretty much all) of that is a lot of quick dips and dunks that was repaid in short order.

Short term loans are not bailouts. The only real bailout was TARP. The short term lending was a mechanism by which banks could keep their liquidity in good shape even while the financial system utterly froze up.

The bigger complaint to be made about the rich being bailed out is how the economic recovery has fit the pattern of the last 35 years where the only thing that tends to happen is that financial assets rise along with upper tier incomes while those that were hurt by the recession barely got any additional help at all. That has very little to do with this inaccurate description of the Fed's lending facilities.

Ghost Dog

(16,881 posts)- blowing and artificially sustaining the present financial asset price bubble now on the verge of popping. Most, probably, of those with serious private wealth and.upper tier incomes, will be advised to get out of asset markets at the right time, leaving the likes of 401ks and pension schemes to burn.

FreakinDJ

(17,644 posts)Scuba

(53,475 posts)Karmadillo

(9,253 posts)they've been getting from UBS. I know some here have referred to this money as "bribes" and some kind of "quid pro quo," but I'd be happy if they just did the right thing and returned all that tainted money.

http://www.theguardian.com/business/2015/jul/30/hillary-clinton-ubs-tax-evasion-settlement-foundation

<edit>

In February 2009, the IRS sued UBS and demanded that it disclose the names of 52,000 possible American tax evaders with secret Swiss bank accounts. In the months that followed – thanks to involvement of Clinton as secretary of state and Swiss lawmakers – a legal settlement was negotiated. On 19 August 2009, it was announced that UBS would pay no fine and would provide the IRS with information about 4,450 accounts within a year.

Since the deal was struck, disclosures by the foundation and the bank show the donations by UBS to the Clinton Foundation growing “from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014”, according to the Wall Street Journal.

The bank also teamed up with the foundation on the Clinton Economic Opportunity Initiative, creating a pilot entrepreneur program through which UBS offered $32m in loans to businesses, the newspaper reported. Other UBS donations to the Clinton Foundation include a $350,000 donation from June 2011 and a $100,000 donation for a charity golf tournament.

Additionally, UBS paid more than $1.5m in speaking fees to Bill Clinton between 2001 and 2014, the newspaper reported.

more...

AzDar

(14,023 posts)Uncle Joe

(58,355 posts)Thanks for your good works, Octafish. ![]()

Duppers

(28,120 posts)pampango

(24,692 posts)with 19 percent of independents, 16 percent of Republicans, and 12 percent of Democrats wanting to do away with the central bank. Among those who identify themselves as supporters of the Tea Party movement, which wants to rein in government, 21 percent want to abolish the Fed.

Americans across the political spectrum say the Fed shouldn’t retain its current structure of independence. Asked if the central bank should be more accountable to Congress, left independent or abolished entirely, 39 percent said it should be held more accountable and 16 percent that it should be abolished. Only 37 percent favor the status quo.

http://www.bloomberg.com/news/articles/2010-12-09/more-than-half-of-americans-want-fed-reined-in-or-abolished

Republican and Tea Party criticism (2010)

During the 2010 midterm elections, the Tea Party movement made the Federal Reserve a major point of attack, which was picked up by Republican (R) candidates across the country. Mike Lee (R) of Utah accused the reserve of trying to “monetize the debt” by printing money to buy government bonds, which the reserve denied. Unsuccessful Senate candidate Ken Buck (R) of Colorado said that Congress should be "shining a light on the Federal Reserve" because it is too cozy with private interests. Senator Rand Paul (R) of Kentucky, son of Congressman Ron Paul, has long attacked the Federal Reserve, arguing that it is hurting the economy by devaluing the dollar and that its monetary policies cause booms and busts.

https://en.wikipedia.org/wiki/Criticism_of_the_Federal_Reserve

From the far-right NewsMax:

An audit of the nation’s central bank comes straight from the playbook of rival Republican candidate Ted Cruz supports as well as former candidate Rand Paul.

Trump criticized Cruz in a recent tweet for missing a Senate vote on an "Audit the Fed" bill in January, which failed in a vote. Republican candidate Marco Rubio and Democratic candidate Bernie Sanders both voted in favor of the legislation, which was proposed by Paul.

“Requiring the Government Accountability Office to conduct a full and independent audit of the Fed each and every year, would be an important step towards making the Federal Reserve a more democratic institution that is responsive to the needs of ordinary Americans rather than the billionaires on Wall Street,” Sanders said in a statement.

“Cruz and Sanders, one suspects, favor the audit for opposing reasons — the former because he wants essentially to abolish it, and to remove the possibility of an expansive monetary policy,” says Bernstein, “whereas Sanders would want to use the audit to enforce the opposite.”

http://www.newsmax.com/Finance/StreetTalk/donald-trump-janet-yellen-federal-reserve-audit/2016/02/25/id/716045/

Republicans want to audit the Federal Reserve in order to abolish it altogether or, at least, to ensure that it enforces "austerity" rather than employment and higher wages; Bernie to see that it is "responsive to the needs of ordinary Americans rather than the billionaires on Wall Street". BIG difference.