Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

2016 Postmortem

Related: About this forumOverseas Accounts: What about the 47,550 AMERICAN accounts that remain hidden at UBS in Switzerland?

A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

Has anybody heard those hard hitting corporate interviewers ask about this? When does the vetting of Clinton begin?

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

12 replies, 937 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (25)

ReplyReply to this post

12 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

Overseas Accounts: What about the 47,550 AMERICAN accounts that remain hidden at UBS in Switzerland? (Original Post)

Skwmom

Apr 2016

OP

I have come across UBS in reading about a number of topics including crooked interest rate swaps

Skwmom

Apr 2016

#4

April 7 2016: UBS, accused of helping tax evaders, leads the way in foreign-connected PAC giving

think

Apr 2016

#3

amborin

(16,631 posts)1. this was so blatant and shameless

Octafish

(55,745 posts)2. Sec. Clinton helped UBS and UBS helped Sec. Clinton.

Sorry to recycle, Skwmom. It's in the interest of integrity:

UBS is a Swiss bank that is enjoying better days, thanks to the US taxpayer and a number of key US political leaders.

Hillary Helps a Bank—and Then It Funnels Millions to the Clintons

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

by CONOR FRIEDERSDORF, The Atlantic, JUL 31, 2015

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

The piece begins by detailing how Clinton helped the global bank.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.” Maybe it’s all a mere coincidence, and when UBS agreed to pay Bill Clinton $1.5 million the relevant decision-maker wasn’t even aware of the vast sum his wife may have saved the bank or the power that she will potentially wield after the 2016 presidential election.

SNIP...

As McClatchy noted last month in a more broadly focused article that also mentions UBS, “Ten of the world’s biggest financial institutions––including UBS, Bank of America, JP Morgan Chase, Citigroup and Goldman Sachs––have hired Bill Clinton numerous times since 2004 to speak for fees totaling more than $6.4 million. Hillary Clinton also has accepted speaking fees from at least one bank. And along with an 11th bank, the French giant BNP Paribas, the financial goliaths also donated as much as $24.9 million to the Clinton Foundation––the family’s global charity set up to tackle causes from the AIDS epidemic in Africa to climate change.”

CONTINUED...

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

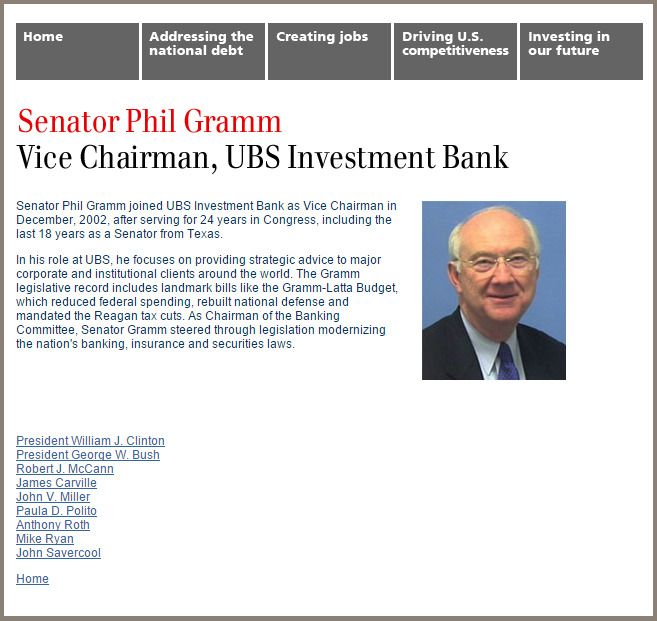

About UBS Wealth Management

It's Buy Partisan

After his exit from the US Senate, Phil Gramm found a job at Swiss bank UBS as vice chairman. He later brought on former President Bill Clinton. What a coincidence, they are the two key figures in repealing Glass-Steagal. Since the New Deal it was the financial regulation that protected the US taxpayer from the Wall Street casino. Oh well, what's a $16 trillion bailout among friends?

It's a Buy-Partisan Who's Who:

President William J. Clinton

President George W. Bush Heh heh heh.

Robert J. McCann

James Carville

John V. Miller

Paula D. Polito

Anthony Roth

Mike Ryan

John Savercool

SOURCE: http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

One of my attorney chums doesn't like to see his name on any committees, event letterhead or political campaign literature. These folks, it seems to me, are past caring.

Some of why DUers and ALL voters should care about Phil Gramm.

The fact the nation's "news media" isn't really following this story should also be of great concern -- for the 99-percent.

Skwmom

(12,685 posts)4. I have come across UBS in reading about a number of topics including crooked interest rate swaps

used to prey on American cities:

http://www.demos.org/blog/3/10/14/detroit%E2%80%99s-bankruptcy-laboratory-study-corruption-municipal-finance

Octafish

(55,745 posts)6. Puerto Rico, too.

How UBS Spread the Pain of Puerto Rico's Debt Crisis to Clients

The Swiss bank packed pension bonds it underwrote into mutual funds it marketed on the island with a hard sell.

David Evans

Bloomberg Markets Magazine, Sept. 22, 2015

EXCERPT...

The UBS Puerto Rico funds were lucrative for the bank, bringing in hundreds of millions of dollars in fees and commissions. The fund family, which had as much as $8.9 billion in assets in 2009, was designed to be heavily invested in the island’s municipal bonds, using borrowed money. By mid-2013, the bonds UBS had underwritten for the pension agency represented more than half of the net assets in five of the funds. The pension agency bonds lost more than 80 percent of their value from when they were issued in 2008 through August of this year. On Sept. 10, Standard & Poor’s predicted with “virtual certainty” that the bonds will default.

Putting bonds UBS had underwritten into funds UBS managed would have been forbidden by the Investment Company Act of 1940—if the funds were sold on the mainland. But Congress exempted Puerto Rico when the law was enacted. Bloomberg Markets first reported on UBS’s activities on the island in 2009.

“UBS made itself a ton of money at the expense of its clients, with these huge conflicts of interest,” says Craig McCann, a former senior economist at the U.S. Securities and Exchange Commission who has been hired by investors’ lawyers to review more than 200 of the arbitration claims.

McCann, a principal at Securities Litigation & Consulting Group in Fairfax, Virginia, says UBS Puerto Rico sold its fixed-income mutual funds and the pension debt to customers with no regard for diversification or the appropriateness of the risk. “Whether it was a $50,000 account or a $50 million account, systematically UBS put clients into the same securities,” he says. “I’ve never seen anything like it.”

The bond funds have landed UBS Puerto Rico in trouble before. In May 2012, UBS paid $26.6 million in fines and restitution and was censured by the SEC, which said the bank had manipulated the prices of the funds in 2008 and 2009. UBS didn’t admit or deny wrongdoing.

CONTINUED...

http://www.bloomberg.com/news/articles/2015-09-22/how-ubs-spread-the-pain-of-puerto-rico-s-debt-crisis-to-clients

The Swiss bank packed pension bonds it underwrote into mutual funds it marketed on the island with a hard sell.

David Evans

Bloomberg Markets Magazine, Sept. 22, 2015

EXCERPT...

The UBS Puerto Rico funds were lucrative for the bank, bringing in hundreds of millions of dollars in fees and commissions. The fund family, which had as much as $8.9 billion in assets in 2009, was designed to be heavily invested in the island’s municipal bonds, using borrowed money. By mid-2013, the bonds UBS had underwritten for the pension agency represented more than half of the net assets in five of the funds. The pension agency bonds lost more than 80 percent of their value from when they were issued in 2008 through August of this year. On Sept. 10, Standard & Poor’s predicted with “virtual certainty” that the bonds will default.

Putting bonds UBS had underwritten into funds UBS managed would have been forbidden by the Investment Company Act of 1940—if the funds were sold on the mainland. But Congress exempted Puerto Rico when the law was enacted. Bloomberg Markets first reported on UBS’s activities on the island in 2009.

“UBS made itself a ton of money at the expense of its clients, with these huge conflicts of interest,” says Craig McCann, a former senior economist at the U.S. Securities and Exchange Commission who has been hired by investors’ lawyers to review more than 200 of the arbitration claims.

McCann, a principal at Securities Litigation & Consulting Group in Fairfax, Virginia, says UBS Puerto Rico sold its fixed-income mutual funds and the pension debt to customers with no regard for diversification or the appropriateness of the risk. “Whether it was a $50,000 account or a $50 million account, systematically UBS put clients into the same securities,” he says. “I’ve never seen anything like it.”

The bond funds have landed UBS Puerto Rico in trouble before. In May 2012, UBS paid $26.6 million in fines and restitution and was censured by the SEC, which said the bank had manipulated the prices of the funds in 2008 and 2009. UBS didn’t admit or deny wrongdoing.

CONTINUED...

http://www.bloomberg.com/news/articles/2015-09-22/how-ubs-spread-the-pain-of-puerto-rico-s-debt-crisis-to-clients

think

(11,641 posts)3. April 7 2016: UBS, accused of helping tax evaders, leads the way in foreign-connected PAC giving

UBS, accused of helping tax evaders, leads the way in foreign-connected PAC giving

As a huge documents leak turns a spotlight on the global tax evasion industry, a Swiss company in hot water for similar activity is responsible for the greatest amount of known foreign-connected money in U.S. elections so far this cycle.

News outlets brought together by the Washington, D.C.-based International Consortium of Investigative Journalists this week began publishing numerous reports, called the Panama Papers, linking the names of the world’s most rich and powerful individuals to secret shell companies in offshore tax havens. The journalists used as source material documents from “the biggest leak in whistleblower history,” according to Wired, which came from a Panamanian law firm that has for decades helped conceal vast amounts of wealth in tax shelters.

But ICIJ had been tracking tax evasion long before helping bring the Panama Papers to light, and in February wrote on the findings of an investigative report by the French newspaper Le Monde on UBS AG. The report showed the Swiss bank “knowingly helped French citizens hide their money from the taxman,” according to ICIJ.

French authorities in 2014 said the bank helped French citizens hide between U.S. $14 billion and $26 billion, according to ICIJ. The bank denied the charges. The report also notes that American authorities opened a new tax evasion case on UBS last year — after the bank paid the U.S. a $780 million fine in 2009.

It’s the bank’s U.S. subsidiary — UBS Americas — that has directed more money to Congress through its political action committee than subsidiaries of any other foreign company. UBS Americas’ PAC has given $645,250 to candidates so far in 2016 and gave about $1.5 million in 2014. The firm in second place isn’t even close: The U.K.’s BAE Systems has given $363,500 so far....

https://www.opensecrets.org/news/2016/04/ubs-accused-of-helping-tax-evaders-leads-the-way-in-foreign-connected-pac-giving/

As a huge documents leak turns a spotlight on the global tax evasion industry, a Swiss company in hot water for similar activity is responsible for the greatest amount of known foreign-connected money in U.S. elections so far this cycle.

News outlets brought together by the Washington, D.C.-based International Consortium of Investigative Journalists this week began publishing numerous reports, called the Panama Papers, linking the names of the world’s most rich and powerful individuals to secret shell companies in offshore tax havens. The journalists used as source material documents from “the biggest leak in whistleblower history,” according to Wired, which came from a Panamanian law firm that has for decades helped conceal vast amounts of wealth in tax shelters.

But ICIJ had been tracking tax evasion long before helping bring the Panama Papers to light, and in February wrote on the findings of an investigative report by the French newspaper Le Monde on UBS AG. The report showed the Swiss bank “knowingly helped French citizens hide their money from the taxman,” according to ICIJ.

French authorities in 2014 said the bank helped French citizens hide between U.S. $14 billion and $26 billion, according to ICIJ. The bank denied the charges. The report also notes that American authorities opened a new tax evasion case on UBS last year — after the bank paid the U.S. a $780 million fine in 2009.

It’s the bank’s U.S. subsidiary — UBS Americas — that has directed more money to Congress through its political action committee than subsidiaries of any other foreign company. UBS Americas’ PAC has given $645,250 to candidates so far in 2016 and gave about $1.5 million in 2014. The firm in second place isn’t even close: The U.K.’s BAE Systems has given $363,500 so far....

https://www.opensecrets.org/news/2016/04/ubs-accused-of-helping-tax-evaders-leads-the-way-in-foreign-connected-pac-giving/

2cannan

(344 posts)5. Can you imagine how grateful the owners of those 47,550 accounts are (to Hillary)? nt

Octafish

(55,745 posts)7. Priceless.

For everything else, there's American Excess.

Skwmom

(12,685 posts)11. Oh, I have wondered about that more than once. n/t

woolldog

(8,791 posts)8. Congrats to Hillary on resolving

such a thorny diplomatic issue. ![]()

Cheese Sandwich

(9,086 posts)9. dayum. nt

Scuba

(53,475 posts)10. Friends of Hillary. Only a woman-hater would expose them.

AuntPatsy

(9,904 posts)12. Bumping this because I think it needs to be read again

And the reasons why concern real people, we forget they re us, we are them.....