2016 Postmortem

Related: About this forumEzra Klein and the Terrible, Horrible, No-Good Tax Calculator

March 30, 2016

By Jim Naureckas

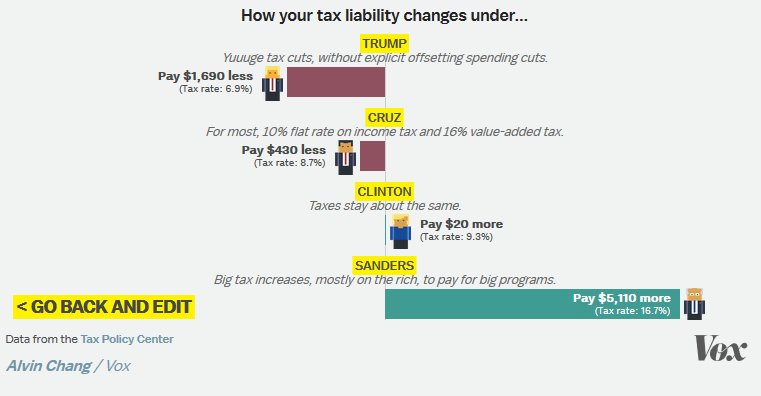

The website Vox (3/25/16) has what editor-in-chief Ezra Klein describes as an “excellent tax calculator” that, in its headline’s promise, “Tells You How Each Presidential Candidate’s Tax Plan Affects You.”

Actually, it does no such thing; it’s a gimmick that is entirely useless except as a deceptive advertisement for Hillary Clinton

As a gimmick, it’s pretty simple. You put in your annual income (actually, your “expanded cash income,” which you probably don’t know even if you know what it is), whether you’re single or married and whether you have no kids, one kid, or two or more kids. And then it tells you what Donald Trump’s, Ted Cruz’s, Hillary Clinton’s and Bernie Sanders’ “plans mean for your federal tax liability.”

Let’s try it out with the US median household income ($43,585), married, two kids. You get a graphic that looks like this:

“Pay $5,110 more”—holy smokes! Stop the revolution, I want to get off! Why didn’t someone (besides Vox’s Alvin Chang) tell me that “Sanders wants to implement massive increases across the board, including on the poor”?

Maybe because he doesn’t—and you wouldn’t pay $5,110 more, or anything like it.

Mostly, that big number you get for the Sanders tax hike when you plug in your income is the payroll tax that employers will pay to cover the cost of a single-payer healthcare system. As the Tax Policy Center, which worked with Vox to create the calculator, explains:

We’re including payroll taxes, excise taxes and corporate income taxes as well as individual income taxes…. Most economists think employers pass their share of the tax on to workers in the form of lower wages.

With all due respect to most economists, this is dubious. Unless you work at the rare enterprise that does not have profit as its primary goal, your bosses are already paying you as little as they think they can get away with. If they get a new cost associated with your employment, they may try to raise their prices. They may look for other areas where they can cut costs. They may even decide that they can no longer afford to employ you. But what they won’t do is suddenly realize that they could have been paying you thousands of dollars less all along without you quitting. (They may even be forced to accept a lower profit rate, though that’s something “most economists” seem to exclude a priori.)

But that’s not even the real problem with Vox’s calculator. Sanders’ plan is based on using a new payroll tax to pay for a single-payer healthcare system, which will relieve businesses of the considerable burden of paying for employee healthcare. Since just about everyone agrees that single-payer is cheaper than what we have now (including Ezra Klein, before Sanders started running against Clinton on a single-payer platform), in theory business as a whole should come out ahead. But certainly you need to take into account that business would be getting a big break on expenses at the same time that it’s getting a new tax, right?

No, Vox thinks you don’t need to take that into account. From the calculator’s FAQ: “The Tax Policy Center’s model does not include spending programs and thus can only show the effects of tax changes.”

Imagine a website—maybe one that seems to have a pronounced pro-Sanders tilt—creating a “Benefits Calculator” that promises to tell you how each candidate’s benefits plan affects you. The calculator guesstimates how much your employer will save with a single-payer plan and, using the same dubious economics, implies that that savings is money in your bank account. What about your employer’s big tax hike? It’s a benefits calculator—it can’t show the effect of tax changes!

Ezra Klein would be the first to say that a website that constructed a machine for telling people that Bernie Sanders would give them thousands of dollars was engaging in partisan hackery. Yet when Vox does the same thing in reverse, it’s data-driven journalism. Or something.

http://fair.org/home/ezra-klein-and-the-terrible-horrible-no-good-tax-calculator/

JackRiddler

(24,979 posts)...into "$5000" in more taxes. This is the replacement of single payer for private insurance premiums, high deductibles, and drug-price gouging.

Jefferson23

(30,099 posts)FlatBaroque

(3,160 posts)Hoe does Team Clinton find every sack of shit to work for them?

hill2016

(1,772 posts)how does a single payer system be overall cheaper by

(1) covering more people (the currently uninsured)

(2) not having co-payments as cost control measure

(3) not having limits on procedures or drugs?

Jefferson23

(30,099 posts)beedle

(1,235 posts)1 - it covers the same number of people. You are ignoring the much higher cost of uncovered people ending up in the emergency room, or 'free' clinics and the costs associated with poor quality heathcare for those who are not covered, or under convered.

2 - There are other 'single-payer' non co-payer examples around the world, and even if you believe that people are abusing the system, they are still less expensive than the current system.

3 - Limits are still there, just based on need vs profits.

1/2. in the short term, you're going to pay much more in health care costs (for the currently uninsured) before the long-term cost savings come through. Why doesn't Sanders account for this short-term spike in his funding (and taxation) proposal?

3. What kind of limits? What if somebody wants a branded vs generic drug? What about experimental vs standard of care therapies? Somehow Sanders waves all of these important issues away.

revbones

(3,660 posts)since your talking points seem to be a bit right-wing and would apply to it as well.

mythology

(9,527 posts)Under the ACA are more expensive than previously insured people.

http://m.huffpost.com/us/entry/obamacare-enrollees-are-sick_us_56face7be4b0143a9b497571

That's not a bad thing, but it does mean if you are proposing bringing in new people who are sicker than average, it's going to cost more.

beedle

(1,235 posts)... currently uninsured are costing money now. They will cost less when they are in the system. If there is an increase in cost short term, then that's what's called 'investment' ... we can't repair the roads because there might be an upfront cost? My roof leaks, but I'll let it destroy my $1M home because it will cost 10K to replace it?

... What if somebody wants branded vs generic drugs, experimental vs standard therapies now? Even in 'single-payer' or 'full-coverage' countries now there are options. You get the basic level of coverage based on need, using what's considered 'conventional' treatments for health issues ... you can then buy insurance on top of that for your 'branded' and experimental services ... you think that the basic insurance coverage now covers all the 'bells & whistles'?

unapatriciated

(5,390 posts)who were uninsured and not receiving health care of any kind are now on the rolls.

I will never understand why some dems care so very little for their fellow man. The repugs I get.

beedle

(1,235 posts)... who would have thought a year or two ago that single-payer insurance would have been so controversial for 'Democrats"?

I'm sure if Hillary suddenly came out and started calling for a return to a monarchy, the same people who are now backing away from single-payer would be backing away from democracy.

Jefferson23

(30,099 posts)http://www.cbsnews.com/news/hillary-clinton-single-payer-health-care-will-never-ever-happen/

She speaks, most of them follow along.

amborin

(16,631 posts)Needless back-office spending is one of the biggest sources of waste in health care, according to health insurers, providers and academics alike.

In a recent Health Affairs article, the authors estimated that administrative expenditures account for 25.3 percent of the average American hospital’s annual spending. No other developed nation comes close. The next highest, the Netherlands, spends 19.8 percent on administration.

Administrative costs in the United States consumed an estimated $156 billion in 2007, with projections to reach $315 billion by 2018 (Collins et al., 2009). With the time, costs, and personnel necessary to process billing and insurance-related (BIR) activities from contracting to payment validation on the provider side and the needs of payers to process claims and credential providers, significant redundancy and inefficiency arises from healthcare administration. Adding to concerns is emerging evidence of an inverse relationship between administrative complexity and qualityofcar e

http://www.ncbi.nlm.nih.gov/books/NBK53942/

hill2016

(1,772 posts)about $3 trillion in health care a year.

Ok let's say you eliminate all administrative costs. That's maybe 10%?

But you are also covering MORE people with MORE benefits and LESS co-payments.

revbones

(3,660 posts)mythology

(9,527 posts)30% of 3 trillion is a bit less than 1 trillion.

And that's before you consider that eliminating all administrative costs is impossible. Even Medicare has some costs.

Also the ACA mandates 80% of premiums be spent on benefits and health care improvement. So there no way to get 30% of the 3 trillion we spend on health care back by eliminating the max 20% a for profit insurer can take to cover admin costs and profit.

revbones

(3,660 posts)Eliminating them and cost drivers such as high executive salaries, marketing, etc... also eliminates that 30%

jeff47

(26,549 posts)You also have to remember the higher costs triggered by our current system.

Yes, co-pays can prevent people from going to the doctor for frivolous things....but they also keep people from going to the doctor for things that turn out to be major problems when they are finally treated.

That cough that just won't go away might not be worth $40....until it costs an enormous pile of money to save you from something like pneumonia or later-stage lung cancer.

You can pay for a whole lot of primary care doctors saying "You just have a cold, get some rest" for the same price as a single hospitalization for pneumonia.

JackRiddler

(24,979 posts)(1) That means in theory one budget for what is now multiple, including Medicaid and Medicare.

(2) Co-payments may still exist, they won't be extortionate.

(3) There are limits currently too. Mounds of them. The "death panels" have existed all along, they're called insurance adjustors.

I think you're asking the wrong questions. Look at Germany (not quite single payer), Canada or Scandinavia (single payer) and ask, how do they get better results in longevity, prevention and health at a lower % GDP spent on health care? Why can't some form of that be implemented here?

The key is in eliminating the profit and growth motives of private insurance. How do almost all systems in place have administrative costs 1/3 or less than the U.S.? How is it that Social Security, lacking the profit-seeking private entities in the middle, gets along with 2% administrative costs?! Get rid of the profit-seeking corporate middleman! The profit motive is still there for the actual medical providers, but with limits on the gouging especially in the pharmaceuticals.

Armstead

(47,803 posts)beam me up scottie

(57,349 posts)Jefferson23

(30,099 posts)amborin

(16,631 posts)Jefferson23

(30,099 posts)Prism

(5,815 posts)"Taaaaaxxxessss!"

Christ on a crutch. Why on earth do Hillary supporters feel a sudden need to go full Tea Party to defend her?

Jefferson23

(30,099 posts)one looks at it.

Prism

(5,815 posts)They may not be using the verbiage, but they're certainly tapping into the sentiment.

Jefferson23

(30,099 posts)beam me up scottie

(57,349 posts)Sometimes this place is indistinguishable from FreeRepublic.

B2G

(9,766 posts)if it's all tied into Single Payer.

Cause that ain't happening anytime soon.

JackRiddler

(24,979 posts)So it's a lie either way: The "$5000" increase is predicated on implementation of a single-payer system that eliminates double that in premiums and deductibles. If it fails in the legislature, the increase also doesn't happen. It's not like he could impose the $5000 just for the hell of it, without a single-payer system.

B2G

(9,766 posts)andym

(5,444 posts)People could input their medical costs and see how the new plan would effect them. The calculator should also provide a more detailed breakdown on personal versus employer costs. How much Bernie's programs might save businesses would be useful. The only problem with a benefits calculator that I see is that Trump's unpaid for tax cut plan might appear to look very good on the surface to many, if a middle class family is really getting $1690 in free money. That's a lot and would be appealing to people who need to work to make their ends meet. OTOH, Trump's plan on the Vox calculator is already going to look attractive, so at least there will be an alternative.

jwirr

(39,215 posts)the election is over? Elections have consequences and when those consequences come back on us we will remember who pushed her off on us.

Jefferson23

(30,099 posts)people being terrified of Trump/Cruz...so their lies and distortions should be forgotten.

It's cunning and unethical but I don't know how else to explain their reasoning.

jwirr

(39,215 posts)MSM or a lot of other bunk I am doing just fine without now.

Jefferson23

(30,099 posts)Skwmom

(12,685 posts)AzDar

(14,023 posts)Jefferson23

(30,099 posts)Thanks for the kick. ![]()

Jefferson23

(30,099 posts)Ash_F

(5,861 posts)Very important fact that everybody should know. All of people do not realize this.

snowy owl

(2,145 posts)I used to really, really like MSNBC and I really, really liked Ezra Klein. And a lot of others who I now know sell their ethics and honesty for a position with the establishment. Yes, Ari Berman too. And Chris Hayes.

I said before Chris is friends with Sam Seder but you haven't seen Sam for a long time - well, actually I haven't watched MSNBC for a long time now - but prior to my not watching, Sam had disappeared. Sam is a Bernie supporter and he'd never sell out. Neither would David Sirota, another writer that I hold in high esteem.

Sam Seder - Ring of Fire with Papantonio and Kennedy online for those who don't know them.

Jefferson23

(30,099 posts)BlueStateLib

(937 posts)https://en.wikipedia.org/wiki/Tax_Policy_Center

http://www.vox.com/policy-and-politics/2016/3/25/11293258/tax-plan-calculator-2016

Jefferson23

(30,099 posts)BlueStateLib

(937 posts)In an analysis released today, the Tax Foundation, an independent tax policy research organization, found that Sanders’ plan would lead to 10.56% lower after-tax income for all taxpayers, and a 17.91% lower after-tax income for the wealthiest Americans. When accounting for reduced GDP, taxpayers would see their after-tax incomes fall by 12.84% on average, the report said.

Jefferson23

(30,099 posts)Broward

(1,976 posts)Clearly, just another partisan rag shilling for right-wingers like Hillary.