progree

progree's JournalProtesters Clash With Police In Brooklyn Center After Deadly Officer-Involved Shooting (MN)

Source: WCCO-TV (CBS affiliate Minneapolis)

Brooklyn Center police say an officer fatally shot a driver Sunday, leading to some clashes between protesters and law enforcement. Here are the latest updates:

9:49 p.m.: The standoff continues outside of the Brooklyn Center Police Department between protesters and law enforcement.

Brooklyn Center police said officers pulled over a driver they said had an outstanding arrest warrant, just before 2 p.m. on the 6300 block of Orchard Avenue. As officers were trying to arrest the driver, police say they tried to get back inside their vehicle. An officer then shot the driver, who then drove a couple blocks more before hitting another vehicle in the area of 63rd Avenue North and Kathrene Drive. No one in that second vehicle was hurt. The driver was pronounced dead at the scene. Police say the officers involved were believed to be wearing activated body cameras at the time of the shooting.

The victim’s mother, Katie Wright, spoke to the crowd. She said her son — 20-year-old Daunte Wright — had been killed by police. She said Wright’s girlfriend was in the car with him at the time of the traffic stop. Police say that woman suffered non-life threatening injuries in the crash, and was taken to North Memorial Health.

Read more: https://minnesota.cbslocal.com/2021/04/11/bca-reporting-to-officer-involved-shooting-in-brooklyn-center/

More background at the article. It is being continuously updated.

Yes, the fatally shot driver is Black.

For non-Minnesotans, Brooklyn Center is the first suburb north of Minneapolis. Minneapolis is of course the city where George Floyd was murdered by then Minneapolis police officer Derek Chauvin, who has been on trial for the past 2 weeks.

Cross-posted at Minnesota Group https://www.democraticunderground.com/105910260

Brooklyn Ctr, MN Police pulled over black driver, fatally shot him, protesters tear-gassed

https://minnesota.cbslocal.com/2021/04/11/bca-reporting-to-officer-involved-shooting-in-brooklyn-center/The story is being continuously updated

9:24 p.m.: A WCCO crew spotted several law enforcement vehicles, including Hennepin County Sheriff’s vans and armored trucks, headed towards the Brooklyn Center Police Department.

9:14 p.m.: Law enforcement are forming a human barricade outside of the Brooklyn Center Police Department, as more protesters gather.

8:19 p.m.: A WCCO crew at the scene is being told by activists that law enforcement is surrounding the area and “corralling” people in an apparent attempt to make mass arrests, like what happened last November during a protest that spilled onto Interstate 94 in Minneapolis.

8:01 p.m.: Protesters are continuing to push law enforcement back.

7:59 p.m.: Law enforcement has deployed tear gas into the crowd of protesters.

For non-Minnesotans, Brooklyn Center is the first suburb north of Minneapolis. Minneapolis is of course the city where George Floyd was murdered by then Minneapolis police officer Derek Chauvin, who has been on trial for the past 2 weeks.

https://twitter.com/JasonDMyles/status/1381410717094526982

Yes, the fatally shot driver is Black.

Cross posted at Latest Breaking News - https://www.democraticunderground.com/10142727465

'A sigh of relief': Crowdfunded cab rides aim to get Asian Americans home safe

NPR, 4/9/21

--snip--

In response to recent attacks against Asian Americans, community-based efforts in the San Francisco Bay Area, New York and Boston are pooling funds for taxi or app-based rides for Asian Americans and Pacific Islanders who feel unsafe walking or taking public transit.

Over the last month alone, Asian Americans have been attacked at work, on the way to church, and while waiting to cross the street. In a widely-cited report, the organization Stop AAPI Hate said it received close to 3,800 reports of incidents ranging from verbal harassment to physical assault from last March to this February.

Candy said her fears worsened last month, after a shooter in Atlanta killed eight people, including six Asian women.

--snip--

"I started thinking about all my student days when I couldn't afford to take cabs and I chose to take the train or walk, even if it was late at night, just to save money," Park said. "I thought, there must be so many people who can't afford these car rides that might be putting themselves at risk."

--snip--

By Thursday, Cafe Maddy Cab had reimbursed at least 400 of more than 1,000 requests. Park said many of the requests have come from nurses, medical personnel and other essential workers who often work night shifts. She's also received messages from people escorting older relatives to COVID-19 vaccinations and doctor appointments.

More: https://www.mprnews.org/story/2021/04/09/npr-a-sigh-of-relief-crowdfunded-cab-rides-aim-to-get-asian-americans-home-safe

=====================================

It's sad that it's come to this. With hate-mongering Trump (and Trumpsters) vigorously fanning the flames -- "China Flu", "Kung Flu".

Cross-posted Asian Group

https://www.democraticunderground.com/12507979

Republican congressman condemned over Islamophobic tweet to Ilhan Omar

The Guardian, April 5, 2021

A police officer was killed when a suspect rammed him and another officer with his car outside the Capitol on Friday. The suspect wielded a knife and was shot dead. The other officer hit by the car survived.

....................

Omar, a Minnesota Democrat, tweeted: “Heartbroken to learn another [police officer] was killed while protecting the Capitol. My thoughts and prayers go out to the officer’s family and the entire Capitol police force. The death toll would have been worse if the assailant had an AR-15 [assault rifle] instead of a knife.”

In response, Congressman Greg Murphy of North Carolina wrote: “Would have been worse if they had been flying planes into the buildings also.”

Omar, who came to the US from Somalia as a child, is one of the first two Muslim women to be elected to Congress.

Murphy was widely rebuked. ..................................

Emphasis added by Progree.

It just never ends.

Rep. Murphy, it would be nice too if they regulated who can buy and carry guns with the same thoroughness they use to keep people with weapons and dangerous backgrounds (background checks) out of planes and to secure the cockpits.

How the COVID relief bill could help reshape the finances of American families

Various excepts

Included in President Joe Biden's $1.9 trillion relief package is a provision that provides many American parents an allowance of $250 a month for each child and $300 for kids under 6.

Although set to last only through this year, ...

The federal government already offered a limited tax break for parents, but the new law expands that in a number of important ways.

First, it vastly expands the amount of money provided to families — 50 percent to 80 percent more for each child.

Second, it's designed to be given out monthly, like an allowance, rather than just once a year.

And third, parents with little or no income still qualify for the full amount.

That's a departure from the existing tax break, which is less generous to low-income workers and gives the poorest families nothing at all.

"This is landmark legislation that would really slash child poverty and target benefits to the lowest-income families that need them the most," says Kris Cox, deputy director of federal tax policy at the left-leaning Center on Budget and Policy Priorities.

Congressional Democrats are already hoping to make the child subsidy payment permanent. Extending the child subsidy would cost about $100 billion a year.

MORE: https://www.mprnews.org/story/2021/03/14/npr-how-the-covid-relief-bill-could-help-reshape-the-finances-of-american-families

Tags: $1.9 Trillion Stimulus, ARPA 2021, American Rescue Plan Act of 2021

Why scientists are very worried about the variant from Brazil (very depressing)

... for some scientists, the most worrying variant [of all the variants that have emerged around the world in the last several months] might be the newest one. A variant called P.1, which emerged in early December in Manaus, Brazil, and by mid-January had already caused a massive resurgence in cases across the city of 2 million people.

On Monday, officials detected the first confirmed case of P.1 in the U.S., specifically in Minnesota.

"If you were to ask me right now, what's most concerning of all the things that I've heard so far, it's the fact that they are reporting a sudden increase in cases in Manaus, Brazil," virologist Jeremy Luban, at the University of Massachusetts, told NPR two weeks ago, before the variant arrived in the U.S. "Manaus already had 75 percent of people infected [in the spring of last year]."

... While the variant from the U.K. took about three months to dominate the outbreak in England, P.1 took only about a month to dominate the outbreak in Manaus. In addition, Manaus had already been hit extremely hard by the virus back in April. One study estimated that the population should have reached herd immunity and the virus shouldn't be able to spread easily in the community. So why would the city see an even bigger surge 10 months later?

(and then details about the variant and particularly several mutations on the surface that make it more effective. Very concerning details -Progree)

"We've been here before with the flu. We're having to live with influenza and figure out a way of staying ahead of the virus by making vaccines on a yearly basis," says Gupta, at the University of Cambridge.

"So I can imagine that we'll be doing something similar with coronavirus. Eventually we'll need to design different vaccines that are targeting different parts of the virus — ones that the virus finds harder to change."

MORE: https://www.mprnews.org/story/2021/01/27/npr-why-scientists-are-very-worried-about-the-variant-from-brazil

Manaus is also the city that's been in the news for running out of oxygen supplies.

Restaurants, bars scramble for propane amid pandemic winter (for outdoor dining)

AP, January 16, 2021

It's one of many new headaches — but a crucial one — that go with setting up tables and tents on sidewalks, streets and patios to comply with public health restrictions.

“You’re in the middle of service and having staff run up and say, ‘We’re out of propane!’" said Melinda Maddox, manager of a whiskey tasting room in Colorado.

Propane long has been a lifeline for people who live in places too remote to get natural gas piped to their homes for heat, hot water and cooking. This winter, 5-gallon propane tanks have proven a new necessity for urban businesses, too, especially in places like the Rocky Mountains, where the sun often takes the edge off the chill and people still enjoy gathering on patios when the heaters are roaring.

The standard-size tanks, which contain pressurized liquid propane that turns to gas as it's released, are usually readily available from gas stations, grocery stores or home improvement stores. But that's not always the case lately as high demand leads to sometimes erratic supplies.

More at: https://kstp.com/coronavirus/restaurants-bars-scramble-for-propane-amid-pandemic-winter/5979997/?cat=12685

I have no idea what all this adds up to as far as amount burned and GHG released. But it's obviously not very "green".

EDIT: I missed the stuff below the ad. e.g. "So far, the surge in demand for small-tank propane hasn't affected overall U.S. propane supply, demand and prices, which are running similar to recent winters, according to the U.S. Energy Information Administration."

But it does take time out of the day to hunt down more propane. Methinks too that this has been a mild winter so far.

Covid data links, revised 12/12/22

ABBREVIATIONS:7dma - 7 day moving average

Quick Links

Updates to this thread (e.g. new links and topics added) https://www.democraticunderground.com/114224534#post1

CDC's Community Levels map (Green, yellow, orange) U.S. map showing all counties

https://covid.cdc.gov/covid-data-tracker/#county-view?list_select_state=all_states&list_select_county=all_counties&data-type=CommunityLevels

CDC's Covid Data Tracker Weekly Review

https://www.cdc.gov/coronavirus/2019-ncov/covid-data/covidview/index.html

New York Times: U.S. States: https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html

. . . Countries of the World: https://www.nytimes.com/interactive/2020/world/coronavirus-maps.html

OurWorldInData.org - Super Site for countries of the world, but doesn't have U.S. states https://ourworldindata.org/coronavirus

Covid Tracking Project: https://covidtracking.com/data

Worldometers: Countries of the world: For country population sizes and the covid situation in each country and the world overall

https://www.worldometers.info/coronavirus/

Worldometers: For U.S. states (and the U.S. overall)

https://www.worldometers.info/coronavirus/country/us

Positivity rates and testing rates and other metrics

https://coronavirus.jhu.edu/testing/tracker/overview

https://covidactnow.org/?s=1301312

https://coronavirus.jhu.edu/testing/individual-states

https://covidtracking.com/data

https://coronavirus.jhu.edu/testing/tracker/map/new-tests-per-100-k-people

Detailed page on positivity and test rates, describing the above pages, post#2 in this thread

The U.S. overall positivity rate, 7dma:

OurWorldInData.org - https://ourworldindata.org/coronavirus

https://coronavirus.jhu.edu/testing/individual-states

(one has to read it from the graph or hover the mouse just right)

U.S. overall testing rate:

OurWorldInData.org -- https://ourworldindata.org/coronavirus

https://covidtracking.com/data

(Some math required, see details in the "U.S. overall testing rate" section below.

Excess mortality - https://ourworldindata.org/excess-mortality-covid

Vaccination rates:

NPR: By state: has (#1#) fully vaccinated, and also (#2#) at least one dose by state: https://www.npr.org/sections/health-shots/2021/01/28/960901166/how-is-the-covid-19-vaccination-campaign-going-in-your-state

New York Times vaccination rates (no paywall, maps and tables galore)

https://www.nytimes.com/interactive/2020/us/covid-19-vaccine-doses.html

BeckersHospitalReview: By state: Number fully vaccinated, population, and percentage fully vaccinated

https://www.beckershospitalreview.com/public-health/states-ranked-by-percentage-of-population-vaccinated-march-15.html

There are a number of other sites that have added vaccination rates -- search below on "vaccin"

RESTRICTIONS, Shutdowns, lockdowns -- see section way below

Alternatives to New York Times

## CovidActNow: https://covidactnow.org/?s=1124253 -- the states are numbered in the listing so don't have to count them like the NYTimes

## Global Epidemics: https://globalepidemics.org/key-metrics-for-covid-suppression/ -- also numbers the states

## Reuters: https://graphics.reuters.com/HEALTH-CORONAVIRUS/USA-TRENDS/dgkvlgkrkpb/index.html -- it has mini-charts of all 50 states all on this page, but are not as much resolution as the New York Times ones

## John Hopkins 50 states' minicharts "map" page, alternative to the NY Times from John Hopkins University

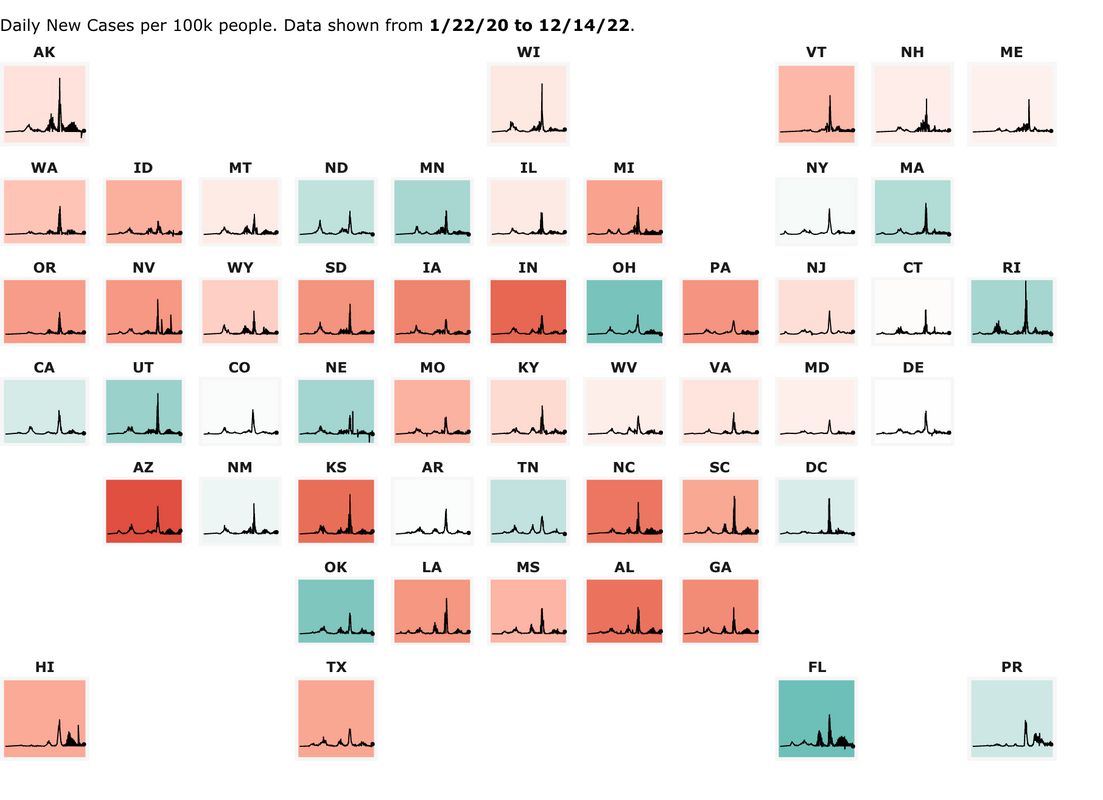

The below "map" of the 50 states' minicharts (which are scaled by daily new cases PER CAPITA), is from the John Hopkins U.https://coronavirus.jhu.edu/data/new-cases-50-states

Purpose: Just to gather together some useful links in one place to check out the Covid situation in a state or country.

Particularly for a U.S. state, it is helpful to know more than just the number of cases (or hospitalizations or deaths), because for example, is 5,000 new cases for a particular state a terrible number or not compared to other states or the U.S. average?.

Helpful context to have so that it can fairly be compared to one's state, to other states and to the U.S. average :

Per Capita -- Often large states are bashed for having high case numbers. Fine. But it helps to provide what its per-capita numbers are and how it compares in that regard to the U.S. average and to other states, e.g. is it 15th best or 12th worst or about median or what.

7 day moving average (7dma). One day data is only marginally useful information. Testing and reported case results vary greatly by day of the week and also just day-to-day statistical volatility. This day-of-the-week effect and volatility varies from state to state. And sometimes days are reported that are actually a combination of 2 or more days and are presented as one day results - very misleading.

7 day moving averages get rid of the day-of-the-week problem. Every 7dma is an average of all 7 weekdays.

As an example of the day-of-the week effect, here is an example from Minnesota, written December 8 by Minnesota Public Radio's David Montgomery:

"Mondays are typically the days when the most people go get tested. And data from Mondays tends to show up on Thursdays and Fridays — since the beginning of September, on average about 10 percent of eventual cases are reported on Wednesday, 35 percent on Thursday, 23 percent on Friday, 13 percent on Saturday, and 16 percent on Sunday." ((Hmm, that totals 97%, meaning that only 3% are reported on Monday and Tuesday combined -Progree))

Daily new cases (as opposed to cumulative total since the pandemic began) -- Daily new cases (best: per capita and 7dma) tell us where the hotspots are NOW, not the states that had a rough spring or summer. (When I do want to look at cumulative totals since the beginning, I choose Worldometers for that (below) )

Trends - Are new cases increasing or decreasing, and how rapidly? I usually look at the mini-charts at the top of the New York Times page, and then click on a state for a detailed look and larger graphs, for example

U.S. with mini-charts for each state, all on one page:

https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html

California as an example: https://www.nytimes.com/interactive/2020/us/california-coronavirus-cases.html

In a posting, realizing that fewer than 10% of the people click a link, I often present a mini-summary, e.g. this from a January 3 posting of Nevada:Daily new cases, 7 day moving average

https://www.nytimes.com/interactive/2020/us/nevada-coronavirus-cases.html

1173 July 20 -- the pandemic high point until early November

277 Sept 13 -- post summer peak low point

2727 Dec 9 -- pandemic peak

1896 January 2 - latest (down 30% from the peak).

This page currently focuses on cases, especially daily new cases per capita, 7dma in these links, because they are the leading indicator. Hospitalization rates and death rates tend to follow weeks after.

However, daily cases per capita in the data we see are reported cases. That in turn depends on the testing rate. Some states have relatively low testing rates and therefore, in general, relatively low reported case rates compared to those that do more testing. There is a special section below " Testing Rates (e.g. tests per day per capita), Positivity Rates" with that information.

Hospitalization rates, especially new admissions rates if available, are the next metric in the timeline that confirm that the situation is improving or worsening, and not just because of a change in testing rates. That and the trend in test positivity rates

DETAILS

New York Times

What's bad is that some people don't have access to the New York Times -- however do note that their coronavirus coverage is free and unlimited, but one has to sign up for that (they might have gotten rid of that requirement). In the many months I've used it, I've never been asked to sign in again.

. . . U.S. States:

https://www.nytimes.com/interactive/2020/us/coronavirus-us-cases.html

I love it for its mini-charts of all 50 states (they are by default drawn to the same scale per capita so that states can be compared). As well as the table where one can rank the states by NEW per capita cases, 7 day moving average.

Warning that testing rates affect the reported case rates, so states that test more may have worse looking case rates than states that test less, and so comparisons aren't fair.

. . . Countries of the World:

https://www.nytimes.com/interactive/2020/world/coronavirus-maps.html

Same comments as for U.S. States.

===############################################===

OurWorldInData.org - Super Site for countries of the world, but doesn't have U.S. states https://ourworldindata.org/coronavirus

This has positivity and also test rates -- for Positivity, choose the "Share of Positive Tests" radio button above the graph. For testing rates, choose the "Tests" radio button above the graph then 7-day rolling average and "Per 1,000 people" checkbox. Has views: Chart, Table, Map. Also can Download. Yes, the Tests per 1000 people 7dma in the chart match the table (the table show the latest day's info (7dma if that's what was selected) )

https://ourworldindata.org/coronavirus

## Excess mortality - https://ourworldindata.org/excess-mortality-covid

## Missing: U.S. states. It's "just" countries of the world.

===############################################===

Covid Tracking Project

CovidTracking: https://covidtracking.com/data

Good for U.S. overall statistics: Daily Tests, Daily Cases, Currently Hospitalized, Daily Deaths -- both for the most recent day, and the 7 day moving average. And Cumulative totals for all of the above (except hospitalization). All with graphs

Then followed by the above for each state. Some (most) have race & ethnicity statistics, long-term care facilities, viral (PCR) tests and antibody tests.

Unfortunately no graphs for the states.

But click on "Historical Data" links to see the daily numbers going all the way back.

===############################################===

Worldometers:

For country population sizes and the covid situation in each country and the world overall (with al the caveats below):

https://www.worldometers.info/coronavirus/

For U.S. states (and the U.S. overall)

https://www.worldometers.info/coronavirus/country/us

Vitally Important: the default "Now" button likely has incomplete and too small New Cases and New Deaths data. Better to click the "Yesterday" button or the "2 days ago" button to make sure to get complete case data for a day.

A sucky thing about Worldometers is that they don't have anything for new cases per 1M population or new deaths per 1M population. After clicking the "Yesterday" or "2 days ago" button as cautioned above, one has to do the math by dividing the New Cases (or New Deaths) by the population. And there's no way to sort the table by new cases per 1M population or new deaths per 1M population because these columns don't exist.

All of the per-capita stuff (Total cases/1M pop, Deaths/1M pop, Tests/1M pop) are cumulative totals since the pandemic began. To me, most of that is ancient history, and I usually care much more about what's been happening the last few days or weeks. But like I said above, New Cases and New Deaths are not given on a per capita basis).

Another caution about New Cases and New Deaths is (besides remembering to click the "Yesterday" or "2 days ago button" so as to get a full day rather than a partial day of information), is that the daily amounts fluctuate quite a lot from day to day with some high days being the result of unusual case backlogs being reported on one day, for example. I much prefer sites that present 7 day moving average so as to smooth out the day-to-day volatility, and to also capture an entire week so as not to get biased data for days of the week where there is usually low or high numbers such as weekends and Mondays etc.

Good things about Worldometers:

. . . Shows the populations

. . . Shows the U.S. overall on the listing of the U.S. states, and the world overall on the listing of countries. A lot of other resources don't do that simple common-sense thing, so that, for example to compare the infection rate of Illinois to the U.S. overall, one has to visit 2 pages, and sometimes can be hard to find.

===############################################===

Testing Rates (e.g. tests per day per capita), Positivity Rates, and other useful web pages with this information

https://www.democraticunderground.com/114224534#post2

===############################################===

Excess mortality - https://ourworldindata.org/excess-mortality-covid

===############################################===

RESTRICTIONS, Shutdowns, lockdowns:

New York Times, all states

. . . https://www.nytimes.com/interactive/2020/us/states-reopen-map-coronavirus.html

Midwest: Coronavirus-Related Restrictions By State, NPR, 12/3/20

. . . https://www.npr.org/2020/06/11/847413697/midwest-coronavirus-related-restrictions-by-state

NPR all states:

. . . https://www.npr.org/series/847328455/coronavirus-restrictions-in-each-state

===############################################===

Alternatives to New York Times

## CovidActNow: https://covidactnow.org/?s=1124253 -- the states are numbered in the listing so don't have to count them like the NYTimes

## Global Epidemics: https://globalepidemics.org/key-metrics-for-covid-suppression/ -- also numbers the states

## Reuters: https://graphics.reuters.com/HEALTH-CORONAVIRUS/USA-TRENDS/dgkvlgkrkpb/index.html -- it has mini-charts of all 50 states all on this page, but are not as much resolution as the New York Times ones

## John Hopkins 50 states' minicharts "map" page, alternative to the NY Times from John Hopkins University

The below "map" of the 50 states' minicharts (which are scaled by daily new cases PER CAPITA), is from the John Hopkins U.

https://coronavirus.jhu.edu/data/new-cases-50-states

-- at that page you can click on individual states on the "map". Showing 3-day moving average of new cases. I prefer the nytimes' charts which are 7 day moving averages). But I'm not sure how up to date the below .jpg image file is, so its better to click the ABOVE link (also the individual states on the above link are click-able to show more info on the states)

Tips

Tired of trying to move the mouse to the exact right position on a graph to read the data point box that pops up? e.g. to get the mouse on the peak point of the graph, or to get it on the last point on the graph --- Turn Mouse Keys on: On Windows 10, hit the Window Key, and type in Mouse Keys, and it will take you to the Settings to turn it on or off.

Also, very importantly, UNcheck the checkbox "Only use Mouse Keys when Num Lock is On"

Then when you want to use Mouse Keys, have NUM LOCK OFF, and use the cursor arrows on your numeric keypad to move the mouse cursor.

When you want to use the numeric keypad to type numbers, turn NUM LOCK ON.

Also I sometimes zoom in on a graph (Control + to zoom in, Control - to zoom out, Control 0 to reset to 100% zoom) in order to position the cursor just right, but that's been getting more and more difficult even when zoomed to the max, so I was glad to find that mouse keys work. Wish to heck they'd just link to their data table

New COVID-19 variant spreads to dozens of countries

Source: National Public Radio

The coronavirus variant that was first spotted last month in the U.K. has now spread to dozens of countries,

Researchers say the new variant -- dubbed B.1.1.7 -- probably originated in the South East region of England in September, before being detected there in November. According to a new report from Imperial College London, Britain's November lockdown did little to curb its spread, which was most prevalent in young people under 20 years old. The World Health Organization says the new variant is responsible for more than half of new infections in the U.K.

The variant is now in dozens of countries, including the United States, where it's been confirmed to have infected people in Colorado, California and Florida. Europe is riddled with the variant, which has been reported in Belgium, France, Germany, Ireland, Italy, the Netherlands, Norway, Spain, Sweden and Switzerland. It has also been detected in Asia, Australia, the Middle East and South America.

The good news is that the new variant doesn't appear to be more deadly. But it is much more contagious -- researchers are still trying to determine exactly how much more, but many have estimated it could be 50 percent more transmissible than the original strain. That may be because it leads to an increased viral load inside a person's nose or respiratory tract -- and so it gets dispersed more easily when people talk or cough. Another theory is that the new variant binds to human cells more easily.

Read more: https://www.mprnews.org/story/2021/01/02/npr-new-covid-19-variant-spreads-to-dozens-of-countries

Ughh. Key quotes from above:

"The World Health Organization says the new variant is responsible for more than half of new infections in the U.K."

"Britain's November lockdown did little to curb its spread"

===========================================

The U.K. now has a higher daily new cases per capita than the U.S. 69 vs. 59 per 100K population.

Color-coded map of the countries of the world -- U.S. and U.K. are among a handful of "burgundy" countries (the worst) in average daily new cases per capita. Hover your mouse over a country to see its average new cases and average new cases per 100k and 14 day trend.

https://www.nytimes.com/interactive/2020/world/coronavirus-maps.html

Followed by a table.

===========================================

U.K. daily new cases up 91% in 14 days (7 day average on Jan 1 vs. 7 day average on December 18).

https://www.nytimes.com/interactive/2020/world/europe/united-kingdom-coronavirus-cases.html

Why are so many financial books, columnists, newletters so biased in favor of Roths?

First note that any Roth conversions for the 2020 tax year must be completed by December 31, 2020 (NOT April 15, 2021 as is the case of contributions). (Edit: obviously the deadline has passed, but never too soon to start considering a 2021 Roth conversion. And one can still contribute to a 2020 Roth until April 15, 2021).I was struggling with a big Roth conversion decision a few days ago, and I decided just as a check on myself, to look at a spreadsheet that has been developed and touted by Bob Carlson, editor of the Retirement Watch newsletter, and author of The New Rules of Retirement and several other books.

https://www.retirementwatch.com/about-bob-carlson

Background Exposition (unfortunately)

My criticism of the three financial wizards' Roth analysis won't be understandable to most people, I don't think, without a bit of explanation first, unfortunately.

If you know this background material, feel free to skip it and go on to what this is all about: "Three Retirement Finance "Wizards" and their mistakes or apples vs. oranges assumptions". But it's important to understand the Side Account and its purpose, which may be different terminology than what you use.

Abbreviations:

TIRA - Traditional IRA.

RIRA and Roth IRA - Roth IRA

Side Account - a regular ordinary taxable account that plays various roles depending on whether we're talking about a Roth conversion or a choice between contributing to a TIRA or to a RIRA. Such as paying taxes on a Roth conversion. Or if we contribute to a TIRA, that's where the tax deduction savings goes. Also where Required Minimum Distributions go.

RMD - Required Minimum Distribution -- an amount one must withdraw from a TIRA and pay taxes on, beginning at age 72.

The starting point is that you have $10,000 in a Traditional IRA (TIRA) and $3,000 in a Side Account

The essence of the Roth conversion decision is that you have to analyze two options: the DO-NOTHING option (keep the TIRA and the Side Account the way they are), or the ROTH CONVERSION option:

DO-NOTHING OPTION: Keep the TIRA the way it is: Say you have $10,000 in a Traditional IRA (TIRA) and $3,000 in a regular taxable account, also known as a Side Account. If you decide NOT to make the Roth conversion, but just keep things status quo, then the TIRA will grow temporarily tax-free until you make required minimum distributions (RMDs) beginning at age 72, and you have to pay taxes on those at your ordinary tax rate at the time. If at some point you liquidate the TIRA account, the first step is transferring it to a regular taxable account and paying taxes on the entire amount liquidated.

(In Fidelity I just specify Withdraw from IRA, and specify the amount, and that is in effect what it does -- transfers the amount I withdraw to my regular taxable account, and then I get a 1099-R declaring that amount, which has to be declared on one's tax return and I have to pay taxes on it at my ordinary tax rate.)

In the meantime, the $3,000 Side Account grows, but one must pay taxes each year on any dividends and interest and capital gains distributions.

In the below I assume that the rate of return is such that the TIRA doubles in value after some N years (because it is growing temporarily tax free), while the Side Account, which is a regular taxable account, has the same rate-or-return pre-tax, but with taxes paid every year it only grows by a factor of 1.6 after-tax over the N years.

I don't show RMD's being taken, let's pretend we're in the pre- age 72 phase throughout the N years.

(If we did have to take some RMDs, I would show them removed from the TIRA and then being added to the Side Account. Additionally taxes would be paid on the RMD, which would come out of the side account. This would cut the growth of the Do-Nothing option by turning some of the tax-deferred growth to taxed annually growth).

Let's say after N years, for some reason we decide to withdraw the $20,000 from the TIRA, perhaps to pay a big bill of some kind or another. That's considered an IRA withdrawal, and taxes must be paid on that amount, at our ordinary tax rate which again is 30% in this example. I call it a "liquidation tax" because I'm wiping out the entire TIRA, but it's just a withdrawal of $20,000 to the IRS.

To be clear, the liquidation tax isn't paid on the entire $24,800 because $4,800 of that is the side account which isn't being liquidated, and anyway liquidation taxes aren't due even if that is taken and spent (leaving aside any capital gains taxes).

======##############=======

ROTH CONVERSION OPTION: If instead, one decides to do a Roth conversion, and if the tax rate is 30% (including state income taxes), then to convert the $10,000 from the TIRA to a Roth IRA (RIRA), one tells Fidelity (or whoever) to transfer $10,000 in the TIRA account to the RIRA account. It then asks, "do you wish to do a Roth conversion?" and tells you the pros and cons of that, and especially that you will owe taxes if you do that.

Anyhoo, when done, $10,000 has been transferred from the TIRA to the RIRA, and one gets a 1099-R declaring that $10,000 has been converted, and that $10,000 has to be declared on one's tax return and taxes paid on it. At a 30% tax rate, that means $3,000 in taxes have to be paid. That money comes from the "Side Account". From then on forward the RIRA is tax-free forever. There are no required minimum distributions are required, and no taxes are ever paid on any withdrawals.

In short, one has taken $3,000 from the side account to pay the conversion taxes, leaving nothing in the side account.

Like in the TIRA, we assume that we need to liquidate the IRA, the RIRA in this scenario, for some reason, after N years.

Comparing the two, the Do Nothing option has a final value of $18,800 while the Roth conversion option has a final value of $20,000. Conclusion: go with the Roth conversion for a $1,200 higher net worth.

But what if we liquidated when, in our retirement, we were in a lower tax bracket, say 20%? Then the Do-Nothing would have a final value of $20,800, which is $800 more than the Roth option. Conclusion: do nothing and have a $800 higher net worth.

There are eligibility requirements and other details, which I'm not going into, here.

Three Retirement Finance "Wizards" and their mistakes or apples vs. oranges assumptions

My whole point in going thru the above is just to lay down the foundational basics. As necessary to explain the unfair assumptions and mistakes some financial "experts" make.

BOB CARLSON - In the Bob Carlson "nest-egg" scenario, he does include the side account thingy correctly (after all we have to account for the conversion taxes on the Roth IRA).

But in the Do-Nothing option, he simply throws RMDs away! Unfortunately I don't show RMDs in my example above, but they are a big deal if running this scenario out several years after age 72 (when RMDs are first required) and when they accumulate to a large sum (or are inherited, and the inheritees have to fully RMD-away the entire account within 10 years (SECURE Act). I don't know if this was an oversight or a deliberate decision, see Lynn, Union Tribune columnist below.

He also mistakenly pays a liquidation tax on the Side Account, the same as if it was a TIRA. Well, the Side Account is a regular taxable account, no taxes are owed even if it is taken and spent (exception: any capital gains taxes, and those would be at the lower capital gains tax rate rather than the ordinary tax rate he assumes). I'm sure this was just a mistake, but anyway, it also hurts the Do-Nothing Option.

Anyway, I'm pissed because I wasted many many hours before December 24th finding and confirming these shortcomings that made the spreadsheet worthless.

In his defense, he does look at many scenarios (including inheritance by the next generation), with many adjustable variables, but I think he lost sight of the forest for the trees.

Lynn, long-ago San Diego Union Tribune Financial Columnist and author of a couple retirement finance books (fortunately this one changed fields, so I'll leave out the full name)

This one is comparing contributing to a Traditional IRA vs contributing to a Roth (this is different than a Roth conversion), but anyway, if you contribute $10,000 to a TIRA, you get a $10,000 tax deduction which provides a $3,000 tax savings (again assuming a 30% tax rate) that in a fair comparison goes into a regular taxable account (Side Account) and is invested, with dividends and interests and cap gains distributions taxed annually like all regular accounts. Leaving one with $10,000 in a TIRA plus $3,000 in a Side Account at the beginning

Whereas if you contribute $10,000 to a Roth, there is no tax deduction, and so all you have is a Roth with $10,000 and a Side Account of $0.

But with breath-taking panache, he explicitly says people would just spend the tax deduction, so the Roth is ALWAYS a better choice. I agree, yup, if you throw away the TIRA contribution tax deduction and tax savings, then no way can a $10,000 TIRA compete with a $10,000 RIRA. Sigh. I had quite a correspondence with him.

Supposedly there are studies that show most people spend their RMDs. I'd like to look under the hood of those studies, I bet people with Roth's spend just as much money. Anyway, inarguably it's not an apples-to-apples comparison, and is not the basis for a valid comparison of the two options -- by assuming in option 1, one pisses away money, while in option 2, one is frugal.

I would also argue that some people who went with the Roth option spend some of their Roth, because after all, if you withdraw $1000 from your Roth, that's it, you pay no taxes and have $1,000 to spend.

Whereas someone with a TIRA who needed $1,000 would have to withdraw $1,429 from the TIRA and pay $429 taxes on it (30% tax rate assumption again). That wouldn't be very appealing at all to me.

Ed Slott, the famed IRA expert. If you haven't heard of him, you don't watch PBS or any other TV, shame shame.

Here I'm discussing his "Parlay Your IRA Into a Family Fortune", (c) 2005 book. I don't know if he's still presenting a phony comparison. To make a long story short, he completely ignores the Side Account, thus he ends up in effect comparing a $100,000 TIRA to a $100,000 RIRA. That's like throwing away the tax deduction when the TIRA was created. Or ignoring the conversion tax when a TIRA was converted to a Roth.

He does consider the RMDs, but he pays no taxes on the RMDs (that favors the TIRA), but assumes no growth in the RMDs either -- they just go under the mattress (that disfavors the TIRA). I've done some analysis that convince me that using reasonable rates of return and tax rates, that on net the two assumptions in in this paragraph disfavor the TIRA and thus relatively favors the Roth.

Frankly I think all three are upselling the Roth IRA to make it seem like they have a sure-fired sure-bet angle that others don't.

Those IRA conversion calculators on the web, and there are many (there are also many Contribute to a Traditional IRA vs. Contribute to a Roth IRA calculators)

These I've had better luck with, but my analysis of most were like nearly 20 years ago. I remember spending time with T Rowe Price's, which I didn't have any major issues with, but that was a long time ago. I also looked at MoneyChimps a few years ago and found it reasonable. I also developed my own based on MoneyChimp's and added some features, as an example of a few:

1. The option of the Side Account being invested in a buy-and-hold no-dividends equity fund with no dividends, so that no taxes are paid until the liquidation year when capital gains taxes are paid. This is the best option for the Side Account and makes the don't convert option look the best.

2. The option of the Side Account being invested in a no-dividend equity fund, but I sell it and buy another one every year, so in effect I pay capital gains taxes annually.

3. The option of the Side Account being invested in a bond fund (or a high dividend but no growth equity fund) where the interest (or dividends) are taxed every year.

My spreadsheet does all 3 of the scenarios (chosen to be extreme) and then I look at the results. With rate of returns on these and the core TIRA and on the Roth being variable, and having 3 time-period tax rates on each as well: a tax rate on the initial conversion, a tax rate during the pre-retirement accumulation phase, and a tax rate during the retirement phase.

My conclusion is that in any fair comparison, the Roth option always beats the no-convert do-nothing option if one assumes the same or higher tax rate in retirement than in one's conversion and accumulation years.

If one assumes lower tax rates in retirement years than the other years, however, then it becomes something that needs to be examined further with a good Roth conversion spreadsheet or calculator, of which I know of none that don't have some serious shortcomings.

It's also a scenario most people and financial planners assume (I think it is safe to say): tax rates in retirement (when there is little or no earned income) will be lower than in most of one's working years. Even when Social Security, a pension, and maybe an annuity kick in.

But be careful: putting all one's money in TIRA's and none in Roth's can lead to huge RMDs down the road (remember: TIRAs have RMD requirements, Roths don't), leading to surprisingly high taxable income and higher tax rates in retirement.

My decision

Fortunately it was easy -- the last 4 years, and 2020, and 2021 are special years for me where I can do Roth conversions at a 30% discount. Reason: if I do a $10,000 Roth conversion, my AGI goes up by $10,000, and what I can deduct in charitable contributions goes up by $3,000, so I end up only paying taxes on a $7,000 increase in taxable income. Making my tax rate on a Roth conversion effectively being 70% of what it normally would, and what it will be in later years, per my projections.

What's this about the magical charitable contribution deduction that makes Roth conversions cheaper?

I gave away my $500,000 farm to Population Connection back in 2016 in exchange for a charitable gift annuity CGA. I don't know how the calculations go, but per IRS regulations, PopConn figured (as I understand it) that the CGA is worth $360,000, so my net charitable contribution was really only $500,000 - 360,000 = $140,000. I am allowed to deduct that $140,000 on my taxes as a charitable contribution with TWO sucky-suck limits:

(a) I can deduct at most 30% of my AGI each year

(b) I have only 6 years to take these deductions: 2016, 2017, 2018, 2019, 2020, and 2021. If I can't deduct the entire $140,000 amount over these 6 years (and I can't), well, too bad, they say life sucks and then you die.

Anyway, it's provision (a) that affects my Roth conversion tax rate: each $1,000 increase in my Roth increases my AGI by $1,000 meaning I'm allowed another 30% of $1,000 = $300 charitable contribution deduction.

======##############=======

If you've gotten this far, thanks for taking the time. The bottom line and the purpose of all this is to warn about really being careful which financial pundits to trust, even the ones with books and TV shows, and likewise be careful about any IRA conversion or contribution decision calculators or other decision-making tools you may find out there.

And to see what others do about decisions involving choices between traditional IRAs and Roth IRAs.

Edited to add: Full disclosure: I'm not a financial or tax professional. I've read a lot, consulted with tax and financial advisers a lot on these darn IRAs, studied conversion calculators and done a lot of analysis, and as an engineer I know math and spreadsheets, but at the end of the day I'm just another message board rando

Profile Information

Gender: MaleHometown: Minnesota

Member since: Sat Jan 1, 2005, 04:45 AM

Number of posts: 10,918